Professional Documents

Culture Documents

Monthly Spotlight August 2010

Uploaded by

Peter MastersonOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Monthly Spotlight August 2010

Uploaded by

Peter MastersonCopyright:

Available Formats

Monthly Spotlight

Volume 7 • Issue 5

August • 2010

www.gmcu.com 800.808.2830

“Discover the Difference”

REG E OPT IN DATE APPROACHES

The date to make your choice whether you want

GMCU to continue to provide the Member Privi-

lege overdraft services for your ATM and one

time debit transactions quickly approaches.

GMCU provides all members in good standing

with a $500 overdraft service called Member

Privilege. We do not encourage overdrafting,

but in an emergency it can offer peace of mind.

Your Member Privilege limit may be available for

checks and other transactions made using your checking account num-

Auto Loan Rates as ber or automatic bill payment and recurring debit card payment. Also, at

your request, we may authorize and pay ATM transfers or withdrawals and

low as: everyday debit card purchases using your limit.

3.99 % APR* In order for us to continue to provide this service to you, it is required

that you “opt in” for the service. You may OPT-IN by completing a

form at any GMCU branch, on-line at www.gmcu.com, or call

for 48 months 800.808.2830.

Or If you do nothing, this service will be discontinued for

your everyday debit card purchases and ATM transac-

4.99 % APR* tions. Meaning, if you do not have enough money in your

account, or if the funds have not yet cleared, your card will be

for 60 months declined.

* The effective date of the change is August 15, 2010 for accounts opened

*APR= Annual Percentage Rate. Cost per thousand is $22.57 for 48 before July 1, 2010. For accounts opened after July 1, 2010 the effective

month term. Cost per thousand is $18.87 for 60 month term. Col-

lateral must be 2008 or newer. On approved credit. Rate and terms date of the change is July 1, 2010. On August 15, 2010, we will not au-

promotion can change at any time. Other favorable rates and terms thorize and pay overdrafts on ATM and everyday debit card transactions

available for older collateral. New money only. Re-finance without account holder consent. Overdrafts may be created by check, ACH,

from another financial accepted if collateral years met. online banking transactions, phone transactions or other electronic means.

An overdraft (OD) fee or insufficient funds (NSF) fee of up to $25 will be

GMCU charged for covering overdrafts that result in a negative balance. Recur-

ring debit card transactions (payments that are set up to bill and pay au-

Holiday tomatically), such as an automatic draft from your health club or insurance

Closing company, may continue to be covered by your overdraft service. Once an

overdraft has occurred you are required to bring your account to a positive

Greater Minnesota Credit Union will be closed on balance within 30 days. We reserve the right not to pay if your account is

Monday, September 6th in observance of Labor Day. not in good standing. Contact us if you have questions.

Changes to GMCU Overdraft Fees

Rate Watch

Effective August 2, 2010 overdraft fees on the following Greater Minne-

sota Credit Union accounts will be capped at five (5) items / $125 per Loans

day, per personal share account: 00 – Prime share, 05 - CirCUs Club, Auto, New - 2008

06 - Secondary Share , 70 – Member Preferred Checking, 73 – Freedom ......................(as low as) 3.99% APR*

Checking, 74 - Advantage Checking, 88 - HSA Individual, 89 - HSA Auto 2007-2003

Family. For example, if you have two personal checking accounts, we ......................(as low as) 6.14% APR*

could pay five (5) overdrafts per account for a total of ten (10) per day. If Boat & RV, New - 2008

you have any questions, please call 800.808.2830 for more information. ......................(as low as) 5.04 APR*

Boat & RV, 2007-2003

......................(as low as) 6.64% APR*

GMCU GOES “BACK-TO-SCHOOL” Unsecured

FOR THE KIDS ......................(as low as) 10.99% APR*

Visa

Visit any GMCU branch in August and drop off your school supply ......................(as low as) 9.49% APR*

donation.

The school supplies donated will be given to the school districts in which Mortgages

our branches are located. First Mortgage

For a list of supplies needed, please visit any branch or our Web site in ......................(as low as) 5.54% APR*

August and click on the branch link. Home Equity

Thank you for thinking of “the kids” this fall. ......................(as low as) 5.54% APR*

Fixed-rate mortgages are available through the

THE GREATER MINNESOTA CREDIT UNION secondary market. For current rates and information,

SOCIAL RESPONSIBILITY COMMITTEE contact Carey at 320.679.3863 or 800.808.2830. Lowest

rate subject to credit score and checking/auto pay

relationship. Rates are subject to change at any time.

