Professional Documents

Culture Documents

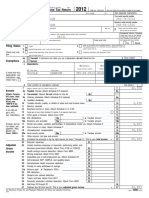

Official Use Only: Pennsylvania Income Tax Return

Uploaded by

gheorghe garduOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Official Use Only: Pennsylvania Income Tax Return

Uploaded by

gheorghe garduCopyright:

Available Formats

1700110057

Pennsylvania Income

PA-40

Tax Return OFFICIAL USE ONLY

PA-40 04-17 (FI)

PA Department of Revenue

Harrisburg, PA 17129 2017 OFFICIAL USE ONLY

PLEASE PRINT IN BLACK INK. ENTER ONE LETTER OR NUMBER IN EACH BOX. FILL IN OVALS COMPLETELY.

START Your Social Security Number Spouse’s Social Security Number (even if filing separately) Extension. See the instructions.

➜ Amended Return. See the instructions.

Residency Status. Fill in only one oval.

CAREFULLY PRINT YOUR SOCIAL SECURITY NUMBER(S) ABOVE

Last Name Suffix R Pennsylvania Resident

N Nonresident

P Part-Year Resident from

Your First Name MI _____ 2017 to ___ ___ 2017

OVERSEAS

Filing Status.

MAIL - S Single

See Foreign

Spouse’s First Name MI J Married, Filing Jointly

Address Instructions

in PA-40 booklet. M Married, Filing Separately

F Final Return. Indicate reason:

Spouse’s Last Name - Only if different from Last Name above Suffix

D Deceased

First Line of Address Taxpayer

Date of death ______ 2017

Spouse

Second Line of Address Date of death ______ 2017

Farmers. Fill in this oval if at least

City or Post Office State ZIP Code two-thirds of your gross income is

from farming.

Name of school district where you lived

Daytime Telephone Number School Code on 12/31/2017:

Your occupation Spouse’s occupation

1a. Gross Compensation. Do not include exempt income, such as combat zone pay and

qualifying retirement benefits. See the instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1a.

1b. Unreimbursed Employee Business Expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1b.

1c. Net Compensation. Subtract Line 1b from Line 1a. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1c.

2. Interest Income. Complete PA Schedule A if required. . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

3. Dividend and Capital Gains Distributions Income. Complete PA Schedule B if required. . . 3.

4. Net Income or Loss from the Operation of a Business, Profession or Farm. . . . 4.

LOSS

5. Net Gain or Loss from the Sale, Exchange or Disposition of Property. . . . . . . . . 5.

LOSS

6. Net Income or Loss from Rents, Royalties, Patents or Copyrights. . . . . . . . . . . . 6.

LOSS

7. Estate or Trust Income. Complete and submit PA Schedule J. . . . . . . . . . . . . . . . . . . . . 7.

8. Gambling and Lottery Winnings. Complete and submit PA Schedule T. . . . . . . . . . . . . . 8.

9. Total PA Taxable Income. Add only the positive income amounts from Lines 1c, 2, 3,

4, 5, 6, 7 and 8. DO NOT ADD any losses reported on Lines 4, 5 or 6. . . . . . . . . . . . . . . 9.

10. Other Deductions. Enter the appropriate code for the type of deduction.

See the instructions for additional information. . . . . . . . . . . . . . . . . . . . . . . . . 10.

11. Adjusted PA Taxable Income. Subtract Line 10 from Line 9. . . . . . . . . . . . . . . . . . . . . . 11.

Side 1

EC OFFICIAL USE ONLY FC

1700110057

Reset Entire Form TOP OF PAGE NEXT PAGE PRINT

PA-40 2017 04-17 (FI) 1700210055 OFFICIAL USE ONLY

START Social Security Number (shown first)

Name(s)

➜

12. PA Tax Liability. Multiply Line 11 by 3.07 percent (0.0307). . . . . . . . . . . . . . . . . . . . . . 12.

13. Total PA Tax Withheld. See the instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.

14. Credit from your 2016 PA Income Tax return. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.

ESTIMATED TAX PAID

15. 2017 Estimated Installment Payments. Fill in oval if including Form REV-459B. 15.

