Professional Documents

Culture Documents

TTF 990 2016

Uploaded by

Teddy Wilson0 ratings0% found this document useful (0 votes)

24 views25 pagesThe Thirteen Foundation - IRS 990 (2016)

Original Title

TTF-990-2016

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Thirteen Foundation - IRS 990 (2016)

Copyright:

© All Rights Reserved

0 ratings0% found this document useful (0 votes)

24 views25 pagesTTF 990 2016

Uploaded by

Teddy WilsonThe Thirteen Foundation - IRS 990 (2016)

Copyright:

© All Rights Reserved

You are on page 1of 25

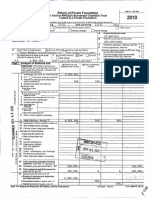

[efile GRAPHIC print - DO NOT PROCESS | As Filed Data -| DLN: 93491317009457|

m9 90-PF OMB No 1545-0052

ream 2016

intemal Revenie Serice rer

bee ecia

Return of Private Foundation

or Section 4947(a)(1) Trust Treated as Private Foundation

> Do not enter social security numbers on this form as it may be made public.

» Information about Form 990-PF and its instructions is at www.lrs.gov/form990pf,

For calendar year 2016, or tax year beginning 01-01-2016 sand ending 12-31-2016

Tame ofTounaaban “A Employer Wentiication number

“The Thirteen Foundation

wso77a

THuribor and atroot (or PO ox Huribar a Ws AOL GeTvered To Sree BaaresS) | ROOTHSURE B Telephone number (see matracions

T7040 Interstate 20

(254) 850-3600

ora Sake ovine, COONEY, WE ZF Toren POET ce Cy cunpoon SION Dy

tea eae on appeaton spending, eee, EY]

Check all that apply Clini turn Clint return of a former publ DA. oven srnnzatons check wre

Crinal retain Ch amended return 2-foreanennstensmaingtn gam”

Claadress change Came change a een eee

H check type of organization WA Section 501(c)3) exert anvate foundation NEE nate nies eee

Csecton 4947(0)(1) nonexemot chantable trust _ Cl other taxable prvate foundation

BAccounting method EA cash CI Accrual oO

of year (from Part Il, col (c), a

line 16)$ 75,793,236 O other (specify)

(Part 1, column (d) must be on cash basis )

under secuon 507(B)1)(8), check here

TERE Anaiysis of Revenue and Expenses (ria) os) aaensona (a) sburserens

of amounts clans (0), (2) an (6) ray no necessary Revenue ard ley) reinvestment ley ates nee | Gorctarte

equal the amounts i column (2) (See ns (ash bass only)

ons) ) boos

7 Contrbutons, aft, grants, ete recewved (atach

Schedule)

2 check BZ ithe foundation is not required to atach

Sch 8 eee eee

2. _Iterest on savings and temporary cash investments aa aa cor

Sa Gross cents

Net rental income or (ess)

| a Net gam or (lose fom sale of assets not online 10

2

5] » cross sales price for al asets on tine 68

3 as.sosad

| 7 capital gain net income (rom Par 1, ine2) + + Tae

Net short-term eaptal gan

Income medications «

20a cross sales ess returns and allowances

b Less. Cost of goods sold :

Gross profit o (loss) (attach schedule)

41 Otherincome (attach schedule) ee Tas sa a 79

12. Total. Addines Lough Mw eee aaa Zane] 20830

13 Compensation of ofcers, rectors, ustees ee

14 Other employes salanes and wages. ees 1a

4g |15 Pension plans, employee benefits

B | recounting eos (attach shedule) os sf 7a

¢ Other professional fees (atte ‘hedule)

2/17 interest

E | 18 taxes (attach schedule) see mstructons) =... [SD ss 1a?

Z 19 depreciation (attach schedule) and depletion... [ey 3186 eq seq

20 occupancy

21 Trevel, conferences, and meetings vs ss

22° Printing and publestions » se vw ee

23. Other expenses (attach schedule) oss. Tae Ta Tsai Tas

Z |24 Total operating and administrative expenses.

| Addiines 3through23 oe 160,309 isa uzex 23687

© |25 Contributions, gifts, grants paid 7,924,429

26, Total expenses and disbursements, A ies 24a

27 Subtract ine 26 fom ine 12

disbursements

bb Net investment income (f negative, enter -0-) aa

€ Adjusted net income(ifnegative,enter-0-) . Ta9084

For Paperwork Reduction Act Notice, see Instructions:

Form 990-PF (2016)

Form 990-PF (2016)

Page 2

GEREE] Setance sheets ee vorenceh yar amounts ely eae novucvons) [ ta) batvaee | — To] Book Vaue |) Far aia Var

