Professional Documents

Culture Documents

2016 Form1095C

Uploaded by

patOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2016 Form1095C

Uploaded by

patCopyright:

Available Formats

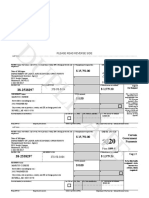

VOID CORRECTED OMB No.

1545-2251 2016

Form 1095-C

APPLICABLE LARGE EMPLOYER'S name, street address, city or town, Employee Offer of Coverage Employer

state or province, country, ZIP or foreign postal code, and telephone no.

Plan Start 14 Offer of 15 Employee Required 16 Section Provided

ROUND STAR INC. Month Coverage Contribution (see 4980H Safe Health

SUPER SOCCER STARS (NY) (Enter (enter instructions) Harbor and

606 COLUMBUS AVENUE 2-digit no.): required Other Relief Insurance

SECOND FLOOR

code) (enter code,

if applicable)

Offer and

NEW YORK CITY NY 10024 12 Coverage

All 12

(646) 793-4805 Months $

Jan 1E $ 239.98

Feb 1E $ 239.98 For Privacy

EMPLOYEE'S name, address, ZIP/postal code & country Mar 1E $ 239.98 Act and

PETER P AMOS Apr 1E $ 239.98 Paperwork

1530 PALISADES AVE Reduction

May 1E $ 239.98

FORT LEE NJ 07024 Act Notice,

Jun 1E $ 239.98 see separate

Jul 1E $ 239.98 instructions.

Do not attach to your tax return. Keep for your records. Aug 1E $ 239.98

Information about Form 1095-C and its separate

instructions is at www.irs.gov/form1095c Sep 1E $ 239.98

APPLICABLE LARGE EMPLOYER'S EMPLOYEE'S social security Oct 1H $ 2A

identification number (EIN) number (SSN) Department of the

Nov 1H $ 2A Treasury -- IRS

13-4136085 XXX-XX-1321 Dec 1H $ 2A 38-2099803

Covered Individuals If Employer provided self-insured coverage, check the box and enter information for each individual enrolled in coverage, including the employee.

(c) DOB (If SSN or other

(d) (e) Months of coverage

(a) Name of covered individual(s) (b) SSN or other TIN TIN is not available)

Covered

all 12 mos. Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

17

18

19

20

21

22

CAA 6 B1095CI NTF 2580809 B95CHPREC Copyright 2016 Greatland/Nelco - Forms Software Only

coverage subsidized by the premium tax credit for you, your spouse, and dependent(s).

Instructions for Recipient For more information about the premium tax credit, see Pub. 974.

You are receiving this Form 1095-C because your employer is an Applicable Large

Employer subject to the employer shared responsibility provision in the Affordable Care 1A. Minimum essential coverage providing minimum value offered to you with an

Act. This Form 1095-C includes information about the health insurance coverage offered employee required contribution for self-only coverage equal to or less than 9.5% (as

to you by your employer. Form 1095-C, Employee Offer of Coverage section, includes adjusted) of the 48 contiguous states single federal poverty line and minimum essential

information about the coverage, if any, your employer offered to you and your spouse and coverage offered to your spouse and dependent(s) (referred to here as a Qualifying

dependent(s). If you purchased health insurance coverage through the Health Insurance Offer). This code may be used to report for specific months for which a Qualifying

Marketplace and wish to claim the premium tax credit, this information will assist you in Offer was made, even if you did not receive a Qualifying Offer for all 12 months of the

determining whether you are eligible. For more information about premium tax credit, see calendar year. For information on the adjustment of the 9.5%, see IRS.gov.

Pub. 974, Premium Tax Credit (PTC). You may receive multiple Forms 1095-C if you had 1B. Minimum essential coverage providing minimum value offered to you and minimum

multiple employers during the year that were Applicable Large Employers (for example, essential coverage NOT offered to your spouse or dependent(s).

you left employment with one Applicable Large Employer and began a new position of 1C. Minimum essential coverage providing minimum value offered to you and minimum

employment with another Applicable Large Employer). In that situation, each Form essential coverage offered to your dependent(s) but NOT your spouse.

1095-C would have information only about health insurance coverage offered to you by

employer identified on form. If your employer is not an Applicable Large Employer it is not 1D. Minimum essential coverage providing minimum value offered to you and minimum

required to furnish you a Form 1095-C providing info. about health coverage it offered. essential coverage offered to your spouse but NOT your dependent(s).