16. 2017 Extension Payment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16.

17. Nonresident Tax Withheld from your PA Schedule(s) NRK-1. (Nonresidents only) . . . . 17.

18. Total Estimated Payments and Credits. Add Lines 14, 15, 16 and 17. . . . . . . . . . . . . 18.

Tax Forgiveness Credit, submit PA Schedule SP Dependents, Part B, Line 2,

19a. Filing Status: Unmarried or Married Deceased 19b. PA Schedule SP. . . . . . . . . . . .

Separated

20. Total Eligibility Income from Part C, Line 11, PA Schedule SP. .

21. Tax Forgiveness Credit from Part D, Line 16, PA Schedule SP. . . . . . . . . . . . . . . . . . 21.

22. Resident Credit. Submit your PA Schedule(s) G-L and/or RK-1. . . . . . . . . . . . . . . . . . 22.

23. Total Other Credits. Submit your PA Schedule OC. . . . . . . . . . . . . . . . . . . . . . . . . . . . 23.

24. TOTAL PAYMENTS and CREDITS. Add Lines 13, 18, 21, 22 and 23. . . . . . . . . . . . . . . 24.

25. USE TAX. Due on internet, mail order or out-of-state purchases. See the instructions. 25.

26. TAX DUE. If the total of Line 12 and Line 25 is more than Line 24,

enter the difference here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26.

27. Penalties and Interest. See the instructions for additional

information. Fill in oval if including Form REV-1630/REV-1630A . . . . . . 27.

28. TOTAL PAYMENT DUE. See the instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28.

29. OVERPAYMENT. If Line 24 is more than the total of Line 12, Line 25 and Line 27

enter the difference here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29.

The total of Lines 30 through 36 must equal Line 29.

30. Refund – Amount of Line 29 you want as a check mailed to you.. . . . . . . . REFUND 30.

31. Credit – Amount of Line 29 you want as a credit to your 2018 estimated account. . . . . 31.

32. Refund donation line. Enter the organization code and donation amount.

32.

See the instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33. Refund donation line. Enter the organization code and donation amount.

See the instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33.

DONATIONS

34. Refund donation line. Enter the organization code and donation amount.

See the instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34.

35. Refund donation line. Enter the organization code and donation amount.

See the instructions. ............................................... 35.

36. Refund donation line. Enter the organization code and donation amount.

See the instructions. ............................................... 36.

SIGNATURE(S). Under penalties of perjury, I (we) declare that I (we) have examined this return, including all accompanying schedules and statements, and to the best of my

(our) belief, they are true, correct, and complete.

Your Signature Date MM/DD/YY E-File Opt Out Preparer’s PTIN

See the instructions.

➜

Please sign after printing.

Spouse’s Signature, if filing jointly Preparer’s Name and Telephone Number Firm FEIN

Please sign after printing.

PLEASE DO NOT CALL ABOUT YOUR REFUND UNTIL EIGHT WEEKS AFTER YOU FILE.

Side 2

1700210055 1700210055

PLEASE DO NOT CALL ABOUT YOUR REFUND UNTIL EIGHT WEEKS AFTER YOU FILE.

Reset Entire Form RETURN TO PAGE 1 PRINT

You might also like

- Official Use Only: Pennsylvania Income Tax ReturnDocument2 pagesOfficial Use Only: Pennsylvania Income Tax ReturnOlivia HaskinsNo ratings yet

- Gov. Walz Tim 2017 Tax Returns - RedactedDocument12 pagesGov. Walz Tim 2017 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz 2014 Tax Returns - RedactedDocument15 pagesGov. Walz 2014 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz 2013 Tax Returns - RedactedDocument17 pagesGov. Walz 2013 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz 2012 Tax Returns - RedactedDocument17 pagesGov. Walz 2012 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz 2015 Tax Returns - RedactedDocument13 pagesGov. Walz 2015 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- CV ApplicationFormDocument4 pagesCV ApplicationFormVijay V RaoNo ratings yet

