Professional Documents

Culture Documents

Whitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)

Uploaded by

Whitehall & CompanyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Whitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)

Uploaded by

Whitehall & CompanyCopyright:

Available Formats

Volume 8, Issue 27

July 3, 2018

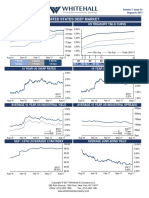

UNITED STATES DEBT MARKET

US LIBOR US TREASURY YIELD CURVE

300 bps 6.00%

250 bps 5.00%

200 bps 4.00%

150 bps 3.00%

100 bps 2.00%

50 bps 1.00%

30yr Avg 15yr Avg Today (7/3/18)

0 bps 0.00% I I I I I I

Jul-17 Oct-17 Jan-18 Apr-18 Jul-18 2 3 5 7 10 30

1 Month 3 Month 6 Month 2yr 3yr 5yr 7yr 10yr 30yr

209 bps 234 bps 250 bps 2.55% 2.62% 2.75% 2.79% 2.86% 2.98%

10 YEAR US SWAP RATES 10 YEAR US TREASURY

3.50% 3.50%

3.00% 3.00%

2.50% 2.50%

2.00% 2.00%

1.50% 1.50%

7/3/18 7/3/18

2.93% 2.86%

1.00% 1.00%

Jul-17 Oct-17 Jan-18 Apr-18 Jul-18 Jul-17 Oct-17 Jan-18 Apr-18 Jul-18

AVERAGE 10 YEAR US INDUSTRIAL YIELD AVERAGE 10 YEAR US INDUSTRIAL SPREADS

200bps

4.50%

4.00% 150bps

3.50%

100bps

3.00%

7/3/18 7/3/18 50bps

A 2.50% A 99 bps

3.85%

BBB 4.34% BBB 148 bps

2.00% 0bps

Jul-17 Oct-17 Jan-18 Apr-18 Jul-18 Jul-17 Oct-17 Jan-18 Apr-18 Jul-18

S&P / LSTA LEVERAGED LOAN INDEX AVERAGE JUNK-BOND YIELD

100.00 7.00%

98.00

6.00%

96.00

94.00

5.00%

92.00

7/3/18 7/3/18

98.04% 6.20%

90.00 4.00%

Jul-17 Oct-17 Jan-18 Apr-18 Jul-18 Jul-17 Oct-17 Jan-18 Apr-18 Jul-18

Copyright © 2018 Whitehall & Company LLC

280 Park Avenue, 15th Floor, New York, NY 10017

Office: (212) 205-1380 Fax: (212) 205-1381

www.whitehallandcompany.com

Volume 8, Issue 27

July 3, 2018

SELECT US PRIVATE PLACEMENTS

Date Issuer Type $mm Years Spread Coupon Rating Sector Country

6/29 Amazon.com Inc CTL $212 21 120bps 4.07% 1 Communications US

6/29 Charter Hall Office Trust Sr Notes $116 7 150bps - 2 Financial Australia

$189 10 160bps

6/29 Consumers Energy Co Sr Notes $100 9 85bps 3.68% 1 Utilities US

$215 20 110bps 4.01%

$185 39 130bps 4.28%

6/29 Scotia Gas Networks (SGN) Sr Secured $150 12 127bps 2.74% 2 Utilities UK

$150 15 132bps 2.87%

6/29 The National Hockey League Sr Notes $107 7 120bps 3.98% 2 Consumer, US

$156 10 130bps 4.12% Cyclical

$362 12 140bps 4.22%

6/29 The Port of Melbourne Sr Notes $340 10 135bps - 2 Consumer, Australia

$360 12 143bps Non-Cyclical

$380 15 150bps

A$85 10 145bps

A$90 12 153bps

A$45 15 180bps

A$115 15 160bps

US PUBLIC MARKET ISSUANCES

SELECT INVESTMENT GRADE ISSUANCES

Date Issuer Type $mm Years Spread Coupon Rating Sector Country

6/28 Alabama Power Company Sr Notes $500 30 130bps 4.30% A-/A1 Utilities US

6/26 Consolidated Edison Company of Sr Notes $640 3 - 2.74% A-/A2 Utilities US

New York

6/27 GS Caltex Corporation Sr Notes $300 5 - 3.88% BBB+/Baa1 Energy South Korea

6/25 Xcel Energy, Inc Sr Notes $500 10 115bps 4.00% BBB+/A3 Utilities US

SELECT BELOW INVESTMENT GRADE ISSUANCES

Date Issuer Type $mm Years Spread Coupon Rating Sector Country

6/25 EQT Midstream Partners LP Sr Notes $1,100 5 200bps 4.75% BBB-/Ba1 Energy US

$850 10 263bps 5.50%

$550 30 350bps 6.50%

6/25 Frontera Energy Corporation Sr Notes $350 5 - 9.70% BB- Energy Canada

\

SELECT CLOSED SYNDICATED LOANS

Date Issuer Type $mm Months Spread Rating Sector Country

6/26 Harris Corporation Rev $1,000 59 150bps - Industrial US

6/26 Houston Fuel Oil Terminal Company Term $600 83 275bps BB-/Ba3 Energy US

LLC

CONTACT WHITEHALL

Jon Cody Timothy Page Richard Ashby Todd Brussel Brian Burchfield Matt Cody Roland DaCosta Thomas Friebel Bob Salandra

Managing Director Managing Director Managing Director Managing Director Managing Director Managing Director Managing Director Managing Director Managing Director

(212) 205-1398 (212) 205-1399 (212) 205-1388 (212) 205-1397 (212) 205-1395 (212) 205-1398 (212) 205-1394 (212) 335-2565 (212) 335-2561

Vincas Snipas Van Thorne Geoffrey Wilson Mark Halpin Nadia Zaets Blaine Burke Nicholas Page Sang Joon Lee Aaron Richardson

Managing Director Managing Director Managing Director Director Director Vice President Vice President Associate Associate

(212) 205-1385 (212) 205-1386 (212) 205-1392 (212) 205-1393 (212) 335-2557 (212) 205-1382 (212) 205-1389 (212) 205-1391 (212) 205-1387

Ted Barrett Charles Joerss Vitaliy Koretskyy Billy Kovanis Keir Wianecki

Analyst Analyst Analyst Analyst Analyst

(212) 205-1396 (212) 335-2555 (212) 335-2551 (212) 335-2550 (212) 335-2552

Source: Bloomberg

