Professional Documents

Culture Documents

Insurance Law Cases For 8.25.18

Uploaded by

Hyuga NejiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Insurance Law Cases For 8.25.18

Uploaded by

Hyuga NejiCopyright:

Available Formats

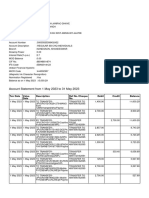

1. Risk and Insurance 1988 to March 14, 1989 (Exhs.

G also G-1) and in said policy the

earthquake endorsement clause as indicated in Exhibits C-1, D-1,

Exhibits E and F-1 was deleted and the entry under

GULF RESORTS, INC., vs. PHILIPPINE CHARTER INSURANCE

Endorsements/Warranties at the time of issue read that plaintiff

CORPORATION renewed its policy with AHAC (AIU) for the period of March 14, 1989 to

DECISION March 14, 1990 under Policy No. 206-4568061-9 (Exh. H) which carried

PUNO, J.: the entry under Endorsement/Warranties at Time of Issue, which read

Before the Court is the petition for certiorari under Rule 45 of the Endorsement to Include Earthquake Shock (Exh. 6-B-1) in the amount of

Revised Rules of Court by petitioner GULF RESORTS, INC., against P10,700.00 and paid P42,658.14 (Exhs. 6-A and 6-B) as premium

respondent PHILIPPINE CHARTER INSURANCE CORPORATION. Petitioner thereof, computed as follows:

assails the appellate court decision[1] which dismissed its two appeals

and affirmed the judgment of the trial court. Item -P7,691,000.00 - on the Clubhouse only

For review are the warring interpretations of petitioner and respondent @ .392%;

on the scope of the insurance companys liability for earthquake damage

to petitioners properties. Petitioner avers that, pursuant to its 1,500,000.00 - on the furniture, etc.

earthquake shock endorsement rider, Insurance Policy No. 31944 covers

all damages to the properties within its resort caused by earthquake. contained in the building

Respondent contends that the rider limits its liability for loss to the two

swimming pools of petitioner. above-mentioned@ .490%;

The facts as established by the court a quo, and affirmed by the 393,000.00- on the two swimming

appellate court are as follows:

pools, only (against the

[P]laintiff is the owner of the Plaza Resort situated at Agoo, La Union

and had its properties in said resort insured originally with the American peril of earthquake

Home Assurance Company (AHAC-AIU). In the first four insurance

policies issued by AHAC-AIU from 1984-85; 1985-86; 1986-1987; and shock only) @ 0.100%

1987-88 (Exhs. C, D, E and F; also Exhs. 1, 2, 3 and 4 respectively), the

risk of loss from earthquake shock was extended only to plaintiffs two 116,600.00- other buildings include

swimming pools, thus, earthquake shock endt. (Item 5 only) (Exhs. C-1;

D-1, and E and two (2) swimming pools only (Exhs. C-1; D-1, E and F-1). as follows:

Item 5 in those policies referred to the two (2) swimming pools only

(Exhs. 1-B, 2-B, 3-B and F-2); that subsequently AHAC(AIU) issued in a) Tilter House- P19,800.00- 0.551%

plaintiffs favor Policy No. 206-4182383-0 covering the period March 14,

Insurance Law JD4301 Page 1

b) Power House- P41,000.00- 0.551% Prem. Tax 409.05

c) House Shed- P55,000.00 -0.540% TOTAL 45,159.92;

P100,000.00 for furniture, fixtures, that the above break-down of premiums shows that plaintiff paid only

P393.00 as premium against earthquake shock (ES); that in all the six

lines air-con and insurance policies (Exhs. C, D, E, F, G and H), the premium against the

peril of earthquake shock is the same, that is P393.00 (Exhs. C and 1-B;

operating equipment 2-B and 3-B-1 and 3-B-2; F-02 and 4-A-1; G-2 and 5-C-1; 6-C-1; issued by

AHAC (Exhs. C, D, E, F, G and H) and in Policy No. 31944 issued by

that plaintiff agreed to insure with defendant the properties covered by defendant, the shock endorsement provide(sic):

AHAC (AIU) Policy No. 206-4568061-9 (Exh. H) provided that the policy

wording and rates in said policy be copied in the policy to be issued by In consideration of the payment by the insured to the company of the

defendant; that defendant issued Policy No. 31944 to plaintiff covering sum included additional premium the Company agrees, notwithstanding

the period of March 14, 1990 to March 14, 1991 for P10,700,600.00 for what is stated in the printed conditions of this policy due to the

a total premium of P45,159.92 (Exh. I); that in the computation of the contrary, that this insurance covers loss or damage to shock to any of

premium, defendants Policy No. 31944 (Exh. I), which is the policy in the property insured by this Policy occasioned by or through or in

question, contained on the right-hand upper portion of page 7 thereof, consequence of earthquake (Exhs. 1-D, 2-D, 3-A, 4-B, 5-A, 6-D and 7-C);

the following:

that in Exhibit 7-C the word included above the underlined portion was

Rate-Various deleted; that on July 16, 1990 an earthquake struck Central Luzon and

Northern Luzon and plaintiffs properties covered by Policy No. 31944

Premium - P37,420.60 F/L issued by defendant, including the two swimming pools in its Agoo Playa

Resort were damaged.[2]

2,061.52 Typhoon

After the earthquake, petitioner advised respondent that it would be

1,030.76 EC making a claim under its Insurance Policy No. 31944 for damages on its

properties. Respondent instructed petitioner to file a formal claim, then

393.00 ES assigned the investigation of the claim to an independent claims

adjuster, Bayne Adjusters and Surveyors, Inc.[3] On July 30, 1990,

Doc. Stamps 3,068.10 respondent, through its adjuster, requested petitioner to submit various

documents in support of its claim. On August 7, 1990, Bayne Adjusters

F.S.T. 776.89 and Surveyors, Inc., through its Vice-President A.R. de Leon,[4] rendered

Insurance Law JD4301 Page 2

a preliminary report[5] finding extensive damage caused by the The above schedule clearly shows that plaintiff paid only a premium of

earthquake to the clubhouse and to the two swimming pools. Mr. de P393.00 against the peril of earthquake shock, the same premium it

Leon stated that except for the swimming pools, all affected items have paid against earthquake shock only on the two swimming pools in all

no coverage for earthquake shocks.[6] On August 11, 1990, petitioner the policies issued by AHAC(AIU) (Exhibits C, D, E, F and G). From this

filed its formal demand[7] for settlement of the damage to all its fact the Court must consequently agree with the position of defendant

properties in the Agoo Playa Resort. On August 23, 1990, respondent that the endorsement rider (Exhibit 7-C) means that only the two

denied petitioners claim on the ground that its insurance policy only swimming pools were insured against earthquake shock.

afforded earthquake shock coverage to the two swimming pools of the

resort.[8] Petitioner and respondent failed to arrive at a settlement.[9] Plaintiff correctly points out that a policy of insurance is a contract of

Thus, on January 24, 1991, petitioner filed a complaint[10] with the adhesion hence, where the language used in an insurance contract or

regional trial court of Pasig praying for the payment of the following: application is such as to create ambiguity the same should be resolved

against the party responsible therefor, i.e., the insurance company

1.) The sum of P5,427,779.00, representing losses sustained by the which prepared the contract. To the mind of [the] Court, the language

insured properties, with interest thereon, as computed under par. 29 of used in the policy in litigation is clear and unambiguous hence there is

the policy (Annex B) until fully paid; no need for interpretation or construction but only application of the

provisions therein.

2.) The sum of P428,842.00 per month, representing continuing losses

sustained by plaintiff on account of defendants refusal to pay the From the above observations the Court finds that only the two (2)

claims; swimming pools had earthquake shock coverage and were heavily

damaged by the earthquake which struck on July 16, 1990. Defendant

3.) The sum of P500,000.00, by way of exemplary damages; having admitted that the damage to the swimming pools was appraised

by defendants adjuster at P386,000.00, defendant must, by virtue of the

4.) The sum of P500,000.00 by way of attorneys fees and expenses of contract of insurance, pay plaintiff said amount.

litigation;

Because it is the finding of the Court as stated in the immediately

5.) Costs.[11] preceding paragraph that defendant is liable only for the damage

caused to the two (2) swimming pools and that defendant has made

Respondent filed its Answer with Special and Affirmative Defenses with known to plaintiff its willingness and readiness to settle said liability,

Compulsory Counterclaims.[12] there is no basis for the grant of the other damages prayed for by

plaintiff. As to the counterclaims of defendant, the Court does not agree

On February 21, 1994, the lower court after trial ruled in favor of the that the action filed by plaintiff is baseless and highly speculative since

respondent, viz: such action is a lawful exercise of the plaintiffs right to come to Court in

the honest belief that their Complaint is meritorious. The prayer,

therefore, of defendant for damages is likewise denied.

