Professional Documents

Culture Documents

Careerin 19-Week Investment Banking Workshop Lbo and M&A

Uploaded by

Chung Chee Yuen0 ratings0% found this document useful (0 votes)

16 views7 pages并购及杠杆收购

Original Title

10_【并购及杠杆收购】_malbo

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document并购及杠杆收购

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views7 pagesCareerin 19-Week Investment Banking Workshop Lbo and M&A

Uploaded by

Chung Chee Yuen并购及杠杆收购

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 7

CareerIn 19-Week Investment Banking Workshop

LBO and M&A

LBO Example

Year 0 1 2 3 4 5

Revenue 1,000 1,200 1,400 1,600 1,800 2,000

EBITDA 100 120 140 160 180 200

Capex (100) (100) (100) (100) (100)

FCF 20 40 60 80 100

Opening Debt 500 480 440 380 300

Less FCF (20) (40) (60) (80) (100)

Closing debt 500 480 440 380 300 200

Enterprise value 800 1,600

Less debt (500) (200)

Equity value 300 1,400

IRR 36%

MoM 4.67 x

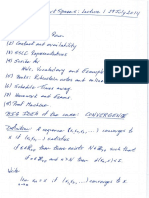

Ace real valuation interview questions: LBO

• What is an LBO? Why do you want to lever up a firm?

• What is a leveraged buyout? How is it different from a merger?

• What company is a typical LBO target of PE firms?

• Why is LBO so profitable?

• Common multiples used by LBO?

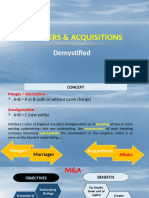

M&A overview

Leading companies employ a three-phased integrated M&A process complemented by

diverse support teams

The M&A process is comprised of three overarching, integrated phases: Pre-Deal,

Deal and Post-Deal

Pre-Deal Phase: Key Activities

Pre-Deal Phase: Target Screening

Deal Phase: Key Activities

Deal Phase: Valuation

Deal Phase: Due Diligence

Deal Phase: Deal Structuring/Financing

Post-Deal Phase: Key Activities

Leading companies employ continual communication, emphasize speed, address

cultural issues and record all acquired mergers and acquisition knowledge

How will an M&A deal influence BS and IS(consolidated)?

Ace real M&A interview questions

• What is control premium? How do you value control premium?

• What are the reasons behind M&A transactions?

• Who will pay more for a company: strategic buyers or financial buyers?

• What is a hostile tender offer?

• Accretive vs. dilutive mergers (P/E1>P/E2, accretive or dilutive? Common

reasons for accretion/dilution?)

• Describe a recent M&A transaction. Does it make sense?

• Can you name two companies that you think should merge?

• Company A is considering acquiring Company B. Company A’s P/E multiple

is 55x, whereas Company B’s P/E multiple is 30x. After A acquires B, will pro

forma EPS rise, fall, or stay the same?

• If Company A buys Company B, what will the balance sheet of the combined

company look like when A acquires <20% / 20%-50% / >50%?

You might also like

- Netflix Equity Debt Convertible Investment Banking Pitch BookDocument15 pagesNetflix Equity Debt Convertible Investment Banking Pitch BookphuNo ratings yet

- 2022 - Chapter02 To 05 - ValueDrivers - UpdatedDocument38 pages2022 - Chapter02 To 05 - ValueDrivers - UpdatedElias MacherNo ratings yet

- Private Equity The Top of The Financial Food ChainDocument46 pagesPrivate Equity The Top of The Financial Food ChainAbhy SinghNo ratings yet

- AF5115 Fall Final Exam Case2Document17 pagesAF5115 Fall Final Exam Case2唐煜No ratings yet

- Tata Tea's Leveraged Buyout of TetleyDocument20 pagesTata Tea's Leveraged Buyout of TetleySahil Singla100% (1)

- Mergers and Acquisition OutlineDocument53 pagesMergers and Acquisition OutlineKasem AhmedNo ratings yet

- Merrill LynchDocument95 pagesMerrill LynchPrajval SomaniNo ratings yet

- M&ADocument151 pagesM&APallavi Prasad100% (1)

- Sealed Air Case StudyDocument8 pagesSealed Air Case StudyDo Ngoc Chau100% (4)

- Attempt Any Four Case Study Case 1: Zip Zap Zoom Car CompanyDocument23 pagesAttempt Any Four Case Study Case 1: Zip Zap Zoom Car CompanyDiabolic Colt100% (1)

