Professional Documents

Culture Documents

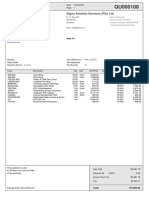

Tariff and Custom PDF

Uploaded by

Marcelino Casil0 ratings0% found this document useful (0 votes)

38 views31 pagesOriginal Title

tariff and custom.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

38 views31 pagesTariff and Custom PDF

Uploaded by

Marcelino CasilCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 31

raat mien oa QleP AVA eh Pe)

SIMPLIFYING TAXATION

Tariff and Customs Code

Atty. Reynaldo G. Geronimo

Partne! t Bue ayoc & De

Bar Examiner in Taxation, 2002 and 2003 | facebook

Pre-Bar Reviewer in various law schools BAR

Pre-Week Reviewer in Tax Ateneo de Manila School of Law REVIEW

ADVISORY

= No part of this work may be reproduced, stored in a

retrieval system, or transmitted in any form or by any

means, electronic, mechanical, photocopying, recording,

scanning, or otherwise except as permitted by Atty.

Reynaldo G. Geronimo.

= While the author has used best efforts in preparing this

work, he makes no representations or warranties with

respect to the accuracy or completeness of the contents

herein and specifically disclaims any implied warranties of

merchantability or fitness for a particular purpose.

= Any hard or soft copy of this work not bearing the

signature of the author on the label comes from an illegal

source. =

MISSION AND VISION

MY MISSION

=™To enable you to pass the

Bar Exam in Taxation

the Second Sunday of

November (Nov. 13, 2016)

n

MY VISION

= Seeing you take your oath

as a lawyer early next

ear, 2017

facebook

‘GERONIMO

BAR

REVIEW

OUR PRE=WEEK TAX CALENDAR

V First Session --Nov. 7 - General Principles of Taxation

VSecond Session - Nov. 8 —National Taxation of Income and

of the Transmission of Wealth

Third Session- Nov . 9 — National Taxation of

vo = Wealth Creation through Domestic Sales

= Transferring Wealth Across Borders

Fourth Session - Nov. 10 = Local Taxation and Tax

Remedies

Fifth Session--Nov. 11- Tax Remedies, Jurisprudence and

Du30 tax program

WHAT YOU CAN EXPECT FROM THIS SLIDE

PRESENTATION ON THE TARIFF AND CUSTOMS CODE

Bi An idea of how

much time you

need to spend

studying the Tariff

and Customs Code

for the!2025 Bar An idea of which

parts of the TCC

that you need to

review

An idea of how

you can monitor

how prepared

you are for the

Exams

HOW TO STUDY THE TARIFF AND C

a | How much time do you According to the Bar Trending Studies conducted by Atty

need to spend studying

Poncevic Geballos, Dean of Liceo de Gagayan University

(2010-11) and Associate Dean of Phillppine Christian

the Tariff and Customs University (2012-present), less than 6% of the 760 Taxation

Code for the 2015 Bar? 2" Questions asked from 1991 t0 2014 were on tne Tariff

Which parts of

the TCC do you

need to review?

and Customs Gode

‘The Supreme Court, as it had done for the past several years,

provided the 2015 Bar candidates with a listing. or a syllabus, of

Covered topics “for the limited purpose of ensuring that Bar

Candidates are guided on the coverage of the 2015 Bar

Examinations.” The section of the syllabus on the TCC lists only 9

major topics. Those are the parts that need your attention.

The Court further said that “all Supreme Court decisions pertinent to

a given Bar subject-and its listed topics and promulgated up to March

15, 2015 are examinable materials within the coverage of the 2015

Bar Examinations.

This Pre-Bar Reviewer on the TCC follows the presentation of the 9

topics as listed in the Syllabus. Examinable decided cases are

discussed as those topics are taken up.

HOW TO STUDY THE TARIFF AND CUSTOMS CODE, CON’T

An idea of how you uf suggestion Is that you

‘ = Join study groups wherein members frequently meet and take

can monitor how turns in discussing tax issues dealt with in the news media

prepared you are

for the Exams = Take several mock bar exams being given by some law schools

(eg Ateneo Law), or bar review outfits (ike ChanRobles) or

conducted by noted law professors, e.g. Mock bars of Dean

Poncevic M. Geballos being given at UP Law.

ee nen

® No part of this work may be reproduced, stored in a retrieval system, or transmitted in any form

or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise except

as permitted in writing by its author, Atty. Reynaldo G. Geronimo.

