Professional Documents

Culture Documents

TTF 990 2012

Uploaded by

Teddy Wilson0 ratings0% found this document useful (0 votes)

18 views39 pagesThe Thirteen Foundation - IRS 990 (2012)

Original Title

TTF-990-2012

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Thirteen Foundation - IRS 990 (2012)

Copyright:

© All Rights Reserved

0 ratings0% found this document useful (0 votes)

18 views39 pagesTTF 990 2012

Uploaded by

Teddy WilsonThe Thirteen Foundation - IRS 990 (2012)

Copyright:

© All Rights Reserved

You are on page 1of 39

’

in 990-PF

‘iar Rowen sence

For calendar year 2012, or tax year beginning

Return of Private Foundation

or Section 4947(a)(1) Nonexempt Charitable Trust

‘Treated as a Private Foundation

ote don may 20a ny fe oan a tty ae enrng reaureens

+2012, and ending

2 No, 0052

2012

TA enrayraettcnionnanber

‘The Thirteen Foundation , 276977311

10235 Interstate 20 | TB —Tasphone nurter Gene vaio

Eastland, 1X 76448 , 254-629-8100

JC texegvonappicaton spending, eck neve ["]

nat return [Jintiatretum of a former subi charty | + Foragn epenabors, chick ere 7G

Final return

© Check all Wat app

Address change

Amended return

lame change

2 fecnepnaatns met he 85% tes ck,

fered sach cmp

al

| Section 4947(2)(1) nonexempt charitable trust ["]Other taxable private foundation | E If private foundation status was terminated

Tar mae iaee alae sradaryea [J Aceaaing lho [RICOGR [Yer | weer con SOKIKAY, Get re >]

(iam Pat cor (0) hie 16) ter (epi) LF ttt founttion si a §0-ront termnation

a 97,579,811. (Path column (8) rust BE Under secon SUCK), cack ere “oO

aaptimar —— see NO

BRT TRiperses Trane amouten |

ess, scum depeegbon

(atachscidis). See Stmt 7 >

4,750, 764 4,150, 764.

oamanr

3,557 5,475, 5.475

15 Other assets (escnbe* See Staten 96,236 4,685.) 4, 685.

16 Total assets (1 be completed by al Hers,

Seethe metructons. Also, see page 1, lem 101,194,658.| 97,579,811] 97,579, e112.

"T7Aesounis payable and acctued expenses. 79,126, 35,317 =

18 Grants payable

Deterred revenue.

20 Loans rom ofr, rectors, trstes, & ober squat persons

21 orgoes an se ots payable atch sche)

22 Other labilties (descnbe

at 9

2,443, 723.

23 Total labiltis (add lines 17 through 22) 81, 569.) 36,046.

Foundations that follow SFAS 117, check here *T :

‘and complete lines 28 through 26 and lines 30 and 31. F

Unrestricted

Temporanly restacte.

26 Permanently restricted

Foundations that do not follow SFAS 117, check here>

‘and complete lines 27 through 31.

Re

Oo vamauD «mz

27 Capital stock, rst prineipa, or current funds 105,900,000.) 108, 401, 000...

28 Pane capt! sul, or end, bla, and eaupent und I

29° Ratanes earrings, ecunulted cone, encowrent, er unde =a, 786, 911] -10, 857, 235,

30, Total net assets oF fund balances (see instructions) 701,113,089.] 97,543, 765.

3

aid nel assesiund balances

101,194,658.) 97,579, 811,

art M[Analysis of Changes in Net Assets or Fund Balances

1 Total net asses 0: fund balances at begining of year ~ Part, column (3), line 30 (must agree wih

and of yar igure reported on prot years rele) 3 | 101,113,089

2. Enler amount rom Part |, line 27a 2 | =8, 486, 438

3 Other creases nt lid i ine 2 (ere, 3 5,252, 265

4 Add lines 1, 2, and 3 4[ 97,878,916

5 Dezesses oot tlued mine 2terize) > See Statement _12 — 3 335,151

6_Tolal net assets or fund balances at end of year (lie 4 minus line 8) — Part cblamn 6) Tine 30 [e357 543, 765.

