Professional Documents

Culture Documents

TTF 990 2014

Uploaded by

Teddy Wilson0 ratings0% found this document useful (0 votes)

21 views29 pagesThe Thirteen Foundation - IRS 990 (2014)

Original Title

TTF-990-2014

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Thirteen Foundation - IRS 990 (2014)

Copyright:

© All Rights Reserved

0 ratings0% found this document useful (0 votes)

21 views29 pagesTTF 990 2014

Uploaded by

Teddy WilsonThe Thirteen Foundation - IRS 990 (2014)

Copyright:

© All Rights Reserved

You are on page 1of 29

rom990-PF

Ss

or Section 4947(a)(1) Trust Treated as Pr

norte Souce

Return of Private Foundation

ate Foundation

> Donot enter social security numbers on this form as it may be made public.

> Information about Form 990-PF and its instructions fs at www.irs.gov/formS90pf.

[efile GRAPHIC print DO NOT PROCESS [As Filed Data — | DLN: 93491316018195]

ne No 1545-0052

2014

Open to Public

een

For calendar year 2014, or tax year beginning 01-01-2014 sand ending 12-31-2014

or

TF eprover aNNCaON Hae

Telephone nanber (ase marocons)

(25 950-2600

IFexerptionappieation pening, check here & FH

Check all that apply F_tnitial return [_Initial return of a former public charity D4. Foregn organaatons, check here te

poe cee Sco setecsate eet 2G

Hcheck type of organization Section 501 (€)(3) exempt private foundation oa ee

section 4947(2)(1) nonexempt chantable trust_[ Other taxable pnvate foundation,

TFeir market value ofall assets at end | 3Accounting method I Cash [Accrual | F 1 te foundaton ma 6o-month eminaton

Deets a Henbemrestrt ert ane

Incomes 90,900,708 th tea tS aE Baa CR DORRT

Aanyveie ol mavenue and expenses | cpacvowernd | cyreimvesmen | ccrmiueedre | “arcanane™

Mec eds Sit) rae eae rout | orc

at ce

i aur

& | 7 Toptaraain net income (rom Part1V, ine 2) TRA

$ [15 Pension plans, employee benefits .

© | 16a Legal fees (attach schedule). cal saa]

Tonner professional fees (attach schedule)

& [28 taxes (attach schedule) (see nstructions) S EE Ree

ie es 785] 32 se

| 21 Travel, conferences, and meetings .

E24 texatopurting and edminit ative expenses

5 Add lines 13 through23.. . . . apagaa: 2.71009 imax ans sane

28 Totalacpenes and labore AGG tnas 26 and

‘Ete of revenue over expenses and dbursements aso

fet nvestnet ico i neptve, enter -0-) a

For Paperwork Reduction Act Notice, see instructions, Cat No 1289%

Form 990-PF (2014)

Form 990-PF (2014) Page 2

DENTE sotance sheets Siti nee ental wear anus ony See vats ) “eee Boa Vase) Fae Ha Va

Accounts recevable

Lest allovance for dou acounts®

4 Pledges receivable

Less allowance or doubit accounts

6 Recevvabes due from oficers, directors, tustes, and other

disquatiied persons (attach schedule) (see instructions)

7 Other notes and loans receeble attach schedule)

Less allovance or doubt accounts >

te

B| 9 presen expenses and deeredeneres sos sss a

|10a_Investments—U S and state government obligations (attach schedule) 3,158,569 9,150,968

Investments—corporte stock fttach schedule). = ve eee + ama Fees Beast

12. Investinante—fand, buldinge and equipmant baste

Less accumulated depreciation (attach schedule)

12 _tnwestments—tmertgege lone

13 _avestments—ther (attach schedule} aaa Bana Bana

14 Land, budings, and equpment basis son

Less. accumlated depreciation atach schedule) 2084 aoubss 9s am

15. otherassets(desenbe® > io Baa on

16 Total ansets (tobe completed by al erases the

ee

Se mie

| 20 Loans rom otcers, directors, trustees, and other disqualiied persons

Bax merasges and othernoespayebi atach shes)

22 Other liabilities (describe P > 73.315]

23_Totalitlitns (ad ines 17 trough 22) 7 0.0 2H

Foundations that fllow SFAS 137, check ewe PT

3] antcomplte tines 2 through 2 and tines 30 and 3.

Blas unrestneted 2.

Glas Tempormnyresincted vs eed

Sa ine

| Foundation that donot follow SFAS 137, check here FF

| and complete ines 27 trough 3.

[27 ceptal stock, tt pnepa or curent finds ee

| 2m Paitin or capa! surplus, erlang, bldg, and equipment tnd

220 Retained earings, accumulated ncome, endowment, or ether funds ae aaa

B]s0 Total net assets o fund balances (see instructions) sso sae

31 Total abities and mat ansts/fund balances (see structions) asa sear

EEE Analysis of changes in Net Assets or Fund Balances

1 Total net assets a fund balances at begining af year—Part Il columa (a) ine 30 (must agree

wth and-ot-yeer gure reporeedonpnoryears atime vee eee ew te dB 105,503,895

Scenics 0 ls 74,659,035

3 oOtherincreases not included nine 2 (itemize) 3

s Decreases not included in tine 2 (itemize) D> Ss 5 2,582,069

6 __Totalnetassetsorfund balances at end of year (ine 4 mus Ine S)-ParTi column ine 30_[ 6 33,262,811

Form 990-PF (2014)

Form 990-PF (2014)

Capital Gains and Losses for Tax on Investment Income

Page 3

(a) List and descnbe the kind{s) of property sold (e 9 , realestate, Coy Row araured|(c) Date acquired| (4) Date sold

story brek warenause, orcammon stock, 200 sha MLC CO) popurchase [mo dey. ve) | (me day. ¥")

da ___1 Pubhely Traded Secures a woso7-v1 | 7018-07-08

b 1 Publicly Traded Secunties P 3032-07-08_| 2014-07-08

1 FNMA Poot a 3033-07-08 | 2014-07-25

Capel Gain Owidende

ican as TH Depreciation aiowes | (a) Cost arother basis (Gon or foesy

(erellowable) lus expense of sale (epuss minus 6)

= EEREEEIG) 24,636,095] 115917

® 43,960,305] 35,233,999 5,774,992

‘

© 13827

‘Complete only for assets shaving gain in column (R) and owned by the foundation on 12/33/69

(Gains (Col (h) gain minus

@) Adustea basis (ho Excess of ol (i) col (k), but not less than -0-)or

OVE Pl ees cuted as of 12/31/69, over col O),tany Losses (Irom col (h))

. 5,774,992

© n340

o

; : Taain also enter in Par, hne 7

2 Capital gain net income of (net capital loss) Wlloss),enter-0-imParci, ime? | | a

3. Net shortterm capital gain or (loss) as defined n sections 1222(5) and (8)

1f gain also enter in Part ine 8, column (c) (see instructions) If (loss), enter -0

inPartt,iine8 eee teas a. ; ee

(EEE cu wn Under Section 4940(e) for Reduced Tax on Net Investment Income.