- Berkshire - IntroDocument2 pagesBerkshire - IntroRohith ThatchanNo ratings yet

- Venture Capital Valuation, + Website: Case Studies and MethodologyFrom EverandVenture Capital Valuation, + Website: Case Studies and MethodologyNo ratings yet

- (Financial Markets and Investments) H. Kent Baker, Greg Filbeck, Halil Kiymaz-Private Equity - Opportunities and Risks-Oxford University Press (2015)Document623 pages(Financial Markets and Investments) H. Kent Baker, Greg Filbeck, Halil Kiymaz-Private Equity - Opportunities and Risks-Oxford University Press (2015)Vincent LloydNo ratings yet

- 2006 LCCI Level 3 (IAS) Series 2Document15 pages2006 LCCI Level 3 (IAS) Series 2rachelmakiyo100% (2)

- Written Assignment Unit 7Document5 pagesWritten Assignment Unit 7rony alexander100% (3)

- 全球投资策略-ESG投资2021:更快、更深、更广-J.P. 摩根-2021.5.13-147页Document148 pages全球投资策略-ESG投资2021:更快、更深、更广-J.P. 摩根-2021.5.13-147页Chung Chee YuenNo ratings yet

- Questions & Answers: Equity Dealing Certification Exam March 2021Document14 pagesQuestions & Answers: Equity Dealing Certification Exam March 2021evans kibetNo ratings yet

- Measuring Business Growth and Global ExpansionDocument35 pagesMeasuring Business Growth and Global Expansiongargiroy2012No ratings yet

- Questions For RevisionDocument3 pagesQuestions For RevisionJohn BawaNo ratings yet

- Mergers and Acquisitions: The Market For Corporate ControlDocument34 pagesMergers and Acquisitions: The Market For Corporate Controlangel23loveNo ratings yet

- Group 10 - Strategy Game - DMS Tech Solutions - RevisedDocument11 pagesGroup 10 - Strategy Game - DMS Tech Solutions - Revisedaswin.v25exNo ratings yet

- Capital Structure TheoryDocument8 pagesCapital Structure TheoryNouman SheikhNo ratings yet

- BFC5935 - Tutorial 9 SolutionsDocument6 pagesBFC5935 - Tutorial 9 SolutionsXue XuNo ratings yet

- BF405 May 2015 PDFDocument4 pagesBF405 May 2015 PDFhuku memeNo ratings yet

- 2.1 - Case Study PT Layara - Capital BudgetingDocument3 pages2.1 - Case Study PT Layara - Capital BudgetingDaniel TjeongNo ratings yet

- ExportDocument21 pagesExportBükre PNo ratings yet

- Credit Risk Assessment 1 - May 2016Document6 pagesCredit Risk Assessment 1 - May 2016Basilio MaliwangaNo ratings yet

- Heriot-Watt University Accounting - December 2016 Section II Case Studies Case Study 1Document6 pagesHeriot-Watt University Accounting - December 2016 Section II Case Studies Case Study 1sanosyNo ratings yet

- ms4 2017 IIDocument4 pagesms4 2017 IIsachin gehlawatNo ratings yet

- 3 - Case Study PT Layara - Capital Budgeting - Smemba 7Document3 pages3 - Case Study PT Layara - Capital Budgeting - Smemba 7CANo ratings yet

- Project Valuation Template (Updated)Document12 pagesProject Valuation Template (Updated)Syed AyazNo ratings yet

- FM SemesterDocument19 pagesFM SemesterSanjay VNo ratings yet

- Numerics On FCF - DCF - 2 Stage GrowthDocument6 pagesNumerics On FCF - DCF - 2 Stage GrowthSudha AgarwalNo ratings yet

- IIBMS Finance Case Study on Zip Zap Zoom Car CompanyDocument18 pagesIIBMS Finance Case Study on Zip Zap Zoom Car Companysainath mistryNo ratings yet

- Measuring and Managing ValueDocument17 pagesMeasuring and Managing ValueHari RaoNo ratings yet

- Better Mousetraps ExerciseDocument11 pagesBetter Mousetraps ExerciseBrl Gnsn0% (1)

- Topic 1.2 Financial Planning Introduction To Business ValuationDocument60 pagesTopic 1.2 Financial Planning Introduction To Business ValuationKarime Lugo ManzaneroNo ratings yet

