Professional Documents

Culture Documents

TTF 990 2013

Uploaded by

Teddy Wilson0 ratings0% found this document useful (0 votes)

19 views127 pagesThe Thirteen Foundation - IRS 990 (2013)

Original Title

TTF-990-2013

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Thirteen Foundation - IRS 990 (2013)

Copyright:

© All Rights Reserved

0 ratings0% found this document useful (0 votes)

19 views127 pagesTTF 990 2013

Uploaded by

Teddy WilsonThe Thirteen Foundation - IRS 990 (2013)

Copyright:

© All Rights Reserved

You are on page 1of 127

rom990-PF

Ss

epnnet te Tey

[efile GRAPHIC print DO NOT PROCESS [As Filed Data — | ‘DLN: 93491309006014]

Return of Private Foundation

or Section 4947(a)(1) Trust Treated as Private Foundation

» Do not enter Social Security numbers on this form as it may be made public. By law, the

IRS cannot redact the information on the form.

> Information about Form 990-PF and its instructions te at www .jrs.gov/form990pf.

ne No 1545-0052

2013

Open to Public

een

For calendar year 2013, or tax year begi

ing 01-01-2013

sand ending 12-31-2013

Tame oF andaton

TF enpTover ANTON FRO

ToT aD Set [or PO Dox haba # MNS Pat GeWeI WHR TERY

Tinitial return

Final return

© Check oll that eppiy

address change [name change

FP section 503 (¢ (3) exempt private foundation

Other taxable pnvate foundation

Heck type of organization

section 4947(2X1) nonexempt chantable trust

T initiat return of a former public charity

‘Amended return

1 Telephone nanber (ase warocons)

254) 50

€ Irexemptionappbeation pending, check here & FH

4. Foregn omanaations, check here or

2% Gk hare and stach compton

I prwate oundaton stats was terminated

{Fair marcet value of all assets at end

of year (from Part IT, l(c)

line 16)%§. 105,583,396

J Accounting method

T other (specity)

(Par, column (a) must ben cash BasIE)

cash P Acenial

Under vectan SO7B}C(A) check hee

Under scion S070))(8) check hee

‘Analysis of Revenue and Expenses (7 | (a) norouw ane (@) babursements

2oiarhetene meres Oy eons ohare syrevene ar | ay nermvesment | ce)apaied ot | Aoeete

recta nc aeons n San (ak ee Poe ao ne

Meas teak teecon)

1 oninbutions, ai, grants, ei recewed (attach Te

schedule)

2 check [ifthe foundations not requred to attach

Interest on savings and temporary cash investinents saa sane SE

Sa Gross rents

Net rental income o oss}

| 6 Net gainor (oss) fom sale of assets not on ine 10 saa

3 | rose sates pce foralassets on ine sa

& | 7 Capital gain net income ([rom Part 1V, line 2) 357,105]

8 Net short-term capita gin Taam

8 Income medications

200 Gross sates iss returns and

Slowerces

b Less costof goods sold «

Gross profit or lose) (attach schedule) >

hs othermcome (attach schedule) o earl Hae aaa

hz otal Add ines through 12 aaa Sasa | am

14 Other employee salanes and wages ad

§ [15 _ Pension lans, employee benefits»

€ | 16a Legal fees (attach schedule). e 21,837| 7200

2 |b Accounting fees (attach schedule). cy 657

FY & other oroessionl fees (attach schedule)

B far meres

E |18 roxas (attach schedule) (see nstructions) S ma re

% |as Deoreciaton (attach schedule) and depletion 5 7a 7a 7a

E | 20 occupancy za ase ios

& | 21 Travel conerances, and meetings

§ [22 Printing and publications J

g [23 Otherexpenses (attach schedule) a 463,113] 452,569 452,569 240,948

2 | 24 Total operating and administrative expenses.

S| saunas 13 enough 23 sssaed asso sasnoe soa

& Js contnbutons ts, grants paid. Cowvaad Tome

25 Total expenses and disbursements. Add ines 24 and sos ToT ae 68

Hs

BF subtack ine 26 Fomine 22

1 Excess of evenie over expenses and dabrsemente saz.

Nat investant incon (if negative, enter -0-) Taart

€__ Adjusted net income negative, enter-0-) Tam

For Paperwork Reduction Act Notice, se instructions,

Cat No T1289% Form 990-PF (2013)

Form 990-PF (2013) Page 2

Z|100 tnvestments—u S and state government obligations (attach schedule)

15 Other assets (describe P ) (s 4.68!

B| 21 Mortgages and other notes payable (attach schedule)... . -

S} 22 other habiities (describe > » 7a) 73,389]

Foundations that otow SFAS 17, check Fare T=

and complet ines 24 through 26 and tines 20 and 3.

Ce eee

G2 remanent restricted | se

| __ Foundations that donot follow SFAS 17, check here (7

3] and complete tes 27 trough 31

2]50 Total net ascteorfund blancs (seepage 17 ofthe

3

51 Totllabiltice and nt aseets/fund balance (cee pose 27 of

Analysis of Changes in Net Assets or Fund Balances

3 ‘Other increases not included in line 2 (itemize) Pe 8 3 8,859,219

c Decreases not included in line 2 (itemize) Ss 3 456,454

Form 990-PF (2013)

Form 990-PF (2013)

Capital Gains and Losses for Tax on Investment Income

Page 3

(a) List and desenbe he kinds) of propery sla (eg, ces estat, ey How acaured] ce oate acqured] (8) Date sole

Testory brick warehouse, or common stock, 200 she MLC Ce) Brpurcnase | mo dariyt) | (mo, dav,

Ga See Additional bate Table

»

4

@ Depreciation slowed (oy Cont orather bane GH Gen ar foray

A eat {or allowable) plus expense of sale (e) plus (f) minus (9)

a_See Adaiioral Bite Table

»