(For optional use by domestic private foundations subject to the section 4940(a) tax on net investment income }

1 section 4940(d)(2) applies, leave this part blank

\Wias the foundation liable forthe section 4942 tax on the distributable amount of any year inthe base period?

Ves," the foundation does not qualify under section 4940(e) Da nat complete this part

1LEnter the eppropriete amount in each column for each year, see instructions before making any entries

T ves F No

tase pod Yes Calear © ©, Drintaton ao

scrapes gerecalente,, | saute quattag dsirtatons | Wet vai of nominees assets eo a)

2013 oss ToL gos 0.09365

2012 13,150,743 96,693,259 013601

zor 3,026,594 60,653,679) 0.04390

2008

2 Tetaloflinet,column(@ 7 LP 027955

3 Average aistrbution ratic forthe 5-year base period—divide the total online 2 by 5, or by

the number of years the foundation has been in existence ifiess than 5 years zea 009318

4 Enter the net value of nonchantable-use assets for 2014 from PartX,line 5... = . [a 101 963,342

S Multiply ines byIINE3. ee ee ee ee ee LS 9,501,352

6 Enter 1% of net investment income (1% of Part Iie 278. 2 ee es LO 85,703

7 Addines Sand. 2 2 ee eee ee 3,587,055

8 Enterqualifying distributions fomPartXiLjinea. 2 2 ee ee LO 14,736,237

If tine 81s equal to or greater then line 7, check the box n Pert VI, line 1b, and complete that part using a Awe taxrate See

the Part Viimstructions

Form 990-PF (2014)

Form 990-PF (2014) Page

Excise Tax Based on Investment Income (Section 4940(a), 4940(b), 4940(e), or 4948—see page 18 of the instructions)

Ia Exempt operating foundations described in section #940 0N2), check here B Pand enter N/A"

nine 2

Date of ruling or determination letter (attach copy of latter if necesary-see

instructions)

bb Domestic foundations that meet te section 4940(e) requirements n Part V, check 1 95,703

here Be fFand enter of Pari lne 278

€ Allother domestic foundations anter 2% ofline 27b Exempt fram organizations enter 4% of

Partisine 12, cal ©)

2 Tak uideransbon 511 (mest sestn 454798) tan nel oudatons ely other

4S see tx omen secon 48470) tune ante andor ont othr

5 Tax based on investment income, Subtract hne 4frombine 3 Itzeroorless,enter-0-. . 2. 6 35,703

6 Cresits/Payments

{2014 estimated tox payments and 2013 overpayment creited ro 201 | 6a es,044

Exempt foreign organzations tox wthheld at source oy

€ Taxpaid wth application for extension oftime to fle (Fom 8868). ee 75,509

sieve eramuia ts cesnas cy einai ee la

7 Total credits and payments Adélines 68 through 6 z 109,844

8 Enter any penalty for underpayment of estimated tax Check here fy sfForm 2220 1s attached @ [8 295

9 Taxdoe. Ifthe total ofimes $ and te morethan ine 7,enteramount owed. ss. ® @

10° Overpayment. fine 71s more than the total oflines $ and 8, enterthe amount overpaid, [30 Tae

11__Enterthe amount ofline 10 ta be cried to 2018 estimated tox 2016 Refunded > [an

Statements Regarding Activities

fn During the ax year, did the foundation attempt to infuence ony national sate, orTocal epilation ord Yes [No

vt partcpate or intervene many political campaign? ee

b idit send more than $100 dunng the year (her directly or ndrecty) for police! purposes (ese Instructions

eter ae

1 the answer is "es" ob, attach deta descpton ofthe activites and copes of any matrals

published or distributed by the foundation in conection withthe atts

€ Did the foundation fle Form 142O-POLFortMEYERP. we ee ee |__|

4 Enterthe amount (fany) oftax on polical expenditures (section 4985) imposed during the year

G) on the foundation § (2) on foundation managers §

Enter th ranbursemant (any) pd bythe foundation dering the year for polical expenditure tax mnposad

an foundation managers Be $

2 Hes the foundation engaged in any acts Hat have nt previously been reported to the IRS? 2 No

11 es, ettachodetoieddescntin ef the acts.

3. Has the foundation made any changes, not previously reported tothe IRS, inte governing instrument, articles

of incorporation, or byana, or other simar instruments? 1f "Yes, "attach conformed cny ofthe changes 3 No

4a oid he foundation have unrelated business gross come of $1,000 or more during the yea? ene

bb 1F*¥e5; hos ified a tax return on Form 990 fortis year? ve eve ve ee tv ee + [ap Ne

5 Was there a hquidatio, terminator, dissolution or substantial contraction dunmg the year? swe ss. No

1 "Ye," tach the statement requ by General Instruction T.

6 Are the requrements of section 508(e) (relating to sectons 4941 through 4545) satsed erther

by language m the governing nstument or

{By state legislation that effectively amends the governing instrument so that no mandatory directions,

that confict wi the state lweremain m the governnginstrument? ve we ee ee ee LO No

7. Did he foundation have atleast $5,000 m assets at any time dunng te yea? ZF "Yes,"complete Part, (©,

be

bb ftheonawersa "Yeo" fone 7, has the foundation furnished a copy ofForm 990-PF tothe Aviomey

General (r designate) of exch state as required by General instruction G? If“, "attach explanation a» | ves

9 ste foundation claming status as a private operating foundation within the meaning of section 49420X3)

or 4942()(5)frcalenda year 2014 orth taxable year beginning n 2024 (se instructons for Par XIV)?

