Professional Documents

Culture Documents

SAPM Course Outline

Uploaded by

ankurs0070 ratings0% found this document useful (0 votes)

116 views2 pagesSecurity Analysis and Portfolio Management is a 50-hour Course. Objective of the Course is to help students improve decision-making skills in management of financial assets. Case studies are as per recent trend of market will decide later, based on time constraint at the end of each module.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSecurity Analysis and Portfolio Management is a 50-hour Course. Objective of the Course is to help students improve decision-making skills in management of financial assets. Case studies are as per recent trend of market will decide later, based on time constraint at the end of each module.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

116 views2 pagesSAPM Course Outline

Uploaded by

ankurs007Security Analysis and Portfolio Management is a 50-hour Course. Objective of the Course is to help students improve decision-making skills in management of financial assets. Case studies are as per recent trend of market will decide later, based on time constraint at the end of each module.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

COURSE OUTLINE

1. Name of the Course: Security Analysis and Portfolio Management

2. Code of the Course: FM 203

3. Description of the Course: MBA-2nd Year/ Semester-I/ 50 hours (1 Session= 70 Min.)

4. Objective of the Course: To help students improve decision-making skills in management of

financial assets through a better understanding of modern theories on portfolio management

and functioning of capital market.

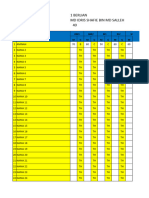

5. Course conducts details:

Sr. No. Topic/Module No. of Chapter No./Book

Sessions

(Tentative)

1 Unit 1: 2 Ch. 1 / B1

Introduction: Investment meaning,

nature and scope, Decision Process

2 Investment Environment, 4 Ch. 1,3 / B1

Measurement of Risk & Return: Ch. 1 / R1

Systematic Risk; Market Risk,

Interest-Rate Risk, Purchasing-

Power (Inflation) Risk

Unsystematic Risk; Business Risk,

Financial (Default Risk),

Other Risks

3 Valuation of Security and Notion 3 Ch. 3 / R2

of dominance Ch. 14,18 / R1

4 Unit 2: 7 Ch. 4,5,6,7,8 / B1

Fundamental Analysis:

Economy, Industry and Company

Analysis

5 Technical Analysis: 3 Ch. 15,16 / B1

Dow Jones Theory, Efficient

Market Hypothesis etc…

6 Unit 3: 4 Ch. 3,17 / B1

Concept of Beta and its Ch. 4,5,6/ R2

classification, Beta-geared,

Ungeared Beta, Project Beta,

Portfolio Beta, Security Market

Line (SML), Capital Market Line

(CML)

7 Unit 4: 8 Ch. 17,18,19 / B1

Techniques of Risk Measurements Ch. 9 / R1

and their Application and Portfolio

Evaluation:

Portfolio Analysis, Selection and

Theories; Markowitz Model,

CAPM

8 Portfolio Revision and 7 Ch. 20 / B1

Reconstruction with Performance Ch. 24,26,27 / R1

Evaluation of Managed Portfolios;

Sharp Ratio, Treynor Ratio and

Jensen’s Alpha

Note: Cases are as per recent trend of market will decide later, based on time constrain at the end

of each module.

6. Text Book:

a. Fischer and Jordan, Security Analysis and Portfolio Management, Prentice Hall, 6th

edition, 1996 (B1)

7. Reference Books:

a. Zvi Bodie, Alex Kane, Alan J. Marcus and Pitabas Mohanty, Investments, 6th edition,

Tata McGraw Hill (R1)

b. I. M. Pandey, Financial Management, 9th edition, Vikas Publication (R2)

c. Investment Management; Security Analysis and Portfolio Management. Bhalla, V.K.

(9th ed., 2003), S. Chand & Co. Ltd. (R3)

d. Investment Analysis and Portfolio Management, Chandra Prasanna (2002), Tata

McGraw Hill, New Delhi (R4)

e. Security Analysis and Portfolio Management, Punithavathy, Pandian (2003), Vikas

Publishing House (R5)

f. Security Analysis and Portfolio Management Avdhani, V.A. (6th ed., 2003), Himalaya

Publishing House (R6)

8. Important Web links: www.nseindia.com , www.bseindia.com , www.sebi.gov.in ,

www.nsdl.co.in , www.nyse.com , www.money.cnn.com

9. Newspaper/Journals/Magazines:

a. Any financial news paper (ET or Business Standards are preferable)

b. Indian Securities Market, A Review

c. NSE Newsletter

d. NSE Factbook

e. Mutual Funds Factbook

10. Evaluation Pattern (Tentative):

a. University Exam: 40%

b. Mid Semester Exam: 30%

c. Quiz: 10%

d. Project Work: 5%

e. Presentations: 5%

f. Class Participation: 5%

g. Assignments: 5%

11. Expected Number of hours to be spent by students outside the class for the course:

a. 6 Hours/week

12. Any other relevant information/suggestion:

a. Student should have registered their self at NSE for the module of Capital Markets

(Dealers) and AMFI (Advisor), which are easy to pass with this subject adding value to

their career.

b. If student are interested in financial service sector, they also should think for clearing

Commodity Market, Debt Market, NSDL, Derivatives Market (Dealers) and Options

Trading Strategies modules of NSE.

