Professional Documents

Culture Documents

Flowchart Protest Taxation Law Review

Uploaded by

Erdie Ambrocio0 ratings0% found this document useful (0 votes)

46 views2 pagesTax Review

Protest

Local Government Tax

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTax Review

Protest

Local Government Tax

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

46 views2 pagesFlowchart Protest Taxation Law Review

Uploaded by

Erdie AmbrocioTax Review

Protest

Local Government Tax

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

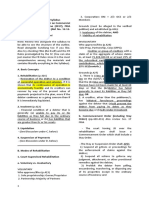

PROTESTING THE FORMAL LETTER OF DEMAND AND FINAL ASSESSMENT NOTICE

Issuance of the Formal Letter of Demand and Final Assessment Notice (1)

The taxpayer may protest administratively against the Formal Letter of

Demand and Final Assessment Notice (FLD/FAN) within 30 days from

the date of receipt. (2)

The taxpayer may file a

written request for REINVESTIGATION

RECONSIDERATION

reconsideration or A Request for Reinvestigation refers to a plea of

A request for reconsideration refers to a plea of re-evaluation

reinvestigation which re-evaluation of an assessment on the basis of newly

of an assessment on the basis of existing records without need

may involve a question discovered or additional evidence that a taxpayer

of additional evidence. (3)

of fact or of law or both. intends to present in the reinvestigation. (4)

The taxpayer shall submit all

If no protest is filed, the assessment becomes final (5)

relevant supporting documents in

support of his protest within sixty

(60) days from date of filing of the

Request for Reinvestigation. (6)

The Request for Reinvestigation or Reconsideration may be:

1. Granted

2. Denied, in whole or in part

3. Unacted

by the Commissioner’s duly authorized representative or by

the Commissioner himself or herself. If no supporting documents are filed, the assessment

becomes final (7)

Commissioner

Commissioner’s Authorized

Representative

INACTION DENIAL INACTION

DENIAL

GRANTED GRANTED (Commissioner)

(Commissioner)

If the protest is not acted upon by If the protest is denied, in whole

the Commissioner’s duly or in part, by the Commissioner’s If the protest or administrative

If the protest or administrative

authorized representative within duly authorized representative appeal is not acted upon by the

appeal, is denied, in whole or in

one hundred eighty (180) days the taxpayer may, either: Commissioner within 180 days

part, by the Commissioner, the

counted from the (i) date of filing counted from the date of filing of

taxpayer may appeal to the CTA

of the protest (Request for 1. Appeal to the CTA; or the protest or the submission of

within 30 days from the date of

Reconsideration) or from the (ii) 2. Elevate his protest to the documents, the taxpayer may

receipt of the decision.

Commissioner End End either:

date of submission of the relevant

supporting documents, the A motion for reconsideration of

taxpayer may: within 30 days from the date of 1. Appeal to the CTA within 30

the Commissioner’s denial of the

receipt of the decision. (9) days from the expiration of the

protest or administrative appeal,

1. Appeal to the CTA within 180-day period, OR

as the case may be, shall not toll

thirty (30) days after the the 30-day period to appeal to the

expiration of the one hundred 2. Await the final decision of the

CTA. (11)

eighty (180)-day period, Commissioner on the disputed

OR assessment. (12)

2. Await the final decision of the

Commissioner’s duly authorized

representative on the disputed

assessment. (8)

The administrative appeal to the

Commissioner will be through a

request for reconsideration and only

issues raised in the decision of the

Commissioner’s duly authorized

representative shall be entertained by

the Commissioner. (10)

If no appeal is made, the assessment becomes final (13)

Appeal to the CTA (14)