- NFC Blue OceanDocument27 pagesNFC Blue OceanPreetham SurendarNo ratings yet

- C C C C C C: O O O O O O O ODocument5 pagesC C C C C C: O O O O O O O OTon ThaoNo ratings yet

- NUS - Jul TR3201 Entrepreneurship Practicum - SY CommentsDocument44 pagesNUS - Jul TR3201 Entrepreneurship Practicum - SY Commentskenneth cheungNo ratings yet

- Investment Banking Valuation Leveraged Buyouts and Mergers and Acquisitions 2nd Edition Rosenbaum Test BankDocument12 pagesInvestment Banking Valuation Leveraged Buyouts and Mergers and Acquisitions 2nd Edition Rosenbaum Test Bankmariowoodtncfjqbrow100% (45)

- Assignment 2 (Business Model)Document13 pagesAssignment 2 (Business Model)Bishal Deb ChowdhuryNo ratings yet

- Chapter 5 Investment Appraisal TechniquesDocument10 pagesChapter 5 Investment Appraisal TechniquesHastings KapalaNo ratings yet

- LEVERAGE - hons.Document7 pagesLEVERAGE - hons.BISHAL ROYNo ratings yet

- FM Handout 5Document32 pagesFM Handout 5Rofiq VedcNo ratings yet

- Chapter 2. An Introduction Investment Appraisal TechniquesDocument10 pagesChapter 2. An Introduction Investment Appraisal TechniquesHastings KapalaNo ratings yet

- CE On Operating SegmentsDocument3 pagesCE On Operating SegmentsalyssaNo ratings yet

- KMB Presentation By:: Mei-Hsuan Chao Zuojia Chen Suyang Hong Jung Hyun KimDocument39 pagesKMB Presentation By:: Mei-Hsuan Chao Zuojia Chen Suyang Hong Jung Hyun KimAnand KopareNo ratings yet

- TFI InternationalDocument43 pagesTFI InternationalJenny QuachNo ratings yet

- RatiosDocument79 pagesRatiosKim Bales BlayNo ratings yet

- Problems P 15-1 Apply Threshold Tests: Net Income Tax RateDocument2 pagesProblems P 15-1 Apply Threshold Tests: Net Income Tax Rateardi yansyahNo ratings yet

- District Resource Centre Mahbubnagar:, Pre-Final Examinations - Jan / Feb - 2011 Management AccountingDocument5 pagesDistrict Resource Centre Mahbubnagar:, Pre-Final Examinations - Jan / Feb - 2011 Management Accountingtadepalli patanjaliNo ratings yet

- Ignou July-December 2017 Solved Assignments at 160 Per AssignmentDocument22 pagesIgnou July-December 2017 Solved Assignments at 160 Per AssignmentDharmendra Singh SikarwarNo ratings yet

- FINAL TEST Evening Financial Management EveningDocument3 pagesFINAL TEST Evening Financial Management EveningKartikaNo ratings yet

- Earnings Management in India: Managers' Fixation On Operating ProfitsDocument27 pagesEarnings Management in India: Managers' Fixation On Operating ProfitsVaibhav KaushikNo ratings yet

- NIM Genap 2. - in Equity Security Market There Are Two Kind of Analysis Namely Fundamental and TechnicalDocument3 pagesNIM Genap 2. - in Equity Security Market There Are Two Kind of Analysis Namely Fundamental and TechnicalyudaNo ratings yet

- Financial Accounting & Analysis: Ratio Analysis Siddharth S. KanungoDocument48 pagesFinancial Accounting & Analysis: Ratio Analysis Siddharth S. KanungoNelson AindNo ratings yet

- Fundamental Principles of Measuring and Managing ValueDocument17 pagesFundamental Principles of Measuring and Managing ValueLuismy VacacelaNo ratings yet

- Practice Quesions Fin Planning ForecastingDocument19 pagesPractice Quesions Fin Planning ForecastingAli HussainNo ratings yet

- Email- ft20examnew@gmail.com - M.B.A (FT) OPEN BOOK ONLINE EXAMINATION SEMESTER - II - Financial ManagementDocument3 pagesEmail- ft20examnew@gmail.com - M.B.A (FT) OPEN BOOK ONLINE EXAMINATION SEMESTER - II - Financial ManagementrajNo ratings yet