c. Student interested in international finance should think for Currency Derivatives

Certification Examination of NSE

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Comics Trip MasterpiecesDocument16 pagesComics Trip MasterpiecesDaniel Constantine100% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Tribebook Wendigo Revised Edition 6244638Document109 pagesTribebook Wendigo Revised Edition 6244638PedroNo ratings yet

- Piggery BookletDocument30 pagesPiggery BookletVeli Ngwenya100% (2)

- Click To Enlarge (The Skeptic's Annotated Bible, Hosea)Document11 pagesClick To Enlarge (The Skeptic's Annotated Bible, Hosea)Philip WellsNo ratings yet

- A Psychological Crusade by Fernando Sorrentino - Text 7Document2 pagesA Psychological Crusade by Fernando Sorrentino - Text 7Donnie DominguezNo ratings yet

- Jamaica Sloane Conference Brochure-1Document4 pagesJamaica Sloane Conference Brochure-1labrishNo ratings yet

- Whether To Use Their GPS To Find Their Way To The New Cool Teen HangoutDocument3 pagesWhether To Use Their GPS To Find Their Way To The New Cool Teen HangoutCarpovici Victor100% (1)

- Estudio - Women Who Suffered Emotionally From Abortion - A Qualitative Synthesis of Their ExperiencesDocument6 pagesEstudio - Women Who Suffered Emotionally From Abortion - A Qualitative Synthesis of Their ExperiencesSharmely CárdenasNo ratings yet

- Fashion Designer Research Paper ThesisDocument4 pagesFashion Designer Research Paper Thesisafbteyrma100% (2)

- Making A Spiritual ConfessionDocument2 pagesMaking A Spiritual ConfessionJoselito FernandezNo ratings yet

- 7 Types of English Adjectives That Every ESL Student Must KnowDocument3 pages7 Types of English Adjectives That Every ESL Student Must KnowBenny James CloresNo ratings yet

- The Wilderness - Chennai TimesDocument1 pageThe Wilderness - Chennai TimesNaveenNo ratings yet

- Xeljanz Initiation ChecklistDocument8 pagesXeljanz Initiation ChecklistRawan ZayedNo ratings yet

- Downloaded From Manuals Search EngineDocument29 pagesDownloaded From Manuals Search EnginehaivermelosantanderNo ratings yet

- World Turtle DayDocument19 pagesWorld Turtle DaymamongelhiNo ratings yet

- TEMPLATE Keputusan Peperiksaan THP 1Document49 pagesTEMPLATE Keputusan Peperiksaan THP 1SABERI BIN BANDU KPM-GuruNo ratings yet

- Rock Classification Gizmo WorksheetDocument4 pagesRock Classification Gizmo WorksheetDiamond실비No ratings yet

- CJ1W-PRT21 PROFIBUS-DP Slave Unit: Operation ManualDocument100 pagesCJ1W-PRT21 PROFIBUS-DP Slave Unit: Operation ManualSergio Eu CaNo ratings yet

- DocuPrint C2255Document2 pagesDocuPrint C2255sydengNo ratings yet

- Chocolate Passion Fruit Layer CakeDocument3 pagesChocolate Passion Fruit Layer Cake4balanarNo ratings yet

- Personal Details: Your Application Form Has Been Submitted Successfully. Payment Is SuccessfulDocument6 pagesPersonal Details: Your Application Form Has Been Submitted Successfully. Payment Is SuccessfulKanchanNo ratings yet

- Indian RailwaysDocument20 pagesIndian RailwaysNirmalNo ratings yet

- Practical No 4Document5 pagesPractical No 4Mahin SarkarNo ratings yet

- ORtHOGRAPHIC Plan FinalDocument8 pagesORtHOGRAPHIC Plan FinalKrizzie Jade CailingNo ratings yet

- Atf Fire Research Laboratory - Technical Bulletin 02 0Document7 pagesAtf Fire Research Laboratory - Technical Bulletin 02 0Mauricio Gallego GilNo ratings yet

- PHYTOCHEMICAL AND CYTOTOXICITY TESTING OF RAMANIA LEAVES (Bouea Macrophylla Griffith) ETHANOL EXTRACT TOWARD VERO CELLS USING MTT ASSAY METHODDocument6 pagesPHYTOCHEMICAL AND CYTOTOXICITY TESTING OF RAMANIA LEAVES (Bouea Macrophylla Griffith) ETHANOL EXTRACT TOWARD VERO CELLS USING MTT ASSAY METHODLaila FitriNo ratings yet

- Question Paper Code:: (10×2 20 Marks)Document2 pagesQuestion Paper Code:: (10×2 20 Marks)Umesh Harihara sudan0% (1)

- PHMSA Amended Corrective Action Order For Plains All American Pipeline Regarding Refugio Oil Spill in Santa Barbara CountyDocument7 pagesPHMSA Amended Corrective Action Order For Plains All American Pipeline Regarding Refugio Oil Spill in Santa Barbara Countygiana_magnoliNo ratings yet

- Jaringan Noordin M. TopDocument38 pagesJaringan Noordin M. TopgiantoNo ratings yet

- Programming Essentials in PythonDocument23 pagesProgramming Essentials in PythonNabeel AmjadNo ratings yet