Professional Documents

Culture Documents

Banking Mon 7718

Uploaded by

Czara DyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Banking Mon 7718

Uploaded by

Czara DyCopyright:

Available Formats

Prohibited Transaction

1. Bank acting as insurer

2. Declare Dividends if at the time of declarations: overdrawn etc

3. conduct business in an unsafe and unsound manner: act or omission that may result to damage or

danger etc

4. unauthorized advertisement

5. employment causal or non-regular personnel in the conduct of its business involving bank deposits (in

line with bank secrecy law)

Ex: messengers who are contractual must not have access to the documents such as pouch or

photocopied.

Prohibitions on Directors Officers employees or agents

1. false entries / fraudulent transactions

2. overvaluing of any security

3. disclosure of info.

4. accepting gifts

5. outsourcing inherent banking functions (seven core banking functions that cannot be outsourced)

Ex: tellering duties cannot be outsourced while credit card services may be outsourced

How BSP handles banks in Distress

I. Conservatorship

II. Receivership

III. Liquidation

Conservatorship is an attempt to save the bank from bankruptcy. Receivership enclosure of bank by BSP

due to probable loss. Liquidation is when there is no hope of rehabilitating the bank then the bank shall

pay the creditors.

Inherent Banking Functions

1. Services normally associated placement of deposits and withdrawals based on recording of

movements.

Ex: analytics of data

2. Granting of loans and extension of credit exposure.

3. Position taking and marking risk taking activities.

4. managing risk exposures.

5. strategic decision making

How conservatorship different from receivership in 2 sentences?

The essential difference between the two is that conservator is not necessarily insolvent but only illiquid

meaning assets are still more than the liability. On the other hand, there is insolvency in the receivership

which means that the assets are lesser than the liability. Conservatorship is to keep the business running

but receivership is to avoid further damage to the depositors.

Distinguish conservator and receiver:

1 year conservator

Receiver will access if business shall continue or close down. Conservator’s duty is to make the business

liquid. More Discretion for receiver.

Liquidation: Stop Operation, discontinue the life of the corporation and distribute its assets to is

creditors

Deposits do not become preferred credits meaning because it does not comply with 2244 of the NCC

and it is not notarized. The law states that once notarized, credit will become preferred credits

automatically.

SINGLE BORROWER’S LIMIT – One of the checklist whether to grant a loan or not.

You cannot put all your eggs in one basket because you will also be liable for the loss.

EXAMPLE: SAN MIGUEL GROUP has may companies. Hence, only one limit, as a general rule. However, if

there is guarantee by BSP or government then it may be exception. Less risky.

UPTO Currency monetary stabilization and functions of BSP Quiz for Wednesday..

You might also like

- Business Lending Module 1. 2Document32 pagesBusiness Lending Module 1. 2godfreybernadethaNo ratings yet

- Previous Question LawDocument43 pagesPrevious Question LawGourango SarkerNo ratings yet

- What Is BankDocument19 pagesWhat Is BankSunayana BasuNo ratings yet

- Company LawDocument4 pagesCompany Lawpurity wanjiruNo ratings yet

- Circular No MF 0431Document2 pagesCircular No MF 0431Phantom KnightsNo ratings yet

- Study Material - Module One - Insolvency and Bankruptcy Law - LAW405Document50 pagesStudy Material - Module One - Insolvency and Bankruptcy Law - LAW405PRASANNA BMNo ratings yet

- CKKKKKKKDocument2 pagesCKKKKKKKC K SachcchitNo ratings yet

- BankingDocument19 pagesBankingTipu SultanNo ratings yet

- Reviewer in BANKING (Dizon Book)Document59 pagesReviewer in BANKING (Dizon Book)Maureen Kascha OsoteoNo ratings yet

- Banking LawsDocument10 pagesBanking LawsJulius MilaNo ratings yet

- Banking Dizon 2Document58 pagesBanking Dizon 2Jackie Dela CruzNo ratings yet

- AssignmentDocument6 pagesAssignmentcollinsjampanaNo ratings yet

- Bankruptcy Law OutlineDocument30 pagesBankruptcy Law Outlinelcahern100% (2)

- Final Quiz ReviewDocument17 pagesFinal Quiz ReviewHibbah OwaisNo ratings yet

- Bank Loan DefaultDocument7 pagesBank Loan DefaultGolam Samdanee TaneemNo ratings yet