1 Cashonea-eteresbeanng 700.99 332509 332510

2 Savings and temporary cash vestments aaa 5 Tee

3 Accounts recvvable 13,7055

Less allowance for doubtful aezounts 1295205 13,7958

4 Pledges recevabie

Less allowance for doubtful accounts

5 Grants recewable « vleeeae

6 Receivables due from officers, directors, trustees, and other

disqualified persons (attach schedule) (see instructions) «

7 other notes and loans recevvabe (attach schedule)

Less allowance for doubtful accounts

| 8 Inventones for ale or use Lo

S| 9 Prepaid expenses and deferred charges « be

2 lioa investments S and state government obligations (attach schedule) Tea S50 TOSSES

bb Investments—corprate stock (attach schedule) Ta 7,605 S10 485

ce _Trvestments-—corporste bonds (attach schedule) 55 Tome T.0R74

11 _Investments—land, buldings, and equipment. basis

Less accumulated deprecation (atach schedule)

12, Investmente=mortgage loans «

13. Investments—other (attach schedule) Tana 76H Teo

14 Land, bukdngs, and equement bess > so

Less accumulated deprecabon (atach schedule) P 630 aed

15. Other assets (deserbe is 7

16 Total assets (to be complete by all flers—see the

ineructions Also, seepage 4, em 1) 750351} 7578026 75,793236

17 Accounts payable and accrued expenses + 3a

18 Grants payable.

&|19 deterred revenue «

| 20 Lean from offcers, directors, trustee, and other equaled persone

Z}21 mortgages and other notes payable (attach schedule).

5

2 )

23. _Totallablities(add ines 17 trough 22) as 3

|,| Foundations that follow SFAS 127, check here » LI

$| and complete lines 24 through 26 and lines 30 and 31.

Elza Unvestnctes

| 25° Temporaniy restricted

[26 Permanently restreted

=| roundations that do not follow SFAS 117, check here P

5 and complete lines 27 through 31.

Bl 27 capita stock, trust prncipal, or current funds. 109,734,729 100,734,72]

$| 26 Paid or capital surplus, or land bldg , and equpment fund

3} 30 Total net assets or fund balances (see instructions) oe 72,882,924 75,793, 04

31 Total liabilities and net assets fund balances (see instructions) 73303511 75.73.24

‘Total net assets o fund balances at beginning of year—Part I, column (a), ine 30 (must agre with end}

ohyear gure reported on prior years Feturn} ey 70,062,926

2. Enter amount from Part, ine 278 22. [2 73,661,622

3 Other increases not included in line 2 (itemize) P * 3 785,289

40 Addlines 1, 2,and3 ee 2. La 76,006,593

5 Decreases not included in line 2 (itemize) PF i) 5 213,687

6 Total net assets or fd balances at end of year (ine 4 minus ine 5)—Part I, column (B), Ine 30 6 75,782,906

Form 990-PF (2016)

Form 990-PF (2016) Page 3

EEEEE Capita Gains and Losses for Tax on Investment Income

@ oa © @

Uist and descnbe the kind(s) of property sold (eg , rel estate, How acau Date acquired | Date sola

estoy brick warehouse, or common stock, 200 ahs MLC Co} Brpurchase | (mo. day. ¥r) | (m0, day, YF)

Ta 1 Publay Traded Secuntes 3018-07-08 | 2016-07-08

i Pubiely Traded Secunties P 2014-07-01 | 2016-07-08

€_Ceptal Gain Dwvidends

4

o @ thy

cross fos price Depreciation allowed Cost or ther basis Gain or (oss)

, (or allowable) plus expense of sale (2) plus (f) minus (g)

2 76,400,681 16,657,343 249,262

» 29,478,625 2,847,213

« ERIE

a

“Compete only For assets showng gain m column (h) and owned by the foundation on ta/sw65 | o

im a 05) Gains (Col (h) gain mnus

i Adjusted bass Excess of col (1) col (i), But net less than “0-) oF

EE a5 of 12/31/69 over cal_(), iFany Losses (from coh),

2 "249,262

& 7,847,213

a

TE gain, also enter in Parti, ine 7

2 capital gain net income or (net captal los) | Hoss); enter-9-'n Part, Ine 7

2 2,611,693

3 Net short-term captal gain or (loss) as defined in sections 1222(5) and (6)

2F ga als eter in Par Ine 8, column (c) ate structions) 1 (oss, eter -0- \

in Part line 8 eee es 3 249,262

!

