Professional Documents

Culture Documents

Legal action threatened for bounced check

Uploaded by

vivivioletteOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Legal action threatened for bounced check

Uploaded by

vivivioletteCopyright:

Available Formats

12 August 2018 Commented [u1]: Can be modified

Group 4

Taft Avenue, corner Menlo Street,

Pasay City Commented [u2]: Don’t know the addressee

Sir/Madam

This is to inform you that the post-dated check you issued with Check Commented [u3]: Should we add the actual post-date

as well? Check must be presented within 90 days

No. xxxxxx for the payment of our services, has been dishonoured by therefrom and proof to that effect

XYZ Bank for lack of funds.

Thus, we would like to remind you of your outstanding obligation with

our company and we request that the full payment be paid entirely in

CASH.

Attached to this letter is a copy of the said check with the stamp of dishonoured

deposit.

Accordingly, FINAL DEMAND is hereby made upon you to settle the

amount of Php 1,500,000 within FIFTEEN (15) days from receipt of Commented [u4]: Prision Correccional to

this letter. Otherwise, we will be constrained to file the necessary legal Commented [u5]: law requires 3 days from notice of

dishonour and 5 days from dishonour sa Art 315 and

action against you to protect the interest of our client. BP22 respectively so sobra

We trust that you will give this matter your prompt and preferential

attention to avoid the expense and inconvenience of litigation.

Truly yours,

ATTY. ______________ Commented [u6]: Do we write on behalf of our client or is it

written by the client himself?

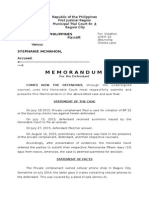

In the instant case, petitioner through counsel, admitted receipt of private complainant's

demand letters sent via registered mail, informing him of the dishonor of the checks and

the reason therefor; and demanding that the value of the check be paid in cash. Commented [u7]: Basis

Pertinent portion of the transcript of stenographic notes, reads: (Ongson vs People)

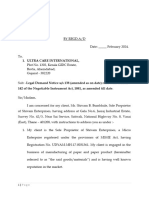

The offenses we are required to complain of are both Estafa

under Art 315(2b) and BP22

Art 315(2b) is Estafa by postdating a check or issuing a check in payment of an

obligation

Elements of which are:

(1) That the offender postdated a check, or issued a check in payment of an obligation

(2) That such postdating or issuing a check was done when the offender had no funds

in the bank, or his funds deposited therein were not sufficient to cover the amount of

the check.

BP22 is Bouncing Checks Law

Elements of which are:

(1) Making, drawing, and issuance of any check to apply on account or for value

(2) Knowledge of the maker, drawer, or issuer that at the time of issue he does not have

sufficient funds in or credit with the drawee bank for the payment of the check in full

upon its presentment

(3) Subsequent dishonor of the check by the drawee bank for insufficiency of funds or

credit, or dishonor for the same reason had not the drawer, without any valid cause,

ordered the bank to stop payment.

SEC. 2. Evidence of knowledge of insufficient funds. - The making, drawing and issuance

of a check payment of which is refused by the drawee because of insufficient funds in or

credit with such bank, when presented within ninety (90) days from the date of the

check, shall be prima facie evidence of knowledge of such insufficiency of funds or credit

unless such maker or drawer pays the holder thereof the amount due thereon, or makes

arrangements for payment in full by the drawee of such check within five (5) banking

days after receiving notice that such check has not been paid by the drawee.

