Professional Documents

Culture Documents

Audit of Cash and Cash Equivalents

Uploaded by

Emma Mariz GarciaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audit of Cash and Cash Equivalents

Uploaded by

Emma Mariz GarciaCopyright:

Available Formats

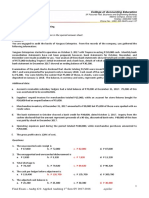

AUDIT OF CASH AND CASH EQUIVALENTS

Problem 1: Problem 3:

The following information has been extracted from the The controller of the OTO Company is in the process of

accounting records of the Hazelnut Company at December 31, preparing the company’s December 31, 2014 financial

2014: statements. He is trying to determine the correct balance of

cash and cash equivalents reported as a current asset in the

Cash on hand (undeposited sales receipts) P 40,800 statement of financial positon. The following items are being

Certificate of time deposit with maturity of considered:

3months 1,000,000 Savings account of P900,000 and a checking account

Customer’s note receivable 40,000 balance of P1,200,00 are held at Manila Bank.

Reconciled balance in AA Bank checking account (14,000) Money market placement with maturity of 3 months,

Reconciled balance in BB Bank checking account 374,000 P7,500,000.

Balance in CC savings account 342, 400 Currency and coins on hand amounted to P11,550

Customers postdated check 54,000 Travel advances of P270,000 for the first quarter of

Employee travel advances 64,000 next year (employee reimbursement will be through

Cash in bond sinking fund 48,000 salary deduction)

Bond sinking fund investments 323,600 Oto Company has purchased P3, 150,000 of

Postage stamp 17,200 commercial paper of Mendez Corp. which is due in

60 days.

What amount should Hazelnut Company report as “cash” at A separate cash fund amounting to P2, 250,000 is

December 31, 2014? restricted for the retirement of long-term debt.

a. 805,200

Petty cash fund of P1,500

b. 757,200

An IOU from an employee of Oto Company in the

c. 743,200

amount of P2,000

d. 703,200

Two certificates of deposit, each totaling P500,000.

These CDs have a maturity of 120 days.

Solution:

Oto company has received a check from a customer

Cash on hand (undeposited sales receipts) P 40,800

in the amount of P187,500 dated January 15, 2015.

Reconciled balance in BB Bank checking account 374,000

Oto Company has agreed to maintain a cash balance

Balance in CC savings account 342, 400

of P50,000 at all times at Manila Bank to ensure

Total Cash P757,200

future credit availability.

On January 1, 2014, Oto Company purchased

Problem 2:

marketable equity securities to be held as trading for

The controller of the Lyric Co. is trying to determine the

P3, 000,000. On December 31, 2014, its market calue

amount of cash and cash equivalents to be reported on its

of P4,300,000.

December 31, 2014, statement of financial position. The

following information is provided:

What should be reported as cash and cash equivalents of

December 31, 2014?

Balances in the company’s account at the Monte a. P13, 763,050

Bank: b. P12,575,550

Checking account – P 540,000 c. P12,751,500

Savings account - P 884,000 d. P12,763,050

Undeposited customer checks of P208,000

Currency and coins on hand of P 23,200

Solution:

Savings account at the Naic bank with a balance of Savings account-Manila Bank P 900,000

P350,000. This account is being used to accumulate Checking account- Manila Bank 1,200,000

cash for future plant expansion (in 2016). Money Market placement 7,500,000

P800,000 balance in a checking account at the Naic Petty cash 1, 500

Bank. In exchange for a line credit, Lyric Co. has Commercial paper 3,150,000

agreed to maintain a minimum balance of 100,000 in Currency and coins on hand 11,550

this account. Total cash and cash equivalents P12,763,050

Treasury bills: 30-day maturity bills totaling

P600,000 and 180-day bills totaling P800,000.

