Professional Documents

Culture Documents

HFF 990 2016

Uploaded by

Teddy Wilson0 ratings0% found this document useful (0 votes)

21 views22 pagesHeavenly Fathers Foundation - IRS 990 (2016)

Original Title

HFF-990-2016

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentHeavenly Fathers Foundation - IRS 990 (2016)

Copyright:

© All Rights Reserved

0 ratings0% found this document useful (0 votes)

21 views22 pagesHFF 990 2016

Uploaded by

Teddy WilsonHeavenly Fathers Foundation - IRS 990 (2016)

Copyright:

© All Rights Reserved

You are on page 1of 22

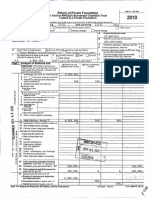

[efile GRAPHIC print - DO NOT PROCESS | As Filed Data -| DLN: 9349125600107)

m9 90-PF OMB No 1545-0052

ream 2016

intemal Revenie Serice rer

bee ecia

Return of Private Foundation

or Section 4947(a)(1) Trust Treated as Private Foundation

> Do not enter social security numbers on this form as it may be made public.

» Information about Form 990-PF and its instructions is at www.lrs.gov/form990pf,

For calendar year 2016, or tax year beginning 01-01-2016 1 and ending 12-31-2016

Tne oon Empl en eaTon ET

ieoveryFabbersFurdaton

r-ese7813

BR we SUG O-E OBO DRT a ESTED SRE WE) | OTT SS

BS coon Ross ee

(027 850-3600

Coo, SISO NS, AREY, wT EP ag POUT CS eS

telat Sea on appeaton spending, eee, EY]

G check al that apply Lina return Llintalretum of former publ Da. forma snatches]

Crit tum Clamended return 2-foreanennstensmaingtn gam”

Caddress change Cl name change a een eee

Hcheck type oferganaation Wl Section 503(€)3) exemot anvate foundation NEE nate nies eee

Dissection 4947(0)(1) nonexemot chartable trust Cl other taxable prvate foundation

Tarr market vale of all assets at end | 3 Accounting method MA cash LI Accrual | F ithe foundevon no Sosmonth wmnaton §

of year (rom Pare, eal (0), aes thder ecbon SOMO) chee are

ing tomes "163,644,022 Other (specty)

(ear, column (d} must Be on cash Bass}

TEER Anatysis of Revenue and Expenses (rmetou! nq) gonanone (a) Osbuserens

‘of amounts in columns (b), (c), and (d) may not necessaniy Sxpensesper (0) Net investment l(c) Adjusted net for chantabve

7 Contrbutons, aft, grants, ete recewved (atach

Schedule)

2 check BZ ithe foundation is not required to atach

Sch 8 eee eee

3 Interest on savings and temporary cash investments aa ear emi

Se Gross rents

Net rental income or (ess)

| 6a Net gan or (loss fom sale of assets not on ine 10 785,

2

5 |» rose sates pce fora asets on line 68

3 sass

| 7 capital gain net income (rom Par 1, ine2) = Tea

Net short-term eaptal gan

Income medications «

20a cross sales ess returns and allowances

b Less. Cost of goods sold :

Gross profit or (loss) (atach schedule)

41 Otherincome (attach schedule) ee Be Fi Tze

42. Total. Add tnes through 11s. ee 358 37 3350007] 37000

13 Compensation oF fics, direc, Wustees, eb

14 Other employee salanes and wages

ig [25 Penson plans, employee benefits

Z| 260. Legal fees (attach schedule) « :

B |b Accounting fees (attach schedule). . . . L 379

¢ Other professional fees (atte ‘hedule)

2/17 interest

& |a8 taxes (tach schedule) (see mstrucvons)

49° Deprecaton (attach schedule) and depletion

20 occupancy

21 Trevel, conferences, and meetings vs ss

22° Pnting and publeatins .

23. Other expenses (attach schedule) oss. ainaF TET Tae

Z |24 Total operating and administrative expenses.

| Addiines 3through23 oe ass nares 22704 °

© |25 Contributions, gifts, grants paid. 1 ee ee 7,876,662| 7,876,652

26 Total expenses and disbursements. Add ines 24 and

27 Subtract ine 26 fom ine 12

disbursements

b Net investment income (if negatve, enter-0-) core

€ Adjusted net income(ifregatve, enter-0-) «+ saa7a9

For Paperwork Reduction Act Notice, see Instructions:

Form 990-PF (2016)

Form 990-PF (2016) Page 2

GREER] baterce sneets Billie or oncel year oun ony texe macuctons) [tay beck vie Biber | ero

1 Caahononnnterestbeanng

2 Savings and temporary cath investments Tey sa TERE

3 Accounts recvvable

Less allowance for doubtful accounts

4 Pledges recewvable

Less allowance for doubifl aczounts

5 Grants recenable «

6 _Recewvables due from officers, rectors, trustees, and other

disqualified persons (attach schedule) (see nstructons) 6. ss

7 Other notes and loans recevvable (attach schedule)

Less allowance for doubtful accounts >

| 8 Invetones for sale or use i

S| 9 prepa expenses and defered charges 66s ss

2 loa investments S and state government obligations (atach schedule) Taaea aa Ta TT

bb Investments—corprate stock (atach schedule) Tnsa707 ia.13.374 Tie.193378

_Investments—corporate bonds (attach schedule) 20.20.09 24965,209 74965,490

11 nvestments—Iand, buidings, and equpment. basis

Less accumulated deprecation (attach schedule)

