Professional Documents

Culture Documents

Domingo vs. Garlitos

Uploaded by

Janeen ZamudioOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Domingo vs. Garlitos

Uploaded by

Janeen ZamudioCopyright:

Available Formats

EN BANC each person shall contribute, and may issue execution if circumstances require" (Rule 89,

G.R. No. L-18994 June 29, 1963 section 6; see also Rule 74, Section 4; Emphasis supplied.) And this is not the instant case.

MELECIO R. DOMINGO, as Commissioner of Internal Revenue, petitioner, The legal basis for such a procedure is the fact that in the testate or intestate proceedings to settle the estate

vs. of a deceased person, the properties belonging to the estate are under the jurisdiction of the court and such

HON. LORENZO C. GARLITOS, in his capacity as Judge of the Court of First Instance of Leyte, jurisdiction continues until said properties have been distributed among the heirs entitled thereto. During

and SIMEONA K. PRICE, as Administratrix of the Intestate Estate of the late Walter Scott the pendency of the proceedings all the estate is in custodia legis and the proper procedure is not to allow

Price, respondents. the sheriff, in case of the court judgment, to seize the properties but to ask the court for an order to require

Office of the Solicitor General and Atty. G. H. Mantolino for petitioner. the administrator to pay the amount due from the estate and required to be paid.

Benedicto and Martinez for respondents. Another ground for denying the petition of the provincial fiscal is the fact that the court having jurisdiction

LABRADOR, J.: of the estate had found that the claim of the estate against the Government has been recognized and an

This is a petition for certiorari and mandamus against the Judge of the Court of First Instance of Leyte, amount of P262,200 has already been appropriated for the purpose by a corresponding law (Rep. Act No.

Ron. Lorenzo C. Garlitos, presiding, seeking to annul certain orders of the court and for an order in this 2700). Under the above circumstances, both the claim of the Government for inheritance taxes and the

Court directing the respondent court below to execute the judgment in favor of the Government against the claim of the intestate for services rendered have already become overdue and demandable is well as fully

estate of Walter Scott Price for internal revenue taxes. liquidated. Compensation, therefore, takes place by operation of law, in accordance with the provisions of

It appears that in Melecio R. Domingo vs. Hon. Judge S. C. Moscoso, G.R. No. L-14674, January 30, Articles 1279 and 1290 of the Civil Code, and both debts are extinguished to the concurrent amount, thus:

1960, this Court declared as final and executory the order for the payment by the estate of the estate and ART. 1200. When all the requisites mentioned in article 1279 are present, compensation takes

inheritance taxes, charges and penalties, amounting to P40,058.55, issued by the Court of First Instance of effect by operation of law, and extinguished both debts to the concurrent amount, eventhough

Leyte in, special proceedings No. 14 entitled "In the matter of the Intestate Estate of the Late Walter Scott the creditors and debtors are not aware of the compensation.

Price." In order to enforce the claims against the estate the fiscal presented a petition dated June 21, 1961, It is clear, therefore, that the petitioner has no clear right to execute the judgment for taxes against the

to the court below for the execution of the judgment. The petition was, however, denied by the court which estate of the deceased Walter Scott Price. Furthermore, the petition for certiorari and mandamus is not the

held that the execution is not justifiable as the Government is indebted to the estate under administration in proper remedy for the petitioner. Appeal is the remedy.

the amount of P262,200. The orders of the court below dated August 20, 1960 and September 28, 1960, The petition is, therefore, dismissed, without costs.

respectively, are as follows: Padilla, Bautista Angelo, Concepcion, Barrera, Paredes, Dizon, Regala and Makalintal, JJ., concur.

Atty. Benedicto submitted a copy of the contract between Mrs. Simeona K. Price, Bengzon, C.J., took no part.

Administratrix of the estate of her late husband Walter Scott Price and Director Zoilo Castrillo

of the Bureau of Lands dated September 19, 1956 and acknowledged before Notary Public

Salvador V. Esguerra, legal adviser in Malacañang to Executive Secretary De Leon dated

December 14, 1956, the note of His Excellency, Pres. Carlos P. Garcia, to Director Castrillo

dated August 2, 1958, directing the latter to pay to Mrs. Price the sum ofP368,140.00, and an

extract of page 765 of Republic Act No. 2700 appropriating the sum of P262.200.00 for the

payment to the Leyte Cadastral Survey, Inc., represented by the administratrix Simeona K.

