Professional Documents

Culture Documents

HFF 990 2013

Uploaded by

Teddy Wilson0 ratings0% found this document useful (0 votes)

23 views124 pagesHeavenly Fathers Foundation - IRS 990 (2013)

Original Title

HFF-990-2013

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentHeavenly Fathers Foundation - IRS 990 (2013)

Copyright:

© All Rights Reserved

0 ratings0% found this document useful (0 votes)

23 views124 pagesHFF 990 2013

Uploaded by

Teddy WilsonHeavenly Fathers Foundation - IRS 990 (2013)

Copyright:

© All Rights Reserved

You are on page 1of 124

rom990-PF

Ss

[efile GRAPHIC print DO NOT PROCESS [As Filed Data — | ‘DLN: 9349130800420]

Return of Private Foundation

or Section 4947(a)(1) Trust Treated as Private Foundation

» Do not enter Social Security numbers on this form as it may be made public. By law, the

IRS cannot redact the information on the form.

> Information about Form 990-PF and its instructions ie at www .irs.gov/form990pf.

ne No 1545-0052

2013

Open to Public

een

For calendar year 2013, or tax year beginning 01-01-2013

1and ending 12-31-2013

Tame of neato

Taner ana sear

425 county Read 168

Tanita return

Final return

© Check oll that oppiy

——_F adavess change [Tame change __|

P section 503 (¢ (3) exempt private foundation

Heck type of organization

section 4947(2)(1 ) nonexempt chantable trust

Tax habe EHS oT GEITEH To STORE SITET

Tinie return of @ former public chenty

‘Amended return

Other taxable private foundation

“Erp ayer ana Hamer

1 Teleone nanber (ase wsrocons)

2s)

IFexemptionappieation pending, check here & [=

4, Foran omanzations, check here or

2. Foran nanztons masini 8% sy

{Fair market value of all aszets at end

of year (from Part I col (c),

line 16)%§. 166,892,412

J Accounting method

T other (specity)

(Part 1, column (@) mus ben cash Base)

Pecash TF accnat | +

Under secton SO7B}CN(8) check here

Under ston S070)()(8), check hee

‘Analysis of Revenue and Expenses (7 | (a) noreuw ant (@) Daburements

Sclotaneis menue 0 (ears nye sgcremnar | ey narmvamen | co sinae vet | Chrstnane

irsmctons) fon boos (ash bo on

1 oninbutions, ai, grants, ei recewed (attach Teare

schedule)

2 check [ifthe foundations not requred to atach

3 Interest on stvings and temporary cash investments aan ae aay

4 Dividends and interest rom secures. Tarai Zanaa| —2anaal

ssa Gross rents

Net rental income o oss)

@ | 62 Net gaimor (loss) rom sale ofaseete not on ine 10, THT

3 | ose sates pce forall assets on ine sa

& | 7 Copitargain net income (trom Part 1V, line 2) 3,306,774

8 Net short-term capital gain Tae

9 Income moaitestons

200 Gross sates less returns and

Slowences

b Less Costof goods sold

Gross profit or (ose) (attach schedule) >

ht othersncome (attach schedule) Ss Ta wae a

li2 Total. Aca tnes 1 through 11 — Tease case] aaer

13 Compensation of oficers, directors, turtees, ete

14 Otheremployee salenes and wages

& [15 Pension pans, employee benefits .

2 | 6a Legal fees (attach schedule).

2 |» Accounting fees (attach schedule). a 7359}

FY) & other professional fees (attach schedule) js zr

3 |a7 interest

B | Deorecaton attach schedule) ana depletion

E |20 occupeney

3 [an travel conferences, and meetings.

|22__pnnting and publications ;

& [23 Otherexpenses (attach schedule) - eo Er Bee Be

F 2 otal opaatog and administrative expanen

S| sasies 13 ehrough 23 wise 206,258 soa °

& 25. contnbutions, ott, grants paid Ta Tas

26 Totalexpenses and disbursements Add lines 24 end sear 655 ess 3a

=

GB subtract ive 28 Fomine 2

Excess of revenue ver expenses and debursements nian

bb Net Investment income (if negative, enter -0-) aaa

€_ Adjusted net income (if negative, enter -0-) Tae

For Paperwork Reduction Act Notice, see instructions,

Cat No E289 Form 990-PF (2013)

Form 990-PF (2013) Page 2

Z|100 tnvestments—u S and state government obligations (attach schedule) 12,764,679] 2,509,311] 2503

15 Other assets (descnbe > al 7083.7 7093.7

B| 21 Mortgages and other notes payable (attach schedule)... . -

) 22 other habuties (describe :

Foundations that otow SFAS 17, check Fare T=

and complet ines 24 through 26 and tines 20 and 3.

Ce eee

G2 remanent restricted | se

| __ Foundations that donot follow SFAS 17, check here (7

3] and complete tes 27 trough 31

2]50 Total net ascteorfund blancs (seepage 17 ofthe

3

51 Totllabiltice and nt aseets/fund balance (cee pose 27 of

Analysis of Changes in Net Assets or Fund Balances

3 ‘Other increases not included in line 2 (itemize) Pe 8 3 15,254,372

c Decreases not included in line 2 (itemize) Ss 3 1

Form 990-PF (2013)

Form 990-PF (2013)

Capital Gains and Losses for Tax on Investment Income

Page 3

(a) List and desenbe he kinds) of propery sla (eg, ces estat, ey How acaured] ce oate acqured] (8) Date sole

Testory brick warehouse, or common stock, 200 she MLC Ce) Brpurcnase | mo dariyt) | (mo, dav,

Ga See Additional bate Table

»

