Professional Documents

Culture Documents

Tax Matrix

Uploaded by

Julo R. TaleonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Matrix

Uploaded by

Julo R. TaleonCopyright:

Available Formats

CORPORATIONS/INSTITUTIONS/ INCOME REAL PROPERTY DONOR’S TAX ESTATE TAX VAT LOCAL TAX CUSTOMS DUTIES

ASSOCIATIONS TAX TAX Sec.234 Sec.101 A (3) Sec.87 D Sec.105 3rd par. Sec.193 RA7160 RA10863 Sec.800

RA7160

Charitable - Sec. 30(E) NIRC Actually CARTER-CPS × × ×

Directly *Charitable *Charitable

Exclusively *Accredited *Social

non-govt org. *Cultural

Religious - Sec. 30(E) NIRC *provided; land, *Research × × × ×

building, institution

Non-Stock/Profit Educational

improvements *Trust × ×

Institution - Art. 14 par.4 (3) Consti.

ADE used *Educ.(Non- *Cooperatives *Consti. Art. 14

Stock/profit) *Non-Stock/Profit par.4 (3)

*incidental *Religious Hospitals and

facilities are no *Cultural Educational

longer covered *Philanthropic institutions

by ADE (Lung *Social *Water Districts

Government Educational Center v. Rosas) × - 0% ×

Institution - Sec. 30(I) NIRC *not more *RA9500 Sec. *RA9500 Sec. 25(c)

than 30% shall 25(d)

be used for -UP Charter of

admin. 2008

purposes

*nature of

organization is

immaterial

*sale of

goods/services

- Exempt with regularity

× - Taxable or habituality

You might also like

- SEC Cover SheetDocument1 pageSEC Cover Sheetlito7769% (35)

- 2015 EnP Board Reviewer - Cid JacoboDocument53 pages2015 EnP Board Reviewer - Cid JacoboRhoderic M. AbacheNo ratings yet

- E13.2 (LO 1) (Accounts and Notes Payable) The Following Are Selected 2022 Transactions ofDocument4 pagesE13.2 (LO 1) (Accounts and Notes Payable) The Following Are Selected 2022 Transactions ofChupa HesNo ratings yet

- Acknowledgement Receipt-BirDocument1 pageAcknowledgement Receipt-BirJulo R. Taleon100% (1)

- Sakiet Ezzit (Tunisia) - Map of Reuse ResourcesDocument13 pagesSakiet Ezzit (Tunisia) - Map of Reuse ResourcesShaimaa AhmedNo ratings yet

- Knowledge Organiser 1.5Document1 pageKnowledge Organiser 1.5Dionysis PonirosNo ratings yet

- Business Unit 1: 2Document11 pagesBusiness Unit 1: 2Han Thi Win KoNo ratings yet

- NGOs Trusts Cooperative Soc AdityaSDocument45 pagesNGOs Trusts Cooperative Soc AdityaSSuyash BarmechaNo ratings yet

- Chapter 5 Part 2Document26 pagesChapter 5 Part 2ISLAM KHALED ZSCNo ratings yet

- Rev - 2 - Eco-Slide - 2-3Document10 pagesRev - 2 - Eco-Slide - 2-3Rizwan KhanNo ratings yet

- Dematerialization Stahel Penalties 23364179Document20 pagesDematerialization Stahel Penalties 2336417948zbxgttsfNo ratings yet

- VBJ Unit3 Term3Document6 pagesVBJ Unit3 Term3ShangNo ratings yet

- Task A2 - Research Plan: What? Why?Document6 pagesTask A2 - Research Plan: What? Why?api-512048609No ratings yet

- Regulatory Map 2018Document104 pagesRegulatory Map 2018beverly villaruelNo ratings yet

- Ngo Darpan SSSDocument3 pagesNgo Darpan SSSRatikanta NayakNo ratings yet

- 2.3 Social Costs and Benefits: Igcse /O Level EconomicsDocument10 pages2.3 Social Costs and Benefits: Igcse /O Level EconomicszainNo ratings yet

- Regulatory Map (2) 2017Document94 pagesRegulatory Map (2) 2017beverly villaruelNo ratings yet

- Day 3Document9 pagesDay 3Dipesh MagratiNo ratings yet

- Sectors of The Indian EconomyDocument4 pagesSectors of The Indian Economyscratchcoder1No ratings yet

