Professional Documents

Culture Documents

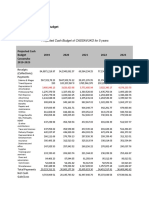

Income Tax - Sta Ana (Case 28)

Uploaded by

Marc Lester Hernandez-Sta Ana0 ratings0% found this document useful (0 votes)

7 views2 pagesIncome tax

Original Title

Income Tax -Sta Ana (Case 28)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIncome tax

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesIncome Tax - Sta Ana (Case 28)

Uploaded by

Marc Lester Hernandez-Sta AnaIncome tax

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

AFISCO vs.

CA

Income Tax

Facts:

41 non-life insurance companies, including petitioner AFISCO entered into

a Quota Share Reinsurance Treaties with Munich, a non-resident foreign

insurance corporation, to cover for All Risk Insurance Policies over

machinery erection, breakdown and boiler explosion. The treaties

required petitioners to form a pool, to which AFISCO and the others

complied.

The pool of machinery insurers submitted a financial statement and filed

an “Information Return of Organization Exempt from Income Tax” for the

year ending 1975, on the basis of which, it was assessed by the CIR

deficiency corporate taxes. A protest was filed but denied by the CIR.

Petitioners contend that they cannot be taxed as a corporation, because

(a) the reinsurance policies were written by them individually and

separately, (b) their liability was limited to the extent of their allocated

share in the original risks insured and not solidary, (c) there was no

common fund, (d) the executive board of the pool did not exercise control

and management of its funds, unlike the board of a corporation, (e) the

pool or clearing house was not and could not possibly have engaged in

the business of reinsurance from which it could have derived income for

itself. They further contend that remittances to Munich are not dividends

and to subject it to tax would be tantamount to an illegal double taxation,

as it would result to taxing the same premium income twice in the hands

of the same taxpayer

ISSUE/S:

Whether or not the pool is taxable as a corporation.

Held: A pool is considered a corporation for taxation purposes. Citing

the case of Evangelista v. CIR, the court held that Sec. 24 of the NIRC

covered these unregistered partnerships and even associations or joint

accounts, which had no legal personalities apart from individual members.

Further, the pool is a partnership as evidence by a common fund, the

existence of executive board and the fact that while the pool is not in

itself, a reinsurer and does not issue any insurance policy, its work is

indispensable, beneficial and economically useful to the business of the

ceding companies and Munich, because without it they would not have

received their premiums.

As to the claim of double taxation, the pool is a taxable entity distinct

from the individual corporate entities of the ceding companies. The tax on

its income is obviously different from the tax on the dividends received by

the said companies. Clearly, there is no double taxation.

As to the argument on prescription, the prescriptive period was totaled

under the Section 333 of the NIRC, because the taxpayer cannot be

located at the address given in the information return filed and for which

reason there was delay in sending the assessment. Further, the law

clearly states that the prescriptive period will be suspended only if the

taxpayer informs the CIR of any change in the address.

You might also like

- Notes For UCSP Lecture - 2nd WeekDocument7 pagesNotes For UCSP Lecture - 2nd WeekMarc Lester Hernandez-Sta AnaNo ratings yet

- Questions For Recit Week 3 - PPGDocument1 pageQuestions For Recit Week 3 - PPGMarc Lester Hernandez-Sta AnaNo ratings yet

- Notes On IdeologyDocument10 pagesNotes On IdeologyMarc Lester Hernandez-Sta AnaNo ratings yet

- Affidavt of Self AdjudicationDocument3 pagesAffidavt of Self AdjudicationMarc Lester Hernandez-Sta AnaNo ratings yet

- Political Law Mock BarDocument7 pagesPolitical Law Mock BarMarc Lester Hernandez-Sta AnaNo ratings yet

- Notes For UCSP - EthnocentrismDocument4 pagesNotes For UCSP - EthnocentrismMarc Lester Hernandez-Sta AnaNo ratings yet

- 1st Notice of MeetingDocument2 pages1st Notice of MeetingMarc Lester Hernandez-Sta AnaNo ratings yet