4

@ Depreciation slowed (oy Cont orather bane GH Gen ar foray

A eat {or allowable) plus expense of sale (e) plus (f) minus (9)

a_See Adaiioral Bite Table

»

4

Caplets only fr aves Shovng gain column i) and owned by ths foundation on TB/STIES @ Gans (eal Wann mee

eT G Adjusted besis Excess ofcol () | el tk, buenot ae tan)

ae of 1/09 Sversol Qh any Uosses trom coh)

5

;

If gain, also enter in Part I, line 8, column (c) (see instructions) If (loss), enter -0- }

‘Qualification Under Section 4940(e) for Reduced Tax on Net Investment Income

ee ee 5 2,991,831

If tine 81s equal to or greater then line 7, check the box in Part VI, line 1b, and complete that part using @ 1% taxrate See

the Part Viimetructions

Form 990-PF (2013)

Form 990-PF (2013)

Excise Tax Based on Investment Income (Section 4940(a), 4940(b), 4940(e), or 4948—see page 18 of the instructions)

x

Page

Exempt operating foundations described n section 4940(€X2), check here Pe [- and enter "N/A

online 2

Date of ruling or determination letter (attach copy of letter if necessary-see

Instructions)

Domestic foundations that mest the section 4940(e) requirements in Part V, check 1 61460

here DF and enter 1% of Part, line 27b

All other domestic foundetions enter 2% of ine 27b Exempt foreign organizations enter 4% of

Parti, line 12, cal (0)

Tax under section 511 (domestic section 4547(a)(1) trusts tnd taxable foundations only Others

enter 0")

‘Add lines 2 and 2. eiaeo

Subtitle & (income) tax (domestic section 4947(aXt) trusts and taxable foundations only Others

enter 0°)

‘Tax based on investenent income, Subtract line 4 from ine 3 If zero or less, enter -0- eiaeo

Credits/Payments

2013 estimated tax payments and 2032 overpayment credited to 2013 | 6a 42,056]

Exempt foreign organizations—tax withheld at source o

‘Tax paid wth application for extension of tm to file (Form 8868) a 22,000]

Backup mthholding erroneously withheld»... ee ee + «| 6a

Total credits and payments Addlines 6a through 6d... 6. ss pee

Enter any penalty for underpayment of estmated tex Check here fF if Form 2220 1 attached

Tax due. Ifthe total of ines § and 81s more than line 7, enter amount owed... s+ «

»

Overpayment. ifline 7 1s more than the total oflines § and 8, enter the amount overpaid. . . ® [10

Enter the amount of ine 10 to be Credited to 2014 estimated tax Pe 2st Refunded [an

Statements Regarding Activities

rs

10

During the tax year, did the foundation attempt to influence any national, state, or local legislation or did

vt participate or intervene in any political campaign? pe eee

Did it spend more than $100 during the year (either directly or indirecty) for political purposes (see page 19 of

the instructions fordefiniton)? sve ee

{Ifthe answer 1s "Yes" to 1a or 1b, attach adetaled description of the activities and coptes of any materals

published or distributed by the foundation in connection with the activities.

Did the foundation fle Form 1120-POL for this year?. os we

Enter the amount (fany) of tax on political expenditures (section 4955) imposed duning the year

(2) On the foundation » § (2) On foundation managers $

Enter the reimbursement (f any) paid by the foundation during the year for political expenditure tax imposed

on foundation managers Pe §

Has the foundation engaged in any activities that have not previously been reported totheIRS? . . . . .

10 "Yes," atach a detaied description of the activities.

Has the foundation made any changes, not previously reported to the IRS, in its governing instrument, articles

of incorporation, or bylaws, orather similar instruments? If "Yes," attach a conformed copy of thechanges

Did the foundation have unrelated business gross income of $1,000 or more duning the year... 2 2. ss

1#"¥e5," has i fled & tax return on Form 9BO-Tfor this year?e vv ee ee

Was there a liquidation, termination, dissolution, or substantial contraction during the year? © ss ss ee

16 "Yes," attach the statement required by Genera Instruction T.

[Are the requirements of section 508(e) (relating to sections 4941 through 4945) satisfied either

‘© By language inthe governing instrument,

‘© By state legislation that effectively amends the governing instrument so that ne mandatory directions

that conflict with the state lawremain inthe governing instrument? © 6s ee ee ee

Did the foundation have atleast $5,000 1n assets at any time during the year? If "Yes,"complete Prt I, l(c), and

Pare wv,

Enter the states to which the foundation reports or wth which its registered (see instructions)

mre

Lf the answers "Yes" to line ?, has the foundation furnished a copy of Form 990-PF to the Attorney.

General (or designate) of each state as required by General Instruction G? If "Mo," attach explanation

1s the foundation claiming status as a private operating foundation within the meaning of section 4842(X3)

0r 49425) for calendar year 2013 or the taxable year beginning in 2013 (see instructions for Part XIV)?

16 Yes," complete Part XIV Be ee ee

Did any persons become substantial contnbutors duning the tax year? If "Yes," attach a schedule listing thesr names

‘and addresses.

rn

ab

&

olelele

Be ele

10

Form 990-PF (2013)

Form 990-PF (2013) Page 5

‘Statements Regarding Activities (continued)

41 Atany time dunng the year, did the foundation, directly or incicectly, own @ controlled entity wahin the

meaning of section 512(b\13)? If"¥es," attach schedule (see instructions). 2 sv ee ee ee ee [ad No

32. Did the foundation make a distribution to a donor advises fund aver which the foundation ora disqualified person had

advisory privileges? If"Yes," attach statement (eee instructions)... eee ee ee Lah No

13 1d the foundation comply withthe public inspection requirements for its annual returns and exemption application? [43 | Yes

Website address N/A

14. The books are in care of PStaci Wks Telephone no P(254)631-4727

Located at 25 County Road 166 Caco TX z1p-+4 76437.