12, Investments—mortgage loans «

13 Investments—other (attach schedule)

14 Land, bulngs, and equpment bass P

Less. accumulated deprecation (attach schedule)

15 Other assets (desenbe siemens

16 Total assets (to be completed by all flers—see the

inatructions Also, seepage 3, tem 1) 150 56,364 163.6401 163.644021

27 Accounts payable and accrued expenses +

18 Grants payable.

L]io deteredreverte

20 Loans from officers, directors, trustees, and other disqualified persons

3 }21 mortgages and other notes payable (attach schedule).

F}o2 other tiabiities {describe B__

23 Total labilities(ads ines 37 trough 22) 7

|| Foundations that follow SFAS 447, check here » LI

8] and complete lines 24 through 26 and lines 30 and 31.

E) 24 Unresincted

| 25 Temporanlyresinctes

z]26 Permanently restricted

=| Foundations that do not follow SFAS 117, check here BZ]

3| and complete lines 27 through 31.

B]27 —capta stock, trust prncipa, or current funds. 147,040.09 147,040.09

3| 28 Paid-in or capital surplus, or land, bldg, and equipment fund

S}29 Retained earnings, accumulated income, endowment, or other funds 17,536,369) Tes0aoni

B)30 total net assets or fund balances (see instructions) 150.576369 763.994,021

31 Total liabilities and net assets/fund balances (see instructions) « 750.5763] 763.604021

“analysis of Changes in Net Assets or Fund Balances

‘L_ Total net assets or Fund balances at beginnng of year-Pare I, column (a, ine 30 (must agree with end]

bfryear gure reported on pre years retary} oe 150,576,368

2. Enter amount from Part, ine 278 2. 71753817

3 Other increases not included in line 2 (itemize) P J 3 6,821,470

4 Addlines 12nd ee ee 4 163,648,021

5 Decreases not included inne 2 (ternzeybe TT 5

6 _ Total net assets a fund balances at end af year (ine 4 minus line 5)—Par I, column (b), ne 30 é 15 64,02

Form 990-PF (2016)

Form 990-PF (2016) Page 3

EEEEE Capita Gains and Losses for Tax on Investment Income

@

(@) no © oy

List and desenbe the kind(s) of property sold (e 9 realestate, aire ate sequred | date sols

Bestory brik warehouse, or common stock, 200 ha MLC Co} Bopurenase | imo, cay, yr) | (mo, day, ¥)

Ta Publely Traded 5 ° yoreoner | 2016-07-02

Publicly Traded 5 P 2015-01-01 | 2016-07-02

4

al w @ thy

Depreciation allowed Cost or ether basis Gain or (los)

Gross sales pnce ania ;

(or allowable) plus expense of sale (e) plus (F) minus (9)

= 37677 44,430.25 “aera

b 39,279,646] 36,195,765] 3153,661

a

(Complete only for assets showing gain in colurnn (h) and owned by the foundation on 2/33/69)

oO

Adhusted basis

as of 12/31/68

(he)

Excess of col (1)

®

FMV as of 12/31/69 over col _(), fany

w

Gains (Col (h) gain minus

col (k}, but not less than -0-) or

Losses (from col (h))

;

Qualification Under Section 4940(6) for Reduced Tax on Net Investment Income

(For optional use by domestic private foundations subject tothe section 4940(a) tax on net investment income )

If section 4940(d)(2) applies, leave this part blank

Was the foundation liable for the section 4942 tax on the distributable amount of any year in the base period? OO ves

If "Yes” the foundation does not qualify under section 4940(e) De not complete ths part

{Enter the appropriate amount m each column for each year, see mstructions before making any entnes

ate penod yrs Calendar eo Dstriien rato

voor (ort aarbognanan)_| Aste quafingdstrbutons (oot aided by et (cD)

2015 73538,504 756,575,752 o0a7ab

2038 7,933,829 69,310,058] 0.04686

2033 5,214,099 148,196,453 0.03518

2012 4.294.617 747,886,204 0.03663

2041 309,574 78,473,301] 0.00395

2Totalofinescoumn() see [B 0.159614

3 Average dstribution ratio for the S-year base period —civide the total on ine 2 by 5, or by the

numberof years te foundation has Seen im existence f less than 5 years 3 0.033969

4 Enver te net value of nonchartable-ase assets for 2016 from Par, ine 5 4 158,645,496

5 Muloply line 4 by line 3 5 5,368,077

6 Enter 1% of net investment incorne (39% of Part, Ine 270) 6 60,174

7 Rad ines 5 and 6 : 7 $448,254

8 Enter qualifying cistnbutions from Part XI, ne 4 2 7,876,662

Ifline 81s equal to or greater than line 7, check the box in Part VI, line 1b, and complete that part using a Tb tax rate See the Part VI

instructions.

