Professional Documents

Culture Documents

CIR vs. Ayala Securities Corp., GR No. L-29485

Uploaded by

Alyza Montilla BurdeosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CIR vs. Ayala Securities Corp., GR No. L-29485

Uploaded by

Alyza Montilla BurdeosCopyright:

Available Formats

G.R. No.

L-29485 November 21, 1980

COMMISSIONER OF INTERNAL REVENUE, petitioner,

vs.

AYALA SECURITIES CORPORATION and THE HONORABLE COURT OF TAX

APPEALS, respondents.

FACTS: On February 21, 1961, the Commissioner of Internal Revenue made an assessment on Ayala

Securities Corporation in the sum of 758,687.04 as 25% surtax and interest on its accumulated surplus of

2,758,442.37 for its fiscal year ending September 30, 1955. Ayala invoked the defense of prescription

against the right of CIR to assess the said tax. It is contended that since its income tax return for 1957

was filed in 1958, and with the clarification by Ayala in its letter dated May 14, 1963, that the amount

sought to be collected was their surtax liability under Section 25 rather than deficiency corporate income

tax under Section 24 of the National Internal Revenue Code, the assessment has already prescribed

under Section 331 of the same Code. The Court of Tax Appeals ruled that the assessment fell under the

5-year prescriptive period provided in Section 331 of the NIRC and that the assessment had, therefore,

been made after the expiration of the said five-year prescriptive period and was of no binding force and

effect.

ISSUE: Whether or not the period to collect the tax on accumulated surplus has prescribed?

RULING: No. the Court's decision of April 8, 1976 is set aside and in lieu thereof, judgment is hereby

rendered ordering respondent corporation to pay the assessment in the sum of P758,687.04 as 25%

surtax on its unreasonably accumulated surplus, plus the 5% surcharge and 1% monthly interest thereon,

pursuant to section 51 (e) of the National Internal Revenue Code, as amended by R. A. 2343.

RATIO: The Court is persuaded by the fundamental principle invoked by the Commission of Internal

Revenue that limitations upon the right of the government to assess and collect taxes will not be

presumed in the absence of clear legislation to the contrary and that where the government has not by

express statutory provision provided a limitation upon its right to assess unpaid taxes, such right is

imprescriptible. There is no such time limit on the right of the Commissioner of Internal Revenue to

assess the 25% tax on unreasonably accumulated surplus provided in section 25 of the Tax Code, since

there is no express statutory provision limiting such right or providing for its prescription. The underlying

purpose of the additional tax in question on a corporation's improperly accumulated profits or surplus is as

set forth in the text of section 25 of the Tax Code itself 1 to avoid the situation where a corporation unduly

retains its surplus instead of declaring and paving dividends to its shareholders or members who would

then have to pay the income tax due on such dividends received by them.

You might also like

- CIR V Ayala Securities CorporationDocument1 pageCIR V Ayala Securities CorporationEmil Bautista100% (1)

- Cir V Hantex Trading Co, Inc. G.R. NO. 136975: March 31, 2005 Callejo, SR., J.: FactsDocument2 pagesCir V Hantex Trading Co, Inc. G.R. NO. 136975: March 31, 2005 Callejo, SR., J.: FactsKate Garo100% (2)

- 5 Chavez Vs Ongpin - DigestDocument2 pages5 Chavez Vs Ongpin - DigestGilbert Mendoza100% (5)

- (SPIT) (CIR v. Benguet Corp.)Document3 pages(SPIT) (CIR v. Benguet Corp.)Matthew JohnsonNo ratings yet

- Renato Diaz V Secretary of FinanceDocument2 pagesRenato Diaz V Secretary of FinanceDexter MantosNo ratings yet

- Philex Mining Vs Cir DigestDocument3 pagesPhilex Mining Vs Cir DigestRyan Acosta100% (2)

- Cagayan Electric Power Vs CIRDocument2 pagesCagayan Electric Power Vs CIRJosephine Huelva VictorNo ratings yet

- Atlas Consolidated Mining V CIR (Case Digest)Document2 pagesAtlas Consolidated Mining V CIR (Case Digest)Jeng Pion100% (1)

- #33 CIR Vs British Overseas Airways CorporationDocument2 pages#33 CIR Vs British Overseas Airways CorporationTeacherEliNo ratings yet

- Pepsi-Cola Vs Municipality of Tanauan DigestDocument3 pagesPepsi-Cola Vs Municipality of Tanauan DigestRyan Acosta100% (1)

- Madrigal Vs RaffertyDocument2 pagesMadrigal Vs RaffertyKirs Tie100% (1)

- CIR v. SC Johnson and Son Inc.Document1 pageCIR v. SC Johnson and Son Inc.Marie Chielo100% (2)