15 Section 4947(a)(t) nonexempt chantable trusts filing Form 990-PF in lieu of Form 1081 —Check here -

land enter the amount of tax-exempt interest received or acerued during the year >

16 At any time duning calendar year 2013, did the foundation have an interest n ora signature or other authority over Yer | No.

1 bank, secunties, or other nancial account ina foreign country?” 16 Ne

See instructions for exceptions and filing requirements for Form TO F 90-22 1 If "Yes"

foreign country

Statements Regarding Activities for Which Form 4720 May Be Required

ile Form 47201 ny ftmis checked inthe "Yes" colar, unless anexcaption apes: Yen

a During te year dhe foundation (rhe crecty or ndvect)

enter the name of the

(2) Engage inthe sale or exchange, or leasing of property with a disqualified person? T ves F No

(2) Borrow money from, lend money to, or othermse extend credit to (or accept i rom)

2 disqualited person? Ti ves F Ne

(3) Furnish goods, services, oF facilities to (or accept them from) a disqualified person? T ves F No

(4) Pay compensation to, or pay or reimburse the expenses ef, a disqualified person? P ves F No

(5) Transfer any income or assets to a disqualified person (or make any of either available

forthe benefit oruse of disqualited person)? vv ee ee ee ee ee Pes Ne

(6) Agree to pay money or property to a government offical? (Exception. Check “No”

ifthe foundation agreed to make a grant to orto employ the official fr @ period

‘after termination of government service, terminating within 90 days). ss ss ss + P¥ee Fe

bb Ifany answer's "Yes" to 12(1)-(6), did any of the acts fal to qualify under the exceptions described in Regulations

section 53 4941 (d}-3 or ma current notice regarding disaster assistance (see page 20 of the nstructions)?.. - | tb No

Organizations relying on a current notice regarding disaster assistance check here... ss 2 es

€ Did the foundation engage ina prior year im any ofthe acts described in 18, other than excepted acts,

that were not corrected before the frst day ofthe tax year beginning in20137, 2. ee ee ee es | te No

2 Taxes on failure to distnbute income (section 4942) (does not apply for years the foundation was a private

operating foundation defined in section 4942()(3) 0r49420)(5))

At the end oftax year 2023, eid the foundation have any undistributed income (lines 6d

land 6e, Pare XI11) for tax year(s) beginning before 20137... ee vv ee ee eee Ves NO

1e"¥es," list the years 20__, 20__, 20__, 20__

1b Are there any years listed in 28 for which the foundation 's not applying the provisions of section 4942(a}(2)

(relating to correct valuation of assets) to the year’s undistributed income? (If applying section 4942(a)(2)

to all years listed, answer "No" and attach statement-—see instructions ) 2» No

€ Ifthe provisions of section 4942(a)(2) ae being applied to any of the years listed in 2a, list the years here

commie ep ae ogsm gue

‘3a Did the foundation hold more than a 2% direct or indirect interest in any business enterpnse at

fany-time during the years oe P08 NO

b_I1"Ves, aid have excess business holdings in 2013 as a result of (4) any purchase by the foundation

or disqualified persons after May 26, 1969, (2) the apse ofthe S-year periad (or longer period approved

by the Commissioner under section 4943(€X7))te dispose of holdings acquired by gift or bequest, or (3)

the lapse of the 10-, 15-, or 20-year frst phase holding period? (Use Schedule C, Farm 4720, to determine

\f the foundation had excess business holdings 2013... 2 ee ee ee ee ee ee | Bb

4a Did the foundation invest dunng the year any amount in @ manner thet would eopardize its chantable purposes? [4a

No

Ne

1b Did the foundation make any investment na prior year (but ater December 31, 1965) that could jeopardize its

chantable purpose that had not been removed from jeopardy before the first day of the tax year beginning in 2013? | 4b No

Form 990-PF (2013)

Form 990-PF (2013) Page 6

Statements Regarding Activities for Which Form 4720 May Be Required (continued)

‘32 Dunng the year did the foundation pay er incur any amount to

(4) Carry on propaganda, or athermse attempt to influence legslation (section 4945(6)? vee F no

(2) Intuence the outcome of any specric public election (see section 4985), orto camry

on, diecty orindirectly, any voterregistration dnve?. wove ve vee ew es Yes FN

(6) Prowce »granto on mavidua for travel, study, or other similar purposes? vee F no

(2) Provide a grantto an organzation other than a charabe, ec organzation desenbad

sn section 509(0)t), (2), 0" (3), orsecton 4960(8)(2) (see nstrctions). . . . « « ¥en FP No

(6) Prowde for any purpose athe than religious, chantable, scientific, trary, oF

sdscatonal purposes, forthe pravention of crusty te children eranimals?. .. 2. Yes FN

be tfany answers "Yeo" to $a(2)-(5), did any ofthe transactions foto gual under the exceptions described in

Organizations relying on a corrent notice regarding disaster assistance check hare... »r

€ Ifthe answers "Ves" to question $0(4), does the foundation clam exemption from the

tax because it maintained expenlture responsibilty forthe grant? ves F No

1"¥e," tach the statement required by Regultons section 534945-5(2).

