Professional Documents

Culture Documents

Acct 2020 Excel Budget Problem Student Template 1

Uploaded by

api-316764247Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acct 2020 Excel Budget Problem Student Template 1

Uploaded by

api-316764247Copyright:

Available Formats

MANAGERIAL ACCOUNTING

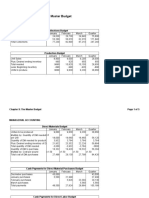

Master Budget

Sales Budget

January February March Quarter

Unit sales (cases) 8,900 9,900 9,200 28,000

Multiply by: Sales price per case 9 9 9 9

Total sales revenue 80,100 89,100 82,800 252,000

Cash Collections Budget

January February March Quarter

Cash collection (30%) 24030 26730 24840 75600

Credit collection (70%) 56070 62370 57960 176400

Total cash collections 80100 89100 82800 252000

Unit sales= Sale in dollars / Selling price per unit

Production Budget

January February March Quarter

Unit sales * 8,900 9,900 9,200 28,000

Plus: Desired ending inventory 990 920 950 950

Total needed 9,890 10,820 10,150 28,950

Less: Beginning inventory 890 990 920 890

Units to produce 9,000 9,830 9,230 28,060

10% * April sale= 9500 * 10%= 9500 units

Chapter 9: The Master Budget Page 1 of 5

MANAGERIAL ACCOUNTING

Direct Materials Budget

January February March Quarter

Units to be produced 9,000 9,830 9,230 28,060

x x x x

Multiply by: Quanity of DM needed per unit 2 2 2 2

Quanity of DM needed for production 18000 19660 18460 56120

Plus: Desired ending inventories of DM 3932 3692 3764 3764

Total quanity of DM needed 21932 23352 22224 59884

Less: Beginning inventory of DM 3600 3932 3692 3600

Quantity of DM to purchase 18332 19420 18532 56284

Multiply by: Cost per found 1.5 1.5 1.5 1.5

Total cost of DM purchase 27498 29130 27798 84426

20% DM that needed for April production

Cash Payments for Direct Material Purchases Budget

January February March Quarter

December purchases (From Account Payable) $43,000 $43,000

January purchases 5500 21998 $27,498

February purchases 5826 23304 $29,130

March purchases 5560 $5,560

Total cash payments 48500 27824 28864 $105,188

20 % for current month, 80% for prior month

Cash Payments for Direct Labor Budget

January February March Quarter

Units to be produced $3,510 $3,834 $3,600 $10,944

Multiply by: Direct labor hours per unit 0.03 0.03 0.03 0.03

Total hours required $105 $115 $108 $328

Multiply by: Direct labor cost per hour $13 $13 $13 $13

Total direct labor hour 1369 1495 1404 4268

Chapter 9: The Master Budget Page 2 of 5

MANAGERIAL ACCOUNTING

Cash Payments for Manufacturing Overhead Budget

January February March Quarter

Rent (Fixed) $6,500 $6,500 $6,500 $19,500

Other MOH (Fixed) $2,900 $2,900 $2,900 $8,700

Variable manufacturing overhead cost 12600 13762 12922 $39,284

Cash payments for manufacturing overhead $22,000 $23,162 $22,322 $67,484

Cash Payments for Operating Expenses Budget

January February March Quarter

Variable opering expenses 10680 11880 11040 33600

Fixed operating expenses $1,400 $1,400 $1,400 4200

Cash payments for operating expenses 12080 13280 12440 37800

Units solds x variable operating expenses per unit sold ($1.20)

Combined Cash Budget

January February March Quarter

Beginning cash balance $4,460 $5,180 $5,344 $4,460

Plus: Cash collections 80100 89100 82800 252000

Total cash avaiable $84,560 $94,280 $88,144 $256,460

Less cash payments:

Direct material purchases 48500 27824 28864 105188

Manufacturing overhead costs $22,000 $23,162 $22,322 $67,484

Operating expenses 12080 13280 12440 37800

Tax payment $10,800 $10,800

Equipment purchases $5,800 $11,600 $15,800 $33,200

Total cash payments 88380 86666 79426 254472

Ending cash balance before financing ($3,820) $7,614 $8,718 $1,988

Financing:

Chapter 9: The Master Budget Page 3 of 5

MANAGERIAL ACCOUNTING

Plus: New borrowings 9000 9000

Less: Debt repayments -2000 -3000 -5000

Less: Interest payments -270 -270 -540

Total financing 9000 -2270 -3270 3460

Ending cash balance $5,180 $5,344 $5,448 $5,448

Interest: $9000 x 1% x 3 months= 270 $270

Total interest $270

Chapter 9: The Master Budget Page 4 of 5

MANAGERIAL ACCOUNTING

Budgeted Manufacturing Cost per Unit

Direct materials cost per unit (2lbs.each x $1.5 per lb.) 3

Direct labor cost per unit 0.03

Variable manufacturing overhead costs per unit 1.4

Fixed manufacturing overhead costs per unit 0.7

Budgeted cost manufacturing one unit 5.13

Budgeted Income Statement

Sale revenue 252,000

Less: Cost of goods sold* ($5.13 x units sold) -143640

Gross profit 108,360

Less: Operating expenses 37800

Less: Depreciation expense -4900

Operating income 65,660

Less: Interest expense -270

Less: Income tax expense (30%) 19617

Net income 45,773

Chapter 9: The Master Budget Page 5 of 5

You might also like

- Tanner McqueenDocument4 pagesTanner Mcqueenapi-242859321No ratings yet

- Excel Budget ProjectDocument7 pagesExcel Budget Projectapi-341205347No ratings yet

- Acct 2020 Excel Budget ProblemDocument6 pagesAcct 2020 Excel Budget Problemapi-307661249No ratings yet

- Excel Budget Problem TemplateDocument2 pagesExcel Budget Problem Templateapi-324651338No ratings yet

- Managerial Accounting Final ProjectDocument5 pagesManagerial Accounting Final Projectapi-382641983No ratings yet

- Acct 2020 EportfolioDocument5 pagesAcct 2020 Eportfolioapi-311375616No ratings yet

- Masterbudget Acct2020Document4 pagesMasterbudget Acct2020api-249190933No ratings yet

- Excel Budget ProblemDocument5 pagesExcel Budget Problemapi-313254091No ratings yet

- Presidio Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualDocument28 pagesPresidio Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualMarc Jim Gregorio100% (1)

- Acct 2020 Excel Master BudgetDocument6 pagesAcct 2020 Excel Master Budgetapi-302665852No ratings yet

- Ivan Madrigals Comprehensive Master Budget Project Version ADocument5 pagesIvan Madrigals Comprehensive Master Budget Project Version Aapi-315768301No ratings yet

- Chapter 9 HomeworkDocument2 pagesChapter 9 Homeworkapi-311464761No ratings yet

- Wasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions ManualDocument12 pagesWasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions Manualapi-356769323No ratings yet

- Comprehensive BudgetDocument5 pagesComprehensive Budgetapi-317125310No ratings yet

- Budget Assignment Norma GDocument5 pagesBudget Assignment Norma Gapi-242614310No ratings yet

- Excel Budget ProjectDocument6 pagesExcel Budget Projectapi-314303195No ratings yet

- Ponderosa-IncDocument6 pagesPonderosa-IncpompomNo ratings yet

- P9-57a 5th Ed Blank Worksheet OnlyDocument7 pagesP9-57a 5th Ed Blank Worksheet Onlyapi-2483356370% (1)

- Master Budget ProjectDocument7 pagesMaster Budget Projectapi-404361400No ratings yet

- Master Decker: Expansion Opporttunities: Calculation of Differential Analysis For Deck BuildingDocument13 pagesMaster Decker: Expansion Opporttunities: Calculation of Differential Analysis For Deck BuildingRitam ChatterjeeNo ratings yet

- Wasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualDocument10 pagesWasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions Manualapi-231890132100% (1)

- Key To Corrections - LEVEL 2 MODULE 7Document9 pagesKey To Corrections - LEVEL 2 MODULE 7UFO CatcherNo ratings yet

- Activity No. 4 - Attach Your Activity With The Filename SURNAME - SECTION - ACT#4Document3 pagesActivity No. 4 - Attach Your Activity With The Filename SURNAME - SECTION - ACT#4-st3v3craft-No ratings yet

- PrestigeDocument13 pagesPrestigeMona SahooNo ratings yet

- Fixed Assets Amount Depreciation (Years) Notes: You Are Fully Funded (Balanced)Document4 pagesFixed Assets Amount Depreciation (Years) Notes: You Are Fully Funded (Balanced)Paulo TorresNo ratings yet

- Business Name Patatasty Currency Symbol P Year End Month December Reporting Year 2020 Year End Reporting Date 29 February 2020Document35 pagesBusiness Name Patatasty Currency Symbol P Year End Month December Reporting Year 2020 Year End Reporting Date 29 February 2020Raschelle MayugbaNo ratings yet

- Exhibit 1 Salem Data Services Summary of Computer: Source: CasewriterDocument5 pagesExhibit 1 Salem Data Services Summary of Computer: Source: CasewriterJagvir Singh Jaglan ms21a025No ratings yet