Insurance Law JD4301 Page 3

WHEREFORE, premises considered, defendant is ordered to pay After review, the appellate court affirmed the decision of the trial court

plaintiffs the sum of THREE HUNDRED EIGHTY SIX THOUSAND PESOS and ruled, thus:

(P386,000.00) representing damage to the two (2) swimming pools, with

interest at 6% per annum from the date of the filing of the Complaint However, after carefully perusing the documentary evidence of both

until defendants obligation to plaintiff is fully paid. parties, We are not convinced that the last two (2) insurance contracts

(Exhs. G and H), which the plaintiff-appellant had with AHAC (AIU) and

No pronouncement as to costs.[13] upon which the subject insurance contract with Philippine Charter

Insurance Corporation is said to have been based and copied (Exh. I),

Petitioners Motion for Reconsideration was denied. Thus, petitioner covered an extended earthquake shock insurance on all the insured

filed an appeal with the Court of Appeals based on the following properties.

assigned errors:[14]

xxx

A. THE TRIAL COURT ERRED IN FINDING THAT PLAINTIFF-APPELLANT

CAN ONLY RECOVER FOR THE DAMAGE TO ITS TWO SWIMMING POOLS We also find that the Court a quo was correct in not granting the

UNDER ITS FIRE POLICY NO. 31944, CONSIDERING ITS PROVISIONS, THE plaintiff-appellants prayer for the imposition of interest 24% on the

CIRCUMSTANCES SURROUNDING THE ISSUANCE OF SAID POLICY AND insurance claim and 6% on loss of income allegedly amounting to

THE ACTUATIONS OF THE PARTIES SUBSEQUENT TO THE EARTHQUAKE P4,280,000.00. Since the defendant-appellant has expressed its

OF JULY 16, 1990. willingness to pay the damage caused on the two (2) swimming pools,

as the Court a quo and this Court correctly found it to be liable only, it

B. THE TRIAL COURT ERRED IN DETERMINING PLAINTIFF-APPELLANTS then cannot be said that it was in default and therefore liable for

RIGHT TO RECOVER UNDER DEFENDANT-APPELLEES POLICY (NO. 31944; interest.

EXH I) BY LIMITING ITSELF TO A CONSIDERATION OF THE SAID POLICY

ISOLATED FROM THE CIRCUMSTANCES SURROUNDING ITS ISSUANCE Coming to the defendant-appellants prayer for an attorneys fees, long-

AND THE ACTUATIONS OF THE PARTIES AFTER THE EARTHQUAKE OF standing is the rule that the award thereof is subject to the sound

JULY 16, 1990. discretion of the court. Thus, if such discretion is well-exercised, it will

not be disturbed on appeal (Castro et al. v. CA, et al., G.R. No. 115838,

C. THE TRIAL COURT ERRED IN NOT HOLDING THAT PLAINTIFF- July 18, 2002). Moreover, being the award thereof an exception rather

APPELLANT IS ENTITLED TO THE DAMAGES CLAIMED, WITH INTEREST than a rule, it is necessary for the court to make findings of facts and

COMPUTED AT 24% PER ANNUM ON CLAIMS ON PROCEEDS OF POLICY. law that would bring the case within the exception and justify the grant

of such award (Country Bankers Insurance Corp. v. Lianga Bay and

On the other hand, respondent filed a partial appeal, assailing the lower Community Multi-Purpose Coop., Inc., G.R. No. 136914, January 25,

courts failure to award it attorneys fees and damages on its compulsory 2002). Therefore, holding that the plaintiff-appellants action is not

counterclaim.

Insurance Law JD4301 Page 4

baseless and highly speculative, We find that the Court a quo did not err Third, that the qualification referring to the two swimming pools had

in granting the same. already been deleted in the earthquake shock endorsement.

WHEREFORE, in view of all the foregoing, both appeals are hereby Fourth, it is unbelievable for respondent to claim that it only made an

DISMISSED and judgment of the Trial Court hereby AFFIRMED in toto. inadvertent omission when it deleted the said qualification.

No costs.[15]

Fifth, that the earthquake shock endorsement rider should be given

Petitioner filed the present petition raising the following issues:[16] precedence over the wording of the insurance policy, because the rider

is the more deliberate expression of the agreement of the contracting

A. WHETHER THE COURT OF APPEALS CORRECTLY HELD THAT UNDER parties.

RESPONDENTS INSURANCE POLICY NO. 31944, ONLY THE TWO (2)

SWIMMING POOLS, RATHER THAN ALL THE PROPERTIES COVERED Sixth, that in their previous insurance policies, limits were placed on the

THEREUNDER, ARE INSURED AGAINST THE RISK OF EARTHQUAKE endorsements/warranties enumerated at the time of issue.

SHOCK.

Seventh, any ambiguity in the earthquake shock endorsement should be

B. WHETHER THE COURT OF APPEALS CORRECTLY DENIED PETITIONERS resolved in favor of petitioner and against respondent. It was

PRAYER FOR DAMAGES WITH INTEREST THEREON AT THE RATE respondent which caused the ambiguity when it made the policy in

CLAIMED, ATTORNEYS FEES AND EXPENSES OF LITIGATION. issue.

Petitioner contends: Eighth, the qualification of the endorsement limiting the earthquake

shock endorsement should be interpreted as a caveat on the standard

First, that the policys earthquake shock endorsement clearly covers all fire insurance policy, such as to remove the two swimming pools from

of the properties insured and not only the swimming pools. It used the the coverage for the risk of fire. It should not be used to limit the

words any property insured by this policy, and it should be interpreted respondents liability for earthquake shock to the two swimming pools

as all inclusive. only.

Second, the unqualified and unrestricted nature of the earthquake Ninth, there is no basis for the appellate court to hold that the

shock endorsement is confirmed in the body of the insurance policy additional premium was not paid under the extended coverage. The

itself, which states that it is [s]ubject to: Other Insurance Clause, premium for the earthquake shock coverage was already included in the

Typhoon Endorsement, Earthquake Shock Endt., Extended Coverage premium paid for the policy.

Endt., FEA Warranty & Annual Payment Agreement On Long Term

Policies.[17] Tenth, the parties contemporaneous and subsequent acts show that

they intended to extend earthquake shock coverage to all insured

properties. When it secured an insurance policy from respondent,

Insurance Law JD4301 Page 5

petitioner told respondent that it wanted an exact replica of its latest from 1990-1991. No additional premium was paid to warrant coverage

insurance policy from American Home Assurance Company (AHAC-AIU), of the other properties in the resort.

which covered all the resorts properties for earthquake shock damage

and respondent agreed. After the July 16, 1990 earthquake, respondent Third, the deletion of the phrase pertaining to the limitation of the

assured petitioner that it was covered for earthquake shock. earthquake shock endorsement to the two swimming pools in the policy

Respondents insurance adjuster, Bayne Adjusters and Surveyors, Inc., schedule did not expand the earthquake shock coverage to all of

likewise requested petitioner to submit the necessary documents for its petitioners properties. As per its agreement with petitioner, respondent

building claims and other repair costs. Thus, under the doctrine of copied its policy from the AHAC-AIU policy provided by petitioner.

equitable estoppel, it cannot deny that the insurance policy it issued to Although the first five policies contained the said qualification in their

petitioner covered all of the properties within the resort. riders title, in the last two policies, this qualification in the title was

deleted. AHAC-AIU, through Mr. J. Baranda III, stated that such deletion

Eleventh, that it is proper for it to avail of a petition for review by was a mere inadvertence. This inadvertence did not make the policy

certiorari under Rule 45 of the Revised Rules of Court as its remedy, and incomplete, nor did it broaden the scope of the endorsement whose

there is no need for calibration of the evidence in order to establish the descriptive title was merely enumerated. Any ambiguity in the policy

facts upon which this petition is based. can be easily resolved by looking at the other provisions, specially the

enumeration of the items insured, where only the two swimming pools

On the other hand, respondent made the following counter were noted as covered for earthquake shock damage.