- CIR vs. Mitsubishi MetalDocument3 pagesCIR vs. Mitsubishi MetalHonorio Bartholomew Chan100% (1)

- Philippine Acetylene Co. Inc vs. CirDocument2 pagesPhilippine Acetylene Co. Inc vs. Cirbrendamanganaan100% (1)

- Phil. Guaranty Co. v. CIRDocument2 pagesPhil. Guaranty Co. v. CIRIshNo ratings yet

- CIR Vs CTA DigestDocument2 pagesCIR Vs CTA DigestAbilene Joy Dela Cruz83% (6)

- CIR Vs BAIER-NICKEL G.R. No. 153793 August 29, 2006Document2 pagesCIR Vs BAIER-NICKEL G.R. No. 153793 August 29, 2006Emil BautistaNo ratings yet

- Philamlife V Cta Case DigestDocument2 pagesPhilamlife V Cta Case DigestAnonymous BvmMuBSwNo ratings yet

- Diaz Vs Secretary of FinanceDocument3 pagesDiaz Vs Secretary of FinanceJoshua Shin100% (5)

- Case Digest Cir vs. BoacDocument1 pageCase Digest Cir vs. BoacAnn SC100% (5)

- Smart Communications, Inc. vs. Municipality of Malvar, BatangasDocument3 pagesSmart Communications, Inc. vs. Municipality of Malvar, BatangasRaquel Doquenia100% (2)

- Caltex v. COA - DigestDocument2 pagesCaltex v. COA - DigestChie Z. Villasanta71% (7)

- Hydro Resources vs. CADocument1 pageHydro Resources vs. CAA Paula Cruz FranciscoNo ratings yet

- Cir V Gotamco DigestDocument1 pageCir V Gotamco DigestDee LMNo ratings yet

- CIR V Vda. de PrietoDocument2 pagesCIR V Vda. de PrietoSophiaFrancescaEspinosa100% (1)

- CIR v. CADocument2 pagesCIR v. CAKristina Karen100% (1)

- Sy Po Vs CTADocument1 pageSy Po Vs CTALizzy WayNo ratings yet

- Case Digests Volume IIIDocument35 pagesCase Digests Volume IIItagacapiz100% (4)

- Honda Car Phils vs. Honda Cars Technical Specialist & Supervisors UnionDocument1 pageHonda Car Phils vs. Honda Cars Technical Specialist & Supervisors UnionNej Adunay100% (1)

- Republic V Salud HIzonDocument2 pagesRepublic V Salud HIzonPJ Hong100% (1)

- Collector v. UstDocument2 pagesCollector v. UstEynab PerezNo ratings yet

- CIR Vs PLDTDocument1 pageCIR Vs PLDTArmstrong BosantogNo ratings yet

- City of Baguio v. Fortunato de Leon GR L-24756Document1 pageCity of Baguio v. Fortunato de Leon GR L-24756Charles Roger RayaNo ratings yet

- CIR vs. BENGUET CORPORATIONDocument3 pagesCIR vs. BENGUET CORPORATIONakosiemNo ratings yet

- CIR Vs The Estate of TodaDocument3 pagesCIR Vs The Estate of TodaLDNo ratings yet

- Fernandez Hermanos Vs CirDocument2 pagesFernandez Hermanos Vs CirKim Lorenzo CalatravaNo ratings yet

- CIR vs. Central Luzon Drug Corp GR. 159647 and CIR Vs Central Luzon Drug Corp. GR No. 148512Document4 pagesCIR vs. Central Luzon Drug Corp GR. 159647 and CIR Vs Central Luzon Drug Corp. GR No. 148512Kath Leen100% (1)

- Basilan Estates Vs CIRDocument2 pagesBasilan Estates Vs CIRKim Lorenzo Calatrava100% (1)

- MERALCO V Province of LagunaDocument2 pagesMERALCO V Province of LagunaJaz Sumalinog100% (1)

- Maceda vs. MacaraigDocument2 pagesMaceda vs. MacaraigShella Antazo100% (5)

- 116-Bisaya Land Transportation Co., Inc. v. CIR, 105 Phil. 1338Document1 page116-Bisaya Land Transportation Co., Inc. v. CIR, 105 Phil. 1338Jopan SJ100% (1)

- Esso Standard V CIRDocument2 pagesEsso Standard V CIRSui100% (1)

- Republic v. Mambulao Lumber Co.Document2 pagesRepublic v. Mambulao Lumber Co.Joni Aquino50% (2)

- Caltex Philippines V CoaDocument1 pageCaltex Philippines V CoaJL A H-Dimaculangan100% (3)

