Professional Documents

Culture Documents

933 2916 1 SM PDF

Uploaded by

afreenessaniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

933 2916 1 SM PDF

Uploaded by

afreenessaniCopyright:

Available Formats

Research

Research Impact of Macroeconomic Indicators on Different . . .

IMPACT OF MACROECONOMIC

INDICATORS ON DIFFERENT

CAPITAL MARKETS IN PAKISTAN

Bilal Nafees1, Faisal Javaid2 & Muhammad Ali Jibran Qamar3

Abstract

This research is about determining the relationship of macro-

economic variables with different capital market indices of Pakistan.

Therefore, for this purpose ARDL (Autoregressive Distributed Lagged

Model) approach to co-integration has been applied to determine

the long run relationship and Toda-Yamamoto causality test to

determine the uni-directional relationship. It is found that the impact

of different macro-economic variables is not exactly the same on

different capital market indices. According to ARDL results, Money

supply (M2) and GDP has positive significant, whereas discount rate

has negative significant impact on KSE100 index.In case of Lahore

stock exchange, none of the macroeconomic variable has significant

impact on LSE25 index. According to the results of Toda-Yamamoto

causality, only inflation has causal relationship with KSE100 and

LSE25 index.

Keywords: Macroeconomic Indicators, Capital Market Indices, Unit

Root Test, Co-integration and Toda-Yama Moto Causality.

JEL Classification: M 210

1-Management Sciences Department, University of Education, Lahore, Pakistan

2-Management Sciences Department, University of Gujra t, Sialkot Campus,

Pa kistan

3-Department of Management Sceinces, COMSATS Institute of Informa tion

Technology, Lahore, Pakistan

577 PAKISTAN BUSINESS REVIEW OCT 2016

Impact of Macroeconomic Indicators on Different . . . Research

Introduction

Capital markets are an essential part of economy of any

country. The capital markets play a critical role in the development

and growth of the financial and non-financial sectors. It ultimately

affects the country’s economy to great extent. Therefore, government,

industrial sector, central bank of the country and the most important

regulators keep close eye on the activities of the capital markets.

The common relationship between the capital market growth

and fluctuations in the national economy was observed long-ago.

Whenever, capital market of country performs well it leaves a positive

impact on economic outlook of the country.

However, deteriorating market share prices can hinder the

ability of company to raise finance from capital markets. Such

companies that are with attractive high share price and wish to expand

through raising equity, often do so by issuing more common stocks,

in this way companies borrow at low cost. Conversely, it turn out to

be much more problematic for such companies that have less attractive

and deteriorating share prices as well.

The capital markets are considered as basis of business

investment because companies offer new shares to finance investment

thus leads to more jobs and economic growth. The capital markets are

also considered as basis of equity financing. However, Capital market

that fluctuates continuously can create a huge impact over economy.

During the last one-and-half decade Rs, 1 trillion has been

raised by the corporate sector in the form of debt and equity through

the capital markets. Out of this 20 percent has been raised by the

Government of Pakistan via privatization through capital markets.4

4-www.kse.com.pk

PAKISTAN BUSINESS REVIEW OCT 2016 578

Research Impact of Macroeconomic Indicators on Different . . .

The investors base stand at just around 250,000 since 1948

in Pakistan. This is too small as compare to Bangladesh, Turkey and

Iran,in which over one and six million Investors are registered with

capital markets respectively5. Therefore, in Pakistan there is a need to

increase investors base because narrow investors not only cause

market volatility and low liquidity but also make the price discovery

mechanism inefficient. The narrow investor base also discourages

the companies that have the potential to be listed on capital markets

because such companies feel that listing might deprive them from the

incentive to raise long-term capital.

Capital market performance is a basic attribute for economic

growth because decline in capital market index pushes economy in

depression while vice versa contributes in economic development.

Capital market indices are statistical measures to determine the state

of the capital market for stakeholders. However, during last two

decades, researchers have put emphasis on the importance of efficient

capital markets because researchers have found that better governed

capital market lays positive impact on economic growth.

At present, in Pakistan, there are three recognized capital

markets. Amongst allcapital markets, Karachi Stock Exchange (KSE)

is the largest in terms of both market capitalization and operations.

The KSE started its operations in 1949. At the time of inauguration, it

was having 54 members and 13 companies were listed. The paid up

capital was Rs. 110 million. As time passes, the KSE remain flourished

and by the end of late nineties registered companies had reached up

to 200 with paid up capital Rs. 18.8 billion. In 2008,increase in number

of registered companies had reached up to 653 that was highest in

history. In 2013, total number of listed companies in KSE were 569

with 5,153,173.78 billion of market capitalization. The second large

capital market of Pakistan is Lahore stock exchange (LSE). The

inauguration of LSE had taken place in 1971 with a vision to widen the

5-http://customstoday.com.pk/

579 PAKISTAN BUSINESS REVIEW OCT 2016

Impact of Macroeconomic Indicators on Different . . . Research

investment base, to develop and flourished capital market in Punjab.

Mostly companies that are listed in LSE are those that are also listed

in KSE.

The literature about macro-economic variables and stock

prices is well establish in developed countries using modern data sets

as well as econometric techniques. On the contrary, such literature is

very limited in thr context of Pakistan. This paper extends the existing

literature in three dimension. We explored literature gap, how different

macro-economic variables could have an impact on both capital markets

of Pakistani.e. KSE, LSE. Whereas, the previous studies have just

focused on KSE.As the impact of macroeconomic variables on capital

markets is well establish in developed economies. Therefore, it is

important to know that whether in developing country like Pakistan

macroeconomic changes should be incorporated while making

investment decision for capital markets or not. Second, this study is

different because of the unique data set used in this study. Third, this

paper follows modern econometric techniques that overcome

shortcomings of time series data.The research objective is to identify

the impact of macro-economic variables (Discount Rate, Money Market

Rate,T-bills Rate,Real Exchange Rate, Money Supply, Inflation and

GDP (Gross Domestic Product), on capital market index of KSE and

LSE.

Literature Review

In Pakistan,the mac-economic variables granger cause the

movement of stock prices (Nishat, Shaheen et al. 2004). Changes in

interest rate, exchange rate and money supply have impact on the

stock prices in the short run in Pakistan(Hasan and Nasir 2008). Stock

market prices have been found an important indicator of

economy(Sohail and Hussain 2009). The causal relationship does not

exist between macro-economic indicators and stock prices(Ali, Rehman

et al. 2010). Macro-economic variables are significant to explain stock

prices return in emerging equity market(Bilson, Brailsford et al.

PAKISTAN BUSINESS REVIEW OCT 2016 580

Research Impact of Macroeconomic Indicators on Different . . .

2001).There exist significant long run relationship between macro-

economic variables and stock prices in Pakistan (Hussain, Aamir et al.

