Professional Documents

Culture Documents

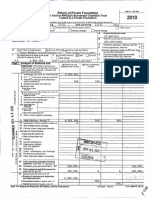

TTF 990 2015

Uploaded by

Teddy Wilson0 ratings0% found this document useful (0 votes)

21 views25 pagesThe Thirteen Foundation - IRS 990 (2015)

Original Title

TTF-990-2015

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Thirteen Foundation - IRS 990 (2015)

Copyright:

© All Rights Reserved

0 ratings0% found this document useful (0 votes)

21 views25 pagesTTF 990 2015

Uploaded by

Teddy WilsonThe Thirteen Foundation - IRS 990 (2015)

Copyright:

© All Rights Reserved

You are on page 1of 25

[efile GRAPHIC p

-om990-PF

2

Department of the Treasury

= DO NOT PROCESS. DIN; 93491315009006

OMB No 1545-0052

2015

Cary

Return of Private Foundation

or Section 4947(a)(1) Trust Treated as Private Foundation

> Do not enter social security numbers on this form as it may be made public.

» Information about Form 990-PF and its instructions is at www./rs.qov/form990pf.

intemal Revenue Service reine

For calendar year 2015, or tax year beginning 01-01-2015 and ending 12-31-2015

276977381

[BTelaphone number (s86 nat

“Wommber and Seat (orPO ox number it mals not Gelvered Yo STeaE BUGS) | Room Toate sons)

17010 Inerstate 20, (254) 950-3600

iy OF wn, sa OF OWE, GuTy, ond ZF oF ToTen BONA ade © tr exemption appicaton spending, check here

Este 76437 rr

G Check allthat apply [tnttial return [initial return of former public charty | 4. Foreign organatons, check hace »

Frinat return [Tamended return rm

Taddress change [Name change 2, Foreign organizations meetng the 85%

test, check here and attach computaton > [

if pte Toundaton status was trmnated

Wecheck type af organization [Section 501 (c)(3) exempt private foundation eee Se oes ee gH

[Section 4947 (a1) nonexemt chantable trust [Other taxable private foundation

Fair market value ofall assets at end | 9Accounting method F¥Cash [Accrual | F If he foundation sm 9 60-mont arminaton

of year (from Part TT, cal (e), T other (speeity) Under section 07{B]()(B},dece here yf

fine 16). 78,903,511 (Part 1, colummn (d) must be on cash basis )

EEE Analysis of Revenue and Expenses @

(The tla of amounts m cours (0), (c), ad (2) May not pear Netinvestment | adysted net | Qsusements

recesony equal te amounts conn (a) ese apenses por | qyy N@Emwestment |___Acbusted net | chant

intron (ay books bose

(cosh 6356 on)

1 Contributions, gifts, grants, ete ,recewed (attach

schedule)

2 check [Futthe foundation 1s not required to

attach

sch 8 Pe eae

3° Interest on savings and temporary cash investments 4505] 532 aes]

Dividends and interest from securities =... 7,060,524] 7086 53 7086531]

Sa Gross rents :

bb Net rental income or (loss)

62 Net gain or (loss) from sale of assets not on line 10 3486,135

Gross sales price for all assets on line 62

45,622,591

‘gain net income (from Part 1V, ine 2). « aaa7a77

8 Net short-term capital gain «

9 Income modifications «

Revenue

10a Gross sales less returns and

allowances

b Less Cost of goods sold .

Gross profit or (loss) (attach schedule) «

hha otherincome attach schedule)... ss [88 sae Tare Tae

kz TotalAdd lines 1 shrough 11 Somos] are

43 Compensation ofoffcers, directors, Wustees, ete

46 Otheremployee salanes and wages sv es + « Tame

gg [28 Pension plans, empioyee bene

3 | sea Legal ves (attach schedule).

|v Accounting ees (attach sehecule) y Taso

S Other professional fees (attach schedule)

Z |47 Interest

2 |s9 depreciation (attach schedule) and depletion » [I 7a 7 7

E [20 oceuancy se ee eee 7a] 7 7

[ar Travel, conferences, and meetings

& [23 Otherexpenses (attach schedule) 3 em aaa se Tame

© |24 Total operating and administrative expenses.

