Professional Documents

Culture Documents

Prob 12

Uploaded by

Neo0 ratings0% found this document useful (0 votes)

10 views3 pagesOriginal Title

Prob 12.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views3 pagesProb 12

Uploaded by

NeoCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

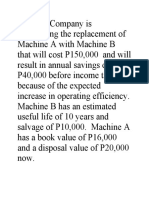

Problem no 12

Solved from product C point of view

No of units produced for A 8000 Tax Rate 30%

No of units produced for B 9500 Surcharge 10%

Investment needed for C 600000 Effective tax rate 33%

Life of the new plant in yrs 5 CAPX at beginning of 3rd yr 150000

Total overhead cost of all 3 products 600000 beginning of 3rd yr = end of 2nd yr

Selling price per unit for C 150 Cost of capital 11%

Material cost per unit for C 50 Subsidy at beginning of 2nd yr = at end of 1st yr

Labour cost per unit for C 30

Expenses cost per unit for C 10

Labour cost increase in 3rd yr 20%

Year (at end) E Sales (in units) MC/u LC/u Exp/u VC/u OC ratio Total VC

1 4200 50 30 10 90 0.194 378000

2 6500 50 30 10 90 0.271 585000

3 7100 50 36 10 96 0.289 681600

4 9400 50 36 10 96 0.349 902400

5 10500 50 36 10 96 0.375 1008000

Therefore total PV of CF 936234

Initial investment 600000

PV of additional investment 121743

NPV 214491

NPV is positive hence project is viable

= at end of 1st yr

Total OC Sales EBITDA Dep EBIT Tax PAT +Dep -CAPX CF

116129 630000 135871 120000 15871 5237 10634 120000 0 130634

162500 975000 227500 120000 107500 35475 72025 120000 150000 42025

173171 1065000 210229 170000 40229 13276 26954 170000 0 196954

209665 1410000 297935 170000 127935 42218 85716 170000 0 255716

225000 1575000 342000 170000 172000 56760 115240 170000 0 285240

Subsidy Total CF PVIF@11% PV of CF

336000 466634 0.901 420391

0 42025 0.812 34108

0 196954 0.731 144011

0 255716 0.659 168448

0 285240 0.593 169276

You might also like

- Payback Period, NPV and PI CalculationsDocument13 pagesPayback Period, NPV and PI CalculationsVedashree MaliNo ratings yet

- Practice Problems 01: NPV Calculation for 5 YearsDocument1 pagePractice Problems 01: NPV Calculation for 5 Yearsইয়াসিন খন্দকার রাতুলNo ratings yet

- Scenario Summary: Changing CellsDocument10 pagesScenario Summary: Changing Cellsjerrynguyen291No ratings yet

- Assignment 3 Feb MBA 1Document17 pagesAssignment 3 Feb MBA 1shahzad aliNo ratings yet

- PEM WorkingDocument33 pagesPEM Workingk60.2112153014No ratings yet

- Paper 2Document5 pagesPaper 2dua95960No ratings yet

- Final Assignment ValuationDocument5 pagesFinal Assignment ValuationSamin ChowdhuryNo ratings yet

- Cup Pa Mania ProjectDocument4 pagesCup Pa Mania ProjectDurgaprasad VelamalaNo ratings yet

- Delta Project and Repco AnalysisDocument9 pagesDelta Project and Repco AnalysisvarunjajooNo ratings yet

- Peony Coffee - Clc62a-V6Document9 pagesPeony Coffee - Clc62a-V6Thuy Duong DONo ratings yet

- Particulars Year 0 Year 1 To 10Document2 pagesParticulars Year 0 Year 1 To 10rajakosuri429No ratings yet

- Financial StatementDocument36 pagesFinancial StatementJigoku ShojuNo ratings yet

- FM2 Assignment 4 - Group 5Document7 pagesFM2 Assignment 4 - Group 5TestNo ratings yet