- Gov. Walz Tim 2009 2010 2011 Tax Returns - RedactedDocument67 pagesGov. Walz Tim 2009 2010 2011 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- 2017 TaxReturnDocument7 pages2017 TaxReturntripsrealplugNo ratings yet

- Form 1040 tax return summaryDocument190 pagesForm 1040 tax return summaryMari Clarke0% (1)

- 2016 Tax ReturnDocument19 pages2016 Tax ReturnPatrick Svitek100% (1)

- A218 DocumentDocument9 pagesA218 DocumentJose AlmonteNo ratings yet

- Form 1040 tax return summaryDocument2 pagesForm 1040 tax return summaryRoo007No ratings yet

- Kia Lopez Form 1040Document2 pagesKia Lopez Form 1040Stephanie RobinsonNo ratings yet

- Dwnload Full Income Tax Fundamentals 2013 31st Edition Whittenburg Solutions Manual PDFDocument35 pagesDwnload Full Income Tax Fundamentals 2013 31st Edition Whittenburg Solutions Manual PDFseritahanger121us100% (10)

- Full Download Income Tax Fundamentals 2013 31st Edition Whittenburg Solutions ManualDocument35 pagesFull Download Income Tax Fundamentals 2013 31st Edition Whittenburg Solutions Manualisaacuru0ji100% (37)

- f1040 PDFDocument2 pagesf1040 PDFHazem El SayedNo ratings yet

- Income Tax Fundamentals 2015 Whittenburg 33rd Edition Solutions ManualDocument6 pagesIncome Tax Fundamentals 2015 Whittenburg 33rd Edition Solutions ManualCharles Davis100% (29)

- FTF1299519215531Document3 pagesFTF1299519215531Leslie Washington100% (1)

- Income Tax Fundamentals 2013 31St Edition Whittenburg Solutions Manual Full Chapter PDFDocument34 pagesIncome Tax Fundamentals 2013 31St Edition Whittenburg Solutions Manual Full Chapter PDFjohndorothy0h3u100% (6)

- Gov. Walz 2020 Tax Returns - RedactedDocument19 pagesGov. Walz 2020 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- 2016 California Resident Income Tax Return Form 540 2ezDocument4 pages2016 California Resident Income Tax Return Form 540 2ezapi-354477702No ratings yet

- Downloadfile 30 PDFDocument114 pagesDownloadfile 30 PDFYianniAnd Sophia0% (1)

- Bio Data: Employee DetailsDocument2 pagesBio Data: Employee DetailsmaloyNo ratings yet

- U.S. Individual Income Tax ReturnDocument2 pagesU.S. Individual Income Tax ReturnKusunoki MasashigeNo ratings yet

- Form 1040 tax return summaryDocument2 pagesForm 1040 tax return summaryarschNo ratings yet

- 2019 Taxpayer Annual: Local Earned Income Tax ReturnDocument5 pages2019 Taxpayer Annual: Local Earned Income Tax ReturnphiamusicNo ratings yet

- Prentice Halls Federal Taxation 2015 Individuals 28Th Edition Pope Solutions Manual Full Chapter PDFDocument48 pagesPrentice Halls Federal Taxation 2015 Individuals 28Th Edition Pope Solutions Manual Full Chapter PDFDavidGarciaerfq100% (6)

- MGPTaxReturn 2020Document64 pagesMGPTaxReturn 2020KGW NewsNo ratings yet

- Know Your Client (Kyc) Application Form (For Individuals) : F I R S T N A M E M I D D L E N A M E L A S T N A M EDocument12 pagesKnow Your Client (Kyc) Application Form (For Individuals) : F I R S T N A M E M I D D L E N A M E L A S T N A M ESskNo ratings yet

- Eddie Salazar PDFDocument11 pagesEddie Salazar PDFsloweddie salazar0% (1)