Price, as directed in the above note of the President. Considering these facts, the Court orders

that the payment of inheritance taxes in the sum of P40,058.55 due the Collector of Internal

Revenue as ordered paid by this Court on July 5, 1960 in accordance with the order of the

Supreme Court promulgated July 30, 1960 in G.R. No. L-14674, be deducted from the amount

of P262,200.00 due and payable to the Administratrix Simeona K. Price, in this estate, the

balance to be paid by the Government to her without further delay. (Order of August 20, 1960)

The Court has nothing further to add to its order dated August 20, 1960 and it orders that the

payment of the claim of the Collector of Internal Revenue be deferred until the Government

shall have paid its accounts to the administratrix herein amounting to P262,200.00. It may not

be amiss to repeat that it is only fair for the Government, as a debtor, to its accounts to its

citizens-creditors before it can insist in the prompt payment of the latter's account to it, specially

taking into consideration that the amount due to the Government draws interests while the

credit due to the present state does not accrue any interest. (Order of September 28, 1960)

The petition to set aside the above orders of the court below and for the execution of the claim of the

Government against the estate must be denied for lack of merit. The ordinary procedure by which to settle

claims of indebtedness against the estate of a deceased person, as an inheritance tax, is for the claimant to

present a claim before the probate court so that said court may order the administrator to pay the amount

thereof. To such effect is the decision of this Court in Aldamiz vs. Judge of the Court of First Instance of

Mindoro, G.R. No. L-2360, Dec. 29, 1949, thus:

. . . a writ of execution is not the proper procedure allowed by the Rules of Court for the

payment of debts and expenses of administration. The proper procedure is for the court to order

the sale of personal estate or the sale or mortgage of real property of the deceased and all debts

or expenses of administrator and with the written notice to all the heirs legatees and devisees

residing in the Philippines, according to Rule 89, section 3, and Rule 90, section 2. And when

sale or mortgage of real estate is to be made, the regulations contained in Rule 90, section 7,

should be complied with.1äwphï1.ñët

Execution may issue only where the devisees, legatees or heirs have entered into possession of

their respective portions in the estate prior to settlement and payment of the debts and expenses

of administration and it is later ascertained that there are such debts and expenses to be paid, in

which case "the court having jurisdiction of the estate may, by order for that purpose, after

hearing, settle the amount of their several liabilities, and order how much and in what manner

You might also like

- Pantranco vs. NLRCDocument4 pagesPantranco vs. NLRCJaneen ZamudioNo ratings yet

- DeclarationOfLivingMan MHTDocument3 pagesDeclarationOfLivingMan MHTRachel Rey100% (3)

- Rent Receipt: #5,6th Cross, 18th Main, Narayan Gowda Layout, Bangalore-29Document1 pageRent Receipt: #5,6th Cross, 18th Main, Narayan Gowda Layout, Bangalore-29Ragavendran KanagarajNo ratings yet

- Legal and Ethical Environment of BusinessDocument356 pagesLegal and Ethical Environment of BusinessMaria Har100% (1)

- Republic Vs Bacolod Murcia MillingDocument7 pagesRepublic Vs Bacolod Murcia MillingRhoddickMagrataNo ratings yet

- Republic vs. Bacolod-Murcia Milling Co. Inc., GR No. L-19824-26 Dated July 9, 1966Document8 pagesRepublic vs. Bacolod-Murcia Milling Co. Inc., GR No. L-19824-26 Dated July 9, 1966MoonNo ratings yet

- Home LoanDocument26 pagesHome LoanVandan SapariaNo ratings yet

- SC Affirms Adultery Conviction Despite PardonDocument1 pageSC Affirms Adultery Conviction Despite PardonRe doNo ratings yet

- Constitutional Construction-Power of Judicial ReviewDocument75 pagesConstitutional Construction-Power of Judicial ReviewJerahmeel CuevasNo ratings yet

- 5yr Prog Case Digests PDFDocument346 pages5yr Prog Case Digests PDFMary Neil GalvisoNo ratings yet

- Bautista v. Commission On ElectionsDocument25 pagesBautista v. Commission On Electionsryusuki takahashiNo ratings yet

- Republic VH IzonDocument4 pagesRepublic VH IzonanailabucaNo ratings yet

- Tax VAT CIR Vs GotamcoDocument3 pagesTax VAT CIR Vs GotamcoRhea Mae A. SibalaNo ratings yet

