Professional Documents

Culture Documents

Application For Taxpayer Identification Number For Company

Uploaded by

simon kinuthiaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Application For Taxpayer Identification Number For Company

Uploaded by

simon kinuthiaCopyright:

Available Formats

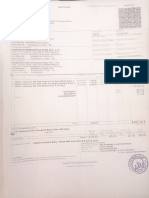

FORM T.Q.

2C

APPLICATION FOR TAXPAYER IDENTIFICATION NUMBER FOR COMPANY,

PARTNERSHIP, TRUST OR ASSOCIATION (See reverse for instruction)

(Please print or type all required information)

(Tick one)

Partnership Trust Accounting Period

Ending Date

Company Association or Club …

……………...……/……………….

Day Month

1. Name of Taxpayer (as registered): ...…………………………………………………………………………………………..

………………………………………………………………………………………………………………….……………….

2. Physical and Mailing Address of principal headquarters of taxpayer:

PHYSICAL ADDRESS MAILING ADDRESS

Road: …………………………………….….. P.O. Box ………………..…. Postal Code ………………..…………………

City Town: ………………………………………………… City Town: ……………….………………………………….…

Location: ………………….……………………………………………………………………………………………………

3. Name of Managing Director or other person(s) authorised to sign tax returns on behalf of the taxpayer:

…………………………………………...………………………………………………………………...……………………

………………..…………………………...…………………………………………………………………………………….

4. Name, Address, and P.I.N. of Certified Public Accountant / Agent: …...……………………………………………………..

…………………………………………………………………………………………………………………….…………..

5. Income Tax File Number(s) if any for this taxpayer: ………………...………………………………………………….…….

6. PAYE File Number(s) for any and all components of this taxpayer wherever situated: ………………………………………

…………………………………………………………………………………………………………………………………..

7. Was this taxpayer or predecessor entities ever located in a district other than the one which services it files now?

Yes ……… No ……… (check one). If yes, please list all names by which it may have been known and other file or PAYE

file numbers which it may have had in other districts: …….......................................……..…………………………………..

……………………………………………………………………………………………………...……………………………

8. (Tick one) Is he a Resident Taxpayer ……………………….. or Non-Resident Taxpayer …………….……..………………

9 Do you now employ or intend in the next 12 months to employ others, any of whom will earn more than KSh 1,452 per

month? Yes ……………… No …………….. (check one).

10. Are you now exempt from Income Tax? If so cite the authority granting the exemption: …………………………………….

……………………………………………………………………………………………………………….………………….

11 I, …………………………………………………………………………., declare that the above is a full and true statement.

I understand that if any information given above is misleading or incorrect I could be subject to any and all penalties or

fines that the law may allow to be imposed.

Signature ………………………………………………….

Full Name (print) …………………………………………

Address ………………………………………………….. PLACE STAMP OR

…………………………………………………………….. SEAL HERE

……………………………………………………………..

Telephone No. …………………………………………..

This form when completed should be mailed or delivered to:

Domestic Taxes Department,

Times Tower

Haile Selassie Avenue

P.O. Box 30742-00100

NAIROBI.

INSTRUCTIONS FOR FORM T.Q. 2C

Item 1

Provide the full name of the taxpayer as registered. If not registered provide the name as known to the

public.

Item 2

Provide physical and mailing address. Physical address is the street location, house number if any, and city

or town.

Item 3

The name provided here should be the same person authorised by the company to sign its tax returns and this statement.

Item 5

If this taxpayer or any part thereof has or had other income tax file numbers list these here. Please list any

such numbers which this taxpayer or predecessor entities had in the present district, any other name(s) by

which it may have been known. (See 7 below for definition of "predecessor entity").

Item 6

We will shortly require that any and all PAYE records for this taxpayer should be consolidated under one file number.

Therefore, list here all PAYE file numbers for this entity or any pay point, office or sub-office possessing a separate

number.