arguments:[18]

Fourth, in its Complaint, petitioner alleged that in its policies from 1984

First, none of the previous policies issued by AHAC-AIU from 1983 to through 1988, the phrase Item 5 P393,000.00 on the two swimming

1990 explicitly extended coverage against earthquake shock to pools only (against the peril of earthquake shock only) meant that only

petitioners insured properties other than on the two swimming pools. the swimming pools were insured for earthquake damage. The same

Petitioner admitted that from 1984 to 1988, only the two swimming phrase is used in toto in the policies from 1989 to 1990, the only

pools were insured against earthquake shock. From 1988 until 1990, the difference being the designation of the two swimming pools as Item 3.

provisions in its policy were practically identical to its earlier policies,

and there was no increase in the premium paid. AHAC-AIU, in a Fifth, in order for the earthquake shock endorsement to be effective,

letter[19] by its representative Manuel C. Quijano, categorically stated premiums must be paid for all the properties covered. In all of its seven

that its previous policy, from which respondents policy was copied, insurance policies, petitioner only paid P393.00 as premium for

covered only earthquake shock for the two swimming pools. coverage of the swimming pools against earthquake shock. No other

premium was paid for earthquake shock coverage on the other

Second, petitioners payment of additional premium in the amount of properties. In addition, the use of the qualifier ANY instead of ALL to

P393.00 shows that the policy only covered earthquake shock damage describe the property covered was done deliberately to enable the

on the two swimming pools. The amount was the same amount paid by parties to specify the properties included for earthquake coverage.

petitioner for earthquake shock coverage on the two swimming pools

Insurance Law JD4301 Page 6

Sixth, petitioner did not inform respondent of its requirement that all of In Insurance Policy No. 31944, four key items are important in the

its properties must be included in the earthquake shock coverage. resolution of the case at bar.

Petitioners own evidence shows that it only required respondent to

follow the exact provisions of its previous policy from AHAC-AIU. First, in the designation of location of risk, only the two swimming pools

Respondent complied with this requirement. Respondents only were specified as included, viz:

deviation from the agreement was when it modified the provisions

regarding the replacement cost endorsement. With regard to the issue ITEM 3 393,000.00 On the two (2) swimming pools only (against the

under litigation, the riders of the old policy and the policy in issue are peril of earthquake shock only)[20]

identical.

Second, under the breakdown for premium payments,[21] it was stated

Seventh, respondent did not do any act or give any assurance to that:

petitioner as would estop it from maintaining that only the two

swimming pools were covered for earthquake shock. The adjusters PREMIUM RECAPITULATION

letter notifying petitioner to present certain documents for its building

claims and repair costs was given to petitioner before the adjuster knew ITEM NOS. AMOUNT RATES PREMIUM

the full coverage of its policy.

xxx

Petitioner anchors its claims on AHAC-AIUs inadvertent deletion of the

phrase Item 5 Only after the descriptive name or title of the Earthquake 3 393,000.00 0.100%-E/S 393.00[22]

Shock Endorsement. However, the words of the policy reflect the

parties clear intention to limit earthquake shock coverage to the two Third, Policy Condition No. 6 stated:

swimming pools.

6. This insurance does not cover any loss or damage occasioned by or

Before petitioner accepted the policy, it had the opportunity to read its through or in consequence, directly or indirectly of any of the following

conditions. It did not object to any deficiency nor did it institute any occurrences, namely:--

action to reform the policy. The policy binds the petitioner.

(a) Earthquake, volcanic eruption or other convulsion of nature. [23]

Eighth, there is no basis for petitioner to claim damages, attorneys fees

and litigation expenses. Since respondent was willing and able to pay for Fourth, the rider attached to the policy, titled Extended Coverage

the damage caused on the two swimming pools, it cannot be considered Endorsement (To Include the Perils of Explosion, Aircraft, Vehicle and

to be in default, and therefore, it is not liable for interest. Smoke), stated, viz:

We hold that the petition is devoid of merit. ANNUAL PAYMENT AGREEMENT ON

Insurance Law JD4301 Page 7

LONG TERM POLICIES provisions and riders, taken and interpreted together, indubitably show

the intention of the parties to extend earthquake shock coverage to the

THE INSURED UNDER THIS POLICY HAVING ESTABLISHED AGGREGATE two swimming pools only.

SUMS INSURED IN EXCESS OF FIVE MILLION PESOS, IN CONSIDERATION

OF A DISCOUNT OF 5% OR 7 % OF THE NET PREMIUM x x x POLICY A careful examination of the premium recapitulation will show that it is

HEREBY UNDERTAKES TO CONTINUE THE INSURANCE UNDER THE the clear intent of the parties to extend earthquake shock coverage only

ABOVE NAMED x x x AND TO PAY THE PREMIUM. to the two swimming pools. Section 2(1) of the Insurance Code defines a

contract of insurance as an agreement whereby one undertakes for a

Earthquake Endorsement consideration to indemnify another against loss, damage or liability

arising from an unknown or contingent event. Thus, an insurance

In consideration of the payment by the Insured to the Company of the contract exists where the following elements concur:

sum of P. . . . . . . . . . . . . . . . . additional premium the Company agrees,

notwithstanding what is stated in the printed conditions of this Policy to 1. The insured has an insurable interest;

the contrary, that this insurance covers loss or damage (including loss or

damage by fire) to any of the property insured by this Policy occasioned 2. The insured is subject to a risk of loss by the happening of the

by or through or in consequence of Earthquake. designated peril;

Provided always that all the conditions of this Policy shall apply (except 3. The insurer assumes the risk;

in so far as they may be hereby expressly varied) and that any reference

therein to loss or damage by fire should be deemed to apply also to loss 4. Such assumption of risk is part of a general scheme to distribute

or damage occasioned by or through or in consequence of actual losses among a large group of persons bearing a similar risk; and

Earthquake.[24]

5. In consideration of the insurer's promise, the insured pays a

Petitioner contends that pursuant to this rider, no qualifications were premium.[26] (Emphasis ours)

placed on the scope of the earthquake shock coverage. Thus, the policy

extended earthquake shock coverage to all of the insured properties. An insurance premium is the consideration paid an insurer for

undertaking to indemnify the insured against a specified peril.[27] In

It is basic that all the provisions of the insurance policy should be fire, casualty, and marine insurance, the premium payable becomes a

examined and interpreted in consonance with each other.[25] All its debt as soon as the risk attaches.[28] In the subject policy, no premium

parts are reflective of the true intent of the parties. The policy cannot payments were made with regard to earthquake shock coverage, except

be construed piecemeal. Certain stipulations cannot be segregated and on the two swimming pools. There is no mention of any premium

then made to control; neither do particular words or phrases necessarily payable for the other resort properties with regard to earthquake shock.

determine its character. Petitioner cannot focus on the earthquake This is consistent with the history of petitioners previous insurance

shock endorsement to the exclusion of the other provisions. All the policies from AHAC-AIU. As borne out by petitioners witnesses:

Insurance Law JD4301 Page 8

CROSS EXAMINATION OF LEOPOLDO MANTOHAC TSN, November 25, A. No, sir. They are our insurance agency.

1991

Q. And they are independent of your company insofar as operations are

pp. 12-13 concerned?

Q. Now Mr. Mantohac, will it be correct to state also that insofar as your A. Yes, sir, they are separate entity.

insurance policy during the period from March 4, 1984 to March 4, 1985

the coverage on earthquake shock was limited to the two swimming Q. But insofar as the procurement of the insurance policy is concerned

pools only? they are of course subject to your instruction, is that not correct?

A. Yes, sir. It is limited to the two swimming pools, specifically shown in A. Yes, sir. The final action is still with us although they can recommend

the warranty, there is a provision here that it was only for item 5. what insurance to take.

Q. More specifically Item 5 states the amount of P393,000.00 Q. In the procurement of the insurance police (sic) from March 14, 1988

corresponding to the two swimming pools only? to March 14, 1989, did you give written instruction to Forte Insurance

Agency advising it that the earthquake shock coverage must extend to

A. Yes, sir. all properties of Agoo Playa Resort in La Union?

CROSS EXAMINATION OF LEOPOLDO MANTOHAC TSN, November 25, A. No, sir. We did not make any written instruction, although we made

1991 an oral instruction to that effect of extending the coverage on (sic) the

other properties of the company.

pp. 23-26

Q. And that instruction, according to you, was very important because in

Q. For the period from March 14, 1988 up to March 14, 1989, did you April 1987 there was an earthquake tremor in La Union?

personally arrange for the procurement of this policy?

