Professional Documents

Culture Documents

Economic of Pineapple in Manipur

Uploaded by

swatijoshi_niam08Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Economic of Pineapple in Manipur

Uploaded by

swatijoshi_niam08Copyright:

Available Formats

Economic evaluation of pineapple cultivation in Manipur

Ningombam Anandkumar Singh1*, Ram Singh2, S.M. Feroze3 and Rajkumar Josmee Singh4

*1College of Post Graduate Sstudies, Central Agricultural University, Umiam, Meghalaya, India

2

College of Post Graduate Sstudies, Central Agricultural University, Umiam, Meghalaya, India

3

College of Post Graduate Sstudies, Umiam, Central Agricultural University, Meghalaya, India

4

College of Post Graduate Sstudies, Central Agricultural University, Umiam, Meghalaya, India

ABSTRACT

The present study was conducted in Thoubal, Bishnupur, Senapati and Churchandpur districts of Manipur. Pineapple cultivation

was found to be economically feasible in the state. . In these districts area under pineapple happened to be the major fruit crop

having more than 70 per cent of the total pineapple area of the state during 2013-14 (GoM, 2014). The investment in pineapple

orchard has been found a profitable business. In overall category, the internal rate of return (IRR) has been found 32.53 and 67.33

per cent during summer and winter season. The net present value, Internal rate of return and Benefit-cost ratio at 8 per cent

discount rate have been reported as `24857.80, 32.53 and 1.23, respectively for overall category of orchard during summer season

and `10454.44, 67.33 and 1.24, respectively for overall category of orchard during winter season. The economic productive life of

pineapple orchard in Manipur has been calculated upto 3 years.

Keywords: Net present value, internal rate of return, benefit-cost ratio, pineapple, orchard, manipur

The horticulture sector has been a driving force Over the last decade, the area under horticulture grew

in stimulating a healthy growth trend in Indian by about 45.78 per cent which boost production by 90.26

agriculture. India is currently producing 277.40 MT of per cent, higher growth rate in horticulture was brought

horticulture produce from an area of 24.20 million ha. about by improvement in productivity of horticulture

crops, which increased by about 30.68 per cent between

Access this article online 2001-02 and 2013-14 (GoI, 2014). India ranks second

in fruits and vegetables production in the world, after

Publisher

Website: China (GoI, 2014). The special thrust given to the sector,

http://www.ndpublisher.in

especially after the introduction of the Horticulture

Mission for North East & Himalayan States (HMNEH)

DOI: 10.5958/0976-4666.2016.00006.1 and the National Horticulture Mission (NHM) in the

10th Five Year Plan has borne positive results. Given

Address for correspondence

N.A. Singh: College of Post Graduate Sstudies, Central Agricultural University, Umiam, Meghalaya. Pin- 793103, India

E-mail: ningomanand@gmail.com

Economic Affairs 61(1): 41-44 March 2016 41

Singh et al.

the increasing pressure on land, the focus of growth Value, Internal rate of return, Benefit-Cost Ratio, Break–

strategy is on raising productivity by supporting Even point and Payback period were used.

high density plantations, protected cultivation, micro

irrigation, quality planting material, rejuvenation of Net present value (NPV)

senile orchards and thrust on post harvest management, Net present value of an investment is the discounted rate

to ensure that farmers do not lose their produce in transit of all cash flow and cash inflow of the orchard during its

from farm gate to the consumer’s plate. The Horticulture life time. It was computed as

(fruits including nuts, vegetables including potato,

tuber crops, mushroom, ornamental plants including

n

( B -C )

NPV= ∑ t tt

cut flowers, spices, plantation crops and medicinal and (1+r )

t=0

aromatic plants) has become a key drivers for economic

development in many of the states in the country and it Where,

contributes 30.4 per cent to GDP of agriculture during

Bt = Gross return in time t

2013-14 (http://www.icar.org.in/en/horticulture.htm).