(1) Section 228, National Internal Revenue Code (RA 8424), par. 3; Section 3.1.3 of RR 12-99, as amended

by Section 2 of RR 18-13

(2) Section 228, National Internal Revenue Code (RA 8424), par. 4; Section 3.1.4, par. 1 of RR 12-99, as

amended by Section 2 of RR 18-13

(3) Section 3.1.4, par. 1(i) of RR 12-99, as amended by Section 2 of RR 18-13

(4) Section 3.1.4, par. 1(ii) of RR 12-99, as amended by Section 2 of RR 18-13

(5) Section 3.1.4, par. 6 of RR 12-99, as amended by Section 2 of RR 18-13

(6) Section 228, National Internal Revenue (RA 8424), par. 5; Section 3.1.4, par. 5 of RR 12-99, as amended

by Section 2 of RR 18-13

(7) Ibid

(8) Section 3.1.4, par. 8 of RR 12-99, as amended by Section 2 of RR 18-13

(9) Section 3.1.4, par. 7 of RR 12-99, as amended by Section 2 of RR 18-13

(10) Ibid

(11) Section 3.1.4, par. 9 of RR 12-99, as amended by Section 2 of RR 18-13

(12) Section 3.1.4, par. 10 of RR 12-99, as amended by Section 2 of RR 18-13

(13) Section 3.1.4, par. 7 of RR 12-99, as amended by Section 2 of RR 18-13

(14) Section 228, National Internal Revenue Code, (RA 8424), par. 6

You might also like

- FRIA Flow Chart FinalDocument44 pagesFRIA Flow Chart FinalM Grazielle EgeniasNo ratings yet

- Court-Supervised Rehabilitation ProceedingsDocument44 pagesCourt-Supervised Rehabilitation ProceedingsJay-r TumamakNo ratings yet

- COMMENCEMENTDocument1 pageCOMMENCEMENTjeremy nicoleNo ratings yet

- The Financial Rehabilitation and Insolvency Act of 2010Document7 pagesThe Financial Rehabilitation and Insolvency Act of 2010Airiz Dela CruzNo ratings yet

- Notes Flow Chart Rule Court-Supervised Rehabilitation A) Court - Supervised RehabilitationDocument44 pagesNotes Flow Chart Rule Court-Supervised Rehabilitation A) Court - Supervised Rehabilitationmark noel navarroNo ratings yet

- COA Region IV-B Procedural Flow-Appeal On Audit DisallowancesDocument2 pagesCOA Region IV-B Procedural Flow-Appeal On Audit DisallowancesChristopher IgnacioNo ratings yet

- Flowchart Disbarment Before IbpDocument1 pageFlowchart Disbarment Before IbpJason MergalNo ratings yet

- Labor Arbiter Decisions and AppealsDocument12 pagesLabor Arbiter Decisions and AppealsRosalyn BahiaNo ratings yet

- PPP - Proced RraccsDocument46 pagesPPP - Proced Rraccsken dexter m. barreraNo ratings yet

- RACCS Sep 17Document13 pagesRACCS Sep 17Dlos ProNo ratings yet

- TABLEDocument4 pagesTABLEPAMELA PARCENo ratings yet

- A.M. No. 12-12-11-SCDocument45 pagesA.M. No. 12-12-11-SCUlyssesNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument26 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress Assembledeinel dcNo ratings yet

- Regional Prosecution Office : Region Xii (Soccsksargen)Document8 pagesRegional Prosecution Office : Region Xii (Soccsksargen)Sunnee BanneeNo ratings yet

- Petitioner Respondent: Lorenzo Shipping Corporation, Commissioner of Internal RevenueDocument19 pagesPetitioner Respondent: Lorenzo Shipping Corporation, Commissioner of Internal RevenueJarvin David ResusNo ratings yet

- Revised Rules On Administrative Cases in The CivilDocument19 pagesRevised Rules On Administrative Cases in The Civilroy rubaNo ratings yet

- BSP V COADocument20 pagesBSP V COARose de DiosNo ratings yet

- Liquidation of Insolvent Juridical DebtorsDocument5 pagesLiquidation of Insolvent Juridical DebtorsbananahchipsNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument26 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledYuri SisonNo ratings yet

- Constitutional Law Case Digest Matrix Set 3Document11 pagesConstitutional Law Case Digest Matrix Set 3Stef Macapagal100% (1)

- Before Judgement Becomes FinalDocument6 pagesBefore Judgement Becomes Finalczabina fatima delicaNo ratings yet

- III.C.2 Capricorn Travel and Tours vs. CA, April 3, 1990Document2 pagesIII.C.2 Capricorn Travel and Tours vs. CA, April 3, 1990Jin AghamNo ratings yet