Form 990-PF (2016)

Form 990-PF (2016) Page 4

TEER & cise Tax Based on Investment Income (Section 4940(a), 4940(b), 4940(e), or 4948—see

1a Exempt operating foundations desenbed in section 4940(d)(2), check here ® L] and enter “N/A on line 1

Date of ruling or determination letter (attach copy of letter if necessary-see instructions)

bb Domestic foundations that meet the secuon 4940(e) requirements n Part V, check a 0.174

here ® EZ and enter 19% of Pare, ine 276

© Al other domeste foundations enter 2% of line 27> Exempt foreign organizations enter A¥e of Par ne 42,

esl (0)

2 Tends 1 oe ton E794) adios orhersenter-o-) [La

3 Add ines 1 and 2. : : 3 eo,174

4 Subtitle A (income) tax {domestic section 4947(a)(1) trusts and te able foundations « only Others enter -0-) 4

5 Tax based on investment income, Subtract line 4 from ine 2 IF zero of les, enter -O- 5 em

6 Credits/Payenente

1 2016 extmated tax payments and 2015 overpayment credited o 2016 | 6a 78,204

bb Exempt foregn organzations—tax withheld at source... ss [6B

¢. Tax paid with appeaton for extension of time to fe (Form 6068)... [6c

Backup withholing erroneousiy wthheld. =... ss Led

7 Tal eed and payments Add lines 68 rough 62 ev ee vw yn 2 70,708

8 ener any penalty for underpayment of estimated tax Check here C1] st Form 2220 is atached

9 Tax due. Ifthe total of nes 5 and 8 1s more than ine 7, enter amount owed... sve 1

10 Overpayment. If ine 7 1s more than the total of nes 5 and 8, enter the amount overpaid, . . [40 ies

11._Ente the amount of ine 10 to be Credited to 2017 estimated tox 10,52 Refunded » [a4

Statements Regarding Activities

1m Dunng the tax year, did the foundation attempt to fluence any national, ale or loa legilation or dd Yes | No

it paropate orintervene i any paltcal campaign? ee ee ee ee DB No.

bb Did it epend more than $100 during the year (ether directly or indirectiy) For polncal purposes (see Instructions

fordefintion). - - ee Dee 4b No

Ifthe answer is “Ves” toa or 1b, attach a detailed description ofthe actmtes and copies of any materas

published or distributed by the foundation in connection with the activities

© Did the foundation file Form 1120-POL for this years ss ev ve ee ee ee ee ee ee [te No

Enter the amount (if any) of tax on political expenditures (section 4955) imposed during the year

(21) On the foundation $ (2) On foundation managers PS

fe. Enter the reimbursement (if any) paid by the foundation dung the year for political expenciture tax imposed

fon foundation managers > $

2. Has the foundation engaged in any activities that have net previously been reported tothe IRS? = ww ee ee | 2 No

If "Yes," attach a detailed descnption of the activites

3. Has the foundation made any changes, not previously reported to the IRS, in its governing instrument, articles

of incorporation, or bylaws, or other similar instruments? IF "Yes," attach a conformed copy ofthe changes. . . . | 3 No

4a _Did the foundation have unrelated business gross income of $1,000 or more during the year”... ss aa No

b IF "Yes," has i filed a tax return on Form 990-T for this year... Pee eee No

5 Was there a lquidabon, termination, dissolution, or substanbal contraction during the year? ee ee +e © [5 No

IF "Yes," attach the statement required by General Instruction T

6 Are the requirements of section 508(e) (relating to sections 4941 through 4945) satisfied either

‘+ By language in the governing instrument, or

‘+ By state legislation that effect.vely amends the governing instrument so that no mandatory directions

that confict with the state law remain in the governing instrument? v5 sv ee ee ee LB No

7 Did the foundation have at least $5,000 in assets at any time during the year7If "Yes," complete Part IT, col (c),

and Part XV Se ee ee ee LL ves

a_ Enter the states to which the foundation reports or with which itis registered (see instructions)

mx

b_ IF the answer s "Yes" te line 7, has the foundation furnished a copy of Form $90-PF to the Attorney

General (or designate) of each state as required by General Instruction G? IF "No," attach explanation « sp | Yes

9 Is the foundation claiming status as @ private operating foundation within the meaning of section 4942())(3)

or 4942(3)(5) for calendar year 2016 or the taxable year beginning in 2016 (see instructions for Part XIV)?