You might also like

- Legal Forms and Practical Exercises by Carmencita C. DabuDocument28 pagesLegal Forms and Practical Exercises by Carmencita C. DabuGlem Josol100% (1)

- Pre Trial BriefDocument8 pagesPre Trial Brief0506shelton100% (2)

- B - Letter 1 - 1st Dispute Letter To Pretend LenderDocument5 pagesB - Letter 1 - 1st Dispute Letter To Pretend Lenderbigwheel897% (31)

- BP Blg. 22 penalizes bouncing checksDocument64 pagesBP Blg. 22 penalizes bouncing checksMae NiagaraNo ratings yet

- Legal Notice Section 138 Cheque BounceDocument7 pagesLegal Notice Section 138 Cheque Bouncejamit amit50% (4)

- FDA Foia Request - 010722Document4 pagesFDA Foia Request - 010722Washington ExaminerNo ratings yet

- Summary of Admitted Facts and Proposed Stipulation in Check Bouncing CaseDocument2 pagesSummary of Admitted Facts and Proposed Stipulation in Check Bouncing Case0506sheltonNo ratings yet

- 43 - Wong v. CaDocument9 pages43 - Wong v. CaVia Rhidda ImperialNo ratings yet

- Metro Manila Court Case Involving Violation of BP 22Document9 pagesMetro Manila Court Case Involving Violation of BP 220506sheltonNo ratings yet

- R-1 - Attorney - Notice of FraudDocument4 pagesR-1 - Attorney - Notice of Fraudderrick100% (5)

- Court Acquits Woman of Bouncing Check Charge Due to Lack of IntentDocument15 pagesCourt Acquits Woman of Bouncing Check Charge Due to Lack of IntentTris LeeNo ratings yet

- Negotiable Instruments Case Digests For November 8Document3 pagesNegotiable Instruments Case Digests For November 8Megan MateoNo ratings yet

- Wong v. Court of Appeals, G.R. No. 117857, February 02, 2001Document10 pagesWong v. Court of Appeals, G.R. No. 117857, February 02, 2001Krister VallenteNo ratings yet

- NIL DigestsDocument7 pagesNIL DigestsaugustofficialsNo ratings yet

- Negotiable Act Sec 138Document10 pagesNegotiable Act Sec 138Maharishi VaidyaNo ratings yet

- BP 22 and .... Paper 1Document4 pagesBP 22 and .... Paper 1James LouieNo ratings yet

- Negotiable Instruments Law Digests Section 1Document13 pagesNegotiable Instruments Law Digests Section 1Jay-ar Rivera BadulisNo ratings yet

- Bpi Card Vs CA DigestDocument3 pagesBpi Card Vs CA DigestErvin SagunNo ratings yet

- Legal NoticeDocument4 pagesLegal NoticewertyderryNo ratings yet

- Memorandum For The AccusedDocument6 pagesMemorandum For The AccusedEman de VeraNo ratings yet

- BPI ECC V CADocument12 pagesBPI ECC V CAMp CasNo ratings yet

- Bax Vs People Case DigestDocument2 pagesBax Vs People Case Digestemjee_11100% (2)

- Letter of DemandDocument6 pagesLetter of Demandgmrp gmpNo ratings yet

- 4 Genius Mind Notice - Final (I)Document5 pages4 Genius Mind Notice - Final (I)tanmaya_purohitNo ratings yet

- Legal Notice Format GuideDocument17 pagesLegal Notice Format GuideCONTENT SCRIBDNo ratings yet

- Court Affirms Conviction for Bounced Check Despite Full PaymentDocument11 pagesCourt Affirms Conviction for Bounced Check Despite Full PaymentMarco AndalNo ratings yet

- Wong V CADocument5 pagesWong V CABrian TomasNo ratings yet

- Bax Vs PeopleDocument6 pagesBax Vs Peoplerambol007No ratings yet

- Nego Case Digests ChecksDocument13 pagesNego Case Digests ChecksRen ConchaNo ratings yet

- Domagsang Acquitted Due to Lack of Written Notice of DishonorDocument4 pagesDomagsang Acquitted Due to Lack of Written Notice of DishonorAntonJohnVincentFriasNo ratings yet

- Memorandum Stephanie FinalDocument4 pagesMemorandum Stephanie FinalAmado Vallejo IIINo ratings yet

- Sample Notice of DishonorDocument4 pagesSample Notice of DishonorDon CorleoneNo ratings yet