5 Ad nes 13 through 23 essed foe 100.5 poe

© | 25 — Contributions, gifts, grants paid 16,999,816] 16,999,816

25 Total expenses and dsbursements.Acd lines 24 and

2 supeactine 26 Fomine 17

a Excess of revenue over expenses and cisbursements -sz.i0e

Net investment income (i negative, enter-0-) a0

€_Adjusted net incomeiitnegative, enter-0-) Ta

For Paperwork Reduction Act Notice, see instructions, Cat No 11269% Form 990-PF (2015)

Form 990-PF (2015) Page 2

[ETEEE) satance sheets Sti e forendof year amount only (See mwscos a Book Vatns | 10) Sook Votes [te For Nar Vale

Coshanon-iterest-bearmg | O05 104259

Savings and temporary cash investments Tae Tara Tas

Accounts receivable B

Less allowance for doubifu accounts

4 Pledges receivable B

Less allowance for doubiful accounts B

Grants recewvable

Recervables due from officers, directors, trustees, and ather

disqualied persons (attach schedule) (See structions).

7 other notes and fans recewable attach schedule)

Less allowance for doubtful accounts

|, | ® _Inventones forsale or use

| 9 Prepaid expenses and deferred charges

Bios nvenmens-U sand state goverment options ach ; ae a

b_Investments-corporate stock (attach schedule) sea Ta Sa

€ Investments corporate bonds (attach schedule) ama aE Bao

11. Investments—Iand, buldings, and equipment basis

Less accumulated deprecation (attach schedule) B

12° _Investments—mortgage loans

13 Investments other attach schedule) re Toe Tae

14 Land, budings, and equipment basis pad

Less” accumulated depreciation (attach schedule) P 2.884 >osshay ac}

45 Other assets (describe B ) (se) 43,195]

16 Total assets(to be completed by al filers see the

G7 Accounts payable and accrued expenses 01 Tae

18° Grants payable

E]as Deferred revenue a

220 Loans from amcers,crecors, trustees, and other sequalined persons

Bar wongages and ater nates payable (attach schedule).

22 other labities (descnbe B )

23 _Total lablties(add ines 17 trough 22) ami 2

~ | Foundations that folow SFAS #37, check here [=

$| anc complete tines 24 through 26 and lines 30 and 33.

Elea unvesinctea

Bl 25 Temporaniy restricted

=| 26 Permanently restricted tid

=| Foundations that do not follow SFAS 117, check here PZ

| and complete lines 27 through 3.

se 27 capreal stock, tust prancipal or current funds rosz70] ros roara

3) 2a paid-in orcaptal surplus or land, 69 and equipment fund

Z}29 Retained earnings, accumulated income, endowment, or other funds Tari | eT

B|s0 Total net assets or fund balancessee instructions) 95,260 7a

31 _Total liabilities and net assets/fund balanceisee instructions) sa 7 cen

‘Analysis of Changes in Net Assets or Fund Balances

1 Total net assets or find balances at beginning ofyear=Part I, column (al tne 30 (must aaree

wth end-of-year igure reported on pror year’ return) 1 99262811

2 enteramount fom Pat f, ne 278 2 712.810.4658

3 otherincreases not ncladed inne 2 (temze) 3

4 Asdlines 1,2, and3 - . [ae waasaats

5 Decreases not included in line 2 (itemize) P . 5 6,569,420

‘ otal net assets orfund balances atend of year ine 4 mus Ine S}-Patit, column (hime 30. 6 79,882,926

Form 990-PF (2015)

rm 990-PF (2015) Page 3

[GEM Capital Gains and Losses for Tax on Investment Income

List ang descnbe the kind{s) of property sold (e 9 , realestate, Howacaured) ate acquired] Date sold

(a) 2-story oriek warehouse, or common stock, 200 sns MLC Co) coy ensayo days 7) | (4) (mo day, ¥F)

Ta__1 Publicly Traded Secunties . Zois-o7-01 | 2015-07-0

bt Publicly Traded Secunties e 2013-07-01 | 2015-07-0

€__ Capital Gain Dividends

@

Depreciation allowed Cost orather base Gain or (lose

eee (f) (or allowable) (g) plus expense of sale (h) (@) plus (f) Arn (9)

a 71326045 21,511,705 185/660

» 24,064 482 20,862,849 3,201,633

€ 232,004

@

‘Complete only for assets shownng gain in column (h) and owned by the foundation on 12/31/69 Gains (Col (R) gain minus

ajusted basis xcess of co! ( col {k), but not less than -0-) oF

(EM an ofizsaaies gyovati2/sies iy evercal Geitany |p “Losses tromeat tO)

2 185,660

» 3,201,633

@

- ; Tigain,olsoenterin Pan ine?