Baa TeeAooaa 120608 Form 90-7F 2012)

+ Form 990-PF @012) The Thirteen Foundation 27-6977311 Page 3

Partilvi,] Capital Gains and Losses for Tax on Investment Income

7 (a) List and describe the kind(s) of properly sold (e.g., real estate, TH) row scaaned | (e) Dale acquved | (GC) Cale sont

2 DUBE See SOI FNS ART SS PES Se Ea

Tage Beaten 12

7

‘

TET TT ee ae ee Fon a

® OO aae Geena ne Seon

7

A

ora OSES Qoeeceree | Setters

;

a [

2 I

Te gain, also enter in Part, ine 7

Ht Ress)renter8: in Part I ne 7 2 Bees

'3_ Net short-term ceptal gain or (loss) as defined in sections 1222(6) and (6)

2. Capital gain net income or (net capital loss)

1991, ao enter n Part, ine 8, column () (se instuctons) (oss), enter 0

inBartiine 8 7 + 3 96,251.

(ParV< [Qualification Under Section AS40(e) for Reduced Tax on Net Investment Income:

(For optional use by domestic private foundations subject to the section 4980(a) tax on nel wnvestment racome )

It section 4940(¢)(2) applies, leave this part blank

‘Wes the foundation lable for the section 4942 taxon the dstnbutable amount of any year in the base period? Lives [xno

It'Yes.' the foundation does not qualify under section 4940(@). Do not complete this part, =

cad SER ay | Meme el cane Sat Ia Brenna

am SE CSE, OSaSaEE,

Tuten 2 0.049001

Amr apnea tensor beret fe ela 3 0.049803,

| 5 Multiply ne 4 by line 3 5 4,825,090

|

6. Ete etm naires ane et Pat ne 2m) ‘ 13,202.

peer 2 4,944,782,

i.e 8 sequal loo tener han ine 7, cheek he box m Fart Vi, ine Tb, and eomplete that par using @ 16 tx rae, See the

art Viinstructions.

BAK Form S80-PF 012}

Forh 990-PF (2012) The Thixteen Foundation 27-6977311 Page 4

* [Part VI_JExcise Tax Based on Investment Income (ection 49400), 4380(0), 4940(¢), oF 4948 — See instructions)

{step Oooo ae INGUOT HENNE [| ee WH oT

b Domestic foundations that meet the section 4940(e) requirements in Part V, 19,702

creo.» ind ete of Part ne 2 (aes

cit ds oth Grn a ol tt)

2 Teen scan 1 et sect 50K) ae adnate

Innaniscie Siasaes§ 2 o.

