Professional Documents

Culture Documents

DEAI Release, May 2018

Uploaded by

WDET 101.9 FM0 ratings0% found this document useful (0 votes)

973 views1 pageHere is the Detroit Economic Activity Index, produced by the Federal Reserve Bank of Chicago, Detroit branch

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentHere is the Detroit Economic Activity Index, produced by the Federal Reserve Bank of Chicago, Detroit branch

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

973 views1 pageDEAI Release, May 2018

Uploaded by

WDET 101.9 FMHere is the Detroit Economic Activity Index, produced by the Federal Reserve Bank of Chicago, Detroit branch

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Embargoed for release: Surve

3:00 pm Eastern Time

The Chica

2:00 pm Central Time

The Detroit Economic Activity Index suggestin

April 19, 2017

The CFSB

May 1, 2018 Contact: Activity In

Laura LaBarbera •

Resp

Media Relations optim

The Detroit Economic Activity Index measures growth in economic activity Federal Reserve

for the city Bank of Chicago

of Detroit. The index for th

312-322-2387

is constructed using a mixed-frequency dynamic factor model of 23 Detroit-specific data series capturing income, and t

employment, residential and commercial real estate activity, electric customer counts, tax revenues, and port activity. presi

What is the Survey of Business Conditions? auto

It is calibrated so that Detroit’s historical growth trend (average) equals zero, meaning that an index value greater than

To support its Beige Book efforts, the

zero implies the city’s economic activity is growing faster than trend and, conversely, a value

Chicago less information

Fed gathers than zerofrom implies

its its • The p

businessunits

contacts usingtrend

an online survey

hiring

activity is growing slower than trend. The index is then measured in standard deviation from growth.

system. Respondents are asked to rate • The p

various aspects of business conditions

Detroit Economic Activity Index of ca

along a seven-point scale ranging from

“substantially increased” to “substantially capit

(standard deviations from trend) rema

decreased.” A series of diffusion indexes

The Detroit Economic Activity Index was +1.04

summarizing the distribution of responses • The w

in February 2018, indicating growth above

is then calculated.

2 trend. Over the past year, the index has aver- index

How are the indexes constructed?

aged +0.67, above its long-run average. Activ

Respondents’ answers on the seven-point

0 scale are assigned a numeric value ranging

75

from +3 to –3. Each diffusion index is

calculated as the difference between the

−2 number of respondents with answers 50

above their respective average responses

and the number of respondents with

Averages

answers below their respective average 25

−4

Current

responses,Previous

divided by the total number12-months

3-months of

respondents. The index is then multiplied 0

+1.04 +0.60 +0.26 +0.67

−6 by 100 so that it ranges from +100 to

1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 −100 and will be +100 if every respondent

provides an above-average answer and -25

–100 if every respondent provides a below-

Current Data (February 2018) average answer. Respondents with no prior

-50

history of responses are excluded from

the calculation.

Series Contribution Historical Range The index can be decomposed into the contribu- -75

What

tions from do the

each numbers mean?

component data series such that 2013

City Income Tax +0.01 Respondents’ respective average answers

the sum of the contributions results in the cur-

Income

Consumer Expenditures 0.00 to a question can be interpreted as repre-

rent value of the index. The contributions com- Manufac

DTE C&I Customer Count 0.00 senting their historical trends or long-run

bine what a given

averages. Thus,series indicates

zero index for the De-

values indicate 75

DTE Residential Customer Count -0.05

troit economy and how related that series is to

that, on balance, activity, hiring, capital

Per Capita Income 0.00

spending, of

other measures or cost pressures

economic are growing

activity. at that

Series 50

Employment +1.36 are moretheir trend rates

closely or that

related outlooks

to other are neutral. re-

components

Labor

Labor Force Participation Rate 0.00 ceive a Positive index values

larger weight indicate

in the index above-average

and will have

growth (or optimistic outlooks) on balance, 25

Unemployment -0.25 larger contributions to the current index value.

and negative values indicate below-average

Weekly Hours Worked 0.00

growth (orrange

The historical pessimistic outlooks)

indicates howon balance.

strong the 0

Building Permits 0.00 current contribution of a series is relative to its

City Property Tax 0.00 history. A contribution to the far right of its

-25

Commercial Construction 0.00 range indicates the strongest reading from a se-

Commercial Leasing 0.00 ries since nextwhile

The1998 CFSBC a contribution to the far left

will be released: -50

Real Estate

Condo Sales 0.00 indicates the weakest reading.