- 06 - Batas Pambansa Bilang 22Document20 pages06 - Batas Pambansa Bilang 22Aaron MañacapNo ratings yet

- L41 and 42 Ballb 3 AprilDocument8 pagesL41 and 42 Ballb 3 AprilOjasvi AroraNo ratings yet

- Wong vs. Court of AppealsDocument5 pagesWong vs. Court of Appealsarsalle2014No ratings yet

- T N I A, 1881: HE Egotiable Nstruments CTDocument10 pagesT N I A, 1881: HE Egotiable Nstruments CTSunirmal BiswasNo ratings yet

- BP22 Worthless Checks Law SummaryDocument16 pagesBP22 Worthless Checks Law SummarynuggsNo ratings yet

- In The Court of District JudgeDocument3 pagesIn The Court of District Judgeaqsa qasimNo ratings yet

- Title ViiDocument11 pagesTitle ViiELLANo ratings yet

- Legal Notice and Next StepsDocument5 pagesLegal Notice and Next StepsBen Munster100% (1)

- Defendant Pedro Martinez's Answer to Lawsuit Over $60K LoanDocument5 pagesDefendant Pedro Martinez's Answer to Lawsuit Over $60K LoanDawn SedigoNo ratings yet

- Obl Icon CasesDocument6 pagesObl Icon CasesKia G. EstavilloNo ratings yet

- BP 22 CasesDocument120 pagesBP 22 Casesakaibengoshi0% (1)

- Petition for acquittal on bouncing checks charges due to lack of written noticeDocument11 pagesPetition for acquittal on bouncing checks charges due to lack of written noticeMak FranciscoNo ratings yet

- Draft Reply Legal Notice Raheja AtalantisDocument7 pagesDraft Reply Legal Notice Raheja AtalantisparbatarvindNo ratings yet

- Apprac - Demand LetterDocument2 pagesApprac - Demand LetterJasfher CallejoNo ratings yet

- Complaint Affi Estafa bp22Document5 pagesComplaint Affi Estafa bp22Shelamarie M. Beltran100% (1)

- Reply To Cheque Bounce NoticeDocument2 pagesReply To Cheque Bounce NoticeIayushsingh SinghNo ratings yet

- BP 22 Jaime Alferez Vs PEOPLE - Notice of DishonorDocument5 pagesBP 22 Jaime Alferez Vs PEOPLE - Notice of DishonorBing Viloria-YapNo ratings yet

- Case Digest JohnDocument29 pagesCase Digest JohnGretchen Alunday Suarez100% (1)

- Estafa or BP 22Document2 pagesEstafa or BP 22Anonymous MikI28PkJcNo ratings yet

- Bouncing CheckDocument4 pagesBouncing CheckBenitez GheroldNo ratings yet

- Banking Law ProjectDocument13 pagesBanking Law ProjectManasa CheekatlaNo ratings yet

- Republic of the Philippines Counter AffidavitDocument4 pagesRepublic of the Philippines Counter Affidavitailyn rentaNo ratings yet

- SCL - Case Digests 1Document24 pagesSCL - Case Digests 1Bhenz Bryle TomilapNo ratings yet

- Bpi V CaDocument17 pagesBpi V CaClarissa SawaliNo ratings yet

- Cruz v. CADocument7 pagesCruz v. CAPamela BalindanNo ratings yet

- 03.02.2024 - 138 Notice v1Document6 pages03.02.2024 - 138 Notice v1Adv KINJAL DESAINo ratings yet

- Cases Bp22Document5 pagesCases Bp22anon_626623467No ratings yet

- Requirements for Presumption of Check DishonorDocument5 pagesRequirements for Presumption of Check DishonorAnna Lesava100% (2)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Case 1Document15 pagesCase 1Denn Reed Tuvera Jr.No ratings yet

- Nation Petroleum Gas vs RCBC Ruling on Service of SummonsDocument2 pagesNation Petroleum Gas vs RCBC Ruling on Service of Summonsviviviolette100% (2)

