Professional Documents

Culture Documents

Unit-Iv Production Cost Estimation

Uploaded by

mechgokul0 ratings0% found this document useful (0 votes)

69 views58 pagescost estimation

Original Title

unit45ppce-161120044909

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcost estimation

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

69 views58 pagesUnit-Iv Production Cost Estimation

Uploaded by

mechgokulcost estimation

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 58

UNIT-IV

PRODUCTION COST ESTIMATION

COST ESTIMATION IN FOUNDRY SHOP:

Foundry is a metal casting process in which the metal is melted and poured into the

moulds to get the components in desired shape and size. Castings are obtained from a

foundry shop.

Generally a foundry shop has the following sections :

1. Pattern Making Section

• In this section the patterns for making the moulds are manufactured.

• The machines involved in making the patterns are very costly and small foundries

may not be able to afford these machines

• Insuch cases the pattern are got made for outside parties who are specialists in

pattern making. Patterns are made either from wood or from a metal.

2. Sand-mixing Section

In this section raw sand is washed to remove clay etc., and various ingredients are

added in the sand for making the cores and moulds.

3. Core-making Section

Cores are made in this section and used in moulds to provide holes or cavities in the

castings.

4.Mould Making Section

This is the section where moulds are made with the help of patterns. The moulds

may be made manually or with moulding machines

5. Melting Section

Metal is melted in the furnace and desired composition of metal is attained by adding

various constituents. Metal may be melted in a cupola or in an induction or in an arc

furnace. In some cases pit furnace is also used for melting the metals.

6. Fettling Section

The molten metal after pouring in the moulds is allowed to cool and the casting is

then taken out of mould. The casting is then cleaned to remove sand and extra

material and is shot blasted in fettling section. In fettling operation risers, runners

and gates are cut off and removed.

7. Inspection Section

The castings are inspected in the inspection section before being sent out of the

factory.

ESTIMATION OF COST OF CASTINGS

The total cost of manufacturing a component consists of following elements :

1. Material cost.

2. Labour cost.

3. Direct other expenses.

4. Overhead expenses

1. Material Cost

(a) Cost of material required for casting is calculated as follows :

(i) From the component drawing, calculate the volume of material required for

casting. This volume multiplied by density of material gives the net weight of the

casting.

(ii) Add the weight of process scrap i.e. weight of runners, gates and risers and

other material consumed as a part of process in getting the casting.

(iii) Add the allowance for metal loss in oxidation in furnace, in cutting the gates

and runners and over runs etc.

(iv) Multiply the total weight by cost per unit weight of the material used.

(v) Subtract the value of scarp return from the amount obtained in step (iv), to get

the direct material cost.

(b) In addition to the direct material, various other materials are used in the process

of manufacture of a casting. Some of the materials are :

(i) Materials required in melting the metal, i.e., coal, limestone and other fluxes etc. The

cost of these materials is calculated by tabulating the value of material used on per

tonne basis and then apportioned on each item.

(ii) Material used in core shop for making the cores, i.e., oils, binders and refractories etc.

The cost of core materials is calculated depending upon the core size and method of

making the core. Similarly the cost of moulding sand ingredients is also calculated.

The expenditure made on these materials is generally expressed as per kg of casting

weight and is covered under overhead costs.

2. Labour Cost

Labour is involved at various stages in a foundry shop. Broadly it is divided into two

categories :

(i) The cost of labour involved in making the cores, baking of cores and moulds is based

on the time taken for making various moulds and cores.

(ii) The cost of labour involved in firing the furnace, melting and pouring of the metal.

Cleaning of castings, fettling, painting of castings etc., is generally calculated on the basis

of per kg of cast weight.

3. Direct Other Expenses

Direct expenses include the expenditure incurred on patterns, core boxes, cost of using

machines and other items which can be directly identified with a particular product. The

cost of patterns, core boxes etc., is distributed on per item basis.

4. Overhead Expenses

The overheads consist of the salary and wages of supervisory staff, pattern shop staff

and inspection staff, administrative expenses, water and electricity charges etc. The

overheads are generally expressed as percentage of labour charges.