- Villanueva vs. City of Iloilo, 26 SCRA 578 (1968) : Castro, J.Document5 pagesVillanueva vs. City of Iloilo, 26 SCRA 578 (1968) : Castro, J.billy joe andresNo ratings yet

- 06-Receivables TheoryDocument2 pages06-Receivables TheoryRegenLudevese100% (4)

- Taxation I General Principles Course OutlineDocument4 pagesTaxation I General Principles Course OutlineJunelyn T. EllaNo ratings yet

- LTO v. City of ButuanDocument2 pagesLTO v. City of Butuan8111 aaa 1118No ratings yet

- GR No. 195834 - Salvador vs. PatriciaDocument2 pagesGR No. 195834 - Salvador vs. PatriciaBea CapeNo ratings yet

- SLC NotesDocument803 pagesSLC NotesManishankar SharmaNo ratings yet

- Risiko LikuiditasDocument19 pagesRisiko LikuiditasmiftaNo ratings yet

- G.R. No. 174156 FIlcar Transport Vs Espinas Registered OwnerDocument13 pagesG.R. No. 174156 FIlcar Transport Vs Espinas Registered OwnerChatNo ratings yet

- Lopez Vs LiboroDocument1 pageLopez Vs LiboroemersonNo ratings yet

- ANTIFENCING - People Vs de GuzmanDocument4 pagesANTIFENCING - People Vs de GuzmanKathlyn DacudaoNo ratings yet

- Cir v. John Gotamco - SonsDocument2 pagesCir v. John Gotamco - SonsLEIGH TARITZ GANANCIALNo ratings yet

- Forensic Chemistry Lecture on Scope and PracticeDocument12 pagesForensic Chemistry Lecture on Scope and Practiceswitch hero100% (1)

- Regalian Doctrine and land classificationDocument80 pagesRegalian Doctrine and land classificationAndrea IvanneNo ratings yet

- 1 Churchill v. ConcepcionDocument7 pages1 Churchill v. ConcepcionJoan Dela CruzNo ratings yet

- CIR Vs CA Power of CIR PDFDocument6 pagesCIR Vs CA Power of CIR PDFLouise Nicole Alcoba100% (1)

- Cred Trans Cases 012316Document143 pagesCred Trans Cases 012316Kristian Weller Peñanueva LicupNo ratings yet

- Kapisanan NG Mga Kawani NG Energy Regulatory Board v. Commissioner Fe Barin, G.R. No. 150974, June 29, 2007Document1 pageKapisanan NG Mga Kawani NG Energy Regulatory Board v. Commissioner Fe Barin, G.R. No. 150974, June 29, 2007Ynah TantugNo ratings yet

- Comelec v. Datu-ImanDocument2 pagesComelec v. Datu-ImanJerome AzarconNo ratings yet

- SALES Chapter 10 Remedies (Tables)Document4 pagesSALES Chapter 10 Remedies (Tables)ada9ablaoNo ratings yet

- Sps. Morata v. Sps. Go (Conciliation Mandatory Even in Cases Under RTC)Document4 pagesSps. Morata v. Sps. Go (Conciliation Mandatory Even in Cases Under RTC)Sarah Jane-Shae O. SemblanteNo ratings yet

- Natcher Vs CADocument2 pagesNatcher Vs CANC BergoniaNo ratings yet

- Labor laws and contractsDocument3 pagesLabor laws and contractsJaneen ZamudioNo ratings yet

- 11 CIR Vs La Suerte Cigar GR No. 144942 PDFDocument6 pages11 CIR Vs La Suerte Cigar GR No. 144942 PDFJeanne CalalinNo ratings yet

- CIR vs. AyalaDocument11 pagesCIR vs. AyalaEvan NervezaNo ratings yet

- Zambales Chromite - Soriano Case DigestsDocument41 pagesZambales Chromite - Soriano Case DigestsJezenEstherB.PatiNo ratings yet

- Perez, Hilado v. CADocument9 pagesPerez, Hilado v. CAPepper PottsNo ratings yet

- Labrador vs. Court of Appeals, April 5, 1990Document2 pagesLabrador vs. Court of Appeals, April 5, 1990Karen Sheila B. Mangusan - Degay100% (1)

