Professional Documents

Culture Documents

Loo, Ooo:, A. 24o, 7oa t92,2SO L Z: ' B. 2oo, 5g3 23a, 7a0 .. Ifi Ur"

Uploaded by

Ryan PelitoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Loo, Ooo:, A. 24o, 7oa t92,2SO L Z: ' B. 2oo, 5g3 23a, 7a0 .. Ifi Ur"

Uploaded by

Ryan PelitoCopyright:

Available Formats

I

Imolicit interest rate l4o/o 4.r.,

Present value of an annuity of 1 in advance for 10 periods dt L4o/o 5.g5 2l) v 'r

Present value of an crdinary annuity of 1 for 10 periods 5.22

Present value of 1 for 1O periods at l4o/o o.27

!!{g$-g residual value loo,ooo L+(

48. How much is the depreciation expense for the year 2At7? ,rr,,ui lrr :,

-L;;,;')-

, a. 24o,7oa c. t92,2SO l€ z/ . ::_i 7..,_:_J..' _ n:{

' b. 2oo,5g3 d- 23a,7a0 t : 7r_

.. 49. How much should chicago company recosnize as losg*g.-!! tinpp-9-rs.1s!ft"- -ifi tJ? (E{J *ur" rc"="o asset is

r. Bro;Q9lftren returned io Bults

a. 30,000

Co.? 1ia-' i^::i

c. 100,000 l'.\ -

i, ,,

b. 70,000 d. 0 I .

,'.-,

\'- , *i-

Miami Company leased equjpment from Heat Inc. on J.u-iy-1, 2+L7-for an 8-year period. lqual

ir,- -payments

.

under the lease are

f900-,Q00tnd are due on.JY-) of each year. The first payment was made on fql-y \39t2. The interest rate conteqphted by Miami

and Heat is-10!. The carffirralue of the equipment on ileat's accounting reccrdsl5,p2,B0o,oo0. Residual ,uf uu fnrrgorgqOalir,"

end of lease term is guaranteed-by Miami. The lease is appropriately recorded as a sal6i$ftluas'e.

Present value of an annuity of 1 in advance for B periods at 10o/o 5.87 i;)i;<-

Present value of an ordinary annuity of 1 for 8 periods at 10o/o 5.33

Present value of 1 for B periods at 10o/o 0.47 41 ;

"t 50. How much is the d,e-aler's profit-that Heat Inc. should recognize for the year 2Ol7? ;p! 1,,ini tp'. i,us

a. 722,000 c. 769,000 'sq..L2 frva.n U21K

b. 3\a:) -

:^31a;

384,500 d. 48,063 ,

i 51. How much is the sales that shoutd be recognized by Heat Inc.?

1; ;;l t ..-)'.t'/

. ;- t

,):t<

, ,r/ r,-

ilr""t .,

3,522,000 c. 3,245,000

b. 3,569,000 d. 3,198,000 I

t- 52' How much is Ure SlEt-,olgoods sold. that should be recognized by Heat Inc. assuming the residual value is

urguqa-OieedZ-

e. 2.800.000 c.3,569,000

5. 2.753,CO0 d.3,522,000

Or !pr'! ':.20L7, Golden State Company ieased a delivery truck from Warriors Company under 6 five-fear operating

rent rcr ine terrn of the lease will be payable as follows: lease. Total

First 9 months at P 2OO,OOO/mo.

Next 18 months at 1O0,OOO/mo.

Next 12 months at BO,OOO/mo. iyi,^, Qp,Ni1',,,

Last 14 months at

Last 7 months at

50,000/mo.

70,000/mo.

_?'.,,- .Ir,r

:',

1-:.'rrt , 't- * ,l ,:: .fr?.;;

53' How much should Golden state company report as r9r!t grpgll,eg for the year ended December 3L, 2ol:7?

a. 862,500

b. 1,150,000

c. 1,800.000

d. 5,750,000

The accountant of Gambit Company presented to you the following information

income tax related balances:

in line with your 2015 audit of Gambit company,s

Pre-tax financial income

Impairment loss on Machinery

P 3,000,000 zt-:

50,000

Unearned rental income

Prepaid advertising expense

350,000 ,fr,I trn'i'i

-i6.j '?';'*

Interest income o,i ti"iu J.posit

it"'"1,y/i Rtl") ?ravn tlii.