4 Did the foundation, dung the year, racer any finds, directly or ndiecty, te pay premiums on

ee ee

bid the foundation, dunng the year pay premiums, decty rinarectiy on a personal benefit contract? |_| no

1 "¥es"to6, file Frm 8570,

7 Atany time dunng the tox year, wos the foundation a party toa prohibited tax shelter sransacton? "Yes FF No

tif yes, da the foundation recive any proceeds orhave any net come atinbutabl tothe transaction? wl | no

Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees,

and Contractors.

I List all officers, directors, trustees, foundation managers and thelr compensation (see instructions)

{b) Title, and average | (e) Compensation | (@) Contnbutions to

(e) Expense account,

(a) Name and address hours perweek | (If not paid, enter | employee benef plans | (@2 Expense accour

devoted to position 7) and deferred compensation

Saw Frrustee Ql

Cisco, TX 76437

Irrastee a

425 County Road 168 jro0

Cisco, 1.76437

"2 Compensation of five highest-paid employees (other than those Induded on line 1—see instructions), f none, enter “NONE

(@) Contributions to

(b) Tile, and average

(a) Name and address ofeach employee | TRG andaverage | | employee benefit | (e) Expense account,

bald more than $50,000 oe plans ené deterred | other allownces

jevated to position crore

‘Total number of other employees padover $50,000... 7 7

Form 990-PF (2013)

Form 990-PF (2013)

Page7

Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees,

and Contractors (continued)

'3_ Five highest-paid independent contractors for professional services (see instructions). If none, enter “NONE”

(2) Name and address of each person paid more than $50,000 (W) Type of service

NONE

otal number of others recewving over $50,000 for professional services!

‘Summary of Direct Charitable Activities

(© compensation

Ee eg Expenses

7

2

:

Summary of Program: Related Investments [see msiruchons

Deere te is EO pv te meses rife nar drm Ye on Wes} OE nea

1

lather progranrelated vestments See page 24 of the mstructions

3

‘Tota, Ada ines i through 3 aces eee

Form 990-PF (2013)

Form 990-PF (2013)

Minimum Investment Return (All domestic foundations must complete this part. Foreign foundations,

see instructions.

Pages

7

5

6

Fair market value of assets not used (or held for use) directly m carrying out chantable, ete

purposes

Average monthly far market valu of secunties. is 133,529,316

Average ofmonthy cosh balances. ve ee ee ee ee ee La 16,926,007

Foirmarke value ofallotherassets (se mstrictons). ve ee ee ee Le n

Total (odsiines ta,b.andeh ee ee ee ee ee eee ee ee fad FEET

Reduction clamed for blockage or other factors rportedon lines 14 and

Le(atach denied explanation. we ee ee es Lael a

Acquistion indebtecness eppiable to lne 4 asses.

finn 150455503

Cash deemed held forchantable activities Enter 1 1/2% ofline 3 (or greater amount, see

instructions) 4 2,256,030

Net value of nonchaitable-te sete Subtract line 4 trom hne 3 Enter here and on Part, ine & 5 748,198,453

Minimum investment rotum.EnierS% oflineS. sss sss... ss Le 7,409,925

ae

sutable Amount (see instructions) (Section 49424)(3) and )(5) private operating

certain foreign organizations check here ® [and do not complete this part.)

Foundations and

TL Minimum investment return fomParX,line6. 2 2 vrs te ee ete ee LE 7409025

2a Taxon investment income for 2013 from Part VI,lineS. . 2.» = | 2a 61,469)

b_ Income tax for 2013 (This does not include the tox from Part Vi)... [2b

a 61460

3 Distnbutable amount before adjustments Subtractline 2efomlinet. - se ee ee ee ee LS 7240.465

4. Recovenes of amounts treated as qualifying distributions. 4

S Addiines 32nd4. 0 ve 5 7340465

6 Deduction from distributable amount (seeimstructions)- ee ee ee ee LS

7 Distributable amount as adjusted Subtract line 6 from line 5 Enter here and on Par XIII,

iva ee eae z 7,348,465

Qualifying Distributions (see instructions)

4 Amounts pard (including administrative expenses) to accomplish charitable, ete , purposes

8 Expenses, contributions, gifts, ete —total from Part, column (d),lne 26... es ee ee | te 5,275,550

1b Program-related investments—total rom PartIX-Be ee ee ee ee ee ee [a

2 Amounts paid to acquire assets used (or held for use) directly in carrying out chantable, ete ,

ue eal

3 Amounts set aside for specific chantable proyects that satisfy the

Suitability test (prior 18S approval required). 38

b Cash distribution test (attach the required schedule. © 2 2 ee ee ee Le

4 Qualifying distributions, Add lines 12 through 36 Enter here and on Part V, line 8, and Part XIII, ime # [4 3275550

'5 Foundations that qualify under section 4840(e) fr the reduced rate of tax on net investment

income Enter 1% of Part I, line 27b (see instructions)... ee ee ee ee LB 61,460

6 Adjusted qualifying distributions. Subtractline Sfromline4. 2 2 2 6 214,090,

[Note: The amount on line 6 wll De used in Part V, column (b),n subsequent years when calculating whether the foundation qualifies for

the section 4940(e) reduction of tax in those years

Form 990-PF (2013)

Form 990-PF (2013)

Undistributed Income (see instructions)

Page 9

Distributable amount for 201.3 from Part XI, line 7

Undistnbuted income, ifany, a8 of the end of 2013

Enter amount for 2012 only. . = + +

Total for prior years 20__, 20__, 20.

@

corpus

)

Years prorte 2012

©. @.