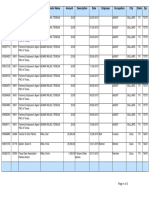

3 asin a2 SGSEV 8 OE _pOOSEV# 100d VINA

wos Grosoes _aseosies euseno eee _—enaraeeie aren BrerWOHTOOd WANG

soca Boss arzav Os evsen0 oresro __@HOOUIWIE _—_vizYGEV 9 SE _1L~GGV# 100d WN

Orr wees acess euszi0 seme eWvaeEIE ——_veuan ZOUSIOR 100d WANE

zs woes __azenes use zene Liviaeele Watley “LLDIOHIOOd WANE

fay res wei euseno we5iz weasaecte __veeveNW ‘EPDIOH 100d WHR

wees zoos _erui0te euszi0 eciior _reneaecie ——_vetvo {EEVON100d_WNNS

wees ‘woes vsses ewsisi0 a euveinese __xOe0182 100d NESW BOIN TLVN L.AOD

wou owes comes eusin0 wei ——oeouvezie ——Cemaev 2 OS FeeeaVCROO On

SLs O6rG'LS 8208'S sHStito ec zoet ozarrezte stzee6v Lk HO'S —LZ8Z6VTIOD OWIHS

ues 21608 196505 eusin0 ise80 BANANeeLE ——aLIYSOD sy GOD TIOD OWT

25985 Wows _evzavis eusi0 esza _aisaanere ——-aasenir—_—» 92 essaLr TOO OWNTHLE

ors seIeris ao toaTs es10 uk O00o} ANGEL 1 S0'E ¥e6z10 TO0s GOD OWT

SOURS saequeqo _swosounico _—PEPESuogantoe pos Ane ding reals wondtoseg

"Wo seer eau sees para

“850] 40 s\UOU! ZL. Pjoy SJaSSE Jo Safes SapNIOUL KLOBAIED SL

‘SUORIESUEI} W119} 1104S

56 ae WWI-NOLLVGNNOd NISL eee

NOTIAW ANG

oress 008 a

ores wszevis —_vevewis zwei tiger 0 sorysscez ana ‘NI SOGTH B3ZIOUSNI

sess aves :

sees evous crus zvovno tear ot porsszse Na ON SOOH HIZIOUING

was ‘0

wos zeeoes arises zvevno zor ot cotsceses XLIA_ONI STWOLUNSO Rev ELIA

wes 08

ies eres or eels i sorzesess oon ont Suanuniva 0”

wes 0s

wes soos owes zen —_zinow oz oorszeses XLUA ONT STVOLUN3OWReIVH XELBIIA

oss os

oss weones cons zverno —zinoo ob ootseeszs XIMA_ONI STVOUNZOWNREVEE KALBA

‘sees ooes

sons ceuiees — sozes'es zureim on socsszoee SQM WV SNOdS 914 TIBHS HOING WAOY

=e 0s

sees ovaices —_soose'as zuenwo oa souvsoceo av ‘ON S301N30 SOT¥NY

ewoies oes

eros + awe —eoHeLUS zen oz oiztoses SHON ONT AOOTONHOL dIKOOUOIN

wens oo08

seoeis sovev'ss wears zuecro —1eW90 _o9e corateisr LUNN! Tld¥9 3OVOLNOW OOSAANI

exreees 0008

eves weecors stasis zveweo S190 ove o1sceuey 21 NORWOO ANvaHwOO SOTERN

ecu01s 000s

eats proses sveacis Zunwno —_14su80 0 soxsoeize vn nn i009 wan

Pawowes $5 9504

SeSWEeM —algns

wong

sq.0 —sieeqgo —suorssnuco «PIES uopsmboe POSAMUEND dng requns vondorea

Geen uo yso saa oud sae pared

“889] J0 SyIuOW Z}. plat SI9SSe JO Safes SapnyoUl KroBa}ED SIL

aes SEM 0} Np PaMOTTESIp SSO] IIA SuORSuSHUA, MIO} 1404S

96 aieg VINF-NOLLVGNNOS NALLUTALL BOHR Rae:

NOTIAW ANG

oopeceeisor soqunysyunos9y

uopEMOsU] XB, Z1Z <

ars9s oo0s

ares wos savas ziveou0 —_zueso 0 sopuntes oad y

woHEULIOJUY XE YL, Z10Z

'SYUOU! Z} VEY) OWI PAY Sjasse Jo Sajes SapN|oU AJOBa}ED SHH

VI-NOLLVGNNO4 NISLUIL

suopoesuesy m9) 3u07]