1 7¥e5," compet Part 0 2 No

10. id any persons become substantial contnbutors dunng the tex year? 1f "Yes," attcho schedule isting ther names

and aderesses. Detect retort ete tee teen tte ess [49] | ne

Form 990-PF (2014)

Form 990-PF (2014) Page 5

‘Statements Regarding Activities (continued)

41 Atany time dunng the year, did the foundation, directly or indirectly, own @ controlled entity wahin the

meaning of section 512(b\13)? If*¥es," attach schedule (see instructions)... sv ee ee ee ee at No

32. Did the foundation make a distribution to a donor advises fund aver which the foundation ora ciequalifieg person had

advisory privileges? If"Yes," attach statement (eee instructions) ee ee ee ee ee Lah No

13 Did the foundation comply withthe public inspection requirements for its annual returns and exemption application? [43 | Yes

Website addrese N/A

14 The books are in care of Robert Ear Telephone no (817) 850-3600

Located at 17010 Inersate 20 Caco Tk z1p-+4 76437

15 Section 4947(a)(t) nonexempt chantable trusts filing Form 990-PF inlieu of Form 4041—Checkhere- ee

‘and enter the amount of ox-enempt interest received or acerued during the year... . sh | a5

16 At ny tne dung calendar year 2014, dhe foundation have an nterestin oa signature or atherauthoty over [es | We

a bank securtes or other nancial account na foreign cour? is [ [ne

aetcunts (E888) THeVee™ ener the am af te Treg Coury

Statements Regarding Activities for Which Form 4720 May Be Required

ile Form 47201 any item's checked inthe "Yes" colurm, ules an exception apes: cs

18 Dunng te yer did the foundation (ether erty or necty)

(a) engage the sale or exchange, or lesing ot property wt isqaies person? ves FF no

(2) sorrowmoney rom lend money to, or thermse extend ere to (or acept trom)

2 dnqualited perso? vee no

(3) Famsn goods, services ofits tor accent them om) a isualite person? vee F no

(4) Pay compensotin to, oreo remburse the expenses of» eiquslife person? ves F no

{G) Transfer any income or essts toa disueliied person (ormake any of eter avaiable

forthe bent or use ofa sesualfed persone wt enw yw ws ee eee Pes Fite

(6 Agree to pay money or propery toa government offral (Exception. Check *No*

the foundation agreed to meke a grant to orto employ the afte fr peg

tier ermiaton of government serie, terminating thn 30 87s ese see Yes Fe

any answers "Yes" toTa(1) (6), cd amyof the act foto ually under the exceptions described n Regulations

Organizations relying on @ current notice regarding disaster assistance check heres». ss eo ET

€ Did the foundation engage ina pror year m any ofthe acts described in 1a, other than excepted acts,

that were not corrected before the frst day ofthe tax year beginning in20147, . . 2. 2 2 2 ee es | te No

2 Toxes on failure to distnbute income (section 4862) (does not app for years the foundation was a private

operating foundation defined in section 4942()(3) 0° 494205)

At the and oftax year 2014, did the foundation have any undistributed income (lines 6d

‘and 6e, Part XI11) for tax year(s) beginning before 20147... ev ev ee ee ees Yes NO

Ie*Yes, list the years 20__, 20__, 20,

bb Are there any years listed in 2a for which the foundation is not applying the provisions of section 4942(a)(2)

(relating to incorrect valuation of assets) to the year’s undistnbuted income? (If applying section 4942(a)(2)

So

tall years listed, answer "No" and attach statement-see instructions) 2s we ee ee 2» No

€ Ifthe provisions of section 4942(a)(2) are being applied to amy of the years listed in 2a, lst the years here

coe ues ogee gt

‘3a Did the foundation hold more than @ 2% direct or indirect interest in any business enterprise at

anytime during the years ve ee P08 NO

bb 1F*¥es," aid ithave excess business holdings in 2014 as a result of (4) any purchase by the foundation

or disqualified persons after May 26, 1969, (2) the lapse of the 5-year period (or longer period approved

by the Commissioner under section 4943(c)(7)) to dispose of holdings acquired by gift or bequest, or (3)

the lapse of the 10-, 15-, or 20-year frst phase holding period? (Use Schedule C, Farm 4720, to determine

Ut the foundation had excess business holdings in 2014). »

a

‘4aDid the foundation invest dung the year any amount in a manner that would eopardize its chantable purposes? No

b_ Did the foundation make any investment na pror year (out aRer December 31, 1969) that could jeopardize its

chantable purpose that had not been removed from jeopardy before the first day of the tax year beginning in 2014? | 4b No

Form 990-PF (2014)

Form 990-PF (2014)

Page 6

[PNAS statements Regarding Activities for Which Form 4720 May Be Required (continued)

‘Se During the year did the foundation pay or incur any amount to

(2) Carry on propaganda, or otherwise attempt to influence legislation (section 4945(e))? T ves F No

(2) Influence the outcome of any specific pubic election (see section 4955), orto carry

on, directly or indirectly, any voterregistration dnve?. 2. vv ve ee ee we es Pes NO

(3) Provide 8 grant to an individual for trevel, study, of other similar purposes? T ves F No

(4) Provide a grant to an organization other than a charitable, etc , organization described

in section 4945(d)(4)(A)? (See mstructions). . se ee ee ee Ves NO

(5) Provide for any purpose other then religious, chantable,selentie, literary, or

‘educational purposes, or for the prevention of cruelty to children oranimals?. . . . . . « (Yes F No

b Ifany answer's "Yes" to Sa(1}-(5), did any of the transactions fil to qualify under the exceptions descnbed in

Regulations section 53 4945 or ma current notice regarding disaster assistance (see instructions)?» . . «+ | Sb No

Organizations relying on a current notice regarding disaster assistance check here... ss 2 2

€ Ifthe answers "Yes" to question 5a(4), does the foundation claim exemption from the

tox because it maintained expenditure responsibilty forthe grant”... ss wwe es Yes NO

1F "Yes," attach the statement required by Regulations section 53.4945-5(d)

{62 Did the foundation, curing the year, receive any funds, directly or indirectly, to pay premiums on

« personal benefit contract? ves F Ne

1b Did the foundation, during the year, pay premiums, directly or indirectly, on a personal benehit contract? « oo No

