Professional Documents

Culture Documents

Problem I Perpetual Inventory System Date Accounts Debit Credit

Uploaded by

Joe Nathaniel Arrieta0 ratings0% found this document useful (0 votes)

20 views2 pagesExample of Journal Entries for Inventory

Original Title

Work7

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentExample of Journal Entries for Inventory

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views2 pagesProblem I Perpetual Inventory System Date Accounts Debit Credit

Uploaded by

Joe Nathaniel ArrietaExample of Journal Entries for Inventory

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Student’s Last Name 1

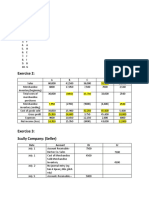

Problem I

Perpetual Inventory System

Date Accounts Debit Credit

July 6 Inventory 1500

Accounts Payable 1500

July 8 Accounts Payable 400

Inventory 400

July 9 Inventory 90

Cash 90

July 19 Accounts Receivable 3500

Sales 3500

Cost of Goods Sold 700

Inventory 700

July 20 Sales Return 300

Accounts Receivable 300

Inventory 90

Cost of Goods Sold 90

July 21 Cash 3136

Sales Discount 64

Accounts Receivable 3200

Accounts Payable 1100

Cash 1067

Inventory 33

Problem II

Periodic Inventory System

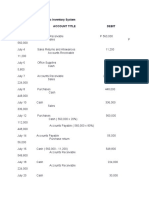

Date Accounts Debit Credit

July 6 Purchases 1500

Accounts Payable 1500

July 8 Accounts Payable 400

Purchase Returns and Allowances 400

Student’s Last Name 2

July 9 Freight-in 90

Cash 90

July 19 Accounts Receivable 3500

Sales 3500

July 20 Sales Return 300

Accounts Receivable 300

July 21 Cash 3136

Sales Discount 64 3200

Accounts Receivable

Accounts Payable 1100

Cash 1067

Purchase Discount 33

Problem III

Using FIFO

Total Cost of Goods Sold

May 10 Sales 400 units

From May 1 Purchases 380 units @ $15 $5,700

From May 5 Purchases 20 units @ $17 $340

May 25 Sales 400 units

From May 5 Purchases 250 units @ $17 $4,250

From May 20 Purchases 150 units @ $22 $3,300

Total Cost of Goods Sold $13,590

Cost of Ending Inventory

From May 20 Purchases

Remaining 150 units @ $22 = $3300

You might also like

- Anastasya Apriliani 008201705017 - POA CH5&6Document8 pagesAnastasya Apriliani 008201705017 - POA CH5&6Anas TasyaNo ratings yet

- Homework 3Document3 pagesHomework 3Gon OutNo ratings yet

- I. SOAL TEORI (Bobot 20) : Inventory. (Bobot 5) Multiple Step Income StatementDocument6 pagesI. SOAL TEORI (Bobot 20) : Inventory. (Bobot 5) Multiple Step Income Statementsyafaatun munajahNo ratings yet

- Perpetual Inventory System Periodic Inventory System Date Account Debit Credit Account Debit CreditDocument9 pagesPerpetual Inventory System Periodic Inventory System Date Account Debit Credit Account Debit CreditTariq MehmoodNo ratings yet

- Group 5Document3 pagesGroup 5Thuy DuonggNo ratings yet

- Syllabus AnswerDocument24 pagesSyllabus AnswerasdfNo ratings yet

- Screenshot 2024-02-26 at 11.45.41 at NightDocument2 pagesScreenshot 2024-02-26 at 11.45.41 at Nightsara.ran.0459No ratings yet

- Fundamentals of Accountancy, Business and Management 1 (Q4W5-7)Document6 pagesFundamentals of Accountancy, Business and Management 1 (Q4W5-7)tsuki100% (1)

- Eva Cammayo Supply Company Journal Entry May 2021 Agnes Ramos Company Journal Entry May 2021Document7 pagesEva Cammayo Supply Company Journal Entry May 2021 Agnes Ramos Company Journal Entry May 2021Stephen ReloxNo ratings yet

- Date Particular Debit Credit: Ans To The Question No - 1Document8 pagesDate Particular Debit Credit: Ans To The Question No - 1Abdul AhadNo ratings yet