What total amount of “cash and cash equivalents” should be

reported in the current asset section of the 2014 statement of

financial positon?

a. 3, 055,200

b. 2, 455,200

c. 2, 955,200

d. 2, 355,200

Solution:

Balance in Monte Bank Checking account P 540,000

Balance in Monte Bank Savings account 884,000

Undeposited customer checks of 208,000

Currency and coins on hand of 23,200

Checking account at the Naic Bank 800,000

Treasury bill - 30-day maturity 600,000

Total cash and cash equivalents P 3, 055,200

You might also like

- MCQ - Intro To AuditDocument13 pagesMCQ - Intro To Auditemc2_mcv74% (27)

- Solution Manual - Partnership & Corporation, 2014-2015 PDFDocument77 pagesSolution Manual - Partnership & Corporation, 2014-2015 PDFRomerJoieUgmadCultura78% (88)

- Prelim Exam ManuscriptDocument10 pagesPrelim Exam ManuscriptJulie Mae Caling MalitNo ratings yet

- CPAR AP - Audit of Cash 2Document6 pagesCPAR AP - Audit of Cash 2John Carlo Cruz100% (2)

- AP PreboardDocument6 pagesAP PreboardMark Kenneth Chan BalicantaNo ratings yet

- Ap RmycDocument16 pagesAp RmycJoseph Bayo BasanNo ratings yet

- Page Comprehensive Theories and ProblemsDocument7 pagesPage Comprehensive Theories and Problemsharley_quinn11No ratings yet

- Audit Cash EquivalentsDocument87 pagesAudit Cash Equivalentspatrise sioson78% (9)

- Auditing Quiz Audit of CashDocument4 pagesAuditing Quiz Audit of CashLoveli Breindaelyn Rivera0% (2)

- This Study Resource Was: Problem 1Document5 pagesThis Study Resource Was: Problem 1xicoyiNo ratings yet

- Ap - 01 Cash and Cash EquivalentsDocument11 pagesAp - 01 Cash and Cash EquivalentsPachi0% (2)

- Financial Asset Debt Securities Practice QuizDocument3 pagesFinancial Asset Debt Securities Practice QuizMarjorie PalmaNo ratings yet

- Audit of Allowance For Doubtful AccountsDocument4 pagesAudit of Allowance For Doubtful AccountsCJ alandyNo ratings yet

- Land & Building Cost Adjustments"TITLE "Machinery Depreciation Calculation" TITLE "Factory Equipment Impairment Analysis"TITLE "Mining Property Depletion & Depreciation ScheduleDocument4 pagesLand & Building Cost Adjustments"TITLE "Machinery Depreciation Calculation" TITLE "Factory Equipment Impairment Analysis"TITLE "Mining Property Depletion & Depreciation ScheduleLlyod Francis LaylayNo ratings yet

- THISISIT! Corp Cash Balance CalculationDocument12 pagesTHISISIT! Corp Cash Balance CalculationRichel ArmayanNo ratings yet

- MODULE 5 - Audit of Cash and Related AccountsDocument176 pagesMODULE 5 - Audit of Cash and Related AccountsAngelo TipaneroNo ratings yet

- Financial Accounting and ReportingDocument3 pagesFinancial Accounting and ReportingEmma Mariz GarciaNo ratings yet

- MSQ-02 - Variable & Absorption Costing (Final)Document11 pagesMSQ-02 - Variable & Absorption Costing (Final)Kevin James Sedurifa OledanNo ratings yet

- 02audit of CashDocument12 pages02audit of CashJeanette FormenteraNo ratings yet

- Cash and Equivalents Audit ProblemsDocument162 pagesCash and Equivalents Audit ProblemsJannah Fate100% (3)

- Audit Problems CashDocument18 pagesAudit Problems CashYenelyn Apistar Cambarijan0% (1)

- Cpa Review School of The Philippines Manila Auditing Problems Audit of Inventories Problem No. 1Document11 pagesCpa Review School of The Philippines Manila Auditing Problems Audit of Inventories Problem No. 1Angelou100% (1)

- TRAPO, Inc. Estimates Its Bad Debt Losses by Aging Its Accounts Receivable. The Aging Schedule ofDocument2 pagesTRAPO, Inc. Estimates Its Bad Debt Losses by Aging Its Accounts Receivable. The Aging Schedule ofAlvinDumanggasNo ratings yet

- Module 1 Partnerships Basic Considerations and OrganizationsDocument33 pagesModule 1 Partnerships Basic Considerations and OrganizationsKaren Portia50% (2)

- Audit of Investments - Set BDocument4 pagesAudit of Investments - Set BZyrah Mae Saez0% (1)

- Problem 5: QuestionsDocument6 pagesProblem 5: QuestionsTk KimNo ratings yet

- InvestmentDocument9 pagesInvestmentJade Malaque0% (1)