Pineapple occupied an importance in the horticultural Ct = Variable cost in time t

wealth and economy of the country. India ranked seventh r = Rate of interest

among the pineapple producing country in the world t = Time period (t = 0, 1, 2……..)

during 2013-14 (GoI, 2014). Among the leading state of

pineapple production, Manipur is in the sixth rank in Internal Rate of Return (IRR)

production and second highest state in terms of area Internal rate of return is the rate of return at which the

coverage under pineapple cultivation; the state shares net present value of a stream of payments/ income is

only 0.75 per cent of the total fruit area of the country equal to zero. It was calculated as

(GoI, 2014). Area under pineapple production was

present worth of the

observed to increase in Manipur, but the productivity

cash flow at the

is still low compare with the other state (GoM, 2014). lower

difference

lower discounte rate

×

The farmers are always interested in maximizing their IRR= + between the

discount rate absolute difference between

two discount rate

profit and not merely production. Therefore, there is a the present worth of the

need to carry out a benefit cost and returns analysis is cash flow at the two discounte rate

carried out systematically and this study is an effort in

that direction. Benefit Cost Ratio (BCR)

The benefit cost ratio (BCR) of an investment is the

Materials and Methods ratio of the discounted value of all cash inflow to the

The present study was conducted in four villages discounted value of all cash inflows during the life of

viz., Lisanmlok and Kaprang of Thoubal district, the project. It was estimated as

Maibamlokpa ching, Wainem and Bungchi Chiru of

Bishnupur district, Khunyai, Khunjao and Khunou

BCR = ∑

n

t (

B / (1 + r )t

)

of Senapati district and Khousabung, Bunglon and t

t=0 ∑ ( Ct ) / (1 + r )

Koirentak of Churchandpur district of Manipur during

2013-14. The primary data were collected from the

Where,

respondents through personal interview method on pre-

tested well structured questionnaire. Total 120 pineapple Bt = Gross return in time t

growers were selected randomly and categorised into

Ct = Variable cost in time t

three categories viz, small (up to 0.58 ha), medium (0.59

to 1.13 ha) and large (1.14 ha and above). For analysis r = Rate of interest

of data, economic efficiency measures viz., Net Present t = Time period (t = 0, 1, 2, ……..)

42 Economic Affairs 61(1): 41-44 March 2016

Economic evaluation of pineapple cultivation in Manipur

Pay-back period `14999.04 for small, `39127.09 for medium, `57076.84 for

the large and the overall was `24857.80, the net present value

The pay-back period is defined as the length of time

was observed high in large category farm as compared to

required to recover an initial investment through cash

small and medium farms. It may be due to better management

flow generated by the investment. It was estimated as

practices and proper use of available resources at large farms.

Cost of investment Internal rate of return ranging from 23.31 per cent in small

Pay back period =

Annual net cash flow to 49.94 per cent in large farm in indicated that pineapple

growing was a profitable enterprise and average rate of return

Break-even point per year for the whole period of the orchard will be 23.31 per

Break-even point is the point at which the cent for small, to 46.34 per cent for medium and 49.94 per

cent for large farm. Average internal rate of return for overall

two curves, total cost curve and total revenue curve

farm was estimated that 32.53 per cent. The B-C ratio was

intersect each other which indicate the level of estimated as 1:1.16 for small, 1:1.34 for medium and 1:1.40

production at which the producer neither loss money for the large category with an average ratio of 1:1.23. The

nor makes a profit. It was calculated by using the benefit cost ratio was found to be more in the large category

following formulae because of increase productivity of large farms. The B-C ratio

analysis indicates that the investment in pineapple orchard is

TFC

BEP = economically viable and on an average 1 investment brings

ASP-AVC

1.23 returns during summer season. The break-even point of

Where, small orchard was reached at 21.64 qtl, 28.69 qtl and 54.97

qtl in small, medium and large category of orchard. Overall,

TFC = Total fixed cost the average break-even point was worked out to be 26.29 qtl.

ASP = Average sale price of pineapple Further, the payback period was estimated at 1.40 years in

AVC = Average variable cost small orchard, 1.10 years in medium orchard and 1.05 years

in large orchard from bearing year. Overall, it was found to be

Results and Discussion 1.27 years after fruiting to repay back the investment incurred

in the orchard during summer season. Therefore, the pineapple

Economic viability of pineapple orchard cultivation was economical in the study area. Similarly, Kichu

The economic feasibility indicators of pineapple orchard and Sharma (2014), and Rymbai et al. (2012) in which study

during summer season are presented in Table 1. The Net reported that the pineapple cultivation was economically

Present Value of pineapple orchard was estimated as feasible.

