Professional Documents

Culture Documents

Form PDF

Uploaded by

Ambika BpOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form PDF

Uploaded by

Ambika BpCopyright:

Available Formats

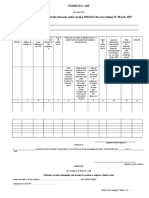

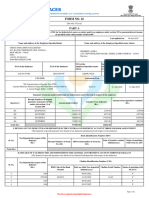

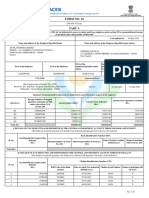

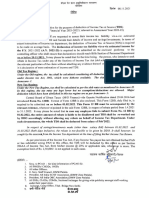

FORM NO.

12B

[See rule 26A]

Form for furnishing details of income under section 192(2) for the year ending 31st March, 2018

Name and address of the employee : Prabhakarappa Shashidhar

Permanent Account No. ____ BFSPS3333A

Residential status ______Resident

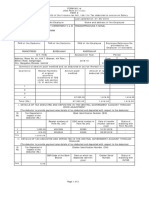

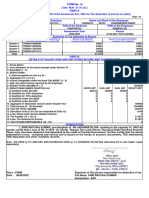

S. No Name and address of TAN of the Permanent Period of Particulars of salary as defined in section 17, paid or due to be paid Total of columns 6, 7, Amount deducted in Total amount of tax Remarks

employer(s) employer(s) as Account Number employment to the employee during the year and 8 respect of life deducted during the

allotted by the of the employer(s) insurance premium, year (enclose

ITO Total amount of Total amount of house Value of perquisites provident fund certificate issued

salary excluding rent allowance, and amount of contribution, etc., to under section 203)

amounts required conveyance allowance accretion to which sec. 80C †

to be shown in and other allowances to employee's provident applies (Give details)

columns 7 and 8 the extent chargeable to fund account (give

tax[See section 10(13A) details in the

read with rule 2A and Annexure)

section 10(14)]

1 2 3 4 5 6 7 8 9 10 11 12

1 Birlasoft India

Limited 01/04/2017 to

DELB06525B AAACB2769E 202366 100974 0 303340 12904 4488

H-9 Sector-63, 18/07/2017

Nodia, 201306

Verification

Prabhakarappa Shashidhar

do hereby declare that what is stated above is true to the best of my knowledge and belief.

I,______________________________________________________

Verified today, the_____________________day of______________________

Place Signature of the employee ____________________

You might also like

- Form For Furnishing Details of Income Under Section 192 (2) For The Year Ending 31 March, 2017Document4 pagesForm For Furnishing Details of Income Under Section 192 (2) For The Year Ending 31 March, 2017Dilip KumarNo ratings yet

- Form No. 12B: (See Rule 26A)Document3 pagesForm No. 12B: (See Rule 26A)sumit vermaNo ratings yet

- Form 12-B Updt23Document4 pagesForm 12-B Updt23Durga prasad DashNo ratings yet

- Form No. 12B Form For Furnishing Details of Income Under Section 192 (2) For The Year Ending 31st MarchDocument3 pagesForm No. 12B Form For Furnishing Details of Income Under Section 192 (2) For The Year Ending 31st MarchkawoNo ratings yet

- FORM 12B - Previous Employment Income DeclarationDocument3 pagesFORM 12B - Previous Employment Income DeclarationsudhakarNo ratings yet

- Annex 6 - Form 12B PDFDocument3 pagesAnnex 6 - Form 12B PDFAnonymous Q1Y71rNo ratings yet

- Form 12B (Previous Employer Income)Document4 pagesForm 12B (Previous Employer Income)Ranga.SathyaNo ratings yet

- Furnishing Income Details - FORM 12BDocument4 pagesFurnishing Income Details - FORM 12BMahi MahajanNo ratings yet

- Income Tax Form 12BDocument3 pagesIncome Tax Form 12BlktyagiNo ratings yet

- Sample Filled Form 12BDocument3 pagesSample Filled Form 12BSanjay sharma50% (2)

- Form No. 12B Form For Furnishing Details of Income Under Section 192 (2) For The Year Ending 31st MarchDocument3 pagesForm No. 12B Form For Furnishing Details of Income Under Section 192 (2) For The Year Ending 31st MarchRakesh PawarNo ratings yet

- Form No. 12B: 2022 Name and Address of The Employee: Permanent Account No.: Residential Status: Date of JoiningDocument3 pagesForm No. 12B: 2022 Name and Address of The Employee: Permanent Account No.: Residential Status: Date of JoiningSantosh Kumar JaiswalNo ratings yet

- 10 Previous Employer 12BDocument3 pages10 Previous Employer 12BvenkyNo ratings yet

- 5-Form12B - Previous Income DetailsDocument2 pages5-Form12B - Previous Income DetailssrinivasNo ratings yet

- Annexure VI - Form 12B - Prior EmploymentDocument1 pageAnnexure VI - Form 12B - Prior EmploymentPruthvi PrakashaNo ratings yet