2012 2013

Excess distributions carryover, any, t0 2013,

From aonb ie seeeaeaa

a

ramsois te

Feom 2032.) 1 1. ss

Total of ines 3a throughe. . sss

Qualifying aistnbutions for 2013 trom Part

XII, lines §. 5,275,550

‘Applied to 2012, but not more than line 23

‘Applied to undistributed income of prior years

(Election required—see instructions). = + + «

Treated a8 distnbutions out of corpus (Election

required~see structions). ss ss ss

Applied to 2013 distributable amount... =

Remaining amount distributed out of corpus

Excess distributions carryaver applied to 2013

(fan amount pears in column (4), the

{Same amount must be show in calurin(3).)

Enter the net total of each column as

indicated below:

Corpus Add lines 31,4¢, and 4e Subtract ine 5

Prior years’ undistnbuted income Subtract

line 46 fom line 20

Enter the amount of prior years’ undistnbutes

tncome for which a notice of deficiency has.

been issued, oron which the section 494 2(a)

taxhas been previously assessed... ss

‘Subtract line 6¢ from line 6b Taxable amount

Undistnbuted income for 2012 Subtract line

43 from line 22, Taxable amount—see

instructions se ee et ee

Undistnbuted income for 2023 Subtract

tines 44-and 5 from line 1 Thvs amount must

bedistnbuted in 20187 sv we ee sa

Amounts treated as distributions out of

corpus to satisfy requirements imposed by

Section 170(b)(1)(F) or 494 2(g)(3) (see

Instructions) oe et ee

Excess distributions carryover from 2008 not

applied online 5 or line 7 {see structions). «

Excess distributions carryover to 2014.

‘Subtract lines 7 and 8 from line 69

Analysis of ine 9

Excess from 2009.

Excess from 2010. 1

Excess from 2011. 1 1

Excess from 2012.» +

Excess from 2013. 1.)

Form 990-PF (2013)

Form 990-PF (2013) Page 10

Private Operating Foundations (see istruchons and Part VIA, queston 9)

foundation, andthe ruling eectve for 201, enter te date ofthe rua.

‘Check box to indicate whether the organization 1s a pnvate operating foundation descnbed in section _4942)(3) or [_49420N5)

.

2a Enter the lesser of the adusted net Tax year Por 3 years

‘neame from Part [or the minimum (e) Total

en (2083 wii mit T2088 a

tnvestment retum from Part X for each

year listed.

b 85% of ine 23 - . :

€ Qualifying distabutons fom Part x11,

ling 4 for each year listed -

4) Amounts included inline 2¢ not used

directly for active conduct of exempt

© Qualitying dietnbutions made directly

foractive conduct of exempt actwities

Subtract line 26 from line 2

3 Complete 3a,b, orc forthe

‘ltermative test relied upon

8 “Assets” alternative test—enter

(2) Value of ail assets

2) Value of assets qualifying

under section 494203 KEM)

b “Endowment” alternative test— enter 2/3

‘of minimum investment return shown in

Part x, line 6 for each year listed.

© “Support” alternative test—enter

(2) Total support other than gross

snvestment income (interest,

dividends, rents, payments

fon secunties loans (section

512(@)(5), or royalties)

(2) Support trom general public

and 5 or more exempt

‘organizations as provided in

Section 4942)(3)(8Ki}-

(2) Largest amount of support

from an exempt organization

(4) Gross investment income

‘Supplementary Information (Complete this part only if the organization had $5,000 or more in

assets at any time during the year—see instructions.)

1 Taformation Regarding Foundation Managers:

‘9 List any managers of the foundation who have contributed more than 2% ofthe total contributions received by the foundation

Before the close of ny tax year (but only ifthey nave contnbuted more than $5,000) (See section $07 (3)(2) )

See Additionel Data Table

B List any managers ofthe foundation who own 10% ormore ofthe stock ofa corporation ran equally large portion of he

‘ovmership of @ partnership or other entity) of which the foundation has 2 10% or greater interest

2 Taformation Regarding Contribution, Grant, Gift, Loan, Scholarship, ete, Programs

‘Check here PIF ifthe foundation only makes contributions to preselected charitable organizations and does not accept

Unsolicited requests for funds Ifthe foundation makes gits, grants, ete (see instructions) to individuale or organisations under

‘other conditions, complete items 24,5, , and d

12 The name, address, and telephone number ofthe person to whom applications should be addressed

'b The form in which applications should be submitted and information and matenals they should mnclude

© Any submission deadlines

Any restrictions or limitations on awards, such as by geographical areas, charitable feds, kinds of institutions or other

factors

Form 990-PF (2013)

Form 990-PF (2013)

Supplementary Information (continued)

3 Grants and Contributions Paid During the Year or Approved for Future Payment

Page 42,

Tf recipient ie an individual

Recprent show any relationship to | Foundation | purpose of grant or

any foundation manager | $t2t¥s of Contribution Amount

Name and address (home or business) | Suv eundation manager | recipient

1 Pad during the year

See Schedule attached None soxicn3) [see attaches 5,275,550

Various TX 76437

Tol) oa 5275550

b Aeproved far future payment

See Schedule attached hone s0x(cx3) [see schedule attached 2,758,300

Various TX 76437

> 2,758,300

Total.

Form 990-PF (2013)

Form 990-PF (2013) Page 12

‘Analysis of Income-Producing Activities

Enter gross amunts unless othermse micated|_Unrlatew business income | tied by ston Sz HO 5 ©

a sited or exempt

) ” yy (a | tinction ncome

1 Program service revenue ausmess | grunt | exclusion code | Amount oy

.

4

‘

9 Fees and contracts fom government agencies

2 Membership dues and assessments.

3 Interest on savings and tamperary cosh

4 Dividends and interest from securities... 16 7479.2

'5 Net rental income or (loss) fom real estate

2a Debt-financed property.

bb Not debt-fnanced propery.