2 Capital gain net income or (net capital loss) I loss), enter=-0- im Parei,tine7 | | ReararT

3 Net short-term capital gain or (los s) as defined in sections 1222(5) and (6)

1 gain, aso enter in Part 1 ine 8, column (€) (see instructions) If (loss), enter -0 \

inPatLimeS se ee ee ess a ils tasjs00

Eno

(For optional use by domestic private foundations subject to the

If section 4940(4)(2) applies, leave this part blank

ication Under Section 4940(e) for Reduced Tax on Net Investment Income

tion 4940(a) tax on net investment income )

Was the foundation liable for the section 4942 tax on the distributable amount of any year in the base period? TP ves No

It"Yes," the foundation does nat qualify under section 4940(e) Do nat complete this part

4 Enter the appropriate amount in each

column for each year, see instructions before making any entries

bate pod urs Calandar © © Detnbuton rao

vciegeedyeorcalrdet | acsunedavalyng tenoutons | et volun of norte sets pate ae

2o1a 11650534 101963342 0 11436

2013 9,531,124 101,777,103 0.09365

2012 13,150,743 96,693,259 013601

201 3,026,694 60,653,679 0.04990

2010

Totalof ine 1, column @h 2 0393815

3. Average distribution ratio forthe 5-year base periog—divide the

the number of years the foundation has been in existence if less 3 0 a9sas4

4 Enter the net value of nonchantable-use assets for 2015 from Part x, line 5. 4 39,019,867

5 Multiply line 4 by ine 3 5 3,764,362

6 Enter 1% of net investment income (19% of Part I, line 27). 6 49,334

7 Add lines 5 and 6. 7 9,813,696

8 Enter qualifying distributions from Part XIT, hne 4, 8 17,270,109

Ifline 8 1s equal to or greater than line 7, check the box in Part V1, line ib, and complete that part using a 1% tax rate See

the Part VI instructions

Form 990-PF (2015)

Form 990-PF (2015) Page 4

Excise Tax Based on Investment Income (Section 4940(a), 49a0(b), 4940(e), oF #940—aee page 18 of the Instructions)

a Exempt operating foundations described in section 4940(4)(2), check here B [—

and enter *N/A" on line 1

Date of ruling ar determination letter

{attach copy of letter if necessary-see Instructions)

b_ Domestic foundations that meet the section 4940(e) requirements 1n Part V, check 1 49,334

here P ffandenter1% ofPartL,line27 + vv et

© sltother domestic foundations enter 2% of ine 27b Exempt foreign organizations enter 4% of

Part, line 12, col (b)

2 Tax under section 511 (domestic section 4947(a){1) trusts and taxable foundations only Others

enter -0-) 2

3 Addlines tand2. 2 ee ee 3 49,334

4 Subtitle A (income) tax (domestic section 4947(a)(2) trusts and taxable foundations only Others

enter -0-) 4

5 Tax based on investment income.Subtract line 4 from line 3 tfzero orless,enter-0-. . . . . [5 49,334

6 Credits Payments

a 2015 estimated tax payments and 2014 overpayment credited to 2015 | 6a 103597|

b Exempt foreign organtzations—tax withheld at source... . . . . | ob

€ Tax paid with application for extension af time to file (Form 8868). - 6

4 Backup withholding erroneously withheld. 2. we we eee ed

7 Total eredits and payments Add lines 6a through 64. . 6. eee z 103,597

8 Enter any penalty for underpayment of estimated tax Check here fy if Form 2220 1s attached

9 Tax duetf the total ofines 5 and 8 is more than ine 7, enteramount owed... . . . . Ph [9

40 Overpayment.if ine 7 1s more than the total of lines 5 and 8, enter the amount overpaid... ® | 40 54,263

11 _Enter the amount ofline 10 to be Credited to 2015 estimated tax 0260 Refunded > | aa