- The Creditors Guide To Insolvency - From Creditsafe LTDDocument7 pagesThe Creditors Guide To Insolvency - From Creditsafe LTDCreditsafe LtdNo ratings yet

- Activities DDocument2 pagesActivities DAAditya Shaujan PaudelNo ratings yet

- BRO Chapter TwoDocument13 pagesBRO Chapter TwoRaghavendra JeevaNo ratings yet

- Jaiib - Functions of Bank Special RelationshipDocument35 pagesJaiib - Functions of Bank Special RelationshipSelva GaneshNo ratings yet

- Document (2) 1Document28 pagesDocument (2) 1Bi bi fathima Bi bi fathimaNo ratings yet

- Banking Law Notes 8Document10 pagesBanking Law Notes 8Afiqah IsmailNo ratings yet

- Lecture 2 (Banking)Document108 pagesLecture 2 (Banking)miles1280100% (1)

- Banking Law and PracticeDocument5 pagesBanking Law and PracticeiantseriweNo ratings yet

- Sole Proprietorrship ND CompanyDocument4 pagesSole Proprietorrship ND Companykhushityagi1338No ratings yet

- Collection Policies and Procedures PrintedDocument10 pagesCollection Policies and Procedures PrintedCarl Joseph Ninobla JosueNo ratings yet

- Banking ReviewerDocument81 pagesBanking ReviewerApril Gan CasabuenaNo ratings yet

- Crypto Insolvency Article 2019Document8 pagesCrypto Insolvency Article 2019Sonja PrstecNo ratings yet

- 2013 Legal Framework of Banking BusinessDocument143 pages2013 Legal Framework of Banking BusinessdreaNo ratings yet

- Process Customer AccountDocument10 pagesProcess Customer Accountnigus100% (8)

- Investment and Portfolio Mngt. Learning Module 2Document6 pagesInvestment and Portfolio Mngt. Learning Module 2Aira AbigailNo ratings yet

- Group 3 Banker's Rights, Lien, Appropriation, Combination and Set-OffDocument12 pagesGroup 3 Banker's Rights, Lien, Appropriation, Combination and Set-OffthhiongomungaiNo ratings yet

- University of Jahangir Nagar Institute of Business AdministrationDocument6 pagesUniversity of Jahangir Nagar Institute of Business Administrationtabassum tasnim SinthyNo ratings yet

- Chapter 9 - Ending The VentureDocument60 pagesChapter 9 - Ending The VentureTeku ThwalaNo ratings yet

- Mbavu AssignmentDocument6 pagesMbavu AssignmenthassankitwangoNo ratings yet

- Credit ManagementDocument22 pagesCredit ManagementAlmira EntrenaNo ratings yet

- Economics Module 02Document7 pagesEconomics Module 02Sanchari SenNo ratings yet

- Corporate LiquidationDocument11 pagesCorporate LiquidationchristineNo ratings yet

- Understanding Bankruptcy in MalaysiaDocument11 pagesUnderstanding Bankruptcy in MalaysiaFardi007No ratings yet

- Bank Duties and RightsDocument6 pagesBank Duties and RightsSthita Prajna Mohanty100% (1)

- A Basic Assumption of Accounting Is That A Business The Contrary Is DiscoveredDocument25 pagesA Basic Assumption of Accounting Is That A Business The Contrary Is DiscoveredYismawNo ratings yet

- Banking ProjectDocument69 pagesBanking Projectठलुआ क्लब100% (1)

- Banking Quizlet MidtermsDocument6 pagesBanking Quizlet MidtermsGRNo ratings yet

- Hailey College of Banking and FinanceDocument18 pagesHailey College of Banking and Financesea waterNo ratings yet

- Test Question (General Banking)Document39 pagesTest Question (General Banking)Meraj TalukderNo ratings yet

- Banking AssgnDocument14 pagesBanking AssgnlinaNo ratings yet

- Payyyyyying Banker and Collllllecting Banker by Chu PersonDocument59 pagesPayyyyyying Banker and Collllllecting Banker by Chu PersonSahirAaryaNo ratings yet

- BankerDocument23 pagesBankerRamnath Reddy Ambati100% (1)

- Banking Law and OperationsDocument35 pagesBanking Law and OperationsViraja GuruNo ratings yet

- Chapter 13 - BankruptcyDocument4 pagesChapter 13 - BankruptcyAlex BerloNo ratings yet

- ADocument142 pagesACarmi HernandezNo ratings yet

- Inactive Bank AccountDocument3 pagesInactive Bank AccountRocio Isabel LuzuriagaNo ratings yet