EEN Qualification Under Section 4940(c) for Reduced Tax on Net Investment Income

(For optional use by domestic

rivate foundations subject to the section 4940(a) tax on net mvestment income )

If section 4940(d)(2) applies, leave this part blank

Was the foundation liable for the section 4942 tax on the distributable amount of any year in the base period? O ves

TE"Yes,” the foundation does not qualify under section 4940(e) Do not complete this part

1_Enter the appropriate amount n each column for each year, see instructions before making any entnes|

Base penod fers Calend oy Distr at

year{ortae year begimangin) | usted qualifying dstnbubons (col {b) ded by 1 (c)

205 17,220,775 39,015,867] 1935

204 650,534 701,963,342 1426

2013 9.531,124] 101,777,203 0.09365

3012 73,150,743 36,693,255] 013601

2041 3,026,694 60,653,575] 04990

2 Total of ine i, column (6) ce z 9.587264

2 umber of yens tre founcaton hes seen mexseence flessthanS years ene, LB 0.137459

4 Enter the net value of nonchartablewuse assets for 2016 from Part X ine 5 4 74,279,402

5 Multiply line 4 by line 3 5 6,724,339

6 Enter 1% of net investment incorne (39% of Part I, Ine 276) 6 41,027

7 Add ines 5 and 6 rn 7 6,765,366

8 Enter qualifying distnbutions from Part XI, ine 4. @ 6,138,116

IFline 81s equal to or greater than ine 7, check the box n Part Vi, ine 1, and complete that par using @ Ts fax rate See the Part VI

instructions

Form 990-PF (2016)

Form 990-PF (2016) Page 4

TEER & cise Tax Based on Investment Income (Section 4940(a), 4940(b), 4940(e), or 4948—see

1a Exempt operating foundations desenbed in section 4940(d)(2), check here ® L] and enter “N/A on line 1

Date of ruling or determination letter (attach copy of letter if necessary-see instructions)

bb Domestic foundations that meet the secuon 4940(e) requirements n Part V, check a 52.054

there ® Cand enter 19% of Part I, line 27b

© Al other domeste foundations enter 2% of line 27 Exempt foreign organizations enter A¥e of Par ne 42,

esl (0)

2 Tends 1 oe ton E794) adios cers entero) [La

3 Add ines 1 and 2. : : 3 32,054

4 Subtitle A (income) tax {domestic section 4947(a)(1) trusts and te able foundations « only Others enter -0-) 4

5 Tax based on investment income, Subtract line 4 from ine 2 IF zero of les, enter -O- 5 3,058

6 Credits/Payenente

1 2016 extmated tax payments and 2015 overpayment credited o 2016 | 6a 129,263

bb Exempt foregn organzations—tax withheld at source... ss [6B

¢. Tax paid with appeaton for extension of time to fe (Form 6068)... [6c

Backup withholing erroneousiy wthheld. =... ss Led

7 Tal eed and payments Add lines 68 rough 62 ev ee vw yn 2 139,269

8 enter any penalty for underpayment of estmated tax Check here FA Form 2220 attached $8) 34

9 Tax due. Ifthe total of nes 5 and 8 1s more than ine 7, enter amount owed... sv vs

10 Overpayment. If ine 7 1s more than the total of nes 5 and 8, enter the amount overpaid, . » [40 ous

11__Enter the amount of line 10 to be Credited to 2017 estimated tax 57,115 |Refundea [an

Statements Regarding Activities

1m Dunng the tax year, did the foundation attempt to fluence any national, ale or loa legilation or dd Yes | No

it paropate orintervene i any paltcal campaign? ee ee ee ee DB No.

bb Did it epend more than $100 during the year (ether directly or indirectiy) For polncal purposes (see Instructions

fordefintion). - - ee Dee 4b No

{the answer 1s "Ves" to 42 of 4b, attach a detaled dascnption of the actunties and copies of any matenais

published or distributed by the foundation in connection with the activities

© Did the foundation file Form 1120-POL for this years ss ev ve ee ee ee ee ee ee [te No

Enter the amount (if any) of tax on political expenditures (section 4955) imposed during the year

(21) On the foundation $ (2) On foundation managers PS

fe. Enter the reimbursement (if any) paid by the foundation dung the year for political expenciture tax imposed

fon foundation managers > $

2. Has the foundation engaged in any activities that have net previously been reported tothe IRS? = ww ee ee | 2 No

If "Yes," attach a detailed descnption of the activites

3. Has the foundation made any changes, not previously reported to the IRS, in its governing instrument, articles

of incorporation, or bylaws, or other similar instruments? IF "Yes," attach a conformed copy ofthe changes. . . . | 3 No

4a _Did the foundation have unrelated business gross income of $1,000 or more during the year”... ss aa No

b IF "Yes," has i filed a tax return on Form 990-T for this year... Pee eee No

5 Was there a lquidabon, termination, dissolution, or substanbal contraction during the year? ee ee +e © [5 No

IF "Yes," attach the statement required by General Instruction T

6 Are the requirements of section 508(e) (relating to sections 4941 through 4945) satisfied either

‘+ By language in the governing instrument, or

‘+ By state legislation that effect.vely amends the governing instrument so that no mandatory directions

that confict with the state law remain in the governing instrument? v5 sv ee ee ee LB No

7 Did the foundation have at least $5,000 in assets at any time during the year7If "Yes," complete Part IT, col (c),

and Part XV Se ee ee ee LL ves

a_ Enter the states to which the foundation reports or with which itis registered (see instructions)

mx

b_ IF the answer s "Yes" te line 7, has the foundation furnished a copy of Form $90-PF to the Attorney

General (or designate) of each state as required by General Instruction G? IF "No," attach explanation « sp | Yes

9 Is the foundation claiming status as @ private operating foundation within the meaning of section 4942())(3)

or 4942(3)(5) for calendar year 2016 or the taxable year beginning in 2016 (see instructions for Part XIV)?