- Tugas Minggu Ke-6 Adifa Shofiya Zulfa 454777Document3 pagesTugas Minggu Ke-6 Adifa Shofiya Zulfa 454777Adifa Shofiya ZulfaNo ratings yet

- Transactions For JulyDocument5 pagesTransactions For JulyJohn Austria100% (2)

- Acc. Prac. Set Group 5Document34 pagesAcc. Prac. Set Group 5Mary Grace SolisNo ratings yet

- Tutorial #3 - Group 5 - PA1 - MarkedDocument8 pagesTutorial #3 - Group 5 - PA1 - MarkedThanh NguyenNo ratings yet

- BibDocument2 pagesBibVivian TamerayNo ratings yet

- HOSP1210 Chapter8extraDocument4 pagesHOSP1210 Chapter8extraMonica AtizadoNo ratings yet

- Tutorial 1. FA2Document11 pagesTutorial 1. FA2bolaemil20No ratings yet

- Ricardo Pangan Company General Journal For The Month of January 2021 Date Accounts Receivable Debit CreditDocument14 pagesRicardo Pangan Company General Journal For The Month of January 2021 Date Accounts Receivable Debit CreditTiamzon Ella Mae M.No ratings yet

- Group 4 AVM-ANS - SHEETDocument31 pagesGroup 4 AVM-ANS - SHEETMary Grace SolisNo ratings yet

- Asistensi 2Document2 pagesAsistensi 2CatherineNo ratings yet

- Exercises For Unit 4 Inventory ValuationDocument3 pagesExercises For Unit 4 Inventory ValuationDr. Mohammad Noor AlamNo ratings yet

- Discussion Guide - Chapter 6 RevisedDocument6 pagesDiscussion Guide - Chapter 6 RevisedKhoi NguyenNo ratings yet

- Course 1Document5 pagesCourse 1Lalaine Joyce PardiñasNo ratings yet

- Exercise 20 21 22Document12 pagesExercise 20 21 22Jap MonteirosNo ratings yet

- Trial Balance SolutionDocument4 pagesTrial Balance SolutionUppertuition FridayNo ratings yet

- Cover Page: Name: ID: SubjectDocument6 pagesCover Page: Name: ID: SubjectMuhammad Yaseen LakhaNo ratings yet

- Accounting 5Document5 pagesAccounting 5SCRIBDerNo ratings yet

- Assigment 9Document5 pagesAssigment 9WinaNo ratings yet

- Steven's Trading Account For The Month: WorkingsDocument5 pagesSteven's Trading Account For The Month: WorkingsAndrei PrunilaNo ratings yet

- Mid Term Review AnswersDocument12 pagesMid Term Review AnswersManasi ChitnisNo ratings yet

- Assignment To Solve AnsweredDocument3 pagesAssignment To Solve AnsweredLorena HoffmannNo ratings yet

- Fra Midterm Question Pgexp 2023Document2 pagesFra Midterm Question Pgexp 2023Sarvesh MishraNo ratings yet

- 20181209080307Document6 pages20181209080307Fadhli Rianata KusumaNo ratings yet

- Accounting For Merchandising Operations ExercisesDocument4 pagesAccounting For Merchandising Operations ExercisesthachuuuNo ratings yet

- Account TitlesDocument8 pagesAccount TitleskdjasldkajNo ratings yet

- Bookkeepping Bsba CompanyDocument3 pagesBookkeepping Bsba CompanyLovely Rose GuinilingNo ratings yet

- Business Math (Excel)Document6 pagesBusiness Math (Excel)mobinil1No ratings yet

- Sales Journal Purcase Journal Cash Receipt Journal Cash Disbursement Journal General JournalDocument15 pagesSales Journal Purcase Journal Cash Receipt Journal Cash Disbursement Journal General JournalNathalia Alexandra PagulayanNo ratings yet

- Sy Capital 39000: 1 or 2 Pages Yellow PadDocument12 pagesSy Capital 39000: 1 or 2 Pages Yellow PadChristian Dale CalderonNo ratings yet

- Date Transactions Perpetual Inventory System Periodic Inventory SystemDocument4 pagesDate Transactions Perpetual Inventory System Periodic Inventory SystemBetina Maxine MendozaNo ratings yet

- Problem SolvingDocument14 pagesProblem SolvingJericho EncarnacionNo ratings yet