‘Statements Regarding Activities

4a During the tax year, did the foundation attempt to influence any national, state, or local legislation or did Yes | No

it participate or intervene in any political campaign? eee iss No

bid t spend more than $109 during the year (either directly or indirectly) for political purposes (see Instructions

fendeharsor)2 ee ae aa ab No

I the answers "Yes" to 4a or 2b, attach adetaled description of the actwities and copies of any materials

published or distributed by the foundation in connection with the activities

€ Did the foundation file Form 4420-POL forthis Year’, vee ae No

Enter the amount (if any} of tax on political expenditures (section 4955) impased duning the year

(2) on the foundation ® § (2) On foundation managers P §

Enter the reimbursement (if any) paid by the foundation during the year for political expenditure tax imposed

on foundation managers §

2 Has the foundation engaged in any activities that have not previously been reported to the IRS? ss ee sw 2 No

11 "¥es,"attach a detaled description ofthe activities

‘3 Has the foundation made any changes, not previously reported to the IRS, in its governing instrument, articles

of incorporation, or bylaws, or other simular instruments? If "Yes," attach a conformed copy of the changes. . « «| 3 No

4a Did the foundation have unrelated business gross income of $1,000 or mare during the year”... ss es + | 4a No

b_ 1F*Ves," has it filed a tax return on Form 990-T forthis year?. ee ee ee PD No

5 Was there a liquidation, termination, dissolution, or substantial contraction dunng the year?» . 6... [8 No

IF "Yes,"attach the statement required by General Instruction T

6 Are the requirements of section 508(e) (relating to sections 4841 through 4945) satisfied either

By language in the governing instrument, oF

‘© By state legislation that effectively amends the governing instrument so that no mandatory directions,

that conflict with the state law remain inthe governing instrument?» 2. 2 ee ee ee ee of 6 No

7 Did the foundation have at least $5,000 in assets at any time during the year?If "Yes," complete Part 11, cal (c),

‘and Part XV Se ee Le | ves

‘8a Enter the states to which the foundation reports or with which itis registered (see instructions)

in

Ifthe answers "Yes* to line 7, has the foundation furnished a copy of Form 990-PF to the Attorney

General (or designate) of each state as required by General Instruction G? If "No," attach explanation « sb | ves

8 1s the foundation claiming status as a private operating foundation within the meaning of section 4942()(3)

0 4942()X5) for calendar year 2015 or the taxable year beginning in 2015 (see instructions for Part XIV)?

I yes;"complete Pat XV ee ee ee el No

40 Did any persons become substantial contributors during the tax year? If "Yes," attach a schedule isting thetr names

and adavesses Sogo giao OdcnG0aqG0l0oco0005008 0 Hl) No

Form 990-PF (2015)

Statements Regarding Activities (continued)

15 section 4247(aX2) nonexemptchantable wusts fing Form 990-PF mlieuofFomma04i—checkhere. =... OR

[EERIE Statements Regarding Activities for which Form 4720 May Be Required

File Form 47201 any items checked inthe "Yes" column, unless an exception apis. Yes | No

ta During the year dd the foundation (ether directy or miecty)

(2 Engace inthe sate or exchange, o easing ofpropety wrth 2 disqualified person? ves ne

(2) Borrow money fom, lend money to, or othermse extend credit to (or accept it

avisqualied person. ce ve tv tt et et tet ee ee eee Pes RF Ne

(2) Furmsn goods, sernices, or facilites to (or accept them from) a disqualited person? Hye pn

-

operating foundation detned im section 4942()(3) oF 4942GX5))

and 6e, Part XIII) for tox year(s) begining before 2013? ee

Yess the years 20, 20, 20, 20__,

b Are thee any years iste n Za for which te foundation s mot appiving the provisions of section 4942(@X2)

(relating to incorrect valuation of assets) to the year’s undistributed income? (If applying section 494 2(a)(2)

to allyears sted, answer *No" and attach statement--see instructions} Dee »| |W

Ifthe prowsions of section 4942(a)2) are being applied to any ofthe years sted in 2a list the years here