- Lisa Volpe Archive Cra 19 PDFDocument46 pagesLisa Volpe Archive Cra 19 PDFLISA VOLPENo ratings yet

- U.S. Individual Income Tax ReturnDocument2 pagesU.S. Individual Income Tax ReturnYudo KunaNo ratings yet

- Sf1 - 2016 - Grade 7 (Year I) - ResiliencyDocument3 pagesSf1 - 2016 - Grade 7 (Year I) - ResiliencyLhot Bilds SiapnoNo ratings yet

- Last Name First Name Middle Name Spouse's Last Name First Name Middle NameDocument7 pagesLast Name First Name Middle Name Spouse's Last Name First Name Middle NameMichelle Manalo CanceranNo ratings yet

- Marriage Application FormDocument1 pageMarriage Application FormAmino NikkiNo ratings yet

- T1 General PDFDocument4 pagesT1 General PDFbatmanbittuNo ratings yet

- GCPP_Enrolment Form_15042024Document4 pagesGCPP_Enrolment Form_15042024Shashank GuptaNo ratings yet

- 2016 California Resident Income Tax Return Form 540 2ezDocument4 pages2016 California Resident Income Tax Return Form 540 2ezapi-351598796No ratings yet

- Agricola Credit Union Membership ApplicationDocument3 pagesAgricola Credit Union Membership ApplicationRiannaNo ratings yet

- Resident Income Tax Return Resident Income Tax ReturnDocument6 pagesResident Income Tax Return Resident Income Tax ReturnlooseshengjiNo ratings yet

- Annex 1 - Enhanced BEEFDocument2 pagesAnnex 1 - Enhanced BEEFBernardo MacaranasNo ratings yet

- Amara Enyia's 2016 Tax ReturnDocument4 pagesAmara Enyia's 2016 Tax ReturnMark KonkolNo ratings yet

- 540 FinalDocument5 pages540 Finalapi-350796322No ratings yet

- China Trust Application Form (L)Document2 pagesChina Trust Application Form (L)bimbot100% (2)

- Amara Enyia's 2017 Tax ReturnDocument4 pagesAmara Enyia's 2017 Tax ReturnMark Konkol100% (1)

- School Form 1 (SF 1) School RegisterDocument4 pagesSchool Form 1 (SF 1) School RegisterKIRIL EytiNo ratings yet

- IUSS Pass Card Subscription RequestDocument1 pageIUSS Pass Card Subscription RequestAjay Kumar SreeramaNo ratings yet

- U.S. Individual Income Tax Return: Victor K LIU 090-54-3760 090-54-2005 1720 El Camino Real 200 Burlingame CA 94010Document6 pagesU.S. Individual Income Tax Return: Victor K LIU 090-54-3760 090-54-2005 1720 El Camino Real 200 Burlingame CA 94010victor liuNo ratings yet

- Ivano Volpe Archive Cra 19 2 PDFDocument50 pagesIvano Volpe Archive Cra 19 2 PDFLISA VOLPENo ratings yet

- Gr. 2 Kokak PalakaDocument6 pagesGr. 2 Kokak PalakaNoemi TolentinoNo ratings yet

- School Form 1 (SF 1) School RegisterDocument2 pagesSchool Form 1 (SF 1) School RegisterJeah GamillaNo ratings yet

- Blank Editable PDF (Esic, Form11,2, Grat)Document8 pagesBlank Editable PDF (Esic, Form11,2, Grat)skondapalli98No ratings yet

- Dawn Income Tax 2019-07-21 - 1563756758720 PDFDocument6 pagesDawn Income Tax 2019-07-21 - 1563756758720 PDFDawn Smith100% (1)

- Demat Form Current Final 27062016Document12 pagesDemat Form Current Final 27062016UjjwalNo ratings yet

- MGPTaxReturn 2019Document49 pagesMGPTaxReturn 2019KGW NewsNo ratings yet

- Recurrent Neural Processes: Preprint. Under ReviewDocument12 pagesRecurrent Neural Processes: Preprint. Under Reviewgheorghe garduNo ratings yet

