Professional Documents

Culture Documents

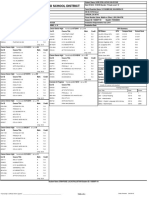

Priority Trade Issue - Revenue - Demystifying Duties

Uploaded by

sulewsamCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Priority Trade Issue - Revenue - Demystifying Duties

Uploaded by

sulewsamCopyright:

Available Formats

rontline

U. S. Customs and Border P r o t e c t i o n H Summer 2010

The Sniffs that Stop Traffic–Page 14

Training’s Best-Case Scenario –Page 20

Desert Sting –Page 34

Demystifying

Duties

What, Why and How of CBP’s

Import Collections Role

By Marcy Mason

For most Americans,

the subject of “duties”

is confusing. Few

have any idea

what duties are

or why they

their product to an importer, who chooses ton or other physical unit of measure. An several nations. Sometimes multilateral trade African Growth and Opportunity Act, which

to import the goods from that country. The ad valorem tariff is a fixed percentage of agreements are regional. An example of a was signed into law in May 2000, is a trade

importer pays the appropriate duty on the the value of an imported article. (The value regional free trade agreement that is currently preference agreement that was established to

product. It is never charged to the country,” is the amount the importer declares as under consideration is the Trans-Pacific foster the economies of sub-Saharan African

she said. “So, for example, if a major U.S. the price actually paid for the goods.) For Partnership. This agreement is intended to nations and to improve economic relations in

retailer buys cotton T-shirts that were example, a specific tariff on citrus fruit is 6 facilitate U.S. trade with seven like-minded the region. The agreement provides duty-free

manufactured in Cambodia and brings them cents per kilogram and an ad valorem tax countries in the Asia Pacific region. The access to the U.S. market for wearing apparel

into the United States to sell, the retailer or on pineapples is 2.1 percent. Cherries are an countries involved in the partnership would from more than 30 eligible African nations

‘importer’ pays 16.5 percent on that product. example of a product with a compound duty include Singapore, Chile, New Zealand, including South Africa, Rwanda, Uganda,

Ultimately, that cost is built into the price of rate with both specific and ad valorem tariffs. Brunei, Australia, Peru and Vietnam. Ethiopia, Kenya and Mauritius.

the T-shirt and passed on to the consumer.” For cherries, the compound duty rate is 99 Some agreements promote free trade Similarly, in 1997, Congress authorized

cents per kilogram plus 6.4 percent. with other nations. These so-called “free another preference program to increase

A Global Classification System Textiles and footwear have some of the trade agreements”

Adding to the complexity are the ways in highest duty rates in the Harmonized Tariff provide duty-free

which duty rates are determined. Since Schedule. But these rates can vary widely. treatment to most

1989, the United States has used an intricate For example, men’s shirts made of cotton, products. However,

classification system called the Harmonized wool or manmade fiber range in duty from the details of each

Tariff Schedule of the United States. The tariff 8 percent to 25 percent. The duty rate for agreement are

schedule, which is approximately 12-inches men’s shirts made primarily of silk, however, negotiated by the

thick and still growing, is published annually is only 1.1 percent. Duties on footwear, with Office of the U.S.

by the U.S. International Trade Commission. the exception of ski boots, can be as high as 48 Trade Representative,

Louisiana Purchase

“It seems to get thicker and thicker every percent. Then there are specific items such as an agency within the

year,” said Laurie Dempsey, a trade policy blankets that also have a wide range. Electric Executive Office of

and program branch chief in CBP’s Office blankets, for example, are subject to 11.4 the President. The

of International Trade. “For each trade percent duty while wool blankets are duty-free. United States has

agreement, there are rules that are unique to A watch is one of the most complex a number of free

that agreement and they’re all included in the items to classify. CBP import specialists, who trade agreements

Harmonized Tariff Schedule.” appraise and classify goods, assess everything including the North

The schedule is based on an from whether the watch has an automatic American Free

H Customs duties funded a number of U.S. government projects international, standardized system for winding mechanism to how many jewels Trade Agreement, or

classifying traded products known as the are in the movement piece to the type of NAFTA, with Canada

of historical significance including the Louisiana Purchase.