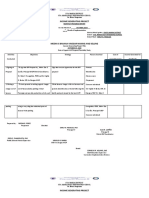

Table 1: Net present value, Internal rate of return, Benefit-Cost ratio, Break-Even point and Payback period during summer season

Category Net Present Internal rate of Benefit- Cost Break-Even Payback

Value (`) return (%) ratio point (Q) period (Year)

Small 14999.04 23.31 1.16 21.64 1.40

Medium 39127.09 46.34 1.34 28.69 1.10

Large 57076.84 49.94 1.40 54.97 1.05

Overall 24857.80 32.53 1.23 26.29 1.27

The economic feasibility indicators of pineapple orchard overall was `10454.44, the net present value was observed

during winter season are presented in Table 2. The Net Present high in large category farm as compared to small and medium

Value of pineapple orchard was estimated as `10515.11 for farms. It may be due to better management practices and

small, `12060.07 for medium, `16964.22 for the large and the proper use of available resources at large farms. Internal rate

Economic Affairs 61(1): 41-44 March 2016 43

Singh et al.

of return ranging from 67.23 per cent in small to 87.02 per during winter season. The break-even point of small orchard

cent in large farm in indicated that pineapple growing was a was reached at 12.81 qtl, 13.46 qtl and 14.33 qtl in small,

profitable enterprise and average rate of return per year for medium and large category of orchard. Overall, the average

the whole period of the orchard will be 67.23 per cent for break-even point was worked out to be 13.32 qtl. Further, the

small, to 79.65 per cent for medium and 87.02 per cent for payback period was estimated at 0.81 years in small orchard,

large farm. Average internal rate of return for overall farm was 0.81 years in medium orchard and 0.71 years in large orchard

estimated that 67.33 per cent. The B-C ratio was estimated as from bearing year. Overall, it was found to be 0.85 years after

1:1.27 for small, 1:1.27 for medium and 1:1.33 for the large fruiting to repay back the investment incurred in the orchard

category with an average ratio of 1:1.24. The benefit cost ratio during winter season. Therefore, the pineapple cultivation was

was found to be more in the large category because of increase economical in the study area. Similarly, Kichu and Sharma

productivity of large farms. The B-C ratio analysis indicates (2014) and Rymbai et al. (2012) in which study reported that

that the investment in pineapple orchard is economically the pineapple cultivation was economically feasible.

viable and on an average 1 investment brings 1.24 returns

Table 2: Net present value, Internal rate of return, Benefit- Cost ratio, Break-Even point and Payback period during winter season

Category Net Present Internal rate of Benefit- Cost Break-Even Payback period

Value (`) return (%) ratio point (Q) (Year)

Small 10515.11 67.23 1.27 12.81 0.81

Medium 12060.07 79.65 1.27 13.46 0.81

Large 16964.22 87.02 1.33 14.33 0.71

Overall 10454.44 67.33 1.24 13.32 0.85

Conclusion 1.05 0.85 year in small, medium, large and overall category.

To enhance the pineapple production in the study area, there

The study has revealed that investment in pineapple orchards

is a need to develop infrastructural facilities to reduce post-

is an economically profitable, financially viable and socially

harvest losses and a suitable scientific package of pineapple in

acceptable business in both summer and winter season in

local dialect should be prepared for the pineapple orchardist.

Manipur. During summe season, the Net Present Value

was work out to be `14999.04, `39127.09, `57076.84 and References

`24857.80 in small, medium, large and overall category.

GoI. 2014. Indian horticulture data base. Government of India.

Internal rate of return was 23.31, 46.34, 49.94 and 32.53 per

NHB.

cent in small, medium, large and overall category. Benefit-

GoM 2014. Directorate of Horticulture and Soil Conservation,

Cost Ratio was at 1.16, 1.34, 1.40 and 1.23 in small, medium, Government of Manipur.

large and overall category. Break–Even point was 21.64, GoM 2013. Directorate of economics and statistics. Government

28.69, 54.97 and 26.29 qtl in small, medium, large and overall of Manipur.

category. Payback period was at 1.40, 1.10, 1.05 and 1.05 year Kichu, Y., and Sharma, A. 2014. Economics and constraint of

in small, medium, large and overall category. During winter pineapple cultivation in Dimapur district of Nagaland Agri-

season, the Net Present Value was work out to be `10515.11, Business Potentials in India. Experiences from the hill states 217-

223.