- Evolve 1907.06902v1 PDFDocument10 pagesEvolve 1907.06902v1 PDFgheorghe garduNo ratings yet

- Know Your Rights PDFDocument1 pageKnow Your Rights PDFgheorghe garduNo ratings yet

- Chapter2 PDFDocument6 pagesChapter2 PDFgheorghe garduNo ratings yet

- Cold Case: The Lost MNIST DigitsDocument9 pagesCold Case: The Lost MNIST Digitsgheorghe garduNo ratings yet

- Nature14539 PDFDocument9 pagesNature14539 PDFOnyong GalarionNo ratings yet

- RGB-D Human Detection and Tracking For Industrial EnvironmentsDocument14 pagesRGB-D Human Detection and Tracking For Industrial Environmentsgheorghe garduNo ratings yet

- Chapter3 PDFDocument16 pagesChapter3 PDFgheorghe garduNo ratings yet

- 10 1 1 161 3556 PDFDocument61 pages10 1 1 161 3556 PDFFikri Ali NawawiNo ratings yet

- Chapter5 PDFDocument18 pagesChapter5 PDFgheorghe garduNo ratings yet

- Chapter4 PDFDocument9 pagesChapter4 PDFgheorghe garduNo ratings yet

- Minsky - Steps Toward Artificial IntelligenceDocument23 pagesMinsky - Steps Toward Artificial IntelligenceHoracio BertorelloNo ratings yet

- Imagenet ClassificationDocument9 pagesImagenet Classificationice117No ratings yet

- Can Computers Create Art?: Aaron HertzmannDocument25 pagesCan Computers Create Art?: Aaron Hertzmanngheorghe garduNo ratings yet

- Turing ComputingDocument29 pagesTuring Computingminkhant86No ratings yet

- Chaos Theory and Weather Prediction PDFDocument1 pageChaos Theory and Weather Prediction PDFgheorghe garduNo ratings yet

- Drive in Trafic PDFDocument20 pagesDrive in Trafic PDFgheorghe garduNo ratings yet

- PythonScientific Simple PDFDocument335 pagesPythonScientific Simple PDFBruno Soares de Castro100% (2)

- RL PyTexas 2017 PDFDocument29 pagesRL PyTexas 2017 PDFgheorghe garduNo ratings yet

- Imagenet ClassificationDocument9 pagesImagenet Classificationice117No ratings yet

- 1503 02531Document9 pages1503 02531Prasad SeemakurthiNo ratings yet

- MLP PDFDocument5 pagesMLP PDFgheorghe garduNo ratings yet

- Anaconda Fusion JupyterCON PDFDocument27 pagesAnaconda Fusion JupyterCON PDFgheorghe garduNo ratings yet

- Chaos - Theory - 10.ISCA RJRS 2018 022 PDFDocument2 pagesChaos - Theory - 10.ISCA RJRS 2018 022 PDFgheorghe garduNo ratings yet

- The Matrix CalculusDocument33 pagesThe Matrix Calculusmaurizio.desio4992No ratings yet

- Chaos Theory PDFDocument36 pagesChaos Theory PDFgheorghe garduNo ratings yet

- Chaos Theory and Weather Prediction PDFDocument1 pageChaos Theory and Weather Prediction PDFgheorghe garduNo ratings yet

- Pro Bono Calif 2019 PDFDocument10 pagesPro Bono Calif 2019 PDFgheorghe garduNo ratings yet

- Chaos TH EMS2017-735 PDFDocument1 pageChaos TH EMS2017-735 PDFgheorghe garduNo ratings yet

- Massachusetts: List of Pro Bono Legal Service ProvidersDocument3 pagesMassachusetts: List of Pro Bono Legal Service Providersgheorghe garduNo ratings yet

- Report Report 23Document9 pagesReport Report 23Pran piyaNo ratings yet

- Income Tax On Individuals Part 2Document22 pagesIncome Tax On Individuals Part 2mmhNo ratings yet

- Income From SalaryDocument16 pagesIncome From SalaryGurpreet Singh100% (1)