Ie "Yes," complete PartXIV we ee ee ee LB No

40 Did any persons become substantial contnbutors during the tax year? If "Yes," attach a schedule listing their names

and addresses eo LO No

Form 990-PF (n0le)

Form 990-PF (2016) Page 5

GEREN Statements Regarding Activities (contmued)

1A Avany ome dung the year did the foundabon, recy or mdrecty, own a Gonuoled erty wan the

meaning of section 512(b)(13)? If "Yes," attach schedule (see instructions). Be ee aL No

42 Dithefundabon make wdetrnston to dorr ave ind oer whic the foundation oa dasutfied parton hd

acwnsory prvlages? Ves; attach statement (eee mstrusions) vs ee et et ee ee 12|__| no

13. Did the foundaon comply with the publ ngpecton requirements forts annual returns and exemption applcazen? 13 [Yes

Webate adsress PIVA

14 The books ae in cae of Pina ws Telephone no (817) 850-3600

Located at 5 Cony Road 360 Cuca 18 zip+4 76437

15 secon 4947(8)(1) nonexemptchantable trusts fing Form 990-PF new of Form 1044 —Checkeres se ee

and ener tre amount of eacexernp mere received or accrued dung the Year Oe Las

16 Acany tre during calendar year 2036, dd the foundation have an interest m ora signature or other authonty over Yes | No

2 bank, secures, or other franca acount i a foregn country? ss[ [no

See nstructons fr exceptions and fling requirements fr FinCEN Form 114, Report of Foregn Bank and Fnancal Accounts

(Goan) f-Yes enter the name of the foreign cou B

GEEKIEEIN Statements Regarding Activities for Which Form 4720 May Be Required

File Form 4720 if any item is checked in the “Yes” column, unless an exception applies. Yes | No

1 Dung the year did the foundation (ether recy or indirect”)

(21) Engage in the sale or exchange, or leesing of property with a

2 ‘Summary of Direct Charitable Activities

LLrethe foundations four lrgest dec car table acovties Gung the tex year Include relevant Babsocal formation sich as te Humber oF ss

organzatons and ater beneficiaries served, conferences convened, reseatch papers reduced, ete ia

1

‘Summary of Program-Related Investments (see instructions)

the two largest program related rvestrnerts made by the foundaton dunng te tx year on ines Pond 2

Allether program-related investments See instructions

3

Total, Add ines 1 through 3

Form 990-PF (2016)

Form 990-PF (2016) Page 8

GEEEEY Minimum investment Return (Al domestic foundations must complete the part Foreign foundatonssee natructons )

1 Fairmarket value of assets not used (oF held for use) directly in carrying aut chartable, ef

purposes

2 Average monthly far market value of secures. see ta 159,920,476

bb Average of monthly cash balances. ab 2,130,941

Fair market value of all ther assets (see mnstructions). 4c 3

Total (add lines 4a, 8, and). ad 16i,06i,8i7

fe Reduction claimed for blockage or other factors reported on nes ia and

te (attach detatled explanation) vv ve te ee te

2 Acqustion indebtedness applicable folie Lassets. sev ee ee ee eee LR

3 Subtractine Zfromiine 16. ve 3 161,061,817

4 Cash deemed held for chantable actwties Enter 1 1/2% of ine 3 (or greater amount, se

acts nol deininis obbibin bon od oboe ooo 4 2,415,921

5 Net value of noncharitable-use assets. Subtract line 4 from ine 3 Enter here and on Part V, tne 4 5 156,645,496

6 _ Minimum investment return. Enter 5% of ine 5 rer 6 7,932,275

Distributable Amount (see instructions) (Section 4942())(3) and ())(5) private operating foundations and certain foreign

BEET canizavons check here LI and do not complete ths pat )

1 Minimum investment return from PartX,ine6. vs vs + vv vv ev pw ye DE 7532278

2a_ Tax on investment income for 2016 from Part VI,ineS. ss da s0,174

bb Income tax for 2016 (Ths does not include the tax from Part VI)... [2b

€ Add ines 28 and 2b. 5 2e 60,174

2 Distnbutable amount before adjustments Subtract line 2c from line 1 Pee 3 7672,101

4 Recoveries of amounts treated as qualifying distnbutions, 4

5 Addines 3 and 4, rer 5 772,101

6 Deduction from distabutable amount (see instructions) ; 6

7__ Distributable amount as adwusted Subtract line 6 from ine 5 Enter here and on Part XII, ne i. 7 772,101

Qualifying Distributions (see instructions)

‘Amounts paid (induding administrative expenses) to accomplish charitable, ete, purposes

2 Expenses, contributions, gift, ete —total from Part I, column (d), line 26. ta 7,876,662

b Program-related investments total rom Part MB ww ee ab

2 Amounts pard to acquire asets used (or held for use) directy in carrying out chantabla, ete,

purposes. cee 2

3 Amounts set aside for specific chantable projects that satisfy the

2 Suttabity test (pror IRS approval required). : 3a

Cash distribution test (attach the required schedule)» vv ee ee ee te 3b

4 Qualifying distributions. Add ines 1a through 38 Enter here and on Part V line 8, and Part XI, ine 4 [4 7576 562

5 Foundations that qualify under section 4940(e) for the reduced rate of tax on net investment

income Enter 1% of Part, ine 27b (see instructions). 5 60,174

6 Adjusted qualifying distributions, Subtract ine 5 from line 4, 6 77616,488

Note: The amount on line 6 will be used in Part V, column (b), in subsequent years when calculating whether the foundation qualifies for

the section 4940(e) reduction of tax in those years

Form 990-PF (2016)

Form 990-PF (2016) Page 9

BEEEESME Undistributed tncome (see mstructons)

@ ©) ©), @

comus Years prior to 2015 2015 2016

Distnbutable amount for 2016 from Part XI, line 7 Terao

Uneistnbuted income, if any, as of the end of 2016

Enter amount for 2015 only. 60

Total for prior years 20, 20, 20

Excess distributions carryover, ff any, to 2016

From 2021,

From 2012.