- Joint Fundraising Agreement (HVF) FINALDocument8 pagesJoint Fundraising Agreement (HVF) FINALCSEvaluationNo ratings yet

- Musorin D EF3e - Int - Filetest - 2aDocument5 pagesMusorin D EF3e - Int - Filetest - 2aDmitrii Ivanov33% (3)

- Vashdeo Gagoomal v. Spouses Villacorta, G.R. No. 192813, January 18, 2012Document3 pagesVashdeo Gagoomal v. Spouses Villacorta, G.R. No. 192813, January 18, 2012Emmanuel SilangNo ratings yet

- Case Digest SalesDocument3 pagesCase Digest Salesantolin becerilNo ratings yet

- 027-Lutz v. Araneta, 98 Phil 148Document3 pages027-Lutz v. Araneta, 98 Phil 148Jopan SJ100% (1)

- Tax Amnesty Renders Case MootDocument2 pagesTax Amnesty Renders Case MootWhoopi Jane MagdozaNo ratings yet

- Eliseo A. SINON, Petitioner, Agriculture-Reorganization Appeals Board AND JUANA BANAN, Respondents. G.R. No. 101251 November 5, 1992 Campos, JR., J.Document3 pagesEliseo A. SINON, Petitioner, Agriculture-Reorganization Appeals Board AND JUANA BANAN, Respondents. G.R. No. 101251 November 5, 1992 Campos, JR., J.Abbie MedinaNo ratings yet

- 1-Evangelista V SantiagoDocument13 pages1-Evangelista V SantiagoChoi Choi100% (1)

- International Harvester Macleod Inc. V.Document6 pagesInternational Harvester Macleod Inc. V.Elmer Dela CruzNo ratings yet

- Separate Legal Personality of CorporationsDocument55 pagesSeparate Legal Personality of CorporationsJanineNo ratings yet

- Reyes vs. RTC of Makati 561 SCRA 593Document11 pagesReyes vs. RTC of Makati 561 SCRA 593morningmindsetNo ratings yet

- Bpi Leasing Corp. v. CA, 416 Scra 4 (2003)Document19 pagesBpi Leasing Corp. v. CA, 416 Scra 4 (2003)inno KalNo ratings yet

- Shangri-La vs. Developers Group of CompanyDocument18 pagesShangri-La vs. Developers Group of CompanyKrister Vallente100% (1)

- CIR v. CTA and PetronDocument15 pagesCIR v. CTA and PetronJennylyn Biltz AlbanoNo ratings yet

- 9 - Aisporna v. CA (GR L-39419, 12 April 1982)Document6 pages9 - Aisporna v. CA (GR L-39419, 12 April 1982)Bj CaridoNo ratings yet

- Lutz vs. Araneta, 98 Phil. 148, December 22, 1955Document6 pagesLutz vs. Araneta, 98 Phil. 148, December 22, 1955milkteaNo ratings yet

- LTD Batch 3Document16 pagesLTD Batch 3Hannah SyNo ratings yet

- La Naval Drug Corp Vs CADocument2 pagesLa Naval Drug Corp Vs CAUE LawNo ratings yet

- CIR - V - Algue, Inc., & CTA G.R. No. L-28896 February 17, 1988Document2 pagesCIR - V - Algue, Inc., & CTA G.R. No. L-28896 February 17, 1988piptipaybNo ratings yet

- CIR Vs Magsaysay Lines - G.R. No. 146984Document9 pagesCIR Vs Magsaysay Lines - G.R. No. 146984Christelle Ayn BaldosNo ratings yet

- WHO vs Aquino Diplomatic Immunity CaseDocument4 pagesWHO vs Aquino Diplomatic Immunity CaseIvy ParillaNo ratings yet

- 18 Manila Electric Company vs. Province of LagunaDocument7 pages18 Manila Electric Company vs. Province of Lagunashlm bNo ratings yet

- Double Jeopardy RulingDocument19 pagesDouble Jeopardy RulingMary Grace Soriano GurtizaNo ratings yet

- Union Bank of The Philippines vs. SantibañezDocument9 pagesUnion Bank of The Philippines vs. SantibañezArjay PuyotNo ratings yet

- Four siblings not liable as partnershipDocument4 pagesFour siblings not liable as partnershipKrister VallenteNo ratings yet

- Bagong Pilipnas Vs NLRCDocument2 pagesBagong Pilipnas Vs NLRCJas Em BejNo ratings yet