Ie "Yes," complete PartXIV we ee ee ee LB No

40 Did any persons become substantial contnbutors during the tax year? If "Yes," attach a schedule listing their names

and addresses eo LO No

Form 990-PF (n0le)

Form 990-PF (2016) Page 5

GEREN Statements Regarding Activities (contmued)

1A Avany ome dung the year did the foundabon, recy or mdrecty, own a Gonuoled erty wan the

meaning of section 512(b)(13)? If "Yes," attach schedule (see instructions). Be ee aL No

42 Dithefundabon make wdetrnston to dorr ave ind oer whic the foundation oa dasutfied parton hd

acwnsory prvlages? Ves; attach statement (eee mstrusions) vs ee et et ee ee 12|__| no

13. Did the foundaon comply with the publ ngpecton requirements forts annual returns and exemption applcazen? 13 [Yes

Webate adsress PIVA

14 The books are in care of cbt En Telephone no (817) 850-3600

Located at 17010 neste 29 Caco TX zip+4 76437

15 secon 4947(a)() nonexemptchantable tute fing Form 990-PF new of Form 1044 —Checkheres se ee sO

and ener tre amount of eacexernp mere received or accrued dung the Year Oe Las

16 Acany tre during calendar year 2036, dd the foundation have an interest m ora signature or other authonty over Yes | No

2 bank, secures, or other franca acount i a foregn country? ss[ [no

See nstructons fr exceptions and fling requirements fr FinCEN Form 114, Report of Foregn Bank and Fnancal Accounts

(Goan) f-Yes enter the name of the foreign cou B

GEEKIEEIN Statements Regarding Activities for Which Form 4720 May Be Required

File Form 4720 if any item is checked in the “Yes” column, unless an exception applies. Yes | No

1 Dung the year did the foundation (ether recy or indirect”)

(21) Engage in the sale or exchange, or leesing of property with a

EEXEEM Summary of Direct Charitable Activities

[Ltt the foundation’ four lergest rac chartabieacbvtes dunng the tax year Include ravant

arganatons ond athe benelcories served, conferences convened, research papers produced, ate

tcl information sich ae the auriber of

Expenses

‘LThe Thirteen Foundation hae direct chantable activity through a wholly owned disregarded entity set up as a Missoun

Limited Liability Company with the following name Reach for Yahweh Internationall D # 60-0768642The expenses

are recorded on Page 1 of Form 990-PF column (4)

2

ERNEEEN Serirnary of Program-Related investments (woe neuuctons)

tax year on ines 1 and >

‘Se largest programrelates investments made by the feundaton dung &

Amount

Allether program-related investments See instructions:

3

Total. Add ines 1 through 3

Form 990-PF (2016)

Form 990-PF (2016) Page 8

GEEEEY Minimum investment Return (Al domestic foundations must complete the part Foreign foundatonssee natructons )

1 Fairmarket value of assets not used (oF held for use) directly in carrying aut chartable, ef

purposes

2 Average monthly far market value of secures. see ta 73,356,627

bb Average of monthly cash balances. ab 3,251,362

Fair market value of all ther assets (see mnstructions). 4c 2,571

Total (add lines 4a, 8, and). ad 75,410,560,

fe Reduction claimed for blockage or other factors reported on nes ia and

te (attach detatled explanation) vv ve te ee te

2 Acqustion indebtedness applicable folie Lassets. sev ee ee ee eee LR

3 Subtractine Zfromiine 16. ve 3 75 10,550

4 Cash deemed held for chantable actwties Enter 1 1/2% of ine 3 (or greater amount, se

acts nol deininis obbibin bon od oboe ooo 4 1,131,158,

5 Net value of noncharitable-use assets. Subtract line 4 from ine 3 Enter here and on Part V, tne 4 5 74,279,402

6 _ Minimum investment return. Enter 5% of ine 5 rer 6 3,713,970

Distributable Amount (see instructions) (Section 4942())(3) and ())(5) private operating foundations and certain foreign

BEET canizavons check here LI and do not complete ths pat )

T Minimum investment return from PartX,n@6. vs vs + vv vv ev pe ye DE 3713970

2a_ Tax on investment income for 2016 from Part VI,ineS. ss da 82,054

bb Income tax for 2016 (Ths does not include the tax from Part VI)... [2b

€ Add ines 28 and 2b. 5 2e 82,054

2 Distnbutable amount before adjustments Subtract line 2c from line 1 Pee 3 3631,916

4 Recoveries of amounts treated as qualifying distnbutions, 4

5 Addines 3 and 4, rer 5 SSB 1S

6 Deduction from distabutable amount (see instructions) ; 6

7__ Distributable amount as adwusted Subtract line 6 from ine 5 Enter here and on Part XII, ne i. 7 3B 1S