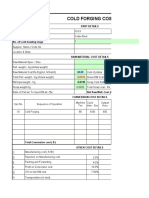

1.Calculate the total cost of CI (Cast Iron) cap shown in Fig. 5.1, from the following

data :

Cost of molten iron at cupola spout = Rs. 30 per kg

Process scrap = 17 percent of net wt. of casting

Process scrap return value = Rs. 5 per kg

Administrative overhead charges = Rs. 2 per kg of metal poured.

Density of material used = 7.2 gms/cc

Solution:

2.A cast iron component is to be manufactured as per Fig. 5.2. Estimate the selling

price per piece from the following data :

Density of material = 7.2 gms/cc

Cost of molten metal at cupola spout = Rs. 20 per kg

Process scrap = 20 percent of net weight

Scrap return value = Rs. 6 per kg

Administrative overheads = Rs. 30 per hour

Sales overheads = 20 percent of factory cost

Profit = 20 percent of factory cost

COST ESTIMATION IN WELDING SHOP

Gas welding :

• The most commonly used gas welding is oxy-acetylene welding. The high temperature

required for welding is obtained by the application of a flame from mixture of oxygen

and acetylene gas.

• The filler material is used to fill the gap between the parts to be welded.

• The welding technique used may be leftward welding or rightward welding.

Leftward welding : In this method, welding is started from right hand side of the

joint and proceeds towards left. This method is used for welding plates upto 5 mm

thick. No edge preparation is required in case of the plates of thickness upto 3 mm.

Rightward welding : This method is adopted for welding thicker plates. Welding

proceeds from left to right. The flame is directed towards the deposited metal and rate

of cooling is very slow

Estimation of Cost in Welding

The total cost of welding consists of the following elements :

1. Direct material cost.

2. Direct labour cost.

3. Direct other expenses.

4. Overheads.

1. Direct Material Cost

The direct material cost in a welded component consists of the following :

(i) Cost of base materials to be welded i.e., sheet, plate, rolled section, casting or

forging. This cost is calculated separately.

(ii) Cost of electrodes/filler material used. The electrode consumption can be estimated

by using the charts supplied by the suppliers. Another way to find the actual weight of

weld metal deposited is to weigh the component before and after the welding and

making allowance for stub end and other losses during welding.

Also the weight of weld metal = Volume of weld × Density of weld material

2. Direct Labour Cost

The direct labour cost is the cost of labour for preparation, welding and finishing

operations.

• Preparation or pre-welding labour cost is the cost associated with preparation of

job for welding, i.e., the edge preparation, machining the sections to be welded

etc. If gas is used in cutting/preparation of edges, its cost is also taken care of.

• Cost of labour in actual welding operation is calculated considering the time in

which arc is actually in operation.

• The cost of labour for finishing operation is the cost of labour involved in

grinding, machining, sand or shot blasting, heat treatment or painting of welded

joints.

3. Direct Other Expenses

The direct other expenses include the cost of power consumed, cost of fixtures used

for a particular job etc.

Cost of power : The cost of power consumed in arc welding can be calculated from the

following formula :

4. Overheads

The overheads include the expenses due to office and supervisory staff, lighting

charges of office and plant, inspection, transport, cost of consumables and

other charges. The cost of equipment is also apportioned to the individual

components in the form of depreciation.

You might also like

- Cost SequenceDocument6 pagesCost SequenceCharanjeet SinghNo ratings yet

- Cost Estimation in Forging Shop 611Document28 pagesCost Estimation in Forging Shop 611Serajul Haque100% (1)

- Fundamentals of CuttingDocument56 pagesFundamentals of CuttingTrevor WarnerNo ratings yet

- Cost Analysis and Cost Reduction of ForgingsDocument16 pagesCost Analysis and Cost Reduction of ForgingsHans wilsonNo ratings yet

- Estimating, Costing and Contracting (ECC)Document5 pagesEstimating, Costing and Contracting (ECC)Bharath A100% (1)

- Mechanical Working of MetalsDocument76 pagesMechanical Working of MetalsPradip GuptaNo ratings yet