= While the author has used best efforts in preparing this work, he makes no representations or

warranties with respect to the accuracy or completeness of the contents herein and specifically

disclaims any implied warranties of merchantability or fitness for a particular purpose.

® Any copy of this work, electronic or in any other media, not bearing the signature of the author

on the label comes from an iilegal source,

THE TARIFF AND CUSTOMS CODE

The first TCC (R.A. 1937) was

enacted on June 22,1957

effective on July 1, 1957

The code now in force is

the ASEAN HARMONIZED TARIFF NOMENCLATURE

established by the members of the Asean

on Aug 7, 2003, as amended

FUNDAMENTAL PRINCIPLES

= A- What is meant by “Tariff”? by “Duties”?

= B- What is the General Rule on the liability of imported

goods to duty?

= C - Whatis the purpose of imposing customs duties?

= D-Whatis the “flexible tariff clause” (FTC) in the

Constitution?

= E - Requirements of Importation

= F - Importations in violation of tax credits under the TCCP

= G - Classification of Imported Goods

= H - Classification of Duties

= |- Remedies

A — WHAT IS MEANT BY “TARIFF”? BY “DUTIES”

‘Tariff’ means the “book

of rates.” More precisely,

it means a book, (Book

One of the TCC), which

contains the particular

tates of tax imposed upon

(a) importation of specific

kinds or classes of goods

into (Title 1) or (b)

exportation (Title Ill) out

of the Philippines

“Duties” or “customs

duties" refers to the tax

that is supposed to be

collected when good are

imported or exported

Schedule |

LIVE ANIMALS; ANIMAL PRODUCTS.

CHAPTER 4: LIVE ANIMALS.

NOTES

1. This Chapter covers all live animals except fish

crustaceans, mollusks (Chapter 3) and microbic cultures

(heading No. 30.02)

Any reference in this Ghapter to a particular genus or

species, except where the context otherwise requires,

includes a reference to the young of that genus or species.

sw ttem for import

01.04 (ive horsesyesses, mules and hinnies

‘A. SUvking-foalé -Free

B. Other -~ ~--ha.&100.000) —? "*

01.02 Live bovine animals (Inetudthig buffaio and carabao)

A. Sucking calves —Free

B. Other -- -hd. P20.000

01.03 Live pigs

0.1.04Live sheep and goats

B —- WHAT IS THE GENERAL RULE ON THE

LIABILITY OF IMPORTED GOODS TO DUTY?

= All articles, when imported from any foreign country into the Philippines, shal! be

subject to duty upon each importation, even though previously exported from the

Philippines, except as otherwise specifically provided for in this Code or in other

laws. (

Yes. Except those provided for Sec. 105 of

the TCC, all importations by the

Government for its own use, or that of its

subordinate branches or instrumentalities,

or corporations, agencies, or

instrumentalities owned or controlled by

the government shall be subject to the

duties, taxes, fees, and other charges

provided forin the TCC. (Sec. 1205)

Yes, that is why upon certification of

the head of the department or

political subdivision concerned, with

the approval of the Auditor General,

that the imported article is actually

being used by the Government or

any of its political subdivision

concerned, the amount of duty, tax

fee or charge is refunded to the

entity which paid it.

C —PURPOSE OF IMPOSING CUSTOMS DUTIES

Customs duties are imposed for any one and, sometimes, for all of the

following purposes:

Raise revenue - BoC second only to BIR

Support foreign policy — Flexible Tariff Clause

Protect domestic economy — Prohibited importations

Implement commitment to other nations — Asean Integration

won =

D - WHAT IS THE FLEXIBLE TARIFF CLAUSE (FTC) IN THE

CONSTITUTION?

The FTC in the Constitution is that provision that empowers Congress, by law, to authorize

the President, to fix within specified limits and subject to such limitations and restrictions

as it may impose, tariff rates, import and export quotas, tonnage and wharfage dues, and

other duties or imposts within the framework of the national development program of the

Government. (Section 28(2), Article VI, Constitution)

ae

Yes. In the interest of national economy, general welfare, and/or national security,

and subject to the limitations prescribed in the TCC, the President upon

recommendation of the NEDA, is empowered to.