2012).The monetary policy has positive and significant impact on

stock prices in Pakistan(Qayyum and Anwar 2011).Aggressive supply

of money and low interest rates are beneficial for investors and they

prefer stocks over bonds(Mishkin 2001). Capital market liberalization

has long-term positive impact on growth of economy. Whereas,

private investment has a positive impact on capital market in short

run for developed countries(Benson Durham 2002).Inflation do not

impact stock prices, monetary policy that ensures stock price stability

may have beneficial impact on capital markets (Cassola and Morana

2004). Macroeconomic indicators and capital market indices have

stable dependence in the long and the short run (Nishat and Shaheen

2004).

Three important factor economic growth, foreign portfolio

investment and financial liberalization policies have significant impact

on capital market development(El-Wassal 2005).

Gross domestic product, interest rate, money supply these

indicators have sound connection with capital market

performance(Binswanger 2001), (Laopodis 2007), (Agrawalla and

Tuteja 2007) and (Padhan 2007).

Tight monetary policy declines the stock market capitalization

and stock prices are considerably interest rate sensitive. Therefore,

interest rate should be considered as an important information while

forecasting the stock prices. (Ioannidis and Kontonikas 2008).In Africa

0.6 %increase in capital market development is caused through

development in financial intermediary sector (Yartey 2008).

The lending rates on bank deposit money have adverse

impact on performance of stock market. Inflation impacts negatively

the stock market performance in Ghana(Kyereboah-Coleman and

Agyire-Tettey 2008). In the long run, consumer price index, exchange

581 PAKISTAN BUSINESS REVIEW OCT 2016

Impact of Macroeconomic Indicators on Different . . . Research

rate, Treasury bill rate, and foreign direct investment cointegrate with

stock market prices. Whereas, consumer price index and exchange

rate movement matter in the short run to predict stock prices

movement(Adam and Tweneboah 2008).

It is found via Johansen co-integration testthat

macroeconomic indicators have significant impact on the capital market

performance in long run. Differences in monetary and fiscal policies

among different countries reported multiple effects of macroeconomic

indicators on the capital market indices performance(Pilinkus 2010).It

is important to think through fiscal and monetary policies while

understanding the relationship between capital market performance

and macroeconomic policies (Chatziantoniou, Duffy et al. 2013).

Research Methodology

Data collection

Data of selected for macro-economic variables has been take

from the International financial statistics (IFS) developed by

International Monetary Fund (IMF) except Gross Domestic Product

(GDP) data. GDP data developed by Pakistan Institute of Development

Economics (PIDE) on quarterly basis has been used. The data of

KSE100 index and LSE25 index has been collected from khistocks

database developed by business recorder Pakistan and from website

of Lahore stock exchange respectively. The collected data is on

quarterly basis ranging from 2000-2015, therefore giving maximum

sixty-four observations. Results of Unit root test, causality and Co-

integration have been obtained using E-Views and Micro fit software

respectively.

Different Stationarity Tests

The data inherits time series characteristics. Therefore, it is

necessary to check the level of stationarity to avoid spurious results.

PAKISTAN BUSINESS REVIEW OCT 2016 582

Research Impact of Macroeconomic Indicators on Different . . .

So, different unit root tests that have been applied to check

stationarity of the time series data, namely are, Augmented Dickey

Fuller (ADF), Augmented Dickey-Fuller Generalized Least Square Test

(ADF-GLS), Phillips-Perron (PP) and NG Perron test. All these tests

have been applied with intercept and intercept & trend only. A time

series data will be known as stationary time series, if its means and

variances are constant over the time and covariance between two

time periods not depends on the actual time lag for which the

covariance is computed. Following are the three properties of such

time series data that is stationary.

E(Xt) = Expected value of Xt for all t is constant

Var (Xt) = Variance of Xt for all value of t is constant

Cov (Xt,, Xt+k) = the covariance for all t and k ‘“ 0 is

constant

The first test that has been applied to check the stationarity of

time series data is known as ADF test. This test was developed by

Dickey and Fuller in 1979. In this test, independent variable is extra

lag of dependent variable. ADF test has been applied considering

two cases i.e. with intercept and trend & intercept.

∆ = + −1 + −1 + € … … … (1)

=1

∆ = + Ϋ + −1 + −1 + € … . (2)

=1

Further, decision relating to the acceptance and rejection of

null hypothesis will be made on the basis of critical values given by

(McKinnon 1991).

The second test to check unit root stationarity is ADF-GLS

test. This test was developed by (Elliott, Rothenberg et al. 1996). This

test is similar to augmented dickey fuller test except in one aspect. In

583 PAKISTAN BUSINESS REVIEW OCT 2016

Impact of Macroeconomic Indicators on Different . . . Research

this test, before performing it, the time series is transformed through

generalized least squares regression. This test is considered more

powerful than the augmented dickey fuller test.

The third test to check unit root stationarity is Phillips-Perron

test. This test was proposed by(Phillips and Perron 1988). This test is

the modification of augmented dickey fuller test. Therefore, in this

approach of unit root test, some mild assumptions were considered

with dickey fuller test. PP test considers fewer restrictions to remove

serial correlation as compare to ADF test. The critical values of this

test were developed by (McKinnon 1991).

The fourth test to check unit root stationarity is NG Perron

test.NG Perron test was developed by (Ng and Perron 1995). In this

unit root test, four dissimilar test statistics have been developed. This

test is actually the modification of (Phillips and Perron 1988) test. The

procedure of selecting the lag length in this test ensures stable results

and minimum loss of power. This is the main advantage of using this

test.

ARDL Approach to Co-integration

ARDL stands for autoregressive distributed lagged model.

This approach first time was propose by (Pesaran and Pesaran 1997)

and (Pesaran and Shin 1998). Then, advance form of this approach to

co-integration was proposed by (Pesaran, Shin et al. 2001). This

approach is considered appropriate if the dependent variable is

integrated of I(1). Further, if some of the independent variables have

order of integration I(0) and some of the independent variables have

order of integration I(1) in context of stationarity of the time series

then ARDL approach to co-integration is considered appropriate.

ARDL approach to co-integration eliminates the problem of

endogeneity. ARDL approach to co-integration assumes that given

time series is a function of current and it’s lagged and lagged values

of one or more given explanatory variables. Many studies have proved

PAKISTAN BUSINESS REVIEW OCT 2016 584

Research Impact of Macroeconomic Indicators on Different . . .

that ARDL approach to co-integration is better as compare to

conventional approach to co-integration such as: (Engle and Granger

1987); (Johansen 1988), (Johansen-Juselius1990), (Gregory and

Hansen 1996; Saikkonen and Lütkepohl 2000). Sample set of this

study has sixty-four number of observations and this approach to

co-integration is better if data set consists of (30-80) observations.