If Yes" to 6b, file Form 8870

7a At any time dunng the tax year, was the foundation a party tea prohibited tax shelter transaction? 7 Yes No

bb_Ityes, did the foundation receive any oroceeds or have any net income attnbutable to the transaction?” »

Information About Officers, Directors, Trustees, Foundation Managers, Highly Pai

and Contractors

Employees,

I List all officers directors, trustees, Foundation managers and their Compensation (see instructions)

(by Mite, and average | (e)Compensason | () Contributions © | ¢— expense account

(a) Nome ond address nours perweek | (iF not paid, enter | employee benefit plans | (@) Expense account,

devoted position es) and deferred compensation

Fame we Frustee a]

37010 1H 20 jroo

Soto Wik ITrustee o|

27010 1H 20, fice

isco, TX 76437

Sonate France lexec Director o|

37010 1H 20 jso00

Cisco, TX 76437

‘2 Compensation of five highest-paid employees (other than those included on line 1—see inatractions), If none, enter "NONE:

(sana and ates otaach ampoyan | PTH andeverne | | COsnavoabaneht| (a) Exsenen acco

paid more than $50,000 7 et plans and deferred ‘other allowances

none

Test number fiber anployees pol oar S50 A00Ga ner ig ace aren

Form 990-PF (2014)

Form 990-PF (2014) Page 7,

Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees,

and Contractors (continued)

'3_ Five highest-paid independent contractors for professional services (see instructions). 1f none, enter "NONE".

(@) Name and adaress of each person paid more than $50,000 (b) Type of service

‘Total number of others receiving over $50,000 for professional services.

EEEEGN summary of Direct Charitable Activities

(© compensation

‘mananons and ther befinnes sored, conferences cena, reser papers poguce, ete

‘The Thirteen Foundation has direct chantable activity through a wholly owned disregarded entiy set up as 8

Missour Limited Liability Company withthe following name Reach for Yahweh Internationall D # 80~

0768042 The expanses are recorded on Page 1 of Farm 990-PF column (d)

Expenses

2

3

[MIE Summary of Program-Related Investments (soe metuchon

mount

1

Allether programrelated investments See mstractions

3

‘Total Ada ines i through

Form 990-PF (2014)

Form 990-PF (2014)

Minimum Investment Return (All domestic foundations must complete this part. Foreign foundations,

see instructions.

Page 8

7 Farmarket va of sts nt oad ad for ue) Uecirn ering ot aman we

avenge meal tr mara oie of secu : Be

f caageer eave ae craze

Se eee ce seer

a teeat(eddinen tend) 3 fossa

« reductonclomedior blockage oretherfeior read on es 1 nd

aie ae dena or ee eee tation | as d

S eee ie eee

eebembrenions oases

4 Cashdeemmd held tr chertabe acts Enter 1/2 ofan 3 (orgrenter mount ee

eee |, per

eee ee te RTE

7 acearcee eee ene son67

Tistibutable Amount (oe Tatruclors) (Secon TSUIST ad YS) pavale operating foundaTans and

cavum foveuh avganaus check hte > and do ot compkte tie art)

a Sosa

bo Teton nvtsonerticnmt be 20:4 om PaRVE a es es | an 5204

Income ayor2014 (Tvs dee notmelde the ex tom Paw Vt e+ [a

o) (amiauctnie ea coamen loncome 0 a noises

{ec oe Ey

eerie 8 ie

7 _Chtntablesmount os acusteg Subtect ine 6 om ine 5 terns anon Part ttbine ts =. [7 oer

Qualitying Distributions (see mtrucvons)

Aros pd (vchdig tomate speees] 0 STOnpIAY COUT, PUD

ee |e rere

see te

2° meas psd ceqre ees ured (ohare) vey ctr out chat,

2 Amounts save especie ehartabie projet satya

oer en

i clarematamaeresei 9

4 qnttygetblne, Asie to though 3 ntarare anon Pre, tna yond Port tae [Ca Eas

5 Feudsvons tha uly ude secu 940(e rine reduce te atone nvesten

ee 52703

+ cn narmcesmermine 6 0 ibe TST

[Note:The amount online 6 wll be used in Part V, column (b), in subsequent years when calculating whether the foundation qualifies for

the section 4940(e) reduction of tax in those years

Form 990-PF (2014)

Form 990-PF (2014)

Undistributed Income (see structions)

Page 9

@

corpus

)

{years priorto 2013

©),

2013

@.

2004

Distrbutable amount for 2024 from Pare XI, line 7

Undistnbuted income, fany, a8 of the end of 2014

Enter amount for 2013 only. . = + +

Total for prior years 20__, 20__, 20.

Excess distributions carryover, any, to 2014

Fromsnneiesaeeeaeaia

Feom2010. . ss ss sa

ramsoti Tas eq

Fom2013, . 1 1. ss 452.285

Total of lines 3a throughe. . vv se

Qualifying aistnbutions for 2014 from Part

XII, ines § 1173527,

‘Applied to 2013, but not more than line 23

[Applied to undistributed income of prior years

(Election required—see instructions). = + + «

Treated a8 distnbutions out of corpus (Election

required-seemstructions). wes = =

Applied to 2014 distributable amount... =

Remaining amount distributed out of corpus

Excess distributions carryaver applied to 2014

(fan amount pears in column (4), the

{Same amount must be show in calurin(3).)

Enter the net total of each column as

indicated below:

Corpus Add lines 31,4¢, and 4e Subtract ine 5

Prior years’ undistnbuted income Subtract

line 46 fom line 20

Enter the amount of prior years’ undistnbutes

tncome for which a notice of deficiency has.

been issued, oron which the section 494 2(a)

taxhas been previously assessed... ss

‘Subtract line 6¢ from line 6b Taxable amount

Undistnbuted income for 2013 Subtract line

43 from line 22, Taxable amount—see

instructions » see oe

Undistnbuted income for 2034 Subtract

tines 44-and 5 from line 1 Thvs amount must

bedistnbuted in 20157 vv ve ee sa

Amounts treated as distributions out of

corpus to satisfy requirements imposed by

Section 170(b)(1)(F) of 494 2(@)(3) (Election may

be required see instructions). . + +--+

Excess distributions carryover from 2009 nat

applied online 5 or line 7 {see structions)...