- Recycling PPPDocument11 pagesRecycling PPPu045327No ratings yet

- Tupad Orientation Presentation 2017Document54 pagesTupad Orientation Presentation 2017Anonymous EvbW4o1U7100% (5)

- Sworn Statement of Assets, Liabilities and Net WorthDocument2 pagesSworn Statement of Assets, Liabilities and Net WorthCarl GarciaNo ratings yet

- TLIMP 2.1 Solid Waste ManagementDocument25 pagesTLIMP 2.1 Solid Waste ManagementgpowerpNo ratings yet

- Indian Economy 1950-1990Document23 pagesIndian Economy 1950-1990Saurav kumar0% (1)

- LGU NotesDocument3 pagesLGU NotesrucellNo ratings yet

- Sample 1 Page ProposalDocument1 pageSample 1 Page ProposalBro. AntonNo ratings yet

- Adobe Scan Feb 08, 2023Document1 pageAdobe Scan Feb 08, 2023Sahil WaliaNo ratings yet

- Javier A2 Research Plan Sustainable Design SewcietyDocument7 pagesJavier A2 Research Plan Sustainable Design Sewcietyapi-512790294No ratings yet

- Externalities: Externalities and Public GoodsDocument5 pagesExternalities: Externalities and Public Goodsrobert habonNo ratings yet

- Green Waste Management Resource GuideDocument20 pagesGreen Waste Management Resource GuideViddesh waskarNo ratings yet

- Business Chap 2Document2 pagesBusiness Chap 2api-293205172No ratings yet

- Environmental and Resource Recovery Efficiency AssDocument6 pagesEnvironmental and Resource Recovery Efficiency AssAli RazzaqNo ratings yet

- Ciu-Intake-Sheet PDF Welfare Public SphereDocument1 pageCiu-Intake-Sheet PDF Welfare Public SpherehannabotingchioNo ratings yet

- SALN LONG BlankDocument3 pagesSALN LONG BlankPeache Nadenne LopezNo ratings yet

- Microeconomic AnalysisDocument32 pagesMicroeconomic AnalysisAbdin AshrafNo ratings yet

- Visit PlanDocument5 pagesVisit PlanSadeque HussainNo ratings yet

- GROUP 5 Public SectorDocument14 pagesGROUP 5 Public SectorAldeon NonanNo ratings yet

- Sectors of Indian Economy With PYQDocument32 pagesSectors of Indian Economy With PYQAnkita DashNo ratings yet

- 2015 SALN Form (PDF) 1 PDFDocument2 pages2015 SALN Form (PDF) 1 PDFAnonymous xJvt1QHseNo ratings yet

- Tax Exemption Granted Under Consti and Tax Code With ProblemsDocument11 pagesTax Exemption Granted Under Consti and Tax Code With ProblemsOSCAR VALERO100% (1)

- July 16 PDFDocument4 pagesJuly 16 PDFShimu ShahrearNo ratings yet

- New England'S Creative Economy: The Nonprofit SectorDocument7 pagesNew England'S Creative Economy: The Nonprofit SectorGreg BurbidgeNo ratings yet

- PRDPMGTDocument8 pagesPRDPMGTANGELINNE FELIZARDONo ratings yet

- Chapter 1 Bus201Document15 pagesChapter 1 Bus201Anik Hasan KhanNo ratings yet

- Full Cost Disclosure ReportDocument3 pagesFull Cost Disclosure ReportTareq Yousef AbualajeenNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument2 pagesSworn Statement of Assets, Liabilities and Net Worthamor mabalotNo ratings yet

- 06 Planning Process PDFDocument48 pages06 Planning Process PDFJohn Michael BlancaflorNo ratings yet

- 2020 Regulatory MapDocument99 pages2020 Regulatory Mapbeverly villaruelNo ratings yet

- SALNform 2011Document2 pagesSALNform 2011Cherry ColladoNo ratings yet

- 03 - Scguide - Eng - 3 - Smart City GuidebookDocument12 pages03 - Scguide - Eng - 3 - Smart City GuidebookSarah JangNo ratings yet

- Social Security in IndiaDocument15 pagesSocial Security in IndiadranshulitrivediNo ratings yet

- New Deir Allaa (Jordan) - Map of Reuse ResourcesDocument7 pagesNew Deir Allaa (Jordan) - Map of Reuse ResourcesShaimaa AhmedNo ratings yet

- Oscar Suy-Perez 06.01 Economic RelationshipsDocument2 pagesOscar Suy-Perez 06.01 Economic RelationshipsOSCAR SUY-PEREZNo ratings yet