- Laminated Object Manufacturing (LOM)Document19 pagesLaminated Object Manufacturing (LOM)PritamKumarPradhan100% (3)

- Casting Cost EstimationDocument3 pagesCasting Cost EstimationSreenath S KallaaraNo ratings yet

- Metal Casting Process - 3Document11 pagesMetal Casting Process - 3kiran_wakchaureNo ratings yet

- Welding Cost Formula For Different Welding ProcessesDocument2 pagesWelding Cost Formula For Different Welding ProcessesmekoxxxNo ratings yet

- Ppce - Unit2. Ppts. 02 Aug 15Document26 pagesPpce - Unit2. Ppts. 02 Aug 15Shivam RajNo ratings yet

- 2000 09 JIMT Cost Estimation Injection MoldingDocument11 pages2000 09 JIMT Cost Estimation Injection MoldingVictor Villouta LunaNo ratings yet

- Amie Fundamentals of Design and Manufacturing DesignDocument3 pagesAmie Fundamentals of Design and Manufacturing DesignAhmed Abotoor50% (6)

- Design of Jigs and Fixtures 2 MarksDocument16 pagesDesign of Jigs and Fixtures 2 MarksParamasivam Veerappan100% (1)

- Force Power in Metal CuttingDocument7 pagesForce Power in Metal CuttingRavinder AntilNo ratings yet

- Lecture-14 Sheet Metal Forming ProcessesDocument34 pagesLecture-14 Sheet Metal Forming ProcessesDida KhalingNo ratings yet

- Incremental Forming in Tailor Welded BlanksDocument24 pagesIncremental Forming in Tailor Welded BlanksSitanshu S0% (1)

- 07 Final Rapid Prototype ReportDocument16 pages07 Final Rapid Prototype ReportpallaviNo ratings yet

- Design of Pelletizing MachineDocument4 pagesDesign of Pelletizing Machinepoulad pousheshNo ratings yet

- Machinery Cost Estimates-IIIDocument52 pagesMachinery Cost Estimates-IIIioanchiNo ratings yet

- Unit 3 MCQ MPDocument11 pagesUnit 3 MCQ MPSandip AwaghadeNo ratings yet

- Sheet Metal Bend AllowanceDocument3 pagesSheet Metal Bend AllowancePrithviraj DagaNo ratings yet

- Blanking Process Cost CalculationDocument3 pagesBlanking Process Cost CalculationVenkateswaran venkateswaran100% (1)

- My ForgingDocument20 pagesMy ForgingRam Janm SinghNo ratings yet

- Automats and Tool LayoutsDocument20 pagesAutomats and Tool LayoutsAyesha IshuNo ratings yet

- Lecture No. 7 Turning ParametersDocument29 pagesLecture No. 7 Turning ParametersMuhammad IrfanNo ratings yet

- Part/Material Inputs: Injection Molding Technical Cost Model MIT - Materials Systems LaboratoryDocument13 pagesPart/Material Inputs: Injection Molding Technical Cost Model MIT - Materials Systems LaboratoryEmba MadrasNo ratings yet

- Estimation of Machining TimeDocument6 pagesEstimation of Machining TimeSuhas100% (1)

- Machine Tool Vibration and DampersDocument42 pagesMachine Tool Vibration and DampersLuis NunesNo ratings yet

- PRESSTOOL MASTER 1st SemDocument111 pagesPRESSTOOL MASTER 1st Semmathapatikumar56No ratings yet

- The Sheet Metal Deep DrawnDocument3 pagesThe Sheet Metal Deep DrawnjoaopedrosousaNo ratings yet

- Reaction Injection MoldingDocument8 pagesReaction Injection MoldingAmeer_Takashim_9385No ratings yet

- A Small Report On The Steel Melting Shop at Bokaro Steel PlantDocument4 pagesA Small Report On The Steel Melting Shop at Bokaro Steel PlantSrikant Mahapatra0% (1)

- Design and Fabrication of Spur Gear Cutting Attachment For Lathe MachineDocument10 pagesDesign and Fabrication of Spur Gear Cutting Attachment For Lathe MachineIJRASETPublicationsNo ratings yet