Item 7

If this taxpayer or any predecessor entity (e.g. a company, partnership or other business bought by the

taxpayer or merged or amalgamated therewith), did at any time have a tax file in another district, please

tick YES and indicate same by giving the file number here, even if you have been advised that such

number or file is now dormant or terminated.

Item 9

A YES to this answer will mean that we will automatically provide you with the Employers PAYE forms

package.

Item 10

If exemption from income tax is claimed, complete this item by citing the full authority and document

providing such exemption.

Item 11

A person listed in line three should sign this document on behalf of the taxpayer and place the taxpayers

stamp or seal if any, thereon at the place indicate for same.

Mail or deliver this completed application to the address shown below. If all information is satisfactory you

shall receive a Personal Identification Number which you must thereafter place on all documents, payments

or other papers as required by the Commissioner. Failure to complete this application completely and

truthfully may subject the person or persons responsible to fine, penalty or both. If you do not receive a

certificate bearing your P.I.N. within three months of submission of this application you may assume the

information you submitted was incomplete or incorrect and must re-apply.

Mail this form to:

Domestic Taxes Department

P.I.N. Unit

P.O. Box 30742

NAIROBI.

Or deliver to:

Times Tower

Haile Selassie Avenue

NAIROBI.

You might also like

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- 2013 Financial StatementsDocument31 pages2013 Financial Statementsapi-307029847100% (1)

- Application Form For The Registration of Importers & ExportersDocument4 pagesApplication Form For The Registration of Importers & ExportersNilamdeen Mohamed ZamilNo ratings yet

- Application Form For The Registration of Importers & ExportersDocument4 pagesApplication Form For The Registration of Importers & ExportersLiveka PrintersNo ratings yet

- Occupational Tax and Registration Return For Wagering: Type or PrintDocument6 pagesOccupational Tax and Registration Return For Wagering: Type or Printdfasdfas1No ratings yet

- 1601 C CompensationDocument2 pages1601 C Compensationjon_cpaNo ratings yet

- Form - 1 & 2Document5 pagesForm - 1 & 2Income TaxNo ratings yet

- TIN Application - Statement of Estimate (Entity)Document5 pagesTIN Application - Statement of Estimate (Entity)Christian Nicolaus MbiseNo ratings yet

- ITX 200.01.E - Estimates - IndividualDocument6 pagesITX 200.01.E - Estimates - IndividualUrusi TeklaNo ratings yet

- Tennessee Department of Revenue: Business Tax ReturnDocument8 pagesTennessee Department of Revenue: Business Tax ReturnwilliamNo ratings yet

- Terminate FormDocument1 pageTerminate FormTiffany DacinoNo ratings yet

- Notification of VAT FormsDocument63 pagesNotification of VAT FormsNandish EthirajNo ratings yet

- Occupational Tax and Registration Return For Wagering: Type or PrintDocument6 pagesOccupational Tax and Registration Return For Wagering: Type or Printrobertledoux2No ratings yet

- Occupational Tax and Registration Return For Wagering: Type or PrintDocument6 pagesOccupational Tax and Registration Return For Wagering: Type or PrintmikeNo ratings yet

- Kyc Form - Corporate - MotorDocument2 pagesKyc Form - Corporate - Motorjoseph hoffarthNo ratings yet

- Form 101 (See Rule 5) Application For Certificate of RegistrationDocument5 pagesForm 101 (See Rule 5) Application For Certificate of RegistrationLatisha MorrisonNo ratings yet

- Loan Application: Company InformationDocument8 pagesLoan Application: Company InformationChristian AwukutseyNo ratings yet

- BusinesslicenseappDocument2 pagesBusinesslicenseappapi-253134164No ratings yet

- Employer's QUARTERLY Federal Tax Return: 5 3 1 3 1 0 0 1 0 Kenifer Corp Computer SolutionsDocument4 pagesEmployer's QUARTERLY Federal Tax Return: 5 3 1 3 1 0 0 1 0 Kenifer Corp Computer SolutionsrobbickelNo ratings yet