- Hilado vs. CIRDocument2 pagesHilado vs. CIRAlan Gultia100% (2)

- Procter & Gamble V Municipality of JagnaDocument2 pagesProcter & Gamble V Municipality of JagnaJackie Canlas100% (3)

- Bonifacia Sy Po Vs CTADocument2 pagesBonifacia Sy Po Vs CTACarl Montemayor50% (2)

- 08 CIR V Baier-NickelDocument1 page08 CIR V Baier-NickelAnn QuebecNo ratings yet

- SMI-ED Vs CIRDocument2 pagesSMI-ED Vs CIRVel June50% (2)

- G.R. No. L-53961Document1 pageG.R. No. L-53961Jannie Ann DayandayanNo ratings yet

- 106 Cir Vs Cta GR No 106611 July 21 1994 DigestDocument1 page106 Cir Vs Cta GR No 106611 July 21 1994 Digestjayinthelongrun33% (3)

- CIR V Marubeni CorpDocument2 pagesCIR V Marubeni CorpJaz Sumalinog75% (8)

- Commissioner of Internal Revenue Vs Isabela Cultural CorporationDocument2 pagesCommissioner of Internal Revenue Vs Isabela Cultural CorporationKim Lorenzo Calatrava100% (2)

- Eastern Theatrical Vs AlfonsoDocument2 pagesEastern Theatrical Vs AlfonsoKirsten Denise B. Habawel-Vega67% (3)

- Luzon Stevedoring Corp vs. CTADocument2 pagesLuzon Stevedoring Corp vs. CTAmaximum jicaNo ratings yet

- CITY OF BAGUIO V. FORTUNATO DE LEON, 25 SCRA 938 - PUBLIC PURPOSE - EQUAL PROTECTION - DigestDocument1 pageCITY OF BAGUIO V. FORTUNATO DE LEON, 25 SCRA 938 - PUBLIC PURPOSE - EQUAL PROTECTION - DigestKate GaroNo ratings yet

- 9 CIR V Ayala Securities Corp. (1980)Document7 pages9 CIR V Ayala Securities Corp. (1980)KristineSherikaChyNo ratings yet

- CIR Vs Ayala Securities CorpDocument7 pagesCIR Vs Ayala Securities Corplen_dy010487No ratings yet

- CIR vs. AyalaDocument11 pagesCIR vs. AyalaEvan NervezaNo ratings yet

- CIR Vs AyalaDocument4 pagesCIR Vs AyalaSheila RosetteNo ratings yet

- Notes Criminal Law 1Document36 pagesNotes Criminal Law 1Alyza Montilla BurdeosNo ratings yet

- A Letter For Mayor Oscar Moreno-2Document5 pagesA Letter For Mayor Oscar Moreno-2Alyza Montilla BurdeosNo ratings yet

- Monthly Accomplishment Report: For The Month of June 2021Document2 pagesMonthly Accomplishment Report: For The Month of June 2021Alyza Montilla BurdeosNo ratings yet

- Religous LeadersDocument1 pageReligous LeadersAlyza Montilla BurdeosNo ratings yet

- AaDocument2 pagesAaAlyza Montilla BurdeosNo ratings yet

- Important Notes On InsuranceDocument1 pageImportant Notes On InsuranceAlyza Montilla BurdeosNo ratings yet

- Legal Ethics ReviewerDocument13 pagesLegal Ethics ReviewerAlyza Montilla BurdeosNo ratings yet

- Your Text Here: Cooking My DreamsDocument5 pagesYour Text Here: Cooking My DreamsAlyza Montilla BurdeosNo ratings yet

- G.R. No. L-39473 April 30, 1979 Republic of The Philippines, Petitioner, Hon. Court of Appeals and Isabel Lastimado, RespondentsDocument6 pagesG.R. No. L-39473 April 30, 1979 Republic of The Philippines, Petitioner, Hon. Court of Appeals and Isabel Lastimado, RespondentsAlyza Montilla BurdeosNo ratings yet

- Extrajudicial Partition of A Parcel of Land Located in Barangay Mataba1Document4 pagesExtrajudicial Partition of A Parcel of Land Located in Barangay Mataba1Alyza Montilla BurdeosNo ratings yet

- 5Document2 pages5Alyza Montilla BurdeosNo ratings yet

- Republic of The Philippines Manila Second Division: Supreme CourtDocument27 pagesRepublic of The Philippines Manila Second Division: Supreme CourtAlyza Montilla BurdeosNo ratings yet

- 3Document2 pages3Alyza Montilla BurdeosNo ratings yet

- 1Document2 pages1Alyza Montilla BurdeosNo ratings yet

- Your Text Here: Cooking My DreamsDocument5 pagesYour Text Here: Cooking My DreamsAlyza Montilla BurdeosNo ratings yet