- Banking Laws and Jurisprudence ReviewerDocument81 pagesBanking Laws and Jurisprudence ReviewerJada MaalaNo ratings yet

- Banking Laws and Jurisprudence ReviewerDocument81 pagesBanking Laws and Jurisprudence ReviewerRonald ErigaNo ratings yet

- Ugbs 401 Assignment 1Document7 pagesUgbs 401 Assignment 1ikkopal92No ratings yet

- Avoid Being Scammed By A Credit Repair CompanyFrom EverandAvoid Being Scammed By A Credit Repair CompanyRating: 3 out of 5 stars3/5 (1)

- BlaaaaaaaahDocument1 pageBlaaaaaaaahCzara DyNo ratings yet

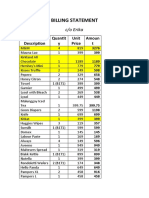

- S&R - Billing StatementDocument4 pagesS&R - Billing StatementCzara DyNo ratings yet

- Republic Vs de GraciaDocument5 pagesRepublic Vs de GraciaRuiz Arenas AgacitaNo ratings yet

- Republic Vs de GraciaDocument5 pagesRepublic Vs de GraciaRuiz Arenas AgacitaNo ratings yet

- Marie Ivonne F. Reyes: Pasig Catholic SchoolDocument1 pageMarie Ivonne F. Reyes: Pasig Catholic SchoolCzara DyNo ratings yet

- Scra 2014Document3 pagesScra 2014Czara DyNo ratings yet

- Castillo vs. RepublicDocument2 pagesCastillo vs. RepublicCzara DyNo ratings yet

- Lacerna Vs CorcinoDocument2 pagesLacerna Vs CorcinobenNo ratings yet

- Barcelote Vs - RepublicDocument2 pagesBarcelote Vs - RepublicCzara DyNo ratings yet

- CORPPPPPPPOOOOOOOOODocument2 pagesCORPPPPPPPOOOOOOOOOCzara DyNo ratings yet

- Corpo Notes 2018 PrelimsDocument14 pagesCorpo Notes 2018 PrelimsCzara DyNo ratings yet

- Nil Cases FinalsDocument37 pagesNil Cases FinalsCzara DyNo ratings yet

- Barcelote Vs - RepublicDocument2 pagesBarcelote Vs - RepublicCzara DyNo ratings yet

- Corpo PrelimsDocument67 pagesCorpo PrelimsCzara DyNo ratings yet

- Torts Finals Pages 15-19Document3 pagesTorts Finals Pages 15-19Czara DyNo ratings yet

- Fujiki vs. MarinayDocument2 pagesFujiki vs. MarinayCzara DyNo ratings yet

- Garcia vs. RecioDocument2 pagesGarcia vs. RecioCzara DyNo ratings yet

- Sunio v. NLRCDocument3 pagesSunio v. NLRCCzara DyNo ratings yet

- G.R. No. L-48955, June 30, 1987)Document8 pagesG.R. No. L-48955, June 30, 1987)Czara DyNo ratings yet

- G.R. No. L-48955, June 30, 1987)Document8 pagesG.R. No. L-48955, June 30, 1987)Czara DyNo ratings yet

- Institution of Heirs. It Will Not Result To IntestacyDocument9 pagesInstitution of Heirs. It Will Not Result To IntestacyCzara DyNo ratings yet

- Page 7 - 8 Proximate or Legal Cause To Legal InjuryDocument12 pagesPage 7 - 8 Proximate or Legal Cause To Legal InjuryCzara DyNo ratings yet

- Policarpio Vs Active BankDocument2 pagesPolicarpio Vs Active BankCzara DyNo ratings yet

- Policarpio Vs Active BankDocument2 pagesPolicarpio Vs Active BankCzara DyNo ratings yet

- Evidence PPT 2018 - Dy NotesDocument14 pagesEvidence PPT 2018 - Dy NotesCzara DyNo ratings yet

- Jimenez vs. FranciscoDocument1 pageJimenez vs. FranciscoCzara DyNo ratings yet

- Proximate or Legal Cause To Legal InjuryDocument12 pagesProximate or Legal Cause To Legal InjuryCzara DyNo ratings yet

- PNB Vs CA DigestDocument3 pagesPNB Vs CA DigestCzara DyNo ratings yet

- Q&A Wills Dean AligadaDocument5 pagesQ&A Wills Dean AligadaCzara DyNo ratings yet