- Phil Stock Exchange Inc Vs CA - 125469 - October 27, 1997 - J. Torres, JR - Second DivisionDocument8 pagesPhil Stock Exchange Inc Vs CA - 125469 - October 27, 1997 - J. Torres, JR - Second Divisionlala reyesNo ratings yet

- Tax DigestsDocument16 pagesTax DigestsReina MarieNo ratings yet

- G.R. No. 78780. July 23, 1987. 152 SCRA 284 Case DigestDocument1 pageG.R. No. 78780. July 23, 1987. 152 SCRA 284 Case DigestKTNo ratings yet

- CJH Development Corporation Vs Bureau of Internal Revenue Et AlDocument6 pagesCJH Development Corporation Vs Bureau of Internal Revenue Et AlThe ChogsNo ratings yet

- CIR v. RTN 1992Document2 pagesCIR v. RTN 1992Aiken Alagban LadinesNo ratings yet

- Labor CaseDocument2 pagesLabor CaseRene ValentosNo ratings yet

- Government Claim Against Estate Denied Due to CompensationDocument2 pagesGovernment Claim Against Estate Denied Due to Compensationroilene checkNo ratings yet

- Nawasa Application FormDocument3 pagesNawasa Application FormJaneen ZamudioNo ratings yet

- Outline in Criminal LawDocument18 pagesOutline in Criminal LawJaneen ZamudioNo ratings yet

- Arellano, Et Al. v. Powertech CorporationDocument4 pagesArellano, Et Al. v. Powertech CorporationJaneen ZamudioNo ratings yet

- Heirs of Anacleto Nieto Vs Municipality of MeycauayanDocument6 pagesHeirs of Anacleto Nieto Vs Municipality of MeycauayanAgatha LeeNo ratings yet

- 065-Ruga v. NLRC G.R. Nos. L-72654-61 January 22, 1990Document2 pages065-Ruga v. NLRC G.R. Nos. L-72654-61 January 22, 1990Janeen ZamudioNo ratings yet

- 004-Mercury Drug Corporation v. NLRC G.R. No. 75662 September 15, 1989Document1 page004-Mercury Drug Corporation v. NLRC G.R. No. 75662 September 15, 1989Janeen ZamudioNo ratings yet

- Shell Refinery Workers Union Appeals Labor Dispute RulingDocument12 pagesShell Refinery Workers Union Appeals Labor Dispute RulingJaneen ZamudioNo ratings yet

- 046-Oriental Mindoro Electric Cooperative, Inc. v. NLRC G.R. No. 111905 JulDocument2 pages046-Oriental Mindoro Electric Cooperative, Inc. v. NLRC G.R. No. 111905 JulJaneen ZamudioNo ratings yet

- Labor Case - StandardsDocument4 pagesLabor Case - StandardsJaneen ZamudioNo ratings yet

- Supreme Court rules on certification election for teachers and non-teaching staffDocument6 pagesSupreme Court rules on certification election for teachers and non-teaching staffJaneen ZamudioNo ratings yet

- Basaya, Jr. Et - Al. vs. MilitanteDocument3 pagesBasaya, Jr. Et - Al. vs. MilitanteCielo ZamudioNo ratings yet

- Labor CaseDocument7 pagesLabor CaseJaneen ZamudioNo ratings yet

- Supreme Court: Republic of The Philippines ManilaDocument1 pageSupreme Court: Republic of The Philippines ManilaJaneen ZamudioNo ratings yet

- 037-Gelmart Industries (Phils.) v. Leogardo G.R. No. 70544 November 5, 1987Document2 pages037-Gelmart Industries (Phils.) v. Leogardo G.R. No. 70544 November 5, 1987Janeen ZamudioNo ratings yet

- Case 1 Carlos vs. VillegasDocument1 pageCase 1 Carlos vs. VillegasJaneen ZamudioNo ratings yet

- Labor CaseDocument1 pageLabor CaseJaneen ZamudioNo ratings yet

- Labor CaseDocument11 pagesLabor CaseJaneen ZamudioNo ratings yet

- Labor CasesDocument1 pageLabor CasesJaneen ZamudioNo ratings yet

- Governing Board TESDADocument2 pagesGoverning Board TESDAJaneen ZamudioNo ratings yet