- Calculate Your Expenses - Home Office Expenses For Employees - Canada - CaDocument3 pagesCalculate Your Expenses - Home Office Expenses For Employees - Canada - CaBriar WoodNo ratings yet

- F 8288 ADocument5 pagesF 8288 AIRSNo ratings yet

- InvoiceDocument1 pageInvoiceatipriya choudharyNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountSuhani GargNo ratings yet

- 456Document4 pages456ziabuttNo ratings yet

- SS Line 1Document3 pagesSS Line 1marlenemartinez119No ratings yet

- Acceptance Payment Form Estate Tax AmnestyDocument1 pageAcceptance Payment Form Estate Tax AmnestyAlvin III SiapianNo ratings yet

- Tax Invoice: B.D. Inno Ventures Private LimitedDocument1 pageTax Invoice: B.D. Inno Ventures Private Limitedzeel dholakiyaNo ratings yet

- It 000135879998 2023 00Document1 pageIt 000135879998 2023 00Qavi UddinNo ratings yet

- Tax and Taxation PDFDocument2 pagesTax and Taxation PDFwinky colinaNo ratings yet

- Form 1615012023 135230 PDFDocument3 pagesForm 1615012023 135230 PDFSahil ThakurNo ratings yet

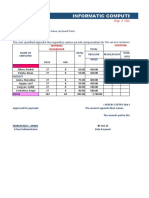

- Payroll: Informatic Computer Institute of Agusan Del SurDocument4 pagesPayroll: Informatic Computer Institute of Agusan Del SurJulius SalasNo ratings yet

- Premium Certificate Financial Year 2021-2022 To Whomsoever It May ConcernDocument2 pagesPremium Certificate Financial Year 2021-2022 To Whomsoever It May Concernrajesh nagarajNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Sahil YadavNo ratings yet

- PLDT 2307 July 2021 Front CorrectedDocument1 pagePLDT 2307 July 2021 Front CorrectedChristopher AbundoNo ratings yet

- TAX 1 Mini Digest Part 2Document6 pagesTAX 1 Mini Digest Part 2Lilu BalgosNo ratings yet

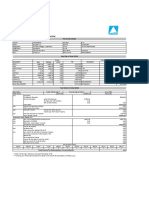

- Altruist Customer Management India PVT LTD: Personal DetailsDocument1 pageAltruist Customer Management India PVT LTD: Personal DetailsSampathKPNo ratings yet

- An Introduction To GST: Himanshu Kushwaha Assistant Professor, Malda College, Malda, West BengalDocument18 pagesAn Introduction To GST: Himanshu Kushwaha Assistant Professor, Malda College, Malda, West Bengalneha pandeyNo ratings yet

- Itr 23-24Document1 pageItr 23-24sunil jadhavNo ratings yet

- IAS 20 Government GrantsDocument1 pageIAS 20 Government Grantsm2mlckNo ratings yet

- Say No To Corruption: Iesco Charges Govt Charges Total ChargesDocument1 pageSay No To Corruption: Iesco Charges Govt Charges Total ChargesUmar FarooqNo ratings yet

- Tax Invoice Shubhojeet Mazumdar: Pay BillDocument1 pageTax Invoice Shubhojeet Mazumdar: Pay BillShubhojeet MazumdarNo ratings yet

- CP575 1372187182568Document3 pagesCP575 1372187182568vinie davisNo ratings yet

- AR Invoice - 20230215 - 150220Document1 pageAR Invoice - 20230215 - 150220Prasad MahaleNo ratings yet

- Boom Lift Purchase Order - 09.01.2019Document1 pageBoom Lift Purchase Order - 09.01.2019sheelaNo ratings yet

- Permit - Alpine MiaDocument2 pagesPermit - Alpine MiakatemesiasNo ratings yet

- Your Phone Bill: Summary of Your AccountDocument8 pagesYour Phone Bill: Summary of Your AccountAna SnjaricNo ratings yet

- Reminder To All Taxpayers Mandated To File and Pay ElectronicallyDocument1 pageReminder To All Taxpayers Mandated To File and Pay ElectronicallyRendall Craig RefugioNo ratings yet

- Net Pay Calculator: The "NIC" and "Income Tax" Tabs Are For Calculation Purposes Only - You Do Not Need To Look at These!Document7 pagesNet Pay Calculator: The "NIC" and "Income Tax" Tabs Are For Calculation Purposes Only - You Do Not Need To Look at These!abhi1648665No ratings yet

- Exhibit 56 November 28 2023 Tax LetterDocument8 pagesExhibit 56 November 28 2023 Tax LetterAnthony TalcottNo ratings yet