- Presented By, Nikhil Varghese LEAD College of Management, PalakkadDocument17 pagesPresented By, Nikhil Varghese LEAD College of Management, PalakkadShivam SethiNo ratings yet

- Unit Title Page No. Month: DemocracyDocument65 pagesUnit Title Page No. Month: DemocracykarthickNo ratings yet

- Topic 5 Answer Key and SolutionsDocument6 pagesTopic 5 Answer Key and SolutionscykenNo ratings yet

- IME PRINT FinalDocument18 pagesIME PRINT FinalNauman LiaqatNo ratings yet

- Skill Shortage Is A Crucial Social IssueDocument21 pagesSkill Shortage Is A Crucial Social Issuead4w8rlNo ratings yet

- Talent Management QuestionnaireDocument3 pagesTalent Management QuestionnaireG Sindhu Ravindran100% (2)

- The Inland Water Transport of Bangladesh and I2Document3 pagesThe Inland Water Transport of Bangladesh and I2Syed Mubashir Ali H ShahNo ratings yet

- Adise SimeDocument11 pagesAdise SimeFikiru BikilaNo ratings yet

- Simulation of A Sustainable Cement Supply Chain Proposal Model ReviewDocument9 pagesSimulation of A Sustainable Cement Supply Chain Proposal Model Reviewbinaym tarikuNo ratings yet

- Research Proposal of Role of Cooperatives On Women EmpowermentDocument9 pagesResearch Proposal of Role of Cooperatives On Women EmpowermentSagar SunuwarNo ratings yet

- K. Marx, F. Engels - The Communist Manifesto PDFDocument77 pagesK. Marx, F. Engels - The Communist Manifesto PDFraghav vaid0% (1)

- 1992 ColwellDocument20 pages1992 ColwellBhagirath BariaNo ratings yet

- Banking Management Chapter 01Document8 pagesBanking Management Chapter 01AsitSinghNo ratings yet

- Jesse - Livermore Market ThoughtsDocument5 pagesJesse - Livermore Market ThoughtsbrijeshagraNo ratings yet

- Disney Pixar Case AnalysisDocument4 pagesDisney Pixar Case AnalysiskbassignmentNo ratings yet

- Job Costing: True / False QuestionsDocument232 pagesJob Costing: True / False QuestionsElaine GimarinoNo ratings yet

- Call For Papers: 11 International Scientific Conference of Business FacultyDocument6 pagesCall For Papers: 11 International Scientific Conference of Business FacultyИванов ХристоNo ratings yet

- Activity - Cultural Differences and HRMDocument3 pagesActivity - Cultural Differences and HRMSaraKovačićNo ratings yet

- Inventory MCQDocument6 pagesInventory MCQsan0z100% (2)

- Onkar SeedsDocument1 pageOnkar SeedsTejaspreet SinghNo ratings yet

- Topic-3-Price Determination Under Perfect CompetitionDocument19 pagesTopic-3-Price Determination Under Perfect Competitionreuben kawongaNo ratings yet

- Maishince Academy Company Profile (Small Size)Document13 pagesMaishince Academy Company Profile (Small Size)Ahmad Bukhari RoslanNo ratings yet

- Post Merger Integration Toolkit - Overview and ApproachDocument30 pagesPost Merger Integration Toolkit - Overview and Approachrindergal0% (1)

- Innovation in Rural MarketingDocument75 pagesInnovation in Rural Marketingm_dattaiasNo ratings yet

- Accounting Activity 4Document2 pagesAccounting Activity 4Audrey Janae SorianoNo ratings yet

- Conceptual Framework For Marketing Strategy in The Context of Small Business: A ReviewDocument13 pagesConceptual Framework For Marketing Strategy in The Context of Small Business: A ReviewJerald MaglantayNo ratings yet

- Job Satisfaction and MoraleDocument21 pagesJob Satisfaction and MoraleChannpreet ChanniNo ratings yet

- Gandhian Philosophy of Wealth Management BBA N107 UNIT IVDocument20 pagesGandhian Philosophy of Wealth Management BBA N107 UNIT IVAmit Kumar97% (29)

- IT Security Specialist Home Credit: About PositionDocument2 pagesIT Security Specialist Home Credit: About PositionPatrikNo ratings yet

- Gacutan - CIR vs. Basf CoatingDocument1 pageGacutan - CIR vs. Basf CoatingAnneNo ratings yet