- Refresher Course: Audit of Cash and Cash EquivalentsDocument4 pagesRefresher Course: Audit of Cash and Cash EquivalentsFery Ann100% (1)

- INVESTMENTS inDocument7 pagesINVESTMENTS inJessa May MendozaNo ratings yet

- Set ADocument5 pagesSet ASomersNo ratings yet

- Debt SecurityDocument9 pagesDebt SecurityMJ YaconNo ratings yet

- Cabigon Problem 1 AuditDocument2 pagesCabigon Problem 1 AuditGianrie Gwyneth CabigonNo ratings yet

- Audit Cash and EquivalentsDocument16 pagesAudit Cash and EquivalentsErnest Andales0% (1)

- Acctg4a 02042017 Exam Quiz1aDocument5 pagesAcctg4a 02042017 Exam Quiz1aPatOcampoNo ratings yet

- Ginebra Corporation liability audit for 2005Document2 pagesGinebra Corporation liability audit for 2005jhobs100% (1)

- Audit of SheDocument3 pagesAudit of ShegbenjielizonNo ratings yet

- Cash FlowDocument5 pagesCash FlowmagoimoiNo ratings yet

- Final Exam 12 PDF FreeDocument17 pagesFinal Exam 12 PDF FreeEmey CalbayNo ratings yet

- PPE NotesDocument4 pagesPPE Notesaldric taclanNo ratings yet

- AP-5903Q - PPE & IntangiblesDocument5 pagesAP-5903Q - PPE & Intangiblesxxxxxxxxx67% (3)

- Jawaban Chapter 1Document12 pagesJawaban Chapter 1Ruth Elisabeth100% (2)

- Emilio Aguinaldo College - Cavite Campus School of Business AdministrationDocument9 pagesEmilio Aguinaldo College - Cavite Campus School of Business AdministrationKarlayaan50% (2)

- Chapter 16Document12 pagesChapter 16WesNo ratings yet

- Batch 19 1st Preboard (P1)Document12 pagesBatch 19 1st Preboard (P1)Mike Oliver Nual100% (1)

- Intermediate Acctg A 1 10Document10 pagesIntermediate Acctg A 1 10Leonila RiveraNo ratings yet

- Print ExamDocument14 pagesPrint ExamkristinamanalangNo ratings yet

- DICTIOFORMULA Audit of CashDocument13 pagesDICTIOFORMULA Audit of CashEza Joy ClaveriasNo ratings yet

- Aud Theo Part 2Document10 pagesAud Theo Part 2Naia Gonzales0% (2)

- Auditing Appplications PrelimsDocument5 pagesAuditing Appplications Prelimsnicole bancoroNo ratings yet

- Auditing Problems: Audit of Cash and Cash Equivalents Problem No. 1Document21 pagesAuditing Problems: Audit of Cash and Cash Equivalents Problem No. 1ATLASNo ratings yet

- FL AfarDocument20 pagesFL AfarKenneth Robledo50% (2)

- Module 5 - Audit of InventoriesDocument23 pagesModule 5 - Audit of InventoriesIvan LandaosNo ratings yet

- Problem On Loan ImpairmentDocument26 pagesProblem On Loan ImpairmentYukiNo ratings yet

- Auditing ProblemsDocument5 pagesAuditing ProblemsJayr BVNo ratings yet

- Intermediate AccountingDocument6 pagesIntermediate AccountingMary Angeline LopezNo ratings yet

- Cash and Cash EquivalentsDocument2 pagesCash and Cash EquivalentsEmma Mariz GarciaNo ratings yet

- Cash and Cash Equivalents BalancesDocument3 pagesCash and Cash Equivalents Balancesdeborah grace sagarioNo ratings yet

- Cash & Cash Equivalents QuizDocument1 pageCash & Cash Equivalents QuizJaypee BignoNo ratings yet

- Cash With AnsDocument6 pagesCash With AnsHhhhhNo ratings yet

- Ap - CashDocument13 pagesAp - CashDiane PascualNo ratings yet

- Exercise 4Document45 pagesExercise 4Neal PeterosNo ratings yet

- Rogon, John Carlo A. BSA 2-1Document69 pagesRogon, John Carlo A. BSA 2-1joulNo ratings yet