In addition, if you, or any other individual who is offered health coverage because of 1E. Minimum essential coverage providing minimum value offered to you and minimum

their relationship to you (referred to here as family members), enrolled in your employer's essential coverage offered to your dependent(s) and spouse.

health plan & that plan is a type of plan referred to as a "self-insured" plan, Form 1095-C, 1F. Minimum essential coverage NOT providing minimum value offered to you, or you

Covered Individuals section provides information to assist you in completing your income and your spouse or dependent(s), or you, your spouse, and dependent(s).

tax return by showing you or those family members had qualifying health coverage

(referred to as "minimum essential coverage") for some or all months during the year. 1G. You were NOT a full-time employee for any month of the calendar year but were

enrolled in self-insured employer-sponsored coverage for one or more months of the

If your employer provided you or a family member health coverage through an insured calendar year. This code will be entered in the All 12 Months box or in the separate

health plan or in another manner, issuer of the insurance or sponsor of the plan providing monthly boxes for all 12 calendar months on line 14.

the coverage will furnish you information about the coverage separately on Form 1095-B,

Health Coverage. Similarly, if you or family member obtained minimum essential coverage 1H. No offer of coverage (you were NOT offered any health coverage or you were

from another source, such as a government-sponsored program, an individual market offered coverage that is NOT minimum essential coverage).

plan, or miscellaneous coverage designated by the Department of Health and Human 1I. Reserved.

Services, the provider of that coverage will furnish you information about that coverage 1J. Minimum essential coverage providing minimum value offered to you; minimum

on Form 1095-B. If you or a family member enrolled in a qualified health plan through a essential coverage conditionally offered to your spouse; and minimum essential

Health Insurance Marketplace, the Health Insurance Marketplace will report information coverage NOT offered to your dependent(s).

about that coverage on Form 1095-A, Health Insurance Marketplace Statement.

Employers are required to furnish Form 1095-C only to the employee. As the

1K. Minimum essential coverage providing minimum value offered to you; minimum

TIP recipient of this Form 1095-C, you should provide a copy to any family members

essential coverage conditionally offered to your spouse; and minimum essential

coverage offered to your dependent(s).

covered under a self-insured employer-sponsored plan listed in the Covered Individuals

section if they request it for their records. Line 15. Reports employee required contribution, which is monthly cost to you for

lowest-cost self-only minimum essential coverage providing minimum value that your

Employee employer offered you. The amount reported on line 15 may not be the amount you paid

Reports information about you, the employee. Reports your social security number (SSN). for coverage if, for example, you chose to enroll in more expensive coverage such as

For your protection, this form may show only the last four digits of your SSN. However, family coverage. Line 15 will show amt. only if code 1B, 1C, 1D, 1E, 1J, or 1K is entered

the employer is required to report your complete SSN to the IRS. on line 14. If you were offered coverage but there is no cost to you for coverage, this

! If you do not provide your SSN and the SSNs of all covered individuals to line will report a "0.00" for amt. For more information, including on how your eligibility

CAUTION the plan administrator, the IRS may not be able to match the Form 1095-C

to determine that you and the other covered individuals have complied

for other healthcare arrangements might affect amt. reported on line 15, see IRS.gov.

with the individual shared responsibility provision. For covered individuals other than

Line 16. Provides IRS information to administer the employer shared responsibility

provisions. Other than a code 2C which reflects your enrollment in your employer's

the employee listed in the Employee's section, a Taxpayer Identification Number (TIN) coverage, none of this information affects your eligibility for the premium tax credit.

may be provided instead of SSN. See the Covered Individuals section. For more information about the employer shared responsibility provisions, see IRS.gov.

Applicable Large Employer Covered Individuals, Lines 17-22

Reports information about your employer. This includes a telephone number for the Reports name, SSN (or TIN for covered individuals other than the listed employee), and

person whom you may call if you have questions about the information reported on the coverage info. about each individual (including any full-time employee & non-full-time

form or to report errors in the information on the form and ask that they be corrected. employee, & any employee's family members) covered under employer's health plan, if

Employer Offer of Coverage, Lines 14-16 plan is "self-insured." A date of birth will be entered in column (c) only if SSN (or TIN for

Line 14. The codes listed below for line 14 describe the coverage that your employer covered individuals other than listed employee) is not entered in column (b). Column (d)

offered to you and your spouse and dependent(s), if any. (If you received an offer of will be checked if individual was covered for at least 1 day in every month of the year.

coverage through a multiemployer plan due to your membership in a union, that offer For individuals who were covered for some but not all months, info. will be entered in

may not be shown on line 14.) The information on line 14 relates to eligibility for column (e) indicating the months for which these individuals were covered. If there

are more than 6 covered individuals, you will receive one or more additional form(s).