(a) increase (by no higher than 100% ad val), reduce, or remove existing rates of

protective duty

(b) establish import quotas or ban imports of any commodity: and

(c) impose an additional duty on all imports not exceeding 10% ad val whenever

necessary. (Sec 40 1a)

D —- WHAT IS THE FLEXIBLE TARIFF CLAUSE (FTC) IN THE

CONSTITUTION? (CONT’D)

Is the President also authorized to modify tariff rates to promote foreign trade?

Yes. For the F cts asa

means of assistance in the economic develonient of the country, in overcoming

domestic unemployment, in increasing the purchasing power of the Philippine peso,

and in establishing and maintaining better relationship between the Philippines and

other countries, the President may modify tariff rates...

In what ways may the President modify tariff rates in to promote foreign trade?

the President may from time to time enter into trade agreements with foreign

governments or instrumentalities, and modify import duties (including any necessary

change in classification) and other import restrictions as may be required or

appropriate to carry out and promote foreign trade with other countries...(Sec. 402a)

D — WHAT IS THE FLEXIBLE TARIFF CLAUSE (FTC) IN THE

CONSTITUTION? (CONT’D)

Certain wood products, mineral products “Premium duty’ is the duty imposed, in addition

(metallic and non-metallic), plants and to export duties, on the difference between the

vegetable products, and animal products, are. current price as established by the Bureau of

‘subject ta Export Duty on the gross F.0.B. ‘Customs and the base price of the products, in

walue at the time of shipment based on the accordance with the schedule specified under

prevailing rate of exchange. (Sec. 514, 1* par) the law (Sec. 514, 2”4 par)

oducts?

Yes. The President, upon the recommendation of the NEDA, may (a) subject any of the products subject

to Export and Premium duties to higher or lower rates, (b) include additional products, (c) exclude. or

exempt any products, or (d) additionally subject any product to export quota. (Sec. 515)

E — REQUIREMENTS OF IMPORTATION

importation begins when the carrying vessel or aircraft

enters the jurisdiction of the Philippines with intention to

unlade therein.

a. Ensure his goods are listed in the

vessel's Cargo Manifest

b. File or make a formal or informal

importation is deemed terminated upon payment of the (less than Php 2,000 or personal

luggage) import entry

Declare correct weight or value

duties, taxes and other charges due upon the articles, or

secured to be paid, at a port of entry AND the legal permit

for withdrawal shall have been granted, or in the case of tax

free importations, until they have legally left the jurisdiction Pay the duties

of the customs. (Sec. 1202) e. Keep records

Rial

Feels ak

The owner of an imported article is the person to whom the Allarlicles imported into the Philippines,

same is consigned. The holder of a bill of lading duly whether subject to duty or not, shail be

indorsed by the consignee therein named, or, if consigned entered through a customhouse at a port of

to order, by the consignor, shall be deemed the consignee entry.(Sec. 1201)

thereof. (Sec. 1203)

F - IMPORTATIONS IN VIOLATION OF TAX

CREDITS UNDER THE TCCP

fratis smugaling?

‘Smuggling is an act of any person who shall fraudulently import or bring into the “Contrabands” are

Philippines, or assist in doing so, any article, contrary to law or to receive, conceal, articles of prohibited

buy, sell or in any manner facilitate the transportation, concealment, or sale of such importation or

article after importation, knowing the same to have been imported contrary to law. It exportation.

includes the exportation of articles in a manner contrary to law, (Sec. 3519) (Sec. 3519)

7 =

Cat 7

* Unlawful importation = Payment of less than the amount due

+ Entry or Exit of articles by means Filing of any false or fraudulent claim for the

of false or fraudulent practices. payment of drawback or refund of duties upon

invoices, declarations, affidavits or exportation of the merchandise

other documents Filing any affidavit, certificate or other document to

Entry of goods at less than their secure to him or others the payment of any

fue weigh cr Ubon & fine drawback, allowance, or refund of duties an the

classification es to quality orvalue exportation of mechandise greater than that legally

ue

G — CLASSIFICATIONS OF IMPORTED GOODS

Imported goods are classified into:

Taxable importation - those permitted to be imported. Ex: flour

wheat

Prohibited importation — those NOT permitted to be imported.