A. Yes, sir.

A. Yes, sir.

Q. And you wanted to protect all your properties against similar tremors

Q. Did you also do this through your insurance agency? in the [future], is that correct?

A. If you are referring to Forte Insurance Agency, yes. A. Yes, sir.

Q. Is Forte Insurance Agency a department or division of your company?

Insurance Law JD4301 Page 9

Q. Now, after this policy was delivered to you did you bother to check

the provisions with respect to your instructions that all properties must pp. 9-12

be covered again by earthquake shock endorsement?

Atty. Mejia:

A. Are you referring to the insurance policy issued by American Home

Assurance Company marked Exhibit G? We respectfully manifest that the same exhibits C to H inclusive have

been previously marked by counsel for defendant as Exhibit[s] 1-6

Atty. Mejia: Yes. inclusive. Did you have occasion to review of (sic) these six (6) policies

issued by your company [in favor] of Agoo Playa Resort?

Witness:

WITNESS:

A. I examined the policy and seeing that the warranty on the earthquake

shock endorsement has no more limitation referring to the two Yes[,] I remember having gone over these policies at one point of time,

swimming pools only, I was contented already that the previous sir.

limitation pertaining to the two swimming pools was already removed.

Q. Now, wach (sic) of these six (6) policies marked in evidence as

Petitioner also cited and relies on the attachment of the phrase Subject Exhibits C to H respectively carries an earthquake shock endorsement[?]

to: Other Insurance Clause, Typhoon Endorsement, Earthquake Shock My question to you is, on the basis on (sic) the wordings indicated in

Endorsement, Extended Coverage Endorsement, FEA Warranty & Exhibits C to H respectively what was the extent of the coverage

Annual Payment Agreement on Long Term Policies[29] to the insurance [against] the peril of earthquake shock as provided for in each of the six

policy as proof of the intent of the parties to extend the coverage for (6) policies?

earthquake shock. However, this phrase is merely an enumeration of

the descriptive titles of the riders, clauses, warranties or endorsements xxx

to which the policy is subject, as required under Section 50, paragraph 2

of the Insurance Code. WITNESS:

We also hold that no significance can be placed on the deletion of the The extent of the coverage is only up to the two (2) swimming pools, sir.

qualification limiting the coverage to the two swimming pools. The

earthquake shock endorsement cannot stand alone. As explained by the Q. Is that for each of the six (6) policies namely: Exhibits C, D, E, F, G and

testimony of Juan Baranda III, underwriter for AHAC-AIU: H?

DIRECT EXAMINATION OF JUAN BARANDA III[30] A. Yes, sir.

TSN, August 11, 1992 ATTY. MEJIA:

Insurance Law JD4301 Page 10

swimming pool, foundations, they are normally affected by earthquake

What is your basis for stating that the coverage against earthquake but not by fire, sir.

shock as provided for in each of the six (6) policies extend to the two (2)

swimming pools only? DIRECT EXAMINATION OF JUAN BARANDA III

WITNESS: TSN, August 11, 1992

Because it says here in the policies, in the enumeration Earthquake pp. 23-25

Shock Endorsement, in the Clauses and Warranties: Item 5 only

(Earthquake Shock Endorsement), sir. Q. Plaintiffs witness, Mr. Mantohac testified and he alleged that only

Exhibits C, D, E and F inclusive [remained] its coverage against

ATTY. MEJIA: earthquake shock to two (2) swimming pools only but that Exhibits G

and H respectively entend the coverage against earthquake shock to all

Witness referring to Exhibit C-1, your Honor. the properties indicated in the respective schedules attached to said

policies, what can you say about that testimony of plaintiffs witness?

WITNESS:

WITNESS:

We do not normally cover earthquake shock endorsement on stand

alone basis. For swimming pools we do cover earthquake shock. For As I have mentioned earlier, earthquake shock cannot stand alone

building we covered it for full earthquake coverage which includes without the other half of it. I assure you that this one covers the two

earthquake shock swimming pools with respect to earthquake shock endorsement. Based

on it, if we are going to look at the premium there has been no change

COURT: with respect to the rates. Everytime (sic) there is a renewal if the

intention of the insurer was to include the earthquake shock, I think

As far as earthquake shock endorsement you do not have a specific there is a substantial increase in the premium. We are not only going to

coverage for other things other than swimming pool? You are covering consider the two (2) swimming pools of the other as stated in the policy.

building? They are covered by a general insurance? As I see, there is no increase in the amount of the premium. I must say

that the coverage was not broaden (sic) to include the other items.

WITNESS:

COURT:

Earthquake shock coverage could not stand alone. If we are covering

building or another we can issue earthquake shock solely but that the They are the same, the premium rates?

moment I see this, the thing that comes to my mind is either insuring a

WITNESS:

Insurance Law JD4301 Page 11

ATTY. ANDRES:

They are the same in the sence (sic), in the amount of the coverage. If

you are going to do some computation based on the rates you will As an insurance executive will you not attach any significance to the

arrive at the same premiums, your Honor. deletion of the qualifying phrase for the policies?

CROSS-EXAMINATION OF JUAN BARANDA III WITNESS:

TSN, September 7, 1992 My answer to that would be, the deletion of that particular phrase is

inadvertent. Being a company underwriter, we do not cover. . it was

pp. 4-6 inadvertent because of the previous policies that we have issued with

no specific attachments, premium rates and so on. It was inadvertent,

ATTY. ANDRES: sir.

Would you as a matter of practice [insure] swimming pools for fire The Court also rejects petitioners contention that respondents

insurance? contemporaneous and subsequent acts to the issuance of the insurance

policy falsely gave the petitioner assurance that the coverage of the

WITNESS: earthquake shock endorsement included all its properties in the resort.

Respondent only insured the properties as intended by the petitioner.

No, we dont, sir. Petitioners own witness testified to this agreement, viz:

Q. That is why the phrase earthquake shock to the two (2) swimming CROSS EXAMINATION OF LEOPOLDO MANTOHAC

pools only was placed, is it not?

TSN, January 14, 1992

A. Yes, sir.

pp. 4-5

ATTY. ANDRES:

Q. Just to be clear about this particular answer of yours Mr. Witness,

Will you not also agree with me that these exhibits, Exhibits G and H what exactly did you tell Atty. Omlas (sic) to copy from Exhibit H for

which you have pointed to during your direct-examination, the phrase purposes of procuring the policy from Philippine Charter Insurance

Item no. 5 only meaning to (sic) the two (2) swimming pools was Corporation?

deleted from the policies issued by AIU, is it not?

A. I told him that the insurance that they will have to get will have the

xxx same provisions as this American Home Insurance Policy No. 206-

4568061-9.

Insurance Law JD4301 Page 12

Q. You are referring to Exhibit H of course? Q. With respect to the items declared for insurance coverage did you

notice any discrepancy at any time between those indicated in Exhibit I

A. Yes, sir, to Exhibit H. and those indicated in Exhibit H respectively?

Q. So, all the provisions here will be the same except that of the A. With regard to the wordings I did not notice any difference because it

premium rates? was exactly the same P393,000.00 on the two (2) swimming pools only

against the peril of earthquake shock which I understood before that

A. Yes, sir. He assured me that with regards to the insurance premium this provision will have to be placed here because this particular

rates that they will be charging will be limited to this one. I (sic) can provision under the peril of earthquake shock only is requested because

even be lesser. this is an insurance policy and therefore cannot be insured against fire,

so this has to be placed.