- Affidavt of Self AdjudicationDocument3 pagesAffidavt of Self AdjudicationMarc Lester Hernandez-Sta AnaNo ratings yet

- UCSP Module 3Document16 pagesUCSP Module 3Eloisa Jane Bituin33% (3)

- Just Causes For TerminationDocument9 pagesJust Causes For TerminationMarc Lester Hernandez-Sta AnaNo ratings yet

- TEEHANKEE, Manuel Antonio J.Document3 pagesTEEHANKEE, Manuel Antonio J.Marc Lester Hernandez-Sta AnaNo ratings yet

- SampleJudicial+Affidavit 1Document4 pagesSampleJudicial+Affidavit 1Thesa Putungan-Salcedo100% (1)

- Saudi Arabia Airlines and Brenda Betia vs. ResebencioDocument2 pagesSaudi Arabia Airlines and Brenda Betia vs. ResebencioMarc Lester Hernandez-Sta AnaNo ratings yet

- Drugs SalientDocument5 pagesDrugs SalientMarc Lester Hernandez-Sta AnaNo ratings yet

- Amendments Introduced by TRAINDocument4 pagesAmendments Introduced by TRAINMarc Lester Hernandez-Sta AnaNo ratings yet

- Case 28 - Khan Vs SimbilloDocument2 pagesCase 28 - Khan Vs SimbilloMarc Lester Hernandez-Sta AnaNo ratings yet

- Insurance liability for private vehicle under common carrier policyDocument73 pagesInsurance liability for private vehicle under common carrier policyMarc Lester Hernandez-Sta Ana100% (1)

- ADRDocument7 pagesADRMarc Lester Hernandez-Sta AnaNo ratings yet

- Case 28 - Khan Vs SimbilloDocument1 pageCase 28 - Khan Vs SimbilloMarc Lester Hernandez-Sta AnaNo ratings yet

- Arguelles Vs Malarayat Rural BankDocument2 pagesArguelles Vs Malarayat Rural BankMarc Lester Hernandez-Sta Ana100% (1)

- Saudi Arabia Airlines and Brenda Betia vs. ResebencioDocument2 pagesSaudi Arabia Airlines and Brenda Betia vs. ResebencioMarc Lester Hernandez-Sta Ana100% (1)

- Arguelles Vs Malarayat Rural BankDocument1 pageArguelles Vs Malarayat Rural BankMarc Lester Hernandez-Sta AnaNo ratings yet

- PMI Vs NLRCDocument2 pagesPMI Vs NLRCMarc Lester Hernandez-Sta AnaNo ratings yet

- Case 28 - Khan Vs SimbilloDocument1 pageCase 28 - Khan Vs SimbilloMarc Lester Hernandez-Sta AnaNo ratings yet

- Clark Investors and Locators Association Inc Vs Secretary of Finance and CirDocument2 pagesClark Investors and Locators Association Inc Vs Secretary of Finance and CirMarc Lester Hernandez-Sta AnaNo ratings yet

- Arguelles Vs Malarayat Rural BankDocument2 pagesArguelles Vs Malarayat Rural BankMarc Lester Hernandez-Sta Ana100% (1)

- Vicente Vs ECCDocument2 pagesVicente Vs ECCMarc Lester Hernandez-Sta AnaNo ratings yet

- Arra Vs GDCIDocument2 pagesArra Vs GDCIMarc Lester Hernandez-Sta AnaNo ratings yet

- Garchitorena Vs CresciniDocument1 pageGarchitorena Vs CresciniMarc Lester Hernandez-Sta AnaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- CRISIL Research Ier Report Fortis HealthcareDocument28 pagesCRISIL Research Ier Report Fortis HealthcareSai SantoshNo ratings yet

- 7 1finalDocument16 pages7 1finalJeffrey HarrisonNo ratings yet

- Switzerland DIGESTDocument2 pagesSwitzerland DIGESTJoseph MacalintalNo ratings yet

- The Last Dinosaur: The U.S. Postal Service, Cato Policy AnalysisDocument13 pagesThe Last Dinosaur: The U.S. Postal Service, Cato Policy AnalysisCato InstituteNo ratings yet