Qualifying Distributions (see instructions)

‘Amounts paid (induding administrative expenses) to accomplish charitable, ete, purposes

2 Expenses, contributions, gift, ete —total from Part I, column (d), line 26. ta 9,138,116

b Program-related investments total rom Part MB ww ee ab

2 Amounts pard to acquire asets used (or held for use) directy in carrying out chantabla, ete,

purposes. cee 2

3 Amounts set aside for specific chantable projects that satisfy the

2 Suttabity test (pror IRS approval required). : 3a

Cash distribution test (attach the required schedule)» vv ee ee ee te 3b

4 Qualifying distributions. Add ines 1a through 38 Enter here and on Part V line 8, and Part XI, ine 4 [4 613816

5 Foundations that qualify under section 4940(e) for the reduced rate of tax on net investment

income Enter 1% of Part, ine 27b (see instructions). 5

6 Adjusted qualifying distributions, Subtract ine 5 from line 4, 6 6138116

Note: The amount on line 6 wll be used in Part V, column (b), n subsequent years when calculating whether the foundation qualifies for

the section 4940(e) reduction of tax in those years

Form 990-PF (2016)

Form 990-PF (2016)

BEEEESME Undistributed tncome (see mstructons)

4. Applied to 20:6 distributable amount.

Remaining amount distributed out of corpus

Page 9

@

Corpus

ey

Years prior to 2015

(2),

2015

(a)

2016

Distnbutable amount for 2016 from Part XI, line 7

ELBE

Uneistnbuted income, if any, as of the end of 2016

Enter amount for 2015 only.

Total for prior years 20, 20, 20

Excess distributions carryover, ff any, to 2016

From 2011 tee 1,244,786]

From 2012.) ss ys 3,355,484

From 2013. 6 6 ss 4.552, 265|

From 2014... ss EZERZE)

From 2015. 7,868,450

Total of lines 3a through e.

33,744,779

Qualifying distributions for 2046 from Part

XI, ines Bs 9338,116

Applied to 2015, but not more than line 2

Applied to undistributed income of pier years

(Election required—see instructions)...

Treated as dstnoutons out of corpus (Election

required—see instructions). sev ee +

3a]

506,209]

Excess distributions carryover applied to 2016

(fan amount appears in column (4), the

‘same amount must be shown in column (a) )

Enter the net total of each column as

indicated below:

Corpus Add lines 3f, 4c, and 4e Subtract line 5

38,250,978]

Prior years’ undistributed income Subtract

line 4b from line 25 .

ter the amount of pror years’ uncistnibuted

income for which a notice of deficiency nas.

Deen issued, or on which the section 4942(a)

tax has been previously assessed.

Subtract line 6c from line 6b Taxable amount

see instructions » 6 clo bid

Undistributed income for 202!

4a from ine 28 Taxable amount—see

instructions

Undistnbuted income for 2016 Subtract ”

lines 4d and 5 from line 1 This amount must

be distnbuted in 2037

‘Amounts treated as distnbutions out of

corpus to satisfy requirements imposed by

section 170(5)(1)(F) oF 4942(g)(3) (Election may

be required - see instructions) « pci

Excess distnbutions carryover from 2013 not

applied on line 5 or line 7 (see structions) +» «

Excess distributions carryover to 2017.

Subtract lines 7 and & from line 6a.

‘Analysis of ine S

Excess from 2022, 8,355,484

Excess from 2013, 4,552,265

Excess from 2014, 5. 8,723,773

Excess from 2015. «+ + 7,868,459

Excess from 24 4,506,200]

Form 990-PF (2016)

Form 990-PF (2016) Page 10

BEEN Private Operating Foundations (cee instructors and Pare VITA, question 5)

1a. Ifthe foundation has received a rung or determinabon eter that = a prvate operating

foundoton, and tering sefecive for 2056" enter the cate ofthe Rings eee. BL

b check bor to indicate whether the erganzaton 2 pvate operating foundation descnbed m section CI 49424(3) or Ol 49e20n5)

2a Enter the lesser ofthe adwutes net Tax year Pror3 years

income from Part 1 or the minimum * : (©) Total

Gay2016 was (a0 wn

under section 4942())(3)(B}())

StaeneemraeaS

nee:

Supplementary Information (Complete this part only if the organization had $5,000 or more in

List any managers of the foundation who own 10% or more of the stack ofa corporation (or an equally large portion of fe

‘ownership of a partnership or other entity) of which the foundation has a 10% or greater i

2 Information Regarding Contribution, Grant, Gift, Loan, Scholarship, ete., Programs

Check here > MZ] if the foundation only makes contributions to preselected charitable organizations and does not accept