- 2.1 Assessment Test 2.2: Receivables Prelim Exam Intermediate AccountingDocument9 pages2.1 Assessment Test 2.2: Receivables Prelim Exam Intermediate AccountingWinoah HubaldeNo ratings yet

- Answer: A Cash in Bank - Tsunami Bank P432,710 Petty Cash Fund 10,250 Time Deposit 1,000,000Document8 pagesAnswer: A Cash in Bank - Tsunami Bank P432,710 Petty Cash Fund 10,250 Time Deposit 1,000,000Live LoveNo ratings yet

- Fin3b Working Capital ManagementDocument11 pagesFin3b Working Capital ManagementEmma Mariz GarciaNo ratings yet

- Assurance & Nonassurance ServicesDocument16 pagesAssurance & Nonassurance ServicesEmma Mariz GarciaNo ratings yet

- Global Management Accounting TrendsDocument2 pagesGlobal Management Accounting TrendsEmma Mariz GarciaNo ratings yet

- Financial Analysis TheoryDocument1 pageFinancial Analysis TheoryEmma Mariz GarciaNo ratings yet

- TB - Chapter21 Mergers and AcquisitionsDocument12 pagesTB - Chapter21 Mergers and AcquisitionsPrincess EspirituNo ratings yet

- Management Consultancy and AccountingDocument10 pagesManagement Consultancy and AccountingEmma Mariz GarciaNo ratings yet

- Capital BudgetingDocument5 pagesCapital BudgetingEmma Mariz GarciaNo ratings yet

- Capital Structure and Leverage MCQsDocument53 pagesCapital Structure and Leverage MCQsArya StarkNo ratings yet

- Time Value of Money Gitman PDFDocument34 pagesTime Value of Money Gitman PDFEmma Mariz GarciaNo ratings yet

- Ifrs 8Document11 pagesIfrs 8TasminNo ratings yet

- Toa 123Document13 pagesToa 123fredeksdiiNo ratings yet

- Train Law PDFDocument27 pagesTrain Law PDFLanieLampasaNo ratings yet

- RMC No 50-2018Document18 pagesRMC No 50-2018JajajaNo ratings yet

- Cpar Afar 1 Final Preboard May 2018Document10 pagesCpar Afar 1 Final Preboard May 2018Emma Mariz Garcia50% (2)

- Audit of Inventories Quiz PrintingDocument2 pagesAudit of Inventories Quiz PrintingEmma Mariz GarciaNo ratings yet

- MasDocument2 pagesMasEmma Mariz GarciaNo ratings yet

- Acc101-FinalRevnew 001yDocument26 pagesAcc101-FinalRevnew 001yJollybelleann MarcosNo ratings yet

- CHAPTER 8 - CapacityDocument5 pagesCHAPTER 8 - CapacityEmma Mariz GarciaNo ratings yet

- Chapter 9 - LocationDocument5 pagesChapter 9 - LocationEmma Mariz GarciaNo ratings yet

- Sde 55Document19 pagesSde 55YaniNo ratings yet

- Cis - Chapter 1Document1 pageCis - Chapter 1Emma Mariz GarciaNo ratings yet

- Bank Reconciliation Without SolutionDocument7 pagesBank Reconciliation Without SolutionEmma Mariz GarciaNo ratings yet

- Solution Manual Partnership Corporation 2014 2015 PDFDocument5 pagesSolution Manual Partnership Corporation 2014 2015 PDFEmma Mariz GarciaNo ratings yet

- Test Bank Auditng ProbDocument11 pagesTest Bank Auditng ProbTinne PaculabaNo ratings yet

- Law On Negotiable InstrumentsDocument16 pagesLaw On Negotiable InstrumentsEmma Mariz GarciaNo ratings yet

- Parnership Corpo NotesDocument15 pagesParnership Corpo NotesMJ YaconNo ratings yet

- Company Registration Status As On 10.12.2019Document1 pageCompany Registration Status As On 10.12.2019Vishav JindalNo ratings yet

- Board of Directors and Key DetailsDocument44 pagesBoard of Directors and Key Detailshitehsmutha662No ratings yet