Toda-Yamamoto Causality

Toda-Yamamoto test is applied to check the causal

relationship. This approach was proposed by Toda and Yamamoto

(1995). Further, enhancement was brought by Rambaldi and Doran

(1996), Zapata and Rambaldi (1997) and (Nishiya, Toda et al. 1998).

This approach is better over conventional error correction model.

While applying this causality test modified Wald restrictions are

applied to obtain results. The lag length is determined using schwartz

criterion. While applying Toda-Yamamoto test, it is not necessary to

check the co-integration as prerequisite amongst all variables. In this

testχ2-distribution is followed when VAR (k + dmax) is applied for

estimation. In VAR (k + dmax), k is maximum lag length, this will be

determine using schwartz criterion and dmax is the maximum order of

integration observed in the given data set. Having determined the (k

+ dmax), system equation is written for each variable. Then, seemingly

unrelated regression (SUR) is applied using system equation. SUR

takes care of the possible simultaneous unbiased, this is considered

one of the prime advantage of using SUR.

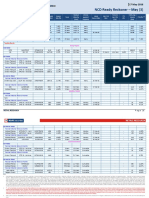

Table.1 shows the results of unit root tests determined

through ADF and ADF-GLS test along with critical values of tests. As

far as ADF test results are concerned, money supply and inflation is

stationary at level only with intercept. Inflation is also stationary at

level with trend & intercept. Unlike to this the discount rate, money

market rate, T-bills rate and real exchange rate have been found

stationary with intercept and trend & intercept at first difference.

585 PAKISTAN BUSINESS REVIEW OCT 2016

Impact of Macroeconomic Indicators on Different . . . Research

Results and Discussion

Table.1

Dickey-Fuller Generalized Least Square Test

Augmented Dickey-Fuller Test (ADF)

(DF-GLS)

At level At first Difference At level At first Difference

Trend& Trend& Trend& Trend&

Variables Intercept Intercept Intercept Intercept

Intercept Intercept Intercept Intercept

Panel A

Discount -

-1.867 -1.957 -4.394*** -4.351*** -1.880 -1.968 -4.440***

Rate 4.439***

Money MKT - - -

-1.684 -2.092 -1.637 -2.089 -9.455***

Rate 10.350*** 10.243*** 8.630***

-

T-Bills Rate -1.800 -1.958 -4.004*** -3.954** -1.793 -2.022 -3.983***

3.763***

Real

-

Exchange -2.285 -2.739 -6.023*** -6.164*** -1.898 -2.232 -5.155***

4.631***

Rate

Money -

-2.795* -1.558 -7.256*** -1.219 -2.163 -4.884***

Supply( M2) 3.830***

-

Inflation -2.768* -3.701** -2.460**

3.792***

GDP -1.391 -0.753 -2.207 -2.346 -0.702 -1.244 -2.211** -2.434

Panel B

KSE100 -

-0.301 -1.779 -5.611*** -5.579*** 0.395 -1.828 -5.581***

Index 5.396***

LSE 25 -

-1.489 -1.595 -7.124*** -7.085*** -0.748 -1.582 -7.127***

Index 7.030***

Test Critical Values

At 1% -3.568 -4.152 -3.577 -4.165 -2.612 -3.77 -2.615 -3.77

At 5% -2.921 -3.502 -2.925 -3.508 -1.947 -3.19 -1.947 -3.19

At 10% -2.598 -3.18 -2.606 -3.184 -1.947 -2.89 -1.612 -2.89

***, **,* Indicates significance level at 1%, 5% and 10% respectively.

Money Supply is also stationary with trend & intercept at

first difference. GDP is not stationary, neither at level nor at first

difference with intercept and trend & intercept. Further, KSE100 index

and LSE25 index both have been found stationary at first difference

with intercept and trend & intercept. According to ADF-GLS results,

scenario is slightly different. Inflation is the only variable that is

stationary at level with both intercept and trend & intercept. Rest of

the other variables are found stationary at first difference. GDP is

stationary at first difference only with intercept. Moreover, KSE100

index and LSE25 index are stationary at first difference.

PAKISTAN BUSINESS REVIEW OCT 2016 586

Research Impact of Macroeconomic Indicators on Different . . .

Table.2

Phillips-Perron Test (PP)

At level At first Difference

Trend & Trend &

Variables Intercept Intercept

Intercept Intercept

Panel A

Disco unt Rate -1.586 -1.668 -4.394** -4.351***

-

Money MKT Rate -1.545 -2.002 -10.046***

10.147***

T-Bills Rate -1.416 -1.715 -4.036*** -4.045***

Real Exchange -2.366 -2.564 -5.783*** -5.928***

Rate

Money Supply M2 -2.719* -2.536 -5.333***

Inflation -1.857 -1.957 -3.771*** -3.766**

GDP -0.887 -0.925 -2.091 -2.206

Panel B

KSE100 Index -0.301 -2.128 -5.636*** -5.607***

LSE 25 Index -1.489 -1.605 -7.124** -7.085***

Test Critical Values

At 1% -3.565 -4.148 -3.568 -4.153

At 5% -2.919 -3.500 -2.921 -3.502

At 10% -2.597 -3.179 -2.599 -3.181

***, **,* Indicates significance level at 1%, 5% and 10% respectively.

The above table conferring the results of PP test. The M2 is

stationary at level only with intercept. All other variables are stationary

at first difference with intercept and trend & intercept. M2 is also

stationary at first difference with trend & intercept. Whereas, GDP is

not stationary at level and first difference with both intercept and

trend & intercept. The KSE100 and LSE25 results show that both are

stationary at first difference with intercept and trend & intercept.

587 PAKISTAN BUSINESS REVIEW OCT 2016

Impact of Macroeconomic Indicators on Different . . . Research

Table.3

NG-Perron Test

MZα MZt MSB MPT

Deterministic terms Deterministic terms Deterministic terms Deterministic terms

Variables c t,c c t,c c t,c c t,c

Ng-Perron at Level

Panel A

Discount Rate -8.089 -9.270 -1.993 -2.106 0.246 0.2 27 3.095 10.018

Money MKT

-4.917 -7.685 -1.560 -1.917 0.317 0.2 49 5.000 11.960

Rate

T-Bills Rate -6.588 -9.870 -1.809 -2.195 0.274 0.2 22 3.736 9.347

Real

Exchange -6.172 -7.694 -1.752 -1.939 0.283 0.2 52 3.983 11.896

Rate

Money Supply

-2.641 -9.329 -1.028 -2.159 0.389 0.2 31 8.795 9.766

M2

- -

Inflation -12.657** -2.513** 0.198** 0.113*** 1.943** 2.791***

37.666*** 4.270***

GDP -1.017 -13.429 -0.490 -2.483 0.482 0.1 85 15.005 7.394

Panel B

KSE100 Index 1 .026 -6.252 0.570 -1.712 0.556 0.2 73 26.399 14.552

LSE 25 Index -1.264 -4.578 -0.607 -1.507 0.480 0.3 29 14.172 19.862.