- Address: of The of The Employee 2021-2022Document3 pagesAddress: of The of The Employee 2021-2022Dipak PArmarNo ratings yet

- Payment of Bonus Act FormsDocument5 pagesPayment of Bonus Act Formspratik06No ratings yet

- FORM16Document10 pagesFORM16Siva Ramakrishna100% (1)

- Form No. 16: (See Rule 31 (1) (A) ) Part ADocument7 pagesForm No. 16: (See Rule 31 (1) (A) ) Part ASiddharth DasNo ratings yet

- New Form 16 AY 11 12Document5 pagesNew Form 16 AY 11 12RMD Financial ServicesNo ratings yet

- Form12B (Past Employer Salary Certificate)Document3 pagesForm12B (Past Employer Salary Certificate)Jackiee1983No ratings yet

- IT Decl Form12BDocument3 pagesIT Decl Form12BPavan KumarNo ratings yet

- DRC01C PartA 09FZMPP1720E2Z8 092023Document2 pagesDRC01C PartA 09FZMPP1720E2Z8 092023ANISH SHAIKHNo ratings yet

- Form 27 Dec 2022Document3 pagesForm 27 Dec 2022srinivasgateNo ratings yet

- Latest Updates in GST - NovDocument6 pagesLatest Updates in GST - NovVishwanath HollaNo ratings yet

- Annual 3683form16Document9 pagesAnnual 3683form16modi jiNo ratings yet

- Circular No. 57/31/2018 GST Dated 04.09.2018Document17 pagesCircular No. 57/31/2018 GST Dated 04.09.2018RAJARAJESHWARI M GNo ratings yet

- Anspg5953f 2018-19Document3 pagesAnspg5953f 2018-19virajv1No ratings yet

- Form No. 16: Part ADocument8 pagesForm No. 16: Part ANidhish AgrawalNo ratings yet

- Employee Tax Declaration - AY 2019-20Document4 pagesEmployee Tax Declaration - AY 2019-20mathuNo ratings yet

- 12bb NR Baria 00402749 2122Document3 pages12bb NR Baria 00402749 2122Dipak PArmarNo ratings yet

- Form 16 FormatDocument2 pagesForm 16 FormatParthVanjaraNo ratings yet

- Globallogic India Limited: Pan No - Aabci2526F Tan No. Deli04813EDocument4 pagesGloballogic India Limited: Pan No - Aabci2526F Tan No. Deli04813EneerajNo ratings yet

- Form No. 16: Part ADocument7 pagesForm No. 16: Part Ahelpdesk svscenterNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument4 pagesForm No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceJeevabinding xeroxNo ratings yet

- Form No 10eDocument3 pagesForm No 10eIncome Tax Department JindNo ratings yet

- Form 16: TLG India Private LimitedDocument9 pagesForm 16: TLG India Private LimitedcagopalofficebackupNo ratings yet

- Form 16 TDS CertificateDocument4 pagesForm 16 TDS Certificateqwerty9999499949No ratings yet

- HDFC Bank Limited: Dear Mr. Vijay Anand A.Document5 pagesHDFC Bank Limited: Dear Mr. Vijay Anand A.A Vijay AnandNo ratings yet

- Form16-2018-19 Part ADocument2 pagesForm16-2018-19 Part AMANJUNATH GOWDANo ratings yet

- Aino Communique Mar 23 113th EditionDocument13 pagesAino Communique Mar 23 113th EditionSwathi JainNo ratings yet

- DownloadDocument6 pagesDownloadpankhewalegNo ratings yet

- Payment of Bonus Rules (Pt.-4)Document9 pagesPayment of Bonus Rules (Pt.-4)Anonymous QyYvWj1No ratings yet

- Nandigam Chandrasekhar Anspc5216h Fy202223 SignedDocument6 pagesNandigam Chandrasekhar Anspc5216h Fy202223 SignedChandrasekhar NandigamNo ratings yet

- Certfcate No.: NB/01992 Form No. 12 BaDocument7 pagesCertfcate No.: NB/01992 Form No. 12 BaKanishk JamwalNo ratings yet

- Form No 16 (By Sagar Goyal)Document3 pagesForm No 16 (By Sagar Goyal)sagarNo ratings yet

- Form 16 Part A: WWW - Taxguru.inDocument10 pagesForm 16 Part A: WWW - Taxguru.inAjit KhurdiaNo ratings yet

- Form No. 16: Part ADocument7 pagesForm No. 16: Part AMithlesh SharmaNo ratings yet

- 2022-23 TDSDocument6 pages2022-23 TDSMujtabaAliKhanNo ratings yet

- Form16 122726 DBKPS7123E AY-2022-23Document9 pagesForm16 122726 DBKPS7123E AY-2022-23Damodar SurisettyNo ratings yet

- Form 16 WORD FORMATEDocument2 pagesForm 16 WORD FORMATEJay83% (46)