- ASYNCHRONOUS ACTIVITY 4 WorksheetsDocument12 pagesASYNCHRONOUS ACTIVITY 4 WorksheetsAbejero Trisha Nicole A.No ratings yet

- Is Fishing Non Motorized BangkaDocument4 pagesIs Fishing Non Motorized BangkaAnonymous EvbW4o1U7No ratings yet

- Wasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions ManualDocument12 pagesWasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions Manualapi-269073570No ratings yet

- Wasatch ManufacturingDocument12 pagesWasatch Manufacturingapi-301899907No ratings yet

- Wasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualDocument5 pagesWasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions Manualapi-284934265No ratings yet

- Excell Budget Assignment-Master BudgetDocument6 pagesExcell Budget Assignment-Master Budgetapi-213470756No ratings yet

- Carolyn Trowbridge Acct 2020 Excel Budget Problem Student Template 1Document8 pagesCarolyn Trowbridge Acct 2020 Excel Budget Problem Student Template 1api-284502690No ratings yet

- Prestige Telephone CompanyDocument8 pagesPrestige Telephone CompanyRiandy Ar RasyidNo ratings yet

- Accounting Chapter 9 Eportfolio ExcelDocument12 pagesAccounting Chapter 9 Eportfolio Excelapi-273030710No ratings yet

- Departmental Accounts PDFDocument7 pagesDepartmental Accounts PDFMwajuma mohamediNo ratings yet

- Numbers Sheet Name Numbers Table NameDocument8 pagesNumbers Sheet Name Numbers Table NameAhmed MahmoudNo ratings yet

- Budget InformationDocument10 pagesBudget InformationIsabella BattiataNo ratings yet

- Budget NumericalDocument3 pagesBudget NumericalNouman SheikhNo ratings yet

- Part 1: Estimate Fcfs and Compute NPVS, Irrs, Paybacks, and PisDocument5 pagesPart 1: Estimate Fcfs and Compute NPVS, Irrs, Paybacks, and Pisvenom_ftwNo ratings yet

- SITXFIN009 Assessment C Bistro Reports V1Document3 pagesSITXFIN009 Assessment C Bistro Reports V1Sylovecy EXoNo ratings yet

- Test 1 & Test 2 - MADocument8 pagesTest 1 & Test 2 - MAChi Nguyễn Thị KimNo ratings yet

- Sales Budget Jan Feb Mar April May TotalDocument2 pagesSales Budget Jan Feb Mar April May Totalwhat everNo ratings yet

- Tori Kallerud Chapter 9 HWDocument12 pagesTori Kallerud Chapter 9 HWapi-325347697No ratings yet

- Bus. Plan YawaDocument7 pagesBus. Plan Yawakaye nicolasNo ratings yet

- MASTERDocument10 pagesMASTERNour SawaftaNo ratings yet

- Bigbud 4th Ed Womack BaileyDocument26 pagesBigbud 4th Ed Womack Baileyapi-356759536No ratings yet

- Cash Budget - John: Budgeting SeminarDocument2 pagesCash Budget - John: Budgeting SeminarPranjal JaiswalNo ratings yet

- Management AccountingDocument6 pagesManagement AccountingBornyNo ratings yet

- Ampalaya Ice CreamDocument12 pagesAmpalaya Ice CreamEdhel Bryan Corsiga SuicoNo ratings yet

- WOODDocument12 pagesWOODJayson ReyesNo ratings yet

- Cameron Fisher Excel Budget ProjectDocument2 pagesCameron Fisher Excel Budget Projectapi-340519862No ratings yet

- Budget Project - Melissa Clevenger 1Document4 pagesBudget Project - Melissa Clevenger 1api-701519196No ratings yet

- SecD Group6 PrestigeDocument12 pagesSecD Group6 PrestigePushpendra Kumar RaiNo ratings yet

- MA FX Q Solution 1 2 3Document4 pagesMA FX Q Solution 1 2 3thalnay zarsoeNo ratings yet

- Assignment Managerial Accounting Chapter 8Document4 pagesAssignment Managerial Accounting Chapter 8nabila IkaNo ratings yet

- Jjcute Functional Budget SolutionDocument4 pagesJjcute Functional Budget Solutionjanjan3256No ratings yet

- Assignment Cost Final Edition1Document5 pagesAssignment Cost Final Edition1Bekama Abdii Koo TesfayeNo ratings yet

- Marginal Costing: Definition: (CIMA London)Document4 pagesMarginal Costing: Definition: (CIMA London)Pankaj2cNo ratings yet