Ng-Perron at First Differences

Panel A

- -

Discount Rate -21.210** -3.223** 0.147*** 0.151** 1.254*** 4.497**

22.432*** 3.301***

Money MKT - -

-23.070** -3.386** 0.128*** 0.146** 0.976*** 4.009**

Rate 29.358*** 3.786***

- -

T-Bills rate -18.797** -3.006** 0.168*** 0.159** 1.567*** 5.207**

17.225*** 2.895***

Real

- -

Exchange -20.152** -3.149** 0.153*** 0.156** 1.545*** 4.671**

19.965*** 3.068***

Rate

Money Supply - -

-20.397** -3.180** 0.175*** 0.155** 1.734*** 4.547**

M2 14.385*** 2.673***

GDP -9.826** -10.795 -2.024** -2.155 0.206** 0.2 00 3.120** 9.247

Panel B

- - - -

KSE100 Index 0.145*** 0.143*** 1.235*** 3.878***

23.040*** 23.952*** 3.343*** 3.448***

- - - -

LSE 25 Index 0.141*** 0.140*** 0.990*** 3.618***

24.969*** 25.202*** 3.530*** 3.549***

Test Critical Values At

1% -13.8 -23.8 -2 .58 -3.42 0.17 0.14 1.78 4.03

5% -8.1 -17.3 -1 .98 -2.91 0.23 0.17 3.17 5.48

10% -5.7 -14.2 -1 .62 -2.62 0.27 0.18 4.45 6.67

***, **,* Indicates significance level at 1%, 5% and 10% respectively. c means that test is been applied only with

intercept and c,t means that test is been applied considering both trend & intercept.

The above table exhibits results of unit root obtained from

NG-Perron test. As per results of NG-Perr on test, only inflation is

stationary at level with intercept and trend & intercept. All other

variables are stationary with intercept and trend & intercept at first

difference except GDP. GDP is stationary only with intercept at first

difference.

PAKISTAN BUSINESS REVIEW OCT 2016 588

Research Impact of Macroeconomic Indicators on Different . . .

Table.4

Order of Integration

Variables ADF DF-GLS PP NG-

PERRON

Trend & Trend & Trend & Trend &

Intercept Intercept Intercept Intercept

Intercept Intercept Intercept Intercept

Discount

Rate

D(Discount

I(1) I(1) I(1) I(1) I(1) I(1) I(1) I(1)

Rate)

Money

MKT Rate

D(Money

I(1) I(1) I(1) I(1) I(1) I(1) I(1) I(1)

MKT Rate)

T-Bills rate

D(T-Bills

I(1) I(1) I(1) I(1) I(1) I(1) I(1) I(1)

rate)

Real

Exchange

Rate

D(Real

Exchange I(1) I(1) I(1) I(1) I(1) I(1) I(1) I(1)

Rate)

Money

I(0) I(0)

Supply M2

D(Money I(1) I(1) I(1) I(1) I(1) I(1)

Supply M2)

Inflation I(0) I(0) I(0) I(0) I(0) I(0)

D(Inflation) I(1) I(1)

GDP

D(GDP) I(1)

KSE100

Index

D(KSE100 I(1) I(1) I(1) I(1) I(1) I(1) I(1) I(1)

Index)

LSE 25

Index

D(LSE 25

I(1) I(1) I(1) I(1) I(1) I(1) I(1) I(1)

Index)

A summary of unit root results regarding order of integration

The above table contains the order of integration of all

variables along with KSE100 and LSE25 index. I(0) means that series

is stationary at level and I(1) means that time series is stationary at

first difference. NG-Perron results have been taken into consideration

for further calculations.

589 PAKISTAN BUSINESS REVIEW OCT 2016

Impact of Macroeconomic Indicators on Different . . . Research

Table.5

Dependent Variable is KSE100 Index selected based on Schwarz

Bayesian Criterion

Regressors Coefficient T-Stats Standard Error Probability

INPT -32.05 -6.529 4.9095 [.000]

Discount Rate -0.524 -3.032 0.172 [.004]

Money MKT Rate -0.006 -0.058 0.112 [.953]

T -Bills rate -0.018 -0.17 0.106 [.865]

Real E xchange Rate 0.124 0.295 0.421 [.769]

Money Supply M2 0.208 2.381 0.087 [.022]

Inflation 0.002 0.05 0.052 [.960]

GDP 4.085 6.568 0.621 [.000]

R-Squared .987 R-Bar Squared .985

D-W statistics 2.275 F-Stat. 411.908

Table.5 contains results of long run co-efficient of

independent variables with KSE100 index. Discount rate, money market

rate and T-bills rate have negative relationship with KSE100 index but

only discount rate is statistically significant. Whereas, real exchange

rate, money supply, inflation and GDP have positive relationship with

KSE100 index but Money supply and GDP are the only variables whose

relationship is statistically significant.

Table.6 contains results of independent variables with LSE25

index. Direction of relationship of independent variables with the LSE25

index is different from the results of KSE100 index. Discount rate and

real exchange rate have negative relationship with LSE25 index but

only discount rate is statistically significant. Whereas, money market

rate, T-bills rate, real exchange rate, money supply, inflation and GDP

have positive relationship with LSE25 index but none of the

independent variables have statistically significant relationship.

PAKISTAN BUSINESS REVIEW OCT 2016 590

Research Impact of Macroeconomic Indicators on Different . . .

Table.6

Dependent Variable is LSE 25 Index selected based on Schwarz

Bayesian Criterion

Regressors Coefficient T-Stats Standard Error Probability

INPT 4.016 0.002 [.000]

Discount Rate -0.503 -2.31 0.217 [.026]

Money MKT Rate 0.028 0.207 0.137 [.837]

T-Bills Rate 0.033 0.263 0.128 [.794]

Real Exchange Rate -0.322 -0.643 0.500 [.524]

Money Supply M2 0.177 1.646 0.108 [.107]

Inflation 0.002 0.040 0.065 [.968]

GDP 0.452 1.565 0.288 [.125]

R-Squared 0.981 R-Bar Squared 0.977

D-W statistics 2.275 F-Stat. 268.581

Toda Yama Moto Granger Causality

Table.7

Toda-Yamamoto Causality Test

Variables KSE100 LSE 25

Discount Rate

1.3788 0.8919

(0.2403) (0.3450)

Money MKT Rate

0.2565 0.0002

(0.6126) (0.9884)

T-Bills rate 1.3560 1.0699

(0.2442) (0.3010)

Real Exchange Rate

1.6567 0.1420

(0.1981) (0.7063)

Money Supply M2

0.0014 0.1420

(0.9702) (0.7063)

Inflat ion 19.8091*** 17.8544***

(0.0000) (0.0000)

GDP 0.4494 2.4254

(0.5026) (0.1194)

***, indicates signif icance of P-values at 1%, P-values

are available in parenthesis

591 PAKISTAN BUSINESS REVIEW OCT 2016

Impact of Macroeconomic Indicators on Different . . . Research

Results of uni-directional relationship of independent variables with

KSE100 and LSE25 determined through Toda-Yamamoto causality are

reported in the above table. The probability values of χ2-distribution

are given in parentheses. Only inflation has been found to cause the

KSE100 and LSE25 index. Except inflation, all variables do not cause

the KSE100 and LSE25 index.