Harmonized Commodity Description and strap the watch has. “The duty is different and Mexico; the

Coding System or the Harmonized System for each piece of the watch,” said Dempsey. Central America Free

for short. More than 200 countries and “There’s a percentage duty on some things Trade Agreement, or

are so important. And who could blame what they’re paying for is incurred from

economies use the Harmonized System, and a specific duty rate on others. An import CAFTA, with Costa

them? The subject of duties is so complex, duty on a product.”

administered by the World Customs specialist needs to know the values of all of Rica, the Dominican

it’s easy to lose sight of why the U.S. There’s also confusion about who pays

Organization in Brussels, Belgium, as a basis those factors to figure out what the duty rate Republic, El Salvador,

government collects them. duties. “Some people think that duties are

for their customs tariffs. is,” she said. “At first glance, classification Guatemala, Honduras

As a result, misconceptions about duties charged to the countries we import goods

Duties are applied in several ways. There can seem mind-numbingly detailed, but it’s and Nicaragua; and

abound. Many Americans don’t understand from,” said Strickler. “For instance, they think

are specific tariffs, ad valorem tariffs, or a important because everything hinges on that bilateral agreements

the rationale behind these tariffs or how that we’re making the people of Cambodia

combination of the two. A specific tariff is a classification.” with Jordan,

they benefit the country. But it is important pay duty to the United States, which is not

fixed number of cents or dollars per pound, Singapore and Chile

information that consumers should know, at all true. The people of Cambodia sell

especially now, at a time when the economy

Trade, Not Aid to name a few.

Trade agreements are another factor that The United

is lagging.

Duties, the tariffs or taxes levied on “Duties continue to be one of the largest comes into play when determining duty rates.

The U.S. gives favorable trade agreements to

States also is involved

in trade preference

imported goods, are a leading source of

countries for many reasons. In some cases, programs, which have

revenue for the federal government with

nearly $24 billion in duties collected by CBP

and deposited in the U.S. Treasury during

sources of U.S. revenue. Last year, $23.5 the U.S. is seeking political cooperation or

wants to help a country’s economy or its

been legislated by

the U.S. Congress to

Photo by James Tourtellotte

people. In other instances, the agreement may assist the economies

fiscal year 2009.

be with a country that shares similar values, of developing

“Most people aren’t aware when duty

has been charged to a particular product,” billion in duties were collected from goods and facilitating trade with that country would

be mutually beneficial.

countries. These

agreements provide

said Assistant U. S. Trade Representative for

The scope of trade agreements varies. duty-free access to

the Office of Textiles Gail Strickler. “They

don’t have a sense of what part, if any, of with an import value of $1.7 trillion.” Bilateral trade agreements are between two

countries. Multilateral agreements are among

U.S. markets for

certain goods. The H A bulk shipment of cocoa beans from the Ivory Coast

arrives at the port of Philadelphia. Whole cocoa beans

are duty-free while cocoa powder and cocoa mixtures

containing sugar have tariffs ranging from 10 percent

8 H Demystifying Duties H of the shipment’s value to 33 cents per kilogram.

prosperity in the Middle East. The agreement free trade access, it could cost the importer During its first year of operation, U.S. merchandise valued at $800 before they must

Photo by James Tourtellotte

established Qualifying Industrial Zones that more for that same item. Therefore, the Customs produced more than $2 million pay duty. The next $1,000 of declared goods

house manufacturing operations in Jordan company chooses to make the jeans in in revenue. For the next 123 years, until is charged a flat rate of 10 percent of the cost

and Egypt. Goods produced in these special Jordan. The same is true for a lot of products income tax legislation passed in 1913, of the merchandise.

free trade zones are part of a trade agreement that come from Morocco, and recently duties collected by the U.S. Customs Service “There’s a certain level of basic

between the United States and Israel. To Congress enacted the Haiti Economic Lift were the economic engine of the country, sophistication that people should have when

qualify, goods produced in these zones must Program (HELP) to help the country recover financing virtually the entire government and they travel abroad,” said Labuda. “People

contain some Israeli input. from the devastation of the earthquake.” its infrastructure. travel overseas and think it’s okay to be