4

Caplets only fr aves Shovng gain column i) and owned by ths foundation on TB/STIES @ Gans (eal Wann mee

eT G Adjusted besis Excess ofcol () | el tk, buenot ae tan)

ae of 1/09 Sversol Qh any Uosses trom coh)

:

s

‘Qualification Under Section 4940(e) for Reduced Tax on Net Investment Income

inves

the foundation does not qualify under section 4940(e) Do not complete this part

11 Enter the appropriate amount in each column for each year, see page 18 of the instructions before making any entries

ee ee 5 9,460,487

‘line & js equal to or greater than line 7, check the box n Part VI ine 1b, and complete that park Using @ AW Taxrate See

the Part Viimetructions

Form 990-PF (2013)

Form 990-PF (2013)

Excise Tax Based on Investment Income (Section 4940(a), 4940(b), 4940(e), or 4948—see page 18 of the instructions)

Page

‘a. Exempt operating foundations descnbed in section 4840(2X2), check here Pe = and enter "W/A

ontine 1

Date of ruling or determination letter (attach copy of letter necessary-cee

inatrctions)

bb Domestic foundations that meet the section 4940(e) requirements in Part, check 1 $5,008

here FF and enter 1% of Part line 27

€ Allother domestic foundtions enter 2% of ine 27b Exempt foreign organizations enter 4% of

Part iniine 12,01 (0)

2 Tokuda section 11 (domestic secton 4547) tats ang tanble oundaton ni omer

3 Add lines t and 2 spo

4 Sb income to dest estin 4547 9) tists and oa fundatons oly Others

5 Tot aed on investment income. Subtract ine fomine 3 Hzer or les, eter-0- 5 Sas

6 Credits/Payments

2 2013 estimated tax payments and 2032 overpayment credited to 2013 | 47,009

bb Exempt foreign organations—tax witheld source»... . Deb

€ Tax paid wth aplication for extension of te to le (Form 8868) se 15,000]

4 Backup mtmholding erroneously wtineld. os ss + Led

7 Total credits and payments Addlines 68 throughéd. «6 2. ev nw 62,000

8 Enter any penalty or underpayment of estimated tax Check here fF Form 2220 ie attached 148

9 Tax due. Ifthe total of lines $ and i= more than line 7, enter amount owed»... = BE

10° Overpayment. Ifline 7 5 more than the total ofines § and enter the amount overpaid... [ a0 eeae

11 _Enterthe amountaf ine 10 to be credited to 2034 etinaed tax ass Refunded > [an

Statements Regarding Activities

18 Dunng the tx year, did the foundation attempt to influence any national, state, or local egislaton or id Yes | ne

se participate or intervene many political campaign? i No

bb Didit spend more than $100 during the year (either directly or indirectly) for poicl purposes (eee page 19 of

is tirctious fo cenmiionye Seon aes ee | an No

{the answer ts "es" to La or 4B, attach a detaled description ofthe activites and copes of any materials

publihed ar distributed bythe fundaton in connection with the activites.

€ Didthe foundation fle Form 1420-POLOFENIS YER? x No

4. Enter the amount any) oftax on political expenditures (section 4955) imposed during the year

(2) on te foundation §___ (2) On foundation managers $

Enter the remmbursement any) pard bythe foundation during the year for political expenditure tax posed

an foundation managers $

2 Has the foundation engaged in any actwties tat have not previously Deen ceportedtotheIRS? «2... | 2 No

1 "Yee atiach adele desertion ofthe activites

3 Has the foundation made any changes, not previously reperted tothe 18S nits governing instrument, articles

af incorporation or bylaws, or other similarinstruments? If "Yes,"attach a conformed cpy of the changes... | 3 No

44a 01d the foundation nave unrelated business gross income of $1,000 or mare dunng the year?. . . . . - - [am Ne

b 1e°Ye8, has led a tax return on FormoBOTforthis eR. vv ee Lae Ne

5S Was there a lquidation, termination, dissolution, or substantial contraction dunng the year? os. LS No

1 Yes, atach the stavement required by General Instracton T

6 Aretha requirements of section 508(e) (celating to sections 4941 through 4945) satisfied either

By language nthe governing mstrument, or

‘© By state legislation that effectively amends the governing instrument zo that no mandatory directions

that confict wth the state lawremain nthe governing instument? 2 se ee ee LO No

7 oud the foundation nave at east $5,000 in assets at any time dung the year? If "Yes," complete Fert I, el (), and

A 7 | vee

fa Enterthe states to which the foundation reports or nth whichis registered (see instructions)

mo

bb Ifthe anawerss "Yes" to line 7, has the foundation fumighed a copy ofForm 990-PF tothe Atorney

Genera (or designate) ofeach state as required by General Instruction G? If No,*atach explanation av | vee

9 Tethe foundation claiming status as a private operating foundation wthin the meaning of section 42420N3)

0 4942445) for calendar year 2013 or the taxable year begining in 2013 (see instructions for Part XIV)?

1 "Yes," compete Part XIV ee ls

10. Didany prong pecan subtatl cotrbtrs dng ihe ta eer es,“ actetelseag ner ames ToT

Form 990-PF (2013)

Form 990-PF (2013) Page 5

‘Statements Regarding Activities (continued)

41 Atany time dunng the year, did the foundation, directly or incicectly, own @ controlled entity wahin the

meaning of section 512(b\13)? If"¥es," attach schedule (see instructions). 2 sv ee ee ee ee [ad No

32. Did the foundation make a distribution to a donor advises fund aver which the foundation ora disqualified person had

advisory privileges? If"Yes," attach statement (eee instructions)... eee ee ee Lah No

13 1d the foundation comply withthe public inspection requirements for its annual returns and exemption application? [43 | Yes

Website address N/A

14 The books are in care of PRobert Ear Telephone no (817) 850-3600

Located at 17010 inesate 20 Caco TK z1p-+4 76437.

