Professional Documents

Culture Documents

Wage Order Revised

Uploaded by

Rochelle CabellezaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wage Order Revised

Uploaded by

Rochelle CabellezaCopyright:

Available Formats

IV.

Wage Order

Salaries are paid twice in a month; therefore first half of the month will be paid on the

25th day of the month and the second half on the 10th of the next month. Cut-off for payroll

computation is every 15th and 30th of the month. If payday falls on holidays, salaries shall be paid

the day before the standard pay date.

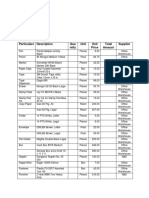

Minimum wage of Region IV-A as of June 30, 2017 (Philippine Statistics Authority)

ranges from Php 283.00 – Php 351.50, which the business is implementing in their salary design.

Employees are expected to be given Php 315.00/day. Managerial employees are given Php

410.00/day.

Overtime Rates. According to article 87 of the Labor Code of the Philippines, there are 2

different overtime rates. The overtime rate for a normal working day in the Philippines is 25%

plus the employee’s regular wage. However, if overtime time is performed on a rest day or

holiday, the overtime rate shall be increased to 30% plus the employee’s regular wage rate.

Overtime Pay for Managers in the Philippines

Managerial employees and officers or members of the managerial staff are not

entitled to overtime pay. However, the designation or the employee’s job title does

not automatically exclude the employee from overtime pay entitlement. It depends if

the employee’s duties and responsibilities qualify to be considered as a managerial

employee or a member of the managerial staff.

V. Employees contract, benefits and compensation

Sick leave – The pertinent provision of the Labor Code applicable to your query is in

Article 95, which provides: Every employee who has rendered at least one year of

service shall be entitled to a yearly service incentive leave of five days with pay. This

provision shall not apply to those who are already enjoying the benefit herein

provided, those enjoying vacation leave with pay of at least five days, and those

employed in establishments with fewer than 10 employees or in establishments

exempted from granting this benefit by the Secretary of Labor after considering the

viability or financial condition of such establishment. The grant of benefit in excess

of that provided the Labor Code shall not be made subject of arbitration or any court

or administrative action.

Rest Day – Every employee shall be provided with a rest period of 1 to 2 days after

every 6 or 5 consecutive working days.

Holiday- On regular holidays, the covered employees are entitled to holiday pay

equivalent to a regular daily wage even if no work is done. If the employer required

work on a regular holiday, the employee is entitled compensation equivalent to twice

the regular rate. There is no holiday pay in retail and service establishments regularly

employing less than 10 employees.

Maternity leave- Senate Bill 1305- Under the bill, all female workers, regardless of

civil status or legitimacy of her child, shall be granted 120 days maternity leave with

pay and an option to extend it for another 30 days without pay. Under the current law,

expectant mothers are allowed only 60 days of paid leave. Single mothers shall also

be granted a total of 150 days maternity leave with pay.

Paternity Leave- Refers to the benefits granted to a married male employee in the

private and public sectors allowing him to take a leave for 7 days, with full pay, for

the first 4 deliveries of his legitimate spouse with whom he is cohabiting.

Conditions for Entitlement to Paternity Leave:

The employee is lawfully married;

He is cohabiting with his legitimate wife;

His wife is pregnant or has delivered a child or suffered a miscarriage or

abortion;

Must be of the first four deliveries;

The employer is notified within reasonable time of the pregnancy and of

date of expected delivery.

13th month pay- The 13th month pay in the Philippines is equivalent to 1/12 of the

basic salary received by an employee within the year. If a Filipino employee for less

than a year (regardless of the cause for the termination of his employment), the

amount due to him is determined by dividing the total salary he received by the

number of months he was employed. The computation of the basic salary does not

include allowances and monetary benefits that are not considered or integrated as part

of the employee’s regular compensation. The items that are taken off the list are: cash

equivalent of unused vacation and sick leave credits; overtime, premium, night

differential and holiday pay, and cost-of-living allowance.

Social Security System (SSS)- Provides benefits and services to the covered

employees and their families. The company and the employees make monthly

contribution to the SSS.

Philippine Health Insurance- Provides health insurance for the covered employees

and their families including allowances for hospitalization, medicines, laboratory

examination, medical fee, surgeon fee etc. However, the allowance will not

necessarily cover the total expense incurred.