You might also like

- Sean 2022 Tax ReturnDocument18 pagesSean 2022 Tax Returnaaakinkumi115100% (1)

- Sipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Document2 pagesSipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Suesa ThapaliyaNo ratings yet

- 1099-R tax form detailsDocument3 pages1099-R tax form detailsRichy FeeneyNo ratings yet

- W2 FinalDocument1 pageW2 FinalWaqar Hussain100% (1)

- Ayyappa Pasupuleti 6883 S IVY WAY APT 13 302 Engelwood, CO 80112Document3 pagesAyyappa Pasupuleti 6883 S IVY WAY APT 13 302 Engelwood, CO 80112swaroopg mphasisNo ratings yet

- 2021 W-2 and Earnings SummaryDocument2 pages2021 W-2 and Earnings SummaryKawljeet Singh KohliNo ratings yet

- 2022 46-1240832 XXX-XX-8976 1410.00: CORRECTED (If Checked)Document2 pages2022 46-1240832 XXX-XX-8976 1410.00: CORRECTED (If Checked)Minerva BetancourtNo ratings yet

- StubsDocument2 pagesStubsAnonymous 8C2bCutL0100% (2)

- CORRECTED (If Checked)Document2 pagesCORRECTED (If Checked)DennisNo ratings yet

- Tri Merge Credit Report SampleDocument9 pagesTri Merge Credit Report SampleHimani SachdevNo ratings yet

- Sarah Paredes 21w2Document2 pagesSarah Paredes 21w2Sarah ParedesNo ratings yet

- Profit Sharing Agreement SampleDocument4 pagesProfit Sharing Agreement SampleCatherine LopezNo ratings yet

- Snowflake 20 s1 A PDFDocument254 pagesSnowflake 20 s1 A PDFLaurenz NnbrNo ratings yet

- Connery 2021Document22 pagesConnery 2021ytprem agu100% (1)

- Attention:: Order Information Returns and Employer Returns OnlineDocument6 pagesAttention:: Order Information Returns and Employer Returns OnlineIRSNo ratings yet

- Tax FormDocument2 pagesTax FormJorge LuissNo ratings yet

- Form 1099GDocument2 pagesForm 1099GMarcus KreseNo ratings yet

- Maplebear, Inc. 50 Beale Street, 6th Floor San Francisco, CA 94105 1,604.65Document2 pagesMaplebear, Inc. 50 Beale Street, 6th Floor San Francisco, CA 94105 1,604.65YoSoyOscarMesaNo ratings yet

- Report on Corporate Tax Planning StrategiesDocument16 pagesReport on Corporate Tax Planning StrategiesRutu Patel0% (1)

- Bill 774719595 DDocument5 pagesBill 774719595 DKrishnasamy SanjeevanNo ratings yet

- NPS TRANSACTION SUMMARYDocument2 pagesNPS TRANSACTION SUMMARYRajakumar Reddy25% (4)

- Tax Remedies QuizDocument5 pagesTax Remedies QuizAnonymous 03JIPKRkNo ratings yet

- Bar Exam Questions Income TaxationDocument11 pagesBar Exam Questions Income TaxationG.B. SevillaNo ratings yet

- Tax Review Class-Msu Case DigestDocument156 pagesTax Review Class-Msu Case DigestShiena Lou B. Amodia-RabacalNo ratings yet

- 0LH47 0LH47 0429 20180101 1095report 001Document1 page0LH47 0LH47 0429 20180101 1095report 001charly4877No ratings yet

- W2 Matthew RussellDocument2 pagesW2 Matthew Russellmatthewrussell661No ratings yet

- SALN-Format-4 (1)Document5 pagesSALN-Format-4 (1)Edmarie P. TabacoldeNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument2 pagesSworn Statement of Assets, Liabilities and Net WorthMark DomingoNo ratings yet

- US Internal Revenue Service: F1099div - 1992Document5 pagesUS Internal Revenue Service: F1099div - 1992IRSNo ratings yet

- Attention:: Order Information Returns and Employer Returns OnlineDocument6 pagesAttention:: Order Information Returns and Employer Returns OnlineIRSNo ratings yet