- (HRB) Universal Health Coverage BillDocument1 page(HRB) Universal Health Coverage BillJonjon BeeNo ratings yet

- 3762 Form PDFDocument2 pages3762 Form PDFAnil KumarNo ratings yet

- MC 2023-049-2-3Document2 pagesMC 2023-049-2-3jigsespinaNo ratings yet

- Product Disclosure Sheet HOUSEOWNER AND HOUSEHOLDER TakafulDocument3 pagesProduct Disclosure Sheet HOUSEOWNER AND HOUSEHOLDER TakafulNordianah AliasNo ratings yet

- CH 2Document19 pagesCH 2Haroon ChatthaNo ratings yet

- Circ36 2002Document3 pagesCirc36 2002Abegail AtokNo ratings yet

- Solid WasteDocument37 pagesSolid Wastedevvie realistaNo ratings yet

- History Super 8Document88 pagesHistory Super 8martgrinbergNo ratings yet

- Cta Eb CV 02328 M 2022sep28 OthDocument5 pagesCta Eb CV 02328 M 2022sep28 OthJulo R. TaleonNo ratings yet

- Track and Trace Your Delivery StatusDocument12 pagesTrack and Trace Your Delivery StatusJulo R. TaleonNo ratings yet

- GR 202151 2021Document19 pagesGR 202151 2021Julo R. TaleonNo ratings yet

- Cta Eb CV 01703 M 2019mar26 OthDocument3 pagesCta Eb CV 01703 M 2019mar26 OthJulo R. TaleonNo ratings yet

- Cta 2D Ac 00247 M 2023feb02 OthDocument7 pagesCta 2D Ac 00247 M 2023feb02 OthJulo R. TaleonNo ratings yet

- Acknowledgement ReceiptDocument2 pagesAcknowledgement ReceiptJulo R. TaleonNo ratings yet

- Acknowledgement Receipt: Ranty P. BelmonteDocument2 pagesAcknowledgement Receipt: Ranty P. BelmonteJulo R. TaleonNo ratings yet

- AO No 07 s'2011 Revised Rules Procedures Governing The Acquisition and DistributionDocument43 pagesAO No 07 s'2011 Revised Rules Procedures Governing The Acquisition and DistributionGlenn TaduranNo ratings yet

- J. Bersamin TaxDocument14 pagesJ. Bersamin TaxJessica JungNo ratings yet

- Acknowledgement Receipt: Ranty P. BelmonteDocument2 pagesAcknowledgement Receipt: Ranty P. BelmonteJulo R. TaleonNo ratings yet

- Lawyer's Oath With AnnotationDocument1 pageLawyer's Oath With AnnotationJulo R. TaleonNo ratings yet

- G.R. No. 189874 Jurisdiction of DARDocument15 pagesG.R. No. 189874 Jurisdiction of DARJulo R. TaleonNo ratings yet

- Legal Ethics PDFDocument5 pagesLegal Ethics PDFJulo R. TaleonNo ratings yet

- Contract For ServicesDocument6 pagesContract For ServicesJulo R. TaleonNo ratings yet

- 2011 Political Law Bar Exam Q&ADocument21 pages2011 Political Law Bar Exam Q&ARaq KhoNo ratings yet

- Legal Opinion On RapeDocument3 pagesLegal Opinion On RapeJulo R. TaleonNo ratings yet

- Comprehensive Dangerous Act of 2002 (R.a. 9165)Document39 pagesComprehensive Dangerous Act of 2002 (R.a. 9165)Karl_Patayon_2642No ratings yet

- Law DigestDocument1 pageLaw DigestJulo R. TaleonNo ratings yet

- Tax Case Digests MidtermsDocument47 pagesTax Case Digests MidtermsJulo R. TaleonNo ratings yet

- Dignos V CADocument1 pageDignos V CAJulo R. TaleonNo ratings yet

- Admin Cases RulingsDocument6 pagesAdmin Cases RulingsJulo R. TaleonNo ratings yet

- Arbitration Assignement by AbelDocument6 pagesArbitration Assignement by AbelJulo R. TaleonNo ratings yet

- Available Digest LaborDocument29 pagesAvailable Digest LaborJulo R. TaleonNo ratings yet

- CrimDocument101 pagesCrimJulo R. TaleonNo ratings yet

- Overgaard v. ValdezDocument8 pagesOvergaard v. ValdezJulo R. TaleonNo ratings yet