Certificates

WE’RE FIRIN’ UP THE GRILLS!

$500 minimum deposit.

FREE Member Appreciation 12 month...........0.75% APY**

18 month...........0.85% APY**

Lunches Are Back! 24 month...........1.16% APY**

36 month...........1.51% APY**

Come on over and sit a spell as you enjoy 48 month...........1.66% APY**

lunch on us. Dates and times for each of 60 month...........2.02% APY**

our branch locations are below. *Annual Percentage Rate.

**Annual Percentage Yield.

Penalty for early withdrawal. Rates are subject

Friday, Aug. 6 Ogilvie 11:00 am - 2:00 pm to change at any time. Rates are current as of

Friday, Aug. 13 Mora 11:00 am - 2:00 pm 7/23/10. For current rates, please go to www.

gmcu.com. For more information, contact our

Friday, Aug. 20 Isle 11:00 am - 2:00 pm Call Center at 800.808.2830.

Thank you to everyone who joined us in Elk River, Milaca and Pine City!

Branch Telephone # Mora, Milaca, Isle, Pine City and Ogilvie Branch Hours

Mora 320.679.3863 Monday - Thursday Friday Saturday

Milaca 320.983.2511 Lobby: 8:30 am - 4:30 pm Lobby: 8:30 am - 6:00 pm Drive-thru: 8:00 am -12:00 pm

Isle 320.676.3607 Drive-thru: 8:00 am - 5:00 pm Drive-thru: 8:00 am - 6:00 pm

Elk River 763.441.3842 Elk River Branch Hours

Pine City 320.629.1178 Monday - Thursday Friday Saturday

Ogilvie 320.272.9918 Lobby: 8:30 am - 4:30 pm Lobby: 8:30 am - 6:00 pm Lobby: 8:30 am -12:00 pm

Drive-thru: 7:30 am - 5:00 pm Drive-thru: 7:30 am - 6:00 pm Drive-thru: 8:00 am -12:00 pm

Call Center Hours

Monday - Thursday Friday Saturday

7:30 am - 5:00 pm 7:30 am - 6:00 pm 8:00 am -12:00 pm

You might also like

- WHAT'S F.R.E.E. CREDIT? the personal game changerFrom EverandWHAT'S F.R.E.E. CREDIT? the personal game changerRating: 2 out of 5 stars2/5 (1)

- October 2023Document5 pagesOctober 2023isaiahdesmondbrown1No ratings yet

- Key Fact Statement of SBM Credilio Credit Card Description FeesDocument5 pagesKey Fact Statement of SBM Credilio Credit Card Description Feesgargmayank489.mgNo ratings yet

- Account Opening DisclosuresDocument7 pagesAccount Opening Disclosuressarahjroberts049No ratings yet

- Account Opening DisclosuresDocument7 pagesAccount Opening DisclosuresMarcus Wilson100% (1)

- Kuch Bhi On EMI - KBE 3 Months Offer Terms and ConditionsDocument1 pageKuch Bhi On EMI - KBE 3 Months Offer Terms and Conditionsdevpal78No ratings yet

- Details of Your Pricing Terms: August 30, 2019Document12 pagesDetails of Your Pricing Terms: August 30, 2019Anais FagundezNo ratings yet

- Cell Phone BillDocument10 pagesCell Phone BillKimBeem100% (1)

- Welcomeletter Ka3024cd0401313Document9 pagesWelcomeletter Ka3024cd0401313davalmobile25No ratings yet

- Account Opening DisclosuresDocument8 pagesAccount Opening Disclosuresitsadozie2No ratings yet

- Account Opening DisclosuresDocument8 pagesAccount Opening DisclosuresEliseu Simplicio de OliveiraNo ratings yet

- GMCU Monthly Spotlight May 2010Document2 pagesGMCU Monthly Spotlight May 2010Peter MastersonNo ratings yet

- Additional Banking Services and Fees For Personal Accounts: Table of ContentsDocument25 pagesAdditional Banking Services and Fees For Personal Accounts: Table of ContentstategberoNo ratings yet