From 2013.

From 2014.

From 2015.

Total of lines 3a through e. 7

Qualifying distributions for 2046 from Part

XI, ines Bs 7,976,562

2 Applied to 2015, but not more than line 2 7,806 60

b Applied to undistributed income of pnier years

(Election required—see instructions). w+ +

butions out of corpus (Election 7

equired—see instructions). we ee se

4 Applied to 20:6 distributable amount. sss» Foe

Remaining amount distributed out of corpus

Treated as 4i

5S Excess dit

(fan amount appears in column (4), the

‘same amount must be shown in column (a) )

6 Enter the net total of each column as

indicated below:

2 Corpus Add lines 3f, 4c, and de Subtract line 5

bb Pror years’ undistnbuted income Subtract

line 4b from line 25 .

ter the amount of pror years’ uncistnibuted

income for which a notice of deficiency nas.

Deen issued, or on which the section 4942(a)

tax has been previously assessed.

4. Subtract line 6c from line 6b Taxable amount

see instructions » 6 clo bid

fe Undistributed income for 202!

4a from ine 28 Taxable amount—see

instructions

Undistnbuted income for 2016 Subtract”

lines 4d and 5 from line 1 This amount must

be distnbuted in 2037

7 Amounts treated as distnbutions out of

corpus to satisfy requirements imposed by

section 170(5)(1)(F) oF 4942(g)(3) (Election may

berequired see instructions)» evs ts

8 Excess distnbutions carryover from 201% not

applied on line 5 or line 7 (see structions) +» «

9 Excess distributions carryover to 2017,

Subtract lines 7 and & from line 6a.

10 Analysis of ine $

a Excess from 202;

Excess from 2013.

4

butions carryover applied to 2036

7,802,040,

Excess from 2014, 5.

Excess from 2015. «+ +

Excess from 24

Form 990-PF (2016)

Form 990-PF (2016) Page 10

BEEN Private Operating Foundations (cee instructors and Pare VITA, question 5)

1a. Ifthe foundation has received a rung or determinabon eter that = a prvate operating

foundoton, and tering sefecive for 2056" enter the cate ofthe Rings eee. BL

b check bor to indicate whether the erganzaton 2 pvate operating foundation descnbed m section CI 49424(3) or Ol 49e20n5)

2a Enter the lesser ofthe adwutes net Tax year Pror3 years

income from Part 1 or the minimum * : (©) Total

Gay2016 was (a0 wn

under section 4942())(3)(B}())

StaeneemraeaS

nee:

Supplementary Information (Complete this part only if the organization had $5,000 or more in

List any managers of the foundation who own 10% or more of the stack ofa corporation (or an equally large portion of fe

‘ownership of a partnership or other entity) of which the foundation has a 10% or greater i

2 Information Regarding Contribution, Grant, Gift, Loan, Scholarship, ete., Programs

Check here > MZ] if the foundation only makes contributions to preselected charitable organizations and does not accept

Unsolicited requests for funds If the foundation makes gifts, grants, etc (see instructions) to individuals or organizations under

other conditions, complete tems 2a, b, ¢, and d

'@ The name, address, and telephone number or email address of the

rson to whom applications should be adcressed

'b The form in which applications should be submitted and information and materals they should include

¢ Any submission deadlines

Any restrictions er limitations on awards, such as by geographical areas, charitable fields, kinds of institutions, or other

factors

Form 990-PF (2016)

Form 990-

F (2016)

Page 12

Supplementary Information (continued)

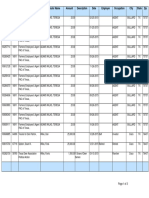

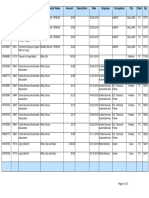

3 Grants and Contributions Paid During the Year or Approved for Future Payment

TFrecpent san mdi,

Recprent show any relationship to | Foundation Purpose of grantor ;

Nau and sldless (homeo bnwessy | anv foundation manager | Satue of contribution cea

lame and address (home or business) | or substantial contributor ld

3 Paid darng the year

‘See Schedule attached None 1501(c)(3) |See attached 7,876,662

Vanous

Vanous, TX 76437

Tol ea 776562

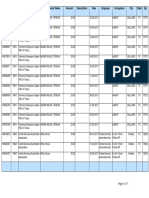

Approved for Fiure payment

See Schedule attached None [501(¢)(3) |See schedule attached 70,000

Vanous

Vanovs, Tx 76437

Tol > 70,008

Form 990-PF (2016)

Form 990-PF (2016)

Page 12

EEREGEEY Ataiyaie of income-Producing Activities

Enter gross amounts unless otherwise indicated

Unrelated business income

Excluded by secbon 512, 513, or S14

(e)

Related or exempt

function income

a 5) e d

1 Program serace revenue susnesy code| _antount | ExcluSen code | _aneont _|(See netuctons)

b

a

__

Fees and contacts om government agencies

2 Membersinp dues and assesment:

3 Interest on savings and temporary ca

investments : 1s rand

4 Dyicends and interest rom secures Fa Zasa.2

5 Netrenal income or (os) from realestate

a Debttinanced propery.