INAWGOVNYN HIVE,

NOTIAW ANG,

ssusczsis aressens'es or tistoer'ss :s01es woy ssovwe wos Guo} 01

wens acues esas eseno znesvicie _vesuirv BsuirwOR 100d van

oo eriores _ ervaras evsz0 SHMOeOHE __VB¥ESPL_ 100d NSGV SOM TWN TWuaas

comes sous coves euszn0 ROOKIE VOGEEBE 100d NSSY ZOLN TWN Wea03

swiees ‘ovveoss sears eusen0 vanvacie __veisoiy GISEHVOH 1004 WANS

araers U0 wows euszi0 oassvine —wasesze 5252608 1008 WINN

wees woos sa 18rIs eusis0 marecie —_sRcasev HEY eeRGEY GOD OTHE

ons oes ise evais0 mnariecie ——_—snceseY —_zhuSy azAGEV GIOO OW Hs

oss sees szous eusi110 ixvanazse 866509 + KO 8F8500 TIOO OMT

esoees Weiaves _easeves custo znvanscie _—_s612h09 _y WES Le GTOO ONTHA

oes ores ovauis mmanecie __sRzasev chy eAGEY GIOO OW

zee wuss sseees euoanszié —_aezza0o @ze00# 1008 NH

6s'96rS eoores: aeziz'es: oasrozete aLise00 LISE0D# 100d OTH

sues wears oe 19¥s SHO HHS _F9SH0D 100d OATH

seers UL er Leas 3511909 + SS BLL WOOO OATH

wes 1se5es veisa6s {866119 dO GOD SOM NVOT SON 103

wus lwasis series ‘Vi0e~es —€ SY —_10ez06 100d WANS

wens erisoes _z0¥ee 1s muaeine __vistzay isezavo 1004 VANS

orvers zewves _esuizes 1S00RC1E _—_VOIZOW GIZOVOHTOOd YN

wuss ovocreis oweavis znssvecie VOSA @SLITVON 1003 WANA

wanes Sieees _ esuerst cassrivie —_vasesi6 9232608 100d VN

wars ees 10 8seas tusu60_w0es69 ——ravewecie —~WaLStHY GiSEHVOH 100d HN

oO PN ——aamqiago—_—avorsounoo ‘onrnine pS ARVERO ang weqas ‘ondineg

"oie, sso. ao eS peed

‘SUMO ZL UeLA 210W Ploy sjosse Jo sejes SepNpUI A1oBo}e0 SL

suonoesue.y a3) S00]

WW

LOT ae VWIE-NOLLVONNOS NATL INOTIAM RNG

‘OOrEEEETSOT s9quINN yaMODDy »

BENT

"3U SUORSIA AAR

Zor ele

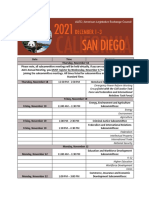

suoneedo| Wana] ev059) ow] wauAS syOH $908 Oa] __OW “UUNS SHON AasTuN UONeOTSy s yom

Gewtee Suoneredo| ~eios| se0sz| x osu 7505 x08 Ol SSnsIOTA VORNTONEY eipary

‘000'008 suonez=do| zoze| xa] vowwag| 322708 Od “buy sera ayn

300°925 Suoneiedo] svrac) xa] puense| (FOr #09 Od “Buy Faia) say AUUNOD pUEHSE;

a oo A

(ale eur Axtied 4a-066 WhO] ~ UONepURGy USSU SUL

‘he TheteeaFouson “Form 990-0 are Xv

faba force iosoa Coviouse nde 100719 redenlsborg Wa _o2a08 [Foes — [Operators 000

[aeriean Maori 7341 Pickwick Drie Sute A Purcetvite [va —[s0i33 [s0()3-— operators ive. .00