Conclusion

In this research, an attempt has been made to drive the relationship

between macro-economic variables with different stock exchange

indices. As far as results of the long run coefficients are concerned,

discount rate is found statistically significant with KSE100 index and

the direction of relationship is opposite. Further, Money supply M2

and GDP have positive and significant relationship with the KSE100

index. On the contrary, in case of LSE25 index, discount rate is the

only variable which is found statically significant and relationship of

discount rate with LSE25 index is opposite as found in case of KSE100.

In case of uni-directional causal relationship, only inflation is causing

both KSE100 and LSE25 index. Therefore, only few macro-economic

variables have an impact on the capital markets. There is a strong

need of better economic policies to maximize benefits from all the

capital marks of Pakistan. Investors should not neglect the changes in

macro-economic variables while making decision of investment in

capital market.

Brown, Durbin Evan (1975), developed CUSUM and CUSUMSQ

test. This testis applied to check the stability of the model. As it

can be seen that plot of all figures are within the bounds, that

shows the stability of model.

PAKISTAN BUSINESS REVIEW OCT 2016 592

Research Impact of Macroeconomic Indicators on Different . . .

593 PAKISTAN BUSINESS REVIEW OCT 2016

Impact of Macroeconomic Indicators on Different . . . Research

References

Adam, A. and G. Tweneboah (2008). “Macroeconomic factors and

stock market movement: Evidence from Ghana.” Available at

SSRN 1289842.

Agrawalla, R. K. and S. Tuteja (2007). “Causality between stock market

development and economic growth: a case study of India.”

Journal of Management Research7(3): 158-168.

Ali, I., K. U. Rehman, et al. (2010). “Causal relationship between macro-

economic indicators and stock exchange prices in Pakistan.”

African Journal of Business Management4(3): 312.

Benson Durham, J. (2002). “The effects of stock market development

on growth and private investment in lower-income countries.”

Emerging Markets Review3(3): 211-232.

Bilson, C. M., T. J. Brailsford, et al. (2001). “Selecting macroeconomic

variables as explanatory factors of emerging stock market

returns.” Pacific-Basin Finance Journal9(4): 401-426.

Binswanger, M. (2001). “Does the stock market still lead real activity?—

An investigation for the G-7 countries.” Financial Markets and

Portfolio Management15(1): 15-29.

Cassola, N. and C. Morana (2004). “Monetary policy and the stock

market in the euro area.” Journal of Policy Modeling26(3): 387-

99.

Chatziantoniou, I., D. Duffy, et al. (2013). “Stock market response to

monetary and fiscal policy shocks: Multi-country evidence.”

Economic Modelling30: 754-769.

El-Wassal, K. A. (2005). “Understanding the growth in emerging stock

markets.” Journal of Emerging Market Finance4(3): 227-261.

Elliott, G., T. J. Rothenberg, et al. (1996). “Efficient tests for an

autoregressive unit root.” Econometrica: journal of the

Econometric Society: 813-836.

Engle, R. F. and C. W. Granger (1987). “Co-integration and error

correction: representation, estimation, and testing.”

Econometrica: journal of the Econometric Society: 251-276.

PAKISTAN BUSINESS REVIEW OCT 2016 594

Research Impact of Macroeconomic Indicators on Different . . .

Gregory, A. W. and B. E. Hansen (1996). “PRACTITIONERS CORNER:

Tests for Cointegration in Models with Regime and Trend

Shifts.” Oxford bulletin of Economics and Statistics58(3): 555-

560.

Hasan, A. and Z. M. Nasir (2008). “Macroeconomic factors and equity

prices: An empirical investigation by using ARDL approach.”

The Pakistan Development Review: 501-513.

Hussain, M. M., M. Aamir, et al. (2012). “The impact of macroeconomic

variables on stock prices: an empirical analysis of Karachi stock

exchange.” Mediterranean Journal of Social Sciences3(3): 295-

312.

Ioannidis, C. and A. Kontonikas (2008). “The impact of monetary

policy on stock prices.” Journal of Policy Modeling30(1): 33-

53.

Johansen, S. (1988). “Statistical analysis of cointegration vectors.”

Journal of economic dynamics and control12(2): 231-254.

Kyereboah-Coleman, A. and K. F. Agyire-Tettey (2008). “Impact of

macroeconomic indicators on stock market performance: The

case of the Ghana Stock Exchange.” Journal of Risk Finance,

The9(4): 365-378.

Laopodis, N. T. (2007). Fiscal policy, monetary policy, and the stock

market. Annual International Conference on Macroeconomic

Analysis and International Finance.

McKinnon, J. G. (1991). “Critical values for cointegration tests.” 1991),

Long-run Economic Relations, Oxford: 267-276.

Mishkin, F. S. (2001). The transmission mechanism and the role of

asset prices in monetary policy, National Bureau of Economic

Research.

Ng, S. and P. Perron (1995). “Unit root tests in ARMA models with

data-dependent methods for the selection of the truncation

lag.” Journal of the American Statistical Association90(429):

268-281.

595 PAKISTAN BUSINESS REVIEW OCT 2016

Impact of Macroeconomic Indicators on Different . . . Research

Nishat, M. and R. Shaheen (2004). “Macroeconomic Factors and

Pakistani Equity Market”.” The Pakistan Development

Review43(4): pp. 619–637.

Nishat, M., R. Shaheen, et al. (2004). “Macroeconomic Factors and the

Pakistani Equity Market [with Comments].” The Pakistan

Development Review: 619-637.

Nishiya, Y., A. Toda, et al. (1998). “Gene cluster for creatinine

degradation in Arthrobacter sp. TE1826.” Molecular and General

Genetics MGG257(5): 581-586.

Padhan, P. C. (2007). “The nexus between stock market and

economic activity: an empirical analysis for India.” International

Journal of Social Economics34(10): 741-753.

Pesaran, H. H. and Y. Shin (1998). “Generalized impulse response

analysis in linear multivariate models.” Economics letters58(1):

17-29.

Pesaran, M. H. and B. Pesaran (1997). Working with Microfit 4.0:

interactive econometric analysis, Oxford University Press.

Pesaran, M. H., Y. Shin, et al. (2001). “Bounds testing approaches to

the analysis of level relationships.” Journal of applied

econometrics16(3): 289-326.

Phillips, P. C. and P. Perron (1988). “Testing for a unit root in time

series regression.” Biometrika75(2): 335-346.