6 Net rental income or (loss) fom personal

property

7 Other investment income.

{8 Gain or (oss) from sales of assets other than

WENO se ve tt ee et ee 18 a06.77

9 Net income oF (loss) from special events

10 Gross proft or (loss) from sales of inventory.

AL Other revenue a yise other mene i 4

nga sue dour 1 2.654

Taw exempt viene 1 22

4

42 Subtotal Aad columns (B),(@), and (@)- = ess)

13 Total. addline 12, columns (b), (4), and(ele + «> eae es ATTREES

(See worksheet in line 13 instructions to venfy calculations

Relationship of Activities to the Accomplishment of Exempt Purposes.

Explain below how each activity for which income is reported n column (e) of Part XVI-A contributed mportantiy t

the accomplishment af the foundation's exempt purposes (other then by providing funds for such purposes) (See

instructions

Line Ne.

Form 990-PF (2013)

Form 99%

F (2013) Page 43,

Information Regarding Transfers To and Transactions and Relationships With

Noncharitable Exempt Organizations

1 Did the organization directly or indirectly engage n any of the following with any other organization described im

section 501(c) ofthe Code (other than section $01 (c)(3) organizations) or im section $27, relating to politcal Yes | No

organizations?

f Transfers from the reporting foundation to a nonchantable exempt organization of

(ce lan No

(2) omer assets. a2) No

b Other transactions

(2) Sales ofassets toa nonchantable exempt organization, © 2 2 ee ee ee ee ee [aC No

(2) Purchases of assets froma nonchantable exempt organization, © vv ee ee ee ee ee aD No

(3) Rental offciities, equipment, or other assets... ve eo + [aC No

(4) Reimbursement arrangements. © 2 6 ee ee ee fate No

(ey oars orion guarantees (cote ee lane) No

(6) Performance of services or membership or fundratsing soliitations. 6) No

€ Sharing of facies, equipment, matling lists, other assets, or paid employees... - - 2 es ee es Lae No

4 Ifthe answer to any of the above 1s "Yes," complete the following schedule Column (b) should alvays show the fair market value

atthe goods, other assets, of services given by the reporting foundation Ifthe foundation received less than fair market value

In any transaction or sharing arrangement, show im column (d) the value of the goods, other assets, or services received

(2) ure ne | (oy Amount motved_| (e) Name of wnctartable exempt oganzaton | (4) Descrpnon of tarsters, wansactons ad shang arangements

2a Te the foundation directly or directly afiiated wth, or related fo, one or more tax-exempt organizations

descnbed in section 501(c) of the Code (other than section S01(c)(3)) orinsection $277... . . . . 2. . ves Fro

bb If-Yes," complete the folowing schedule

{@) Name of oganzaton (©) Type of ongangaton (e) besepton of enone

Under penalties of penury, I declare that I have examined this return, including accompanying schedules and statements, end to

the best of my knowedge and belief it's true, correct, and complete Declaration of preparer (other than taxpayer orhiduciary) 1s

Sign | based on all information of which preparer has any knowledge

Herel )

Paid Vietork Munson ploy

Prepares

Only Firm's address > ‘6060 N Central Expwy Suite 560 Dallas, TX 75206 |Phoneno (214) 237-2920

Form 990-PF (2013)

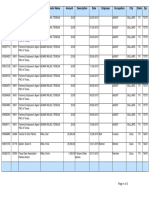

\S and Losses for Tax on Investment Income - Columns a - d

Form 990PF Part IV - Capital Gé

(@) List and descnbe the kind(s) of property sold (e 9 , real estate, (b) How (© date (a) Date sola

2-story bnick warehouse, or common stock, 200 shs MLC Co) acquired acquired | (mo, day, yr)

PoPurchase | (mo , day, yr)

‘See ST Sch attached BNY Mellon P 2013-07-01 | 2013-07-15

SeeST Sch attached BNY Mellon P 2013-01-01 | 2013-07-01

SeeLT Schattached BNY Mellon P 2012-07-01 | 2013-07-01

SeeLT Schattached ANY Mellon P 2012-07-01 | 2013-07-01

Capital Gain Dividends

Form 990PF Part IV - Capital Gains and Losses for Tax on Investment Income - Columns e - h

(@) Gross sales price

(F) Depreciation allowed

(9) Cost or other baste

(hy Goin or (oss)

(Grallowable) lus expense of sale (e}plus (9 minus (9)

726,025, 761,435 35.410

15,794,197 14,123,192 1,661,005

348,296 350,202 9,906

333,026

Form 990PF Part IV - Capital Gains and Losses for Tax on Investment Income - Columns i

‘Complete only for assets showing gain in column (h) and owned by the foundation on 12/31/69

(EMV a5 0F12/31/69,

( Adustes basis

a of 12/31/69

(W Excess oF col (0)

over col Q),ifany

(Gains (Col (R) gain minus

col (k), but not less than -0-)or

Losses (trom col (h))

1,357,258

735,410

1,661,005

9,906

Form 990PF Part XV Line 1a - List any managers of the foundation who have contributed more than 2% of

the total contributions received by the foundation before the close of any tax year (but only if they have

contributed more than $5,000).