- 2018-19 - One97 Communications LTDDocument2 pages2018-19 - One97 Communications LTDBALBINDER MALLNo ratings yet

- ADEPY3125F 2018-19 Form 16 Part BDocument2 pagesADEPY3125F 2018-19 Form 16 Part BAnilNo ratings yet

- Form16 W0000000 GO004610X 2022 20221Document1 pageForm16 W0000000 GO004610X 2022 20221Dharamveer SinghNo ratings yet

- Form 16 2021-2022Document10 pagesForm 16 2021-2022ArchanaNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Bureau of Internal Revenue: Republic of The Philippines Department of Finance Quezon CityDocument4 pagesBureau of Internal Revenue: Republic of The Philippines Department of Finance Quezon CityPrecious AnonuevoNo ratings yet

- RMC No. 102-2020 Annex ADocument2 pagesRMC No. 102-2020 Annex AHerzl Hali V. HermosaNo ratings yet

- CH 1 AmericoDocument10 pagesCH 1 Americojordi92500No ratings yet

- Book Value of Old Asset Cash Payment Cost of New AssetDocument2 pagesBook Value of Old Asset Cash Payment Cost of New AssetPasaoa Clarice V.No ratings yet

- 760 Scra 652 PDFDocument2 pages760 Scra 652 PDFGhost RiderNo ratings yet

- BBP Form 1Document3 pagesBBP Form 1Umalo Libmanan Camarines SurNo ratings yet

- Annexure - Gstam - I (Registered Person's Master File - RPMF To Be Updated On Regular Intervals) - Registered Person's ProfileDocument6 pagesAnnexure - Gstam - I (Registered Person's Master File - RPMF To Be Updated On Regular Intervals) - Registered Person's ProfileHarsh Mani0% (2)

- 17 Ona Vs CIRDocument7 pages17 Ona Vs CIRcertiorari19No ratings yet

- 12 PDFDocument2 pages12 PDFNarayana rao dubaNo ratings yet

- ACTIVITYDocument4 pagesACTIVITYLuna KimNo ratings yet

- Fauquier Good Scout Award Flyer 2018Document1 pageFauquier Good Scout Award Flyer 2018Fauquier NowNo ratings yet

- Asia International Auctioneers, Inc. v. CIRDocument1 pageAsia International Auctioneers, Inc. v. CIRJulie Ann Edquila Padua100% (1)

- 83 ITR 362 106 ITR 119: EditorDocument3 pages83 ITR 362 106 ITR 119: EditorKunwarbir Singh lohatNo ratings yet

- Salary SlipDocument1 pageSalary SlipMonty WaghmareNo ratings yet

- New Microsoft Office Excel WorksheetDocument10 pagesNew Microsoft Office Excel WorksheetACCOUNTS AMBIKAPURNo ratings yet

- Deletions From Cumulative List of Organizations Contributions To Which Are Deductible Under Section 170 of The Code Announcement 2006-28Document1 pageDeletions From Cumulative List of Organizations Contributions To Which Are Deductible Under Section 170 of The Code Announcement 2006-28IRSNo ratings yet

- PLDT Vs Davao City Case DigestDocument3 pagesPLDT Vs Davao City Case DigestRecon DiverNo ratings yet

- RPH 1Document2 pagesRPH 1Amor VillaNo ratings yet

- CTS India Night Shift PolicyDocument4 pagesCTS India Night Shift Policynivasshaan50% (2)

- Apex Clearing One Dallas Center 350 North ST Paul Suite 1300 DALLAS, TX 75201 in Account WithDocument8 pagesApex Clearing One Dallas Center 350 North ST Paul Suite 1300 DALLAS, TX 75201 in Account WithMandy PaweenaNo ratings yet

- Taxation of Employment IncomeDocument7 pagesTaxation of Employment IncomeJamvy Jose FernandezNo ratings yet

- Eco 1)Document3 pagesEco 1)A BPNo ratings yet

- Offer Letter 3Document2 pagesOffer Letter 3kps vlogsNo ratings yet

- Case 1Document3 pagesCase 1Naveen AttigeriNo ratings yet

- Ethiopian Tax Law New Text BookDocument526 pagesEthiopian Tax Law New Text BookUserNo ratings yet

- Foreign Contractor Tax (FCT) : Section A - Multiple Choice QuestionsDocument16 pagesForeign Contractor Tax (FCT) : Section A - Multiple Choice QuestionsWanda NguyenNo ratings yet

- Inter Paper11Document553 pagesInter Paper11PANDUNo ratings yet

- Orca Share Media1540033147945Document17 pagesOrca Share Media1540033147945Melady Sison CequeñaNo ratings yet

- Sample Earnest Money Receipt AgreementDocument2 pagesSample Earnest Money Receipt AgreementRamil AustriaNo ratings yet

- 12 Task Performance 1Document2 pages12 Task Performance 1Maricar EgnpNo ratings yet