VI. Business permit and legal forms

The legal requirements for starting a business in the Philippines depend on its type of

business and industry. Partnerships and corporations are required to be registered with the

Securities and Exchange Commission (SEC), while single proprietorship businesses are not.

Proprietorships are instead required to register with the Department of Trade and Industry (DTI)

for the registration of their business name. The following are the basic requirements to operate

legally:

SEC registration- for registering as a partnership or corporation

DTI registration- for registering your business trade name (BTR)

Mayor’s business permit- for getting the license to operate within the city or

municipality and payment of your local business taxes.

BIR registration- for getting TIN, official receipts and invoices, registering your

books of accounts, and paying your national internal revenue taxes (Income tax,

VAT or Percentage Tax, Withholding Taxes, etc.).

SSS, Phil Health and Pag-Ibig Fund registration- for registering yourself or

company as an employer for remitting your employee’s contribution together with

your employer’s share.

Usually, the BIR and the City/ Municipality Office require the certificates of registration

with the SEC or DTI before a business can be registered with them.

VII. Payslip- is a piece of paper given to an employee every payday which states how

much money he or she has earned, how much tax and deduction for SSS, Phil.Health and Pag-

ibig fund has been taken off.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Chapter IV Management Study Notes RoshDocument18 pagesChapter IV Management Study Notes RoshRochelle CabellezaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- NOTES in Business LawDocument10 pagesNOTES in Business LawCyanLouiseM.Ellixir100% (13)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Negotiable Instruments ReviewerDocument31 pagesNegotiable Instruments ReviewerFaye Cience BoholNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- ObligationDocument1 pageObligationRochelle CabellezaNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Chapter12 - AnswerDocument26 pagesChapter12 - AnswerAubreyNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- NegoDocument2 pagesNegoRochelle CabellezaNo ratings yet

- Chapter14 - Answer PDFDocument18 pagesChapter14 - Answer PDFJONAS VINCENT SamsonNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- BLT Quizzer (Unknown) - Law On Negotiable InstrumentsDocument7 pagesBLT Quizzer (Unknown) - Law On Negotiable InstrumentsJasper Ivan PeraltaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Managerial Decision-Making and Management Accounting InformationDocument92 pagesManagerial Decision-Making and Management Accounting InformationRochelle CabellezaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- NegoDocument2 pagesNegoRochelle CabellezaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Office SuppliesDocument3 pagesOffice SuppliesRochelle CabellezaNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Standard Costs and Operating Performance Measures: Mcgraw-Hill/IrwinDocument24 pagesStandard Costs and Operating Performance Measures: Mcgraw-Hill/IrwinRochelle CabellezaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Chart of Accounts AssetsDocument3 pagesChart of Accounts AssetsRochelle CabellezaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Taxation LawDocument130 pagesTaxation LawJon BandomaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Guitar ChordsDocument5 pagesGuitar ChordsRochelle CabellezaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Profitability Analysis: Appendix BDocument17 pagesProfitability Analysis: Appendix BRochelle CabellezaNo ratings yet

- The Accountant BASICDocument20 pagesThe Accountant BASICRochelle CabellezaNo ratings yet

- RFBT - AMLA Notes (Picture) PDFDocument9 pagesRFBT - AMLA Notes (Picture) PDFRochelle CabellezaNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Audit - Exam1Document3 pagesAudit - Exam1Mark Angelo ArceoNo ratings yet

- CHAP 2 Information Technology Auditing and AssuranceDocument5 pagesCHAP 2 Information Technology Auditing and AssuranceRochelle CabellezaNo ratings yet

- Pricing Products and Services: Appendix ADocument18 pagesPricing Products and Services: Appendix ARochelle CabellezaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Maintenance ManagementDocument36 pagesMaintenance ManagementRochelle CabellezaNo ratings yet

- Title Text BlockDocument1 pageTitle Text BlockRochelle CabellezaNo ratings yet

- Title Text BlockDocument1 pageTitle Text BlockRochelle CabellezaNo ratings yet

- Audit - Exam2Document2 pagesAudit - Exam2Mark Angelo ArceoNo ratings yet

- AP-5907 CashDocument12 pagesAP-5907 CashAiko E. LaraNo ratings yet

- Audit - Exam3Document2 pagesAudit - Exam3Mark Angelo ArceoNo ratings yet

- 20 Principles of Material HandlingDocument3 pages20 Principles of Material HandlingNerz CionNo ratings yet

