Professional Documents

Culture Documents

Washing Machine

Uploaded by

Chandrakant TiwariCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Washing Machine

Uploaded by

Chandrakant TiwariCopyright:

Available Formats

According to India Washing Machine Market Outlook, 2022, washing machine

market in India is divided into two technology types, one is semi-automatic

machine and the other is fully automatic machine.

Growing disposable income and easy financing options is one of the important

reasons of more inclination towards fully automatic machines.

LG, Samsung, IFB, Whirlpool, Videocon and Godrej are the leading players in the

washing machine industry of India.

Washing Machine - 8.8%

India remains an under penetrated market, with sub-par levels as compared to the

global average.

• Increasing levels of income, and urbanization

• Improved affordability of products, with India centric product introductions

• Product innovation and availability of new variants of products

• Rise in the share of organized retail

• India

• Large potential consumer market

• Advanced capabilities in plastics and metal fabrication, and electrical

equipment manufacturing

• Low labor costs

• India’s taxation system is unusually complex, especially where indirect taxes

are concerned. While income tax, excise and customs duty are set by the Central

Government, states and municipalities also levy their own taxes.

Product Differentiation: - In washing machine industry the product is

differentiated on basis of top load or front load, capacity of machine (which

ranges from 4.5kg to 10 kg), based on energy rating given by BEE, and based on

spin cycle.

India remains an underpenetrated market, with sub-par levels as compared to

the global average. • Local consumption and market penetration need to be

driven through primary sales (first time purchase), as compared to secondary

(replacement) sales, which is predominant in the urban markets. •

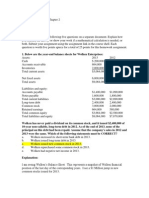

Reduction in the total cost of ownership remains key to growth. India’s taxation

system is complex, especially where indirect taxes are concerned. While income

tax, excise and customs duty are set by the Central Government, states and

municipalities also levy their own taxes. At its present structure, the total tax

incidence in India stands at around 25%–30%, whereas the

Corresponding tariffs in other Asian countries are between 7% and 17%. Central

sales tax (CST) is applicable when domestic manufacturers procure components

from other States, which cannot be set off against Sales Tax (CST/VAT) payable

on end products. This increases the cost of procuring components for domestic

manufacturers.

India’s taxation system is unusually complex, especially where indirect taxes are

concerned. While income tax, excise and customs duty are set by the Central

Government, states and municipalities also levy their own taxes.

Capital Requirement: - the high cost of working capital and capex – related

financing (receivable and payable due to high interest rates is a major challenge

faced by domestic manufacturers, since it increases the overall cost of finance.

The cost of capital at 12% to 14% is much higher than the global average of 5% -

7%.

Switching cost: -

Access to distribution channel: -

Government policies: -

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- An Introduction To Alternative InvestmentsDocument20 pagesAn Introduction To Alternative InvestmentshbobadillapNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- DTCC Glossary Jan 2014Document14 pagesDTCC Glossary Jan 2014zubairulhassanNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- http:// rgiclservices.reliancegeneral.co.in/ PDFDownload/ViewPDF.aspx? PolicyNo=1104262348016357 &| PolicyNo:1104262348016357 | CustName:RAJESH HARISHCHANDRA MHASHELKAR | Prod:2348 | RSD:19-Jul-2016 | RED:18-Jul-2017Document2 pageshttp:// rgiclservices.reliancegeneral.co.in/ PDFDownload/ViewPDF.aspx? PolicyNo=1104262348016357 &| PolicyNo:1104262348016357 | CustName:RAJESH HARISHCHANDRA MHASHELKAR | Prod:2348 | RSD:19-Jul-2016 | RED:18-Jul-2017RGILNo ratings yet

- Crawford, Ian Peter - Davies, Tony - Corporate Finance and Financial Strategy-Pearson (2014)Document976 pagesCrawford, Ian Peter - Davies, Tony - Corporate Finance and Financial Strategy-Pearson (2014)RizkyRamadhan50% (2)

- FinQuiz Level1Mock2018Version2JuneAMSolutionsDocument79 pagesFinQuiz Level1Mock2018Version2JuneAMSolutionsYash Joglekar100% (2)

- List of All CompaniesDocument82 pagesList of All CompaniesAjit KanojiaNo ratings yet

- Distribution Competitiveness GuideDocument12 pagesDistribution Competitiveness GuideEilyn PimientaNo ratings yet

- Utf-8 - 5 Rosales V AlfonsoDocument1 pageUtf-8 - 5 Rosales V Alfonsocmv mendozaNo ratings yet

- Tfs 2015 Product Disclosure StatementDocument116 pagesTfs 2015 Product Disclosure StatementRahul RahuNo ratings yet

- Credit Rating AgenciesDocument17 pagesCredit Rating AgencieskakpatelNo ratings yet

- Course Outline Islamic Finance 2019Document3 pagesCourse Outline Islamic Finance 2019Sami sarwarNo ratings yet

- 09 - Chapter 2 PDFDocument40 pages09 - Chapter 2 PDFKiran PatelNo ratings yet

- SIM Inflation Plus Fund Class B4 Latest13 PDFDocument4 pagesSIM Inflation Plus Fund Class B4 Latest13 PDFSizweNo ratings yet

- Adda Leaf PlatesDocument5 pagesAdda Leaf PlatesSenkatuuka LukeNo ratings yet

- Dissolution Deed.Document2 pagesDissolution Deed.Jatinder SandhuNo ratings yet

- Bkm9e Answers Chap007Document12 pagesBkm9e Answers Chap007AhmadYaseenNo ratings yet

- Hand in Hand - Case Study 02Document4 pagesHand in Hand - Case Study 02Dzenan OmanovicNo ratings yet

- Breakeven Analysiscase StudyDocument7 pagesBreakeven Analysiscase StudyAlkadir del AzizNo ratings yet

- Determinant of Foreign Direct Investment in The Malaysian Manufacturing SectorDocument9 pagesDeterminant of Foreign Direct Investment in The Malaysian Manufacturing Sectornur_anthonyNo ratings yet

- Introduction To Foreign Exchange MarketsDocument16 pagesIntroduction To Foreign Exchange MarketsMalik BilalNo ratings yet

- FIN 534 Homework Chap.2Document3 pagesFIN 534 Homework Chap.2Jenna KiragisNo ratings yet

- Sierra Leone Export Development and Investment Corporation (Sledic)Document15 pagesSierra Leone Export Development and Investment Corporation (Sledic)Vinod Kumar SaoNo ratings yet

- EY Transparency Report 2012Document27 pagesEY Transparency Report 2012teddytopNo ratings yet

- Select Emerging Manager ProgramsDocument2 pagesSelect Emerging Manager ProgramsDavid Toll100% (2)

- Summer Internship ProjectDocument25 pagesSummer Internship ProjectMegha PatelNo ratings yet

- Lesson 2 - Applications of Valuing Cash FlowsDocument10 pagesLesson 2 - Applications of Valuing Cash FlowsStephen MagudhaNo ratings yet

- Reasearch PaperDocument21 pagesReasearch PaperTweenie DalumpinesNo ratings yet

- 01 Long QuizDocument6 pages01 Long Quizgiana riveraNo ratings yet

- Chapter 5Document36 pagesChapter 5Baby KhorNo ratings yet

- 2019 WB 3262 TradablePatterns CorrelationsTechnicalAnalysisofCommoditiesIndicesFXDocument72 pages2019 WB 3262 TradablePatterns CorrelationsTechnicalAnalysisofCommoditiesIndicesFXsteilerNo ratings yet