CROSS EXAMINATION OF LEOPOLDO MANTOHAC

The verbal assurances allegedly given by respondents representative

TSN, January 14, 1992 Atty. Umlas were not proved. Atty. Umlas categorically denied having

given such assurances.

pp. 12-14

Finally, petitioner puts much stress on the letter of respondents

Atty. Mejia: independent claims adjuster, Bayne Adjusters and Surveyors, Inc. But as

testified to by the representative of Bayne Adjusters and Surveyors, Inc.,

Q. Will it be correct to state[,] Mr. Witness, that you made a comparison respondent never meant to lead petitioner to believe that the

of the provisions and scope of coverage of Exhibits I and H sometime in endorsement for earthquake shock covered properties other than the

the third week of March, 1990 or thereabout? two swimming pools, viz:

A. Yes, sir, about that time. DIRECT EXAMINATION OF ALBERTO DE LEON (Bayne

Q. And at that time did you notice any discrepancy or difference Adjusters and Surveyors, Inc.)

between the policy wordings as well as scope of coverage of Exhibits I

and H respectively? TSN, January 26, 1993

A. No, sir, I did not discover any difference inasmuch (sic) as I was pp. 22-26

assured already that the policy wordings and rates were copied from

the insurance policy I sent them but it was only when this case erupted

that we discovered some discrepancies.

Insurance Law JD4301 Page 13

Q. Do you recall the circumstances that led to your discussion regarding corporation, prepares the stipulations in the contract, while the other

the extent of coverage of the policy issued by Philippine Charter party merely affixes his signature or his "adhesion" thereto. Through the

Insurance Corporation? years, the courts have held that in these type of contracts, the parties

do not bargain on equal footing, the weaker party's participation being

A. I remember that when I returned to the office after the inspection, I reduced to the alternative to take it or leave it. Thus, these contracts

got a photocopy of the insurance coverage policy and it was indicated are viewed as traps for the weaker party whom the courts of justice

under Item 3 specifically that the coverage is only for earthquake shock. must protect.[32] Consequently, any ambiguity therein is resolved

Then, I remember I had a talk with Atty. Umlas (sic), and I relayed to him against the insurer, or construed liberally in favor of the insured.[33]

what I had found out in the policy and he confirmed to me indeed only

Item 3 which were the two swimming pools have coverage for The case law will show that this Court will only rule out blind adherence

earthquake shock. to terms where facts and circumstances will show that they are basically

one-sided.[34] Thus, we have called on lower courts to remain careful in

xxx scrutinizing the factual circumstances behind each case to determine

the efficacy of the claims of contending parties. In Development Bank of

Q. Now, may we know from you Engr. de Leon your basis, if any, for the Philippines v. National Merchandising Corporation, et al.,[35] the

stating that except for the swimming pools all affected items have no parties, who were acute businessmen of experience, were presumed to

coverage for earthquake shock? have assented to the assailed documents with full knowledge.

xxx We cannot apply the general rule on contracts of adhesion to the case

at bar. Petitioner cannot claim it did not know the provisions of the

A. I based my statement on my findings, because upon my examination policy. From the inception of the policy, petitioner had required the

of the policy I found out that under Item 3 it was specific on the respondent to copy verbatim the provisions and terms of its latest

wordings that on the two swimming pools only, then enclosed in insurance policy from AHAC-AIU. The testimony of Mr. Leopoldo

parenthesis (against the peril[s] of earthquake shock only), and Mantohac, a direct participant in securing the insurance policy of

secondly, when I examined the summary of premium payment only petitioner, is reflective of petitioners knowledge, viz:

Item 3 which refers to the swimming pools have a computation for

premium payment for earthquake shock and all the other items have no DIRECT EXAMINATION OF LEOPOLDO MANTOHAC[36]

computation for payment of premiums.

TSN, September 23, 1991

In sum, there is no ambiguity in the terms of the contract and its riders.

Petitioner cannot rely on the general rule that insurance contracts are pp. 20-21

contracts of adhesion which should be liberally construed in favor of the

insured and strictly against the insurer company which usually prepares Q. Did you indicate to Atty. Omlas (sic) what kind of policy you would

it.[31] A contract of adhesion is one wherein a party, usually a want for those facilities in Agoo Playa?

Insurance Law JD4301 Page 14

RAFAEL ENRIQUEZ vs,

A. Yes, sir. I told him that I will agree to that renewal of this policy under SUN LIFE ASSURANCE COMPANY OF CANADA

Philippine Charter Insurance Corporation as long as it will follow the MALCOLM, J.:

same or exact provisions of the previous insurance policy we had with

American Home Assurance Corporation. This is an action brought by the plaintiff ad administrator of the estate

of the late Joaquin Ma. Herrer to recover from the defendant life

Q. Did you take any step Mr. Witness to ensure that the provisions insurance company the sum of pesos 6,000 paid by the deceased for a

which you wanted in the American Home Insurance policy are to be life annuity. The trial court gave judgment for the defendant. Plaintiff

incorporated in the PCIC policy? appeals.

A. Yes, sir. The undisputed facts are these: On September 24, 1917, Joaquin Herrer

made application to the Sun Life Assurance Company of Canada through

Q. What steps did you take? its office in Manila for a life annuity. Two days later he paid the sum of

P6,000 to the manager of the company's Manila office and was given a

A. When I examined the policy of the Philippine Charter Insurance receipt reading as follows:

Corporation I specifically told him that the policy and wordings shall be

copied from the AIU Policy No. 206-4568061-9. MANILA, I. F., 26 de septiembre, 1917.

Respondent, in compliance with the condition set by the petitioner, PROVISIONAL RECEIPT Pesos 6,000

copied AIU Policy No. 206-4568061-9 in drafting its Insurance Policy No.

31944. It is true that there was variance in some terms, specifically in Recibi la suma de seis mil pesos de Don Joaquin Herrer de Manila como

the replacement cost endorsement, but the principal provisions of the prima dela Renta Vitalicia solicitada por dicho Don Joaquin Herrer hoy,

policy remained essentially similar to AHAC-AIUs policy. Consequently, sujeta al examen medico y aprobacion de la Oficina Central de la

we cannot apply the "fine print" or "contract of adhesion" rule in this Compañia.

case as the parties intent to limit the coverage of the policy to the two

swimming pools only is not ambiguous.[37] The application was immediately forwarded to the head office of the

company at Montreal, Canada. On November 26, 1917, the head office

IN VIEW WHEREOF, the judgment of the Court of Appeals is affirmed. gave notice of acceptance by cable to Manila. (Whether on the same

The petition for certiorari is dismissed. No costs. day the cable was received notice was sent by the Manila office of

Herrer that the application had been accepted, is a disputed point,

SO ORDERED. which will be discussed later.) On December 4, 1917, the policy was

issued at Montreal. On December 18, 1917, attorney Aurelio A. Torres

Austria-Martinez, Callejo, Sr., Tinga, and Chico-Nazario, JJ., concur. wrote to the Manila office of the company stating that Herrer desired to

withdraw his application. The following day the local office replied to

Insurance Law JD4301 Page 15

Mr. Torres, stating that the policy had been issued, and called attention company, was placed in the ordinary channels for transmission, but as

to the notification of November 26, 1917. This letter was received by far as we know, was never actually mailed and thus was never received

Mr. Torres on the morning of December 21, 1917. Mr. Herrer died on by the applicant.

December 20, 1917.

Not forgetting our conclusion of fact, it next becomes necessary to

As above suggested, the issue of fact raised by the evidence is whether determine the law which should be applied to the facts. In order to

Herrer received notice of acceptance of his application. To resolve this reach our legal goal, the obvious signposts along the way must be

question, we propose to go directly to the evidence of record. noticed.

The chief clerk of the Manila office of the Sun Life Assurance Company Until quite recently, all of the provisions concerning life insurance in the

of Canada at the time of the trial testified that he prepared the letter Philippines were found in the Code of Commerce and the Civil Code. In

introduced in evidence as Exhibit 3, of date November 26, 1917, and the Code of the Commerce, there formerly existed Title VIII of Book III

handed it to the local manager, Mr. E. E. White, for signature. The and Section III of Title III of Book III, which dealt with insurance

witness admitted on cross-examination that after preparing the letter contracts. In the Civil Code there formerly existed and presumably still

and giving it to he manager, he new nothing of what became of it. The exist, Chapters II and IV, entitled insurance contracts and life annuities,

local manager, Mr. White, testified to having received the cablegram respectively, of Title XII of Book IV. On the after July 1, 1915, there was,

accepting the application of Mr. Herrer from the home office on however, in force the Insurance Act. No. 2427. Chapter IV of this Act

November 26, 1917. He said that on the same day he signed a letter concerns life and health insurance. The Act expressly repealed Title VIII

notifying Mr. Herrer of this acceptance. The witness further said that of Book II and Section III of Title III of Book III of the code of Commerce.

letters, after being signed, were sent to the chief clerk and placed on The law of insurance is consequently now found in the Insurance Act

the mailing desk for transmission. The witness could not tell if the letter and the Civil Code.

had every actually been placed in the mails. Mr. Tuason, who was the

chief clerk, on November 26, 1917, was not called as a witness. For the While, as just noticed, the Insurance Act deals with life insurance, it is

defense, attorney Manuel Torres testified to having prepared the will of silent as to the methods to be followed in order that there may be a

Joaquin Ma. Herrer, that on this occasion, Mr. Herrer mentioned his contract of insurance. On the other hand, the Civil Code, in article 1802,

application for a life annuity, and that he said that the only document not only describes a contact of life annuity markedly similar to the one

relating to the transaction in his possession was the provisional receipt. we are considering, but in two other articles, gives strong clues as to the

Rafael Enriquez, the administrator of the estate, testified that he had proper disposition of the case. For instance, article 16 of the Civil Code

gone through the effects of the deceased and had found no letter of provides that "In matters which are governed by special laws, any

notification from the insurance company to Mr. Herrer. deficiency of the latter shall be supplied by the provisions of this Code."