- Corporate Strategic Financial DecisionDocument22 pagesCorporate Strategic Financial Decisionsaloni jainNo ratings yet

- Merger and AkuisisiDocument35 pagesMerger and Akuisisidwi suhartantoNo ratings yet

- MANAGEMENT ACCOUNTING & CONTROL 306 Ele Paper IIIDocument5 pagesMANAGEMENT ACCOUNTING & CONTROL 306 Ele Paper IIItadepalli patanjaliNo ratings yet

- College of Administration and Finance Sciences Assignment 1Document4 pagesCollege of Administration and Finance Sciences Assignment 1ايهاب حسنىNo ratings yet

- Current Ratio (Amount in RS.)Document10 pagesCurrent Ratio (Amount in RS.)Balakrishna ChakaliNo ratings yet

- Everage: Sales (S) 90,000 90,000 3000 Units at Rs. 30/-Per Unit 15 Per Unit 45,000 45,000Document20 pagesEverage: Sales (S) 90,000 90,000 3000 Units at Rs. 30/-Per Unit 15 Per Unit 45,000 45,000anon_67206536260% (5)

- Financial Planning and Forecasting ObjectivesDocument13 pagesFinancial Planning and Forecasting Objectiveslethiphuongdan50% (2)

- Outperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueFrom EverandOutperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueNo ratings yet

- Centerview Presentation On Project Canine 12 Dec 2012Document31 pagesCenterview Presentation On Project Canine 12 Dec 2012Chung Chee YuenNo ratings yet

- Elliott Telecom Italia Third Presentation March 2019Document40 pagesElliott Telecom Italia Third Presentation March 2019Chung Chee YuenNo ratings yet

- CHK Industy 4.0 - Chapter 2 SlidesDocument14 pagesCHK Industy 4.0 - Chapter 2 SlidesChung Chee YuenNo ratings yet

- CHK Industy 4.0 - Chapter 4 SlidesDocument36 pagesCHK Industy 4.0 - Chapter 4 SlidesChung Chee YuenNo ratings yet

- Elliott Samsung Electronics Presentation Oct 2016Document31 pagesElliott Samsung Electronics Presentation Oct 2016Chung Chee YuenNo ratings yet

- CHK Industy 4.0 - Chapter 4 SlidesDocument36 pagesCHK Industy 4.0 - Chapter 4 SlidesChung Chee YuenNo ratings yet

- AQCMP 2015 - Superconductivity I - 1Document41 pagesAQCMP 2015 - Superconductivity I - 1Chung Chee YuenNo ratings yet

- Problem Set ZeroBonds SOLDocument4 pagesProblem Set ZeroBonds SOLChung Chee YuenNo ratings yet

- Building World-Class Finance and Performance Management CapabilitiesDocument8 pagesBuilding World-Class Finance and Performance Management CapabilitiesChung Chee YuenNo ratings yet

- CHK Industy 4.0 - Chapter 1 SlidesDocument97 pagesCHK Industy 4.0 - Chapter 1 SlidesChung Chee YuenNo ratings yet

- Semester 2 Assessment, 2014Document15 pagesSemester 2 Assessment, 2014Chung Chee YuenNo ratings yet

- Careerin 19-Week Investment Banking Workshop Behavioral Interview Guidance IDocument10 pagesCareerin 19-Week Investment Banking Workshop Behavioral Interview Guidance IChung Chee YuenNo ratings yet

- 9 投行技术面试【估值】 valDocument6 pages9 投行技术面试【估值】 valChung Chee YuenNo ratings yet

- Lec 36 Proofs of Hilbert ProjectionsDocument5 pagesLec 36 Proofs of Hilbert ProjectionsChung Chee YuenNo ratings yet

- ZeemanDocument13 pagesZeemanChung Chee YuenNo ratings yet

- PHYC10001 Physics 1 Advanced: Where We AreDocument15 pagesPHYC10001 Physics 1 Advanced: Where We AreChung Chee YuenNo ratings yet

- Lec 1 and 2 Housekeeping and ExamplesDocument3 pagesLec 1 and 2 Housekeeping and ExamplesChung Chee YuenNo ratings yet

- Phyc10001 Lecture 29 Waves5web PDFDocument12 pagesPhyc10001 Lecture 29 Waves5web PDFChung Chee YuenNo ratings yet

- BF 2011-Sample Final 1 SolutionsDocument5 pagesBF 2011-Sample Final 1 SolutionsChung Chee YuenNo ratings yet