250,000

80,000

*) ,'fr|';

Excess tax depreciation over accoUnting depreciation

Installment sale which will be recognized as taxable income upon collection

Bad debts expense using a method under accrual basis

420,000

900,000

75,000

k[:,9\il*

Provision for warranty

Income.tax rate is constant at 30o/o for all years

1BO,O00 ihr #[::H t

:r 54. How much is the deferred tax asset at December 31, 2O15?

ir a. 196,500 b. 47I,OOO c. 191,500 d. 495,000

,: 55. How much is the deferred tax liability at December 31, 2Ol5?

a. 196,500 b. 47L,OOA c. 1g1,50O d. 495,000

sorcerer's stone company had the foflowing ordinary share activity in 2417:

January 1- 5OO,0OO ordinary shares outstanding 5n,i *Lr ',1, ,7

i{-I--

March 1- Issued new 60,000 ordinary shares b1'r: .. ? I to'.,ru= int-

lune 1- Ordinary share was split 2 for 1

\

November 1- Reacquired 48,000 ordinary shares uik Y L,'i-L

r ('^

=

u * N(91_ '..1','{

PREWEEK-FATI BATCH 3' }

You might also like

- 3j-2Q!7. Iunds Iiot: ,,.rse. O1Document1 page3j-2Q!7. Iunds Iiot: ,,.rse. O1Ryan PelitoNo ratings yet

- Practice Multiple Choice Test 3: II-llDocument10 pagesPractice Multiple Choice Test 3: II-llapi-3834751No ratings yet

- Pitysics: Zimbabwe School Examii' (At'IonsDocument5 pagesPitysics: Zimbabwe School Examii' (At'IonsLaura MkandlaNo ratings yet

- Errors and Accounting ChangesDocument8 pagesErrors and Accounting ChangesAndrew Benedict PardilloNo ratings yet

- Darc!:, (,'1 "... 1 T),, t:1, Il, /LDocument3 pagesDarc!:, (,'1 "... 1 T),, t:1, Il, /LRohit Parmar (Computer Operator, Bangalore)No ratings yet

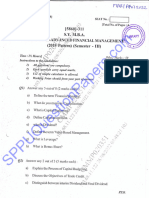

- Postgraduate PG Mba Semester 3 2022 May Advanced Financial Management Pattern 2019Document4 pagesPostgraduate PG Mba Semester 3 2022 May Advanced Financial Management Pattern 2019girishpawarudgirkarNo ratings yet

- Postgraduate PG Mba Semester 3 2022 March Advanced Financial Management Pattern 2019Document4 pagesPostgraduate PG Mba Semester 3 2022 March Advanced Financial Management Pattern 2019Tushar ChaudhariNo ratings yet

- Img 20240226 0001Document1 pageImg 20240226 0001joyalconada230No ratings yet

- Accountant Sample PaperDocument10 pagesAccountant Sample PaperAgastya KarnwalNo ratings yet

- 62-Sakoli, MaharashtraDocument3 pages62-Sakoli, MaharashtraAtul YadavNo ratings yet

- Jan-Feb2023 18Document1 pageJan-Feb2023 18Umera AhmedNo ratings yet

- MPC002758 - GC (LMA) ' Oct'22 Salary AdjDocument8 pagesMPC002758 - GC (LMA) ' Oct'22 Salary AdjKhushboo AgrawalNo ratings yet

- TL M Ry: Distributed: C. Outstanding:....... / C. No - Otsslettersoutstanding:....... ."/.. E. Issuecl:.Document1 pageTL M Ry: Distributed: C. Outstanding:....... / C. No - Otsslettersoutstanding:....... ."/.. E. Issuecl:.Osman BanguraNo ratings yet

- Big City - 5334 - (Bert Paige-Pol Stone)Document35 pagesBig City - 5334 - (Bert Paige-Pol Stone)Ralph SuttonNo ratings yet

- Sorcerer's Stone Company EPS and Share ValuationDocument1 pageSorcerer's Stone Company EPS and Share ValuationRyan PelitoNo ratings yet

- Dec 208 Jan 2019Document2 pagesDec 208 Jan 2019Keshava PrajwalNo ratings yet

- Capital Budgeting Analysis for Lewisville WarehouseDocument14 pagesCapital Budgeting Analysis for Lewisville WarehouseQueen Jean MielNo ratings yet

- Fundamentals Of: Fifth GmosDocument1 pageFundamentals Of: Fifth GmospatilrajucNo ratings yet

- Adobe Scan Nov 20, 2020Document1 pageAdobe Scan Nov 20, 2020Leila BrownNo ratings yet

- Accounting for Current AssetsDocument1 pageAccounting for Current AssetsRyan PelitoNo ratings yet