Excess distributions carryover to 2015.

‘Subtract lines 7 and 8 from line 69

Analysis of line 9

Excess from 2010. 99.5

Excess from 2013. 1 Tava aq

Excess from 2012. 1 | 3355 04

Excess from 2013.» 7352285

Excess from 2014. 1.) 53.77

Form 990-PF (2014)

Form 990-PF (2014) Page 10

Private Operating Foundations (see instruchons and Part VIA, queston 9)

foundation andthe rulings etectve for 2014 enter the date ofthe rua.

‘Check box to indicate whether the organization 1s a pnvate operating foundation descnbed in section _4942)(3) or [_49420N5)

.

2a Enter the lesser of the adusted net Tax year Por 3 years

‘neame from Part [or the minimum (e) Total

en 2014 wits 2082 won a

tnvestment retum from Part X for each

year listed.

b 85% of ine 23 - . :

€ Qualifying distabutons fom Part x11,

ling 4 for each year listed -

4) Amounts included inline 2¢ not used

directly for active conduct of exempt

© Qualitying dietnbutions made directly

foractive conduct of exempt actwities

Subtract line 26 from line 2

3 Complete 3a,b, orc forthe

‘ltermative test relied upon

8 “Assets” alternative test—enter

(2) Value of ail assets

2) Value of assets qualifying

under section 494203 KEM)

b “Endowment” alternative test— enter 2/3

‘of minimum investment return shown in

Part x, line 6 for each year listed.

© “Support” alternative test—enter

(2) Total support other than gross

snvestment income (interest,

dividends, rents, payments

fon secunties loans (section

512(@)(5), or royalties)

(2) Support trom general public

and 5 or more exempt

‘organizations as provided in

Section 4942)(3)(8Ki}-

(2) Largest amount of support

from an exempt organization

(4) Gross investment income

‘Supplementary Information (Complete this part only if the organization had $5,000 or more in

assets at any time during the year—see instructions.)

1 Taformation Regarding Foundation Managers:

‘9 List any managers of the foundation who have contributed more than 2% ofthe total contributions received by the foundation

Before the close of ny tax year (but only ifthey nave contnbuted more than $5,000) (See section $07 (3)(2) )

See Additionel Data Table

B List any managers ofthe foundation who own 10% ormore ofthe stock ofa corporation ran equally large portion of he

‘ovmership of @ partnership or other entity) of which the foundation has 2 10% or greater interest

2 Taformation Regarding Contribution, Grant, Gift, Loan, Scholarship, ete, Programs

‘Check here PIF ifthe foundation only makes contributions to preselected charitable organizations and does not accept

Unsolicited requests for funds Ifthe foundation makes gits, grants, ete (see instructions) to individuale or organisations under

‘other conditions, complete items 24,5, , and d

‘9 The name, address, and telephone number or email address ofthe person to whom applications should be addressed

'b The form in which applications should be submitted and information and matenals they should mnclude

© Any submission deadlines

Any restrictions or limitations on awards, such as by geographical areas, charitable feds, kinds of institutions or other

factors

Form 990-PF (2014)

Form 990-PF (2014)

Supplementary Information (continued)

3 Grants and Contributions Paid During the Year or Approved for Future Payment

Page 42,

eae Tfrecipient san mdi | ounaation

showany rlatonsmp to | FoUNatIOn | purpose of grant or —

Name and address (home orbusiness) | gy" ycroesrconenacrer | recipient copa

= fac danng the yoor

See sch of Donees addressesstatus © None lsoxcexsy — vancus 11,353,471

Vanous, TX 76637

etal eee eee >a Tiassa

© Approved for Faure payment

See Sch ofDonees addresses status |uone s0x%ex3) — vanous 17,273,918

Yanous.1X 76437

> ia7agi

Total.

Form 990-PF (2014)

Form 990-PF (2014) Page 12

‘Analysis of Income-Producing Activities

Enter gross amunts unless othermse micated|_Unrlatew business income | tied by ston Sz HO 5 ©

a sited or exempt

) ” yy (a | tinction ncome

1 Program service revenue ausmess | grunt | exclusion code | Amount oy

.

4

‘

9 Fees and contracts fom government agencies

2 Membership dues and assessments.

3 Interest on savings and tamperary cosh

4 Dividends and interest from securities... 16 Tas8 si

'5 Net rental income or (loss) fom real estate

2a Debt-financed property.

bb Not debt-fnanced propery.

6 Net rental income or (loss) fom personal

property

7 Other investment income.

{8 Gain or (oss) from sales of assets other than

WENO se ve tt ee et ee 18 2260.01

9 Net income oF (loss) from special events

10 Gross proft or (loss) from sales of inventory.

A Other revenue @ ipeome fom Kis i srs

bb tise ncome @ sty 1050 1 H

4

42 Subtotal Aad columns (B),(@), and (@)- = 359.39)

13 Total. addline 12, columns (b), (4), and(ele + «> eae es $35,308

(See worksheet in line 13 instructions to venfy calculations

Relationship of Activities to the Accomplishment of Exempt Purposes.

Explain below how each activity for which income is reported n column (e) of Part XVI-A contributed mportantiy t

the accomplishment af the foundation's exempt purposes (other then by providing funds for such purposes) (See

instructions

Line Ne.

Form 990-PF (2018)

Form 990-PF (2014) Page 43,

Information Regarding Transfers To and Transactions and Relationships With

Noncharitable Exempt Organizations

1 Did the organization directly or indirectly engage n any of the following with any other organization described im

section 501(c) ofthe Code (other than section $01 (c)(3) organizations) or in section 527, relating to politics! Yes | No

organizations?

