Professional Documents

Culture Documents

Far 34PW-2 PDF

Uploaded by

Ryan PelitoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Far 34PW-2 PDF

Uploaded by

Ryan PelitoCopyright:

Available Formats

'l -rl

4i ii ..,,.r, ,r,,,,,h,*

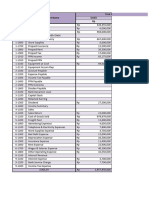

The followrng transactions affecting the accounts receivable of Sweden Co. took place during the year 2016:

" --1-.i. 7-";'

I

i.:,

Sales (cash anrl credit) P 600.000 .

1,.. .

1

Cash received from cash customers 209,800- n -fr

';"-'.:. - Cash received from credit customers (P237,65A was received ;_r",fit ,'".:.",i i,'.:. -

t :.

from customers who took advantage of the discount feature ' \i ' 'J _

,i..,. ,j.*n "'t"7,"

,

..ii ^..",".,"i"*",:?[r:l;r*g::TTiiai:;idi-

' Credit memoranda issued to credit customers for sales returns and

allowances

'o?',333

25,000

'

i,/.i,' 1..

,:

1-f - Cash refunds given to cash customers for sales returrs and allowances 15,000 - . . t''r

' Recoveries on accounts receivable written off as uncolle,Jible in prior periods -:'- l,,l'

( lot included in cash collecticrrs above ) 8,500 , ..,

t.;;.t.A,',-t i:i','-

An,;lgifreof receivables indicate that *P 7,5O0 of the egcounts receivable.batance are'deemed uncollectible' '),,^

t ,,i'T-3,'.' .,"i :, f.b'f-

The following balances were taken from the December 31, 2015 balance sheet: Accounts Receivable- P 90,00O; Allowance fpr badi

debts- P 1,400

r 6. What is the accounts receivable ledger balance at December 31, 2O16?

a. 60,000 c.52.650

b. 61,150 d. ,0,000

\.. 7, How much is the!?q-g*e!_tii expense reported in the income statement for the year ended December 31, 2016?

'i a. 4,9OO c. 7,500

b. 2,600 d.11,100

On January 1,2OL5, Thailand Company sold a building for P--5,000,q0f0 to Bangkok Company. Bangkok Company paid P-5q-O,O0O

.down and signed a noninterest bearing note for the balance which is payable in3 equal annual installments every gecelatber;31 of

'each year. The carrying value oJ the building is P4,2O0)000. Assume prevailing interest rate-for a note of this type is L?o/o. The

presentvalueof.anordinaryannirtyof lforthreepbriodsis2.40lB- *,;...

.r"- ,._.,;j i,,.,).:.,, itt.;,;kfi.{t.

l. t '- ?

,' i',1-.: f.. f-' \

a. How much as the interest income for the year 2016? "^-i ii

a. 600,000 c. 432,324

b. 492,324 d. 540,000 -l ' {.1

it

\,...-t.,

9. How much is the carrying value of notes on December 3L, 2O16?

a. 3,000,000 c.2,535,O24 f ,-) J ''

b. 3,602,700 d.4,o35,024

Zeus Con-rpany rncluded the fol:olrring items in ri-s inventory on December 31, 2O16:

> Merchandise out on consignment to Hera, at .sales price, p3,000,000

> Goods purchased in transit, FOB Shipprng point 2,000,000

, 1'r'.

Goods held on consignment from Ares Company 1,000,000

i Goods sold in transit ,FOB shipping point, at sel€s pnce 4,500,000

> Freight paid by Zeus on consigned goods to t.lei-a 1OO,00O

> Freight paid by Ares Company 5O,0OO

> Freight paid by Zeus on goods purchased 10,000 f't\

> Freight paid by Zeus on goods sold to custon-rer j r',, ;'..-'?; 20,000

> Mark-up on cost is25ok. Consigned goods were still unsdld at December 31,2016,

10. How much should be included in zeus's correct cost of inventory on December 31, 2O16 ? '

\ a. 5,010,000 c. 4,410,000

b. 4,510,000 d. 5,000,000

During 2016, Tartarus Company signe$a nonceDceleble ccntract to purchase 5O0 sacks of rice at p9O0 per sack with delivery to

be

made in z!]t on December st,1ot$ tne iiice c{ir-ii6 r,iir.i falien t,: P 850 per sack. on May 9, 2017, Tartarus company accepts

deliveryof ricewhenthepriceisPSs0persack. \. n.,-,... ' ,:ii /'rj

-.9":1,.v;' },r.pv]r,-1. -.\,laf ,.;l ,,: -,'*,., ,.; j.r1,.. l, ,"'.--1

i1... i ,,1 ,.,,.,,,, !.