- Additive Manufacturing Student NotesDocument90 pagesAdditive Manufacturing Student NotesUdayaKumar100% (1)

- Design of Angular Post JigDocument41 pagesDesign of Angular Post JigRobo Raja100% (2)

- New Instructions Manual - New (30-06-2022)Document19 pagesNew Instructions Manual - New (30-06-2022)rarhi.krish8480No ratings yet

- Estimating and CostingDocument135 pagesEstimating and CostingShamim AkhtarNo ratings yet

- Theory of Metal CuttingDocument24 pagesTheory of Metal CuttingOmkar BedadeNo ratings yet

- GPI - Cost Sheet For Cap Prodcution-2Document54 pagesGPI - Cost Sheet For Cap Prodcution-2Narayana MugalurNo ratings yet

- Thermal Aspects of Machining Module 1Document75 pagesThermal Aspects of Machining Module 1Libin AbrahamNo ratings yet

- Value Engg 3 8.fucntion Cost Worth AnalysisDocument11 pagesValue Engg 3 8.fucntion Cost Worth AnalysisVenkateshanNo ratings yet

- 6-2 Machining Processes IDocument44 pages6-2 Machining Processes IOmar Ahmed100% (1)

- MachinabilityDocument5 pagesMachinabilityAshwin KumarNo ratings yet

- Manufacturing TechnologyDocument41 pagesManufacturing Technologysharmashn50% (2)

- Process Planning & Cost Estimation - Department of Mechanical EngineeringDocument12 pagesProcess Planning & Cost Estimation - Department of Mechanical EngineeringRoji C SajiNo ratings yet

- Unit-V (Advanced Forming Processes)Document30 pagesUnit-V (Advanced Forming Processes)Er Vishal Divya Jagadale100% (1)

- Bimetal Desingers GuideDocument50 pagesBimetal Desingers GuideAnjana2893No ratings yet

- Sheet Metal WorkingDocument23 pagesSheet Metal WorkingSujit MishraNo ratings yet

- 94.cold Forging Cost Estimation SheetDocument5 pages94.cold Forging Cost Estimation SheetVenkateswaran venkateswaranNo ratings yet

- Powder MetallurgyDocument24 pagesPowder MetallurgyMilan PanchalNo ratings yet

- Orbital ForgingDocument4 pagesOrbital ForgingMrLanternNo ratings yet

- Forging, Rolling, Extrusion and Drawing ProcessesDocument45 pagesForging, Rolling, Extrusion and Drawing ProcessesHarshan Arumugam100% (1)

- MACHINING-lathe and Milling)Document29 pagesMACHINING-lathe and Milling)YosephNo ratings yet

- Workshop PracticeDocument87 pagesWorkshop Practiceahmedkhalidhussain100% (2)

- Production Planning & ControlDocument24 pagesProduction Planning & ControlHari Prasad Reddy Yedula100% (1)

- Lecture Notes-IIIDocument20 pagesLecture Notes-IIITuğbaNo ratings yet

- Open Ended ProjectDocument7 pagesOpen Ended Projectmahesh kulkarniNo ratings yet

- ME6005/Process Planning & Cost Estimation Year/sem:IV/VIIDocument13 pagesME6005/Process Planning & Cost Estimation Year/sem:IV/VIIArshad RSNo ratings yet

- Pollution From Si Engines & Their ControlDocument49 pagesPollution From Si Engines & Their Controlewee76No ratings yet

- Cryogenics Liquid Hydrogen StorageDocument17 pagesCryogenics Liquid Hydrogen Storagemechgokul0% (1)

- GATE Mechanical Question Paper 2013Document13 pagesGATE Mechanical Question Paper 2013robinthomas9900No ratings yet

- Radiation Heat TransferDocument36 pagesRadiation Heat TransfermechgokulNo ratings yet

- National Certification Examination 2004: FOR Energy ManagersDocument6 pagesNational Certification Examination 2004: FOR Energy ManagersAnonymous syHQ7YANo ratings yet