- The 2011 NLRC Rules of Procedure summarizedDocument25 pagesThe 2011 NLRC Rules of Procedure summarizednikkisals100% (2)

- Reimbursement Claim Process Flow (Intellicare)Document1 pageReimbursement Claim Process Flow (Intellicare)JunnoKaiserNo ratings yet

- 45 CFR 1641.24 - Appeal-Reconsideration of DebarmentDocument2 pages45 CFR 1641.24 - Appeal-Reconsideration of DebarmentmtcengineeringNo ratings yet

- Uniformed Domain Name Dispute Resolution FlowchartDocument2 pagesUniformed Domain Name Dispute Resolution Flowchartaquanesse21No ratings yet

- Assignment Flowchart 1Document3 pagesAssignment Flowchart 1RosedemaeBolongaita100% (1)

- Supreme Court Judgment on Time Limit for Curing Defects in Insolvency ApplicationDocument32 pagesSupreme Court Judgment on Time Limit for Curing Defects in Insolvency ApplicationradhakrishnaNo ratings yet

- Financial Rehabilitation and Insolvency Act (FRIA) of 2010" 1. Liquidation of Insolvent Juridical DebtorsDocument9 pagesFinancial Rehabilitation and Insolvency Act (FRIA) of 2010" 1. Liquidation of Insolvent Juridical DebtorsKNo ratings yet

- The 2011 NLRC Rules of Procedure, As AmendedDocument12 pagesThe 2011 NLRC Rules of Procedure, As AmendedJoyceNo ratings yet

- Fria NotesDocument6 pagesFria NotesRad IsnaniNo ratings yet

- Remedies of a TaxpayerDocument1 pageRemedies of a TaxpayerPrincess Mae SamborioNo ratings yet

- Labor Relations Procedure Rules PDFDocument14 pagesLabor Relations Procedure Rules PDFBret BalbuenaNo ratings yet

- WHEREFORE, The Decision Appealed From Is Hereby REVERSED. TheDocument2 pagesWHEREFORE, The Decision Appealed From Is Hereby REVERSED. TheAprail Jessem BalageoNo ratings yet

- Judicial Review of Admin ActionDocument21 pagesJudicial Review of Admin ActionJm CruzNo ratings yet

- Procedural Flowchart of The Appeal Process For Rulings of Prosecutors in Preliminary InvestigationsDocument1 pageProcedural Flowchart of The Appeal Process For Rulings of Prosecutors in Preliminary InvestigationsVikki AmorioNo ratings yet

- NLRC Appeal ProcedureDocument3 pagesNLRC Appeal ProcedureEJ Plan100% (3)

- Bullet QQR Taxation Law FinalDocument46 pagesBullet QQR Taxation Law FinalPrincess Janine Sy100% (2)

- Writ of Kalikasan: Nature, Requirements and ProcessDocument5 pagesWrit of Kalikasan: Nature, Requirements and ProcessJhon Dave MacatolNo ratings yet

- Digest Office of The Ombudsman V Samaniego 2008Document3 pagesDigest Office of The Ombudsman V Samaniego 2008Lea Gabrielle FariolaNo ratings yet

- Phil Assets Vs FasttectDocument5 pagesPhil Assets Vs FasttectAnty CastilloNo ratings yet

- Administrative Remedies in TaxDocument11 pagesAdministrative Remedies in TaxEFASNo ratings yet

- Environmental Law Procedures SummaryDocument3 pagesEnvironmental Law Procedures SummaryIsildur's HeirNo ratings yet

- 07 Protest Remedies Blacklisting Termination - EDITEDDocument84 pages07 Protest Remedies Blacklisting Termination - EDITEDmaricorNo ratings yet

- Flow of Complaint HandlingDocument1 pageFlow of Complaint Handlingjaenalmarip13No ratings yet

- Citizen ProperDocument11 pagesCitizen ProperVikram Kumar GuptaNo ratings yet

- RA 9520 & 10142 Financial Rehab & Insolvency ActsDocument4 pagesRA 9520 & 10142 Financial Rehab & Insolvency ActsMichelle Galapon LagunaNo ratings yet