[astemby of Yaw, MDa Caza 0 80x50 eco fe —r6as7 [onsen [operation 395,000

[assembly of vahweh, Eaton eps, Mi oA? n Gunna Ra [stonfogde [927 [enreh—[opestone 100,000

cary Sonst Church, cst. Po vorses esco frees? [enureh [operation 5.000

[cater camp Corporation PO borsie ean fx —[75a35_|ste)3 —[Operauon 5.000

[center fo Contino 56s Oceaana Ghd lox Angler ea [0057 [03 — fopratone 000

church of cst, ce ro doxzs cao i [curr —[Opertone 000

[churn ofthe Naarene, Cio, po sox351 eseo In [eturch [Operators 5.000

[eco vluneer Fie Deparment In concaiton [seo ie Tse) —[operauon 35.000

eros enbrs regrany Care CNT ne Po tones Stephenie [rx [s01e)3 — [operate 15.000

[Fastin county Crs Cente po sox 1010 sina Ie [s01e)3 —JOperanons 2,757

Fatnd County Teen CBE Fo Gox25 [cuca ie Tse)? —[operavos 500

Estnd County Gneral fund Sa Ore Org HTeTEcon Agr std be [stds — [operators 70,000

Eastin Court Gpen Gor Fo box 57 cuca fe Ts0ie)3 —Joperaton 0023

Esviand Volunteer Fre Depart [ia sean snd i Teoies—looerstons 25,000

Fy Renae Covel ne for ose nw [washington Joc [0001 [sae operators 65000.

Fes Assembly of Varah nan, TE S05 County Road ear ie [uh —looeratons 32000

rat apt church, Co, Te co west 8h lesco ia chien [Operations 760

fat rts Chsvn Flowing Gorman Poona (soos ia enuren — [operations 300

recs onthe Far ess txploeroe [csnrcoSpange [co Ja0920_[so{¢3 [Operations 7,300,000

rene Conn foc Govermene Ana PBs eenty [7 § Mh Seat 7S lsemark fNo[s8so8 [soca — [operons 1308775

[cong Bt Church Esta 1 0574 Higa 182 fers [x 6448 [omer — Operate 5.000,

namiton County Cave Net 123 wang Sree anton fre [76591_fsoejs —loperatons 5,00

Fsrbet ernst re eis €oubin Graie RS —[cotumiue lox [as229_Iso1els — [operators 75,00

essa of Mar F [01 westwors Orve [Mam Serge [rt 33168 [so [Operators 10,000

Tb ete Foundsion [passacsen Ae RE Washington [OC —[20002|sae3 — [operations Son

Internsona gdm ule Falah Eavnd TX [600s Fgh esstand [rx {retes [churn Operators 5.000

[enya isson Po toxs: nochepar ji [6s279 sion operons 6196

ubery counsel fo. sox 00774 forego jt —a2ese [bores — operons 50.00

lte oyrames, ne fro-to02326 berton fx reao2[s0|23—Jopraton 725,00

[lear hort of agents 1 59 ago vind Boa tan Peat [crren— persion 000

[Med Reon Mnstes po bo s052 sco xfrs085 [sols —JOperatons aiaasr

[Mourn top Church, Co, rosa 268 eco Tra [77 [enueh — [operators 5000

Rew of ath nstes po ox 70677 Nero Rany Ea Ares Wissen Jopertons S00

sng Star voluniee Fe Dearne 0. bossa eng ter [lx [76077 [S012 — [operations 35.00

nero le Chreh,Estnd, Tx ro. sor tt Ease Fx —[7saae[enuren —lOperatons S00

[Second Spit che, Ranger, TE Poon Set ees Fx [yeaa7 —eroren —lOperanons S00

Shao Ase oYaweh SEES Hoover Roce ae hu [stort 5013 —loperanens wae

sat Poi Network an20 1th Sree Tvigion Wva [22201 s01e)3 —lOperasone Tss625

[exs Home Seheol cosine r.soxo7e7 lbbock Fr [eesa_satei7 — operators ian]

Hex hight to ule Comms EoveavonaT Fond Seo centre Fa owen i [7636—s03—Jopermbons > 3,000

fhe Fertecosta of tng, stand Po Boxass Eastand fe —[eset [onreh Operation 5.000

the Sota Rokr Po box 1068 Estnd Ix [ries —[s0e)s —JOperatons 700,00

anv ssombiya Mesa Rotapon, MO at: Non Roby Fao Road Racepon IMo~]65219 [cnuren —JOperavans 30,500

fawehs FystoneAneomby, Fysown, PA Fo. doxats Peyton i707 [enreh operations t.000|

[ahwel'sRestorshon ni, Hols Summa, WO |p. Soxt63 Hoke Summa [MO [68003_[ehoreh [operators 3]

Fem 8868 Application for Extension of Time To File an

(Pm asa 21) Exempt Organization Return Gon nate

‘iba ewan coc File a separate application for each return.