Ex: pornographic materials

Conditionally free importation (aka “regulated” [Sec of Finance

v. Kutangbato, Aug 7, 2013]) - those efempt from the payment

of import duties upon comp! a with the formalities prescribed

in accordance with law, or with the regulations which shall be

promulgated by the Commissioner of Customs with the approval

of the Secretary of Finance. Ex: Returning residents

SSIFICATION OF DUTIES

Duties are classified into:

a. Regular or Ordinary Duties - those duties imposed by reason of the mere fact

of importation and are usually based on dutiable value or dutiable weight

b. Special Duties - those imposed when certain conditions are present, such as,

when the importation, because of factors other than its intrinsic worth, is

considered either harmful to the economy, or incompatible with our national

interest

If tax base is:

Ad valorem or dutiable value- basis is

* transaction value of the actual importation itself;

+ transaction value of identical goods;

* transaction value of similar good;

+ deductive value;

* computed value; or

+ fallback value

‘Specific basis is specification, eg weight

H — CLASSIFICATION OF DUTIES, CONT’D

+ Method One: transaction value of the gaods imported — the price actually paid or payable when

sold for export to the Philippines, with adjustments

+ Method Two: transaction of identical goods — transaction value of identical (same in all respects)

‘goods sold for export to the Philippines and exported at or about the same time

+ Method Three: transaction value of similar goods— “similar’, i. although not alike in all respects,

have characteristics and like component materials which enable them to perform the same

functions and to be commercially interchangeable.

* Method Four: Deductive value — based on the unit price at which the imported goods, or identical

or similar goods, are sold in the Philippines, in the same condition as when imported in the

greatest aggregate quantity at or about time of importation

+ Method Five: Computed value — the sum of cost or value of materials in processing the imported

goods, amount of profit and general expenses usually reflected in the sale of goods by producers

in the country of export, freight and insurance. cost of packaging, etc.

* Method Six: Fallback value — value determined by using other reasonable means and on the

basis of data available in the Philippines (Sec 204)

SSIFICATION OF DUTIES, CONT’D

Step One: Making of the import entry (formal or informal) -Imported

articles must be “entered” in the customhouse at the port of entry

within thirty days from date of discharge of the last package from the

vessel by the importer, or authorized person (Sec. 1301 & ff}

Step Two: Examination, classification and appraisal of the imported

articles. (Sec 1401 &ff)

Step Three: Liquidation (payment) of duties and withdrawal of the

articles from customs.(Sec. 1601 & ff)

H — CLASSIFICATION OF DUTIES, CONT’D

4. Anti-dumping duty:

imposed by the Secretary

of Trade and Industry or

the Secretary of

‘Agriculture Finance when

the imported articles are,

after investigation, are to

be being sold or likely to

be sold in the Philippines,

ata price less than its fair

value AND the

importation or sale of

which might injure, or

prevent the

establishment of, or is

likely to injure an industry

in the Philippines;

2. Countervailing duty -

Imposed by the Secretary of

Secretary of Agricuture, after

investigation, on articles upon

the production, manufacture

or export of which any bounty,

subsidy or subvention is

directly or indirectly granted in

the country of origin andlor

exportation, AND the

importation is likely to

materially injure an

established industry, or

prevent or considerably retard

the establishment of an

industry in the Philippines;

3. Diseriminatory Duty — Imposed by the

President, in the amount not exceeding

100 per cent of the existing rates upon

articles from any foreign country that:

+ Imposes any unreasonable charge,

exaction, regulation or imitation on

Philippine goods which is not equally

enforced upon the like articles of

every foreign country; or

« Discriminates in fact against the

commerce of the Philippines in

respect to any customs, tonnage, or

port duty, fee, charge, exaction,

classification, regulation, condition,

restriction or prohibition, in such

manner as to place the commerce af

the oie at a disadvantage

compared with the commerce of any

foreign country.

LASSIFICATION OF DUTIES, CONT’D

—

4, Marking Duty - Imposed

by the Commissioner of

‘on

every article of foreign origin

imported into the Philippines

requiring their being marked

in any official language of the

Philippines and in a

conspicuous place as legibly,

indelibly and permanently as

the nature of the article (or

container) will permit in such

manner as to indicate to an

ultimate purchaser in the

Philippines the name of the

couniry of origin of the article.