- Sameer Overseas Compared To Gallant Serrano CaseDocument8 pagesSameer Overseas Compared To Gallant Serrano CasemaechmedinaNo ratings yet

- 009-Associated Labor Union v. Borromeo G.R. No. L-26461 November 27, 1968Document2 pages009-Associated Labor Union v. Borromeo G.R. No. L-26461 November 27, 1968Janeen ZamudioNo ratings yet

- 011-Franklin Baker Company v. Trajano G.R. No. 75039 January 28, 1988Document2 pages011-Franklin Baker Company v. Trajano G.R. No. 75039 January 28, 1988Janeen ZamudioNo ratings yet

- Cases 1-6 PDFDocument30 pagesCases 1-6 PDFJaneen ZamudioNo ratings yet

- Telefunken Semconductors Employees Union vs. CADocument12 pagesTelefunken Semconductors Employees Union vs. CAJaneen ZamudioNo ratings yet

- BLR order for certification election assailedDocument2 pagesBLR order for certification election assailedJaneen ZamudioNo ratings yet

- 022-Dy v. NLRC G.R. No. L-68544 October 27, 1986Document2 pages022-Dy v. NLRC G.R. No. L-68544 October 27, 1986Janeen ZamudioNo ratings yet

- Concept Builders vs. NLRCDocument2 pagesConcept Builders vs. NLRCJaneen ZamudioNo ratings yet

- Kukan Int vs. ReyesDocument4 pagesKukan Int vs. ReyesJaneen ZamudioNo ratings yet

- MFRS123Document23 pagesMFRS123Kelvin Leong100% (1)

- AJK AdoptationsDocument20 pagesAJK AdoptationsAsif Masood Raja88% (8)

- LTD Case To DigestDocument75 pagesLTD Case To DigestSandro SorianoNo ratings yet

- Canara Bank Education LoanDocument23 pagesCanara Bank Education Loanprashun ChoudharyNo ratings yet

- 2023form - Impact Evaluation FormDocument11 pages2023form - Impact Evaluation FormKram Ynothna BulahanNo ratings yet

- UNIT II PPT - Venture CapitalDocument28 pagesUNIT II PPT - Venture CapitalShivam Goel100% (1)

- MH, GUJ & MP Textile Policy ComparisionDocument16 pagesMH, GUJ & MP Textile Policy Comparisionsureshganji06No ratings yet

- Income Tax II Illustration Clubbing of Incomes PDFDocument1 pageIncome Tax II Illustration Clubbing of Incomes PDFSubramanian SenthilNo ratings yet

- Bond ValuationDocument13 pagesBond Valuationsouvik.icfaiNo ratings yet

- Accommodation Bills of ExchangeDocument5 pagesAccommodation Bills of Exchangenaumanahmad867129No ratings yet

- Financial Statement Analysis Chapter 10 PPPDocument32 pagesFinancial Statement Analysis Chapter 10 PPPToufiq AitNo ratings yet

- Mba 1 Sem Management Accounting 4519201 S 2019 Summer 2019 PDFDocument4 pagesMba 1 Sem Management Accounting 4519201 S 2019 Summer 2019 PDFDeepakNo ratings yet

- Article - Effectiveness of Internal Control System in State Commercial Banks in Sri LankaDocument20 pagesArticle - Effectiveness of Internal Control System in State Commercial Banks in Sri LankaMahendra KunkuNo ratings yet

- Every Transfer of ImmovableDocument3 pagesEvery Transfer of ImmovableAdan HoodaNo ratings yet

- A Project On Sme Sector in India - Recent 9886649997Document72 pagesA Project On Sme Sector in India - Recent 9886649997Nadeem Naddu89% (9)

- Adjusting Entries Practice QuestionsDocument7 pagesAdjusting Entries Practice QuestionsmianwaseemNo ratings yet

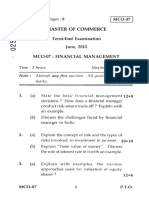

- MCO-7 June12Document7 pagesMCO-7 June12BinayKPNo ratings yet

- Creative Brief For Perodua MyviDocument10 pagesCreative Brief For Perodua MyviIsnanda Sofman Johara SiregarNo ratings yet

- 2019 BUSINESS LAW EXAMINABLE SUPPLEMENTDocument21 pages2019 BUSINESS LAW EXAMINABLE SUPPLEMENTQwerty19oNo ratings yet