- INDIVIDUAL APPLICATION FOR MEMBERSHIP August 2022Document4 pagesINDIVIDUAL APPLICATION FOR MEMBERSHIP August 2022macklean lionelNo ratings yet

- BIR Form No. 2553Document2 pagesBIR Form No. 2553fatmaaleahNo ratings yet

- Power of Attorney Authorization To Disclose Tax InformationDocument4 pagesPower of Attorney Authorization To Disclose Tax InformationaghorbanzadehNo ratings yet

- Itx203 02 e - Return of Income Entity Colored OrangeDocument9 pagesItx203 02 e - Return of Income Entity Colored OrangeGregory MabinaNo ratings yet

- Fernando Vazquez567935467Document21 pagesFernando Vazquez567935467Richivee100% (2)

- 2551QDocument3 pages2551QJerry Bantilan JrNo ratings yet

- Final FormDocument14 pagesFinal FormPUSHKAR PATIDARNo ratings yet

- TDS Manual 2007 BDocument51 pagesTDS Manual 2007 BVijaysreeram TalluruNo ratings yet

- Form 1065 InstructionsDocument45 pagesForm 1065 InstructionsWilliam BulshtNo ratings yet

- Application For Registration: (For Certain Excise Tax Activities)Document6 pagesApplication For Registration: (For Certain Excise Tax Activities)douglas jonesNo ratings yet

- SBI FASTag Full KYC Application FormDocument4 pagesSBI FASTag Full KYC Application FormYogant BhureNo ratings yet

- BIR Form 1601 c1Document2 pagesBIR Form 1601 c1Ver ArocenaNo ratings yet

- Tax Return - 2018-2019Document30 pagesTax Return - 2018-2019kutner8181No ratings yet

- Bir 53Document4 pagesBir 53toofuuNo ratings yet

- VAT Procedure in MaharashtraDocument14 pagesVAT Procedure in MaharashtraDeva DrillTechNo ratings yet

- SBI FASTag Application Form - Individual - FULL-KYC-minDocument3 pagesSBI FASTag Application Form - Individual - FULL-KYC-minSaravanan SNo ratings yet

- FASTag CAF Individual Full KYCDocument8 pagesFASTag CAF Individual Full KYCpgsbeNo ratings yet

- Employer's QUARTERLY Federal Tax Return: Part 1: Answer These Questions For This QuarterDocument4 pagesEmployer's QUARTERLY Federal Tax Return: Part 1: Answer These Questions For This QuarterFrancis Wolfgang UrbanNo ratings yet

- Poa Beready 1Document2 pagesPoa Beready 1Cristian Stefan SalaruNo ratings yet

- Private KYC Reg FormDocument2 pagesPrivate KYC Reg FormOlanrewaju AdeyanjuNo ratings yet

- Public Records Filing For New Business Entity: State of New Jersey Division of RevenueDocument4 pagesPublic Records Filing For New Business Entity: State of New Jersey Division of RevenueGJHPENo ratings yet

- US TaxRefunds Short NewJerseyDocument11 pagesUS TaxRefunds Short NewJerseyKeziah Cyra PapasNo ratings yet

- Bir EtformDocument3 pagesBir EtformrjgingerpenNo ratings yet

- Rttax Usa EngDocument8 pagesRttax Usa EngRodion ChesovNo ratings yet

- Form 9465 (Installment Agreement Request)Document2 pagesForm 9465 (Installment Agreement Request)Benne JamesNo ratings yet

- Account Holder: AEOI Self-Certification For An Entity Account HolderDocument5 pagesAccount Holder: AEOI Self-Certification For An Entity Account HolderNigil josephNo ratings yet

- Trade Acc Application v6 PDFDocument5 pagesTrade Acc Application v6 PDFCarneala IlieNo ratings yet

- Claim FormsDocument4 pagesClaim FormsThaworn ThaweeaphiradeemaitreeNo ratings yet

- Form 19 PF New IntellectDocument2 pagesForm 19 PF New IntellectPavan Kumar ReddyNo ratings yet