5, Safeguard duty-(RA. No. 88

General safeguard duty — duty

imposed by the Secretary of

Trade after positively

determining that a product is

being imported in increased

quantities, whether absolute or

felative to domestic

production, as to be a

substantial cause of injury or

threat thereof to the domestic

industry;

Special safeguard duty for

agriculture- imposed by the

Commissioner of Customs,

upon request of the Secretary

of Agriculture through the

Secretary of Finance, on an

agricultural product

consistent with our

international obligations,

either (a) when its cumulative

import volume exceeds the

trigger volume, or (b), even if

trigger volume is not

exceeded, it fails the price

test

esd Ui) es}

Attachment of Tax Lien (Sec. 1204)

Imposition of Fines &Forfeitures and

Seizure proceedings (Notice to importer

is required by due process) — (Com'r of

Customs v New Frontier Sugar, June 11

2014)

Sale of property in customs custody

Judicial

Action for declaratory relief — to determine

legality ofits issuances, like a Customs

Memorandum Order classifying certain

articles (Com’r of Customs v. Hypermix

Feeds Corp, Feb 1, 2012)

Action for collection of duties, usually

when lien is lost because goods have

been released; liability attaches to the

goods

| — REMEDIES, CONT'D

Ataxpayer must first take his ADMINSTRATIVE REMEDIES and only after exhaustion of

administrative remedies, resort to JUDICIAL REMEDIES.

Administrative Remedies

a. Protest

b. Abandonment

c. Abatement and Refund

Judicial Remedies

| — REMEDIES, CONT'D

MINISTRATIV

A. PROTEST

When taxpayer may protest: he disagrees with the ruling or decision of the Collector of Customs. Payment

under protest essential.

Within what period may protest be filed: within 15 days from payment or from occurrence of event that

fendered payment illegal or erroneous; taxpayer may ask for release pending protest

+ — Effect of failure to protest on time: action of Collector becomes final, except for manifest errors.

How a protest case is resolved administratively:

+ The Collector must conduet a hearing de parte. Notice is part of due process in protest cases.

+ Ifthe Collector decides against the taxpayer, the taxpayer has 15 days to appeal to the

Commissioner,

* The Commissioner, in deciding the appeal, need not conduct a hearing.

* Ifthe taxpayer is unsatisfied with the ruling of the Commissioner, appeal must be made to the CTA

within the 30-day reglementary period. Taxpayer need not ask for reconsideration where such is

futile, as when Com’r says his decision is final. (Com'r v. Oilink International, July 2, 2014)

|— REMEDIES, CONT'D

Sees

When taxpayer may resort to abandonment: When taxpayer wants to relieve himself of the duty of

paying duties.

How: express or implied

Instances of implied abandonment:

(a) failure to file an import entry within 30 days from discharge of goods; or

(b) having filed an entry, failure to claim goods within 15 days.

When implied abandonment is deemed effected: when so declared by Collector

Remedy of owner against implied abandonment:

‘Owner may reclaim the articles at anytime before the goods are sold or otherwise disposed of by

paying the duties

Effect on the owner of abandonment: relief from payment of duties, taxes and other charges, BUT NOT

criminal lability

|— REMEDIES, CONT'D

Instances when refunds may be made:

Abatement cases, ~ eg missing packages, deficiencies in contents before arrival, losses after arrival,

dead of injured animals.

Drawback cases — eg refund or tax credit granted on duties that had been paid on products that.

(a) are subsequently exported, eg fuel on vessels _ in intermational trade

(b) articles used as raw materials for items subsequently exported

|— REMEDIES, CONT'D

From decisions of Commissioner From decisions of Commissioner

in cases involving in cases involving

(a) liability for customs duties, fees, disregard or denial of due process:

and other money charges; fegular courts

(b) seizure, detention and release of

property affected; From decisions of Sec. of Finance:

(c) fines, forfeitures and penalties in cases imposing

imposed In relation thereto: and (1) dumping duty;

(d) other matters arising under (2) countervailing duty;

Customs law and other laws in cases of automatic review by Commissioner of

administered by Bureau of the Collector's decision, where decision is.

Customs: adverse to the Government:

To CTA within 30 days CTA

FUNCTIONS OF THE TARIFF COMMISSION

= Study impact of customs and tariff laws on the country

= Relate the rate of duties on raw materials to the finished products

= Investigate effect of tariff relations between the Phil and other

countries and effect of importations on the economy

= In general, investigate the operation of tariff and customs law on

domestic industries and labor in the country

THANK YOU AND GOOD LUCK

2016 BAR REVIEW RESOURCES: FOR MORE INFORMATION, VISIT

* Pre-Week Reviewer on Taxation:

* Final Month Review: The Last Watering Stop faceboo

+ Tariff and Customs Code

HOW TO PREPARE FOR

the Philippine Bar Examinations

eroteal

BAR

REVIEW

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- 10 TRAIN Tax Reform Items That You Probably Didn't KnowDocument5 pages10 TRAIN Tax Reform Items That You Probably Didn't KnowMarcelino CasilNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Suggested Answers On The 2018 Bar Questions On Persons and Family RelationsDocument14 pagesSuggested Answers On The 2018 Bar Questions On Persons and Family RelationsDave A. SajordaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Imgtopdf Generated 0105200524047Document506 pagesImgtopdf Generated 0105200524047Marcelino CasilNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Last minute tips in political lawDocument42 pagesLast minute tips in political lawRecson BangibangNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Estate and Donor's Tax PDFDocument34 pagesEstate and Donor's Tax PDFMarcelino CasilNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- SMC vs. Ca 2002Document6 pagesSMC vs. Ca 2002Marcelino CasilNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Bar Examination 2008 Civil LawDocument7 pagesBar Examination 2008 Civil LawMyos RicasaNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- DocumentDocument6 pagesDocumentMarcelino CasilNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- DocumentDocument6 pagesDocumentMarcelino CasilNo ratings yet

- Suggested Answers On The 2018 Bar Questions On Persons and Family RelationsDocument14 pagesSuggested Answers On The 2018 Bar Questions On Persons and Family RelationsDave A. SajordaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Last minute tips in political lawDocument42 pagesLast minute tips in political lawRecson BangibangNo ratings yet

- Estate and Donor's Tax PDFDocument34 pagesEstate and Donor's Tax PDFMarcelino CasilNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Negotiable Instruments Law Notes Atty Zarah Villanueva CastroDocument16 pagesNegotiable Instruments Law Notes Atty Zarah Villanueva CastroMarcelino CasilNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- 10 TRAIN Tax Reform Items That You Probably Didn't KnowDocument5 pages10 TRAIN Tax Reform Items That You Probably Didn't KnowMarcelino CasilNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Suggested Answers On The 2018 Bar Questions On Persons and Family RelationsDocument14 pagesSuggested Answers On The 2018 Bar Questions On Persons and Family RelationsDave A. SajordaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- POL SyllabusDocument6 pagesPOL SyllabusclarizzzNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- SBCA 2011 Acads Lumbera Tax Notes - Washout WatermarkDocument76 pagesSBCA 2011 Acads Lumbera Tax Notes - Washout WatermarkArdy Falejo Fajutag100% (2)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Answering Bar Questions PDFDocument34 pagesAnswering Bar Questions PDFMarcelino CasilNo ratings yet

- Tax Remedies PDFDocument68 pagesTax Remedies PDFMarcelino CasilNo ratings yet

- Consolidated Civil Law QQR 1 PDFDocument33 pagesConsolidated Civil Law QQR 1 PDFMarcelino CasilNo ratings yet

- 2015 Taxation Law - Atty Noel Ortega PDFDocument28 pages2015 Taxation Law - Atty Noel Ortega PDFViner VillariñaNo ratings yet

- General Principles PDFDocument86 pagesGeneral Principles PDFMarcelino CasilNo ratings yet

- Faqs On Foreign Investment in The PhilippinesDocument8 pagesFaqs On Foreign Investment in The PhilippinesVanillaSkyIIINo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 10 TRAIN Tax Reform Items That You Probably Didn't KnowDocument5 pages10 TRAIN Tax Reform Items That You Probably Didn't KnowMarcelino CasilNo ratings yet

- Poquiz Labor Law ReviewerDocument16 pagesPoquiz Labor Law Reviewerwhisper13941No ratings yet

- Legal Forms ReviewerDocument18 pagesLegal Forms ReviewerRonz RoganNo ratings yet

- 10 TRAIN Tax Reform Items That You Probably Didn't KnowDocument5 pages10 TRAIN Tax Reform Items That You Probably Didn't KnowMarcelino CasilNo ratings yet

- OBLIGATIONS TITLEDocument105 pagesOBLIGATIONS TITLEEmerson L. Macapagal84% (19)

- 2014 Labor Law Answers PDFDocument20 pages2014 Labor Law Answers PDFdemosrea100% (1)

- Airtel Xstreme Fiber BillDocument2 pagesAirtel Xstreme Fiber BillShivKuMarNo ratings yet