- SOC - CC MITC 2.01 - With Schedule of ChargesDocument8 pagesSOC - CC MITC 2.01 - With Schedule of Chargessyed imranNo ratings yet

- Credit Card PDS V42 (Eng) - CompressedDocument4 pagesCredit Card PDS V42 (Eng) - Compressedrf_1238No ratings yet

- Account Opening DisclosuresDocument7 pagesAccount Opening Disclosures4cydfngkt9No ratings yet

- Account Opening DisclosuresDocument9 pagesAccount Opening DisclosuresEAZY CHARNo ratings yet

- My Productdisclosure SheetDocument8 pagesMy Productdisclosure SheetNesa rachenamotyNo ratings yet

- Welcomeletter Up3043tw0038268Document4 pagesWelcomeletter Up3043tw0038268Mohammad AarifNo ratings yet

- Product Disclosure Sheet: 1. What Is This Product About?Document8 pagesProduct Disclosure Sheet: 1. What Is This Product About?Yusdaud DaudNo ratings yet

- BUCKS CONCRETE & PAVERS INC - AmTrust Workers' Compensation PolicyDocument37 pagesBUCKS CONCRETE & PAVERS INC - AmTrust Workers' Compensation PolicyYvette BroadwaterNo ratings yet

- Bank of India (Card Products Department) Most Important Terms and Conditions (Mitcs)Document16 pagesBank of India (Card Products Department) Most Important Terms and Conditions (Mitcs)Arun CHNo ratings yet

- FD ReceiptDocument2 pagesFD Receiptthetrilight2023No ratings yet

- Sign Here X - : Product Disclosure SheetDocument4 pagesSign Here X - : Product Disclosure SheetJosh lamNo ratings yet

- PNC Bank - Virtual Wallet Student FeesDocument5 pagesPNC Bank - Virtual Wallet Student FeesBobNo ratings yet

- FD ReceiptDocument2 pagesFD Receiptthetrilight2023No ratings yet

- Account Opening DisclosuresDocument7 pagesAccount Opening DisclosureschelseamfwilsonNo ratings yet

- Credit Card I PdsDocument11 pagesCredit Card I PdsIskandar ZulqarnainNo ratings yet

- Easy SavingsDocument2 pagesEasy SavingsPepper JackNo ratings yet

- MemoDocument3 pagesMemoEjNo ratings yet

- Account Opening DisclosuresDocument7 pagesAccount Opening DisclosuresLauren EgasNo ratings yet

- Key Facts Sheet JuneDocument1 pageKey Facts Sheet Junerichardshalders80No ratings yet

- C1T4 - Intro To Credit Cards Part 2 PDFDocument10 pagesC1T4 - Intro To Credit Cards Part 2 PDFTanmoy IimcNo ratings yet

- 2018 FRM CandidateGuideDocument14 pages2018 FRM CandidateGuideSagar SuriNo ratings yet

- Am Bank Creditcard ABC Fa QDocument4 pagesAm Bank Creditcard ABC Fa QyaumiNo ratings yet

- Welcome Letter 33875975Document3 pagesWelcome Letter 33875975Raj KumarNo ratings yet

- PDS Revision Eng & BM Online (Final)Document6 pagesPDS Revision Eng & BM Online (Final)Faiziya BanuNo ratings yet

- Your TELUS Bill: Account SummaryDocument4 pagesYour TELUS Bill: Account Summarydummy accountNo ratings yet

- FD ReceiptDocument2 pagesFD ReceiptKiranNo ratings yet

- In Smartcard Product Terms and ConditionsDocument3 pagesIn Smartcard Product Terms and ConditionsIshan ShahNo ratings yet

- EStmtPDFServlet PDFDocument3 pagesEStmtPDFServlet PDFYi Shu LowNo ratings yet

- Most Important Terms and Conditions - 2Document10 pagesMost Important Terms and Conditions - 2Mohit AroraNo ratings yet

- MicroEnterprise Loan (Puhunan Sa Pagbabago at Pag-Asenso - P3 Loan)Document6 pagesMicroEnterprise Loan (Puhunan Sa Pagbabago at Pag-Asenso - P3 Loan)Jan RootsNo ratings yet

- Cardmember Agreement Rates and Fees TableDocument15 pagesCardmember Agreement Rates and Fees TableMatt D FNo ratings yet