, 11. In Decem_ber 31, 2O16 income statement, what amount o{_op,s_g1_!,Uf_clrgsg*c.oMlltmendsrhould be recogniziid?' '

a. 15,000 c. ziooo

b, 10,000 d. 0

t 12' what amount of j9-c9vgr,y of loss.on purchase commitment shoutd Tartarus recognize on May gt ZO,-7,?

a. 10,000 c.25,000 lt,-./..,.L,, .1, i, .'.r.,p.i,l , - ;..1r., ,:l. i,,

.

b' 15'ooo d' 0 : 1" ^.

Grapes Comp,anv purchased 20-OOO2rdinary shares .rf Ubas Corp. for PTOO,OOO which includes P5,OOO transaction cost, on January

-', ii',)tf /: ,,;',/..{

7,2077. December 31, 201fthe shares were selling at !l2r rvhich increased to_l3tj,on December 31, 2018.

On lune 30, 2019, Ubas Corp. distributed 20olo bonus issu,-:. Oir July 15, 20i9, Grapes Company sold'15,000 shares 6tl'q.3$ per

share, On December 3!, 2O!9, Ubas Corp. sTEIes iere sellrng at e34.lper share.

r r i'

If Grapes Companv classified the investment as held for.IradLnS-rdetdr6gglhe_fglglgin.S!

, 13, The amount of unrealized-gains,or.lossfi jrrit Shoutd be included in the profit or loss statement for the year

/ ended December 31,2O17.

b. 55,000 d. 20,000 l,

PREWEEK-FAR ( BATCH 34 ) D^-^ a a

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Carding 20K To Bitcoin For $100Document7 pagesCarding 20K To Bitcoin For $100Kamerom CunninghamNo ratings yet

- UntitledDocument247 pagesUntitledSTYX HELIX100% (1)

- Barclays CMBS Strategy Weekly Comparing Moodys and Kroll Valuations On 2015 CondDocument20 pagesBarclays CMBS Strategy Weekly Comparing Moodys and Kroll Valuations On 2015 CondykkwonNo ratings yet

- Entrepreneurship - Quarter 2 Week 9Document8 pagesEntrepreneurship - Quarter 2 Week 9SHEEN ALUBANo ratings yet

- 01 REA Mock 250 ItemsDocument31 pages01 REA Mock 250 ItemsRECEPTION AND DIAGNOSTIC CENTER RDC MEDICAL SECTIONNo ratings yet

- AMFI Sample 500 Questions.Document35 pagesAMFI Sample 500 Questions.amankumar sahuNo ratings yet

- Chap 009Document20 pagesChap 009Ela PelariNo ratings yet

- 1,,, A. o 61-Oo, Ooo c.200,000: Tirii.t'Document1 page1,,, A. o 61-Oo, Ooo c.200,000: Tirii.t'Ryan PelitoNo ratings yet

- Far 34PW-9 PDFDocument1 pageFar 34PW-9 PDFRyan PelitoNo ratings yet

- Loo, Ooo:, A. 24o, 7oa t92,2SO L Z: ' B. 2oo, 5g3 23a, 7a0 .. Ifi Ur"Document1 pageLoo, Ooo:, A. 24o, 7oa t92,2SO L Z: ' B. 2oo, 5g3 23a, 7a0 .. Ifi Ur"Ryan PelitoNo ratings yet

- 3j-2Q!7. Iunds Iiot: ,,.rse. O1Document1 page3j-2Q!7. Iunds Iiot: ,,.rse. O1Ryan PelitoNo ratings yet

- Far 34PW-1 PDFDocument1 pageFar 34PW-1 PDFRyan PelitoNo ratings yet

- P1 3402-2 PDFDocument1 pageP1 3402-2 PDFRyan PelitoNo ratings yet

- 'iil'ff: Ii:: 2eo, Ooo t5'7,3L3 " 161,104 164,895)Document1 page'iil'ff: Ii:: 2eo, Ooo t5'7,3L3 " 161,104 164,895)Ryan PelitoNo ratings yet

- Ap 34PW-2 PDFDocument1 pageAp 34PW-2 PDFRyan PelitoNo ratings yet

- Prt6,8oo Li (I, Ffi: Ffihouldthecompanyreport?c) P206,800?/rJ.I,,,:Jl, JDocument1 pagePrt6,8oo Li (I, Ffi: Ffihouldthecompanyreport?c) P206,800?/rJ.I,,,:Jl, JRyan PelitoNo ratings yet