B Not debenanced propery

6 "Net rental ncome or (es) arn personal property

7 Otherinvestment income. s+

8 Gain or (los) fom sales of assets other than

9 Netincome o (ss) rom speci evens

10. Gross profit or (038) fom sales of ventory

11 Other revenue

b otter mvestnent nce is aed

a

12 Subtotal Add columns (),(@), and (e). cae

13 Total. Add line 12, columns (b), (4), and (e).

‘See worksheet inline 13 instructions to venfy calculations )

a EY Relationship of Activities to the Accomplishment of Exempt Purposes

Explain below how each ach

Line No.

v

instructions )

ity for which income is reported in column (e) of Part XVI-A contributed importantly to

the accomplishment of the foundation's exempt purposes (other than by providing funds for such purposes) (See

13 539,387

Form 990-PF (2016)

Form 990-PF (2016) Page 13

Information Regarding Transfers To and Transactions and Relationships With Noncharitable

EERE exempt organizations

1 Did the organization directly or indirect engage m any of the folowing with any other organization descnbed in section 501

() of the Code (other than section 504(c)(3) organizations) or in section 527, relating to political organizations? Yes | No

2 Transfers from the reporting foundation to a noncharitable exempt organization of

Clee ene ee Booopo poo nooo grt) No

(2) Other assets, ee ee [ety No

bb Other transactions

(1) Sales of assets to a noncharitable exempt organization, © ee ee ee ee [aca No

(2) Purchases of assets from a noncharitable exempt organization, ee ee ee ee ee ee [CRD] No

(3) Rental of faciities, equipment, or other assets ce ee ee fabCay] No

(4) Reimbursement arrangements. 6 eee ee ee ee ee fC No

(5) Loans or loan guarantees. ce eee ab(5)| No

(6) Performance of services or membership or fundraising solicitations. ©. . 7 + + ee ee ee ee «|b C6Y No

Shanng of facites, equipment, mailing lists, other assets, or paid employees 6 + sts sv et te te No

4 If the answer to any of the above is "Yes," complete the following schedule Column (b) should always show the fair market value

of the goods, other assets, or services given by the reporting foundation Ifthe foundation received less than fair market value

In any transaction or sharing arrangement, show in column (d) the value of the goods, other assets, or services received

(a) une to | (b) Amount volved | (c) Name of nonchantable exempt organzaton | (4) Descapton of transfers, transactions, and shanng arrangements

as the foundation directly or indirectly affliated with, or related to, one or more tax-exem

3 organizations

described in section 501(c) of the Code (other than section 501(c)(3)) orin section 5277,» . » ss + « + + Doves Mino

bb If "Yes," complete the following schedule

(a) Name of organzaton (b) Type of organzabon ©) desenbon of relationship

Under penalties of perjury, I declare that I have examined this retum, including accompanying schedules and statements, and to the best

of my knowledge and belief, tis true, correct, and complete Declaration of preparer (other than taxpayer) Is based on al information of

Sign| which preparer has any knowledge

Herely see poe yn ae Sa

Sianature of effcer or trustee Date Tie

FrintType preparer's name | Prepares Signature ate

w/TyPe ore * bie check i self

‘Victor K Munson employed » Pot2asss7

Paid

Preparer [fis namem vitor K Munson CPA

Use Only Firm's EIN

Firms addrese > 6060 N Central Expwy Sure 560

Dallas, TX 75206 Phone no (214) 237-2920

Form 990-PF (2016)

Form 990PF Part XV

contributions rect

than $5,000)

[Don wins

[ea wits

ion who have contributed more than 2% of the total

‘ed by the foundation before the close of any tax year (but only if they have contributed more

TY 2016 Accounting Fees Schedule

Name: Heavenly Fathers Foundation

EIN: 27-6987913

Software ID: 16000303

Software Version: 2016v3.0

Category Amount Net Investment | Adjusted Net | Disbursements

Income Income for Charitable

Purposes

‘Accounting fees 5,450 0 0 0

3491256001007

int DO NOT PROCESS [As Filed Data] DLN:

TY 2016 Other Assets Schedule

GRAPHIC

Name: Heavenly Fathers Foundation

EIN: 27-6987913

Software ID: 16000303

Software Version: 2016v3.0

Other Assets Schedule

Description ing of Year- | Endof Year-Book | End of Year - Fair

‘Book Value value Market Value

Alternative investments 12,679,688 14,911,682 14,911,683

1

Rounding

[efile GRAPHIC print - DO NOT PROCESS DLN: 93491256001007

TY 2016 Other Expenses Schedule

Name: Heavenly Fathers Foundation

EIN: 27-6987913

Software ID: 16000303

Software Version: 2016v3.0

Other Expenses Schedule

Description Revenue and Net Investment ‘Adjusted Net | Disbursements for

Expenses per Income Income Charitable

Books Purposes

“Amortization expense 605

“Amortization of bond prem/dise 3 446. 446

Brokerage fees 357,578 208,793 206,793

Federal income tax 40,000

Foreign tax withheld on dividendincome 12,885 25,542 95,542

Miscellaneous investment exp @ BNY 39,924 39,924

3491256001007

int DO NOT PROCESS [As Filed Data] DLN:

TY 2016 Other Income Schedule

GRAPHIC

Name: Heavenly Fathers Foundation

EIN: 27-6987913

Software ID: 16000303

Software Version: 2016v3.0

Other Income Schedule

Description Revenue And Net Investment | Adjusted Net Income

Expenses Per Books Income

Capital gains distr 225,239 186,802 186,802

‘Other investment income 11,440 25,282 25,282

[efile GRAPHIC (DO NOT PROCESS. DLN: 93491256001007|

TY 2016 Other Increases Schedule

Name: Heavenly Fathers Foundation

EIN: 27-6987913

Software ID: 16000303

Software Version: 2016v3.0

Description Amount

Increase in unrealized appreciation 6,821,470

Heavenly rurhet's Fin

200

Bs DEEL

cunt

LOEB 4

Form GOFF (2012) Hart SY supwlemertary Infeimat om icontinued}

age Us

{ated Sueriburis Par During hz Seat ot Approved tor Future Fey

i reupient wan indmadual,

show any velatonsivpte —— reamdatran

any fauncighon manager status of Parner ol geant

ar subsoncat centribuiar rumor egnenkusion amount

a Yon dang the ee eee ~ oe

You Chen ca Mores Waistry uw Attu 88,098

aera Serking apea needs 81,828

6, TF AST-5537 91 But 7 180%

os

Pee Hosen Masts

8035 Hh

spilone, TCABES

Fase Tale

Sav Eiki ga Gr Sune 20

Colorade Sponge (0 8087

seremy House

1845. 2ng

Abtene (79601

Rosana County Crt Center, tne

900 F Man

Fastland, 1760s

Caavstoads!

728 He Francis St

Aspen, 0 816)

yhe Oper cer

1908 Hy hveay 298

Fe, TH 7863

seo Set

2D Re 90

he 26937

uvibow Magan

Alo-agate Leociunent Center

PP Bo 1405

Brovenw.cod, FX Y6RO4

Pe aposs Unnnursiy

2°By Bolas Conger Ahad #07

Haracun 2010

pet nf Thesssans Oaks

2892 14 ory Court, Sue 4)

eats Mou, CA 9320

sallogton tile Genter

42 1, Diason de

selingion, Te 78041

berty Course!

PO Bor sau774

Cotand., FL 32088

sone

sone

sous

Sager

chorea

sons

sone

sauna

hu

sone?

soneys

Radio and mitcenet Pregensaring

reg prevention nregiare

sont antrsnnes indo vals

vetoes

2stanwe rd, CE paskor saieny

Furara

yg bat

Gpen Poa peojerte

Salaeves tor Ear eston

Renate

FHS CA Corley prowsains

Sean Sprows cag nary

Lineegeney Shaves Gennes

brgetiol euppoet

0

i69,0ne

su0

#5000

20,ri

Ace

Be de

2,009

ssoiua

2it:8?

ju.000

Comunity Bish Study e-feens

9% South Seaman

Eastland, 1X 764

sca Lond Faery

M38 W interstate 20)

Cisco, TK 76437-5927

Sealand Menon at Muspicat

300 § Daughtetty ave

astland 1) 26488

Fh sangelisin Fellos snip

Visi State Ragrovag

Warrenton, 0 63.584

Natal Christian Foundation South Flores

JN Fedurat Fwy secon Flore

Fr Lauderdale, 1.35368

Centar of Nope Parker County

523 Fsto Panto, Suite D

Weathetiurd, Ta 7085

‘chsa Recreational Agwesuon

900 Conrac Hilton Old

Cue, T» 76437

Seoalatons

1a93 1 20 West

40, 1% 7hg87

The Gitean': Imerrianenst

58 Contaey Bod

Aashuitin, LW 37214

Hogetbest Internatronat

‘5000 Arlington Centre Bis, Suite 2277

Cofuomus ho 83920

ew River Feitoweshle

1295 Martin Breve

erathortord, 1k JER86

Passion tle

PU Box 862723

Mariesta, GA 30062

Plage orks Education Ever

ake Washington St

aekland, CA SIBOY

asl

Boys oud Girls Clubs uf FE wrth

7X8 E Belhinap Se

Fe Werth, YA 6211

Fallowshly of Chlsuns Atletes

FO boa 6804

Abiiene, 1% 23608

okay Brptat Chur

AWOL Canrad Hino ive

1 eo, TH 16837

senor

yu

Smt

sox

sone

sone

503{e}8

antes

south

hue

poets

sostes

somes

SOHN

Geant bon toad

vical Equipe

‘Gog Maw tubs martes

Desens

Bulldrig interme revovations

Annu Fumgraner

‘Dowasrign tor ncady kids at Christm,

Progearaminy, and education

Borat

China pus tle cuenparge

111)8) PS33% Selroole

Suppor

Salary foe now dvartor

Foernre firemen halen,

250 1

132,500

09,000

seat

10.186

ays 008)

