Professional Documents

Culture Documents

GST Format

Uploaded by

Anmol GoyalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GST Format

Uploaded by

Anmol GoyalCopyright:

Available Formats

Form in Excel by Finotax

Please enable macros to use all features of the form.

* Important : Please see notes overleaf before Single Copy (to be sent to the ZAO)

filling up the challan

Tax Applicable (Tick One)*

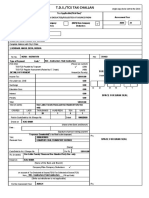

CHALLAN (0020) INCOME-TAX ON COMPANIES ` Assessment Year

NO./ (CORPORATION TAX) 2018 - 19

ITNS 280 (0021) INCOME TAX (OTHER THAN

COMPANIES)

Permanent Account Number

AAUPG3787C

Full Name

ANIL GOYAL

Complete Address with City & State

406, SALASAR PUJA,VENKATESH PARK, BHAYANDER WEST

Tel. No. 9825209267 Pin 401107

Type of Payment (Tick One)

Advance Tax (100) Surtax (102)

Self Assessment Tax (300) Tax on Distributed Profits of Domestic Companies (106)

Tax on Regular Assessment (400) Tax on Distributed Income to Unit Holders (107)

DETAILS OF PAYMENTS Amount (in Rs. Only) FOR USE IN RECEIVING BANK

Income Tax 20000 Debit to A/c / Cheque credited on

Surcharge

Education Cess - -

Interest D D M M Y Y

Penalty

Others

Total 20000 SPACE FOR BANK SEAL

Total (in words) Rupees twenty thousand only

CRORES LACS THOUSANDS HUNDREDS TENS UNITS

20 0 0 0

Paid in Cash/Debit to A/c /Cheque No. Dated

Drawn on

(Name of the Bank and Branch)

Date: Rs.

Form in Excel by Finotax

Please enable macros to use all features of the form.

Signature of person making payment

Taxpayers Counterfoil (To be filled up by tax payer)

PAN AAUPG3787C

Received from ANIL GOYAL

(Name)

Cash/ Debit to A/c /Cheque No. 0 For Rs. 20000

Rupees twenty thousand only

Rs. (in words)

Drawn on 0

(Name of the Bank and Branch)

on account of Companies/Other than Companies/Tax

Income Tax on (Strike out whichever is not applicable)

Type of Payment (To be filled up by person making the payment) Rs.

for the Assessment Year 2018 - 19

Form in Excel by Finotax

Please enable macros to use all features of the form.

*NOTES

1. Please use a separate challan for each type of payment.

2. Please note that quoting your Permanent Account Number (PAN) is mandatory.

3. Please note that quoting false PAN may attract a penalty of Rs. 10,000/- as per section 272B of I.T.

Act, 1961.

4. Please note that to deposit Appeal Fees either Major Head 020 or 021 (depending upon the tax

payer’s status) has to be ticked under ‘Tax Applicable’. Followed by this; Minor Head: Self

Assessment Tax (300) has to be ticked under ‘Type of Payment’ and the amount is to filled under

Others in ‘Details of Payments’.

5. To deposit taxes, appeal fees, etc. in respect of block period cases, enter the first Assessment Year of

the block period followed by the last Assessment Year of the period. For example, if the block period is

1/04/85 to 5/3/96, it would be entered as 1986-97 in the space indicated for Assessment Year. If taxes

are being deposited, tick the box Self Assessment (300) under Type of Payment and fill up amount

under ‘Tax’ while in respect of appeal fees, enter amount under ‘Others’.

PLEASE USE THIS CHALLAN FOR DEPOSITING TAXES (TYPES OF PAYMENT) MENTIONED OVERLEAF.

KINDLY DO NOT USE THIS CHALLAN FOR DEPOSITING TAX DEDUCTION AT SOURCE (TDS)

KINDLY ENSURE THAT THE BANK’S ACKNOWLEDGEMENT CONTAINS THE FOLLOWING:

1. 7 DIGIT BSR CODE OF THE BANK BRANCH

2. DATE OF DEPOSIT OF CHALLAN (DD MM YY)

3. CHALLAN SERIAL NUMBER

THESE WILL HAVE TO BE QUOTED IN YOUR RETURN OF INCOME.