°® Ifyou are fling Tor an Automvaile S-Month Extension, complete only Part and check this Box

© Ifyou ae tiling for an Additional (Not Automatic) 3-Month Extension, complete only Part Il (on page 2 of this form),

Do not complete Part il uniess you have already been granted an automatic 3-month extention on a previously filed Form 8968.

Electronic filing (ee). You can electronically file Form 8868 if you need a 3-month automatic extension of te to fle (6 months for 2

corporation requred fo fle Form 990-1), 0: a8 additanal (not automatic) month extension of ime. You ean electrnicaly tle Form 868 to

fequest an extension of ume tote ary ofthe forms isted in Part | or Pat wih the exception of Farm 8870, Information Retun for Transfers

Associated With Certain Personal Benefit Contracts, wnich must be sent fo the IRS in paper format (See insiructons). For more details on the

electron fing of ts form, vist nwi.irs.gov/etia and cick on e-file for Ghariies & Nonpronts.

PAI@i.| Automatic 3-Month Extension of Time. Only submit orginal (no copies needed).

A corporation requred ta ile Form 990-1 and requesting an eulomaic 6-month extension ~ check ths box and complete Pat only...» []

{lather comeratins (neuding 1120-C hers), pernerships, REMICs, and usts must use Form 7008 to request an extension of time to fe

Enter fler's identifying number, see Instructions

TSS SR BTN OTT FS TSTORS ET TEA aT ESSE

The Thirteen Foundation l27~-6977321

in sete 958 eam able onbe? FS POTS N ROTOTORT Sal ey RRB AT

10235 Interstate 20

Eastland, TX 76448

Enter the Return code for the return that this application is for (hie a separate application for each return).

‘application Return [Appleton Roun

iSfor ‘ode’ fis For Cod

Ferm So Form OEE T_— [Form 350-7 ompar oF

Form 390.8. G2 [Foren 1087 08

Form 4720 poawiad 03 |Foxm-a720 w

Form 930-PF ‘64 |Form 5227 70,

Form 980-7 Gocton 4OV@) of OBA) aD 5 [Form 6065 Tr

Form 960°T (vustofer than above) 5 ]Fom 6870 2

# Te books aein he cateot* Josh Widks _

Tele No. 254-44: FAX No, = a

© tine organzaton does not have an ofice Gr plage of business in the United Stale, cheek is box .

© tah 1s fora Group Retun, enter the organizalio’s fou digit Group Exemption Number (GEN) UF ths forthe we group,

cheek tis box... []-Ifiis for pat of the group, check ths box...” []end allah a ist wih The names and EINS ofall members

the extensions fr

TTrequest an auiomate Safar Monihs Tora Copan Tegured To We Farm S507) ararsan TU

ol 8/35 _ 20.13 ,, to file the exempt organization return fr the erganzation named above

“Te eitension i ToF he ofganaton’s return for

> [Rcalendar year 20 12 or

> [Jiexyeorbeginnng 20 __, and ending a.