- Irda Act 1999Document7 pagesIrda Act 1999Bhawana SharmaNo ratings yet

- Achievement of Organizational Targets and Objectives Using Management AuditDocument21 pagesAchievement of Organizational Targets and Objectives Using Management AuditNwigwe Promise ChukwuebukaNo ratings yet

- Taghipour, 2015Document19 pagesTaghipour, 2015SurahmanNo ratings yet

- Ethics in Financial ManagmentDocument24 pagesEthics in Financial ManagmentKhalid AzeemNo ratings yet

- Feedback - MOCKP1DEDocument12 pagesFeedback - MOCKP1DERaman ANo ratings yet

- Advacc 3Document2 pagesAdvacc 3Daniel RaeNo ratings yet

- ACCA F8 Mock Exam 2016 SessionDocument7 pagesACCA F8 Mock Exam 2016 SessionPakAccountants50% (2)

- Value of Internal Auditing: Assurance, Insight, ObjectivityDocument14 pagesValue of Internal Auditing: Assurance, Insight, ObjectivityAnonymous 7CxwuBUJz3No ratings yet

- India Entry Strategy BrochureDocument30 pagesIndia Entry Strategy BrochureRahul BhanNo ratings yet

- Asset Accounting PDFDocument308 pagesAsset Accounting PDFFarooqAli86% (7)

- SoundCloud: Directors' Report, Consolidated Financial Statements, Y/e 31 December 2015Document23 pagesSoundCloud: Directors' Report, Consolidated Financial Statements, Y/e 31 December 2015Digital Music NewsNo ratings yet

- Ajay KamatDocument6 pagesAjay Kamatdr_shaikhfaisalNo ratings yet

- Cost Audit PDFDocument37 pagesCost Audit PDFAl Amin Sarkar0% (1)

- Halaman 470 (P9-3B)Document4 pagesHalaman 470 (P9-3B)anon_21838122No ratings yet

- Corporate Governance Disclosure Checklist - Periods Commencing On or After 1 April 2022Document44 pagesCorporate Governance Disclosure Checklist - Periods Commencing On or After 1 April 2022judy mbuguaNo ratings yet

- Syllabus For Chartered Accountant in Nepal TelecomDocument3 pagesSyllabus For Chartered Accountant in Nepal Telecomsanu81100% (1)

- Accounting Information Systems, 6: Edition James A. HallDocument41 pagesAccounting Information Systems, 6: Edition James A. HallLaezelie SorianoNo ratings yet

- Chapter 2 - Project Life CycleDocument36 pagesChapter 2 - Project Life Cycleselamawit tafesseNo ratings yet

- 15 Chapter 6Document193 pages15 Chapter 6Tamizh KumarNo ratings yet

- LatestDocument50 pagesLatestWan Ameerah50% (2)

- Perf & Env Audit Manual 111Document134 pagesPerf & Env Audit Manual 111hNo ratings yet

- Expenditure Cycle: Purchasing and Cash DisbursementsDocument15 pagesExpenditure Cycle: Purchasing and Cash DisbursementsAllisbi HakimNo ratings yet

- تأثير ممارسات المحاسبة الإبداعية على جودة التدقيق في المؤسسات الاقتصادية الجزائرية -دراسة حالة محاسبي المؤسسات الاقتصادية ومكاتب محافظي الحسابات في الغرب الجزائري PDFDocument25 pagesتأثير ممارسات المحاسبة الإبداعية على جودة التدقيق في المؤسسات الاقتصادية الجزائرية -دراسة حالة محاسبي المؤسسات الاقتصادية ومكاتب محافظي الحسابات في الغرب الجزائري PDFFatima ZahraNo ratings yet

- AEC6 BudgetingDocument2 pagesAEC6 BudgetingjolinaNo ratings yet

- Financial Accounting Hub PDFDocument6 pagesFinancial Accounting Hub PDFvenuoracle9No ratings yet

- Student HandbookDocument58 pagesStudent HandbookmalwackNo ratings yet

- Standard Audit Programme Guides (SAPGs) for ReviewsDocument10 pagesStandard Audit Programme Guides (SAPGs) for Reviewslhea Shelmar Cauilan100% (1)

- SA Home Affairs Department Lose 4,616 Permanent Residence ApplicationsDocument176 pagesSA Home Affairs Department Lose 4,616 Permanent Residence ApplicationsBusiness Daily Zimbabwe67% (3)