Unsolicited requests for funds If the foundation makes gifts, grants, etc (see instructions) to individuals or organizations under

other conditions, complete tems 2a, b, ¢, and d

'@ The name, address, and telephone number or email address of the

rson to whom applications should be adcressed

'b The form in which applications should be submitted and information and materals they should include

¢ Any submission deadlines

Any restrictions er limitations on awards, such as by geographical areas, charitable fields, kinds of institutions, or other

factors

Form 990-PF (2016)

Form 990-

F (2016)

Page 12

Supplementary Information (continued)

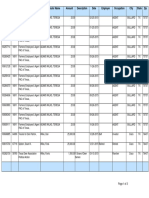

3 Grants and Contributions Paid During the Year or Approved for Future Payment

Trecprent ean need

Recpient show any reatonehis eo | FOUN | Purpose of grant oF

Tune and sddiens (home wb any foundaton manager | Zest ceontabuton ‘Armount

lame and address (home or business) | 2” foundation manager :

3 Paid during the year

See sen of Donees addressesstatus © |None s021<;3)—_ Vanous 7,924,428

Vanous

Vanous,T_ 7647

Tow ea Tana aS

Approved for fture payment

‘See Sch of Donees addresses stat None [501(¢)(3) Various. 4,000,000

Venous

Vanous,T¢_76497

Total 3 77500,000

Form 990-PF (2016)

Form 990-PF (2016)

EEREGEEY Ataiyaie of income-Producing Activities

Page 12

Enter gross amounts unless otherwise indicated

Unrelated business income

Excluded by secbon 512, 513, or S14

(e)

Related or exempt

function income

a 5) e d

1 Program serace revenue susnesy code| _antount | ExcluSen code | _aneont _|(See netuctons)

b

a

__

Fees and contacts om government agencies

2 Membersinp dues and assesment:

3 Interest on savings and temporary ca

investments : 1s 20421

4 Dyicends and interest rom secures Fa said

5 Netrenal income or (os) from realestate

a Debttinanced propery.

B Not debenanced propery

6 "Net rental ncome or (es) arn personal property

7 Otherinvestment income. s+

8 Gain or (los) fom sales of assets other than

9 Netincome o (ss) rom speci evens

10. Gross profit or (038) fom sales of ventory

11 Other revenue

b Hise cone @ HV 098 8 ‘i

toss Peres 8

12 Subtotal Add columns (), @, and (e). zai

13 Total. Add line 12, columns (b), (4), and (e).

‘See worksheet inline 13 instructions to venty calculations )

5 EJ Relationship of Activities to the Accomplishment of Exempt Purposes

Line No. | Explain below how each act

1B

ity for which income 1s reported in column (e) of Part XVIA contributed importantly to

Fi” | the accomplishment of the foundation's exempt purposes (other than by providing funds for such purposes) (See

instructions )

431,176

Form 990-PF (2016)

Form 990-PF (2016) Page 13

Information Regarding Transfers To and Transactions and Relationships With Noncharitable

EERE exempt organizations

1 Did the organization directly or indirect engage m any of the folowing with any other organization descnbed in section 501

() of the Code (other than section 504(c)(3) organizations) or in section 527, relating to political organizations? Yes | No

2 Transfers from the reporting foundation to a noncharitable exempt organization of

Clee ene ee Booopo poo nooo grt) No

(2) Other assets, ee ee [ety No

bb Other transactions

(1) Sales of assets to a noncharitable exempt organization, © ee ee ee ee [aca No

(2) Purchases of assets from a noncharitable exempt organization, ee ee ee ee ee ee [CRD] No

(3) Rental of faciities, equipment, or other assets ce ee ee fabCay] No

(4) Reimbursement arrangements. 6 eee ee ee ee ee fC No

(5) Loans or loan guarantees. ce eee ab(5)| No

(6) Performance of services or membership or fundraising solicitations. ©. . 7 + + ee ee ee ee «|b C6Y No

Shanng of facites, equipment, mailing lists, other assets, or paid employees 6 + sts sv et te te No

4 If the answer to any of the above is "Yes," complete the following schedule Column (b) should always show the fair market value

of the goods, other assets, or services given by the reporting foundation Ifthe foundation received less than fair market value

In any transaction or sharing arrangement, show in column (d) the value of the goods, other assets, or services received

(a) une to | (b) Amount volved | (c) Name of nonchantable exempt organzaton | (4) Descapton of transfers, transactions, and shanng arrangements

as the foundation directly or indirectly affliated with, or related to, one or more tax-exem

3 organizations

described in section 501(c) of the Code (other than section 501(c)(3)) orin section 5277,» . » ss + « + + Doves Mino

bb If "Yes," complete the following schedule

(a) Name of organzaton (b) Type of organzabon ©) desenbon of relationship

Under penalties of perjury, I declare that I have examined this retum, including accompanying schedules and statements, and to the best

of my knowledge and belief, tis true, correct, and complete Declaration of preparer (other than taxpayer) Is based on al information of