- Final CaseDocument25 pagesFinal CaseSakshi SharmaNo ratings yet

- Case01 02Document24 pagesCase01 02Sakshi SharmaNo ratings yet

- 322 Assignment 2 SubmissionDocument9 pages322 Assignment 2 SubmissionMirza Mushahid BaigNo ratings yet

- Bhimsen CaseDocument2 pagesBhimsen CaseNikhil Gauns DessaiNo ratings yet

- Bank A and B - Bank XDocument4 pagesBank A and B - Bank XSoleil SierraNo ratings yet

- Strama Activity 2 SolmanDocument7 pagesStrama Activity 2 SolmanPaupauNo ratings yet

- FNCE371 Assignment 1: Case 3: Credit Policy ManagementDocument18 pagesFNCE371 Assignment 1: Case 3: Credit Policy ManagementsmaNo ratings yet

- Year Sales Volume Sales VC FC DepDocument8 pagesYear Sales Volume Sales VC FC DepMohammad Umair SheraziNo ratings yet

- EKOMIGKUIS14MEIDocument5 pagesEKOMIGKUIS14MEImeri erlinaNo ratings yet

- Proceso de Obtencion de AcetonaDocument11 pagesProceso de Obtencion de AcetonaRenzo Acevedo CanoNo ratings yet

- "Fete N Fiesta" Management Team: Names ShareholdingDocument9 pages"Fete N Fiesta" Management Team: Names ShareholdingMuskan AliNo ratings yet

- Chapter 9Document4 pagesChapter 9thinkestanNo ratings yet

- TH M NH Coffee BeanDocument6 pagesTH M NH Coffee BeanRuselleNo ratings yet

- Sensitivity and Breakeven Analysis: Lecture No. 29 Professor C. S. Park Fundamentals of Engineering EconomicsDocument26 pagesSensitivity and Breakeven Analysis: Lecture No. 29 Professor C. S. Park Fundamentals of Engineering EconomicsFeni Ayu LestariNo ratings yet

- Finance&Accounts T3 SolutionDocument4 pagesFinance&Accounts T3 Solutionkanika thakurNo ratings yet

- Finance II Cours 8 2021Document53 pagesFinance II Cours 8 2021Fiveer FreelancerNo ratings yet

- The Apex Manufacturing Company:: Problem # 1Document10 pagesThe Apex Manufacturing Company:: Problem # 1mamunur rashidNo ratings yet

- CH 15Document6 pagesCH 15palashNo ratings yet

- BSFIN - Your Final OutputsDocument6 pagesBSFIN - Your Final OutputsPaul Jures DulfoNo ratings yet

- Determining Cash Flows for Investment AnalysisDocument19 pagesDetermining Cash Flows for Investment AnalysisJack mazeNo ratings yet

- Estimation of Initial Investment: A) Preliminary and Preoperating ExpDocument14 pagesEstimation of Initial Investment: A) Preliminary and Preoperating ExpShiv Pratap SinghNo ratings yet

- Cash Flow EstimationDocument14 pagesCash Flow Estimation0241ASHAYNo ratings yet

- ACYFMG2 Quiz 2 QuestionsDocument41 pagesACYFMG2 Quiz 2 QuestionsArnold BernasNo ratings yet

- Budgetary ControlDocument14 pagesBudgetary ControlCool BuddyNo ratings yet

- Lab 221 HS10002Document7 pagesLab 221 HS10002aayush.5.parasharNo ratings yet

- Electricity Bill Advertising: Software RentDocument5 pagesElectricity Bill Advertising: Software RentHasiburNo ratings yet

- Corporate Income Tax Computations Over 3 YearsDocument61 pagesCorporate Income Tax Computations Over 3 YearsMay Grethel Joy Perante100% (1)

- BTDocument6 pagesBTthanhlong2692000No ratings yet

- PGP25394 Keshav Sureka G CFDocument13 pagesPGP25394 Keshav Sureka G CFKeshavSurekaNo ratings yet

- Capital Budgeting and Sneakers Project AnalysisDocument6 pagesCapital Budgeting and Sneakers Project Analysisshik171294No ratings yet