Home Sales +0.01

May 31, 2017

3:00 pm Eastern Time

Median Condo Price +0.01 -75

Median Home Price -0.02

2:00 pm Central Time 2013

Net Absorption CRE 0.00 Notes:

firms th

Non-office Rents +0.01 similar

terms,

Office Rents 0.00 growth

Vacancy Rate CRE 0.00 The Detroit Economic Activity Index is a re-

search project of the Federal Reserve Bank of

Trade

Exports -0.03

Chicago. For more information, contact Paul

Imports 0.00

Traub: paul.traub@chi.frb.org.

You might also like

- Mental Health Across The Criminal Legal ContinuumDocument24 pagesMental Health Across The Criminal Legal ContinuumWDET 101.9 FMNo ratings yet

- Infographic - Michigan School Finance at The Crossroads: A Quarter Century of State ControlDocument1 pageInfographic - Michigan School Finance at The Crossroads: A Quarter Century of State ControlWDET 101.9 FMNo ratings yet

- Did The Past Economic Recovery Result in Shared Prosperity?Document33 pagesDid The Past Economic Recovery Result in Shared Prosperity?WDET 101.9 FMNo ratings yet

- Greens RecipeDocument2 pagesGreens RecipeWDET 101.9 FMNo ratings yet

- NTSB Preliminary Report On Arizona FatalityDocument4 pagesNTSB Preliminary Report On Arizona FatalityWDET 101.9 FMNo ratings yet

- Marathon Application and Variance RequestDocument43 pagesMarathon Application and Variance RequestWDET 101.9 FMNo ratings yet

- Lake Erie Harmful Algal Bloom Early ProjectionDocument1 pageLake Erie Harmful Algal Bloom Early ProjectionWDET 101.9 FMNo ratings yet

- Asian Carp Control MeasuresDocument2 pagesAsian Carp Control MeasuresWDET 101.9 FMNo ratings yet

- Algae Bloom Forecast 5/23/19Document1 pageAlgae Bloom Forecast 5/23/19WDET 101.9 FMNo ratings yet

- 2019 Combined BracketsDocument2 pages2019 Combined BracketsWDET 101.9 FMNo ratings yet

- Bell Pepeprs RecipeDocument2 pagesBell Pepeprs RecipeWDET 101.9 FMNo ratings yet

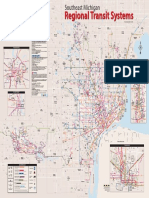

- 2014 Regional System MapDocument1 page2014 Regional System MapWDET 101.9 FMNo ratings yet

- 2019 Wayne County Road ScheduleDocument7 pages2019 Wayne County Road ScheduleWDET 101.9 FMNo ratings yet

- Residential Road Program Introduction 2019Document6 pagesResidential Road Program Introduction 2019WDET 101.9 FMNo ratings yet

- PFAS in Drinking WaterDocument2 pagesPFAS in Drinking WaterWDET 101.9 FMNo ratings yet

- Lake Erie Bill of RightsDocument3 pagesLake Erie Bill of RightsWDET 101.9 FMNo ratings yet

- Black GarlicDocument2 pagesBlack GarlicWDET 101.9 FMNo ratings yet

- Detroit Census MapDocument1 pageDetroit Census MapWDET 101.9 FMNo ratings yet

- What's Fresh: Sweet Corn SoupDocument2 pagesWhat's Fresh: Sweet Corn SoupWDET 101.9 FMNo ratings yet

- Pickled Summer SquashDocument2 pagesPickled Summer SquashWDET 101.9 FMNo ratings yet

- Winter 2018-19 OutlookDocument6 pagesWinter 2018-19 OutlookWDET 101.9 FMNo ratings yet

- IRS Tax Reform Basics For Individuals 2018Document14 pagesIRS Tax Reform Basics For Individuals 2018WDET 101.9 FMNo ratings yet

- WDET's Preschool BallotDocument1 pageWDET's Preschool BallotWDET 101.9 FMNo ratings yet

- Jim Hines DJC Interview TranscriptDocument15 pagesJim Hines DJC Interview TranscriptWDET 101.9 FMNo ratings yet

- Shri Thanedar DJC Interview TranscriptDocument12 pagesShri Thanedar DJC Interview TranscriptWDET 101.9 FMNo ratings yet

- Gretchen Whitmer DJC Interview TranscriptDocument15 pagesGretchen Whitmer DJC Interview TranscriptWDET 101.9 FMNo ratings yet

- Patrick Colbeck DJC Interview TranscriptDocument14 pagesPatrick Colbeck DJC Interview TranscriptWDET 101.9 FMNo ratings yet

- Brian Calley DJC Interview TranscriptDocument14 pagesBrian Calley DJC Interview TranscriptWDET 101.9 FMNo ratings yet