20, 20, 20, 20

3a Did the foundation hold more tan a 24 dvect or mdrect interest m any business enterprise at

anytime durngtheyear?. vv te te tet tet terete t vee fre

b 1f¥es° di ithave excess business holdings in 2015 as a result of (4) any purchase by the foundation

or disqualified persons ater May 26, 1969, (2) the lapse a the 5-year pend (or longerperoé approved

by the Commissioner under section 494 3(c)(7)) ta dispose of holdings acquired by gift or bequest, or (3)

the apse ofthe 10-,15-, or 20-year ist phase holding period?{Use Schedule Fo 4720, to determine

ifthe foundation had excess business holdings ip 2015}. vv vv tvs evs eee eee es [ao] [ne

42 id the foundation vest during the year any amount a manner tat would jeopardize ts chantable puposes? aa [no

bid the foundation make any investment ma prior year (ut ater December 31, 1969) that could jeopardize its

chantable purpose that had not been removed from jeopardy before the fst day ofthe tax year beginning n 2025? | ab | | we

Form 990-PF (2015)

Form 990-PF (2015) Page 6

Statements Regarding Activities for Which Form 4720 May Be Required (Continued)

a Dunng the year did the foundanon pay or cur any amount to

(1) carry on propaganda, or otherwise attempt to inluence legislation (section 4945(e))? [ves No

(2) nfuence the outcome of any specie public election (see section 4955), orto carry

on, directly or ndrectly, any voter registration drive? Po

(2) Provide a grant to an ndvidual for travel, study, or ether similar purposes? een ees

(4) Provide a grant to an organization other than a chantable, etc , organization described

in section 4945(d)(4)(A)? (See instructions). 6 se ee ee ee ee + ves FF NO

(5) Provide for any purpose other than religious, chartabe, scientific, Iterary, 0

educational purposes, of forthe prevention of cruelty to children or animals? . - . - - Fyes FF No

bb any answer is "Yes" to Sa(2)=(5), did anyor the transactions fal to quality under the exceptions described i

Regulations section 53 4945 or m a current notice regarding disaster assistance (see structions)? « sb No

Organizations relying on a current noice regarding disaster assistance checkhere, - se. 2. oP

=

€ Ihthe anower we "Yes" to question 5a(4), does the foundation claim exemption from the

tax because i maintained expenditure responsibilty forthe grant?. . . ss + ss + «ves FN

11 "Yes," attach the statement required by Regulations section 53 4945-5(d)

Did the foundation, during the year, receive any funds, directly or mdnecty, to pay premums on

personal beneftcontract?. . ee tee ee ee tet tet ee Ives eno

Did the foundation, during the year, pay premiums, directly or indirectly, ona personal benefit contract? o No

11 "¥es" to 6b, hile Form 8870

7a Atany time during the tax year, was the foundation a party toa prohibited tax shelter transaction? [yes [No

b_Ityes, id the foundation recewe any proceeds or have any net income attributable to the transaction? [|_| ne

Teta Eormation About officers, Directors, Trustees, Foundation Managers, Highly Paid Employees,

and Contractors

List all officers, directors, trustees, foundation managers and their compensation (see instructions).

a)

Title, and average | (¢) Compensation(IF Contributions to

Expense account,

Fams ¢ Wiks [Trustee o

17010 IH 20 00

17010 IH 20 Jf 00

17010 1H 20 29 00

Cisco, TX 76437

2__Compensation of five highest-paid employees (other than those included on line 4—see instructions). If none, enter “NONE.”