1 Transfers from the reporting foundation to @ nonchantable exempt organization of

(ay cash. saa No

(2) omer assets. (2) No

bb other transactions

(2) Sales of assets to a noncharitable exampt organization. - [soc] No

(2) Purchases of assets from a nonchantable exempt organization. {x02 No

(3) Rental offciities, equipment, or other assets. a3) No

(4) Reimbursement arrangements. a No

(5) Loans or loan guarantees. 5) No

(6) Performance of services or membership or fundrarsing soliitations 6) No

Sharing of facilites, equipment, mauling lists, other assets, or paid employees. ae No

4 Ifthe answer to any of the above is "Yes," complete the following schedule Column (b) should alvays show the fair market value

ofthe goods, other assets, of services given by the reporting foundation If the foundation received less than fair market value

In any transaction or sharing arrangement, show im column (d) the value of the goods, other assets, or services received

(2) urene | (Amount woed | (e) Name of wnctartable exempt oeanzanon | (a) Oescrpon of warstes, wansactons ad shanagarangaments

2a Is the foundation directly or indirectly affliated wih, or related to, one or more tax-exempt organizations

desenbed in section 501(c) of the Code (other than section 501 (c)(3)) orin section 5277, Pres Fro

bb If-Yes;" complete the folowing schedule

{e) tame of ganzaton (6) Type of ompenaten (ep Descopton of rtarah

Under penatuies of penury, 1 declare tat Ihave examined tha returm, cluding accompanying schedules and statements and to

the best of my knowledge and bei, vs true, correct, and complete. Declaration of preprer (other than taxpeyet) = based on al

___ | information af nich preparer has any krowedge

Sign ETS TT

Her) . ors.

Sianature of ofceror trustee pete

Date creck Woah

PanerType preparers name | Prepares signature

Victor Munson employed eI pou2isse7

Paid Firm's name Firms EEN

Preparer] Victork uncon CPA

Mee rexoadanere

only ae

6060 N Central Expmy Suite S60. alas, Tx 75208 Prone tp (aia) 237-2920

Form 990-PF (2014)

Form 990PF Part XV Line 1a - List any managers of the foundation who have contributed more than 2% of

the total contributions received by the foundation before the close of any tax year (but only if they have

contributed more than $5,000).

Farns © Wilks

Down Wilks

[efile GRAPHIC print DO NOT PROCESS [As Filed Data — | DLN: 93491316018195]

TY 2014 Accounting Fees Schedule

Name: The Thirteen Foundation

EIN: 27-6977311

Software ID: 14000265

Software Version: 2014v5.0

Category ‘Amount Net Investment Adjusted Net | Disbursements for

Income Income Charitable

Purposes

‘counting and tox 11,500 0 ° °

planing

Jefile GRAPHIC print - DO NOT PROCESS _J As Filed

3491316018195

Note: To capture the full content of this document, please select landscape mode (11” x 8.5") when printing.

TY 2014 Amortization Schedule

Name: The Thirteen Foundation

EIN: 27-6977311

Software ID: 14000265

Software Version: 2014v5.0

‘Description of Amortized Expenses Date acquired, ] Amount | Deduction or ] Amortization Method | current Your | Net investmant | Adjusted net | Total Amount of

Completed, or | Amortized | Prior Yours Amortization | "" Income Trcome, | “Amortization

‘expended

‘oganaaton cok Boor oF ean rr 150000 “07 Ta

[As Filed Data — J

TY 2014 Cash Distribution Explanation Statement

Name: The Thirteen Foundation

EIN: 27-6977311

14000265

2014v5.0

The amount “set aside" in 2013 under the "cash distnbution test”

was $ 3,100,000. The amount distributed in 2014 to meet the

distribution requirements under Reg. Sec. 53.4942(a)-3(b)(7)(1)

was $ 2,510,000The balance of the $ 590,000 will be distributed

with the allowed 60 month penod

lefile GRAPHIC

int - DO NOT PROCESS.

As Filed

Note: To capture the full content of this document, please select landscape mode (11” x 8.5") when printing.

TY 2014 Depreciation Schedule

Name: The Thirteen Foundation

EIN: 27-6977311

3491316018195

Software ID: 14000265

Software Version: 2014v5.0

Description of Date] costorother | Por Years | computation Method Rate / ‘current years | Netinvestment ] Adjusted wet | Cost of coods

Property pequires ‘eae Depreciation te (Wo years) ‘Depreciation Income Income ‘Sold not

Expense Included

[efile GRAPHIC print — DO NOT PROCESS TAs Filed Data- J DIN: 93491316018195]

TY 2014 Land, Etc. Schedule

Name: The Thirteen Foundation

EIN: 27-6977311

Software ID: 14000265

Software Version: 2014v5.0

Category / Item Cost / Other | Accumulated ] Book Value | End of Year Fair

Basis Depreciation Market Value

Machinery and Equipment 6,030 2,081 3,949 3,949

[efile GRAPHIC print DO NOT PROCESS [As Filed Data — | DLN: 93491316018195]

TY 2014 Legal Fees Schedule

Name: The Thirteen Foundation

EIN: 27-6977311

Software ID: 14000265

Software Version: 2014v5.0

Category ‘Amount, Net Investment | Adjusted Net | Disbursements for

Income Income Charitable

Purposes

Legal fees 3.462 ° ° °

[efile GRAPHIC print — DO NOT PROCESS TAs Filed Data- J DIN: 93491316018195]

TY 2014 Other Assets Schedule

Name: The Thirteen Foundation

EIN: 27-6977311

Software ID: 14000265

Software Version: 2014v5.0

Description ‘Beginning of Year- | End of vear-Book | End of Year Fair

Book Valve Value Market Val

Rounding 1

[efile GRAPHIC print DO NOT PROCESS [As Filed Data — | DLN: 93491316018195]

TY 2014 Other Decreases Schedule

Name: The Thirteen Foundation

EIN: 27-6977311

Software ID: 14000265

Software Version: 2014v5.0

Description ‘Amount

Disbursements for chantalble purposes 382,766

Net Unrealized Loss on Investments 2,199,303

[efile GRAPHIC print DO NOT PROCESS [As Filed Data — |

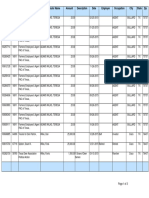

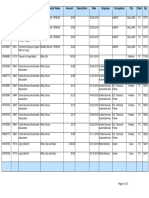

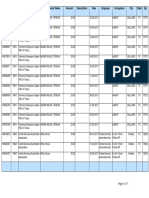

TY 2014 Other Expenses Schedule

27-6977311

14000265

2014v5.0

The Thirteen Foundation

Description

Revenue and Expenses

Net Investment

‘Adjusted Net Income

Disbursements for

Per Books. Income Charitable Purposes

Brokerage and bank fees 105,499 128,940 128,940, 12

Contracted services 1382

Depreciation - various, 40,100

Donations ~ net 65,009,

Dues & subsenptions 2,120 2,120 2420

Foreign tax W/H- dividends 6520 35,343 3543

Insurance other 7.510

Insurance -employee 35.445

License and fees 85

Miscellaneous 744

Miscellaneous Ine /Exp “4535

Office expense 4,079

Postage, delivery & supplies 738

Pyime pror ye, Grant Part XII line 300) 2,510,000,

Seminars & training 35,646

Supplies 9,920 4360 4960 4,508,

Travel 45.225

Unites 3835

Veicle expense 11.698

[efile GRAPHIC print — DO NOT PROCESS TAs Filed Data- J DIN: 93491316018195]