- MAIN IDEAS IN CHAPTER 1, TOPIC 1, © Kermit Keeling: Solution - PAGE 1Document25 pagesMAIN IDEAS IN CHAPTER 1, TOPIC 1, © Kermit Keeling: Solution - PAGE 1юрий локтионовNo ratings yet

- PRINT in BLACK INK. Ovals Must Be Filled in Completely.Document2 pagesPRINT in BLACK INK. Ovals Must Be Filled in Completely.mik2bgNo ratings yet

- Goodlett Quail 2019 Form 1065 SC SignedDocument19 pagesGoodlett Quail 2019 Form 1065 SC SignedSue StevenNo ratings yet

- 2551 MDocument2 pages2551 MAdrian AyrosoNo ratings yet

- GOJ Client Banking Info FormDocument3 pagesGOJ Client Banking Info FormDamion CampbellNo ratings yet

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnKaradi KuttiNo ratings yet

- BilndDocument3 pagesBilndxabehe6146No ratings yet

- 1601 CDocument2 pages1601 CChedrick Fabros SalguetNo ratings yet

- Return For Provisional Tax PaymentDocument2 pagesReturn For Provisional Tax PaymentByron KanengoniNo ratings yet

- ACC 105 Lesson 4 Assignment 1 3-11bDocument4 pagesACC 105 Lesson 4 Assignment 1 3-11bJennifer BaileyNo ratings yet

- Customer Registration Form Airtel Final 23 10 2015Document2 pagesCustomer Registration Form Airtel Final 23 10 2015ayNo ratings yet

- Members Id Card PDFDocument2 pagesMembers Id Card PDFsimon kinuthiaNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing Detailssimon kinuthiaNo ratings yet

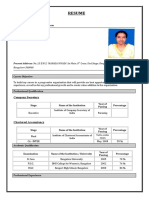

- Curriculum VitaeDocument1 pageCurriculum Vitaesimon kinuthiaNo ratings yet

- Ou SH Ou SH: Ous OusDocument72 pagesOu SH Ou SH: Ous OusellecincoNo ratings yet

- CardDocument1 pageCardsimon kinuthiaNo ratings yet

- Bonza Creative Arts: Invoice #001Document1 pageBonza Creative Arts: Invoice #001simon kinuthiaNo ratings yet

- Final Wedding Card SampleDocument4 pagesFinal Wedding Card Samplesimon kinuthiaNo ratings yet

- Counselling NotesDocument5 pagesCounselling Notessimon kinuthiaNo ratings yet

- Ega WearDocument2 pagesEga Wearsimon kinuthiaNo ratings yet

- Cover Letter Christine OumaDocument1 pageCover Letter Christine Oumasimon kinuthiaNo ratings yet

- CounsellingDocument1 pageCounsellingsimon kinuthiaNo ratings yet

- Curriculum Vitae: Personal Details Name: Christine Atieno Ouma Telephone: 0719871122 ProfessionDocument4 pagesCurriculum Vitae: Personal Details Name: Christine Atieno Ouma Telephone: 0719871122 Professionsimon kinuthiaNo ratings yet

- Development of Human PsychologyDocument6 pagesDevelopment of Human Psychologysimon kinuthiaNo ratings yet

- HPDocument4 pagesHPsimon kinuthiaNo ratings yet

- Counselling NotesDocument5 pagesCounselling Notessimon kinuthiaNo ratings yet

- Counselling NotesDocument5 pagesCounselling Notessimon kinuthiaNo ratings yet

- Pension Fund 1992-2022Document9 pagesPension Fund 1992-2022DominikNo ratings yet

- SSI FAQs Updated 2021Document2 pagesSSI FAQs Updated 2021Indiana Family to FamilyNo ratings yet

- BillDocument6 pagesBillVelmani KananNo ratings yet

- Adobe Scan 15-Feb-2024Document3 pagesAdobe Scan 15-Feb-2024Ganta AravindNo ratings yet

- How To Complete Your W-8Ben FormDocument2 pagesHow To Complete Your W-8Ben FormSun WestNo ratings yet