15 Section 4947(a)(t) nonexempt chantable trusts filing Form 990-PF in lieu of Form 1081 —Check here -

land enter the amount of tax-exempt interest received or acerued during the year >

16 At any time duning calendar year 2013, did the foundation have an interest n ora signature or other authority over Yer | No.

1 bank, secunties, or other nancial account ina foreign country?” 16 Ne

See instructions for exceptions and filing requirements for Form TO F 90-22 1 If "Yes"

foreign country

Statements Regarding Activities for Which Form 4720 May Be Required

ile Form 47201 ny ftmis checked inthe "Yes" colar, unless anexcaption apes: Yen

a During te year dhe foundation (rhe crecty or ndvect)

enter the name of the

(2) Engage inthe sale or exchange, or leasing of property with a disqualified person? T ves F No

(2) Borrow money from, lend money to, or othermse extend credit to (or accept i rom)

2 disqualited person? Ti ves F Ne

(3) Furnish goods, services, oF facilities to (or accept them from) a disqualified person? T ves F No

(4) Pay compensation to, or pay or reimburse the expenses ef, a disqualified person? P ves F No

(5) Transfer any income or assets to a disqualified person (or make any of either available

forthe benefit oruse of disqualited person)? vv ee ee ee ee ee Pes Ne

(6) Agree to pay money or property to a government offical? (Exception. Check “No”

ifthe foundation agreed to make a grant to orto employ the official fr @ period

‘after termination of government service, terminating within 90 days). ss ss ss + P¥ee Fe

bb Ifany answer's "Yes" to 12(1)-(6), did any of the acts fal to qualify under the exceptions described in Regulations

section 53 4941 (d}-3 or ma current notice regarding disaster assistance (see page 20 of the nstructions)?.. - | tb No

Organizations relying on a current notice regarding disaster assistance check here... ss 2 es

€ Did the foundation engage ina prior year im any ofthe acts described in 18, other than excepted acts,

that were not corrected before the frst day ofthe tax year beginning in20137, 2. ee ee ee es | te No

2 Taxes on failure to distnbute income (section 4942) (does not apply for years the foundation was a private

operating foundation defined in section 4942()(3) 0r49420)(5))

At the end oftax year 2023, eid the foundation have any undistributed income (lines 6d

land 6e, Pare XI11) for tax year(s) beginning before 20137... ee vv ee ee eee Ves NO

1e"¥es," list the years 20__, 20__, 20__, 20__

1b Are there any years listed in 28 for which the foundation 's not applying the provisions of section 4942(a}(2)

(relating to correct valuation of assets) to the year’s undistributed income? (If applying section 4942(a)(2)

to all years listed, answer "No" and attach statement-—see instructions ) 2» No

€ Ifthe provisions of section 4942(a)(2) ae being applied to any of the years listed in 2a, list the years here

commie ep ae ogsm gue

‘3a Did the foundation hold more than a 2% direct or indirect interest in any business enterpnse at

fany-time during the years oe P08 NO

b_I1"Ves, aid have excess business holdings in 2013 as a result of (4) any purchase by the foundation

or disqualified persons after May 26, 1969, (2) the apse ofthe S-year periad (or longer period approved

by the Commissioner under section 4943(€X7))te dispose of holdings acquired by gift or bequest, or (3)

the lapse of the 10-, 15-, or 20-year frst phase holding period? (Use Schedule C, Farm 4720, to determine

\f the foundation had excess business holdings 2013... 2 ee ee ee ee ee ee | Bb

4a Did the foundation invest dunng the year any amount in @ manner thet would eopardize its chantable purposes? [4a

No

Ne

1b Did the foundation make any investment na prior year (but ater December 31, 1965) that could jeopardize its

chantable purpose that had not been removed from jeopardy before the first day of the tax year beginning in 2013? | 4b No

Form 990-PF (2013)

Form 990-PF (2013)

Page 6

[MAWES statements Regarding Activities for Which Form 4720 May Be Required (continued)

‘Se During the year did the foundation pay or incur any amount to

(2) Carry on propaganda, or otherwise attempt to influence legislation (section 4945(e))? T ves F No

(2) Influence the outcome of any specific pubic election (see section 4955), orto carry

on, directly or indirectly, any voterregistration dnve?. 2. vv ve ee ee we es Pes NO

(3) Provide 8 grant to an individual for trevel, study, of other similar purposes? T ves F No

(4) Provide a grant to an organization other than a charitable, etc , organization described

sn section 509(a)(t, (2), oF (3), or Section 4940(4)(2)? (see instructions)... . . . . » [Yes No

(5) Provide for any purpose other then religious, chantable,seientie, literary, or

‘educational purposes, or for the prevention of cruelty to children oranimals?. . . . . . « (Yes F No

b Ifany answer's "Yes" to Sa(1}-(5), did any of the transactions fil to qualify under the exceptions descnbed in

Regulations section 53 4945 or ma current notice regarding disaster assistance (see instructions)?» . . «+ | Sb No

Organizations relying on a current notice regarding disaster assistance check here... ss 2 2

€ Ifthe answers "Yes" to question 5a(4), does the foundation claim exemption from the

tox because it maintained expenditure responsibilty forthe grant”... ss wwe es Yes NO

1F "Yes," attach the statement required by Regulations section 53.4945-5(d)

{62 Did the foundation, curing the year, receive any funds, directly or indirectly, to pay premiums on

« personal benefit contract? ves F Ne

1b Did the foundation, during the year, pay premiums, directly or indirectly, on a personal benefit contract? « oo No

If Yes" to 6b, file Form 8870

7a At any time dunng the tax year, was the foundation a party tea prohibited tax shelter transaction? 7 Yes No

bb_Ityes, did the foundation receive any oroceeds or have any net income attnbutable to the transaction?” »