- Solar Energy Notes 3Document5 pagesSolar Energy Notes 3mechgokulNo ratings yet

- U-3 Rankine CycleDocument12 pagesU-3 Rankine CyclemechgokulNo ratings yet

- QpmeDocument16 pagesQpmeSandeep PandeyNo ratings yet

- Principle Investigator: Prof. R.V. Ravikrishna, Indian Institute of Science (Iisc), BangaloreDocument1 pagePrinciple Investigator: Prof. R.V. Ravikrishna, Indian Institute of Science (Iisc), BangaloremechgokulNo ratings yet

- MM4GDP - Final Report - Biogas PDFDocument52 pagesMM4GDP - Final Report - Biogas PDFmechgokulNo ratings yet

- Ministry of New and Renewable Energy (Bio-Energy Technology Development Group-BGFP)Document3 pagesMinistry of New and Renewable Energy (Bio-Energy Technology Development Group-BGFP)mechgokul100% (1)

- Planning and Design For Commercialization of Biogas Bottling Plant For Production of Green and Low Cost Fuel With Utilization of Biomass ResourcesDocument4 pagesPlanning and Design For Commercialization of Biogas Bottling Plant For Production of Green and Low Cost Fuel With Utilization of Biomass ResourcesBiswa Jyoti GuptaNo ratings yet

- Subhashri - M P No. 11 of 2013Document29 pagesSubhashri - M P No. 11 of 2013mechgokulNo ratings yet

- Professional Ethics ObjectiveDocument5 pagesProfessional Ethics ObjectivemechgokulNo ratings yet

- 2.7 Cogeneration - Revised (Table Format) PDFDocument9 pages2.7 Cogeneration - Revised (Table Format) PDFSagar Sanjay SonawaneNo ratings yet

- You Should Spend About 20 Minutes On This Task.: DearDocument2 pagesYou Should Spend About 20 Minutes On This Task.: DearmechgokulNo ratings yet

- 2.8 Waste Heat BasicsDocument9 pages2.8 Waste Heat BasicsRajwardhan PawarNo ratings yet

- 2.5 Insulation & RefractoriesDocument9 pages2.5 Insulation & Refractoriesriyazcomm_257961932No ratings yet

- 2.2 BoilersDocument9 pages2.2 BoilersSalihibnuali KpNo ratings yet

- 151 ADocument19 pages151 AViru JaiNo ratings yet

- 2.4 Furnaces - Revised (Table Format) PDFDocument7 pages2.4 Furnaces - Revised (Table Format) PDFSagar Sanjay SonawaneNo ratings yet

- Chapter 2.3: Steam System: Part-I: Objective Type Questions and AnswersDocument7 pagesChapter 2.3: Steam System: Part-I: Objective Type Questions and Answersmaran2786No ratings yet

- FBC BoilersDocument8 pagesFBC Boilerssk3146No ratings yet

- 2.1 Fuels - CombustionDocument8 pages2.1 Fuels - Combustionank_mehraNo ratings yet

- Cryogenics Liquid Hydrogen StorageDocument17 pagesCryogenics Liquid Hydrogen Storagemechgokul0% (1)

- Evolution of Entrepreneurship in IndiaDocument10 pagesEvolution of Entrepreneurship in IndiamechgokulNo ratings yet

- Unit 2Document28 pagesUnit 2mechgokulNo ratings yet

- Em3a PDFDocument7 pagesEm3a PDFMayukh DebdasNo ratings yet

- Rural EntrepreneurshipDocument32 pagesRural EntrepreneurshipmechgokulNo ratings yet

- Rural EntrepreneurshipDocument32 pagesRural EntrepreneurshipmechgokulNo ratings yet

- Lesson Tasks: Lesson Plan: Addition and Subtraction To 20Document2 pagesLesson Tasks: Lesson Plan: Addition and Subtraction To 20Марина СтанојевићNo ratings yet

- An Overview of Marketing - Week 1Document7 pagesAn Overview of Marketing - Week 1Jowjie TVNo ratings yet

- Homelite 18V Hedge Trimmer - UT31840 - Users ManualDocument18 pagesHomelite 18V Hedge Trimmer - UT31840 - Users ManualgunterivNo ratings yet