- Product Design & Development: Concept SelectionDocument39 pagesProduct Design & Development: Concept SelectionNabbo SainNo ratings yet

- Bangladesh University of Professionals (BUP) Faculty of Business Studies (FBS)Document71 pagesBangladesh University of Professionals (BUP) Faculty of Business Studies (FBS)শাফায়াতরাব্বিNo ratings yet

- Meaning and Reasons For International TradeDocument6 pagesMeaning and Reasons For International TradeMOHAMMED DEMMUNo ratings yet

- Adrenalin Functional Document - Sonali Bank PDFDocument8 pagesAdrenalin Functional Document - Sonali Bank PDFAhsan ZamanNo ratings yet

- Digital Economy and Development of E-CommerceDocument4 pagesDigital Economy and Development of E-CommerceEditor IJTSRDNo ratings yet

- DepartmentationDocument9 pagesDepartmentationArjunsingh HajeriNo ratings yet

- Industrial Relations & Labour Laws: ObjectivesDocument40 pagesIndustrial Relations & Labour Laws: ObjectivesAditya KulkarniNo ratings yet

- 55888bos45300 PDFDocument18 pages55888bos45300 PDFSourav ChamoliNo ratings yet

- ACN - Outsourcing Overview V02Document35 pagesACN - Outsourcing Overview V02Dimpi DhimanNo ratings yet

- Solved On January 1 Year 1 Luzak Company Issued A 120 000Document1 pageSolved On January 1 Year 1 Luzak Company Issued A 120 000Anbu jaromiaNo ratings yet

- Real Estate Buyer GuideDocument18 pagesReal Estate Buyer GuideJustin Huynh0% (1)

- Perhaps You Wondered What Ben Kinmore Who Lives Off inDocument2 pagesPerhaps You Wondered What Ben Kinmore Who Lives Off intrilocksp SinghNo ratings yet

- Trading Options On Technical - Anjana GDocument96 pagesTrading Options On Technical - Anjana Gcodingfreek007100% (1)

- Data Analysis PortfolioDocument20 pagesData Analysis PortfoliokalakanishkNo ratings yet

- Cycle Count ProcessDocument41 pagesCycle Count ProcessRjNo ratings yet

- 6p Mock Exam AnswersDocument44 pages6p Mock Exam Answersshexi325No ratings yet

- ERM and QRM in Life InsuranceDocument236 pagesERM and QRM in Life InsuranceLoic MawetNo ratings yet

- 3 - Curefoods - MOA - Altered - October 9, 2021 PDFDocument4 pages3 - Curefoods - MOA - Altered - October 9, 2021 PDFAbhishekShubhamGabrielNo ratings yet

- Corporate Finance Institute - Financial-Modeling-GuidelinesDocument95 pagesCorporate Finance Institute - Financial-Modeling-GuidelinesTan Pheng SoonNo ratings yet

- Grievance Handling Policy LSMDocument4 pagesGrievance Handling Policy LSMEngr Muhammad Zubair FarooqNo ratings yet

- Next Generation Internal AuditDocument22 pagesNext Generation Internal AuditWajahat Ali100% (2)

- El Nido Plaza - 2960, 2982, 2990 E. Colorado BLVD, Pasadena - For LeaseDocument3 pagesEl Nido Plaza - 2960, 2982, 2990 E. Colorado BLVD, Pasadena - For LeaseJohn AlleNo ratings yet

- Mcdonald'S Corp.: Consolidated Cash Flow StatementDocument2 pagesMcdonald'S Corp.: Consolidated Cash Flow StatementDhruwan ShahNo ratings yet

- ABM 221 Managerial AccountingDocument136 pagesABM 221 Managerial AccountingTimothy MaluwaNo ratings yet

- Annual Marketing PlanDocument5 pagesAnnual Marketing PlanAmirul Amin IVNo ratings yet

- Dead Fish Don't Swim Upstream: Real Life Lessons in EntrepreneurshipDocument34 pagesDead Fish Don't Swim Upstream: Real Life Lessons in EntrepreneurshipCharlene KronstedtNo ratings yet

- The Walt Disney CompanyDocument4 pagesThe Walt Disney CompanyAhsan Ul HaqNo ratings yet

- 16 Quintanar v. CCDocument3 pages16 Quintanar v. CCIELTSNo ratings yet

- Master Plan Amritsar - 2031: Guru Ramdas School of Planning, Guru Nanak Dev University, Amritsar (Punjab)Document31 pagesMaster Plan Amritsar - 2031: Guru Ramdas School of Planning, Guru Nanak Dev University, Amritsar (Punjab)Säbrinä ShukrìNo ratings yet