- Excuse LetterDocument1 pageExcuse LetterRochelle CabellezaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Depr Fixed AssetDocument6 pagesDepr Fixed AssetRanib Bhakta SainjuNo ratings yet

- STO Express 2021 Annual Report Highlights Key DataDocument222 pagesSTO Express 2021 Annual Report Highlights Key DataAkNo ratings yet

- Cfas Chapters SummaryDocument16 pagesCfas Chapters Summarydm3store.05No ratings yet

- Chapter Six - Audit of Current LiabilityDocument4 pagesChapter Six - Audit of Current LiabilityBantamkak Fikadu100% (1)

- Cash Oriented Business ActivitiesDocument5 pagesCash Oriented Business ActivitiesVenus AreolaNo ratings yet

- Question 1Document12 pagesQuestion 1lalaNo ratings yet

- Evaluate Financial MisstatementsDocument11 pagesEvaluate Financial MisstatementsSebastian GarciaNo ratings yet

- Fundamental Analysis of Banking SectorsDocument56 pagesFundamental Analysis of Banking Sectorssidhant kumarNo ratings yet

- ACCT101 - Prelim - THEORY (25 PTS)Document3 pagesACCT101 - Prelim - THEORY (25 PTS)Accounting 201100% (1)

- Ikea Strategy AssessmentDocument6 pagesIkea Strategy Assessmentc.enekwe8981100% (1)

- Case Study: Delta Life Insurance CoDocument15 pagesCase Study: Delta Life Insurance CoDipok RayNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Process of Fundamental Analysis PDFDocument8 pagesProcess of Fundamental Analysis PDFajay.1k7625100% (1)

- Unit 6 Internal Competences and Resources: StructureDocument30 pagesUnit 6 Internal Competences and Resources: StructureRadhika KidambiNo ratings yet

- BCCC173938 Tender Doc PDFDocument391 pagesBCCC173938 Tender Doc PDFTrapti SinghNo ratings yet

- Chapter 4Document103 pagesChapter 4JeanetteMcduffieNo ratings yet

- Santa Barbara Budget Book 10-11 CompleteDocument716 pagesSanta Barbara Budget Book 10-11 CompleteGlenn HendrixNo ratings yet

- Allied Office ProductsDocument5 pagesAllied Office ProductsAdeel Jalil100% (1)

- Salary Slip (70015409 February, 2023)Document1 pageSalary Slip (70015409 February, 2023)حامدولیNo ratings yet

- QuestionsDocument30 pagesQuestionsArra VillanuevaNo ratings yet

- QUIZ in AUDIT OF SHAREHOLDERS EQUITYDocument2 pagesQUIZ in AUDIT OF SHAREHOLDERS EQUITYLugh Tuatha DeNo ratings yet

- Courier Company Business PlanDocument35 pagesCourier Company Business PlanAdina Banea100% (3)

- Partnership Firm Trading and Profit Loss AccountsDocument23 pagesPartnership Firm Trading and Profit Loss Accountskunjap0% (1)

- Accounting Information System I SEMESTER I 2010/2011: Group AssignmentDocument9 pagesAccounting Information System I SEMESTER I 2010/2011: Group AssignmentxaraprotocolNo ratings yet

- CFAS NotesDocument16 pagesCFAS NotesKeith SalesNo ratings yet

- Econ 1 PS2 KeyDocument4 pagesEcon 1 PS2 KeyDavid LamNo ratings yet

- HR Monthly Business Review Sample PresentationDocument10 pagesHR Monthly Business Review Sample PresentationRoxana Butnaru100% (1)

- Description of The BusinessDocument113 pagesDescription of The BusinessAngelica Beleo MadalangNo ratings yet

- AKMy 6e ch10 SMDocument79 pagesAKMy 6e ch10 SMRobin Oegema71% (7)

- 13-Page Legal Questionnaire MCQ & Essay QuestionsDocument49 pages13-Page Legal Questionnaire MCQ & Essay QuestionsJohnKyleMendozaNo ratings yet

- IS Excel Participant - Simplified v2Document9 pagesIS Excel Participant - Simplified v2deepika0% (1)

- The Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityFrom EverandThe Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityNo ratings yet

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)

- Broadway General Manager: Demystifying the Most Important and Least Understood Role in Show BusinessFrom EverandBroadway General Manager: Demystifying the Most Important and Least Understood Role in Show BusinessNo ratings yet