- Foreclosure LetterDocument3 pagesForeclosure LetterSyed ShahbazNo ratings yet

- Khalid RR1814B29 PFP 2NDDocument8 pagesKhalid RR1814B29 PFP 2NDRR1814B29No ratings yet

- Key Facts StatementDocument4 pagesKey Facts StatementQuality SecretNo ratings yet

- Sudheer Loan Letter PDFDocument7 pagesSudheer Loan Letter PDFmr copy xeroxNo ratings yet

- Most Important Terms & ConditionsDocument75 pagesMost Important Terms & Conditionsjamin2020No ratings yet

- Apds PerformDocument16 pagesApds PerformMaryroseNo ratings yet

- Credit, Collection and Compliance Application # 3 - Managing CreditDocument3 pagesCredit, Collection and Compliance Application # 3 - Managing CreditGabriel Matthew Lanzarfel GabudNo ratings yet

- SuperCard MITC PDFDocument47 pagesSuperCard MITC PDFPrudhvi RajNo ratings yet

- BrightWay Acquistion Terms AMF89 35.99 NDocument6 pagesBrightWay Acquistion Terms AMF89 35.99 Njlp036046gmail.comNo ratings yet

- ReceiptDocument2 pagesReceiptchetanpagare985No ratings yet

- Instant EMI - BriefDocument4 pagesInstant EMI - Briefmohit sinhaNo ratings yet

- Credit Card TipsDocument2 pagesCredit Card TipsdasdgerwqrwqeNo ratings yet

- Central Bank of IndiaDocument1 pageCentral Bank of IndiaSoutik ChakrabortyNo ratings yet

- Jisort System Write-UpDocument15 pagesJisort System Write-UpsgichoNo ratings yet

- Circus Club Summer 2010Document2 pagesCircus Club Summer 2010Peter MastersonNo ratings yet

- Quarterly Interest Spring 2010Document2 pagesQuarterly Interest Spring 2010Peter MastersonNo ratings yet

- GMoney Winter 2010Document2 pagesGMoney Winter 2010Peter MastersonNo ratings yet

- GMoney Spring 2010Document2 pagesGMoney Spring 2010Peter MastersonNo ratings yet

- Quarterly Interest Winter 10Document2 pagesQuarterly Interest Winter 10Peter MastersonNo ratings yet

- Quarterly Interest Summer 2010Document2 pagesQuarterly Interest Summer 2010Peter MastersonNo ratings yet

- GMCU Monthly Spotlight March 2010Document2 pagesGMCU Monthly Spotlight March 2010Peter MastersonNo ratings yet

- December 09 Monthly SpotlightDocument2 pagesDecember 09 Monthly SpotlightPeter MastersonNo ratings yet

- GMCU Monthly Spotlight May 2010Document2 pagesGMCU Monthly Spotlight May 2010Peter MastersonNo ratings yet

- August Monthly SpotlightDocument2 pagesAugust Monthly SpotlightPeter MastersonNo ratings yet

- GMCU Monthly Spotlight February 2010Document2 pagesGMCU Monthly Spotlight February 2010Peter MastersonNo ratings yet

- GMCU Monthly Spotlight June 2010Document2 pagesGMCU Monthly Spotlight June 2010Peter MastersonNo ratings yet

- November Monthly Spotlight 09Document2 pagesNovember Monthly Spotlight 09Peter MastersonNo ratings yet

- September Monthly SpotlightDocument2 pagesSeptember Monthly SpotlightPeter MastersonNo ratings yet

- GMCUQuart News Summer 09 FINALDocument2 pagesGMCUQuart News Summer 09 FINALPeter MastersonNo ratings yet

- December 09 Monthly SpotlightDocument2 pagesDecember 09 Monthly SpotlightPeter MastersonNo ratings yet

- Applicant's StatementDocument2 pagesApplicant's StatementPeter MastersonNo ratings yet

- GMCU Skip A Payment09Document2 pagesGMCU Skip A Payment09Peter MastersonNo ratings yet

- Fee Changes 51509Document1 pageFee Changes 51509Peter MastersonNo ratings yet

- FIC Scholarship Application Packet 2010Document5 pagesFIC Scholarship Application Packet 2010Peter MastersonNo ratings yet

- ERCRContractDocument3 pagesERCRContractPeter Masterson100% (1)