- Day 5 QuizDocument15 pagesDay 5 QuiznimnimNo ratings yet

- P5 3aDocument4 pagesP5 3aTrang Quynh DinhNo ratings yet

- Spring 2023 - MGT101 - 1 - SOLDocument3 pagesSpring 2023 - MGT101 - 1 - SOLAyesha SajidNo ratings yet

- Inventory Costing ScheduleDocument7 pagesInventory Costing Schedulelala gasNo ratings yet

- Soal UAS 2015.2016 KajianDocument4 pagesSoal UAS 2015.2016 Kajiansyafaatun munajahNo ratings yet

- Acc Unit-5-AnswersDocument5 pagesAcc Unit-5-AnswersGeorgeNo ratings yet

- Jan Mark Castillo - BSA 1 Chapter-6-Business-Transactions-And-Their-AnalysisDocument8 pagesJan Mark Castillo - BSA 1 Chapter-6-Business-Transactions-And-Their-AnalysisJan Mark CastilloNo ratings yet

- P5-3BDocument6 pagesP5-3BGiang HoàngNo ratings yet

- (IFA 10) - Rendy Filiang - 1402210324Document12 pages(IFA 10) - Rendy Filiang - 1402210324RENDY FILIANGNo ratings yet

- ACT 201 AssignmentDocument4 pagesACT 201 AssignmentTamzid IslamNo ratings yet

- Jawaban & Latihan UAS AKDAS 1Document15 pagesJawaban & Latihan UAS AKDAS 1Cindy Tri WidiaNo ratings yet

- Pilaps & VilsDocument15 pagesPilaps & VilsGwendolyn PansoyNo ratings yet

- Excersice 3 Aliaga Alexa May S. AbulDocument1 pageExcersice 3 Aliaga Alexa May S. Abul48pgcw62kkNo ratings yet

- Problem 5Document42 pagesProblem 5aliyah1999hajNo ratings yet

- Taran Fabm Assignment 2Document4 pagesTaran Fabm Assignment 2Christoper TaranNo ratings yet

- Home Control Work - Variant 10 - Le Duc Tuan Minh - IFF18-3kDocument15 pagesHome Control Work - Variant 10 - Le Duc Tuan Minh - IFF18-3kMinh LêNo ratings yet

- ACCA104 - Inventory Cost FlowDocument13 pagesACCA104 - Inventory Cost FlowAnaluz Cristine B. CeaNo ratings yet

- Exercise 13-4 Date Accounts Debit CreditDocument2 pagesExercise 13-4 Date Accounts Debit CreditJoe Nathaniel ArrietaNo ratings yet

- MERGEDocument10 pagesMERGEJoe Nathaniel ArrietaNo ratings yet

- Motion and Types of MotionDocument15 pagesMotion and Types of MotionLudy LynNo ratings yet

- China BankDocument10 pagesChina BankJoe Nathaniel ArrietaNo ratings yet

- Fin PlantersDocument3 pagesFin PlantersJoe Nathaniel ArrietaNo ratings yet

- Fin Financial ImpactDocument3 pagesFin Financial ImpactJoe Nathaniel ArrietaNo ratings yet

- Prinz Magtulis (The Philippine Star) - Updated September 7, 2016 - 12:00amDocument2 pagesPrinz Magtulis (The Philippine Star) - Updated September 7, 2016 - 12:00amJoe Nathaniel ArrietaNo ratings yet

- FoodsDocument1 pageFoodsJoe Nathaniel ArrietaNo ratings yet

- Punnettsquarelesson PDFDocument6 pagesPunnettsquarelesson PDFJoe Nathaniel ArrietaNo ratings yet

- Turkmenistan o TurkmeniaDocument3 pagesTurkmenistan o TurkmeniaJoe Nathaniel ArrietaNo ratings yet

- Business CommunicationDocument19 pagesBusiness CommunicationJoe Nathaniel ArrietaNo ratings yet

- JOLLIBEEDocument14 pagesJOLLIBEEJoe Nathaniel Arrieta67% (3)

- Answer Key 6Document7 pagesAnswer Key 6Joe Nathaniel ArrietaNo ratings yet

- Object-Oriented Analysis and Modeling Using The Uml: Mcgraw-Hill/IrwinDocument48 pagesObject-Oriented Analysis and Modeling Using The Uml: Mcgraw-Hill/IrwinJadesh ChandaNo ratings yet