- Your Vi Bill: Mr. Punjab National BankDocument3 pagesYour Vi Bill: Mr. Punjab National Bankkaranjain88No ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Challan 280Document2 pagesChallan 280Rahul SinglaNo ratings yet

- Form DVAT 24: Notice of Default Assessment of Tax and Interest Under Section 32Document2 pagesForm DVAT 24: Notice of Default Assessment of Tax and Interest Under Section 32hhhhhhhuuuuuyyuyyyyyNo ratings yet

- Scan QR Code at Cinema for Movie TicketsDocument1 pageScan QR Code at Cinema for Movie TicketsHadif IrfanNo ratings yet

- Contact Meralco for Bill Inquiries or Visit WebsiteDocument2 pagesContact Meralco for Bill Inquiries or Visit WebsiteJoris YapNo ratings yet

- Refund Policy - 2020: Drake Tax Software and Drake Accounting SoftwareDocument2 pagesRefund Policy - 2020: Drake Tax Software and Drake Accounting SoftwareMukesh MistriNo ratings yet

- 11th Cost and RevenueDocument2 pages11th Cost and Revenueshaurya patelNo ratings yet

- Rajasthan Housing Board, Circle - Iii, JaipurDocument1 pageRajasthan Housing Board, Circle - Iii, JaipurAshish AshishNo ratings yet

- Airtel broadband monthly statementDocument3 pagesAirtel broadband monthly statementsanjith_shelly290No ratings yet

- Caf GST Booster m1 m20Document94 pagesCaf GST Booster m1 m20thotasravani 1997No ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Question TAX GMDocument7 pagesQuestion TAX GMAshutosh Kr. Sahuwala 7bNo ratings yet

- FILE - 20220513 - 151826 - Chapter 5 Protection - DoneDocument40 pagesFILE - 20220513 - 151826 - Chapter 5 Protection - DoneHuyền TràNo ratings yet

- Tax Invoice/Bill of Supply/Cash MemoDocument1 pageTax Invoice/Bill of Supply/Cash MemoYash singhNo ratings yet

- Accommodation Receipt: Tirumala Tirupati DevasthanamsDocument2 pagesAccommodation Receipt: Tirumala Tirupati DevasthanamsTrivikram Rao KancharapuNo ratings yet

- Customs Clearance Lecture 10 - de Minimis ImportationDocument57 pagesCustoms Clearance Lecture 10 - de Minimis ImportationHarrenNo ratings yet

- ConfirmationDocument2 pagesConfirmationsunny singhNo ratings yet

- Shivam MobileDocument1 pageShivam MobileShivam GuptaNo ratings yet

- Unit-Ii GSTDocument28 pagesUnit-Ii GSTVaibhav ArwadeNo ratings yet

- GST Rate On Packers and MoversDocument2 pagesGST Rate On Packers and MoversSaiRamNo ratings yet

- Gmail - Go Airlines Limited - GST InvoiceDocument1 pageGmail - Go Airlines Limited - GST InvoiceSimranpreet SInghNo ratings yet

- 1 KOM 2 631690 20749516 KOM H: Sad 500 - Customs Declaration FormDocument1 page1 KOM 2 631690 20749516 KOM H: Sad 500 - Customs Declaration Formalsone07No ratings yet

- Meaning and Introduction of GSTDocument6 pagesMeaning and Introduction of GSTAshish BomzanNo ratings yet

- Signa Aviation Services (Pty) LTD: Bill To: Ship ToDocument1 pageSigna Aviation Services (Pty) LTD: Bill To: Ship ToForexx 101No ratings yet

- PSPCL Bill 3002374203 Due On 2022-AUG-12Document1 pagePSPCL Bill 3002374203 Due On 2022-AUG-12Daman KashyapNo ratings yet

- Nigerian Law of Taxation by IsochukwuDocument16 pagesNigerian Law of Taxation by IsochukwuVite Researchers100% (3)

- Understanding Customs Duty in IndiaDocument35 pagesUnderstanding Customs Duty in Indiarohit singh100% (3)

- KIA QuotationDocument1 pageKIA Quotationlogan paulNo ratings yet

- KMV Projects Draft Work Order for Road ExcavationDocument4 pagesKMV Projects Draft Work Order for Road ExcavationPrasad BoniNo ratings yet

- Regional Trading Blocs-Are They Barriers To Free Trade?Document20 pagesRegional Trading Blocs-Are They Barriers To Free Trade?sandeepkumarbaranwalNo ratings yet