- CabillanDocument12 pagesCabillanvivivioletteNo ratings yet

- de CastroDocument10 pagesde CastrovivivioletteNo ratings yet

- Case Doctrines DLP TableDocument14 pagesCase Doctrines DLP TablevivivioletteNo ratings yet

- Palileo vs. Planters Development BankDocument2 pagesPalileo vs. Planters Development BankvivivioletteNo ratings yet

- Philippines v. Roa: Court upholds murder conviction despite insanity defenseDocument12 pagesPhilippines v. Roa: Court upholds murder conviction despite insanity defensevivivioletteNo ratings yet

- BautistaDocument5 pagesBautistavivivioletteNo ratings yet

- Sandiganbayan jurisdiction over Disini upheldDocument20 pagesSandiganbayan jurisdiction over Disini upheldvivivioletteNo ratings yet

- Service of summons on nonresident petitioner invalidDocument4 pagesService of summons on nonresident petitioner invalidvivivioletteNo ratings yet

- Labor Law Central2020Document117 pagesLabor Law Central2020vivivioletteNo ratings yet

- Hongnkong vs. BroquezaDocument8 pagesHongnkong vs. BroquezavivivioletteNo ratings yet

- Legal Ethics Central2020Document188 pagesLegal Ethics Central2020vivivioletteNo ratings yet

- Petitioners Vs Vs Respondents: Third DivisionDocument8 pagesPetitioners Vs Vs Respondents: Third DivisionMigoy DANo ratings yet

- Form BK-3 Certificate of EmploymentDocument1 pageForm BK-3 Certificate of EmploymentMark Anthony Carreon MalateNo ratings yet

- Articles of Incorporation of ABC CorporationDocument6 pagesArticles of Incorporation of ABC CorporationvivivioletteNo ratings yet

- Civ2 Reviewer PDFDocument133 pagesCiv2 Reviewer PDFvivivioletteNo ratings yet

- Counter AffidavitDocument3 pagesCounter AffidavitvivivioletteNo ratings yet

- Efficient Use of Paper Rule A.M. No. 11-9-4-SCDocument3 pagesEfficient Use of Paper Rule A.M. No. 11-9-4-SCRodney Atibula100% (3)

- 280 LaborDocument1 page280 LaborvivivioletteNo ratings yet

- Icc International Court of ArbitrationDocument2 pagesIcc International Court of ArbitrationvivivioletteNo ratings yet

- Icc International Court of ArbitrationDocument2 pagesIcc International Court of ArbitrationvivivioletteNo ratings yet

- Irr Doj Department Circular No. 98 S 2009Document45 pagesIrr Doj Department Circular No. 98 S 2009vivivioletteNo ratings yet

- Certification of Non Forum Shopping - Small Money ClaimsDocument1 pageCertification of Non Forum Shopping - Small Money Claimsrupertville12No ratings yet

- XXVII. 16. Tantano v. Espina-CaboverdeDocument12 pagesXXVII. 16. Tantano v. Espina-CaboverdeBarrrMaidenNo ratings yet

- Practice Court 1Document4 pagesPractice Court 1vivivioletteNo ratings yet

- R23 - 8. People v. BustamanteDocument2 pagesR23 - 8. People v. BustamantevivivioletteNo ratings yet

- Judicial AffidavitDocument4 pagesJudicial AffidavitvivivioletteNo ratings yet

- Insurance Cases Blucross Vs NEOMIDocument4 pagesInsurance Cases Blucross Vs NEOMIvivivioletteNo ratings yet

- Commitment OrderDocument1 pageCommitment OrdervivivioletteNo ratings yet

- Tan Vs SabandalDocument7 pagesTan Vs SabandalMar Joe100% (1)

- 14-556 The Mattachine Society of Washington DCDocument48 pages14-556 The Mattachine Society of Washington DCDowning Post NewsNo ratings yet