2 he tax yer entered imine 1 for less than 12 month, check reason: [Jina return Drinat rum

lenange in accounting pevod

‘3 ts eppzaion for Form 990-8, 990-PF, 990-T, 4720, or 606, enter the tentative te, less ery

omeWhdable edt, See inatuctng sauu| gals 13,000.

bits eppieshon sf Form 990-PF, 990-7, 4720, oF GOED, enter any refundable eres and estate tex

payments made, Inlode any prior yéar overpayment alowad as 9 crea als. 8,000

€ Balanes ue, Subial ine 3 fom line 3a. Include your payment with ts form, i regu, by using

EFTPS (Glecrone Pederai Tax Payment System). Seo vittuctons acls 5,000.

auton, you a8 gaa o make an elstonc fund wheal wth tas Form B85, See Form 8483-E0 and Form 8579-£0 for

Baymont istivetions

‘BAA For Privacy Act and Paperwork Redclion ACI Notice, see Instructions: Form 858 Rev VOI)

Form 8868 (Rev 1-2013) Page2

* It you are dling for an Adatfonal (Not Automatic) S Month Extension, complete only Parti and check this bor

Note. Only compete Pati i you have already been granted an automatic 3-month extension on @ previously Hed Form 868.

4 if jou ae ting for an Automatic -Month Extension, complete only Part (on page 1).

(Pari [Additional (Not Automatic) 3-Month Extension of Time, Only file the original (no copies needed).

Enter fler'sidantiying number, se instraclions

ae SAE oT WE FE HATO Ey nan vant CN 3

Type or

pint” [The Thirteen Foundation 76977311

oor Talento marian ease ete ———

cote

abe. |Victor K. Munson, CPA

Mire, [S060 N. Central Expwy.. suite $60

Dallas, TX 75206

Enter the Return code forthe return that this application is for (tie @ seperate application for each return)

Application Retura [Application

is For Code. [is For

Foi S50 or Form SEZ a : Ta

Form 990-8 [ee [Form toa 08

Form 4720 (nda 03 [Form 4720 i

Form S80.0F [04 [Form $227, 10

Form 990-7 (eelion OTA) or AOBT=) Fost) [05 [Form 6068 17

Form $90-T (ius oer than above) nC leat

‘STOP! Do not complete Part itt you were not already granted an automatic 3month extension on a previously filed Form 8868,

"memes serena Joel BORE ag paca

Teleotene N= 8) TED RB Ne

+ ine cgoneaiod ETS E heres '

* Ile efor @Goup tur, ener he organization's low dik Group Exemption Number (GEN) fore

viol gun, checkin box.» []. itis for pao te group, cheak ns box» [Jane attache bt Wie cb Gnd EN fa

member the extersion fo.

4 oquest an additional 3-month extension of time until

5 Forcalenésr yesr 2012. ,, oF other tax year beginning

Ihe tax year entered inline 51s for lass than 12 months, check reeser

[onange in accounting period

7 Siete in detail why you need the extension. Information necessary _to file an accurate and timely __

As ently. avaijable. Therefore,

‘requested to obtain the information to complete the tax return,

Bai ths apptcaton is fc Form $90-BL, 990-PF, 990-T, 4720, or 6068, enter the lentalve ta, less any

nonvetuneable edi. See instructions

Bil ths ppicaion { Ferm $90-Pr. 990-T, 4720, or 969, ener any flundable SeenON =

ents made. include any prier yéer overpayment alowed as a cell and eny amount paid previously» |=

srt orm 8865. emcees coo eee eee! ais bb, coo.

© Balance due Sula ine Bb am tne Ba: nchase you! ayant wih hs form, require, by Un

EFTPS (Cleclonic Federal Tex Baymont System). See naVuclons eee acls o

Signature and Verification must be completed for Part ironly.

meh gm wuingscamparyig hd

soma dee Munem ms CPA om > Borla

BAA Faas ENS Form B868 Rev 12013)

emer ado the es my one a IE 8,

You might also like

- DFPC Prayer List UpdatedDocument1 pageDFPC Prayer List UpdatedTeddy WilsonNo ratings yet

- 2021 States and Nation Policy Summit AgendaDocument4 pages2021 States and Nation Policy Summit AgendaTeddy WilsonNo ratings yet