- Code of Conduct For Public OfficialDocument17 pagesCode of Conduct For Public OfficialHaNo ratings yet

- Notes 3 Mineral Dressing Notes by Prof. SBS Tekam PDFDocument3 pagesNotes 3 Mineral Dressing Notes by Prof. SBS Tekam PDFNikhil SinghNo ratings yet

- Nurses Guide To Family Assessment and InterventionDocument9 pagesNurses Guide To Family Assessment and InterventionKaye CorNo ratings yet

- Leonard Nadler' ModelDocument3 pagesLeonard Nadler' ModelPiet Gabz67% (3)

- QFW Series SteamDocument8 pagesQFW Series Steamnikon_fa50% (2)

- Abhishek Parmar: Personal DetailsDocument2 pagesAbhishek Parmar: Personal DetailsabhishekparmarNo ratings yet

- Proposal For A Working Procedure To Accurately Exchange Existing and New Calculated Protection Settings Between A TSO and Consulting CompaniesDocument9 pagesProposal For A Working Procedure To Accurately Exchange Existing and New Calculated Protection Settings Between A TSO and Consulting CompaniesanonymNo ratings yet

- LC 67002000 B Hr-Jumbo enDocument2 pagesLC 67002000 B Hr-Jumbo enJulio OrtegaNo ratings yet

- BPI - I ExercisesDocument241 pagesBPI - I Exercisesdivyajeevan89No ratings yet

- The Role of IT in TQM L'Oreal Case StudyDocument9 pagesThe Role of IT in TQM L'Oreal Case StudyUdrea RoxanaNo ratings yet

- A Database For Handwritten Text Recognition ResearchDocument5 pagesA Database For Handwritten Text Recognition Researchtweety492No ratings yet

- Permeability PropertiesDocument12 pagesPermeability Propertieskiwi27_87No ratings yet

- Title - Dating Virtual To Coffee Table Keywords - Dating, Application BlogDocument3 pagesTitle - Dating Virtual To Coffee Table Keywords - Dating, Application BlogRajni DhimanNo ratings yet

- GNT 52 60HZ enDocument4 pagesGNT 52 60HZ enEduardo VicoNo ratings yet

- Fortigate System Admin 40 Mr2Document115 pagesFortigate System Admin 40 Mr2KhaleelNo ratings yet

- MVC Training Course Prerequisite: WWW - Focustech.InDocument2 pagesMVC Training Course Prerequisite: WWW - Focustech.InLakshman Samanth ReddyNo ratings yet

- P&CDocument18 pagesP&Cmailrgn2176No ratings yet

- Sailpoint Topic Wise SyllabusDocument2 pagesSailpoint Topic Wise SyllabusKishore KodaliNo ratings yet

- EDL E-Catalogue 2021-22 With ApticoDocument78 pagesEDL E-Catalogue 2021-22 With Apticotkteetopoi1No ratings yet

- A Quick Guide To Artificial IntelligenceDocument41 pagesA Quick Guide To Artificial IntelligenceFrancis Violet Raymond100% (2)

- The Impact of Online Games To The AcademicDocument20 pagesThe Impact of Online Games To The AcademicJessica BacaniNo ratings yet

- Vishakha BroadbandDocument6 pagesVishakha Broadbandvishakha sonawaneNo ratings yet

- Inglês - Advérbios - Adverbs.Document18 pagesInglês - Advérbios - Adverbs.KhyashiNo ratings yet

- Army Public School No.1 Jabalpur Practical List - Computer Science Class - XIIDocument4 pagesArmy Public School No.1 Jabalpur Practical List - Computer Science Class - XIIAdityaNo ratings yet

- TDS-11SH Top Drive D392004689-MKT-001 Rev. 01Document2 pagesTDS-11SH Top Drive D392004689-MKT-001 Rev. 01Israel Medina100% (2)

- Part TOEFLDocument7 pagesPart TOEFLFrisca Rahma DwinantiNo ratings yet

- Ton Miles Calculation 1Document17 pagesTon Miles Calculation 1Alexander Armando Clemente Andrade100% (1)