Instead of supplying foreign aid to As the main source of income for the oblivious about duties, but it doesn’t work

countries, nations are given an opportunity A U.S. Economic Engine young nation, Customs duties funded a that way. There are enough good resources

to trade with the United States. When Historically, duties have been an important number of projects of historical significance. for people to learn the rules and regulations.

people are gainfully employed and see their revenue source for the United States. America’s These included paying off the Revolutionary The CBP website is one of them [cbp.gov/

country’s overall economy improving, it economic growth and development have War debt, financing the Louisiana Purchase, travel],” she said. “Travelers should research

spills over into other areas. Economic aid depended on duties since the country’s birth. acquiring the Oregon territories and the the website’s ‘Know Before You Go’ section

of this sort promotes peace and provides a Despite the fact that the American colonies states of Florida and Alaska. Duties also to familiarize themselves with the procedures

preventative measure against terrorist activity deeply resented tariffs imposed by the British, financed the Lewis and Clark Expedition, applicable to duties.”

in susceptible regions. the cash-strapped, fledgling nation realized the building of the U.S. naval and military

The effects of trade agreements also that it needed income to ensure its survival. academies and the city of Washington, D.C.

H One of the roles of CBP is to assure that imports are accurately Analyzing Commercial Cargo

trickle down to the consumer level. “It helps On July 4, 1789, the Second Act of the described and do not violate intellectual property rights. When commercial cargo enters the U.S.,

consumers to know why products come from First Congress of the United States authorized Big Benefits a CBP import specialist is responsible for

the countries they come from, especially the collection of duties, or fees, on imported Today, duties continue to be one of the largest appraising the goods and determining if

with apparel,” said Strickler. “Someone may goods to fund the new federal government. sources of U.S. revenue. Last year, $23.5 competitive tend to have the higher duty-rate share of the money collected from duties their value has been classified accurately by

look at a label inside a pair of jeans and see The Third Act of Congress established a billion in duties were collected from goods items such as textiles, agricultural products comes from imported textiles. Last year, the importer. The import specialist will also

that they’re made in Jordan and think, ‘Why system of tariffs on the tonnage of ships. And with an import value of $1.7 trillion. Duties and some finished automotive vehicles such textile imports generated 46 percent or $10.2 verify if the amount of duty paid is correct.

would a company be making garments in a few weeks later, on July 31, 1789, the Fifth also provide protective measures for U.S. as trucks. But there’s no hard and fast rule billion in revenue for the United States. Importers must declare the value of their

Jordan?’ The reason,” she said, “is that we Act of Congress established the beginnings industries. “They attempt to level the playing that says this is not dutiable and this is,” she Compared to other countries, U.S. duties goods when the merchandise arrives at a U.S.

have a free trade agreement with Jordan, and of the U.S. Customs Service with customs field, so that U.S. industries can compete said. For example, as Dempsey pointed out, are low. “We don’t charge as much duty as port. They do this by presenting a document

if that garment were made in a country that districts, ports of entry and the machinery for fairly,” said Janet Labuda, the director of high-tech computer chips and integrated some countries that charge exorbitant duties called “an entry,” which has detailed

wasn’t part of an agreement that allowed for collecting duties. CBP’s textile/apparel division in the Office circuits typically are duty-free. “Silicon Valley on our products,” said Labuda. “For example, information about the shipment including its

of International Trade. Furthermore, produces a lot of the integrated circuits here, if women’s cotton blouses are shipped into value and classification.

duties give the United States but they import huge quantities of them, too,” the U.S. from India, the standard duty rate All imported goods are screened using

negotiating leverage through she said. “It’s in the best interest of American is 19.7 percent. But if we ship cotton blouses sophisticated targeting techniques, but only a