You might also like

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Challan No./ Itns 280: Details of Payments For Use in Receiving BankDocument3 pagesChallan No./ Itns 280: Details of Payments For Use in Receiving BankSatish BatchaNo ratings yet

- Challan No. ITNS 280Document2 pagesChallan No. ITNS 280RAHUL AGARWALNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Challanitns 280Document1 pageChallanitns 280saritabh05No ratings yet

- Challan 280Document2 pagesChallan 280Rahul SinglaNo ratings yet

- Income Tax Challan - 280Document1 pageIncome Tax Challan - 280Subrata SarkarNo ratings yet

- Self Assessment Tax Challan NiDocument1 pageSelf Assessment Tax Challan NiNitin KarwaNo ratings yet

- T.D.S. / T.C.S. Tax Challan: To Any Person or Web Site For Publication or For Commercial or Any Other UseDocument10 pagesT.D.S. / T.C.S. Tax Challan: To Any Person or Web Site For Publication or For Commercial or Any Other UseHARDEEPTHAPARNo ratings yet

- Tax Payment Challan 280Document2 pagesTax Payment Challan 280analystbankNo ratings yet

- Single (Copy To Be Sent The ZAO)Document1 pageSingle (Copy To Be Sent The ZAO)James GonzalezNo ratings yet

- Challan 280Document1 pageChallan 280Jayesh BajpaiNo ratings yet

- ImportantDocument1 pageImportantWilliam SureshNo ratings yet

- For Payment From July 2005 OnwardsDocument1 pageFor Payment From July 2005 Onwardsvijay123*75% (4)

- Ganapati TDS ChalanDocument3 pagesGanapati TDS ChalanPruthiv RajNo ratings yet

- Itns-281 TDS ChallanDocument1 pageItns-281 TDS Challanvirendra36999100% (2)

- Sri Ram SilksDocument1 pageSri Ram SilksMathanagopal KNo ratings yet

- Challan No./ ITNS 282: Tax Applicable (Tick One)Document2 pagesChallan No./ ITNS 282: Tax Applicable (Tick One)satishkumar.mandora.smNo ratings yet

- ChallanDocument1 pageChallanShilesh GargNo ratings yet

- Challan PDFDocument1 pageChallan PDFShilesh GargNo ratings yet

- Challan No. ITNS 281Document1 pageChallan No. ITNS 281jagdish412301No ratings yet

- Tds ChallanDocument2 pagesTds Challannilesh vithalaniNo ratings yet

- Ganraj ConstructionDocument2 pagesGanraj ConstructionSUNIL GAIKWADNo ratings yet

- Itns 285Document2 pagesItns 285Anurag SharmaNo ratings yet

- Challan No. / Itns 280: Tax Applicable (Tick One) Assessment YearDocument1 pageChallan No. / Itns 280: Tax Applicable (Tick One) Assessment YearKaran AsodariyaNo ratings yet

- Advance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersDocument1 pageAdvance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersAnujaNo ratings yet

- Arvind Kumar SoniDocument1 pageArvind Kumar SoniAngad MundraNo ratings yet

- Challan Advance TaxDocument1 pageChallan Advance Taxamit22505No ratings yet

- TDS ChallanDocument1 pageTDS ChallanJayNo ratings yet

- ChallanDocument1 pageChallanYash KavteNo ratings yet

- Tds/Tcs Tax Challan: AADP12345KDocument3 pagesTds/Tcs Tax Challan: AADP12345KC.A. Ankit JainNo ratings yet

- TDS ChallanDocument1 pageTDS ChallanJainsanjaykumarNo ratings yet

- AQSPS8791C: 1, Pithampur, PITHAMPUR, MADHYA PRADESH-454001Document1 pageAQSPS8791C: 1, Pithampur, PITHAMPUR, MADHYA PRADESH-454001pavanNo ratings yet

- Draft Challan IchhaDocument1 pageDraft Challan IchhaSneha SharmaNo ratings yet

- Challan Salary 192 PDFDocument1 pageChallan Salary 192 PDFVipin Kumar ChandelNo ratings yet

- Challan No. ITNS 280: Tax Applicable Assessment YearDocument1 pageChallan No. ITNS 280: Tax Applicable Assessment YearSuresh KumarNo ratings yet

- Income Tax - Bank Remittance CHALLANDocument1 pageIncome Tax - Bank Remittance CHALLANvivek anandanNo ratings yet

- ITNS 280: Challan No. Challan No. ITNS 281Document1 pageITNS 280: Challan No. Challan No. ITNS 281Sar-Im Teron AcousticNo ratings yet