- SEC Form 23-A Filing by Coco Deuce Holdings for Axelum ResourcesDocument6 pagesSEC Form 23-A Filing by Coco Deuce Holdings for Axelum ResourcesCarlsberg AndresNo ratings yet

- Request RfpdocumentsDocument221 pagesRequest RfpdocumentsSHASHANKNo ratings yet

- Img 0002Document3 pagesImg 0002Ayan DuttaNo ratings yet

- Adobe Scan 6 Feb 2024Document2 pagesAdobe Scan 6 Feb 2024kohinoorcheema06No ratings yet

- HMWSSB Tender Time Rule RelaxationDocument2 pagesHMWSSB Tender Time Rule RelaxationNarsing RaoNo ratings yet

- b#3231333Document1 pageb#3231333Abdullah Shahbaz CheemaNo ratings yet

- A-Levels Accounting 2004 AnswersDocument36 pagesA-Levels Accounting 2004 Answersbetty makushaNo ratings yet

- GSM and CDMA comparisonDocument1 pageGSM and CDMA comparisonGaurav KataraNo ratings yet

- Cel464 Minor1 Sem1 08Document1 pageCel464 Minor1 Sem1 08donotpanicNo ratings yet

- Quality Control PlanDocument15 pagesQuality Control PlanMuhammad IrfandiNo ratings yet

- FS'-P I: ???33: E ,'.". (,, A RyDocument2 pagesFS'-P I: ???33: E ,'.". (,, A RyAnurekha PrasadNo ratings yet

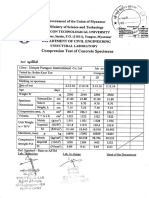

- Compression Test Results of Concrete SpecimensDocument1 pageCompression Test Results of Concrete SpecimensMin Khant KyawNo ratings yet

- XXXX PDFDocument1 pageXXXX PDFMin Khant KyawNo ratings yet

- RESA First Pre-Board ExamDocument14 pagesRESA First Pre-Board ExamMark LagsNo ratings yet

- Decision: Republic of The Philippines of Tax Appeals QuezonDocument6 pagesDecision: Republic of The Philippines of Tax Appeals QuezonGabriel EmersonNo ratings yet

- Decision: Republic of The Philippines of Tax Appeals QuezonDocument6 pagesDecision: Republic of The Philippines of Tax Appeals QuezonGabriel EmersonNo ratings yet

- Zimbabwe' T (Ocl: Examii/Ations CILDocument6 pagesZimbabwe' T (Ocl: Examii/Ations CILLaura MkandlaNo ratings yet

- BRC - Bananaman Review Center Set2Document16 pagesBRC - Bananaman Review Center Set2Paul AbonitaNo ratings yet

- Cost analysis and decision makingDocument4 pagesCost analysis and decision makingyen c aNo ratings yet

- Financial Results - Q3 2020-21Document8 pagesFinancial Results - Q3 2020-21Puneet kumarNo ratings yet

- Tamil Nadu Urban Land Tax Act, 1966 PDFDocument58 pagesTamil Nadu Urban Land Tax Act, 1966 PDFLatest Laws TeamNo ratings yet

- Tamil Nadu Urban Land Tax Act, 1966Document58 pagesTamil Nadu Urban Land Tax Act, 1966Latest Laws TeamNo ratings yet

- 14-!L9Rsyq) .Y SL (S: 22) (T T (G //, (T,'Oo /ruDocument1 page14-!L9Rsyq) .Y SL (S: 22) (T T (G //, (T,'Oo /ruJimuel Sanchez CayabasNo ratings yet

- Me-Construction Sem1 Ccam-Cbcgs May19Document1 pageMe-Construction Sem1 Ccam-Cbcgs May19Rohil JulaniyaNo ratings yet

- 078 Bhadra All QuestionsDocument9 pages078 Bhadra All QuestionsNabin KalauniNo ratings yet

- Amul Business ModelDocument8 pagesAmul Business ModelSʜʌʜwʌj HʋsʌɩŋNo ratings yet

- Chrome Plate ADA237402Document351 pagesChrome Plate ADA237402Keily VilcarromeroNo ratings yet

- PBCS SR Taguig Q1 2020Document7 pagesPBCS SR Taguig Q1 2020Jeon JungkookNo ratings yet

- Producing hollow cement blocks with the CETA-RAM machineDocument17 pagesProducing hollow cement blocks with the CETA-RAM machinecowboyNo ratings yet