s5.000

72.000

19 uN0 ue

1099.00

an an Go

310 60

lourishang cree of ue

96 Rourke Lie

veeasher beard, T4 76087

ester county Chih Welhare Bosra

SLE Moin ot

Eestiond, Ta 76408

“Tena Pythian Homes

PO Rox 239

Wauthertoid, 1 7605

otal

bb Approved tor future paynaen

‘seu Sener Nutiban Programe

PO Box 192

fee0, Ta 16437

faut

sah

sutis}s

S0utehs

Suyanate

jor eo0ay bids at Ghrstenas

Sunny for bien

Salas fur Dirouien

fos Darsctor «2

45,0300

06 wh

2049 00

5500

deur

Tae

Form 930.05

You might also like

- Capitol Riot Map 1.11.21Document1 pageCapitol Riot Map 1.11.21Teddy WilsonNo ratings yet

- 2021 States and Nation Policy Summit AgendaDocument4 pages2021 States and Nation Policy Summit AgendaTeddy WilsonNo ratings yet

- DFPC Prayer List UpdatedDocument1 pageDFPC Prayer List UpdatedTeddy WilsonNo ratings yet

- Wilks Family Campaign Contributions - Texas (2016)Document9 pagesWilks Family Campaign Contributions - Texas (2016)Teddy WilsonNo ratings yet

- PF Return of Private Foundation: ExpensesDocument20 pagesPF Return of Private Foundation: ExpensesTeddy WilsonNo ratings yet

- Texas HHSC Request For ApplicationDocument104 pagesTexas HHSC Request For ApplicationTeddy WilsonNo ratings yet

- Human Coalition - Texas Grant ContractDocument455 pagesHuman Coalition - Texas Grant ContractTeddy Wilson100% (1)

- Wilks Family Campaign Contributions - Texas (2015)Document3 pagesWilks Family Campaign Contributions - Texas (2015)Teddy WilsonNo ratings yet

- PP v. JegleyDocument148 pagesPP v. JegleyTeddy WilsonNo ratings yet

- WWHA V PaxtonDocument43 pagesWWHA V PaxtonTeddy WilsonNo ratings yet

- Wilks Family Campaign Contributions - Texas (2018)Document3 pagesWilks Family Campaign Contributions - Texas (2018)Teddy WilsonNo ratings yet

- Wilks Family Campaign Contributions - Texas (2017)Document7 pagesWilks Family Campaign Contributions - Texas (2017)Teddy WilsonNo ratings yet

- TTF 990 2011Document43 pagesTTF 990 2011Teddy WilsonNo ratings yet

- HFF 990 2013Document124 pagesHFF 990 2013Teddy WilsonNo ratings yet

- Return of Private FoundationDocument40 pagesReturn of Private FoundationTeddy WilsonNo ratings yet

- Texas A2A Program FY2018 Q2 (Pregnancy Help Center of Lufkin Annual Monitoring)Document4 pagesTexas A2A Program FY2018 Q2 (Pregnancy Help Center of Lufkin Annual Monitoring)Teddy WilsonNo ratings yet

- HFF 990 2012Document35 pagesHFF 990 2012Teddy WilsonNo ratings yet

- HFF 990 2014Document22 pagesHFF 990 2014Teddy WilsonNo ratings yet

- TTF 990 2016Document25 pagesTTF 990 2016Teddy WilsonNo ratings yet

- Form 990-PF Return of Private FoundationDocument18 pagesForm 990-PF Return of Private FoundationTeddy WilsonNo ratings yet

- TTF 990 2012Document39 pagesTTF 990 2012Teddy WilsonNo ratings yet

- HFF 990 2015Document21 pagesHFF 990 2015Teddy WilsonNo ratings yet

- TTF 990 2013Document127 pagesTTF 990 2013Teddy WilsonNo ratings yet

- Texas A2A Program FY2017 Q4 (Foundation For Life Facility Tour)Document3 pagesTexas A2A Program FY2017 Q4 (Foundation For Life Facility Tour)Teddy WilsonNo ratings yet

- TTF 990 2014Document29 pagesTTF 990 2014Teddy WilsonNo ratings yet

- Texas A2A Program FY2018 Q2 (Foundation For Life Annual Monitoring)Document3 pagesTexas A2A Program FY2018 Q2 (Foundation For Life Annual Monitoring)Teddy WilsonNo ratings yet

- TTF 990 2015Document25 pagesTTF 990 2015Teddy WilsonNo ratings yet

- Texas A2A Program FY2018 Q1 (Pregnancy Care Center Huntsville - Facility Tour)Document2 pagesTexas A2A Program FY2018 Q1 (Pregnancy Care Center Huntsville - Facility Tour)Teddy WilsonNo ratings yet

- Texas A2A Program FY2017 Q1 (Facility Tours)Document2 pagesTexas A2A Program FY2017 Q1 (Facility Tours)Teddy WilsonNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)