- Vivekananda Sports & Cultural Aacademy - Volleyball CourtDocument4 pagesVivekananda Sports & Cultural Aacademy - Volleyball CourtVinay RajNo ratings yet

- 94 M.E. Holdings V CIRDocument3 pages94 M.E. Holdings V CIRMatt LedesmaNo ratings yet

- 623FIN Taxation Management McqsDocument65 pages623FIN Taxation Management Mcqsasad abbas100% (2)

- BIR Form 1702-RT 2018Document8 pagesBIR Form 1702-RT 2018Krisha Pioco TabanaoNo ratings yet

- Taxation PDFDocument27 pagesTaxation PDFnanabaNo ratings yet

- All About Tax Deducted at SourceDocument3 pagesAll About Tax Deducted at SourceBala VinayagamNo ratings yet

- 2020 Proteus Offshore, LLC Form 1065 Partnerships Tax Return - FilingDocument17 pages2020 Proteus Offshore, LLC Form 1065 Partnerships Tax Return - FilingPeter Kitchen100% (2)

- 1702 Ghai2011Document5 pages1702 Ghai2011Janice CarridoNo ratings yet

- Chapter 06 Test BankDocument47 pagesChapter 06 Test BankBrandon LeeNo ratings yet

- Notes of VG SIR For Case Law 2016Document18 pagesNotes of VG SIR For Case Law 2016chanduNo ratings yet

- Zuckerman2015 Tax ReturnDocument3 pagesZuckerman2015 Tax ReturnAnonymous 2zbzrvNo ratings yet

- DTB Orientation (PIT & CIT) FINALDocument37 pagesDTB Orientation (PIT & CIT) FINALCourt NanquilNo ratings yet

- Advance Taxation (P6) Summary of NoteDocument31 pagesAdvance Taxation (P6) Summary of NoteYivon TeoNo ratings yet

- Chapter 5Document11 pagesChapter 5lijijiw23No ratings yet

- Title R.A. 7432 R.A. 9257 R.A. 9994 - ExpandedDocument11 pagesTitle R.A. 7432 R.A. 9257 R.A. 9994 - ExpandedAngel Alejo AcobaNo ratings yet

- Taxation of PartnershipDocument14 pagesTaxation of PartnershipJoy ConsigeneNo ratings yet

- IT Savings Proofs Submission - FY 2021-22: AuthorDocument9 pagesIT Savings Proofs Submission - FY 2021-22: Authormunash2kumarNo ratings yet

- Destroyed Inventory Deduction ProceduresDocument7 pagesDestroyed Inventory Deduction ProceduresCliff DaquioagNo ratings yet

- How to save up to 46,800 in Income Tax on your SalaryDocument12 pagesHow to save up to 46,800 in Income Tax on your SalaryIndiranNo ratings yet

- Tax Law Reviewer SummaryDocument244 pagesTax Law Reviewer SummaryJustin Gabriel Ramirez LLanaNo ratings yet

- Taxation Theory QuestionsDocument7 pagesTaxation Theory QuestionsPrince kumarNo ratings yet

- Taxation Law Q&A (Final)Document17 pagesTaxation Law Q&A (Final)Daphne Dianne Mendoza100% (1)

- Estate Tax - 1Document16 pagesEstate Tax - 1kikimtaehyungNo ratings yet

- Deductions from Gross Estate for Funeral ExpensesDocument93 pagesDeductions from Gross Estate for Funeral ExpensesMARIA50% (2)

- Greytip April PayslipDocument1 pageGreytip April PayslipvigneshNo ratings yet

- What Is ISO?: ISO 9001 ISO 14001 BS EN 15713Document7 pagesWhat Is ISO?: ISO 9001 ISO 14001 BS EN 15713Sushant ChaurasiaNo ratings yet

- Solved Stan Rented An Office Building To Clay For 3 000 PerDocument1 pageSolved Stan Rented An Office Building To Clay For 3 000 PerAnbu jaromiaNo ratings yet