Sign| which preparer has any knowledge

Herely see pone yn ae Sa

Sianature of effcer or trustee Date Tie

FrintType preparer's name | Prepares Signature ate

w/TyPe ore * bie check i self

‘Victor K Munson employed » Pot2asss7

Paid

Preparer [fis namem vitor K Munson CPA

Use Only Firm's EIN

Firms addrese > 6060 N Central Expwy Sure 560

Dallas, TX 75206 Phone no (214) 237-2920

Form 990-PF (2016)

Form 990PF Part XV

contributions rect

than $5,000)

[roms wits

[Beane wis

ion who have contributed more than 2% of the total

‘ed by the foundation before the close of any tax year (but only if they have contributed more

TY 2016 Accounting Fees Schedule

Name: The Thirteen Foundation

EIN: 27-6977311

Software ID: 16000303

Software Version: 2016v3.0

Category Amount Net Investment | Adjusted Net | Disbursements

Income Income for Charitable

Purposes

‘Accounting fees

8,650 0 0

[efile GRAPHIC (DO NOT PROCESS.

Note: To capture the full content of this document, please select landscape mode (11" x 8.5

TY 2016 Amortization Schedule

'93491317009457|

Name: The Thirteen Foundation

EIN: 27-6977311

Software ID: 16000303

Software Version: 2016v3.0

amortized

Income Income | “Amortization

| oonemoree nite eam aaa soon a aaa

[efile GRAPHIC

int - DO NOT PROCESS. DIN: 93491317009457

Note: To capture the full content of this document, please select landscape mode (11" x 8.5") when printing.

TY 2016 Depreciation Schedule

Name: The Thirteen Foundation

EIN: 27-6977311

Software ID: 16000303

Software Version: 2016v3.0

Description of Date] Cost or other ] Prior Years’ | Computation Method Rate / ‘Current Year's | Net Investment | Adjusted Net | Cost of Goods

Property ‘Acquired Basis Depreciation Life (# oF years) Depreciation Income Income ‘Sold Not

Expense Included

‘Computer 2015-10-07, 3.633 2.8855 10 0000 788 24 28

efi

TY 2016 Land, Etc.

Schedule

Name:

EIN:

Software ID:

Software Versi

GRAPHIC print - DO NOT PROCESS

As Filed Data

The Thirteen Foundation

27-6977311

16000303

nz 2016v3.0

DLN.

3491317009457

Category / Item

Cost / Other

Basis

Accumulated

Depreciation

Book Value

End of Year Fair

Market Value

Machinery and Equipment

6,030

6,030

[efile GRAPHIC DO NOT PROCESS. DLN: 93491317009457|

TY 2016 Other Decreases Schedule

Name: The Thirteen Foundation

EIN: 27-6977311

Software ID: 16000303

Software Version: 2016v3.0

Description Amount

Disbursements for chantalble purposes

213,687

[efile GRAPHIC print - DO NOT PROCESS | As Filed Data - | DLN: 93491317009457|

TY 2016 Other Expenses Schedule

Name: The Thirteen Foundation

EIN: 27-6977311

Software ID: 16000303

Software Vet 2016v3.0

Other Expenses Schedule

Description Revenue and Net Investment ‘Adjusted Net isbursements for

Expenses per Income Income Charitable

Books Purposes:

“Amortization 407

“Amortization of bond prem/dise 2,084 Ea Ea

Brokerage and bank fees 63,859 62,048 62,844 564

Contracted services 4,955

Depreciation - various 13,157

Donations ~ net 42,263,

Dues & subscriptions 120 60

Foreign tax W/H- dividends 3,837 26,621, 26,821

Gain on sale of equiament “11,477

Insurance 684 1,367

Other Expenses Schedule

Description Revenue and Net investment | Adjusted Net | Disbursements for

Expenses per Income Income ‘Charitable

Books Purposes

Licence and fees 3,008

Materials and suppies 3,833

Meals & entertainment 5 3313,

Miscellaneous “1036 3,258

Office expense 2,853,

(Other investment expense BNY Mellon 27,592 27,592

6 187

Repairs & maintenance 2,773

Supplies other 2.176

Travel 1238 26,467

Other Expenses Schedule

Description Revenue and Net Investment Adjusted Net | Disbursements for

Expenses per Income Income Charitable

Books Purposes.

Ublities 930

Vehicle expense 33 5318

GRAPHIC

nt

DO NOT PROCESS.