- 1 Department of Environment and Natural Resources (DENR) vs. United Planners Consultants, Inc. (UPCI), 751 SCRA 389, February 23, 2015Document11 pages1 Department of Environment and Natural Resources (DENR) vs. United Planners Consultants, Inc. (UPCI), 751 SCRA 389, February 23, 2015Michael Joseph SamsonNo ratings yet

- Tax Remedies MappingDocument6 pagesTax Remedies MappingRikka Cassandra ReyesNo ratings yet

- SC Cases Batch 1Document49 pagesSC Cases Batch 1William SantosNo ratings yet

- Fria SummaryDocument5 pagesFria SummaryBelteshazzarL.CabacangNo ratings yet

- Regarding 6020 (B) ReturnsDocument4 pagesRegarding 6020 (B) ReturnsjpschubbsNo ratings yet

- Taxpayers' Rights and Remedies GuideDocument124 pagesTaxpayers' Rights and Remedies GuideNovi Mari NobleNo ratings yet

- Remedies LKGDocument41 pagesRemedies LKGHNicdaoNo ratings yet

- IBP Disbarment and Supreme Court Suspension ProceduresDocument5 pagesIBP Disbarment and Supreme Court Suspension Proceduresada mae santoniaNo ratings yet

- UntitledDocument2 pagesUntitledJose DiazNo ratings yet

- Companies Act 1956 Compliance ChecklistDocument34 pagesCompanies Act 1956 Compliance ChecklistDivya PoojariNo ratings yet

- COA - Citizens - Charter - Dec2021 Petition For Review StepsDocument10 pagesCOA - Citizens - Charter - Dec2021 Petition For Review StepsLovely MacarioNo ratings yet

- Nego 1Document20 pagesNego 1carl dianneNo ratings yet

- SB Jurisdiction Over Forfeiture CasesDocument138 pagesSB Jurisdiction Over Forfeiture CasesErdie Ambrocio100% (1)

- GSIS Vs CADocument19 pagesGSIS Vs CAErdie AmbrocioNo ratings yet

- DISINI Vs Secretary of JusticeDocument2 pagesDISINI Vs Secretary of JusticeErdie AmbrocioNo ratings yet

- Filipino Merchants Vs CADocument7 pagesFilipino Merchants Vs CAErdie AmbrocioNo ratings yet

- Court upholds jurisdiction of environmental court over mining caseDocument6 pagesCourt upholds jurisdiction of environmental court over mining caseLenvicElicerLesiguesNo ratings yet

- Cmo 2 2000Document10 pagesCmo 2 2000Erdie AmbrocioNo ratings yet

- Fortune VS CaDocument7 pagesFortune VS CaShiena Lou B. Amodia-RabacalNo ratings yet

- Office of The City ProsecutorDocument5 pagesOffice of The City ProsecutorErdie AmbrocioNo ratings yet

- Arnado Vs ComelecDocument62 pagesArnado Vs ComelecErdie AmbrocioNo ratings yet

- Cadalin V POEADocument25 pagesCadalin V POEAronaldraedelmundoNo ratings yet

- Saudi Arabian AirlinesDocument10 pagesSaudi Arabian AirlinesofficeofrfsmraNo ratings yet

- Saudi Arabian AirlinesDocument10 pagesSaudi Arabian AirlinesofficeofrfsmraNo ratings yet

- Statutory ConstructionDocument2 pagesStatutory ConstructionErdie AmbrocioNo ratings yet

- Roces Vs Posadas (Digest)Document1 pageRoces Vs Posadas (Digest)Erdie AmbrocioNo ratings yet

- Statutory ConstructionDocument2 pagesStatutory ConstructionErdie AmbrocioNo ratings yet

- Apple Strategic Audit AnalysisDocument14 pagesApple Strategic Audit AnalysisShaff Mubashir BhattiNo ratings yet

- Catalogueofsanfr00sanfrich PDFDocument310 pagesCatalogueofsanfr00sanfrich PDFMonserrat Benítez CastilloNo ratings yet

- Chemistry Presentation Week2Document17 pagesChemistry Presentation Week2Mohammad SaadNo ratings yet

- 1982 SAMAHAN ConstitutionDocument11 pages1982 SAMAHAN ConstitutionSAMAHAN Central BoardNo ratings yet