On the supposition, therefore, which is incontestable, that the special

Our deduction from the evidence on this issue must be that the letter of law on the subject of insurance is deficient in enunciating the principles

November 26, 1917, notifying Mr. Herrer that his application had been governing acceptance, the subject-matter of the Civil code, if there be

accepted, was prepared and signed in the local office of the insurance any, would be controlling. In the Civil Code is found article 1262

Insurance Law JD4301 Page 16

providing that "Consent is shown by the concurrence of offer and acceptance made by letter shall not bind the person making the offer

acceptance with respect to the thing and the consideration which are to except from the time it came to his knowledge. The pertinent fact is,

constitute the contract. An acceptance made by letter shall not bind the that according to the provisional receipt, three things had to be

person making the offer except from the time it came to his knowledge. accomplished by the insurance company before there was a contract:

The contract, in such case, is presumed to have been entered into at the (1) There had to be a medical examination of the applicant; (2) there

place where the offer was made." This latter article is in opposition to had to be approval of the application by the head office of the company;

the provisions of article 54 of the Code of Commerce. and (3) this approval had in some way to be communicated by the

company to the applicant. The further admitted facts are that the head

If no mistake has been made in announcing the successive steps by office in Montreal did accept the application, did cable the Manila office

which we reach a conclusion, then the only duty remaining is for the to that effect, did actually issue the policy and did, through its agent in

court to apply the law as it is found. The legislature in its wisdom having Manila, actually write the letter of notification and place it in the usual

enacted a new law on insurance, and expressly repealed the provisions channels for transmission to the addressee. The fact as to the letter of

in the Code of Commerce on the same subject, and having thus left a notification thus fails to concur with the essential elements of the

void in the commercial law, it would seem logical to make use of the general rule pertaining to the mailing and delivery of mail matter as

only pertinent provision of law found in the Civil code, closely related to announced by the American courts, namely, when a letter or other mail

the chapter concerning life annuities. matter is addressed and mailed with postage prepaid there is a

rebuttable presumption of fact that it was received by the addressee as

The Civil Code rule, that an acceptance made by letter shall bind the soon as it could have been transmitted to him in the ordinary course of

person making the offer only from the date it came to his knowledge, the mails. But if any one of these elemental facts fails to appear, it is

may not be the best expression of modern commercial usage. Still it fatal to the presumption. For instance, a letter will not be presumed to

must be admitted that its enforcement avoids uncertainty and tends to have been received by the addressee unless it is shown that it was

security. Not only this, but in order that the principle may not be taken deposited in the post-office, properly addressed and stamped. (See 22

too lightly, let it be noticed that it is identical with the principles C.J., 96, and 49 L. R. A. [N. S.], pp. 458, et seq., notes.)

announced by a considerable number of respectable courts in the

United States. The courts who take this view have expressly held that an We hold that the contract for a life annuity in the case at bar was not

acceptance of an offer of insurance not actually or constructively perfected because it has not been proved satisfactorily that the

communicated to the proposer does not make a contract. Only the acceptance of the application ever came to the knowledge of the

mailing of acceptance, it has been said, completes the contract of applicant.lawph!l.net

insurance, as the locus poenitentiae is ended when the acceptance has

passed beyond the control of the party. (I Joyce, The Law of Insurance, Judgment is reversed, and the plaintiff shall have and recover from the

pp. 235, 244.) defendant the sum of P6,000 with legal interest from November 20,

1918, until paid, without special finding as to costs in either instance. So

In resume, therefore, the law applicable to the case is found to be the ordered.

second paragraph of article 1262 of the Civil Code providing that an

Insurance Law JD4301 Page 17

Mapa, C.J., Araullo, Avanceña and Villamor, JJ., concur. Pascuala Vda. de Ebrado also filed her claim as the widow of the

Johnson, J., dissents. deceased insured. She asserts that she is the one entitled to the

insurance proceeds, not the common-law wife, Carponia T. Ebrado.

THE INSULAR LIFE ASSURANCE COMPANY, LTD.

In doubt as to whom the insurance proceeds shall be paid, the insurer,

vs.

The Insular Life Assurance Co., Ltd. commenced an action for

CARPONIA T. EBRADO and PASCUALA VDA. DE EBRADO Interpleader before the Court of First Instance of Rizal on April 29, 1970.

MARTIN, J.:

After the issues have been joined, a pre-trial conference was held on

This is a novel question in insurance law: Can a common-law wife July 8, 1972, after which, a pre-trial order was entered reading as

named as beneficiary in the life insurance policy of a legally married follows: ñé+.£ªwph!1

man claim the proceeds thereof in case of death of the latter?

During the pre-trial conference, the parties manifested to the court.

On September 1, 1968, Buenaventura Cristor Ebrado was issued by The that there is no possibility of amicable settlement. Hence, the Court

Life Assurance Co., Ltd., Policy No. 009929 on a whole-life for P5,882.00 proceeded to have the parties submit their evidence for the purpose of

with a, rider for Accidental Death for the same amount Buenaventura C. the pre-trial and make admissions for the purpose of pretrial. During

Ebrado designated T. Ebrado as the revocable beneficiary in his policy. this conference, parties Carponia T. Ebrado and Pascuala Ebrado agreed

He to her as his wife. and stipulated: 1) that the deceased Buenaventura Ebrado was married

to Pascuala Ebrado with whom she has six — (legitimate) namely;

On October 21, 1969, Buenaventura C. Ebrado died as a result of an t Hernando, Cresencio, Elsa, Erlinda, Felizardo and Helen, all surnamed

when he was hit by a failing branch of a tree. As the policy was in force, Ebrado; 2) that during the lifetime of the deceased, he was insured with

The Insular Life Assurance Co., Ltd. liable to pay the coverage in the Insular Life Assurance Co. Under Policy No. 009929 whole life plan,

total amount of P11,745.73, representing the face value of the policy in dated September 1, 1968 for the sum of P5,882.00 with the rider for

the amount of P5,882.00 plus the additional benefits for accidental accidental death benefit as evidenced by Exhibits A for plaintiffs and

death also in the amount of P5,882.00 and the refund of P18.00 paid for Exhibit 1 for the defendant Pascuala and Exhibit 7 for Carponia Ebrado;

the premium due November, 1969, minus the unpaid premiums and 3) that during the lifetime of Buenaventura Ebrado, he was living with

interest thereon due for January and February, 1969, in the sum of his common-wife, Carponia Ebrado, with whom she had 2 children

P36.27. although he was not legally separated from his legal wife; 4) that

Buenaventura in accident on October 21, 1969 as evidenced by the

Carponia T. Ebrado filed with the insurer a claim for the proceeds of the death Exhibit 3 and affidavit of the police report of his death Exhibit 5;

Policy as the designated beneficiary therein, although she admits that 5) that complainant Carponia Ebrado filed claim with the Insular Life

she and the insured Buenaventura C. Ebrado were merely living as Assurance Co. which was contested by Pascuala Ebrado who also filed

husband and wife without the benefit of marriage. claim for the proceeds of said policy 6) that in view ofthe adverse claims

the insurance company filed this action against the two herein claimants

Insurance Law JD4301 Page 18

Carponia and Pascuala Ebrado; 7) that there is now due from the Insular only necessary that such fact be established by preponderance of

Life Assurance Co. as proceeds of the policy P11,745.73; 8) that the evidence in the trial. Since it is agreed in their stipulation above-quoted

beneficiary designated by the insured in the policy is Carponia Ebrado that the deceased insured and defendant Carponia T. Ebrado were living

and the insured made reservation to change the beneficiary but together as husband and wife without being legally married and that

although the insured made the option to change the beneficiary, same the marriage of the insured with the other defendant Pascuala Vda. de

was never changed up to the time of his death and the wife did not have Ebrado was valid and still existing at the time the insurance in question

any opportunity to write the company that there was reservation to was purchased there is no question that defendant Carponia T. Ebrado

change the designation of the parties agreed that a decision be is disqualified from becoming the beneficiary of the policy in question

rendered based on and stipulation of facts as to who among the two and as such she is not entitled to the proceeds of the insurance upon

claimants is entitled to the policy. the death of the insured.