Photo by James Tourtellotte

trade agreements. “When a companies to have those items be duty-free.” to India, our goods would be charged small fraction of them are examined. In 2009,

country is given access to 300 35 percent.” CBP examined less than one percent of the

million U.S. consumers duty- Revenue Collections on the Rise The operational workings of the duty goods imported into the country for revenue

free, it’s a very, very large carrot Nonetheless, with the exception of last process aren’t always clear to the public either. purposes. “There’s a whole complicated series

to put out there,” said Strickler. year, the volume of imports and the money Although passengers traveling to the United of rules about why we examine something or

Yet despite the benefits collected from duties are increasing. “We’re States and commercial cargo shipments must why we don’t,” explained Dempsey. “We use

that duties provide, there’s importing more,” said Dan Baldwin, both enter the country through U.S. Customs, risk management principles to determine what

significant pressure on a global assistant commissioner of CBP’s Office of the duty collection process is different for is high-risk, what we would like to look at, and

scale to do away with them. International Trade. “If you look at the trade each. Passengers interact with Customs and what we just want to randomly look at.”

“There’s a worldwide effort to trends for the five previous years, they’re Border Protection officers, who determine After cargo is released, an importer has

reduce tariffs among countries,” going up.” On a typical day, CBP processes if the goods a traveler is bringing into the 10 days to pay duties on the goods and file a

said Dempsey. Discussions $4.7 billion in imports and collects $81 country have been declared properly. In most document called “an entry summary,” which

at the Doha Development million in duties, fees and taxes. The lion’s cases, passengers are entitled to bring in provides even more detailed information

Round, the most recent trade about the value and classification of the

negotiations held by the World merchandise contained in the shipment.

Trade Organization, included “In terms of laws that pertain to duties, The paperwork, duties, and associated fees

a key objective to lower trade are collected and processed by a CBP entry

barriers around the world.

“Duties have gone down CBP safeguards American companies from specialist. However, that’s not the end of

the review. Import specialists then have as

over the years,” said Dempsey, long as 10 months to check the shipment’s

H A CBP officer at the busiest cargo port in the nation, Los Angeles/Long Beach

noting that only 30 percent

of the goods imported into

predatory pricing practices and, in doing so, paperwork to make sure that everything is

classified properly. “When the import duties

in California, awaits a cargo container. the U.S. are dutiable. “The are high amounts, there is a greater potential

U.S. industries that are still protects the U.S. economy."

10 H Demystifying Duties H Frontline H summer 2010 11

that people were shipping things to the review importers that have been selected collecting and protecting the revenue.” Duty deposited into the General Fund, which is

U.S. and describing them in an accurate based on targeted criteria or referrals. rates, which are signed into law by Congress, used to pay for the core functions of the

way? So we came up with a scientific, can only be changed through acts of U.S. government including funding the

statistical measurement system that Preventing Predatory Pricing Congress or proclamations by the president. military, building critical infrastructure such

randomly tests goods that are coming Another one of CBP’s major responsibilities The U.S. Department of Commerce is as roads and bridges and paying for the

into the country.” The statistical system, is law enforcement. The agency enforces responsible for determining rates for justice system,” said Sandra Salstrom, a U.S.

known as “compliance measurement,” laws for nearly 50 U.S. government agencies. antidumping and countervailing duties. Treasury, Department spokesperson.

entails a physical examination of goods. In terms of laws that pertain to duties, Last year, one of the most high-profile Although few seem to notice the

“We still have a dynamic yarn and fabric CBP safeguards American companies from examples of safeguarding U.S. industries money collected from duties, it would be

manufacturing operation in the United predatory pricing practices and, in doing involved Chinese passenger vehicle and light very noticeable if the funds were gone.