Information About Officers, Directors, Trustees, Foundation Managers, Highly Pai

and Contractors

Employees,

I List all officers directors, trustees, Foundation managers and their Compensation (see instructions)

(by Mite, and average | (e)Compensason | () Contributions © | ¢— expense account

(a) Nome ond address nours perweek | (iF not paid, enter | employee benefit plans | (@) Expense account,

devoted position es) and deferred compensation

Fame we Frustee a]

37010 1H 20 jroo

Soto Wik ITrustee o|

27010 1H 20, fice

isco, TX 76437

Sonate France lexec Director o|

37010 1H 20 jso00

Cisco, TX 76437

‘2 Compensation of five highest-paid employees (other than those included on line 1—see inatractions), If none, enter "NONE:

(sana and ates otaach ampoyan | PTH andeverne | | COsnavoabaneht| (a) Exsenen acco

paid more than $50,000 7 et plans and deferred ‘other allowances

none

Test number fiber anployees pol oar S50 A00Ga ner ig ace aren

Form 990-PF (2013)

Form 990-PF (2013) Page 7,

Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees,

and Contractors (continued)

'3_ Five highest-paid independent contractors for professional services (see instructions). 1f none, enter "NONE".

(@) Name and adaress of each person paid more than $50,000 (b) Type of service

‘Total number of others receiving over $50,000 for professional services.

EEEEGN summary of Direct Charitable Activities

(© compensation

‘mananons and ther befinnes sored, conferences cena, reser papers poguce, ete

‘The Thirteen Foundation has direct chantable activity through a wholly owned disregarded entiy set up as 8

Missour Limited Liability Company withthe following name Reach for Yahweh Internationall D # 80~

0768042 The expanses are recorded on Page 1 of Farm 990-PF column (d)

Expenses

2

3

[MIE Summary of Program-Related Investments (soe metuchon

mount

1

Allether programrelated investments See page 24 of he instructions

3

‘Total Ada ines i through

Form 990-PF (2013)

Form 990-PF (2013)

Minimum Investment Return (All domestic foundations must complete this part. Foreign foundations,

see instructions.

Pages

7

5

6

Fair market value of assets not used (or held for use) directly m carrying out chantable, ete

purposes

Average monthly far market valu of secunties. is 97.427.533

Average ofmonthy cosh balances. ve ee ee ee ee ee La 5.360,375

Foirmarke value ofallotherassets (se mstrictons). ve ee ee ee Le 39,100

Total (odsiines ta,b.andeh ee ee ee ee ee eee ee ee fad 103,327,008

Reduction clamed for blockage or other factors rportedon lines 14 and

Le(atach denied explanation. we ee ee es Lael a

Acquistion indebtecness eppiable to lne 4 asses.

finn 105 397,008

Cash deemed held forchantable activities Enter 1 1/2% ofline 3 (or greater amount, see

instructions) 4 1,549,905

Net value of nonchaitable-te sete Subtract line 4 trom hne 3 Enter here and on Part, ine & 5 101,777,103

Minimum investment rotum.EnierS% oflineS. sss sss... ss Le 5,088,055

ae

sutable Amount (see instructions) (Section 49424)(3) and )(5) private operating

certain foreign organizations check here ® [and do not complete this part.)

Foundations and

TL Minimum investment return fomParX,line6. 2 2 vrs te ee ete ee LE 3080,855

2a Taxon investment income for 2013 from Part VI,lineS. . 2.» = | 2a 55,009)

b_ Income tax for 2013 (This does not include the tox from Part Vi)... [2b

a 55,008

3 Distnbutable amount before adjustments Subtractline 2efomlinet. - se ee ee ee ee LS 5,033,847

4. Recovenes of amounts treated as qualifying distributions. 4

S Addiines 32nd4. 0 ve 5 5033867

6 Deduction from distributable amount (seeimstructions)- ee ee ee ee LS

7 Distributable amount as adjusted Subtract line 6 from line 5 Enter here and on Par XIII,

iva ee eae z 5,033,847

Qualifying Distributions (see instructions)

4 Amounts pard (including administrative expenses) to accomplish charitable, ete , purposes

8 Expenses, contributions, gifts, ete —total from Part, column (d),lne 26... es ee ee | te 6,486,132

1b Program-related investments—total rom PartIX-Be ee ee ee ee ee ee [a

2 Amounts paid to acquire assets used (or held for use) directly in carrying out chantable, ete ,

ue eal

3 Amounts set aside for specific chantable proyects that satisfy the

Suitability test (prior 18S approval required). 38

cash distribution test (attach the required schedule). ee ee La 3,400,000

4 Qualifying distributions, Add lines 12 through 36 Enter here and on Part V, line 8, and Part XIII, ime # [4 9,586,132

'5 Foundations that qualify under section 4840(e) fr the reduced rate of tax on net investment

income Enter 1% of Part I, line 27b (see instructions)... ee ee ee ee LB 55,008

6 Adjusted qualifying distributions. Subtractline Sfromline4. 2 2 2 6 osani24

[Note The amount online 6 wll De used in Part V, column (b),n subsequent years when calculating whether the foundation qualifies for

the section 4940(e) reduction of tax in those years

Form 990-PF (2013)

Form 990-PF (2013)

Undistributed Income (see structions)

Page 9

@

corpus

)

years priorto 2012

@),

2012

@.

2013

Distributable amount for 201.3 from Part XI, line 7

Undistnbuted income, ifany, a8 of the end of 2013

Enter amount for 2012 only. . = + +

Total for prior years 20__, 20__, 20.

Excess distributions carryover, any, to 2013,

From aonb ie seeeaeaa

a

ramsois te Sa

Feom 2032.) 1 1. ss 3355.04

Total of lines 3a throughe. vv se

Qualifying aistnbutions for 2013 from Part

XII, ines § 9,596,132

‘Applied to 2012, but not more than line 23

‘Applied to undistributed income of prior years

(Election required—see mstructions). es > +

Treated a8 distnbutions out of corpus (Election

required-seemstructions). wes =e

Applied to 2013 distributable amount... =

Remaining amount distributed out of corpus

Excess distributions carryaver applied to 2013

(fan amount pears in column (4), the

{Same amount must be show in calurin(3).)