- EOB Presentation Slides - Feb 2021Document39 pagesEOB Presentation Slides - Feb 2021888 BiliyardsNo ratings yet

- Case Bco: IncomeDocument19 pagesCase Bco: IncomeMuhammad Abdullah FarooqNo ratings yet

- FM 2019 SolutionsDocument6 pagesFM 2019 Solutionsaditikotere92No ratings yet

- MC200912013 GSFM7514Document6 pagesMC200912013 GSFM7514Yaga KanggaNo ratings yet

- Anindita SenguptaDocument8 pagesAnindita Senguptandim betaNo ratings yet

- Capital Budgeting Machine Purchase Saves Rs. 11 Lacs AnnuallyDocument14 pagesCapital Budgeting Machine Purchase Saves Rs. 11 Lacs AnnuallybhaskkarNo ratings yet

- Phuket Beach Hotel - 2022Document10 pagesPhuket Beach Hotel - 2022Gavani Durga SaiNo ratings yet

- Solution-Class Exercise 2-Capital BudgetingDocument56 pagesSolution-Class Exercise 2-Capital Budgetinggaurav shettyNo ratings yet

- Final Capital Budgeting Class DiscussionDocument88 pagesFinal Capital Budgeting Class Discussiongaurav shettyNo ratings yet

- Srinath SirDocument19 pagesSrinath Sirmy Vinay100% (1)

- Presentation On Variable and Absorption CostingDocument24 pagesPresentation On Variable and Absorption Costingsmurtazaali84No ratings yet

- Capital LeverageDocument11 pagesCapital LeverageFoysal AhmedNo ratings yet

- Income StatementDocument3 pagesIncome StatementBiswajit SarmaNo ratings yet

- Capital Budgeting ExamplesDocument16 pagesCapital Budgeting ExamplesMuhammad azeemNo ratings yet

- Nayana Purohit 1823177Document51 pagesNayana Purohit 1823177Aditi SinglaNo ratings yet

- Addtl Exercises 10 12Document5 pagesAddtl Exercises 10 12John Lester C AlagNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Problem No 12: Beginning of 3rd Yr End of 2nd Yr Subsidy at Beginning of 2nd Yr at End of 1st YrDocument3 pagesProblem No 12: Beginning of 3rd Yr End of 2nd Yr Subsidy at Beginning of 2nd Yr at End of 1st YrNeoNo ratings yet

- Prob 27Document1 pageProb 27NeoNo ratings yet

- DesigningDocument10 pagesDesigningamrin jannatNo ratings yet

- Financial Statement & Ratio AnalysisDocument37 pagesFinancial Statement & Ratio AnalysisNeha BhayaniNo ratings yet

- Syl 9Document111 pagesSyl 9JH ShifatNo ratings yet

- Ratio Analysis (1) READ PDFDocument17 pagesRatio Analysis (1) READ PDFNeoNo ratings yet

- Nalysis ND Nterpretation F Inancial TatementsDocument76 pagesNalysis ND Nterpretation F Inancial Tatementsafridi3089No ratings yet

- Chapter 20 Sustainable Marketing: Social Responsibility and EthicsDocument45 pagesChapter 20 Sustainable Marketing: Social Responsibility and EthicsNeoNo ratings yet

- Problem SolvingDocument34 pagesProblem SolvingHardeep Kaur100% (1)

- Accounting Ratios: Inancial Statements Aim at Providing FDocument47 pagesAccounting Ratios: Inancial Statements Aim at Providing Fabc100% (1)

- Maynard Company (A) Balance Sheet Asofjune1 AssetsDocument9 pagesMaynard Company (A) Balance Sheet Asofjune1 AssetsNeoNo ratings yet

- 12 Maths Revision Book Answers 1 PDFDocument13 pages12 Maths Revision Book Answers 1 PDFNeoNo ratings yet

- INFORME FINALlllllllllllllllllllDocument133 pagesINFORME FINALlllllllllllllllllllAnonymous Rr3py6jdCpNo ratings yet

