Professional Documents

Culture Documents

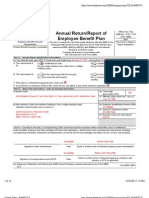

Form IR8A YA 2018

Uploaded by

Sandeep Kumar0 ratings0% found this document useful (0 votes)

346 views2 pagesIR8A

Original Title

Form IR8A YA 2018 (Doc)

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIR8A

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

346 views2 pagesForm IR8A YA 2018

Uploaded by

Sandeep KumarIR8A

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

2018 FORM IR8A

Return of Employee’s Remuneration for the Year Ended 31 Dec 2017

Fill in this form and give it to your employee by 1 Mar 2018

(DO NOT SUBMIT THIS FORM TO IRAS UNLESS REQUESTED)

This Form will take about 10 minutes to complete. Please get ready the employee’s personal particulars and details of his/her employment

income. Please read the explanatory notes when completing this form.

Employer’s Tax Ref. No. / UEN Employee’s Tax Ref. No. : *NRIC / FIN (Foreign Identification No.)

Full Name of Employee as per NRIC / FIN Date of Birth Sex Nationality

Residential Address Designation Bank to which salary is credited

If employment commenced and/or ceased during the year, state: Date of Commencement Date of Cessation

(See Explanatory Note 7)

INCOME (See Explanatory Note 11 unless otherwise specified) $

a) Gross Salary, Fees, Leave Pay, Wages and Overtime Pay

b) Bonus (non-contractual bonus paid in 2017 and/or contractual bonus)

c) Director’s fees (approved at the company’s AGM/EGM on / / )

d) Others:

1. Allowances: (i) Transport $ (ii) Entertainment $ (iii) Others $

2. Gross Commission for the period / / to / / * Monthly and/or other adhoc payment

3. Pension

4. Lump sum payment

(i) Gratuity $ (ii) Notice Pay $ (iii) Ex-gratia payment $

(iv) Others (please state nature) $

(v) Compensation for loss of office $ Approval obtained from IRAS: *Yes/No Date of approval: ..........

Reason for payment: Length of service:

Basis of arriving at the payment: (Give details separately if space is insufficient)

5. Retirement benefits including gratuities/pension/commutation of pension/lump sum payments, etc from

Pension/Provident Fund: Name of Fund

(Amount accrued up to 31 Dec 1992 $ ) Amount accrued from 1993:

6. Contributions made by employer to any Pension/Provident Fund constituted outside Singapore without tax concession:

Contributions made by employer to any Pension/Provident Fund constituted outside Singapore with tax

concession:

Name of the overseas pension/provident fund:

Full Amount of the contributions : Are contributions mandatory: *Yes/No

Were contributions charged / deductions claimed by a Singapore permanent establishment: *Yes/No

7. Excess/Voluntary contribution to CPF by employer (less amount refunded/to be refunded):

[Complete the Form IR8S]

8. Gains or profits from Employee Stock Option (ESOP)/other forms of Employee Share Ownership (ESOW) Plans:

[Complete the Appendix 8B]

9. Value of Benefits-in-kind [See Explanatory Note 14 and complete Appendix 8A]

TOTAL (items d1 to d9)

e) 1. Remission: Amount of Income $....................

2. Overseas Posting: *Full Year/Part of the Year (See Explanatory Note 10a)

3. Exempt Income: $ ............... (See Explanatory Note 10b)

f) If yes and fully borne by employer, DO NOT enter any amount in (i) and (ii)

Employee’s income

tax borne by (i) If tax is partially borne by employer, state the amount of income for which tax is borne by employer

employer?

* YES / NO (ii) If a fixed amount of tax is borne by employee, state the amount to be paid by employee

DEDUCTIONS (See Explanatory Note 12 - Deductions)

EMPLOYEE’S COMPULSORY contribution to *CPF/Designated Pension or Provident Fund (less amount refunded/to be

refunded) Name of Fund :

(Please apply the appropriate CPF rates published by CPF Board on its website ‘www.cpf.gov.sg’. Do not include

excess/voluntary contributions to CPF, voluntary contributions to Medisave Account, voluntary contributions to

Retirement Sum Topping-up Scheme, SRS contributions and contributions to Overseas Pension or Provident Fund in

this item)

Donations deducted from salaries for:

*Yayasan Mendaki Fund/Community Chest of Singapore/SINDA/CDAC/ECF/Other tax exempt donations

Contributions deducted from salaries to Mosque Building Fund :

Life Insurance premiums deducted from salaries:

DECLARATION (See Explanatory Note 4)

Name of Employer :

Address of Employer :

Name of authorised person making the declaration Designation Tel. No. Signature Date

There are penalties for failing to give a return or furnishing an incorrect or late return.