- Module 0Document13 pagesModule 0Chung Chee YuenNo ratings yet

- Lec 10 Interiors Closures 16082016Document5 pagesLec 10 Interiors Closures 16082016Chung Chee YuenNo ratings yet

- Discrete Mathematics Asssignment 3Document4 pagesDiscrete Mathematics Asssignment 3Chung Chee YuenNo ratings yet

- Module 0Document13 pagesModule 0Chung Chee YuenNo ratings yet

- Lec 3 and 4 HolderinequalitesDocument5 pagesLec 3 and 4 HolderinequalitesChung Chee YuenNo ratings yet

- MAST20004 Probability Assignment SolutionsDocument3 pagesMAST20004 Probability Assignment SolutionsChung Chee YuenNo ratings yet

- Mast 20009 Exam 2015Document4 pagesMast 20009 Exam 2015Chung Chee YuenNo ratings yet

- Unit-5 New Venture Expansion Strategies & IssuesDocument26 pagesUnit-5 New Venture Expansion Strategies & IssuesHimadhar SaduNo ratings yet

- History of Canara BankDocument8 pagesHistory of Canara BankVikas Tirmale100% (1)

- LBO Model - ValuationDocument6 pagesLBO Model - ValuationsashaathrgNo ratings yet

- Interview Related QuestionsDocument8 pagesInterview Related QuestionsAnshita GargNo ratings yet

- Private Equity HistoryDocument3 pagesPrivate Equity HistorynbaffourNo ratings yet

- Paul M. Kirwin v. Price Communications Corp., 391 F.3d 1323, 11th Cir. (2004)Document6 pagesPaul M. Kirwin v. Price Communications Corp., 391 F.3d 1323, 11th Cir. (2004)Scribd Government DocsNo ratings yet

- Pe Investment ThesisDocument8 pagesPe Investment Thesissarahdavisjackson100% (2)

- Takeovers: Reading: Takeovers, Mergers and BuyoutsDocument4 pagesTakeovers: Reading: Takeovers, Mergers and BuyoutsFreakin 23No ratings yet

- Essay Topics: Corporate FinanceDocument3 pagesEssay Topics: Corporate FinanceBen SetoNo ratings yet

- Discretionary vs. Systematic:: Two Contrasting Hedge Fund ApproachesDocument3 pagesDiscretionary vs. Systematic:: Two Contrasting Hedge Fund ApproachesNorbert DurandNo ratings yet

- Valuation Models in Excel !Document28 pagesValuation Models in Excel !DAKSHANo ratings yet

- CASEDocument19 pagesCASEF-RR RRINo ratings yet

- Download full Bond Markets Analysis And Strategies 8Th Edition Fabozzi Solutions Manual pdfDocument52 pagesDownload full Bond Markets Analysis And Strategies 8Th Edition Fabozzi Solutions Manual pdfwilliam.ely879100% (6)

- Chapter 14 Accessing Resources For Growth From External SourcesDocument28 pagesChapter 14 Accessing Resources For Growth From External Sourcesmkahnum12No ratings yet

- Corporate Restructuring Decisions: Leverage BuyoutDocument10 pagesCorporate Restructuring Decisions: Leverage BuyoutDushyant MudgalNo ratings yet

- STRATEGIC MANAGEMENT: KEY FUNCTIONAL STRATEGIESDocument22 pagesSTRATEGIC MANAGEMENT: KEY FUNCTIONAL STRATEGIESDemonSideNo ratings yet

- SFD NotesDocument125 pagesSFD NotesPampana Sainikhitha9997100% (1)

- Insider View of Private Equity Industry Strengths and Areas for ImprovementDocument22 pagesInsider View of Private Equity Industry Strengths and Areas for Improvementmlieb737No ratings yet

- Xiaojia CV enDocument4 pagesXiaojia CV enapi-434978142No ratings yet

- Autozone WriteupDocument7 pagesAutozone WriteupRon BourbondyNo ratings yet

- Glossary FinancialDocument2 pagesGlossary FinancialJULIETTE MISHELLE OSUNA BASTIDASNo ratings yet

- Formulation of Functional Strategy: Financial: Prof. Prashant Mehta National Law University, JodhpurDocument11 pagesFormulation of Functional Strategy: Financial: Prof. Prashant Mehta National Law University, JodhpurShahbaz ArtsNo ratings yet