- Jurisprudence On Land Titles and RegistrationDocument50 pagesJurisprudence On Land Titles and RegistrationOrlan DizonNo ratings yet

- 01 - Ang Ladlad LGBT vs. ComelecDocument41 pages01 - Ang Ladlad LGBT vs. ComelecJulo R. TaleonNo ratings yet

- LEVY AND COLLECTION OF GST - AbhiDocument14 pagesLEVY AND COLLECTION OF GST - AbhiAbhishek Abhi100% (1)

- Day1 - 06 - Ramona Volciuc-Ionescu - Volvic-Ionescu SCADocument21 pagesDay1 - 06 - Ramona Volciuc-Ionescu - Volvic-Ionescu SCAaegean227No ratings yet

- Adobe Scan 09 Jan 2024Document1 pageAdobe Scan 09 Jan 2024swapna vijayNo ratings yet

- Activity - Statement of Cash Flows AnalysisDocument3 pagesActivity - Statement of Cash Flows AnalysisKATHRYN CLAUDETTE RESENTE100% (1)

- NSV - May-2021 - 1606 - TAJ FOOD (PRIVATE) LIMITEDDocument1 pageNSV - May-2021 - 1606 - TAJ FOOD (PRIVATE) LIMITEDIkram Ul Haq SidhuNo ratings yet

- CBK POWER LTD Vs CIRDocument2 pagesCBK POWER LTD Vs CIRJM Ragaza67% (3)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)hameed dec13No ratings yet

- Idbi Incomesurance Endowment and Money Back PlanDocument16 pagesIdbi Incomesurance Endowment and Money Back PlanRonaldNo ratings yet

- Lembar JawabDocument9 pagesLembar JawabRita CahyaniNo ratings yet

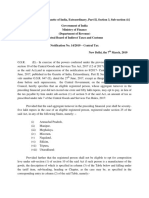

- Notfctn 14 Central Tax English 2019Document2 pagesNotfctn 14 Central Tax English 2019sathishmrNo ratings yet

- Income StatementDocument3 pagesIncome StatementAlyssa Denise E. OrtezaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruASHISANo ratings yet

- Genjrl 1Document1 pageGenjrl 1Tiara AjaNo ratings yet

- Aa00189422 PDFDocument3 pagesAa00189422 PDFUday PawarNo ratings yet

- Payroll Accounting 2015 25Th Edition Bieg Test Bank Full Chapter PDFDocument42 pagesPayroll Accounting 2015 25Th Edition Bieg Test Bank Full Chapter PDFcaninerawboned.2rfl4089% (9)

- Lecture 3 - Income Taxation (Corporate)Document5 pagesLecture 3 - Income Taxation (Corporate)Paula MerrilesNo ratings yet

- MCMQVKDocument2 pagesMCMQVKKarthikeya MandavaNo ratings yet

- Shabu Batak TaxationDocument41 pagesShabu Batak TaxationJOSHUA M. ESCOTONo ratings yet

- Chapter 1 of Introduction With Margin 1111-1-2Document33 pagesChapter 1 of Introduction With Margin 1111-1-2YogiNo ratings yet

- Take To MeetingDocument2 pagesTake To MeetingpeterbobNo ratings yet

- Income TaxDocument35 pagesIncome TaxAmer Hussien ManarosNo ratings yet

- Lorena Kukovičić - TAXATIONDocument17 pagesLorena Kukovičić - TAXATIONlorenaNo ratings yet

- Form 60Document3 pagesForm 60Kamal SharmaNo ratings yet

- 01 Seep 1Document19 pages01 Seep 1van phanNo ratings yet

- Your IRS Form W-8 Has Been ReceivedDocument2 pagesYour IRS Form W-8 Has Been ReceivedManishDikshitNo ratings yet

- Approved Incentives For The Spedu Region: Category of Incentives Existing TaxesDocument2 pagesApproved Incentives For The Spedu Region: Category of Incentives Existing TaxesDulas DulasNo ratings yet

- Life Always Begins With One Step Outside of Your Comfort Zone.Document21 pagesLife Always Begins With One Step Outside of Your Comfort Zone.Czarina PanganibanNo ratings yet

- AC557 W5 HW Questions/AnswersDocument5 pagesAC557 W5 HW Questions/AnswersDominickdad100% (3)

- Tax Amnesty Return On DelinquenciesDocument3 pagesTax Amnesty Return On DelinquenciesIML2016No ratings yet