- Income Tax Payment Challan: PSID #: 138414509Document1 pageIncome Tax Payment Challan: PSID #: 138414509naeem1990No ratings yet

- TCS TenduDocument1 pageTCS TenduSwetha KarthickNo ratings yet

- Income Tax Payment Challan: PSID #: 138458243Document1 pageIncome Tax Payment Challan: PSID #: 138458243naeem1990No ratings yet

- Itax Form 2006Document4 pagesItax Form 2006AliMuzaffarNo ratings yet

- Income Tax Payment Challan: PSID #: 138637167Document1 pageIncome Tax Payment Challan: PSID #: 138637167naeem1990No ratings yet

- Challan 280Document6 pagesChallan 280Narendra PrajapatiNo ratings yet

- Income Tax Payment Challan: PSID #: 138384574Document1 pageIncome Tax Payment Challan: PSID #: 138384574naeem1990No ratings yet

- ChallanDocument1 pageChallanabhi7991No ratings yet

- Income Tax Payment Challan: PSID #: 40198754Document1 pageIncome Tax Payment Challan: PSID #: 40198754WasimNo ratings yet

- 01-Uptown ServicesDocument2 pages01-Uptown ServicesMarina ButlayNo ratings yet

- Income Tax Payment Challan: PSID #: 42079719Document1 pageIncome Tax Payment Challan: PSID #: 42079719gandapur khanNo ratings yet

- Lapay Wali, Post Office Chawinda, Teshil PASRUR, Sialkot, Pasrur. Fiaz Ahmed BhattiDocument4 pagesLapay Wali, Post Office Chawinda, Teshil PASRUR, Sialkot, Pasrur. Fiaz Ahmed BhattiDAYYAN AHMED BHATTNo ratings yet

- Return 2008Document73 pagesReturn 2008sahil-ujNo ratings yet

- Tds Challan 281 Excel FormatDocument459 pagesTds Challan 281 Excel FormatSaravana Kumar0% (1)

- It 000092233928 2020 01Document1 pageIt 000092233928 2020 01naeem1990No ratings yet

- One and Done 2307Document2 pagesOne and Done 2307Maricris LegaspiNo ratings yet

- Income Tax Payment Challan: PSID #: 138458893Document1 pageIncome Tax Payment Challan: PSID #: 138458893naeem1990No ratings yet

- (0021) Non Company Deductees A: T.D.S./T.C.S. Tax ChallanDocument3 pages(0021) Non Company Deductees A: T.D.S./T.C.S. Tax ChallanRambabuNo ratings yet

- 2307 Thedeleons Co LTDDocument2 pages2307 Thedeleons Co LTDRACHEL DAMALERIONo ratings yet

- It 000111296083 2020 00Document1 pageIt 000111296083 2020 00Usman ArifNo ratings yet

- Certificate of Creditable Tax Withheld at SourceDocument2 pagesCertificate of Creditable Tax Withheld at SourceMaricar Lelaine SecretarioNo ratings yet

- Project GuidelinesDocument21 pagesProject GuidelinesAnmol GoyalNo ratings yet

- International Financing and International Financial MarketsDocument40 pagesInternational Financing and International Financial MarketsAnmol GoyalNo ratings yet

- Account Summary: Account Nickname: Account Type: Account CurrencyDocument1 pageAccount Summary: Account Nickname: Account Type: Account CurrencyAnmol GoyalNo ratings yet

- Date: 25/01/2018 To, ABG Shipyard - LTD Dahej, District Bharuch GujaratDocument1 pageDate: 25/01/2018 To, ABG Shipyard - LTD Dahej, District Bharuch GujaratAnmol GoyalNo ratings yet

- Scrip Scrip Name Isin POA Non Poa Broker Collatral in Short Out Short Net Qty Closing Price Market ValueDocument1 pageScrip Scrip Name Isin POA Non Poa Broker Collatral in Short Out Short Net Qty Closing Price Market ValueAnmol GoyalNo ratings yet

- Business Statistics - Session 5d PPT MBJHcpEdu8Document10 pagesBusiness Statistics - Session 5d PPT MBJHcpEdu8Anmol GoyalNo ratings yet

- Nmims Global Access - School For Continuing Education: Dec-2017 Exam Booking ReceiptDocument1 pageNmims Global Access - School For Continuing Education: Dec-2017 Exam Booking ReceiptAnmol GoyalNo ratings yet