- Brochure - Ratan K Singh Essay Writing Competition On International Arbitration - 2.0 PDFDocument8 pagesBrochure - Ratan K Singh Essay Writing Competition On International Arbitration - 2.0 PDFArihant RoyNo ratings yet

- Eriodic Ransaction Eport: Hon. Judy Chu MemberDocument9 pagesEriodic Ransaction Eport: Hon. Judy Chu MemberZerohedgeNo ratings yet

- AHMEDABAD-380 014.: Office of The Ombudsman Name of The Ombudsmen Contact Details AhmedabadDocument8 pagesAHMEDABAD-380 014.: Office of The Ombudsman Name of The Ombudsmen Contact Details AhmedabadPatrick AdamsNo ratings yet

- Baystate V Bentley (Gorton, Software, Copyright, Data Structures)Document17 pagesBaystate V Bentley (Gorton, Software, Copyright, Data Structures)gesmerNo ratings yet

- Affidavit of Mutilation of Philippine Passport: IN WITNESS WHEREOF, I Have Hereunto Set My Hand This 4Document1 pageAffidavit of Mutilation of Philippine Passport: IN WITNESS WHEREOF, I Have Hereunto Set My Hand This 4Richard Conrad Foronda SalangoNo ratings yet

- Thread - o - Ring - Fittings (TD Williamson) PDFDocument4 pagesThread - o - Ring - Fittings (TD Williamson) PDFRahul RaghukumarNo ratings yet

- Print Bus 100 CH 13 - QuizletDocument2 pagesPrint Bus 100 CH 13 - QuizletMac TorejaNo ratings yet

- Carey Alcohol in The AtlanticDocument217 pagesCarey Alcohol in The AtlanticJosé Luis Cervantes CortésNo ratings yet

- QSPOT571423: Create Booking Within 24 HoursDocument2 pagesQSPOT571423: Create Booking Within 24 HoursNaimesh TrivediNo ratings yet

- Kathi Raning Rawat V State of SaurashtraDocument2 pagesKathi Raning Rawat V State of SaurashtraLucas KaneNo ratings yet

- BIZ ADMIN INDUSTRIAL TRAINING REPORTDocument14 pagesBIZ ADMIN INDUSTRIAL TRAINING REPORTghostbirdNo ratings yet

- Quezon City District IV - Project of Precinct - 2Document73 pagesQuezon City District IV - Project of Precinct - 2bobituchi100% (1)

- Heartbalm Statutes and Deceit Actions PDFDocument29 pagesHeartbalm Statutes and Deceit Actions PDFJoahanna AcharonNo ratings yet

- Phrasal Verbs CardsDocument2 pagesPhrasal Verbs CardsElenaNo ratings yet

- Islamic Mangement Vs Conventional ManagementDocument18 pagesIslamic Mangement Vs Conventional Managementlick100% (1)

- SS 102 - Pakistan Studies-Culture & Heritage (ZS)Document7 pagesSS 102 - Pakistan Studies-Culture & Heritage (ZS)BushraShehzadNo ratings yet

- DENR confiscation caseDocument347 pagesDENR confiscation caseRyan BalladaresNo ratings yet

- Case Digests - Simple LoanDocument14 pagesCase Digests - Simple LoanDeb BieNo ratings yet

- Labour Laws Individual Assignment - Code On Wages Subject Code: MHR4CCHR05Document5 pagesLabour Laws Individual Assignment - Code On Wages Subject Code: MHR4CCHR05Seher BhatiaNo ratings yet

- PDF 05 EuroMedJeunesse Etude LEBANON 090325Document28 pagesPDF 05 EuroMedJeunesse Etude LEBANON 090325ermetemNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument9 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceN.prem kumarNo ratings yet

- NLIU 9th International Mediation Tournament RulesDocument9 pagesNLIU 9th International Mediation Tournament RulesVipul ShuklaNo ratings yet

- H.C.G. Paper 1 History & Civics examDocument5 pagesH.C.G. Paper 1 History & Civics examGreatAkbar1100% (1)

- WEEK 5 ACCT444 Group Project 14-34Document6 pagesWEEK 5 ACCT444 Group Project 14-34Spencer Nath100% (2)

- PenaltiesDocument143 pagesPenaltiesRexenne MarieNo ratings yet