Professional Documents

Culture Documents

Jao Vs CA 249 SCRA 45

Uploaded by

Bilton ChengOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jao Vs CA 249 SCRA 45

Uploaded by

Bilton ChengCopyright:

Available Formats

Angelo Sy 3-E. Atty.

Dante Bravo Tax 1

Jao vs Ca 249 SCRA 45

October 6, 1995

ROMERO, J.:

Facts: On August 10, 1990, the Office of the Director, Enforcement and Security Services

(ESS), Bureau of Customs, received information regarding the presence of allegedly untaxed

vehicles and parts in the premises owned by a certain Pat Hao located along Quirino Avenue,

Paranaque and Honduras St., Makati. After conducting a surveillance of the two places,

respondent Major Jaime Maglipon, Chief of Operations and Intelligence of the ESS,

recommended the issuance of warrants of seizure and detention against the articles stored in the

premises. District Collector of Customs Titus Villanueva issued the warrants of seizure and

detention and subsequently issued it against the petitioner. They were barred from entering the

place, but somehow some members were able to force themselves inside the premises. They

were able to inspect the premises and noted that some articles were present which were not

included in the list contained in the warrant.. Hence, on August 15, 1990, amended warrants of

seizure and detention were issued by Villanueva. Petitioners then filled a case for injunction and

damages before the RTC. Respondents then filed a motion to dismiss the case on the ground that

the RTC has no jurisdiction over the subject matter, claiming that it was the Bureau of Customs

that had exclusive jurisdiction over it.

Issue: W/N the Bureau of Customs has exclusive jurisdiction over the case

Held: Yes. The Bureau of Customs has exclusive jurisdiction over the case. The Collector of

Customs sitting in seizure and forfeiture proceedings has exclusive jurisdiction o hear and

determine all questions touching on the seizure and forfeiture of dutiable goods. The Regional

Trial Courts are precluded from assuming cognizance over such matters even through petitions

of certiorari, prohibition or mandamus. It is likewise well-settled that the provisions of the Tariff

and Customs Code and that of Republic Act No. 1125, as amended, otherwise known as "An Act

Creating the Court of Tax Appeals," specify the proper fora and procedure for the ventilation of

any legal objections or issues raised concerning these proceedings. Thus, actions of the Collector

of Customs are appealable to the Commissioner of Customs, whose decision, in turn, is subject

to the exclusive appellate jurisdiction of the Court of Tax Appeals and from there to the Court of

Appeals. he rule that Regional Trial Courts have no review powers over such proceedings is

anchored upon the policy of placing no unnecessary hindrance on the government's drive, not

only to prevent smuggling and other frauds upon Customs, but more importantly, to render

effective and efficient the collection of import and export duties due the State, which enables the

government to carry out the functions it has been instituted to perform.

You might also like

- 1ST BATCH People V Gines People V BernasDocument12 pages1ST BATCH People V Gines People V BernasBilton ChengNo ratings yet

- 1ST BATCH People V Gines People V BernasDocument12 pages1ST BATCH People V Gines People V BernasBilton ChengNo ratings yet

- Legwri Demand LetterDocument5 pagesLegwri Demand LetterBilton ChengNo ratings yet

- 5TH Francisco V CA To People V YlaganDocument7 pages5TH Francisco V CA To People V YlaganBilton ChengNo ratings yet

- 2nd Batch Churchil-De MesaDocument6 pages2nd Batch Churchil-De MesaBilton ChengNo ratings yet

- US Vs Sotevento To People vs. MapalaoDocument11 pagesUS Vs Sotevento To People vs. MapalaoBilton ChengNo ratings yet

- Sales Digest 1-12Document5 pagesSales Digest 1-12Bilton ChengNo ratings yet

- Legwri Demand LetterDocument5 pagesLegwri Demand LetterBilton ChengNo ratings yet

- Republic Act NoDocument7 pagesRepublic Act NoKenneth M. BondocNo ratings yet

- Republic Act NoDocument7 pagesRepublic Act NoKenneth M. BondocNo ratings yet

- Pubcorp Cases FinalsDocument20 pagesPubcorp Cases FinalsBilton ChengNo ratings yet

- Republic Act NoDocument7 pagesRepublic Act NoKenneth M. BondocNo ratings yet

- Leg Wri Wri WriDocument6 pagesLeg Wri Wri WriBilton ChengNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Case Law: Spec Pro Midterms Reviewer (Atty. Chua)Document8 pagesCase Law: Spec Pro Midterms Reviewer (Atty. Chua)kathNo ratings yet

- Alvarado Vs Gaviola JRDocument7 pagesAlvarado Vs Gaviola JRIvan Montealegre ConchasNo ratings yet