Dan H Wilks:

‘Staci Wike

[As Filed Data — J

TY 2013 Accounting Fees Schedule

Name: Heavenly Fathers Foundation

EIN: 27-6987913

Software ID: 13000170

Software Version: 2013v3.1

Category ‘Amount Net Investment Adjusted Net | Disbursements for

Income Income Charitable

Purposes

‘Accounting fees 7.850 0 0 °

[efile GRAPHIC print — DO NOT PROCESS TAs Filed Data-[DIN: 93491308004204]

TY 2013 Other Assets Schedule

Name: Heavenly Fathers Foundation

EIN: 27-6987913

Software ID: 13000170

Software Version: 2013v3.1

Description ‘Beginning of Year- | End of vear-Book | End of Year Fair

Book Valve Value Market Value

Alternative investments 7,091,356 7,091,356

‘Organization cost net of amortization 1815 1815

[efile GRAPHIC print DO NOT PROCESS [As Filed Data — | DLN: 93491308004204]

TY 2013 Other Decreases Schedule

Name: Heavenly Fathers Foundation

EIN: 27-6987913

Software ID: 13000170

Software Version: 2013v3.1

Description ‘Amount

Rounding 1

[efile GRAPHIC print — DO NOT PROCESS TAs Filed Data-[DIN: 93491308004204]

TY 2013 Other Expenses Schedule

Name: Heavenly Fathers Foundation

EIN: 27-6987913

Software ID: 13000170

Software Version: 2013v3.1

Description Revenue and Expenses] Net Investment | Adjusted Net Income | Disbursements for

per Books. Income Charitable Purposes

‘Amortization expense 605

‘Amortization of Bond prem/aise 15

Brokerage fees 105,043 195,043 195,043

Federal income tx 42,059

Foreign tax withheld on divigendineame 94,033, 94,033 94,033

Miscellaneous investment exp @ BNY 27,179 27473) 27479)

[efile GRAPHIC print — DO NOT PROCESS TAs Filed Data-[DIN: 93491308004204]

TY 2013 Other Income Schedule

Name: Heavenly Fathers Foundation

EIN: 27-6987913

Software ID: 13000170

Software Version: 2013v3.1

Description Revenue And Net Investment | Adjusted Net Income

Expenses Per Books Income

Orginal eeue discount 12,658 12,658 12,658

Tax exempt dividends 136,221

[As Filed Data — J

TY 2013 Other Increases Schedule

Name: Heavenly Fathers Foundation

EIN: 27-6987913

Software ID: 13000170

Software Version: 2013v3.1

Description ‘Amount

Unrealized gain on investments 15,254,372

[efile GRAPHIC print — DO NOT PROCESS TAs Filed Data-[DIN: 93491308004204]

TY 2013 Other Professional Fees Schedule

Name: Heavenly Fathers Foundation

EIN: 27-6987913

Software ID: 13000170

Software Version: 2013v3.1

Category ‘Amount, Net Investment | Adjusted Net | Disbursements for

Income Income Charitable

Purposes

Other professional fees 4.568 ° ° °

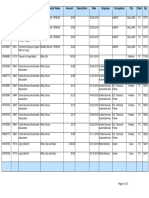

near 65 Nu Vana

arate es NT ULO VANS

seo ISeHeNA Sa

SOS TSYHSINN Sur

#00 Wa HALE

HOO Ws URLSEaN

pu09 Wis waLSUENT

HOD TARY SUA MINOW

SaniNaUTIATSOUIIVA

ny F___ Su Sasa: NIOOULVET

er 1 SNIS=SSaNRIND DOuLGvaT

eur ‘#309 VRID

Euroa 0. sveroa

(> a SHOD WRI

senza rors

350] 0 Biome Arena say 218 Kou

‘286 vonges geal sepun OWEN ‘su1eb jede9 01 aojnvua 1oU B18 $9860] 10 Su10E osmY SOU ABZEI SUOIDIS

NI SON 15>

DNL ONVEE 55

) 1d 109d wn

tres S.S9eH

5. bare sore YSSW19 915 sO HN

caren YSSVID-o 4 1STINOEENWV

raze

‘one

a

: n Powers SOG ALVES HOM

. ae ‘3409 ALTEIV Hav

rd HOD ATE TI) Noa

oe Ear SAISOAS ONIREIOORN BART

088 Cee

o W198 TNGUMRAIZINI REWNCT

0. ea 2

o 1a

ir ow eeu

ry cea

“hie ‘Mat Ni SPROBANY te

BeIbsraze aia ah RI SSINOULW 1

sess waisereee 7) ei

e01aes. De =

ET 7 =

1 ie 1688 Dre Seritaeet——_GeCEGA_Y AGS TIS SAR ANAACLUINADD

Tao aw AN “599 spa Herkworg Gen ae Sane

S03t.0 stUOW 2) ploy Sjecse 70 aIes sapNou OB HIE Su\L

vestivay WHOA 3204S

VINCROLLVONAOA SUAHLVA ATNZAVAIL

ware raves

er

ue EI .OGe 109 OH

Meese FREED OWTHS

hivereeie a SEED ORTH

Lite TES OATHS

Himoo £57 uo mao OMI

sumie SMP aso cop ONS

Read

Pees

= leone res

coors

SAE ON'GSIOOUS BANE

vee ODS TIS awa

SU1_ ON SOAS BNISSIOONSESUNIT

or "xo HAN UNCD 09

sioss5 oo RI EROOTONHOZL ANA HOE

8 Fee hwo rae

sonewsojuy 3¥y, £T0Z

Bos

=

as 218

cry

mee were

BH re socio 7008

ORURIFIE E> Fone Toa

OuNFE Sky saree TOOd VANE

own aE)

ACEI 3321000 NESW SAM Livi WwHD0D4

z0ste couse = ao enw a

‘anos 7 Sonat BY INES Wa Woman OTIOGY

ort a ‘sorne0 BY LVS Tee mioHNWOD OTN

we serets ‘e120 are Fovarores ABLE YOWNOUENreNOO MNVELIOS.