Upon motion of the parties, they are given ten (10) days to file their From this judgment, Carponia T. Ebrado appealed to the Court of

simultaneous memoranda from the receipt of this order. Appeals, but on July 11, 1976, the Appellate Court certified the case to

Us as involving only questions of law.

SO ORDERED.

We affirm the judgment of the lower court.

On September 25, 1972, the trial court rendered judgment declaring

among others, Carponia T. Ebrado disqualified from becoming 1. It is quite unfortunate that the Insurance Act (RA 2327, as

beneficiary of the insured Buenaventura Cristor Ebrado and directing amended) or even the new Insurance Code (PD No. 612, as amended)

the payment of the insurance proceeds to the estate of the deceased does not contain any specific provision grossly resolutory of the prime

insured. The trial court held: ñé+.£ªwph!1 question at hand. Section 50 of the Insurance Act which provides that

"(t)he insurance shag be applied exclusively to the proper interest of the

It is patent from the last paragraph of Art. 739 of the Civil Code that a person in whose name it is made" 1 cannot be validly seized upon to

criminal conviction for adultery or concubinage is not essential in order hold that the mm includes the beneficiary. The word "interest" highly

to establish the disqualification mentioned therein. Neither is it also suggests that the provision refers only to the "insured" and not to the

necessary that a finding of such guilt or commission of those acts be beneficiary, since a contract of insurance is personal in character. 2

made in a separate independent action brought for the purpose. The Otherwise, the prohibitory laws against illicit relationships especially on

guilt of the donee (beneficiary) may be proved by preponderance of property and descent will be rendered nugatory, as the same could

evidence in the same proceeding (the action brought to declare the easily be circumvented by modes of insurance. Rather, the general rules

nullity of the donation). of civil law should be applied to resolve this void in the Insurance Law.

Article 2011 of the New Civil Code states: "The contract of insurance is

It is, however, essential that such adultery or concubinage exists at the governed by special laws. Matters not expressly provided for in such

time defendant Carponia T. Ebrado was made beneficiary in the policy special laws shall be regulated by this Code." When not otherwise

in question for the disqualification and incapacity to exist and that it is specifically provided for by the Insurance Law, the contract of life

Insurance Law JD4301 Page 19

insurance is governed by the general rules of the civil law regulating the courts will, so far as possible treat it as a will and determine the

contracts. 3 And under Article 2012 of the same Code, "any person who effect of a clause designating the beneficiary by rules under which wins

is forbidden from receiving any donation under Article 739 cannot be are interpreted. 6

named beneficiary of a fife insurance policy by the person who cannot

make a donation to him. 4 Common-law spouses are, definitely, barred 3. Policy considerations and dictates of morality rightly justify the

from receiving donations from each other. Article 739 of the new Civil institution of a barrier between common law spouses in record to

Code provides: ñé+.£ªwph!1 Property relations since such hip ultimately encroaches upon the nuptial

and filial rights of the legitimate family There is every reason to hold

The following donations shall be void: that the bar in donations between legitimate spouses and those

between illegitimate ones should be enforced in life insurance policies

1. Those made between persons who were guilty of adultery or since the same are based on similar consideration As above pointed out,

concubinage at the time of donation; a beneficiary in a fife insurance policy is no different from a donee. Both

are recipients of pure beneficence. So long as manage remains the

Those made between persons found guilty of the same criminal offense, threshold of family laws, reason and morality dictate that the

in consideration thereof; impediments imposed upon married couple should likewise be imposed

upon extra-marital relationship. If legitimate relationship is

3. Those made to a public officer or his wife, descendants or circumscribed by these legal disabilities, with more reason should an

ascendants by reason of his office. illicit relationship be restricted by these disabilities. Thus, in Matabuena

v. Cervantes, 7 this Court, through Justice Fernando, said: ñé+.£ªwph!1

In the case referred to in No. 1, the action for declaration of nullity may

be brought by the spouse of the donor or donee; and the guilt of the If the policy of the law is, in the language of the opinion of the then

donee may be proved by preponderance of evidence in the same action. Justice J.B.L. Reyes of that court (Court of Appeals), 'to prohibit

donations in favor of the other consort and his descendants because of

2. In essence, a life insurance policy is no different from a civil and undue and improper pressure and influence upon the donor, a

donation insofar as the beneficiary is concerned. Both are founded upon prejudice deeply rooted in our ancient law;" por-que no se enganen

the same consideration: liberality. A beneficiary is like a donee, because desponjandose el uno al otro por amor que han de consuno' (According

from the premiums of the policy which the insured pays out of liberality, to) the Partidas (Part IV, Tit. XI, LAW IV), reiterating the rationale 'No

the beneficiary will receive the proceeds or profits of said insurance. As Mutuato amore invicem spoliarentur' the Pandects (Bk, 24, Titl. 1, De

a consequence, the proscription in Article 739 of the new Civil Code donat, inter virum et uxorem); then there is very reason to apply the

should equally operate in life insurance contracts. The mandate of same prohibitive policy to persons living together as husband and wife

Article 2012 cannot be laid aside: any person who cannot receive a without the benefit of nuptials. For it is not to be doubted that assent to

donation cannot be named as beneficiary in the life insurance policy of such irregular connection for thirty years bespeaks greater influence of

the person who cannot make the donation. 5 Under American law, a one party over the other, so that the danger that the law seeks to avoid

policy of life insurance is considered as a testament and in construing it, is correspondingly increased. Moreover, as already pointed out by

Insurance Law JD4301 Page 20

Ulpian (in his lib. 32 ad Sabinum, fr. 1), 'it would not be just that such The underscored clause neatly conveys that no criminal conviction for

donations should subsist, lest the condition 6f those who incurred guilt the offense is a condition precedent. In fact, it cannot even be from the

should turn out to be better.' So long as marriage remains the aforequoted provision that a prosecution is needed. On the contrary,

cornerstone of our family law, reason and morality alike demand that the law plainly states that the guilt of the party may be proved "in the

the disabilities attached to marriage should likewise attach to same acting for declaration of nullity of donation. And, it would be

concubinage. sufficient if evidence preponderates upon the guilt of the consort for

the offense indicated. The quantum of proof in criminal cases is not

It is hardly necessary to add that even in the absence of the above demanded.

pronouncement, any other conclusion cannot stand the test of scrutiny.

It would be to indict the frame of the Civil Code for a failure to apply a In the caw before Us, the requisite proof of common-law relationship

laudable rule to a situation which in its essentials cannot be between the insured and the beneficiary has been conveniently

distinguished. Moreover, if it is at all to be differentiated the policy of supplied by the stipulations between the parties in the pre-trial

the law which embodies a deeply rooted notion of what is just and what conference of the case. It case agreed upon and stipulated therein that

is right would be nullified if such irregular relationship instead of being the deceased insured Buenaventura C. Ebrado was married to Pascuala

visited with disabilities would be attended with benefits. Certainly a Ebrado with whom she has six legitimate children; that during his

legal norm should not be susceptible to such a reproach. If there is lifetime, the deceased insured was living with his common-law wife,

every any occasion where the principle of statutory construction that Carponia Ebrado, with whom he has two children. These stipulations are

what is within the spirit of the law is as much a part of it as what is nothing less than judicial admissions which, as a consequence, no longer

written, this is it. Otherwise the basic purpose discernible in such codal require proof and cannot be contradicted. 8 A fortiori, on the basis of

provision would not be attained. Whatever omission may be apparent in these admissions, a judgment may be validly rendered without going

an interpretation purely literal of the language used must be remedied through the rigors of a trial for the sole purpose of proving the illicit

by an adherence to its avowed objective. liaison between the insured and the beneficiary. In fact, in that pretrial,

the parties even agreed "that a decision be rendered based on this

4. We do not think that a conviction for adultery or concubinage is agreement and stipulation of facts as to who among the two claimants

exacted before the disabilities mentioned in Article 739 may effectuate. is entitled to the policy."