- view (5)Document32 pagesview (5)pocalocomocoNo ratings yet

- Ilovepdf MergedDocument2 pagesIlovepdf MergedSuman AgarwalNo ratings yet

- Additional BillDocument2 pagesAdditional BillReynaldo PesqueraNo ratings yet

- 15ME206 5 SemDocument2 pages15ME206 5 SemFortune FireNo ratings yet

- Estimating and Costing for Building WorksDocument16 pagesEstimating and Costing for Building Workshyper gamyNo ratings yet

- Cape Chemistry 2015 U2 p2 MsDocument15 pagesCape Chemistry 2015 U2 p2 MsYagna LallNo ratings yet

- Empirical Metallogeny: Depositional Environments, Lithologic Associations and Metallic OresFrom EverandEmpirical Metallogeny: Depositional Environments, Lithologic Associations and Metallic OresNo ratings yet

- Solution Manual for an Introduction to Equilibrium ThermodynamicsFrom EverandSolution Manual for an Introduction to Equilibrium ThermodynamicsNo ratings yet

- P1 3403-2 PDFDocument1 pageP1 3403-2 PDFRyan PelitoNo ratings yet

- Far 34PW-2 PDFDocument1 pageFar 34PW-2 PDFRyan PelitoNo ratings yet

- P1 3401-2 PDFDocument1 pageP1 3401-2 PDFRyan PelitoNo ratings yet

- Financial Accounting and Reporting Fundamentals ReviewDocument1 pageFinancial Accounting and Reporting Fundamentals ReviewRyan PelitoNo ratings yet

- Far 34PW-6 PDFDocument1 pageFar 34PW-6 PDFRyan PelitoNo ratings yet

- Sorcerer's Stone Company EPS and Share ValuationDocument1 pageSorcerer's Stone Company EPS and Share ValuationRyan PelitoNo ratings yet

- Far 34PW-9 PDFDocument1 pageFar 34PW-9 PDFRyan PelitoNo ratings yet

- P1 3402-1 PDFDocument1 pageP1 3402-1 PDFRyan PelitoNo ratings yet

- Prt6,8oo Li (I, Ffi: Ffihouldthecompanyreport?c) P206,800?/rJ.I,,,:Jl, JDocument1 pagePrt6,8oo Li (I, Ffi: Ffihouldthecompanyreport?c) P206,800?/rJ.I,,,:Jl, JRyan PelitoNo ratings yet

- P1 3403-3 PDFDocument1 pageP1 3403-3 PDFRyan PelitoNo ratings yet

- P1 3401-1Document1 pageP1 3401-1Ryan PelitoNo ratings yet

- P1 3402-2 PDFDocument1 pageP1 3402-2 PDFRyan PelitoNo ratings yet

- 'iil'ff: Ii:: 2eo, Ooo t5'7,3L3 " 161,104 164,895)Document1 page'iil'ff: Ii:: 2eo, Ooo t5'7,3L3 " 161,104 164,895)Ryan PelitoNo ratings yet

- Accounting for Current AssetsDocument1 pageAccounting for Current AssetsRyan PelitoNo ratings yet

- Analyzing Cash AccountsDocument1 pageAnalyzing Cash AccountsRyan PelitoNo ratings yet

- Market ProjDocument5 pagesMarket ProjRyan PelitoNo ratings yet

- Frequency Polygon: Class Limits Class Boundari Es F X CFDocument2 pagesFrequency Polygon: Class Limits Class Boundari Es F X CFRyan PelitoNo ratings yet

- Ap 34PW2-3 PDFDocument1 pageAp 34PW2-3 PDFRyan PelitoNo ratings yet

- Ap 34PW-2 PDFDocument1 pageAp 34PW-2 PDFRyan PelitoNo ratings yet

- Ac Pas 8Document9 pagesAc Pas 8Ryan PelitoNo ratings yet

- Ap 34PW2-1 PDFDocument1 pageAp 34PW2-1 PDFRyan PelitoNo ratings yet

- Audit procedures and financial statement cyclesDocument1 pageAudit procedures and financial statement cyclesRyan PelitoNo ratings yet

- Ap 34PW2-2 PDFDocument1 pageAp 34PW2-2 PDFRyan PelitoNo ratings yet

- Reyes TacandongDocument1 pageReyes TacandongRyan PelitoNo ratings yet

- SculptureDocument2 pagesSculptureRyan PelitoNo ratings yet

- Ac Pas 8Document9 pagesAc Pas 8Ryan PelitoNo ratings yet

- Kursus Binaan Bangunan B-010: Struktur Yuran Latihan & Kemudahan AsramaDocument4 pagesKursus Binaan Bangunan B-010: Struktur Yuran Latihan & Kemudahan AsramaAzman SyafriNo ratings yet