States,” said Labuda. “So we’ll do a random so, protects the U.S. economy. CBP enforces truck tires. In September 2009, President “Duties are an important source of

check to see if a shipment that’s described antidumping and countervailing duty laws. Obama issued an executive order adding a revenue,” said Labuda. “They make a major

as ladies’ silk blouses is really made of silk These protections impose penalties on 35 percent duty to the tires so that American contribution to our economy.”

or a manmade fiber such as polyester. If suspiciously low-priced imports to prevent manufacturers could compete more fairly.

we find that the blouse is made of unfair competition from economically Many penalties, however, are significantly

polyester, the duty rate is close to 30 harming U.S. industries. higher. For example, to import fresh garlic

percent, considerably more than silk, One of the predatory practices, from China, an importer must pay an

which is 6.9 percent.” “dumping,” is when a country charges a lower antidumping duty of 376.67 percent over the

Fibers are then analyzed at CBP’s price for a product in a foreign market than standard duty rate of 43 cents per kilogram.

H New or used foreign made vehicles, for personal use or for sale, typically Laboratories and Scientific Services it charges for the same product in its own, In other words, for 300 kilograms of fresh

are dutiable at 2.5 percent of their value. Teleforensic Center to determine their domestic market. The other unfair pricing garlic valued at $10,000, an importer would

content. “We do an analysis to make sure that practice, “countervailing,” is when a foreign pay $129 in duty plus an additional $37,667

the fibers are, in fact, silk as declared and not government subsidizes its exports so that in antidumping duties.

for fraud or other types of underhandedness,” fiscal integrity. “We test transactions to polyester,” explained Labuda. “People ‘mis- they can be sold at a lower price than the Perhaps one of the biggest

said Dempsey. “This is the time when import make sure that we’re collecting the right describe’ their products to get around paying product can be domestically produced and misconceptions about duties is what

specialists can review the paperwork carefully revenues,” said Labuda. “In the mid-1990s, the duties. This is one form of evasion. The sold in another country. happens to the money. As in earlier times,

to verify that the declared value of the goods Congress asked U.S. Customs how we knew other is undervaluing goods.” “CBP has no ability as an agency to the collected funds are used to support the

is accurate.” we were collecting the amount of duties we CBP also conducts audits. The agency set or adjust duty rates,” said Labuda. “As nation. “Duties, like tax revenue or other

But that’s not all CBP does to ensure were supposed to collect. How did we know has 350 auditors nationwide who annually an agency, we merely enforce the law by payments made to the U.S. Treasury, are

Dangerous New Trend in Counterfeit Imports: Inferior, Dangerous Fitness Equipment

U .S. Customs and Border Protection

has identified an alarming new trend

involving the importation of counterfeit exercise

fitness DVDs, home gyms and their accessories,

and popular infomercial products. Currently, the

most commonly seen infringed items are AB Circle,

product looks like, including the logo, the color, the

design, the wording on the label, and the packaging.

The following may be considered red flags that to

and failures during normal usage.

• Improper packaging. Most genuine

exercise and fitness products come with

and pirated items than those of the

genuine product, and pirated DVDs

may not always play properly on a

equipment. The counterfeit equipment may Bowflex, and P90X. raise the consumer’s suspicion about the authenticity nutritional and/or fitness guides and DVD player or computer.

use inferior design and construction, and may In all of fiscal year 2009, which ended Sept. and legitimacy of the product. instructional manuals. In many cases,

contain inferior components, such as an unsteady 30, 2009, CBP made 26 seizures of fake exercise these are packaged inside a high-quality In addition to putting consumer health and financial and

base or an improperly positioned bench, which equipment and DVDs with a domestic value of • Distribution and sale through a channel box that may contain detailed artwork safety at risk, the theft of intellectual property and defense systems.

can lead to muscle pulls, and facial, neck, and approximately $834,000. In the first five months of that differs from the information and advertisements. Counterfeited and trade in counterfeit and pirated goods threatens IPR seizures increased significantly

back injuries. Counterfeit products typically do FY 2010, CBP has already made 57 seizures with a posted on the manufacturer's website pirated goods are often missing the America’s innovation based-economy, the from FY 2002 to FY 2008. The number of IPR

not meet consumer health or safety standards. domestic value of nearly $2.1 million. about where to purchase the product. manuals and other materials. If there are competitiveness of our businesses, the jobs of U.S. seizures increased by 158 percent to 14,992, and

As the federal agency responsible for the Despite increased surveillance by CBP, Manufacturers typically only sell their manuals, they may contain misspellings workers, and, in some cases, national security. The the domestic value of IPR seizures increased by 175

management, control and protection of U.S. borders, numerous fakes still end up on the market. products through authorized retail and other inaccuracies. Further, most trade in these illegitimate goods is associated with percent to over $272 million during this period.