Enter the net total of each column as

indicated below:

Corpus Add lines 31,4¢, and 4e Subtract ine 5

Prior years’ undistnbuted income Subtract

line 46 fom line 20

Enter the amount of prior years’ undistnbutes

tncome for which a notice of deficiency has.

been issued, oron which the section 494 2(a)

taxhas been previously assessed... ss

‘Subtract line 6¢ from line 6b Taxable amount

Undistnbuted income for 2012 Subtract line

43 from line 22, Taxable amount—see

instructions » see oe

Undistnbuted income for 2023 Subtract

tines 44-and 5 from line 1 Thvs amount must

bedistnbuted in 20187 sv we ee sa

Amounts treated as distributions out of

corpus to satisfy requirements imposed by

Section 170(b)(1)(F) or 494 2(g)(3) (see

Instructions) oe et ee

Excess distributions carryover from 2008 not

applied online 5 or line 7 {see structions). «

Excess distributions carryover to 2014.

‘Subtract lines 7 and 8 from line 69

Analysis of ine 9

Excess from 2009.

Excess from 2010. 1 Eau

Excess from 2011. 1 1 Tae eq

Excess from 2012.» + 5395.04

Excess from 2013. 1.) 552.255

Form 990-PF (2013)

Form 990-PF (2013) Page 10

Private Operating Foundations (see istruchons and Part VIA, queston 9)

foundation, andthe ruling eectve for 201, enter te date ofthe rua.

‘Check box to indicate whether the organization 1s a pnvate operating foundation descnbed in section _4942)(3) or [_49420N5)

.

2a Enter the lesser of the adusted net Tax year Por 3 years

‘neame from Part [or the minimum (e) Total

en (2083 wii mit T2088 a

tnvestment retum from Part X for each

year listed.

b 85% of ine 23 - . :

€ Qualifying distabutons fom Part x11,

ling 4 for each year listed -

4) Amounts included inline 2¢ not used

directly for active conduct of exempt

© Qualitying dietnbutions made directly

foractive conduct of exempt actwities

Subtract line 26 from line 2

3 Complete 3a,b, orc forthe

‘ltermative test relied upon

8 “Assets” alternative test—enter

(2) Value of ail assets

2) Value of assets qualifying

under section 494203 KEM)

b “Endowment” alternative test— enter 2/3

‘of minimum investment return shown in

Part x, line 6 for each year listed.

© “Support” alternative test—enter

(2) Total support other than gross

snvestment income (interest,

dividends, rents, payments

fon secunties loans (section

512(@)(5), or royalties)

(2) Support trom general public

and 5 or more exempt

‘organizations as provided in

Section 4942)(3)(8Ki}-

(2) Largest amount of support

from an exempt organization

(4) Gross investment income

‘Supplementary Information (Complete this part only if the organization had $5,000 or more in

assets at any time during the year—see instructions.)

1 Taformation Regarding Foundation Managers:

‘9 List any managers of the foundation who have contributed more than 2% ofthe total contributions received by the foundation

Before the close of ny tax year (but only ifthey nave contnbuted more than $5,000) (See section $07 (3)(2) )

See Additionel Data Table

B List any managers ofthe foundation who own 10% ormore ofthe stock ofa corporation ran equally large portion of he

‘ovmership of @ partnership or other entity) of which the foundation has 2 10% or greater interest

2 Taformation Regarding Contribution, Grant, Gift, Loan, Scholarship, ete, Programs

‘Check here PIF ifthe foundation only makes contributions to preselected charitable organizations and does not accept

Unsolicited requests for funds Ifthe foundation makes gits, grants, ete (see instructions) to individuale or organisations under

‘other conditions, complete items 24,5, , and d

12 The name, address, and telephone number ofthe person to whom applications should be addressed

'b The form in which applications should be submitted and information and matenals they should mnclude

© Any submission deadlines

Any restrictions or limitations on awards, such as by geographical areas, charitable feds, kinds of institutions or other

factors

Form 990-PF (2013)

Form 990-PF (2013)

Supplementary Information (continued)

3 Grants and Contributions Paid During the Year or Approved for Future Payment

Page 42,

eae Tfrecipient san mdi | ounaation

showany rlatonsmp to | FoUNatIOn | purpose of grant or —

Name and address (home orbusiness) | gy" ycroesrconenacrer | recipient copa

= fac danng the yoor

See sch of Donees addressesstatus © None lsoxcexsy — vancus 6,089,820

Vanous, TX 76637

etal eee eee > 3 349,820

© Approved for Faure payment

See Sch ofDonees addresses status |uone s0x%ex3) — vanous 19,817,613

Yanous.1X 76437

> Tesi sis

Total.

Form 990-PF (2013)

Form 990-PF (2013) Page 12

‘Analysis of Income-Producing Activities

Enter gross amounts unless otherwse indicated | Unrelated business income | excel by secon S12, 518 or S14 oy

a Related or exempt

cutee a . w funetion income

1 Program service revenue vine Amount | Exclusion code | Amount ao

b

4

t

{9 Fees and contracts from government agencies

2 Membership dues and assessments.

3 Interest on savings and tamprary cosh

4 Dividends and interest from secunties 1 7,326,309

'5 Net rental income or (loss) from real esta

1 Debt-financed property.

Not debt-fnenced propery.