- The Revenue CycleDocument8 pagesThe Revenue CycleLy LyNo ratings yet

- 6th Semester SyllabusDocument5 pages6th Semester Syllabusz0nej.a.sanibirdsNo ratings yet

- Wells Fargo Statement - Sept 2021Document6 pagesWells Fargo Statement - Sept 2021pradeep yadavNo ratings yet

- Cabinet & Cabinet CommitteeDocument9 pagesCabinet & Cabinet Committeegautam kumarNo ratings yet

- Create PHP CRUD App DatabaseDocument6 pagesCreate PHP CRUD App DatabasearyaNo ratings yet

- Succession in General: A. Universal - This Is Very Catchy-It Involves The Entire Estate or Fractional or Aliquot orDocument9 pagesSuccession in General: A. Universal - This Is Very Catchy-It Involves The Entire Estate or Fractional or Aliquot orMYANo ratings yet

- 8 Types of Failure in A ChristianDocument7 pages8 Types of Failure in A ChristianKarl Jason JosolNo ratings yet

- Victim Compensation in GermanyDocument49 pagesVictim Compensation in GermanyMayuri YadavNo ratings yet

- Dvash-Banks v. U.S. Dep't of StateDocument2 pagesDvash-Banks v. U.S. Dep't of StateJohn Froy TabingoNo ratings yet

- DENR confiscation caseDocument347 pagesDENR confiscation caseRyan BalladaresNo ratings yet

- Managerial Accounting CASE Solves Missing Data Income StatementDocument3 pagesManagerial Accounting CASE Solves Missing Data Income StatementAlphaNo ratings yet

- Lumbini Grade 9 Test 2 PhysDocument8 pagesLumbini Grade 9 Test 2 PhysSnow WhiteNo ratings yet

- Right to Life and Duty to Investigate Under ICCPRDocument16 pagesRight to Life and Duty to Investigate Under ICCPRRosedemaeBolongaitaNo ratings yet

- Swot Analysis of IB in PakistanDocument2 pagesSwot Analysis of IB in PakistanMubeen Zubair100% (2)

- Pronabec - Beca 18 (Sugerencias)Document18 pagesPronabec - Beca 18 (Sugerencias)Marco Sifuentes ChNo ratings yet

- Case Chapter 02Document2 pagesCase Chapter 02Pandit PurnajuaraNo ratings yet

- PowerFlex 750 Series AC Drive - Custom V - HZ and Fan - Pump DifferencesDocument5 pagesPowerFlex 750 Series AC Drive - Custom V - HZ and Fan - Pump DifferencesAndrii AverianovNo ratings yet

- CAPISTRANO vs. LIMCUANDODocument1 pageCAPISTRANO vs. LIMCUANDOElaine Grace R. AntenorNo ratings yet

- Form 1 Sentence Indication Practice Direction: Number ... of 2016 Request For Sentence Indication (Direction 3.3 Procedure')Document3 pagesForm 1 Sentence Indication Practice Direction: Number ... of 2016 Request For Sentence Indication (Direction 3.3 Procedure')Gail HoadNo ratings yet

- Assignment No 1. Pak 301Document3 pagesAssignment No 1. Pak 301Muhammad KashifNo ratings yet

- Guidelines on sick and vacation leaveDocument2 pagesGuidelines on sick and vacation leaveMyLz SabaLanNo ratings yet

- New General Ledger IntroductionDocument3 pagesNew General Ledger IntroductionManohar GoudNo ratings yet

- Democratization and StabilizationDocument2 pagesDemocratization and StabilizationAleah Jehan AbuatNo ratings yet

- 15 09 Project-TimelineDocument14 pages15 09 Project-TimelineAULIA ANNANo ratings yet

- Patrice Jean - Communism Unmasked PDFDocument280 pagesPatrice Jean - Communism Unmasked PDFPablo100% (1)

- Armstrong BCE3 Install 507120-01Document18 pagesArmstrong BCE3 Install 507120-01manchuricoNo ratings yet

- International Law Obligation of States to Enact Legislation to Fulfill Treaty TermsDocument17 pagesInternational Law Obligation of States to Enact Legislation to Fulfill Treaty TermsFbarrsNo ratings yet

- Final Sociology Project - Dowry SystemDocument18 pagesFinal Sociology Project - Dowry Systemrajpurohit_dhruv1142% (12)

- Nabina Saha ThesisDocument283 pagesNabina Saha Thesissurendra reddyNo ratings yet