Pilinkus, D. (2010). “Macroeconomic indicators and their impact on

stock market performance in the short and long run: the case of

the Baltic States.” Technological and Economic Development

of Economy(2): 291-304.

Qayyum, A. and S. Anwar (2011). “Impact of Monetary Policy on the

Volatility of Stock Market in Pakistan.” International Journal of

Business and Social Science2(11).

Rambaldi, A. N. and H. E. Doran (1996). Testing for Granger Non-

casuality in Cointegrated Systems Made Easy, Department of

Econometrics, University of New England.

Saikkonen, P. and H. Lütkepohl (2000). “Testing for the cointegrating

rank of a VAR process with structural shifts.” Journal of business

& economic statistics18(4): 451-464.

PAKISTAN BUSINESS REVIEW OCT 2016 596

Research Impact of Macroeconomic Indicators on Different . . .

Sohail, N. and Z. Hussain (2009). “Long-run and short-run relationship

between macroeconomic variables and stock prices in Pakistan:

The case of Lahore Stock Exchange.” Pakistan Economic and

Social Review: 183-198.

Toda, H. Y. and T. Yamamoto (1995). “Statistical inference in vector

autoregressions with possibly integrated processes.” Journal

of econometrics66(1): 225-250.

Yartey, C. A. (2008). “The determinants of stock market development

in emerging economies: is South Africa different?” IMF

Working Papers: 1-31.

Zapata, H. O. and A. N. Rambaldi (1997). “Monte Carlo evidence on

cointegration and causation.” Oxford bulletin of Economics

and Statistics59(2): 285-298.

597 PAKISTAN BUSINESS REVIEW OCT 2016

You might also like

- Indian Stock Market and Investors StrategyFrom EverandIndian Stock Market and Investors StrategyRating: 3.5 out of 5 stars3.5/5 (3)

- Investment ArticleDocument15 pagesInvestment ArticleShabbir HussainNo ratings yet

- Macroeconomic Determinants of Stock Market Capitalization in An Emerging Market Fresh Evidence From Cointegration With Unknown Structural BreaksDocument26 pagesMacroeconomic Determinants of Stock Market Capitalization in An Emerging Market Fresh Evidence From Cointegration With Unknown Structural BreaksJEAN PIERRE RIVERA HUANUCONo ratings yet

- Relationship between stock volatility and macro variables in PakistanDocument21 pagesRelationship between stock volatility and macro variables in PakistanMuhammadIjazAslamNo ratings yet

- FDI and Stock Market DevelopmentDocument8 pagesFDI and Stock Market DevelopmentSyed Ali AhmedNo ratings yet

- Macroeconomic Variables Impact on Pakistan Stock PricesDocument9 pagesMacroeconomic Variables Impact on Pakistan Stock PricesBabar NawazNo ratings yet

- Pakistan Stock ExchangeDocument15 pagesPakistan Stock ExchangeHamza ShafiqNo ratings yet

- Impact of Interest Rate On Stock Market Evidence From Pakistani MarketDocument6 pagesImpact of Interest Rate On Stock Market Evidence From Pakistani MarketbadarNo ratings yet

- M NishatDocument22 pagesM NishatHameeda AkhtarNo ratings yet

- Literature Review: Stock Exchange & SEBI An Evolution in Indian Financial Market & Economy As A WholeDocument6 pagesLiterature Review: Stock Exchange & SEBI An Evolution in Indian Financial Market & Economy As A WholeRaghunath AgarwallaNo ratings yet

- Institute of Business Management: Seminar in Economic Polices Thesis Paper OnDocument19 pagesInstitute of Business Management: Seminar in Economic Polices Thesis Paper OnArsalan NadeemNo ratings yet

- 2 - Sentiment and ReturnsDocument22 pages2 - Sentiment and ReturnsZahra HafeezNo ratings yet

- An Evaluation of Investors' Behavior and Sentiments During Heavy Fluctuation in Stock Index A Case Study of Pakistan Stock ExchangeDocument11 pagesAn Evaluation of Investors' Behavior and Sentiments During Heavy Fluctuation in Stock Index A Case Study of Pakistan Stock Exchangejohn jamesNo ratings yet

- Topic: Introduction of Impact of Interest Rate On Stock MarketDocument9 pagesTopic: Introduction of Impact of Interest Rate On Stock MarketWaqas AliNo ratings yet

- D Manuscript (Kashif) ECOP D 21 00598Document22 pagesD Manuscript (Kashif) ECOP D 21 00598Muhammad Tauseef AnwarNo ratings yet

- My Publication, PJSS, CAL and InvestmentDocument10 pagesMy Publication, PJSS, CAL and InvestmentAtiq ur Rehman QamarNo ratings yet

- Jurnal Emi19718Document15 pagesJurnal Emi19718Joksa UnitedNo ratings yet

- The Impact of Macroeconomic Variables On Stock Prices in PakistanDocument10 pagesThe Impact of Macroeconomic Variables On Stock Prices in PakistanJosep CorbynNo ratings yet

- Macro Article ProjectDocument8 pagesMacro Article ProjectAli AzgarNo ratings yet

- Tax Revenue, Stock Market and Economic Growth of Pakistan: AbstractDocument9 pagesTax Revenue, Stock Market and Economic Growth of Pakistan: Abstractanon_795578451No ratings yet

- 4480-Article Text-10676-1-10-20210607Document6 pages4480-Article Text-10676-1-10-20210607Haris MirzaNo ratings yet

- Effect of Economic Variable On BricsDocument14 pagesEffect of Economic Variable On BricsPratikMasalkarNo ratings yet

- Sample Chapter 1Document9 pagesSample Chapter 1Surya RanaNo ratings yet

- Regression ModelDocument9 pagesRegression ModelDivya BhardwajNo ratings yet

- Stock Market Capitalization and Its Macroeconomic Determinants: An Empirical Investigation From Emerging EconomyDocument17 pagesStock Market Capitalization and Its Macroeconomic Determinants: An Empirical Investigation From Emerging Economytubanaz0213No ratings yet

- project reviewDocument13 pagesproject reviewsai pawanismNo ratings yet

- The Determinants of Stock Prices in PakistanDocument17 pagesThe Determinants of Stock Prices in PakistaneditoraessNo ratings yet

- Secondary Capital Market of Nepal: Assessing The Relationship Between Share Transaction and NEPSE IndexDocument10 pagesSecondary Capital Market of Nepal: Assessing The Relationship Between Share Transaction and NEPSE IndexSonam ShahNo ratings yet

- IJMRES 1 Paper Vol 7 No1 2017Document29 pagesIJMRES 1 Paper Vol 7 No1 2017International Journal of Management Research and Emerging SciencesNo ratings yet