IR8A (1/2018) * Delete where applicable

You might also like

- Ir8a (M) 2010Document1 pageIr8a (M) 2010gk9f5e6ho1owcldxNo ratings yet

- 1a. IR8A (M) - YA 2012 - v1Document1 page1a. IR8A (M) - YA 2012 - v1freepublic9No ratings yet

- Form Ir8a - Ya 2017Document2 pagesForm Ir8a - Ya 2017Naga RajNo ratings yet

- DT 0103 Personal Income Tax Return Form v1Document5 pagesDT 0103 Personal Income Tax Return Form v1okatakyie1990100% (1)

- Ghana Revenue Authority: Personal Income Tax ReturnDocument5 pagesGhana Revenue Authority: Personal Income Tax ReturnDavid Biah100% (1)

- Pay Bill GazettedDocument3 pagesPay Bill Gazettedibrahimshahghotki_20No ratings yet

- Certificate of Collection or Deduction of Tax-2018-19Document2 pagesCertificate of Collection or Deduction of Tax-2018-19Sarfraz Ali100% (1)

- US Internal Revenue Service: I1065bsk - 2004Document10 pagesUS Internal Revenue Service: I1065bsk - 2004IRSNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Adam AkbarNo ratings yet

- Obverse: Received For The Month of .. 20 . Classification MonthlyDocument2 pagesObverse: Received For The Month of .. 20 . Classification MonthlyAbdul Rehman CheemaNo ratings yet

- Partner's Instructions For Schedule K-1 (Form 1065) : Internal Revenue ServiceDocument10 pagesPartner's Instructions For Schedule K-1 (Form 1065) : Internal Revenue ServiceIRSNo ratings yet

- US Internal Revenue Service: f1040nr - 2005Document5 pagesUS Internal Revenue Service: f1040nr - 2005IRSNo ratings yet

- 0 - 1098 Mortgage Interest 2022 - 01122023 - 162111Document1 page0 - 1098 Mortgage Interest 2022 - 01122023 - 162111Osvaldo CalderonUACJNo ratings yet

- Annexure-IV Form For Furnishing Pensioner / Family Pensioner DetailsDocument4 pagesAnnexure-IV Form For Furnishing Pensioner / Family Pensioner DetailsSrinivasavaradan EsNo ratings yet

- US Internal Revenue Service: I1065bsk - 2005Document10 pagesUS Internal Revenue Service: I1065bsk - 2005IRSNo ratings yet

- 2019 03 27 19 17 48 254 - DGCPK4360Q - 2018Document5 pages2019 03 27 19 17 48 254 - DGCPK4360Q - 2018TAX GURUNo ratings yet

- Employee Proof Submission Form - 2011-12Document5 pagesEmployee Proof Submission Form - 2011-12aby_000No ratings yet

- Pdf&rendition 1 PDFDocument1 pagePdf&rendition 1 PDFainaa batrisyiaNo ratings yet

- To: Corporate Taxation, ICOMM Tele Limited, Head OfficeDocument52 pagesTo: Corporate Taxation, ICOMM Tele Limited, Head OfficesandeepNo ratings yet

- Tax Investments Format 2010-11Document2 pagesTax Investments Format 2010-11mcnavineNo ratings yet

- Employee Tax Declaration - AY 2019-20Document4 pagesEmployee Tax Declaration - AY 2019-20mathuNo ratings yet

- 182 Day in PY (2022-2023) : and 365 Days in 4 PPY (2018 - 2022)Document13 pages182 Day in PY (2022-2023) : and 365 Days in 4 PPY (2018 - 2022)nadiyakadri246No ratings yet

- IT Declaration Form 2016-17Document11 pagesIT Declaration Form 2016-17JoooNo ratings yet

- HD527Document1 pageHD527nataliecheung324No ratings yet

- For Mir 210508Document7 pagesFor Mir 210508jegathesan RamasamyNo ratings yet

- Staten of EarningsDocument7 pagesStaten of EarningsEcaterina DavidovNo ratings yet

- Gratuity Affidavit FormatDocument3 pagesGratuity Affidavit FormatSAI ASSOCIATE100% (1)

- DownloadDocument6 pagesDownloadpankhewalegNo ratings yet

- AFGIS 212 Survival Benefit Claim FormDocument1 pageAFGIS 212 Survival Benefit Claim FormSashank NalluriNo ratings yet