This market letter is not to be construed as a recommendation to buy, hold or sell any particular security.

Copyright © 2018 Whitehall & Company LLC

280 Park Avenue, 15th Floor, New York, NY 10017

Office: (212) 205-1380 Fax: (212) 205-1381

www.whitehallandcompany.com

You might also like

- WhitehallDocument2 pagesWhitehallWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 10 (March 6, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 10 (March 6, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 25 (June 19, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 25 (June 19, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 39 (October 3, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 39 (October 3, 2017)Whitehall & CompanyNo ratings yet

- United States Debt Market: Us Libor Us Treasury Yield CurveDocument2 pagesUnited States Debt Market: Us Libor Us Treasury Yield CurveWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 43 (October 31, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 43 (October 31, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 21 (May 23, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 21 (May 23, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 24 (June 19, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 24 (June 19, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 25 (June 27, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 25 (June 27, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 10 (March 7, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 10 (March 7, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 48 (December 5, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 48 (December 5, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 41 (October 17, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 41 (October 17, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 11 (March 13, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 11 (March 13, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 42 (October 24, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 42 (October 24, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 38 (September 26, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 38 (September 26, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 45 (November 14, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 45 (November 14, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 7 (February 13, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 7 (February 13, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 8 (February 21, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 8 (February 21, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 50 (December 19, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 50 (December 19, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 44 (November 7, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 44 (November 7, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 31 (August 09, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 31 (August 09, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 23 (June 12, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 23 (June 12, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 46 (November 21, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 46 (November 21, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 36 (September 12, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 36 (September 12, 2017)Whitehall & CompanyNo ratings yet

- TO% Category Format Division TO% TO% Slabs TO% Slabs TO%: Trade Offers - Secondary Towns (1st Jan Till 31st Jan)Document1 pageTO% Category Format Division TO% TO% Slabs TO% Slabs TO%: Trade Offers - Secondary Towns (1st Jan Till 31st Jan)Malik Raheel AhmadNo ratings yet

- IC Email Marketing Dashboard Template 8673Document7 pagesIC Email Marketing Dashboard Template 8673Haytham NasefNo ratings yet

- 1.06 Whitehall: Monitoring The Markets Vol. 01 Iss. 06 (Mar 8, 2011)Document2 pages1.06 Whitehall: Monitoring The Markets Vol. 01 Iss. 06 (Mar 8, 2011)Whitehall & CompanyNo ratings yet

- Tube Molding Report - Sept 2010.Document3 pagesTube Molding Report - Sept 2010.Ogero Otekki MusaNo ratings yet

- Indice de Precios: Materias Primas PlasticasDocument1 pageIndice de Precios: Materias Primas PlasticasMelisa JaksicNo ratings yet

- HBA INTEREST CALCULATOR ShareDocument1 pageHBA INTEREST CALCULATOR ShareLazy BuoyNo ratings yet