@ Tile, and average

Name and adéress ofeach employee pant | "hours perwees | (e) Compensation | employee benefit |_| Expense account

Tore than $50,000 (©) cevoted to postion peu ceter

WoNE

Total number afother emplayees pad over $50,000. 7

Form 990-PF (2015)

You might also like

- Capitol Riot Map 1.11.21Document1 pageCapitol Riot Map 1.11.21Teddy WilsonNo ratings yet

- 2021 States and Nation Policy Summit AgendaDocument4 pages2021 States and Nation Policy Summit AgendaTeddy WilsonNo ratings yet

- DFPC Prayer List UpdatedDocument1 pageDFPC Prayer List UpdatedTeddy WilsonNo ratings yet

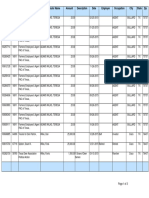

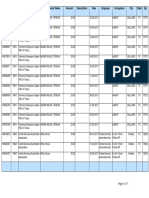

- Wilks Family Campaign Contributions - Texas (2016)Document9 pagesWilks Family Campaign Contributions - Texas (2016)Teddy WilsonNo ratings yet

- PF Return of Private Foundation: ExpensesDocument20 pagesPF Return of Private Foundation: ExpensesTeddy WilsonNo ratings yet

- Texas HHSC Request For ApplicationDocument104 pagesTexas HHSC Request For ApplicationTeddy WilsonNo ratings yet

- Human Coalition - Texas Grant ContractDocument455 pagesHuman Coalition - Texas Grant ContractTeddy Wilson100% (1)

- Wilks Family Campaign Contributions - Texas (2015)Document3 pagesWilks Family Campaign Contributions - Texas (2015)Teddy WilsonNo ratings yet

- PP v. JegleyDocument148 pagesPP v. JegleyTeddy WilsonNo ratings yet

- WWHA V PaxtonDocument43 pagesWWHA V PaxtonTeddy WilsonNo ratings yet

- Wilks Family Campaign Contributions - Texas (2018)Document3 pagesWilks Family Campaign Contributions - Texas (2018)Teddy WilsonNo ratings yet

- Wilks Family Campaign Contributions - Texas (2017)Document7 pagesWilks Family Campaign Contributions - Texas (2017)Teddy WilsonNo ratings yet

- Form 990-PF Return of Private FoundationDocument18 pagesForm 990-PF Return of Private FoundationTeddy WilsonNo ratings yet

- HFF 990 2013Document124 pagesHFF 990 2013Teddy WilsonNo ratings yet

- Return of Private FoundationDocument40 pagesReturn of Private FoundationTeddy WilsonNo ratings yet

- Texas A2A Program FY2018 Q2 (Pregnancy Help Center of Lufkin Annual Monitoring)Document4 pagesTexas A2A Program FY2018 Q2 (Pregnancy Help Center of Lufkin Annual Monitoring)Teddy WilsonNo ratings yet

- HFF 990 2012Document35 pagesHFF 990 2012Teddy WilsonNo ratings yet

- HFF 990 2014Document22 pagesHFF 990 2014Teddy WilsonNo ratings yet

- TTF 990 2016Document25 pagesTTF 990 2016Teddy WilsonNo ratings yet

- HFF 990 2016Document22 pagesHFF 990 2016Teddy WilsonNo ratings yet

- TTF 990 2011Document43 pagesTTF 990 2011Teddy WilsonNo ratings yet

- HFF 990 2015Document21 pagesHFF 990 2015Teddy WilsonNo ratings yet

- TTF 990 2012Document39 pagesTTF 990 2012Teddy WilsonNo ratings yet

- Texas A2A Program FY2017 Q4 (Foundation For Life Facility Tour)Document3 pagesTexas A2A Program FY2017 Q4 (Foundation For Life Facility Tour)Teddy WilsonNo ratings yet

- TTF 990 2013Document127 pagesTTF 990 2013Teddy WilsonNo ratings yet

- Texas A2A Program FY2018 Q2 (Foundation For Life Annual Monitoring)Document3 pagesTexas A2A Program FY2018 Q2 (Foundation For Life Annual Monitoring)Teddy WilsonNo ratings yet

- TTF 990 2014Document29 pagesTTF 990 2014Teddy WilsonNo ratings yet

- Texas A2A Program FY2018 Q1 (Pregnancy Care Center Huntsville - Facility Tour)Document2 pagesTexas A2A Program FY2018 Q1 (Pregnancy Care Center Huntsville - Facility Tour)Teddy WilsonNo ratings yet

- Texas A2A Program FY2017 Q1 (Facility Tours)Document2 pagesTexas A2A Program FY2017 Q1 (Facility Tours)Teddy WilsonNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)