CBP is working hard to protect consumers and Frequently, they are offered for sale on eBay or outlets or websites. The consumer should genuine DVD sets are housed in a high- smuggling and other illegal activities, and often While CBP statistics show the total value of imports

businesses by getting this potentially hazardous Craigslist, or in retail outlets that specialize in high- determine whether or not the seller quality cardboard wallet casing with funds criminal enterprises. Counterfeiting and declined 25 percent in FY 2009, the domestic value

merchandise off the market. CBP is identifying and volume, low-value merchandise. is authorized to sell the product. The individual pockets for each disc. Suspect piracy damage America’s economic vitality directly of IPR seizures decreased just 4 percent from $272.7

targeting high-risk shipments for inspection and At first glance, these products appear to be manufacturer’s website is a good source DVD sets may not contain all of the by reducing sales of legitimate goods, and indirectly million to $260.7 million. The number of seizures

working with the manufacturers whose products are genuine. CBP, however, cautions consumers to take for this information. DVDs and may be in plastic bags that do by reducing employment, incentives to engage declined only 1 percent from 14,992 in FY 2008 to

being copied to raise awareness of the problem. a closer look. Consumers should pay particular • Lack of a product warrantee. Most not protect them from scratching. The in research and development, and tax revenues. 14,841 in FY 2009, with more than 90 percent of

CBP has seen various types of counterfeited attention to the way the goods are shipped and reputable manufacturers will warrantee colors on the boxes and DVD wallet Counterfeit and pirated products can also cripple these IPR seizures resulting from CBP action.

exercise and fitness products, including basic familiarize themselves with what the genuine their products against production defects casing may be duller on the counterfeited critical infrastructure such as communications, —Lynn Hollinger

12 H Demystifying Duties H Frontline H summer 2010 13

You might also like

- 2018-19 DC Swing! CalendarDocument2 pages2018-19 DC Swing! CalendarsulewsamNo ratings yet

- DCDD - Publicity Committee - Planning Meeting - AGENDA (July 2018) (2018!07!10)Document2 pagesDCDD - Publicity Committee - Planning Meeting - AGENDA (July 2018) (2018!07!10)sulewsamNo ratings yet

- Steadfast Partnership - International Advisory Program - Frontline MagazineDocument5 pagesSteadfast Partnership - International Advisory Program - Frontline MagazinesulewsamNo ratings yet

- ICE-HSI - National IPR CenterDocument23 pagesICE-HSI - National IPR CentersulewsamNo ratings yet

- Priority Trade Issue - Textiles - Textile Verification TeamsDocument7 pagesPriority Trade Issue - Textiles - Textile Verification TeamssulewsamNo ratings yet

- Research Study - Collected Letters of SupportDocument7 pagesResearch Study - Collected Letters of SupportsulewsamNo ratings yet

- The Bear Is LooseDocument7 pagesThe Bear Is LoosesulewsamNo ratings yet

- DHS Pride - June Pride Ceremony FlierDocument1 pageDHS Pride - June Pride Ceremony FliersulewsamNo ratings yet

- DHS Pride - Press ReleaseDocument2 pagesDHS Pride - Press ReleasesulewsamNo ratings yet

- DHS Pride By-Laws and Charter Final 10-25-11Document8 pagesDHS Pride By-Laws and Charter Final 10-25-11sulewsamNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Unit 6 Part 2Document7 pagesUnit 6 Part 2api-297591968No ratings yet

- IM 2 - Multiple Choice QuestionsDocument33 pagesIM 2 - Multiple Choice QuestionsHeirvy Nicolas100% (1)