- Annual Report Final 2Document2 pagesAnnual Report Final 2Peter MastersonNo ratings yet

- GMCU Spring 2007 NewsletterDocument2 pagesGMCU Spring 2007 NewsletterPeter MastersonNo ratings yet

- Argument On Workplace SafetyDocument2 pagesArgument On Workplace SafetyEeshan BhagwatNo ratings yet

- G12 ABM Marketing Lesson 1 (Part 1)Document10 pagesG12 ABM Marketing Lesson 1 (Part 1)Leo SuingNo ratings yet

- Progress Test 4 KeyDocument2 pagesProgress Test 4 Keyalesenan100% (1)

- Guide To Importing in ZimbabweDocument22 pagesGuide To Importing in ZimbabweMandla DubeNo ratings yet

- Internship ReportDocument20 pagesInternship ReportbumbumpingNo ratings yet

- PAC DocumentDocument554 pagesPAC DocumentOlakachuna AdonijaNo ratings yet

- Cross TAB in Crystal ReportsDocument15 pagesCross TAB in Crystal ReportsMarcelo Damasceno ValeNo ratings yet

- Alok Kumar Singh Section C WAC I 3Document7 pagesAlok Kumar Singh Section C WAC I 3Alok SinghNo ratings yet

- Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity StatementsDocument36 pagesMultinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity StatementsahmedNo ratings yet

- SCADocument14 pagesSCANITIN rajputNo ratings yet

- Sales SUALOGDocument21 pagesSales SUALOGEynab Perez100% (1)

- Maruti Car ManufactureDocument37 pagesMaruti Car ManufactureVema AbhiramNo ratings yet

- 1st Quarterly Exam Questions - TLE 9Document28 pages1st Quarterly Exam Questions - TLE 9Ronald Maxilom AtibagosNo ratings yet

- I INVENTED THE MODERN AGE: The Rise of Henry Ford by Richard SnowDocument18 pagesI INVENTED THE MODERN AGE: The Rise of Henry Ford by Richard SnowSimon and SchusterNo ratings yet

- Chapter 15 PartnershipDocument56 pagesChapter 15 PartnershipNurullita KartikaNo ratings yet

- Ias 2Document29 pagesIas 2MK RKNo ratings yet

- BSBMGT517 Manage Operational Plan Template V1.0619Document14 pagesBSBMGT517 Manage Operational Plan Template V1.0619Edward AndreyNo ratings yet

- A Flock of Red Flags PDFDocument10 pagesA Flock of Red Flags PDFSillyBee1205No ratings yet

- Lesson 1: Company Formation and Conversion: Choice of Form of Business EntityDocument13 pagesLesson 1: Company Formation and Conversion: Choice of Form of Business EntityMamtha MNo ratings yet

- 1 Electrolux CaseDocument3 pages1 Electrolux CaseAndreea Conoro0% (1)

- Air Travel Demand ElasticitiesDocument69 pagesAir Travel Demand ElasticitiesKatiaNo ratings yet

- Design & Build Toyo Batangas WH Evaluation SUMMARYDocument1 pageDesign & Build Toyo Batangas WH Evaluation SUMMARYvina clarisse OsiasNo ratings yet

- Modern OfficeDocument10 pagesModern OfficesonuNo ratings yet

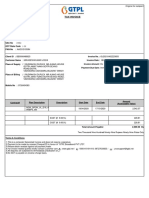

- Tax Invoice: U64204GJ2008PTC054111 24AADCG1959N1ZA 9984 GJDocument1 pageTax Invoice: U64204GJ2008PTC054111 24AADCG1959N1ZA 9984 GJMrugesh Joshi50% (2)

- Retail Store Operations Reliance Retail LTD: Summer Project/Internship ReportDocument48 pagesRetail Store Operations Reliance Retail LTD: Summer Project/Internship ReportRaviRamchandaniNo ratings yet

- Project On Max Life InsuranseDocument48 pagesProject On Max Life InsuranseSumit PatelNo ratings yet

- Gauwelo ProfileDocument9 pagesGauwelo ProfileMONA TECHNo ratings yet

- President Uhuru Kenyatta's Madaraka Day SpeechDocument8 pagesPresident Uhuru Kenyatta's Madaraka Day SpeechState House Kenya100% (1)

- Clementi TownDocument3 pagesClementi TownjuronglakesideNo ratings yet