- First Amendment Coalition Vs City of Bakersfield: Opening BriefDocument595 pagesFirst Amendment Coalition Vs City of Bakersfield: Opening BriefAnthony WrightNo ratings yet

- Right To Constitutional RemediesDocument33 pagesRight To Constitutional RemediesMohammad Irfan100% (1)

- Roman v. USA - Document No. 1Document5 pagesRoman v. USA - Document No. 1Justia.comNo ratings yet

- 3 Year - V - Sem - FinalDocument208 pages3 Year - V - Sem - FinalKARTHIK ANo ratings yet

- Notice of Appeal Filed in Probate CourtDocument2 pagesNotice of Appeal Filed in Probate CourtJanet and JamesNo ratings yet

- Online Indian legal format for Special Power of AttorneyDocument3 pagesOnline Indian legal format for Special Power of AttorneySam MagomnangNo ratings yet

- Sss Vs UbanaDocument6 pagesSss Vs UbanakornNo ratings yet

- Candano Shipping Lines vs. Sugata-OnDocument2 pagesCandano Shipping Lines vs. Sugata-OnAr LineNo ratings yet

- Warren Jeffs Motion in LimineDocument12 pagesWarren Jeffs Motion in LimineBen WinslowNo ratings yet

- Mariam Kairuz property dispute caseDocument7 pagesMariam Kairuz property dispute caseReginald Matt Aquino SantiagoNo ratings yet

- Supreme Court Suspends Lawyer for Libelous Letter and Conflict of InterestDocument9 pagesSupreme Court Suspends Lawyer for Libelous Letter and Conflict of InterestJillen SuanNo ratings yet

- Phillips Petroleum v. ShuttsDocument2 pagesPhillips Petroleum v. Shuttscrlstinaaa100% (1)

- Land Revenue Code and RulesDocument310 pagesLand Revenue Code and RulesVividh PawaskarNo ratings yet

- FULL TEXT Torts A.1 To A.3 PDFDocument192 pagesFULL TEXT Torts A.1 To A.3 PDFKim EstalNo ratings yet

- FORMAN v. CATHEL Et Al - Document No. 17Document3 pagesFORMAN v. CATHEL Et Al - Document No. 17Justia.comNo ratings yet

- Crim 2 #12 Nostradamus Villanueva Petitioner, vs. Priscilla R. DomingoDocument2 pagesCrim 2 #12 Nostradamus Villanueva Petitioner, vs. Priscilla R. DomingoAmy Lou CabayaoNo ratings yet

- Code of Civil Procedure GuideDocument113 pagesCode of Civil Procedure GuideNamrata PriyaNo ratings yet

- April 9 Regular City Council MeetingDocument2 pagesApril 9 Regular City Council MeetingThe Brookhaven PostNo ratings yet

- Supreme Court upholds service of decision despite counsel's failure to update addressDocument3 pagesSupreme Court upholds service of decision despite counsel's failure to update addressAliyah SandersNo ratings yet

- CSP-I-08 Writing of MinutesDocument4 pagesCSP-I-08 Writing of MinutesSaiful FaisalNo ratings yet

- PAL V NLRC DigestDocument1 pagePAL V NLRC Digestsamme1010100% (1)

- Water Prevention Act 1974Document22 pagesWater Prevention Act 1974Tanmay TiwariNo ratings yet

- Court extends time for appealDocument11 pagesCourt extends time for appealJoyce MasweNo ratings yet

- Snow Removal QASPDocument4 pagesSnow Removal QASPboki11080No ratings yet

- PAL liable for damages after bypassing airport due to bad weatherDocument48 pagesPAL liable for damages after bypassing airport due to bad weatherShiela Mae Angolluan BoquironNo ratings yet

- Saudi Airlines petition to annul rulings in damages suitDocument222 pagesSaudi Airlines petition to annul rulings in damages suitbaguvix borlaloyNo ratings yet

- 01 ORTIGAS V HERRERADocument1 page01 ORTIGAS V HERRERACornelio Francis PangilinanNo ratings yet