[As Filed bata -] DIN:

TY 2016 Other Income Schedule

3491317009457

Name: The Thirteen Foundation

EIN: 27-6977311

Software ID: 16000303

Software Version: 2016v3.0

Other Income Schedule

Description Revenue And Net Investment | Adjusted Net Income

Expenses Per Books Income

Income from K-15 472,528 236,368 236,368

Misc income @ BNY 1099 4 7,337 7.337

[efile GRAPHIC (DO NOT PROCESS. DLN: 93491317009457|

TY 2016 Other Increases Schedule

Name: The Thirteen Foundation

EIN: 27-6977311

Software ID: 16000303

Software Version: 2016v3.0

Description Amount

Net Unrealized Gain on Investments

785,289

[efile GRAPHIC DO NOT PROCESS. DLN: 93491317009457|

TY 2016 Taxes Schedule

Name: The Thirteen Foundation

EIN: 27-6977311

Software ID: 16000303

Software Version: 2016v3.0

Category Amount Net Investment | Adjusted Net | Disbursements

Income Income for Charitable

Purposes

Federal income tax 05,144

Property tax: 1,487

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Capitol Riot Map 1.11.21Document1 pageCapitol Riot Map 1.11.21Teddy WilsonNo ratings yet

- WWHA V PaxtonDocument43 pagesWWHA V PaxtonTeddy WilsonNo ratings yet

- 2021 States and Nation Policy Summit AgendaDocument4 pages2021 States and Nation Policy Summit AgendaTeddy WilsonNo ratings yet

- DFPC Prayer List UpdatedDocument1 pageDFPC Prayer List UpdatedTeddy WilsonNo ratings yet

- PP v. JegleyDocument148 pagesPP v. JegleyTeddy WilsonNo ratings yet

- Human Coalition - Texas Grant ContractDocument455 pagesHuman Coalition - Texas Grant ContractTeddy Wilson100% (1)

- Texas HHSC Request For ApplicationDocument104 pagesTexas HHSC Request For ApplicationTeddy WilsonNo ratings yet

- Wilks Family Campaign Contributions - Texas (2015)Document3 pagesWilks Family Campaign Contributions - Texas (2015)Teddy WilsonNo ratings yet

- PF Return of Private Foundation: ExpensesDocument20 pagesPF Return of Private Foundation: ExpensesTeddy WilsonNo ratings yet

- Wilks Family Campaign Contributions - Texas (2018)Document3 pagesWilks Family Campaign Contributions - Texas (2018)Teddy WilsonNo ratings yet

- Wilks Family Campaign Contributions - Texas (2017)Document7 pagesWilks Family Campaign Contributions - Texas (2017)Teddy WilsonNo ratings yet

- Wilks Family Campaign Contributions - Texas (2016)Document9 pagesWilks Family Campaign Contributions - Texas (2016)Teddy WilsonNo ratings yet

- HFF 990 2012Document35 pagesHFF 990 2012Teddy WilsonNo ratings yet

- Return of Private FoundationDocument40 pagesReturn of Private FoundationTeddy WilsonNo ratings yet

- HFF 990 2016Document22 pagesHFF 990 2016Teddy WilsonNo ratings yet

- TTF 990 2011Document43 pagesTTF 990 2011Teddy WilsonNo ratings yet

- HFF 990 2015Document21 pagesHFF 990 2015Teddy WilsonNo ratings yet

- HFF 990 2013Document124 pagesHFF 990 2013Teddy WilsonNo ratings yet

- HFF 990 2014Document22 pagesHFF 990 2014Teddy WilsonNo ratings yet

- Form 990-PF Return of Private FoundationDocument18 pagesForm 990-PF Return of Private FoundationTeddy WilsonNo ratings yet

- TTF 990 2014Document29 pagesTTF 990 2014Teddy WilsonNo ratings yet

- TTF 990 2012Document39 pagesTTF 990 2012Teddy WilsonNo ratings yet

- TTF 990 2013Document127 pagesTTF 990 2013Teddy WilsonNo ratings yet

- Texas A2A Program FY2017 Q4 (Foundation For Life Facility Tour)Document3 pagesTexas A2A Program FY2017 Q4 (Foundation For Life Facility Tour)Teddy WilsonNo ratings yet

- Texas A2A Program FY2018 Q2 (Foundation For Life Annual Monitoring)Document3 pagesTexas A2A Program FY2018 Q2 (Foundation For Life Annual Monitoring)Teddy WilsonNo ratings yet

- TTF 990 2015Document25 pagesTTF 990 2015Teddy WilsonNo ratings yet

- Texas A2A Program FY2018 Q2 (Pregnancy Help Center of Lufkin Annual Monitoring)Document4 pagesTexas A2A Program FY2018 Q2 (Pregnancy Help Center of Lufkin Annual Monitoring)Teddy WilsonNo ratings yet

- Texas A2A Program FY2018 Q1 (Pregnancy Care Center Huntsville - Facility Tour)Document2 pagesTexas A2A Program FY2018 Q1 (Pregnancy Care Center Huntsville - Facility Tour)Teddy WilsonNo ratings yet

- Texas A2A Program FY2017 Q1 (Facility Tours)Document2 pagesTexas A2A Program FY2017 Q1 (Facility Tours)Teddy WilsonNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)