66 Net rental income or (loss) fom personal

property «

7 Other investment income.

{8 Gain or (loss) from sales of assets other than

ety rear 18 3,605,104

19 Net ncome or (loss) from special events

10 Gross proft or (loss) from sales of inventory.

AL Other revenue ine candewood

bb fcome fom K-12 1 372 sal

{dWordw deanbuton 7 Taste

¢ Tax oxergtcatend 1 3.354

32 Subtotal Add columns (B) (@), and (e)- 625.20

13 Total Add tine 12, colurmas (b), (4), and (e) 1 e524

(See worksheet in line 23 instructions to venfy calculations

Relationship of Activities to the Accomplishment of Exempt Purposes

Explain below how each activity for which income is reported n column (e) of Part XVI-A contributed importantly to

the accomplishment af the foundation's exempt purposes (other than by providing funds fer such purposes) (See

instructions )

Form 990-PF (2013)

Form 99%

F (2013) Page 43,

Information Regarding Transfers To and Transactions and Relationships With

Noncharitable Exempt Organizations

1 Did the organization directly or indirectly engage n any of the following with any other organization described im

section 501(c) ofthe Code (other than section $01 (c)(3) organizations) or im section $27, relating to politcal Yes | No

organizations?

f Transfers from the reporting foundation to a nonchantable exempt organization of

(ce lan No

(2) omer assets. a2) No

b Other transactions

(2) Sales ofassets toa nonchantable exempt organization, © 2 2 ee ee ee ee ee [aC No

(2) Purchases of assets froma nonchantable exempt organization, © vv ee ee ee ee ee aD No

(3) Rental offciities, equipment, or other assets... ve eo + [aC No

(4) Reimbursement arrangements. © 2 6 ee ee ee fate No

(ey oars orion guarantees (cote ee lane) No

(6) Performance of services or membership or fundratsing soliitations. 6) No

€ Sharing of facies, equipment, matling lists, other assets, or paid employees... - - 2 es ee es Lae No

4 Ifthe answer to any of the above 1s "Yes," complete the following schedule Column (b) should alvays show the fair market value

atthe goods, other assets, of services given by the reporting foundation Ifthe foundation received less than fair market value

In any transaction or sharing arrangement, show im column (d) the value of the goods, other assets, or services received

(2) ure ne | (oy Amount motved_| (e) Name of wnctartable exempt oganzaton | (4) Descrpnon of tarsters, wansactons ad shang arangements

2a Te the foundation directly or directly afiiated wth, or related fo, one or more tax-exempt organizations

descnbed in section 501(c) of the Code (other than section S01(c)(3)) orinsection $277... . . . . 2. . ves Fro

bb If-Yes," complete the folowing schedule

{@) Name of oganzaton (©) Type of ongangaton (e) besepton of enone

Under penalties of penury, I declare that I have examined this return, including accompanying schedules and statements, end to

the best of my knowedge and belief it's true, correct, and complete Declaration of preparer (other than taxpayer orhiduciary) 1s

Sign | based on all information of which preparer has any knowledge

Herel )

Paid Vietork Munson ploy

Prepares

Only Firm's address > ‘6060 N Central Expwy Suite 560 Dallas, TX 75206 |Phoneno (214) 237-2920

Form 990-PF (2013)

Form 990PF Part IV - Capital Gains and Losses for Tax on Investment Income - Columns a -d

{@) List and descnbe the kind{s) of property sold (eg , realestate, (b) How acquired | (€) Date acquired] (a) Date sold

‘Pestory bnek warehouse, or common stack, 200 she MLC Ce) P—Purchase | (mo, day, yr) | (me, day, yr)

D—Donation

See Gain/Loss Seh Attached BNY Mellon ° 2013-01-01 _| 2013-07-03,

See Gain/Loss Sch Attached BNY Mellon ° 2013-01-01 _| 2013-07-01,

See Gain/Loss Sch Attached BNY Mellon ? 2012-01-01 _| 2013-07-03,

See Gain/Loss Sch Attached BNY Mellon ° 2022-01-01 _| 2013-07-01

7217700 § Platinum Tax-Exempt Fund ° 2022-04-01 | 2013-01-08

324182 02 Optima Pertners Focus Fund . 2012-04-01 _| 2013-01-03,

Capital Gain Dividends

Form 990PF Part IV - Capital G

1s and Losses for Tax on Investment Income - Columns e - h

(@) Gross sales price

(F) Depreciation allowed

(9) Cost or other baste

(hy Goin or (oss)

(Grallowable) lus expense of sale (e}plus (9 minus (9)

387,293 395,271 “7.978

15,693,944 16,243,815 2,450,029,

71,862 72,395 533

314,206, 3,000,000 114,208

4068484 3,800,000, 260,484

Form 990PF Part IV - Capital Gains and Losses for Tax on Investment Income - Columns i

‘Complete only for assets showing gain in column (h)and owned by the foundation on 12/31/69

(EMV a5 0F12/31/69,

( Adustes basis

a of 12/31/69

(Wo Excess of co )

over col Q),ifany

(Gains (Col (R) gain minus

col (k), but not less than -0-)or

Losses (trom col (h))

720,874

“7378

2,450,029,

533

114,206

260,484

Form 990PF Part XV Line 1a - List any managers of the foundation who have contributed more than 2% of

the total contributions received by the foundation before the close of any tax year (but only if they have

contributed more than $5,000).

Farns © Wilks

Down Wilks

[ete GRAPHIC print- DONOT PROCESS [As Filed Data LN: 9349730000604]

Schedule B Schedule of Contributors [ou Ne ABOUT

Semen > nach oF 390-£2, oF 990-8.

Sete > insrmaton aout Scheaue 8 Form 990, 980°, or 80 PF) anditsinstuctons isa} — 2013

Pans Reason eure goviernee

Hare ofthe operation Trployar Hen ction wanar

27-6977311,

‘Organization type (check one}

Filers of: Section:

Form 920 or 990-62 S01(e}(_) (enter nurber) organzation

4947a)(1) nonexempt chantable trust not treated as a prwvate foundation

527 poltical organzation

.