TY 2014 Other Income Schedule

Name: The Thirteen Foundation

EIN: 27-6977311

Software ID: 14000265

Software Version: 2014v5.0

Description Revenue And Net Investment | Adjusted Net Income

Expenses Per Books Income

Income fom Kas 372,909 10,759 10,759

Mise income @ BNY 1099 1 22,655 22,655

(Other invest Partnerships 27,707 27.707 27,707

[efile GRAPHIC print DO NOT PROCESS [As Filed Data — | DLN: 93491316018195]

TY 2014 Taxes Schedule

Name: The Thirteen Foundation

EIN: 27-6977311

Software ID: 14000265

Software Version: 2014v5.0

Category ‘Amount. Net Investment | Adjusted Net | Disbursements for

Income Income Charitable

Purposes

Federal income tox 59,315

Payroll taxes 9.16

Property 2827

[ete GRAPHIC print- DONOT PROCESS [As Filed Data DUN: 9340751601610]

Schedule B Schedule of Contributors [ue Na ASA OON7

Semen > nach oF 390-£2, oF 990-9.

Sem ey > intrmaton abut Scheaue 8 Form 990,980 22, or 80 PF) andisinstuctons isa} — 2014

porecerien ronregov terns

Have ofthe rperiation Tployar Went ction wanbar

The Thirteen Foundation

27-6977311,

‘Organization type (check one)

Filers of: Section:

Form 90 or 990-62

S01(0}(_) (enter nurber) organzation

+4947(a)(1) nonexeret chantable trust not treated a a prwvate foundation

r

r

T 527 poitcal orgenzaton

Form 900-5 F s01(639) exempt pve foundation

T 494721) nonexempt chartable ust treated asa prvatefeurdaton

r

501(o\(3) taxable private foundation

‘Check f your organzaton i covered by the General Rule or 2 Special Rule.

Note. Only a section 501(¢}(7), (8), oF (10) organzatin can check boxes for both the General Rue and a Special Rule See instructons

General Rule

F For an organzation fing Form 930, 990-£Z, or 990-FF that received, during the year, contnbutions totaling $5,000 or more (In money or

ther property) from any one contributor Complete Parts andi See instructions for determning 2 contributors total contributions

‘Special Rules

For an organzation described n secton 504(0)(3) fang Form 990 or 990-EZ that met the 338% support test of the reguiations

Under sections £09(2}(1) and 170(b)(1}(A)(w), that checked Schedule A (Focm390 or 980-2), Part ine 13, 16a, or 165, and that

recerved from any one contrbuor, during the year, total contreutons of the greater of (1) $5,000 or (2) 2% of the amount on (1) Form 990,

Part Vil ine 4h, or (1) Form990-£2, Ine 1 Complete Parts land

For an organzation described n secton 507(}(7), (8), oF (10) fing Form 990 or 9904€2 that received ftom any one contributor,

‘during the year, total contnbutons of more than $1,000 exclusively for relgous, chartable, scien, iteray, or educatonal purposes, of

for the prevention of cruety to chidiren or anmmals ‘Complete Pats {land I

For an organzation described n secton 504(¢)7), (8), oF (10) fing Form 990 or 990-£7 that recewed from any one contributor,

‘during the year, controutions exclusively for religous, chartable, etc, purposes, but no such contributions totaled more than $7,000 if

ths box is checked, enter here the total coninbutios that were recewved dunng the year for an exclusively relgous, chartable, tc

purpose Do not complete any of the parts unless the General Rule apples to ths organzation because f received nonexclusively

Telgous, chartable, etc, contributions totang $5,000 oF rere dunng the year ms

Caution. An organzation thats not covered by the General Rule andior the Special Rules does not fle Schedule B (Form 990,

{990-E7, or 960-FF), but f must answer "No™ on Part W, ne 2, of ts Form $80, or check the box on ine Hof ts

Form 920-£2 or on ts Form 30°F, Part | ne 2, to certify that does not meet the filng requrements of Schedule B (Form980,

990-£2, oF 990-FF)

for Form 960, $90.62, of 990PF

We Sara “Schedule B (Form 990, SUEZ, oF 850F) (2018)

Schedule 8 (Form 960, 990-£7, or 990.FF) (2014)

‘Name of organization

The Thirteen Foundation

Page 2

Employer Wentification number

276977332

Contbufors a ania Wann ope P aan TN

(a)

No.

(b)

Name, address, and ZIP +4

¢)

Total contributions

@

‘Type of contribution

Farris Wilks

Trace, TRVEAST

Person 7

Payroll =

Noncash

(Complete Pat fo nancash

conto)

a)

C)

Name, address, and ZIP +4

Cc)

Total contributions

@

‘Type of contribution

Tinea, THTEAST

437030 Interstate 20

ses

Person 7

Payroll

Noncash — [~

(Complete Part foe nensaeh

@)

we)

Name, address, and ZIP +4

)

Total contributions

@

‘Type of contribution

Person

Payroll 7

Noncash

(Complete Pat foe noneaeh

cormbutore )

@)

)

Name, address, and ZIP +4

¢)

Total contributions

@

‘Type of contribution

Person [~

Payroll =

Noncash

(Complete Pat fo nencash

contnbutore )

@)

C)

Name, address, and ZIP +4

(¢)

Total contributions

@

‘Type of contribution

Person [7

Payroll =

Noncash — [-

(Complete Pat lf neneash

@)

)

Name, address, and ZIP +4

Total contributions

@

‘Type of contribution

Porson

Payroll 7

Noncash

(Complete Pat foe nonsash

contbutone )

reer reer

Schedule B (Form 980, 980-£2, or 900.FF) (2014)

Name of organization

The Thirteen Foundation

Page 3

Employer Wentification number

Panag ness Property cm esta Uncapped aoa

(a) No. (c)

(b) (d)

i Description of noncash property given ere Date received

(a) No (e)

(b) (d)

fon Description of noncash property given FUY (or estimate) Date received

te) Fi (or estima ‘a

Description of noncash property given MV (or estimate) Date received

a oe fe) “s)

Description of noncash property given

FMV (or estimate)

(see mstructions) Date received

(2) No.