- BacteriasDocument2 pagesBacteriasJoe Nathaniel ArrietaNo ratings yet

- Bidcoro - Fi - BBP - V1 0 - 23.05.16Document73 pagesBidcoro - Fi - BBP - V1 0 - 23.05.16Srinivas YakkalaNo ratings yet

- Fundamentals of Accounting 1 Draft PDFDocument78 pagesFundamentals of Accounting 1 Draft PDFyumira khateNo ratings yet

- Account Receivable ManagemntDocument12 pagesAccount Receivable ManagemntmehmuddaNo ratings yet

- Final Revised FM 1. Procedure Manual V18-010715 - FMS UpdateDocument138 pagesFinal Revised FM 1. Procedure Manual V18-010715 - FMS UpdateZekarias AsgidomNo ratings yet

- JT Merchandise Navasquez (Periodic)Document14 pagesJT Merchandise Navasquez (Periodic)John cook100% (1)

- DocxDocument352 pagesDocxsino akoNo ratings yet

- Financial Ratio AnalysisDocument80 pagesFinancial Ratio AnalysisAppleCorpuzDelaRosaNo ratings yet

- 1AA3 Practice Final PDFDocument19 pages1AA3 Practice Final PDFLucas KrennNo ratings yet

- Substantive Tests of Receivables and SalesDocument8 pagesSubstantive Tests of Receivables and SalesMa Tiffany Gura RobleNo ratings yet

- All Formats To Be Used For Pearson Edexcel Igcse Accounting Year 10 Final Exams Aug 2022Document13 pagesAll Formats To Be Used For Pearson Edexcel Igcse Accounting Year 10 Final Exams Aug 2022Noor Waqas100% (1)

- Dispute MGMT Config GuideDocument64 pagesDispute MGMT Config Guidervmvenkat92% (25)

- 01 - Accounting For Trades and Other ReceivablesDocument5 pages01 - Accounting For Trades and Other ReceivablesCatherine CaleroNo ratings yet

- Financial StatementsDocument6 pagesFinancial StatementsLuiNo ratings yet

- Soal Homework Chapter 12 (Set B) TM 3-4Document3 pagesSoal Homework Chapter 12 (Set B) TM 3-4gandhunkNo ratings yet

- Journalize The Following Transactions That Occurred in January 2016 For PDFDocument1 pageJournalize The Following Transactions That Occurred in January 2016 For PDFhassan taimourNo ratings yet

- Financial Ratio Analysis ProblemDocument6 pagesFinancial Ratio Analysis ProblemMaribel ZafeNo ratings yet

- Questions 2nd BatchDocument41 pagesQuestions 2nd BatchSachie BeltejarNo ratings yet

- Intermediate AccountingDocument12 pagesIntermediate AccountingLeah BakerNo ratings yet

- Sap FI NotesDocument46 pagesSap FI NotesPrasad PunupuNo ratings yet

- Accounting For InventoriesDocument11 pagesAccounting For InventoriesAllyssa A.No ratings yet

- Financial Accounting Ii Sample QuizDocument2 pagesFinancial Accounting Ii Sample QuizThea FloresNo ratings yet

- CashFlow With SolutionsDocument82 pagesCashFlow With SolutionsHermen Kapello100% (2)

- Accounting Information Systems Global 14th Edition Romney Solutions ManualDocument15 pagesAccounting Information Systems Global 14th Edition Romney Solutions Manualkris mNo ratings yet

- Ratio. AnalysisDocument72 pagesRatio. AnalysisRaveendhar.S -MCANo ratings yet

- Analysis of Financial StatementsDocument33 pagesAnalysis of Financial StatementsKushal Lapasia100% (1)

- 3 Midterm A - AnswerDocument12 pages3 Midterm A - AnswerAllison0% (1)

- Chapter 03 - The Accounting Cycle: Capturing Economic EventsDocument143 pagesChapter 03 - The Accounting Cycle: Capturing Economic EventsElio BazNo ratings yet

- Exercise ProjectDocument3 pagesExercise ProjectHassenNo ratings yet

- ACG2071 Managerial AccountingDocument40 pagesACG2071 Managerial AccountingJadeNo ratings yet

- Adjustments Quiz 1 - Answer KeyDocument7 pagesAdjustments Quiz 1 - Answer KeyAngelie JalandoniNo ratings yet