7

r

Form 90-5 F 501(039) exempt pate foundation

T 494721) nonexempt chartable ust reated asa prvatefoundaton

7

501(6\(3) taxable private foundaton

‘Check f your organzaton is covered by the General Rule or a Special Rule.

Note. Only a section 501(¢}(7), (8), oF (10) organzaton can check boxes for both the General Rule and a Special Rule See instructions

General Rule

F For an organzation ting Form950, 990-E2, or 990-FF that recewed, during the year, $5,000 or more (In money or

property) from any one contributer Complete Pats Land I

‘Special Rules:

F Fora section 501(6)(3) organization fing Form990 or 990-EZ that met the 33118% support test of the reguations

Under sections 509(2)(1) and 170(b)(7)(A)(v) and recewed from any one contributor, dunng the year, @ contrioution of the

greater of (1) $5,000 or (2) 2% ofthe ammount on (i Form 990, Pat Vl, ne 1h, or (x) Form 990-£2, ine 1 Complete Parts | and i

Fora section 501(¢}(7), (8), oF (10) organzatio fing Form 990 or 890-E2 that recewed from any one contributor,

{duning the year, total contnbutons of more than $1,000 for use exclusively for reigious, chartabie,

‘scent, iterary, or educational purposes, of forthe preventon of cruelly to chikren or anmrais Complete Pats | Il and

0

For a section 501(¢)(7) (8), of (10) organzation fling Form 990 or 990-EZ that recewved from any one contributor,

‘duning the year, controutions for use exclusively for reigous, chartable, etc, purposes, but these contnibutons did

rot total more than $1,000 I this box is checked, enter here the total contributions that were received durng

the year for an exclusively reigous, chantable, etc, purpose Do not complete any of the pats unless the General Rule

applies fo ths organwaton because & recewed nonexclusively relgous, chartabie, etc, cortnbutions of $5,000 or more

(Cinco oy eag 7st (Complete Par for

roncash corrttions )

(a) (b) (ce) (d)

No. Name, address, and ZIP +4 Total contributions | _Type of contribution

a Person 7

Payroll = 7

s Noncash >

(Complete Par for

@) iS (e) @

No. Name, address, and ZIP +4 Total contributions ‘Type of contribution

Person 7

Payroll 7

: Noncash [-

(Complete Par for

roncash conto )

@ oy @ @

Ne. Name. address, and ZIP +4 Total contributions | Type of contribution

Person es

Payroll

: Noneash

(Complete Par for

roncash eorrbtions)

@ ) © @

No. Name, address, and ZIP +4 Total contributions | _Type of contribution

Person 7

Payroll

$ Noncash >

(Complete Part for

reer reer

Schedule 8 (Form 990, 990-£2, or 990.FF) (2013)

Name of organization

Noncash Property is nevusos) re niene copes Pari tegen ae Toa

Page 3

Employer Wentification number

)

Description of noneash property given

«) a

FUV (or estimate) pec

{use mutcton®)

(2) No.

CO) i (ay

ey Description of noncash property given ee Date received

to) tc a)

Description of noncash property given

FMV (or estimate)

(see instructions) Date received

(2) Neo.

(>) a @

iad Description of noncash property given ua anaea Date received

fea Description of noncash property ven MY for estimate Date received

(a) No. (ey

from (b) (d)

perl Description of noncash property given ae ncaa Date received

eee eee eee ee

Schedule B (Form 980, 980-£7, or 900.FF) (2013)

Name of organization

Page 4

‘Employer Mentification number

‘Exclusively religious, charitable, etc, individual contributions to section 501(6)7) (8). or (10) organizations:

that total more than 1,000 for the year. Complete colurs (a) through (e) and th

For organzatons corrleting Part Il enter the total of exclusively relgous, chartable,

1 folow ng ine entry

contributons of $1,000 or less forthe year (Enter ths mformation once See mstructons ) 8

Use dupicate copes of Part if addtonal space is needed

(b) Purpose of gitt

(6) Use of gitt

(4) Description of how gift is held

Transferee’s name, address, and ZIP 4

Te) Transfer of gift

Relationship of transferor to transferee

13) Ne.

trom

Part

(b) Purpose of gitt

(6) Use of gitt

(4) Description of how gift is held

Transferee’s name, address, and ZIP 4

Te) Transfer of git

Relationship of transferor to transferee

(b) Purpose of gitt

(6) Use of gitt

(4) Description of how gift is held

Transferee's name, address, and ZIP 4

{e) Transfer of git

Relationship of transferor to transferee

Ta) Ne.

from

Part

(b) Purpose of gitt

(6) Use of gitt

(2) Description of how gift is held

Transferee’s name, address, and ZIP 4

{e) Transfer of git

Relationship of transferor to transferee

reer

[As Filed Data — J

TY 2013 Accounting Fees Schedule

Name: The Thirteen Foundation

EIN: 27-6977311

Software ID: 13000170

Software Version: 2013v3.1

Category ‘Amount Net Investment Adjusted Net | Disbursements for

Income Income Charitable

Purposes

Aecounting & 6.967 0 ° °

administrative

[As Filed Data — J

TY 2013 Cash Distribution Explanation Statement

Name: The Thirteen Foundation

EIN: 27-6977311

Software ID: 13000170

Software Version: 2013v3.1

Explanation: See explanation and detail for "set aside" attached. The amount

set aside will be paid within the specified time not to exceed more

than 60 months. The 2013 tax year is the first/imitial year to

record/claim an amount set aside to future distnbution as a

"qualified distribution".

lefile GRAPHIC

int - DO NOT PROCESS.

As Filed

Note: To capture the full content of this document, please select landscape mode (11” x 8.5") when printing.

TY 2013 Depreciation Schedule

Name: The Thirteen Foundation

EIN: 27-6977311

3491309006014.