- 2012 Mid Term Fiscal Policy ReviewDocument170 pages2012 Mid Term Fiscal Policy ReviewgizzarNo ratings yet

- Sanitation and Public Health Program in BatangasDocument12 pagesSanitation and Public Health Program in BatangasGellie Lara BautistaNo ratings yet

- American Imperialism WebquestDocument3 pagesAmerican Imperialism WebquestBigboiNo ratings yet

- AAI Fact Sheet 5Document1 pageAAI Fact Sheet 5UnitedWayChicagoNo ratings yet

- Royal Rangers Gold Merit RequirementsDocument27 pagesRoyal Rangers Gold Merit Requirementsccm2361No ratings yet

- Economics of Strategy 6th Edition Solution Manual by Besanko, Dranove, Schaefer, ShanleyDocument6 pagesEconomics of Strategy 6th Edition Solution Manual by Besanko, Dranove, Schaefer, ShanleyDown0% (2)

- 29 Palms SurveyDocument3 pages29 Palms SurveyHal ShurtleffNo ratings yet

- The Growing Need For Multilanguage Customer Support: Research Report & Best Practices GuideDocument45 pagesThe Growing Need For Multilanguage Customer Support: Research Report & Best Practices GuideSangram SabatNo ratings yet

- Winnipeg 20161120 A003 A005 PDFDocument2 pagesWinnipeg 20161120 A003 A005 PDFDanielle DoironNo ratings yet

- ICIS Ethylene and Derivatives (S&D Outlooks) Jan 2019Document9 pagesICIS Ethylene and Derivatives (S&D Outlooks) Jan 2019willbeacham100% (3)

- DI CFS FSI Outlook-BankingDocument70 pagesDI CFS FSI Outlook-Bankinghuizhi guoNo ratings yet

- Singapore International Airlines - Strategy With Smile PDFDocument19 pagesSingapore International Airlines - Strategy With Smile PDFNikita SinhaNo ratings yet

- Oaktree Capital Howard Marks MemoDocument16 pagesOaktree Capital Howard Marks Memomarketfolly.com100% (3)

- Pol 120 Syllabus Edt Spring 2022Document6 pagesPol 120 Syllabus Edt Spring 2022La BombaNo ratings yet

- American Cinema of The 1910sDocument297 pagesAmerican Cinema of The 1910sLeandro Ferrer100% (6)

- Daniel McWilliams - Inv Resume 1Document3 pagesDaniel McWilliams - Inv Resume 1dmacsrdbNo ratings yet

- 2013 E&P Salary Report - CSI Recruiting PDFDocument46 pages2013 E&P Salary Report - CSI Recruiting PDFBilal AmjadNo ratings yet

- Christian Ethics:: Association With PoliticsDocument8 pagesChristian Ethics:: Association With PoliticsIvan CordovaNo ratings yet

- Francis Fukuyama - The Primacy of CultureDocument3 pagesFrancis Fukuyama - The Primacy of CultureYin Li Toh0% (1)

- Brown V Board Research PaperDocument7 pagesBrown V Board Research Paperafnlamxovhaexz100% (1)

- Notice of Voluntary Dismissal of SuitDocument2 pagesNotice of Voluntary Dismissal of SuitBasseemNo ratings yet

- English 12 Test 2Document5 pagesEnglish 12 Test 2Anonymous N6ccr9MVNo ratings yet

- Erin TranscriptDocument1 pageErin Transcriptapi-461228697No ratings yet

- Muhlenberg Architects - Tracy and SwartwoutDocument6 pagesMuhlenberg Architects - Tracy and SwartwoutDeborah Joyce DoweNo ratings yet

- US-China Relations - A Changing World OrderDocument17 pagesUS-China Relations - A Changing World OrderOwen LerouxNo ratings yet

- Feasibility Study of GarmentDocument54 pagesFeasibility Study of GarmentTemesgen Regassa79% (14)

- Krishna BinderDocument27 pagesKrishna Binderapi-3785105No ratings yet

- Texas: American Expeditions and SettlementDocument3 pagesTexas: American Expeditions and Settlementnacho975No ratings yet