`12060.07, `16964.22 and `10454.44 in small, medium, large

and overall category. Internal rate of return was 67.23, 79.65, Rymbai, D., Singh, R., Feroze, S. M. and Bardoloi, R. 2012. Benefit-

cost ratio analysis of pineapple orchard in Meghalaya. Indian

87.02 and 67.33 per cent in small, medium, large and overall Journal of Hill Farming 25(1): 9-12.

category. Benefit-Cost Ratio was at 1.27, 1.27, 1.33 and 1.24

in small, medium, large and overall category. Break–Even

Websites

point was 12.81, 13.46, 14.33 and 13.32 qtl in small, medium,

large and overall category. Payback period was at 0.81, 0.71, (http://www.icar.org.in/en/horticulture.htm)

44 Economic Affairs 61(1): 41-44 March 2016

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Chocolate Recipes 2Document81 pagesChocolate Recipes 2kathrynbax100% (2)

- Social Studies 7th Grade Africa Teacher NotesDocument29 pagesSocial Studies 7th Grade Africa Teacher NotesDavid BriggsNo ratings yet

- Crafting A Livelihood - DasraDocument37 pagesCrafting A Livelihood - Dasraswatijoshi_niam08No ratings yet

- 2 Revised BIMP-EAGA PresentationDocument61 pages2 Revised BIMP-EAGA PresentationCarlos C. Tabunda, Jr.No ratings yet

- Customer Service Handbook English PDFDocument22 pagesCustomer Service Handbook English PDFsasikumar_s7898100% (1)

- Agricultural Marketing in UttarkhandDocument12 pagesAgricultural Marketing in Uttarkhandswatijoshi_niam08No ratings yet

- Global Potato Flakes IndutryDocument8 pagesGlobal Potato Flakes Indutryswatijoshi_niam08No ratings yet

- Cpri Vision 2050Document39 pagesCpri Vision 2050swatijoshi_niam08No ratings yet

- Kufri FrysonaDocument7 pagesKufri Frysonaswatijoshi_niam08No ratings yet

- Bhutan RNR Statistics-2017Document170 pagesBhutan RNR Statistics-2017swatijoshi_niam08No ratings yet

- Case of Potato Export BangladeshDocument6 pagesCase of Potato Export Bangladeshswatijoshi_niam08No ratings yet

- Potato Study A Competitive Analysis of The South African Potato Industry 051009Document73 pagesPotato Study A Competitive Analysis of The South African Potato Industry 051009swatijoshi_niam08No ratings yet

- Technical Newsletters Agriculture Web 062016Document8 pagesTechnical Newsletters Agriculture Web 062016swatijoshi_niam08No ratings yet

- Vision 2022-Dairy Development English - 0 - 0Document68 pagesVision 2022-Dairy Development English - 0 - 0swatijoshi_niam08No ratings yet

- Psws Probability Prop Size BierrenbachDocument5 pagesPsws Probability Prop Size BierrenbachCarlos Isla RiffoNo ratings yet

- Vision 2022-Dairy Development English - 0 - 0Document68 pagesVision 2022-Dairy Development English - 0 - 0swatijoshi_niam08No ratings yet

- Vision 2022-Dairy Development English - 0 - 0 PDFDocument68 pagesVision 2022-Dairy Development English - 0 - 0 PDFswatijoshi_niam08No ratings yet

- Vision 2022-Dairy Development English - 0 - 0Document68 pagesVision 2022-Dairy Development English - 0 - 0swatijoshi_niam08No ratings yet

- Basic Animal Husbandry and Fisheries Statistics 2017 (English Version) - 5Document188 pagesBasic Animal Husbandry and Fisheries Statistics 2017 (English Version) - 5swatijoshi_niam08No ratings yet

- Food Processing January 2017Document48 pagesFood Processing January 2017swatijoshi_niam08No ratings yet

- ACTIF Report On Competitive Supply Side Analysis of CTA Sectors in - Kenya, Sudan, Tanzania and Uganda - Varun Vaid - 2011Document155 pagesACTIF Report On Competitive Supply Side Analysis of CTA Sectors in - Kenya, Sudan, Tanzania and Uganda - Varun Vaid - 2011swatijoshi_niam08No ratings yet

- USDA Report On AppleDocument9 pagesUSDA Report On Appleswatijoshi_niam08No ratings yet