- Camfil Air Filtration India Private Limited Tax Declaration Form For The Financial Year 2018-19Document3 pagesCamfil Air Filtration India Private Limited Tax Declaration Form For The Financial Year 2018-19सौरव डेNo ratings yet

- Income Tax - SalaryDocument18 pagesIncome Tax - SalaryhanumanthaiahgowdaNo ratings yet

- Application of Gratuity by A NomineeDocument5 pagesApplication of Gratuity by A NomineelibinpouloseNo ratings yet

- Unit 2 Income From SalariesDocument21 pagesUnit 2 Income From SalariesShreya SilNo ratings yet

- New IT Declaration FormDocument2 pagesNew IT Declaration FormMahakaal Digital PointNo ratings yet

- Form No. 25A: IhndiDocument9 pagesForm No. 25A: Ihndibinu012No ratings yet

- IT Declaration Form 2019-20Document1 pageIT Declaration Form 2019-20KarunaNo ratings yet

- 103120000000007839Document3 pages103120000000007839ShilpaMurthyNo ratings yet

- Sunday, April 5, 2009: Income Under The Head Salary (Section 15 - 17)Document14 pagesSunday, April 5, 2009: Income Under The Head Salary (Section 15 - 17)Prashant singhNo ratings yet

- PFMDocument42 pagesPFMRavi PandeyNo ratings yet

- Form GST Rfd11Document63 pagesForm GST Rfd11forbooksNo ratings yet

- SSS - Employee - Investment - Declaration - Form12BB - FY 2022-23Document10 pagesSSS - Employee - Investment - Declaration - Form12BB - FY 2022-23gowtham DevNo ratings yet

- IT Declaration Format-05-12-2023Document6 pagesIT Declaration Format-05-12-2023somaNo ratings yet

- Chapter-9 Salary IncomeDocument21 pagesChapter-9 Salary IncomeDhrubo Chandro RoyNo ratings yet

- US Internal Revenue Service: f5500 - 1995Document6 pagesUS Internal Revenue Service: f5500 - 1995IRSNo ratings yet

- Retirement Plan of Trustees 2007Document14 pagesRetirement Plan of Trustees 2007Latisha WalkerNo ratings yet

- Total Income 1Document31 pagesTotal Income 1swatiNo ratings yet

- Claim For Refund and Request For Abatement: See Separate InstructionsDocument1 pageClaim For Refund and Request For Abatement: See Separate InstructionsYang JeanNo ratings yet

- Composite Declaration Form - 11: (To Be Retained by Employer For Future Reference) Employees' Provident Fund OrganizationDocument2 pagesComposite Declaration Form - 11: (To Be Retained by Employer For Future Reference) Employees' Provident Fund OrganizationManasNo ratings yet

- US Internal Revenue Service: f941 - 2000Document4 pagesUS Internal Revenue Service: f941 - 2000IRSNo ratings yet

- Employee's Withholding Certificate: Step 1: Enter Personal InformationDocument4 pagesEmployee's Withholding Certificate: Step 1: Enter Personal InformationcstaknysNo ratings yet

- Sophiea B - Associate Customer EngagementDocument5 pagesSophiea B - Associate Customer EngagementGloryNo ratings yet

- Income Fom SayDocument39 pagesIncome Fom SayAli NadafNo ratings yet

- US Internal Revenue Service: f941 - 2003Document4 pagesUS Internal Revenue Service: f941 - 2003IRSNo ratings yet

- Salary ExemptionsDocument47 pagesSalary ExemptionsCodamination ChannelNo ratings yet

- Annex This Schedule To The Return of Income If You Have Income From SalariesDocument18 pagesAnnex This Schedule To The Return of Income If You Have Income From SalariessajedulNo ratings yet

- Carpenters Welfare Fund 2007Document18 pagesCarpenters Welfare Fund 2007Latisha WalkerNo ratings yet

- Please Read The Notes Overleaf Before Completing This FormDocument2 pagesPlease Read The Notes Overleaf Before Completing This FormTnes 1995No ratings yet

- Form8 2007 08Document5 pagesForm8 2007 08api-3850174No ratings yet

- 2.2 Module 2 Part 2Document12 pages2.2 Module 2 Part 2Arpita ArtaniNo ratings yet

- 2.2-Module 2-Part 2 PDFDocument12 pages2.2-Module 2-Part 2 PDFArpita ArtaniNo ratings yet