- The Impact of Capital Market On Economic Growth: A Malaysian OutlookDocument7 pagesThe Impact of Capital Market On Economic Growth: A Malaysian OutlookMuhammad SalehNo ratings yet

- Foreign Capital Inflows and Stock Market Development in PakistanDocument10 pagesForeign Capital Inflows and Stock Market Development in PakistanSadaf KazmiNo ratings yet

- MPRA Paper 60791Document10 pagesMPRA Paper 60791Hameeda AkhtarNo ratings yet

- RechrpprDocument10 pagesRechrpprNiam MahmudNo ratings yet

- Pakistan's Economy & Financial MarketsDocument11 pagesPakistan's Economy & Financial MarketsXeeshan Bashir100% (1)

- The Impact of Macroeconomic Variables on Stock Market Returns in PakistanDocument7 pagesThe Impact of Macroeconomic Variables on Stock Market Returns in PakistanBabar NawazNo ratings yet

- MPRA Paper 55657 PDFDocument22 pagesMPRA Paper 55657 PDFKelyneNo ratings yet

- Reseach AssignmentDocument11 pagesReseach AssignmentShravan GuptaNo ratings yet

- Macroeconomic Variables and Stock Market Returns: Full Information Maximum Likelihood EstimationDocument16 pagesMacroeconomic Variables and Stock Market Returns: Full Information Maximum Likelihood EstimationJalal AhmadNo ratings yet

- Stock Market Crash in BangladeshDocument26 pagesStock Market Crash in BangladeshhrikilNo ratings yet

- Ijm 12 04 002Document7 pagesIjm 12 04 002IAEME PublicationNo ratings yet

- Dynamic of Exchange Rate Volatility and Capital InflowsDocument9 pagesDynamic of Exchange Rate Volatility and Capital InflowsFaisalAbbasNo ratings yet

- Impact of Exchange Rate On Stock Market: International Review of Economics & Finance January 2015Document5 pagesImpact of Exchange Rate On Stock Market: International Review of Economics & Finance January 2015Thanh NgânNo ratings yet

- Q:What Has Been The Effect of Creating Pakistan Stock Exchange in Place of ISE, LSE and KSE?Document3 pagesQ:What Has Been The Effect of Creating Pakistan Stock Exchange in Place of ISE, LSE and KSE?Rohail Khan NiaziNo ratings yet

- Does Stock Market Development Cause Economic Growth? A Time Series Analysis For Bangladesh EconomyDocument9 pagesDoes Stock Market Development Cause Economic Growth? A Time Series Analysis For Bangladesh EconomyPushpa BaruaNo ratings yet

- Effects of Macroeconomic Variables on Stock Returns in PakistanDocument7 pagesEffects of Macroeconomic Variables on Stock Returns in PakistanHafeez KhanNo ratings yet

- Foreign Portfolio Flows and Their Impact On Financial Markets in IndiaDocument22 pagesForeign Portfolio Flows and Their Impact On Financial Markets in IndiaAdarsh KumarNo ratings yet

- Impact of Economic Policy Uncertainty and Macroeconomic Factors On Stock Market Volatility - Evidence From Islamic IndicesDocument10 pagesImpact of Economic Policy Uncertainty and Macroeconomic Factors On Stock Market Volatility - Evidence From Islamic Indicesisna lisaNo ratings yet

- Causes and Consequences of Trade Deficit in PakistanDocument11 pagesCauses and Consequences of Trade Deficit in PakistanMaham SajjadNo ratings yet

- The_relationship_between_political_instability_andDocument14 pagesThe_relationship_between_political_instability_andCyclop StarNo ratings yet

- OTD Research About MARKET RETURNSDocument9 pagesOTD Research About MARKET RETURNSObaid R.No ratings yet

- CHAPTER 1 Sample For Thesis ProposalDocument6 pagesCHAPTER 1 Sample For Thesis ProposalAnonymous H8b371UnNo ratings yet

- Towards AnDocument17 pagesTowards AnShofa AbdullahNo ratings yet

- Investment in Financial Securities in India Since GlobalisationDocument10 pagesInvestment in Financial Securities in India Since GlobalisationrajatNo ratings yet

- Analyzing The Impact of Financial Market On Economic Growth: Evidence From PakistanDocument12 pagesAnalyzing The Impact of Financial Market On Economic Growth: Evidence From PakistanIAEME PublicationNo ratings yet

- The Stock Market and The Economy in PakistanDocument8 pagesThe Stock Market and The Economy in PakistanHannah NazirNo ratings yet

- 10 1108 - Jeas 03 2013 0011Document19 pages10 1108 - Jeas 03 2013 0011ANUBHA SRIVASTAVA BUSINESS AND MANAGEMENT (BGR)No ratings yet

- Impact of Inflation On Stock Prices PakistanDocument6 pagesImpact of Inflation On Stock Prices PakistanmanzarNo ratings yet

- SSRN Id2342128Document15 pagesSSRN Id2342128Thảo KiềuNo ratings yet

- Capital Market ReformsDocument150 pagesCapital Market ReformsShahid Mehmood100% (1)

- Impact of Inflation and Its Effects On Karachi Stock Exchange (Kse)Document9 pagesImpact of Inflation and Its Effects On Karachi Stock Exchange (Kse)Anonymous uY667INo ratings yet

- Case Study SolutionDocument6 pagesCase Study Solutionafreenessani100% (2)

- Research Exam Sample QuestionDocument11 pagesResearch Exam Sample QuestionAnna Dominique RomuloNo ratings yet

- Financial Management Pilot Exam QuestionsDocument24 pagesFinancial Management Pilot Exam QuestionsafreenessaniNo ratings yet

- Sample Chapter PDFDocument10 pagesSample Chapter PDFafreenessaniNo ratings yet

- Effects of Economic Indicators on Financial MarketsDocument6 pagesEffects of Economic Indicators on Financial MarketsafreenessaniNo ratings yet

- High-Low Method ER PDFDocument8 pagesHigh-Low Method ER PDFafreenessaniNo ratings yet

- MIT15 401F08 FinalDocument29 pagesMIT15 401F08 FinalfloatingbrainNo ratings yet

- ECON252 Final PracticeExam PDFDocument11 pagesECON252 Final PracticeExam PDFafreenessaniNo ratings yet

- Diversification PDFDocument1 pageDiversification PDFafreenessaniNo ratings yet

- F3 Specimen Exam 2014 PDFDocument21 pagesF3 Specimen Exam 2014 PDFgrrrklNo ratings yet

- Lanen 3e: Chapter 8 Process Costing Practice QuizDocument12 pagesLanen 3e: Chapter 8 Process Costing Practice QuizafreenessaniNo ratings yet

- High-Low Method CR PDFDocument11 pagesHigh-Low Method CR PDFafreenessaniNo ratings yet

- Cost-Volume-Profit Analysis: in BriefDocument42 pagesCost-Volume-Profit Analysis: in Briefanshgoel62100% (1)