Software ID: 13000170

Software Version: 2013v3.1

Description of Date] costorother | Por Years | computation Method Rate / ‘current years | Netinvestment ] Adjusted wet | Cost of coods

Property pequires ‘eae Depreciation te (Wo years) ‘Depreciation Income Income ‘Sold not

Expense Included

[efile GRAPHIC print — DO NOT PROCESS TAs Filed Data-[DIN: 93491309006014]

TY 2013 Land, Etc. Schedule

Name: The Thirteen Foundation

EIN: 27-6977311

Software ID: 13000170

Software Version: 2013v3.1

Category / Item Cost / Other | Accumulated ] Book Value | End of Year Fair

Basis Depreciation Market Value

Machinery and Equipment 6,030 1,318 4,712 4,712

[efile GRAPHIC print — DO NOT PROCESS TAs Filed Data-[DIN: 93491309006014]

TY 2013 Legal Fees Schedule

Name: The Thirteen Foundation

EIN: 27-6977311

Software ID: 13000170

Software Version: 2013v3.1

Category ‘Amount, Net Investment | Adjusted Net | Disbursements for

Income Income Charitable

Purposes

Legal & professional 21,837 ° ° 1,200

[efile GRAPHIC print DO NOT PROCESS [As Filed Data — | DLN: 93491309006014]

TY 2013 Other Decreases Schedule

Name: The Thirteen Foundation

EIN: 27-6977311

Software ID: 13000170

Software Version: 2013v3.1

Description ‘Amount

Disbursements for chantalble purposes 436,312

Prior penod federal tax adjustment 20,142

[As Filed Data — J

TY 2013 Other Expenses Schedule

Name: The Thirteen Foundation

EIN: 27-6977311

Software ID: 13000170

Software Version: 2013v3.1

Description Revenue and Expenses] Net Investment | Adjusted Net Income | Disbursements for

per Books. Income Charitable Purposes

‘Amortization of bond prem/Aise 239) 239) 2439

Brokerage and bank fees 102,219 102,154 102,154 231

Depreciation - various: 41,567

Donations - net 61,631

Dues & subsenptions 2azt 2azt aaa

Expenses from Kis 255,398 255,398 255,396

Foreign tax W/H- dividends 35,025 55,025 35,025,

Insurance -enployee 33,815

Tnvestment fees BNY 17,336 17,336 17,336

Meals & entertainment 1756 6664

Miscellaneous 176

Ofice expense 857

Postage, delivery & supplies 194

Printing 70

‘Strategie Partners expenses 16,398 18,398 18,398

Supplies 101

Travel 7548 56,324

Unites 2572

Vehicle expense 2A75 23,258

[efile GRAPHIC print — DO NOT PROCESS TAs Filed Data-[DIN: 93491309006014]

TY 2013 Other Income Schedule

Name: The Thirteen Foundation

EIN: 27-6977311

Software ID: 13000170

Software Version: 2013v3.1

Description Revenue And Net Investment | Adjusted Net Income

Expenses Per Books Income

Tne Candlewoods Strategie 196,470 196.470, 196.470

Income fom Kas 372,581 372.581 372,581

Mise meome @ BNY 1099 15,294 18,294 18,294

Non-div aistnbution 73,524

Tax exempt dividend 3,054

[As Filed Data — J

TY 2013 Other Increases Schedule

Name: The Thirteen Foundation

EIN: 27-6977311

Software ID: 13000170

Software Version: 2013v3.1

Description ‘Amount

Book income in excess of income on 990-PF 245,870

Prior penod adjustment 1,104

[efile GRAPHIC print — DO NOT PROCESS TAs Filed Data-[DIN: 93491309006014]

TY 2013 Other Liabilities Schedule

Name: The Thirteen Foundation

EIN: 27-6977311

Software ID: 13000170

Software Version: 2013v3.1

Description Beginning of Year - | End of Year - Book

Book Value Value

‘Accrued federal taxes 60,685

[As Filed Data — J

TY 2013 Substantial Contributors Schedule

Name: The Thirteen Foundation

EIN: 27-6977311

Software ID: 13000170

Software Version: 2013v3.1

Name Address.

Farne Wike 170101420,

Cisco, TX 76437

Down Wilks: 170101420

Cisco, TX 76437

[efile GRAPHIC print DO NOT PROCESS [As Filed Data — | DLN: 93491309006014]

TY 2013 Taxes Schedule

Name: The Thirteen Foundation

EIN: 27-6977311

Software ID: 13000170

Software Version: 2013v3.1

Category ‘Amount. Net Investment | Adjusted Net | Disbursements for

Income Income Charitable

Purposes

Federal income tox 60,685

Payroll taxes 13.222

Property 3,105

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Capitol Riot Map 1.11.21Document1 pageCapitol Riot Map 1.11.21Teddy WilsonNo ratings yet

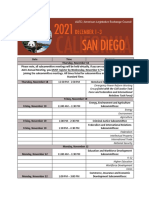

- 2021 States and Nation Policy Summit AgendaDocument4 pages2021 States and Nation Policy Summit AgendaTeddy WilsonNo ratings yet

- Human Coalition - Texas Grant ContractDocument455 pagesHuman Coalition - Texas Grant ContractTeddy Wilson100% (1)

- PF Return of Private Foundation: ExpensesDocument20 pagesPF Return of Private Foundation: ExpensesTeddy WilsonNo ratings yet

- Return of Private FoundationDocument40 pagesReturn of Private FoundationTeddy WilsonNo ratings yet

- Texas A2A Program FY2018 Q2 (Pregnancy Help Center of Lufkin Annual Monitoring)Document4 pagesTexas A2A Program FY2018 Q2 (Pregnancy Help Center of Lufkin Annual Monitoring)Teddy WilsonNo ratings yet

- Texas A2A Program FY2017 Q4 (YTD Totals)Document7 pagesTexas A2A Program FY2017 Q4 (YTD Totals)Teddy WilsonNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)