- Topic 3 - Compensation IncomeDocument13 pagesTopic 3 - Compensation IncomeRoxanne DiazNo ratings yet

- Edu 2012 Spring Fsa BooksDocument6 pagesEdu 2012 Spring Fsa BooksSivi Almanaf Ali ShahabNo ratings yet

- Retirement & Welfare Benefits: Securing The Right To Deferred and Contingent BenefitsDocument73 pagesRetirement & Welfare Benefits: Securing The Right To Deferred and Contingent BenefitsramdevsajanNo ratings yet

- Sip On Income TaxDocument75 pagesSip On Income TaxGaurav Jain0% (1)

- Fin e 59 2016Document10 pagesFin e 59 2016Brooks OrtizNo ratings yet

- Finance (Pension) Department: G.O.No.75, Dated: 14 March, 2013Document3 pagesFinance (Pension) Department: G.O.No.75, Dated: 14 March, 2013Bernadette RajNo ratings yet

- Wages and Time RecorDocument4 pagesWages and Time Recornurfitriana sandiniNo ratings yet

- DLP Deferred AnnuityDocument7 pagesDLP Deferred AnnuityVal Daryl AnhaoNo ratings yet

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Income Tax and VATDocument8 pagesThe Institute of Chartered Accountants of Nepal: Suggested Answers of Income Tax and VATDipen AdhikariNo ratings yet

- EPF - Form 2Document2 pagesEPF - Form 2Ankit ShawNo ratings yet

- Nama: Regita Pramesty Ayu P NIM: F0316104 Kelas: ADocument3 pagesNama: Regita Pramesty Ayu P NIM: F0316104 Kelas: APrabawati Kesuma BrataNo ratings yet

- Robinhood Trailing Stop LossDocument3 pagesRobinhood Trailing Stop Lossj39jdj92oijtNo ratings yet

- Day 2Document4 pagesDay 2Rafay ZamanNo ratings yet

- Social Legislation - Case DigestsDocument27 pagesSocial Legislation - Case Digestskrys_elleNo ratings yet

- Nism V-A Mutual Fund Question and Answers: QuestionsDocument7 pagesNism V-A Mutual Fund Question and Answers: Questionsritesh sinhaNo ratings yet

- Simplifying Security: Encouraging Better Retirement DecisionsDocument76 pagesSimplifying Security: Encouraging Better Retirement DecisionsScribd Government DocsNo ratings yet

- cOMP aPPTMNT - dEC 2014Document20 pagescOMP aPPTMNT - dEC 2014Rajesh ShuklaNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountsakthivelNo ratings yet

- IAS 19 - Employee Benefits (2011)Document6 pagesIAS 19 - Employee Benefits (2011)Katrina EustaceNo ratings yet

- Notes Forming Part of Financial StatementsDocument58 pagesNotes Forming Part of Financial StatementsAndrew StarkNo ratings yet

- Restoration TableDocument2 pagesRestoration TableMuhammad Farooq AwanNo ratings yet

- 2022 T1 Form - CompletedDocument8 pages2022 T1 Form - CompletedARSH GROVERNo ratings yet

- Head Description: Income Tax Ratio Gross Income/Tax LiabilityDocument4 pagesHead Description: Income Tax Ratio Gross Income/Tax LiabilityGhodawatNo ratings yet

- Goodyear Philippines Inc. vs. AngusDocument1 pageGoodyear Philippines Inc. vs. AngusAnn MarieNo ratings yet

- Dental Treatment Refund Form PDFDocument4 pagesDental Treatment Refund Form PDFMick BurnsNo ratings yet

- STT456Weeks8to9 S2015 Annot PDFDocument47 pagesSTT456Weeks8to9 S2015 Annot PDFHông HoaNo ratings yet

- Social LegislationDocument18 pagesSocial LegislationSjaneyNo ratings yet

- Chapter-3: Inter-Temporal Tax Planning Using Alternative Tax Vehicles Constant Tax RateDocument3 pagesChapter-3: Inter-Temporal Tax Planning Using Alternative Tax Vehicles Constant Tax RatetanvirNo ratings yet

- Pre Need PlansDocument11 pagesPre Need PlansEmille Martin Crisostomo Munsayac IINo ratings yet

- Quiz #4 (Engineering Economy) Quiz #4 (Engineering Economy) : TH ND TH NDDocument1 pageQuiz #4 (Engineering Economy) Quiz #4 (Engineering Economy) : TH ND TH NDMiko F. RodriguezNo ratings yet