- Excel Files Individuals AopDocument8 pagesExcel Files Individuals Aopapi-3700469No ratings yet

- 20200731-0100004846-SMOA-Mall-SERAPHINA INCDocument5 pages20200731-0100004846-SMOA-Mall-SERAPHINA INCEdjon AndalNo ratings yet

- Impact of GST in Textile Sector: Group 1 (Girls)Document29 pagesImpact of GST in Textile Sector: Group 1 (Girls)SREYANo ratings yet

- Lecture 2Document24 pagesLecture 2Bình MinhNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Aniket BaraskarNo ratings yet

- Karkits Corporation Excel Copy PasteDocument2 pagesKarkits Corporation Excel Copy PasteCoke Aidenry SaludoNo ratings yet

- Income Tax Amendments For May-2023Document12 pagesIncome Tax Amendments For May-2023Shubham krNo ratings yet

- TDS ChalanDocument1 pageTDS ChalanRAKHAL BAIRAGINo ratings yet

- Kelompok 5 - ALK Problem 9-3Document4 pagesKelompok 5 - ALK Problem 9-3UmiUmiNo ratings yet

- IRC Codes and RegulationsDocument34 pagesIRC Codes and RegulationsWilly BeaminNo ratings yet

- TirumalaDocument2 pagesTirumalaSureshNo ratings yet

- The University of Lahore: Regular Fee VoucherDocument1 pageThe University of Lahore: Regular Fee VoucherWaseem Ajmal50% (2)

- Investigation 2024 GR 12Document6 pagesInvestigation 2024 GR 12koekoeorefileNo ratings yet

- Offer Letter-IntelenetDocument2 pagesOffer Letter-Intelenetkkarthi557No ratings yet

- Stylistic FurnitureDocument6 pagesStylistic FurnitureJaideep ChauhanNo ratings yet

- How Much Do You Owe? Your Account Summary Previous BillDocument3 pagesHow Much Do You Owe? Your Account Summary Previous BillEzzeddineNo ratings yet

- Assessment of Local Fiscal PerformanceDocument2 pagesAssessment of Local Fiscal PerformanceKei SenpaiNo ratings yet

- QC TreasurerDocument2 pagesQC TreasurerFrozen RawNo ratings yet

- PGBP - SolutionDocument7 pagesPGBP - SolutionmuskaanNo ratings yet

- Cashmemosm m31s Repairing 07 09 23Document2 pagesCashmemosm m31s Repairing 07 09 23Atul Kumar SinghNo ratings yet

- Current Transformer, Potential Transformer, CTS, PTS, Resin Cast CT, Resin Cast PT, Metering Panel, SMC Box, Deep Drawn Box, LT Distribution Box, Structures, Metering UnitDocument2 pagesCurrent Transformer, Potential Transformer, CTS, PTS, Resin Cast CT, Resin Cast PT, Metering Panel, SMC Box, Deep Drawn Box, LT Distribution Box, Structures, Metering UnitSharafatNo ratings yet

- EY Invoice - ORG - IN91MH3M008232Document1 pageEY Invoice - ORG - IN91MH3M008232AltafNo ratings yet

- Part 1 What Is PFMDocument4 pagesPart 1 What Is PFMchartoolanmanNo ratings yet

- Iesco Online BillDocument2 pagesIesco Online BillRajan MaiNo ratings yet

- Manasa Resume - 1Document3 pagesManasa Resume - 1ManasaNo ratings yet

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- Ben & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooFrom EverandBen & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooRating: 5 out of 5 stars5/5 (2)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseFrom EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNo ratings yet

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationFrom EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo ratings yet

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderNo ratings yet

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- Indian Polity with Indian Constitution & Parliamentary AffairsFrom EverandIndian Polity with Indian Constitution & Parliamentary AffairsNo ratings yet

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionRating: 5 out of 5 stars5/5 (27)

- The SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsFrom EverandThe SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsNo ratings yet

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipFrom EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNo ratings yet