- Ho3 1Document3 pagesHo3 1afreenessaniNo ratings yet

- Robinson Lawn Chair CompanyDocument3 pagesRobinson Lawn Chair CompanymmmmmmmmmmmmmmmNo ratings yet

- Quiz Chapter 4 Solutions Process Costing MethodsDocument7 pagesQuiz Chapter 4 Solutions Process Costing MethodsRinokukunNo ratings yet

- variance accounting PQ MCQsDocument1 pagevariance accounting PQ MCQsafreenessaniNo ratings yet

- Horngren ch03 PDFDocument40 pagesHorngren ch03 PDFNaveed Mughal AcmaNo ratings yet

- Budgeting and Profit Planning CR PDFDocument27 pagesBudgeting and Profit Planning CR PDFafreenessaniNo ratings yet

- Lanen 3e: Chapter 8 Process Costing Practice QuizDocument12 pagesLanen 3e: Chapter 8 Process Costing Practice QuizafreenessaniNo ratings yet

- Robinson Lawn Chair CompanyDocument3 pagesRobinson Lawn Chair CompanymmmmmmmmmmmmmmmNo ratings yet

- Ho3 1Document3 pagesHo3 1afreenessaniNo ratings yet

- Karachi University Cost Accounting Exam ReviewDocument18 pagesKarachi University Cost Accounting Exam ReviewAzeem MajeedNo ratings yet

- Cost-Volume-Profit Analysis: in BriefDocument42 pagesCost-Volume-Profit Analysis: in Briefanshgoel62100% (1)

- Karachi University Cost Accounting Exam ReviewDocument18 pagesKarachi University Cost Accounting Exam ReviewAzeem MajeedNo ratings yet

- Mutual Funds ExplainedDocument3 pagesMutual Funds ExplainedafreenessaniNo ratings yet

- Quiz Chapter 4 Solutions Process Costing MethodsDocument7 pagesQuiz Chapter 4 Solutions Process Costing MethodsRinokukunNo ratings yet

- Paper Chromatography MSDocument23 pagesPaper Chromatography MSafreenessaniNo ratings yet

- Title Page of PCDocument2 pagesTitle Page of PCafreenessaniNo ratings yet

- Chief Financial Officer in San Francisco Bay CA Kevin BerryDocument2 pagesChief Financial Officer in San Francisco Bay CA Kevin BerryKevinBerry1No ratings yet

- Group structure analysisDocument3 pagesGroup structure analysisKamaruzzaman MohdNo ratings yet

- FI504 Case Study 1Document17 pagesFI504 Case Study 1Scott SmithNo ratings yet

- 2011 Houlihan Lokey PPA Study PDFDocument49 pages2011 Houlihan Lokey PPA Study PDFSoloUnico100% (1)

- Dundee Securities - Focus On The Juniors - PDAC2011Document140 pagesDundee Securities - Focus On The Juniors - PDAC2011sirgalNo ratings yet

- RR 1-98Document9 pagesRR 1-98Crnc NavidadNo ratings yet

- Profitable Trading Secrets: Lessons from a Decade of TradingDocument31 pagesProfitable Trading Secrets: Lessons from a Decade of TradingIrene Salvador100% (2)

- Introduction to Derivatives: Risk Management, Trading Efficiency and ParticipantsDocument82 pagesIntroduction to Derivatives: Risk Management, Trading Efficiency and Participantskware215No ratings yet

- Outsource Partners InternationalDocument95 pagesOutsource Partners Internationalbharat100% (1)

- All FormulaDocument7 pagesAll FormulaLeeshNo ratings yet

- Syllabus Private Equity Spring MGMT E2790 2013Document8 pagesSyllabus Private Equity Spring MGMT E2790 2013eruditeaviatorNo ratings yet

- An Appraisal of Grameen Mutual Fund 12Document9 pagesAn Appraisal of Grameen Mutual Fund 12Saikat PaulNo ratings yet

- Top AA+ rated tax-free bonds under 15 yearsDocument3 pagesTop AA+ rated tax-free bonds under 15 yearsumaganNo ratings yet

- Financial Performance of Rinl Using Financial Ratios and Comparision With Tata, Sail and JSWDocument6 pagesFinancial Performance of Rinl Using Financial Ratios and Comparision With Tata, Sail and JSWNIHANTH MALAPATINo ratings yet

- Law ExamDocument13 pagesLaw Examraj5720No ratings yet

- 20 Basic Accounting Terms List For Preparation of PPSC, FPSC & NTS Tests - Government Jobs & Private Jobs in Pakistan 2018Document3 pages20 Basic Accounting Terms List For Preparation of PPSC, FPSC & NTS Tests - Government Jobs & Private Jobs in Pakistan 2018Dustar Ali HaideriNo ratings yet

- Demat AccountDocument4 pagesDemat AccountNIHARIKA AGARWALNo ratings yet

- A Comparison of Mean-Variance and Mean-Semivariance Optimisation On The JseDocument10 pagesA Comparison of Mean-Variance and Mean-Semivariance Optimisation On The JseRodolpho Cammarosano de LimaNo ratings yet

- QUANTITATIVE STRATEGIES RESEARCH NOTES GADGETSDocument43 pagesQUANTITATIVE STRATEGIES RESEARCH NOTES GADGETSHongchul HaNo ratings yet

- Consumer Financing in Pakistan Issues & Challenges - PROJECTDocument88 pagesConsumer Financing in Pakistan Issues & Challenges - PROJECTFarman Memon100% (1)

- LATAM AIRLINES GROUP S A 09-2012 (Inglés)Document172 pagesLATAM AIRLINES GROUP S A 09-2012 (Inglés)chequeadoNo ratings yet

- Setting An Audit StrategyDocument14 pagesSetting An Audit Strategyhassanjamil123No ratings yet

- MANABIK Pension Scheme Provides Rs 1000 Monthly AidDocument8 pagesMANABIK Pension Scheme Provides Rs 1000 Monthly AidpriyamdawnNo ratings yet

- Financial Markets Meaning, Types and WorkingDocument15 pagesFinancial Markets Meaning, Types and WorkingRainman577100% (1)

- Transfer of Ownership PackageDocument12 pagesTransfer of Ownership PackageMichael Schulte100% (4)

- International Valuation Standards - 2020 MCQDocument18 pagesInternational Valuation Standards - 2020 MCQNikhil Tidke100% (2)

- Instructions / Checklist For Filling KYC FormDocument22 pagesInstructions / Checklist For Filling KYC FormRohit JadhavNo ratings yet

- Mutual Funds NotesDocument3 pagesMutual Funds NotesSrivani AlooruNo ratings yet

- Buyers PacketDocument10 pagesBuyers PacketMark Coppola100% (2)

- International Capital BudgetingDocument28 pagesInternational Capital BudgetingMatt ToothacreNo ratings yet