- Capitol Riot Map 1.11.21Document1 pageCapitol Riot Map 1.11.21Teddy WilsonNo ratings yet

- Wilks Family Campaign Contributions - Texas (2015)Document3 pagesWilks Family Campaign Contributions - Texas (2015)Teddy WilsonNo ratings yet

- PP v. JegleyDocument148 pagesPP v. JegleyTeddy WilsonNo ratings yet

- Human Coalition - Texas Grant ContractDocument455 pagesHuman Coalition - Texas Grant ContractTeddy Wilson100% (1)

- Texas HHSC Request For ApplicationDocument104 pagesTexas HHSC Request For ApplicationTeddy WilsonNo ratings yet

- WWHA V PaxtonDocument43 pagesWWHA V PaxtonTeddy WilsonNo ratings yet

- HFF 990 2012Document35 pagesHFF 990 2012Teddy WilsonNo ratings yet

- PF Return of Private Foundation: ExpensesDocument20 pagesPF Return of Private Foundation: ExpensesTeddy WilsonNo ratings yet

- Wilks Family Campaign Contributions - Texas (2017)Document7 pagesWilks Family Campaign Contributions - Texas (2017)Teddy WilsonNo ratings yet

- Return of Private FoundationDocument40 pagesReturn of Private FoundationTeddy WilsonNo ratings yet

- HFF 990 2013Document124 pagesHFF 990 2013Teddy WilsonNo ratings yet

- Wilks Family Campaign Contributions - Texas (2016)Document9 pagesWilks Family Campaign Contributions - Texas (2016)Teddy WilsonNo ratings yet

- Wilks Family Campaign Contributions - Texas (2018)Document3 pagesWilks Family Campaign Contributions - Texas (2018)Teddy WilsonNo ratings yet

- HFF 990 2014Document22 pagesHFF 990 2014Teddy WilsonNo ratings yet

- TTF 990 2016Document25 pagesTTF 990 2016Teddy WilsonNo ratings yet

- Texas A2A Program FY2018 Q2 (Pregnancy Help Center of Lufkin Annual Monitoring)Document4 pagesTexas A2A Program FY2018 Q2 (Pregnancy Help Center of Lufkin Annual Monitoring)Teddy WilsonNo ratings yet

- HFF 990 2016Document22 pagesHFF 990 2016Teddy WilsonNo ratings yet

- Form 990-PF Return of Private FoundationDocument18 pagesForm 990-PF Return of Private FoundationTeddy WilsonNo ratings yet

- Texas A2A Program FY2017 Q1 (Facility Tours)Document2 pagesTexas A2A Program FY2017 Q1 (Facility Tours)Teddy WilsonNo ratings yet

- TTF 990 2013Document127 pagesTTF 990 2013Teddy WilsonNo ratings yet

- TTF 990 2014Document29 pagesTTF 990 2014Teddy WilsonNo ratings yet

- HFF 990 2015Document21 pagesHFF 990 2015Teddy WilsonNo ratings yet

- TTF 990 2011Document43 pagesTTF 990 2011Teddy WilsonNo ratings yet

- TTF 990 2015Document25 pagesTTF 990 2015Teddy WilsonNo ratings yet

- Texas A2A Program FY2018 Q1 (Pregnancy Care Center Huntsville - Facility Tour)Document2 pagesTexas A2A Program FY2018 Q1 (Pregnancy Care Center Huntsville - Facility Tour)Teddy WilsonNo ratings yet

- Texas A2A Program FY2018 Q2 (Foundation For Life Annual Monitoring)Document3 pagesTexas A2A Program FY2018 Q2 (Foundation For Life Annual Monitoring)Teddy WilsonNo ratings yet

- Texas A2A Program FY2017 Q4 (Foundation For Life Facility Tour)Document3 pagesTexas A2A Program FY2017 Q4 (Foundation For Life Facility Tour)Teddy WilsonNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)