aoes fo 20 SSPE 3 Susana 80

a 20 oo an80e0 192 ‘SN anOMF NOTED

2 rresses Diy SIVASE Twas WSHaMINCO STIOSY

ween. 9 NT anOW NOOVBD

5a 705 08 Sav Ua GUSNES Dy SICAVAON

sov0080se Die ED SOND BOR LISSY NALS

sma KS ‘srva0muse ‘Dew Uo TOVORUON LASS

eres aes BSP, SOHNE a

onan an = SS ao oa

6z ota FACROMLVENNOL

ECETSOL ANgAHAN pMO>>¥

ULLOJE] NEL £107

LV AINIAY:I0

oe wicker

Era DA uNowe MISTY

370 MBN ae 1geONDS

(808 ALOT

Br eces

TONED

a

ORISEOF

EODIS “@

a:

cut

oe

oe

263

230

cazzees

canes

NI Se HSRSUSASCUIY UKs

‘SNS ReSIUNO MMV SVEN

sreeas

wees

EN! NOU TNO NDA

%0 downsriee 5 adrov 00 GNOWO ANOS

ory 7A__ ON BNOLNDINFIROD NOZTLIN

ZA__ 94 ShOLEINNANOD NOL

eyes

hago

850

S180

0300 # AT

ROD 8A

S099 S015 nozoo Rani 7

a5 a8 Wits 00d NSSTSINTe WuRas

880) 19 squoU 2;

YIRPNOLLVUNNOd SHTALY ATNZAV IE

You might also like

- DFPC Prayer List UpdatedDocument1 pageDFPC Prayer List UpdatedTeddy WilsonNo ratings yet

- 2021 States and Nation Policy Summit AgendaDocument4 pages2021 States and Nation Policy Summit AgendaTeddy WilsonNo ratings yet

- Capitol Riot Map 1.11.21Document1 pageCapitol Riot Map 1.11.21Teddy WilsonNo ratings yet

- Wilks Family Campaign Contributions - Texas (2015)Document3 pagesWilks Family Campaign Contributions - Texas (2015)Teddy WilsonNo ratings yet

- PP v. JegleyDocument148 pagesPP v. JegleyTeddy WilsonNo ratings yet

- Human Coalition - Texas Grant ContractDocument455 pagesHuman Coalition - Texas Grant ContractTeddy Wilson100% (1)

- Texas HHSC Request For ApplicationDocument104 pagesTexas HHSC Request For ApplicationTeddy WilsonNo ratings yet

- WWHA V PaxtonDocument43 pagesWWHA V PaxtonTeddy WilsonNo ratings yet

- HFF 990 2012Document35 pagesHFF 990 2012Teddy WilsonNo ratings yet

- PF Return of Private Foundation: ExpensesDocument20 pagesPF Return of Private Foundation: ExpensesTeddy WilsonNo ratings yet

- Wilks Family Campaign Contributions - Texas (2017)Document7 pagesWilks Family Campaign Contributions - Texas (2017)Teddy WilsonNo ratings yet

- Return of Private FoundationDocument40 pagesReturn of Private FoundationTeddy WilsonNo ratings yet

- HFF 990 2014Document22 pagesHFF 990 2014Teddy WilsonNo ratings yet

- Wilks Family Campaign Contributions - Texas (2016)Document9 pagesWilks Family Campaign Contributions - Texas (2016)Teddy WilsonNo ratings yet

- Wilks Family Campaign Contributions - Texas (2018)Document3 pagesWilks Family Campaign Contributions - Texas (2018)Teddy WilsonNo ratings yet

- HFF 990 2015Document21 pagesHFF 990 2015Teddy WilsonNo ratings yet

- TTF 990 2016Document25 pagesTTF 990 2016Teddy WilsonNo ratings yet

- Texas A2A Program FY2018 Q2 (Pregnancy Help Center of Lufkin Annual Monitoring)Document4 pagesTexas A2A Program FY2018 Q2 (Pregnancy Help Center of Lufkin Annual Monitoring)Teddy WilsonNo ratings yet

- Form 990-PF Return of Private FoundationDocument18 pagesForm 990-PF Return of Private FoundationTeddy WilsonNo ratings yet

- TTF 990 2011Document43 pagesTTF 990 2011Teddy WilsonNo ratings yet

- Texas A2A Program FY2017 Q1 (Facility Tours)Document2 pagesTexas A2A Program FY2017 Q1 (Facility Tours)Teddy WilsonNo ratings yet

- TTF 990 2013Document127 pagesTTF 990 2013Teddy WilsonNo ratings yet

- TTF 990 2014Document29 pagesTTF 990 2014Teddy WilsonNo ratings yet

- HFF 990 2016Document22 pagesHFF 990 2016Teddy WilsonNo ratings yet

- TTF 990 2012Document39 pagesTTF 990 2012Teddy WilsonNo ratings yet

- TTF 990 2015Document25 pagesTTF 990 2015Teddy WilsonNo ratings yet

- Texas A2A Program FY2018 Q1 (Pregnancy Care Center Huntsville - Facility Tour)Document2 pagesTexas A2A Program FY2018 Q1 (Pregnancy Care Center Huntsville - Facility Tour)Teddy WilsonNo ratings yet

- Texas A2A Program FY2018 Q2 (Foundation For Life Annual Monitoring)Document3 pagesTexas A2A Program FY2018 Q2 (Foundation For Life Annual Monitoring)Teddy WilsonNo ratings yet

- Texas A2A Program FY2017 Q4 (Foundation For Life Facility Tour)Document3 pagesTexas A2A Program FY2017 Q4 (Foundation For Life Facility Tour)Teddy WilsonNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)