- Pagbabago Program - Land For The Landless Acquisition Under Torrens System Real Property Act 1858Document3 pagesPagbabago Program - Land For The Landless Acquisition Under Torrens System Real Property Act 1858Romeo A. Garing Sr.0% (1)

- Burgos vs. Esperon - G.R. No. 202976 - February 19, 2014Document15 pagesBurgos vs. Esperon - G.R. No. 202976 - February 19, 2014Mai AlterNo ratings yet

- Legaspi Towers v. Muer: Derivative suit improperDocument1 pageLegaspi Towers v. Muer: Derivative suit improperArado JeromeNo ratings yet

- Court rules builder must be paid market value for apartment buildingDocument8 pagesCourt rules builder must be paid market value for apartment buildingTintin SumawayNo ratings yet

- New 5. PNB 202308Document3 pagesNew 5. PNB 202308Russ TuazonNo ratings yet

- Parens Patriae Doctrine ExplainedDocument3 pagesParens Patriae Doctrine ExplainedIVAN CONRADNo ratings yet

- Compulsory MootDocument39 pagesCompulsory MootKanish JindalNo ratings yet

- En Banc (G.R. No. L-8964. July 31, 1956.) JUAN EDADES, Plaintiff-Appellant, vs. SEVERINO EDADES, ET AL., Defendants-AppelleesDocument21 pagesEn Banc (G.R. No. L-8964. July 31, 1956.) JUAN EDADES, Plaintiff-Appellant, vs. SEVERINO EDADES, ET AL., Defendants-AppelleesTetris BattleNo ratings yet

- 52-Page Reading on Jurisprudence Theory and Law SourcesDocument44 pages52-Page Reading on Jurisprudence Theory and Law Sourcesyash jain100% (1)

- Rubber World V NLRCDocument7 pagesRubber World V NLRCRobert MantoNo ratings yet

- Moot Court and InternshipDocument18 pagesMoot Court and InternshipshivaniNo ratings yet

- Figuera vs. AngDocument2 pagesFiguera vs. AngGlenn Rey D. AninoNo ratings yet

- Introductory Notes of John MacasioDocument12 pagesIntroductory Notes of John MacasioJohn J. MacasioNo ratings yet

- SC upholds CA ruling on land registrationDocument2 pagesSC upholds CA ruling on land registrationManuel DancelNo ratings yet

- 12 CorralDocument18 pages12 CorralKGTorresNo ratings yet

- Bangalore DraftDocument6 pagesBangalore Draftjoebanpaza1No ratings yet

- GR No 221029Document20 pagesGR No 221029Cherry UrsuaNo ratings yet

- Letter of Appoinment As ResellerDocument3 pagesLetter of Appoinment As ResellerSaw Seong PeenNo ratings yet

- Test 10 MDocument9 pagesTest 10 MritikaNo ratings yet

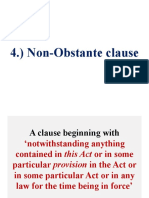

- Non-Obstante Clause - Slide-IiDocument66 pagesNon-Obstante Clause - Slide-Iidk0895100% (1)

- Rhonda Wells V Rachel GrahamDocument5 pagesRhonda Wells V Rachel GrahamRobert WilonskyNo ratings yet

- Holy Child Colleges of ButuanDocument4 pagesHoly Child Colleges of ButuanRico T. MusongNo ratings yet

- European Union - EU: A Concise Guide to the 28-Nation Economic and Political BlocDocument6 pagesEuropean Union - EU: A Concise Guide to the 28-Nation Economic and Political BlocAhtisham Alam GujjarNo ratings yet

- United States v. Jack Lee Colson, Delton C. Copeland, 662 F.2d 1389, 11th Cir. (1981)Document5 pagesUnited States v. Jack Lee Colson, Delton C. Copeland, 662 F.2d 1389, 11th Cir. (1981)Scribd Government DocsNo ratings yet

- Executive Order 9066Document2 pagesExecutive Order 9066Mark TutoneNo ratings yet

- Dulay vs. TorzuelaDocument4 pagesDulay vs. TorzuelaLyleThereseNo ratings yet

- Petitioner Vs Vs Respondent Arturo S. Santos E.P.Mallari & AssociatesDocument7 pagesPetitioner Vs Vs Respondent Arturo S. Santos E.P.Mallari & AssociatesAnne MadambaNo ratings yet

- Pilinas Shell Petroleum Vs Coc - GR No. 176380 June 18, 2009Document1 pagePilinas Shell Petroleum Vs Coc - GR No. 176380 June 18, 2009Ray John Uy-Maldecer AgregadoNo ratings yet