- IcacDocument7 pagesIcacswatijoshi_niam08No ratings yet

- Comparitive Analysis of Cotton Sector ReformDocument13 pagesComparitive Analysis of Cotton Sector Reformswatijoshi_niam08No ratings yet

- TurmericDocument13 pagesTurmericvaratharaj_mech1582No ratings yet

- Comparitive Analysis of Cotton Sector ReformDocument13 pagesComparitive Analysis of Cotton Sector Reformswatijoshi_niam08No ratings yet

- French Style ServiceDocument25 pagesFrench Style Serviceamalyna_said0% (1)

- Breadmaker DelonghiDocument27 pagesBreadmaker DelonghiLagoon400No ratings yet

- Introduction To Ricettario Di Pasticceria e Cucina Del Nord ItaliaDocument3 pagesIntroduction To Ricettario Di Pasticceria e Cucina Del Nord ItaliajackNo ratings yet

- Frozen ProductsDocument14 pagesFrozen ProductsSteffi ClaroNo ratings yet

- Elicitors in Plant Tissue Culture PDFDocument6 pagesElicitors in Plant Tissue Culture PDFPavithra SivarajaNo ratings yet

- Eat Well... Stay WellDocument23 pagesEat Well... Stay WellZeeZeeNo ratings yet

- Reproductive Performance and Blood Constituents of Damascus Goats As Affected by YeastDocument18 pagesReproductive Performance and Blood Constituents of Damascus Goats As Affected by YeastRaj CellaNo ratings yet

- WMJ March 2019Document25 pagesWMJ March 2019Anonymous WIhmu39ibwNo ratings yet

- Consumer Behavior - Dominoz & PizzaDocument27 pagesConsumer Behavior - Dominoz & PizzaAmrit Raz100% (1)

- 2015 Summer Program InfromationDocument3 pages2015 Summer Program InfromationSylvieGProteauNo ratings yet

- CAS-No.: Molecular Formula: Structure:: Amendment 49Document7 pagesCAS-No.: Molecular Formula: Structure:: Amendment 49Luig ZattaNo ratings yet

- Chicken Tikka Masala - Cafe DelitesDocument9 pagesChicken Tikka Masala - Cafe Delitesliunokas davidNo ratings yet

- Appetite: Jayson L. Lusk, Brenna EllisonDocument7 pagesAppetite: Jayson L. Lusk, Brenna EllisonAnisa DyahNo ratings yet

- Soal B Inggris LM Kelas XIDocument5 pagesSoal B Inggris LM Kelas XISiti Atiqah ElsaputraNo ratings yet

- Beth Bartram Free Meal PlannerDocument1 pageBeth Bartram Free Meal PlannermakeupdianacNo ratings yet

- The Ants' Party: Find, Circle and WriteDocument3 pagesThe Ants' Party: Find, Circle and WriteLucas Raul CuezzoNo ratings yet

- Beginner Unit 11a (2) (2) ResueltoDocument3 pagesBeginner Unit 11a (2) (2) ResueltoCarlos Fabian LopezNo ratings yet

- CarbohydratesDocument10 pagesCarbohydratesshajmalikNo ratings yet

- Supporting Biofuels: A Case Study On The Law of Unintended Consequences?Document14 pagesSupporting Biofuels: A Case Study On The Law of Unintended Consequences?LTE002No ratings yet

- Suka Meena B. Perez Igp November To June Final Igp Finalmonthly Progress ReportDocument25 pagesSuka Meena B. Perez Igp November To June Final Igp Finalmonthly Progress ReportMEENA PEREZNo ratings yet

- Step by Step To The Perfect PedicureDocument6 pagesStep by Step To The Perfect PedicurepinkyNo ratings yet

- S1 GE PaperDocument8 pagesS1 GE PapermelanieplchanNo ratings yet

- Essay - India The Problem of Poverty Amidst PlentyDocument11 pagesEssay - India The Problem of Poverty Amidst PlentysibiadhithyaNo ratings yet

- Oksana Resume 2018Document1 pageOksana Resume 2018api-404432279No ratings yet

- 201208081Document1 page201208081Yng TangNo ratings yet

- Creating An Effective China "Cold Supply Chain": Current Status, Challenges and Implementation ConsiderationsDocument20 pagesCreating An Effective China "Cold Supply Chain": Current Status, Challenges and Implementation ConsiderationsfarhafarhaNo ratings yet