- SCHEDULE TITLEDocument32 pagesSCHEDULE TITLEOlan BeeNo ratings yet

- Propuesta OVBK - V2Document3 pagesPropuesta OVBK - V2JUAN CAMILO GUZMANNo ratings yet

- S-Curve Talang Jimar Rev-8 (New)Document1 pageS-Curve Talang Jimar Rev-8 (New)wahyu hidayatNo ratings yet

- Grafik PKPDocument10 pagesGrafik PKPNIA KURNIASIHNo ratings yet

- Monthly Defect Percentages by WeekDocument2 pagesMonthly Defect Percentages by WeekshreenareshNo ratings yet

- 1ntercept: Atlanta Falcons (1-0)Document1 page1ntercept: Atlanta Falcons (1-0)api-369514202No ratings yet

- 26 08 2021-PoultryDocument14 pages26 08 2021-PoultryIgnacio López LazarenoNo ratings yet

- 1.04 Whitehall: Monitoring The Markets Vol. 01 Iss. 04 (Feb. 22, 2011)Document2 pages1.04 Whitehall: Monitoring The Markets Vol. 01 Iss. 04 (Feb. 22, 2011)Whitehall & CompanyNo ratings yet

- The COVID-19 Impact On Consumption in Real Time and High DefinitionDocument7 pagesThe COVID-19 Impact On Consumption in Real Time and High DefinitionBryan GonzalesNo ratings yet

- Measuring Money SupplyDocument22 pagesMeasuring Money SupplyElvin DavidNo ratings yet

- 3.work Progress Curves ActualDocument1 page3.work Progress Curves ActualRim BdidaNo ratings yet

- [배포]_23년_물류_시황_회고_및_24년_전망_231207_주요_Q_A_포함 (1)Document26 pages[배포]_23년_물류_시황_회고_및_24년_전망_231207_주요_Q_A_포함 (1)최장윤No ratings yet

- 1.-Coeficientes y Cedulas de Cultivos de La Region PunoDocument5 pages1.-Coeficientes y Cedulas de Cultivos de La Region PunoJackelinne Tello ChavezNo ratings yet

- The Data Strengthens Evidence That Vietnam Is A Potential Market For FMCGDocument3 pagesThe Data Strengthens Evidence That Vietnam Is A Potential Market For FMCGQuang Võ MinhNo ratings yet

- IC Retail Analysis Dashboard1Document9 pagesIC Retail Analysis Dashboard1minhmaruNo ratings yet

- 1ntercept: Pittsburgh Steelers (1-0)Document1 page1ntercept: Pittsburgh Steelers (1-0)api-369514202No ratings yet

- 1ntercept: Cincinnati Bengals (0-1)Document1 page1ntercept: Cincinnati Bengals (0-1)api-369514202No ratings yet

- Audit Cuci TanganDocument6 pagesAudit Cuci TanganDewi HastutiNo ratings yet

- Projectdevelopment 424779589062211Document6 pagesProjectdevelopment 424779589062211Adrian bambaNo ratings yet

- 1.07 Whitehall: Monitoring The Markets Vol. 01 Iss. 07 (Mar 16, 2011)Document2 pages1.07 Whitehall: Monitoring The Markets Vol. 01 Iss. 07 (Mar 16, 2011)Whitehall & CompanyNo ratings yet

- Profit RatesDocument3 pagesProfit RatesMuneeb AkhtarNo ratings yet

- Client Logo: Contract No ABC /XY/YY/ZZ Project Name, Location Overall Progress S CurveDocument1 pageClient Logo: Contract No ABC /XY/YY/ZZ Project Name, Location Overall Progress S CurveAbhishek KumarNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 18Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 18Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 36 (September 5, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 36 (September 5, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 18 (May 1, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 18 (May 1, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 24 (June 12, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 24 (June 12, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 29 (July 25, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 29 (July 25, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 34 (August 21, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 34 (August 21, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 23 (June 5, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 23 (June 5, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 22 (June 5, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 22 (June 5, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 28 (July 10, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 28 (July 10, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 16 (April 17, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 16 (April 17, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 18Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 18Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 15 (April 10, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 15 (April 10, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 11 (March 13, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 11 (March 13, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 9 (February 27, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 9 (February 27, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 8 (February 21, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 8 (February 21, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 7 (February 13, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 7 (February 13, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 6 (February 6, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 6 (February 6, 2017)Whitehall & CompanyNo ratings yet

![[배포]_23년_물류_시황_회고_및_24년_전망_231207_주요_Q_A_포함 (1)](https://imgv2-2-f.scribdassets.com/img/document/719845222/149x198/d8ebab17c6/1712196292?v=1)