More specifically, with record to the disability on "persons who were

guilty of adultery or concubinage at the time of the donation," Article ACCORDINGLY, the appealed judgment of the lower court is hereby

739 itself provides: ñé+.£ªwph!1 affirmed. Carponia T. Ebrado is hereby declared disqualified to be the

beneficiary of the late Buenaventura C. Ebrado in his life insurance

In the case referred to in No. 1, the action for declaration of nullity may policy. As a consequence, the proceeds of the policy are hereby held

be brought by the spouse of the donor or donee; and the guilty of the payable to the estate of the deceased insured. Costs against Carponia T.

donee may be proved by preponderance of evidence in the same action. Ebrado.

SO ORDERED.

Insurance Law JD4301 Page 21

sank, resulting in the damage or loss of 1,162 bales of hemp loaded

Teehankee (Chairman), Makasiar, Muñ;oz Palma, Fernandez and therein. On October 30, 1952, Macleod promptly notified the carrier's

Guerrero, JJ., concur. main office in Manila and its branch in Davao advising it of its liability.

The damaged hemp was brought to Odell Plantation in Madaum, Davao,

COMPAÑIA MARITIMAvs. for cleaning, washing, reconditioning, and redrying. During the period

from November 1-15, 1952, the carrier's trucks and lighters hauled from

INSURANCE COMPANY OF NORTH AMERICA

Odell to Macleod at Sasa a total of 2,197.75 piculs of the reconditioned

BAUTISTA ANGELO, J.:

hemp out of the original cargo of 1,162 bales weighing 2,324 piculs

which had a total value of 116,835.00. After reclassification, the value of

Sometime in October, 1952, Macleod and Company of the Philippines

the reconditioned hemp was reduced to P84,887.28, or a loss in value of

contracted by telephone the services of the Compañia Maritima, a

P31,947.72. Adding to this last amount the sum of P8,863.30

shipping corporation, for the shipment of 2,645 bales of hemp from the

representing Macleod's expenses in checking, grading, rebating, and

former's Sasa private pier at Davao City to Manila and for their

other fees for washing, cleaning and redrying in the amount of

subsequent transhipment to Boston, Massachusetts, U.S.A. on board

P19.610.00, the total loss adds up to P60,421.02.

the S.S. Steel Navigator. This oral contract was later on confirmed by a

formal and written booking issued by Macleod's branch office in Sasa

All abaca shipments of Macleod, including the 1,162 bales loaded on the

and handcarried to Compañia Maritima's branch office in Davao in

carrier's LCT No. 1025, were insured with the Insurance Company of

compliance with which the latter sent to Macleod's private wharf LCT

North America against all losses and damages. In due time, Macleod

Nos. 1023 and 1025 on which the loading of the hemp was completed

filed a claim for the loss it suffered as above stated with said insurance

on October 29, 1952. These two lighters were manned each by a patron

company, and after the same had been processed, the sum of

and an assistant patron. The patrons of both barges issued the

P64,018.55 was paid, which was noted down in a document which aside

corresponding carrier's receipts and that issued by the patron of Barge

from being a receipt of the amount paid, was a subrogation agreement

No. 1025 reads in part:

between Macleod and the insurance company wherein the former

assigned to the latter its rights over the insured and damaged cargo.

Received in behalf of S.S. Bowline Knot in good order and condition

Having failed to recover from the carrier the sum of P60,421.02, which

from MACLEOD AND COMPANY OF PHILIPPINES, Sasa Davao, for

is the only amount supported by receipts, the insurance company

transhipment at Manila onto S.S. Steel Navigator.

instituted the present action on October 28, 1953. After trial, the court

a quo rendered judgment ordering the carrier to pay the insurance

FINAL DESTINATION: Boston.

company the sum of P60,421.02, with legal interest thereon from the

date of the filing of the complaint until fully paid, and the costs. This

Thereafter, the two loaded barges left Macleod's wharf and proceeded

judgment was affirmed by the Court of Appeals on December 14, 1960.

to and moored at the government's marginal wharf in the same place to

Hence, this petition for review.

await the arrival of the S.S. Bowline Knot belonging to Compañia

Maritima on which the hemp was to be loaded. During the night of

October 29, 1952, or at the early hours of October 30, LCT No. 1025

Insurance Law JD4301 Page 22

The issues posed before us are: (1) Was there a contract of carriage FINAL DESTINATION: Boston.

between the carrier and the shipper even if the loss occurred when the

hemp was loaded on a barge owned by the carrier which was loaded The fact that the carrier sent its lighters free of charge to take the hemp

free of charge and was not actually loaded on the S.S. Bowline Knot from Macleod's wharf at Sasa preparatory to its loading onto the ship

which would carry the hemp to Manila and no bill of lading was issued Bowline Knot does not in any way impair the contract of carriage

therefore?; (2) Was the damage caused to the cargo or the sinking of already entered into between the carrier and the shipper, for that

the barge where it was loaded due to a fortuitous event, storm or preparatory step is but part and parcel of said contract of carriage. The

natural disaster that would exempt the carrier from liability?; (3) Can lighters were merely employed as the first step of the voyage, but once

respondent insurance company sue the carrier under its insurance that step was taken and the hemp delivered to the carrier's employees,

contract as assignee of Macleod in spite of the fact that the liability of the rights and obligations of the parties attached thereby subjecting

the carrier as insurer is not recognized in this jurisdiction?; (4) Has the them to the principles and usages of the maritime law. In other words,

Court of Appeals erred in regarding Exhibit NNN-1 as an implied here we have a complete contract of carriage the consummation of

admission by the carrier of the correctness and sufficiency of the which has already begun: the shipper delivering the cargo to the carrier,

shipper's statement of accounts contrary to the burden of proof rule?; and the latter taking possession thereof by placing it on a lighter

and (5) Can the insurance company maintain this suit without proof of manned by its authorized employees, under which Macleod became

its personality to do so? entitled to the privilege secured to him by law for its safe transportation

and delivery, and the carrier to the full payment of its freight upon

1. This issue should be answered in the affirmative. As found by completion of the voyage.

the Court of Appeals, Macleod and Company contracted by telephone

the services of petitioner to ship the hemp in question from the The receipt of goods by the carrier has been said to lie at the foundation

former's private pier at Sasa, Davao City, to Manila, to be subsequently of the contract to carry and deliver, and if actually no goods are

transhipped to Boston, Massachusetts, U.S.A., which oral contract was received there can be no such contract. The liability and responsibility of

later confirmed by a formal and written booking issued by the shipper's the carrier under a contract for the carriage of goods commence on

branch office, Davao City, in virtue of which the carrier sent two of its their actual delivery to, or receipt by, the carrier or an authorized agent.

lighters to undertake the service. It also appears that the patrons of said ... and delivery to a lighter in charge of a vessel for shipment on the

lighters were employees of the carrier with due authority to undertake vessel, where it is the custom to deliver in that way, is a good delivery

the transportation and to sign the documents that may be necessary and binds the vessel receiving the freight, the liability commencing at

therefor so much so that the patron of LCT No. 1025 signed the receipt the time of delivery to the lighter. ... and, similarly, where there is a

covering the cargo of hemp loaded therein as follows: . contract to carry goods from one port to another, and they cannot be

loaded directly on the vessel and lighters are sent by the vessel to bring

Received in behalf of S.S. Bowline Knot in good order and condition the goods to it, the lighters are for the time its substitutes, so that the

from MACLEOD AND COMPANY OF PHILIPPINES, Sasa Davao, for bill of landing is applicable to the goods as soon as they are placed on

transhipment at Manila onto S.S. Steel Navigator. the lighters. (80 C.J.S., p. 901, emphasis supplied)

Insurance Law JD4301 Page 23

... The test as to whether the relation of shipper and carrier had been Viso, pp. 314-315; Robles vs. Santos, 44 O.G. 2268). In other words, the