- 6 - Supply Change ManagementDocument19 pages6 - Supply Change ManagementWall JohnNo ratings yet

- RA 7183 FirecrackersDocument2 pagesRA 7183 FirecrackersKathreen Lavapie100% (1)

- 9731ch04Document44 pages9731ch04Yuki TakenoNo ratings yet

- 790 Pi SpeedxDocument1 page790 Pi SpeedxtaniyaNo ratings yet

- Answer DashDocument6 pagesAnswer DashJeffrey AmitNo ratings yet

- Budget Review of NepalDocument10 pagesBudget Review of NepalBasanta BhetwalNo ratings yet

- Schmitt NF JumpDocument1 pageSchmitt NF JumpKim PalmieroNo ratings yet

- Export Import Condition of BangladeshDocument19 pagesExport Import Condition of BangladeshYeasir Malik100% (9)

- Name and Address: No. Name of Contact and Phone / Fax NumbersDocument1 pageName and Address: No. Name of Contact and Phone / Fax NumbersmohammedNo ratings yet

- Accounting equation problems and solutionsDocument2 pagesAccounting equation problems and solutionsSenthil ArasuNo ratings yet

- Student Partners Program (SPP) ChecklistDocument4 pagesStudent Partners Program (SPP) ChecklistSoney ArjunNo ratings yet

- Jaen Public Market Efficiency Plan - FinalDocument126 pagesJaen Public Market Efficiency Plan - FinalBebot Bolisay100% (2)

- Botswana Review 2010Document176 pagesBotswana Review 2010BrabysNo ratings yet

- Network PlanningDocument59 pagesNetwork PlanningVignesh ManickamNo ratings yet

- CCS NewsletterDocument2 pagesCCS NewsletterCindy Mitchell KirbyNo ratings yet

- CKB Bonded Logistics Center Presentation Kit - Rev - 2017Document31 pagesCKB Bonded Logistics Center Presentation Kit - Rev - 2017Yôgáà C Erlànggà100% (2)

- John Ashton Arizona Speech 2013Document6 pagesJohn Ashton Arizona Speech 2013climatehomescribdNo ratings yet

- Finance Manager Reporting Planning in Los Angeles, CA ResumeDocument2 pagesFinance Manager Reporting Planning in Los Angeles, CA ResumeRCTBLPONo ratings yet

- Impact of Annales School On Ottoman StudiesDocument16 pagesImpact of Annales School On Ottoman StudiesAlperBalcıNo ratings yet

- Example Accounting Ledgers ACC406Document5 pagesExample Accounting Ledgers ACC406AinaAteerahNo ratings yet

- IE Singapore MRA GrantDocument4 pagesIE Singapore MRA GrantAlfizanNo ratings yet

- Suburban Nation: The Rise of Sprawl and The Decline of The American DreamDocument30 pagesSuburban Nation: The Rise of Sprawl and The Decline of The American DreamFernando Abad100% (1)

- FLYFokker Fokker 70 Leaflet - 1Document4 pagesFLYFokker Fokker 70 Leaflet - 1FredyBrizuelaNo ratings yet

- BELENDocument22 pagesBELENLuzbe BelenNo ratings yet

- Teacher's Notes - Reading File 7: Learning Objectives in This LessonDocument1 pageTeacher's Notes - Reading File 7: Learning Objectives in This LessonKsusha HNo ratings yet

- Indonesian Maritime Logistics Reforms Support Early ImpactsDocument8 pagesIndonesian Maritime Logistics Reforms Support Early ImpactsOctadian PNo ratings yet

- B.Satyanarayana Rao: PPT ON Agricultural Income in Indian Income Tax Act 1961Document17 pagesB.Satyanarayana Rao: PPT ON Agricultural Income in Indian Income Tax Act 1961EricKenNo ratings yet

- López Quispe Alejandro MagnoDocument91 pagesLópez Quispe Alejandro MagnoAssasin WildNo ratings yet

- Why Do Famines PersistDocument9 pagesWhy Do Famines PersistJose Maria CisnerosNo ratings yet