(0) a (a)

ia Description of noncash property given Lill lbcdetioare | Date received

Part (ase structions)

(a) Ne. (

) S)

ma Description of noncash property given FUY (or estimate) Date received

errr ere

Schedule B (Form 980, 980-£2, or 900.FF) (2014)

Name of organization

The Thirteen Foundation

Page 4

‘Employer Mentification number

Exclusively religious, charitable, etc, contributions to organizations described in section 501(6)7). (8), oF (10)

that total more than $1,000 for the year from any one contributor. Complete courns (a) through (e) and the following ine

entry For organzations completng Part Il enter the total of exclusively reigious, char

the year (Enter ths formation once See mstructons )

Use dupicate copes of Parti additonal space is needed

table, etc, contrsutons of $1,000 oF less for

3

Ta) Ro.

rom (b) Purpose of git (6) Use of gitt {(@) Description of how gift is held

Part

(e) Transfer of gift

Transferee’s name, address, and ZIP 4 Relationship of transferor to transferee

Ta) Ro,

rom (b) Purpose of git (6) Use of gitt {(@) Description of how gift is held

Part

(e) Transfer of gift

Transferee’s name, address, and ZIP 4 Relationship of transferor to transferee

Ta) Ro.

‘rom (b) Purpose of git (6) Use of gitt {(@) Description of how gift is held

Part

(e) Transfer of gift

Transferee’s name, address, and ZIP 4 Relationship of transferor to transferee

Ta) Ro.

‘rom (b) Purpose of git (6) Use of gitt {(@) Description of how gift is held

Part

(e) Transfer of gift

Transferee’s name, address, and ZIP 4 Relationship of transferor to transferee

a ee

You might also like

- Capitol Riot Map 1.11.21Document1 pageCapitol Riot Map 1.11.21Teddy WilsonNo ratings yet

- 2021 States and Nation Policy Summit AgendaDocument4 pages2021 States and Nation Policy Summit AgendaTeddy WilsonNo ratings yet

- Wilks Family Campaign Contributions - Texas (2015)Document3 pagesWilks Family Campaign Contributions - Texas (2015)Teddy WilsonNo ratings yet

- Wilks Family Campaign Contributions - Texas (2018)Document3 pagesWilks Family Campaign Contributions - Texas (2018)Teddy WilsonNo ratings yet

- Texas HHSC Request For ApplicationDocument104 pagesTexas HHSC Request For ApplicationTeddy WilsonNo ratings yet

- PF Return of Private Foundation: ExpensesDocument20 pagesPF Return of Private Foundation: ExpensesTeddy WilsonNo ratings yet

- PP v. JegleyDocument148 pagesPP v. JegleyTeddy WilsonNo ratings yet

- DFPC Prayer List UpdatedDocument1 pageDFPC Prayer List UpdatedTeddy WilsonNo ratings yet

- Human Coalition - Texas Grant ContractDocument455 pagesHuman Coalition - Texas Grant ContractTeddy Wilson100% (1)

- WWHA V PaxtonDocument43 pagesWWHA V PaxtonTeddy WilsonNo ratings yet

- Wilks Family Campaign Contributions - Texas (2017)Document7 pagesWilks Family Campaign Contributions - Texas (2017)Teddy WilsonNo ratings yet

- Wilks Family Campaign Contributions - Texas (2016)Document9 pagesWilks Family Campaign Contributions - Texas (2016)Teddy WilsonNo ratings yet

- HFF 990 2012Document35 pagesHFF 990 2012Teddy WilsonNo ratings yet

- Return of Private FoundationDocument40 pagesReturn of Private FoundationTeddy WilsonNo ratings yet

- HFF 990 2015Document21 pagesHFF 990 2015Teddy WilsonNo ratings yet

- HFF 990 2014Document22 pagesHFF 990 2014Teddy WilsonNo ratings yet

- HFF 990 2016Document22 pagesHFF 990 2016Teddy WilsonNo ratings yet

- HFF 990 2013Document124 pagesHFF 990 2013Teddy WilsonNo ratings yet

- Form 990-PF Return of Private FoundationDocument18 pagesForm 990-PF Return of Private FoundationTeddy WilsonNo ratings yet

- TTF 990 2011Document43 pagesTTF 990 2011Teddy WilsonNo ratings yet

- TTF 990 2016Document25 pagesTTF 990 2016Teddy WilsonNo ratings yet

- TTF 990 2012Document39 pagesTTF 990 2012Teddy WilsonNo ratings yet

- Texas A2A Program FY2018 Q2 (Pregnancy Help Center of Lufkin Annual Monitoring)Document4 pagesTexas A2A Program FY2018 Q2 (Pregnancy Help Center of Lufkin Annual Monitoring)Teddy WilsonNo ratings yet

- TTF 990 2013Document127 pagesTTF 990 2013Teddy WilsonNo ratings yet

- Texas A2A Program FY2017 Q4 (Foundation For Life Facility Tour)Document3 pagesTexas A2A Program FY2017 Q4 (Foundation For Life Facility Tour)Teddy WilsonNo ratings yet

- Texas A2A Program FY2017 Q1 (Facility Tours)Document2 pagesTexas A2A Program FY2017 Q1 (Facility Tours)Teddy WilsonNo ratings yet

- TTF 990 2015Document25 pagesTTF 990 2015Teddy WilsonNo ratings yet

- Texas A2A Program FY2018 Q2 (Foundation For Life Annual Monitoring)Document3 pagesTexas A2A Program FY2018 Q2 (Foundation For Life Annual Monitoring)Teddy WilsonNo ratings yet

- Texas A2A Program FY2018 Q1 (Pregnancy Care Center Huntsville - Facility Tour)Document2 pagesTexas A2A Program FY2018 Q1 (Pregnancy Care Center Huntsville - Facility Tour)Teddy WilsonNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)