- Competitor AnalysisDocument4 pagesCompetitor AnalysisAnmol GoyalNo ratings yet

- Letter Abg ShipyardDocument1 pageLetter Abg ShipyardAnmol GoyalNo ratings yet

- Essentials of HRM - Assignment December 2017 UOXFq3l0ap PDFDocument2 pagesEssentials of HRM - Assignment December 2017 UOXFq3l0ap PDFAnmol GoyalNo ratings yet

- E - Commerce Chapter 11Document19 pagesE - Commerce Chapter 11Md. RuHul A.No ratings yet

- VFIPL Annual Report FY 2022 23Document134 pagesVFIPL Annual Report FY 2022 23Shiva BhardwajNo ratings yet

- Treasury and Subsidiary Treasury RulesDocument407 pagesTreasury and Subsidiary Treasury RulesBilalNumanNo ratings yet

- 0438Document7 pages0438murtaza5500No ratings yet

- ONGC - EPP - Apple Offer - 03-10-22Document3 pagesONGC - EPP - Apple Offer - 03-10-22sameer bakshiNo ratings yet

- Accounting Basics 3Document74 pagesAccounting Basics 3Mukund kelaNo ratings yet

- Cleaners WorksheetDocument1 pageCleaners WorksheetSeijuro Akashi100% (1)

- Unit - 1: Retail Banking - IntroductionDocument3 pagesUnit - 1: Retail Banking - IntroductionZara KhatriNo ratings yet

- Visa ReceiptDocument1 pageVisa ReceiptAnonymous Dkc838No ratings yet

- GL Account Balance QueryDocument5 pagesGL Account Balance QueryKhalil ShafeekNo ratings yet

- Application Form For Membership: Personal DetailsDocument2 pagesApplication Form For Membership: Personal DetailsnalakasaNo ratings yet

- Yanis Varoufakis - A Letter To My Daughter About The Black Magic of BankingDocument8 pagesYanis Varoufakis - A Letter To My Daughter About The Black Magic of BankingSasko MateskiNo ratings yet

- Bank Statement March - 2019Document13 pagesBank Statement March - 2019Rowella De MesaNo ratings yet

- Dumaguete Cathedral Credit Coop VS CirDocument2 pagesDumaguete Cathedral Credit Coop VS CirJuris Formaran100% (2)

- Statement 2023 1Document5 pagesStatement 2023 1ArmaanNo ratings yet

- BOC Main Branch ContactDocument3 pagesBOC Main Branch ContactshakecokeNo ratings yet

- National Bank of PakistanDocument27 pagesNational Bank of Pakistansara243910% (1)

- Excel Financial Formulas: Future ValueDocument4 pagesExcel Financial Formulas: Future ValueAsad MuhammadNo ratings yet

- Balance SheetDocument2 pagesBalance SheetAbdul Samad ButtNo ratings yet

- Form 16 SV PDFDocument2 pagesForm 16 SV PDFPravin HireNo ratings yet

- 2 (A) Case Study-Istisna NewDocument20 pages2 (A) Case Study-Istisna Newafshi1850% (2)

- How To Trade It For Serious Profit (Even If You're A Complete Beginner)Document124 pagesHow To Trade It For Serious Profit (Even If You're A Complete Beginner)Johannes CajegasNo ratings yet

- Cerulli Asset Management in Southeast Asia 2012 Info PacketDocument13 pagesCerulli Asset Management in Southeast Asia 2012 Info PacketHaMy TranNo ratings yet

- G.R. No. 159709Document6 pagesG.R. No. 159709Delsie FalculanNo ratings yet

- On May 31 2015 Reber Company Had A Cash BalanceDocument1 pageOn May 31 2015 Reber Company Had A Cash BalanceAmit PandeyNo ratings yet

- Tables: Calculators: Approved Calculators May Be Used. Stationary: Yellow Answer BookletDocument9 pagesTables: Calculators: Approved Calculators May Be Used. Stationary: Yellow Answer BookletMinh LeNo ratings yet

- Conceptual Framework Quiz 2Document2 pagesConceptual Framework Quiz 2AcissejNo ratings yet

- International Banking ConsolidationDocument30 pagesInternational Banking ConsolidationAkshay AggarwalNo ratings yet

- Bank Islam Malaysia BHD v. Lim Kok Hoe & Anor and Other AppealsDocument19 pagesBank Islam Malaysia BHD v. Lim Kok Hoe & Anor and Other AppealsAlae KieferNo ratings yet

- KeemekDocument3 pagesKeemekAshwani KhandelwalNo ratings yet