- P1 3402-1 PDFDocument1 pageP1 3402-1 PDFRyan PelitoNo ratings yet

- Accountin - , I.t,: ,., ResaDocument1 pageAccountin - , I.t,: ,., ResaRyan PelitoNo ratings yet

- Ap 34PW2-4Document1 pageAp 34PW2-4Ryan PelitoNo ratings yet

- Ap 34PW2-2 PDFDocument1 pageAp 34PW2-2 PDFRyan PelitoNo ratings yet

- Ap 34PW-1 PDFDocument1 pageAp 34PW-1 PDFRyan PelitoNo ratings yet

- Reyes TacandongDocument1 pageReyes TacandongRyan PelitoNo ratings yet

- Market ProjDocument5 pagesMarket ProjRyan PelitoNo ratings yet

- SculptureDocument2 pagesSculptureRyan PelitoNo ratings yet

- Frequency Polygon: Class Limits Class Boundari Es F X CFDocument2 pagesFrequency Polygon: Class Limits Class Boundari Es F X CFRyan PelitoNo ratings yet

- ACCT 302 - Assignment 01 - Questions PaperDocument4 pagesACCT 302 - Assignment 01 - Questions Paperايهاب حسنىNo ratings yet

- Siklus Akuntansi Pada PT Adi JayaDocument11 pagesSiklus Akuntansi Pada PT Adi Jayafitrianura04No ratings yet

- BMA 12e SM CH 16 FinalDocument15 pagesBMA 12e SM CH 16 Finalmandy YiuNo ratings yet

- Option Trading Playbook Prior To ExpirationDocument2 pagesOption Trading Playbook Prior To ExpirationRavi RamanNo ratings yet

- Daily Cash Flow Template ExcelDocument60 pagesDaily Cash Flow Template ExcelPro ResourcesNo ratings yet

- Overseas Bank of Manila vs. Court of AppealsDocument10 pagesOverseas Bank of Manila vs. Court of AppealsClaudia LapazNo ratings yet

- Case StudyDocument2 pagesCase Studyaly catNo ratings yet

- Notes On Mishkin Chapter 8 (Econ 353, Tesfatsion)Document10 pagesNotes On Mishkin Chapter 8 (Econ 353, Tesfatsion)Karthikeyan PandiarasuNo ratings yet

- Foreign Exchange Spot Forward SwapDocument2 pagesForeign Exchange Spot Forward SwapSherzad DurraniNo ratings yet

- Narasimham Committee ReportDocument4 pagesNarasimham Committee ReportSumit MehtaNo ratings yet

- Financial Literacy For KidsDocument7 pagesFinancial Literacy For KidsNithiNo ratings yet

- Finable 23Document45 pagesFinable 23Manisha PandaNo ratings yet

- The Foreign Exchange Matrix: A New Framework For Traders To Understand Currency MovementsDocument7 pagesThe Foreign Exchange Matrix: A New Framework For Traders To Understand Currency MovementsAnthony FilpoNo ratings yet

- (External) / (Externe)Document6 pages(External) / (Externe)Corey SmallsNo ratings yet

- UBS Investment Fund Account/Custody Account RegulationsDocument2 pagesUBS Investment Fund Account/Custody Account RegulationsLeonardo RivasNo ratings yet

- Basic Format Published AccountDocument4 pagesBasic Format Published AccountNur Fatin Fasihah Sa'at100% (1)

- 1 Income From PGBPDocument12 pages1 Income From PGBPAllaretrashNo ratings yet

- Macroeconomics: Principles ofDocument56 pagesMacroeconomics: Principles ofKogo VickNo ratings yet

- Exercise 2 - AccountingDocument2 pagesExercise 2 - AccountingAnna Jeramos25% (4)

- Managerial Economics An Analysis of Business IssuesDocument25 pagesManagerial Economics An Analysis of Business Issueslinda zyongweNo ratings yet

- Course Module 5 Mathematics of InvestmentDocument22 pagesCourse Module 5 Mathematics of InvestmentAnne Maerick Jersey OteroNo ratings yet

- Bank Loan Monthly Payment 1,984 Set Cell: Deemed Rental To Value: Deposit Interest by Changing CellDocument18 pagesBank Loan Monthly Payment 1,984 Set Cell: Deemed Rental To Value: Deposit Interest by Changing Cellhstham08No ratings yet

- Chapter 9 Interest and DepreciationDocument24 pagesChapter 9 Interest and Depreciationluca.castelvetere04No ratings yet