- Problem Session-2 15.03.2012Document44 pagesProblem Session-2 15.03.2012Chi Toan Dang TranNo ratings yet

- Agency Correspondence: Allianz Life Insurance Malaysia BerhadDocument2 pagesAgency Correspondence: Allianz Life Insurance Malaysia BerhadKt TanNo ratings yet

- Motor Scheme - 2023 (NEW) Insurance Quotatio: Vehicle Owner Quotation No Quotation ValidityDocument2 pagesMotor Scheme - 2023 (NEW) Insurance Quotatio: Vehicle Owner Quotation No Quotation ValidityPrashant SoniNo ratings yet

- ITC Provisions and Rules in GSTDocument8 pagesITC Provisions and Rules in GSTAnonymous ikQZphNo ratings yet

- Law 1.2Document7 pagesLaw 1.2CharlesNo ratings yet

- UX Project FINAL PRESENTATIONDocument34 pagesUX Project FINAL PRESENTATIONprime developersNo ratings yet

- A Fire & Allied PerilsDocument6 pagesA Fire & Allied PerilsDhin Mohammed MorshedNo ratings yet

- Aac3 of 2006 Authencity and Serviceability of Aircraft PartsDocument7 pagesAac3 of 2006 Authencity and Serviceability of Aircraft PartsSingh Vineet Kumar -No ratings yet

- Insurance Code RevDocument13 pagesInsurance Code RevPaterno S. Brotamonte Jr.No ratings yet

- RitzDocument2 pagesRitzप्रितम उत्तम लोखंडेNo ratings yet

- Case On Special ContractDocument6 pagesCase On Special ContractShrestha Steve SalvatoreNo ratings yet

- FIN320 Tutorial W2Document4 pagesFIN320 Tutorial W2Sally OngNo ratings yet

- Adjesting ProcessDocument17 pagesAdjesting Processjh.chee02No ratings yet

- Carlos H CollazoDocument2 pagesCarlos H CollazocarloshiramNo ratings yet

- Sample Financial StatementDocument8 pagesSample Financial StatementMax Sedric L LaylayNo ratings yet

- (Risk Management and Insurance 1) Exam Questions Code 3Document3 pages(Risk Management and Insurance 1) Exam Questions Code 3trang100% (1)

- Negotiating Expatriate PackagesDocument7 pagesNegotiating Expatriate PackagesMuhammad QadeerNo ratings yet

- Standard Operating Procedure (SOP) For Handling of Surrender Claim Cases in PLI-RPLI 05.09.23Document19 pagesStandard Operating Procedure (SOP) For Handling of Surrender Claim Cases in PLI-RPLI 05.09.23Anirban HiraNo ratings yet

- FHA FULL Condo Questionnaire 12-09Document2 pagesFHA FULL Condo Questionnaire 12-09The Pinnacle TeamNo ratings yet

- OmiDocument42 pagesOmiRUPESHKENENo ratings yet

- A Project Report FOR: Sikkim Manipal UniversityDocument42 pagesA Project Report FOR: Sikkim Manipal UniversitydharmendraasatiNo ratings yet

- Axis Bank (H.R.)Document99 pagesAxis Bank (H.R.)Priya NotInterested SolankiNo ratings yet

- கனடா ஈழமுரசு Issue - 276Document20 pagesகனடா ஈழமுரசு Issue - 276Muraleetharan.KNo ratings yet

- Aviation InsuranceDocument25 pagesAviation InsuranceratidwivediNo ratings yet

- Jack Welch's Leadership StyleDocument12 pagesJack Welch's Leadership StyleRÓBINSON ANTONIO CASTRO PEINADONo ratings yet

- Ramsey Williams Case 83: The Broken Employment Contract? 2/16/05 Human Resource Management Shawn KeoughDocument4 pagesRamsey Williams Case 83: The Broken Employment Contract? 2/16/05 Human Resource Management Shawn KeoughRamsey WilliamsNo ratings yet