- Abdul El-Sayed DJC Interview TranscriptDocument18 pagesAbdul El-Sayed DJC Interview TranscriptWDET 101.9 FMNo ratings yet

- Voters Not Politicians ProposalDocument8 pagesVoters Not Politicians ProposalWDET 101.9 FMNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Municipal bond yieldsDocument2 pagesMunicipal bond yieldsDaniyal AliNo ratings yet

- Selection of Warehouse LocationDocument79 pagesSelection of Warehouse Locationlatifah 6698No ratings yet

- Impact of Globalization On Indian EconomyDocument32 pagesImpact of Globalization On Indian EconomyAbhijeet Kulshreshtha88% (24)

- Fiscal Policy of Pakistan MCQs For FPSC Inspector Inland Revenue Test Set 1Document2 pagesFiscal Policy of Pakistan MCQs For FPSC Inspector Inland Revenue Test Set 1Abdul hafeezNo ratings yet

- HowTo TDS 88 India in SAP B1Document89 pagesHowTo TDS 88 India in SAP B1Satish Prabhakar DokeNo ratings yet

- How To Create Your Own Paycheck Stub TemplateDocument1 pageHow To Create Your Own Paycheck Stub TemplatePaycheck Stub TemplatesNo ratings yet

- KushalDocument1 pageKushalKushal SinghalNo ratings yet

- Dr. Reddy's - 900011757Document1 pageDr. Reddy's - 900011757srinivaskurellaNo ratings yet

- Review 2Document3 pagesReview 2Tracy LeeNo ratings yet

- Strategies to Increase Advertising Tax Revenue in Bogor DistrictDocument16 pagesStrategies to Increase Advertising Tax Revenue in Bogor DistrictZulNo ratings yet

- Taco 0088166061500044Document1 pageTaco 0088166061500044Sourav ChakrabortyNo ratings yet

- LEC03D BSA 2102 012021-Government GrantsDocument2 pagesLEC03D BSA 2102 012021-Government GrantsKatarame LermanNo ratings yet

- Chapter 13 Managerial AccountingDocument168 pagesChapter 13 Managerial AccountingChandler Schleifs100% (4)

- Chapter 10-Financial Reporting in Public SectorDocument22 pagesChapter 10-Financial Reporting in Public SectorRifky Kesuma100% (2)

- Mis Proposal Ay 2019 2020Document15 pagesMis Proposal Ay 2019 2020Emmanuel Duria CaindecNo ratings yet

- Dimma HoneyDocument9 pagesDimma HoneyAnonymous h2hxB1No ratings yet

- Bir Ruling No. 013-05Document3 pagesBir Ruling No. 013-05Anonymous gyYqhBhCvsNo ratings yet

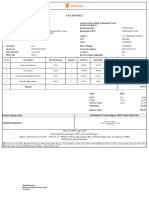

- AC InvoiceDocument1 pageAC Invoicek.rganthNo ratings yet

- Gift TaxDocument3 pagesGift TaxBiswas LitonNo ratings yet

- Ligj Nr. 34, Dt. 17.6.2019 Ligji I Ri - EN (1) OkDocument15 pagesLigj Nr. 34, Dt. 17.6.2019 Ligji I Ri - EN (1) OkEgiNo ratings yet

- Tax Integration CookbookDocument76 pagesTax Integration CookbookM.Medina100% (1)

- 3Document26 pages3JDNo ratings yet

- Difference Between Indian and United State tXATION SystemDocument8 pagesDifference Between Indian and United State tXATION SystemamitNo ratings yet

- Herald 1st Sem Issue School Year 2013-2014Document20 pagesHerald 1st Sem Issue School Year 2013-2014Anabel Quinto Sta CruzNo ratings yet

- Financial Services: An OverviewDocument13 pagesFinancial Services: An OverviewKarthick KumarNo ratings yet

- Ratio Analysis of PIADocument16 pagesRatio Analysis of PIAMalik Saad Noman100% (5)

- Epayments Import TemplateDocument6 pagesEpayments Import TemplateMohammad MohsinNo ratings yet

- Lesson 15: TaxationDocument2 pagesLesson 15: TaxationMa. Luisa RenidoNo ratings yet

- Andrew Bradley, Positive Rights, Negative Rights and Health CareDocument5 pagesAndrew Bradley, Positive Rights, Negative Rights and Health CareBonNo ratings yet

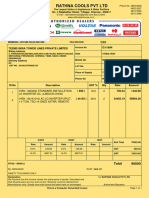

- Sanket SafetyDocument1 pageSanket SafetyManoj GaikwadNo ratings yet