- RF 1Document4 pagesRF 1sweetviolet0303No ratings yet

- fileDocument4 pagesfilepurnaprasadghimire2020No ratings yet

- US Internal Revenue Service: F5498msa - 2002Document5 pagesUS Internal Revenue Service: F5498msa - 2002IRSNo ratings yet

- Record of Employment (Roe) : Payroll DepartmentDocument2 pagesRecord of Employment (Roe) : Payroll Departmentcaadani5005No ratings yet

- 2022 1099necDocument2 pages2022 1099necShirley MazariegosNo ratings yet

- SEC Form 23-B - RCGBDocument5 pagesSEC Form 23-B - RCGBanne anneNo ratings yet

- US Internal Revenue Service: F940ez - 1997Document4 pagesUS Internal Revenue Service: F940ez - 1997IRSNo ratings yet

- (DD/MM/YYYY) : (Please See Rule 12 of The Income-Tax Rules, 1962) (Also See Attached Instructions)Document3 pages(DD/MM/YYYY) : (Please See Rule 12 of The Income-Tax Rules, 1962) (Also See Attached Instructions)nilihitaNo ratings yet

- Sf-Of-190120 - Selector Maniobra y Sensor Presión - EisaDocument1 pageSf-Of-190120 - Selector Maniobra y Sensor Presión - EisaDaidys Iveth EspinosaNo ratings yet

- 2023-1099NECDocument2 pages2023-1099NECjose.oliverosflacNo ratings yet

- US Internal Revenue Service: F940ez - 1995Document4 pagesUS Internal Revenue Service: F940ez - 1995IRSNo ratings yet

- US Internal Revenue Service: f1099ptr - 2006Document6 pagesUS Internal Revenue Service: f1099ptr - 2006IRSNo ratings yet

- US Internal Revenue Service: f1098t - 1998Document5 pagesUS Internal Revenue Service: f1098t - 1998IRSNo ratings yet

- DSP Inc 1099-11 Print - CFMDocument1 pageDSP Inc 1099-11 Print - CFMKenneth BarcottNo ratings yet

- US Internal Revenue Service: F940ez - 1998Document2 pagesUS Internal Revenue Service: F940ez - 1998IRSNo ratings yet

- 2018 Saln Revised 2015Document3 pages2018 Saln Revised 2015Billones Rebalde MarnelleNo ratings yet

- 1099 HsuxixfkrDocument1 page1099 HsuxixfkrhayyandaiNo ratings yet

- Attention:: by U.S. Mail (Or by CallingDocument6 pagesAttention:: by U.S. Mail (Or by CallingIRSNo ratings yet

- US Internal Revenue Service: F1099oid - 1992Document5 pagesUS Internal Revenue Service: F1099oid - 1992IRSNo ratings yet

- 2015 SALN Form Uncle BongDocument4 pages2015 SALN Form Uncle BongJayson Ayon MendozaNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument1 pageCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasMARJONNo ratings yet

- US Internal Revenue Service: F5498msa - 2000Document5 pagesUS Internal Revenue Service: F5498msa - 2000IRSNo ratings yet

- Form 8822 (Rev. October 2015)Document2 pagesForm 8822 (Rev. October 2015)tiffany jeffcoatNo ratings yet

- Open Unemployment Benefits LetterDocument2 pagesOpen Unemployment Benefits Letterpenelope feitNo ratings yet

- Attention:: by U.S. Mail (Or by CallingDocument6 pagesAttention:: by U.S. Mail (Or by CallingIRSNo ratings yet

- US Internal Revenue Service: F1099int - 1992Document4 pagesUS Internal Revenue Service: F1099int - 1992IRSNo ratings yet

- Sworn Statement of Assets, Liabilities and Networth: A. Real PropertiesDocument3 pagesSworn Statement of Assets, Liabilities and Networth: A. Real PropertiesJudith CabisoNo ratings yet

- Unemployment compensation and state tax infoDocument1 pageUnemployment compensation and state tax infoJackson kaylaNo ratings yet

- International Purchase Order: Supplier DetailsDocument1 pageInternational Purchase Order: Supplier DetailsMichael martinezNo ratings yet

- US Internal Revenue Service: F940ez - 1999Document2 pagesUS Internal Revenue Service: F940ez - 1999IRSNo ratings yet

- Mel RoeDocument2 pagesMel RoejesseNo ratings yet

- Forsyth County: Be Filed inDocument18 pagesForsyth County: Be Filed inpds1100% (2)

- Cover Sheet: COL Financial Group, IncDocument3 pagesCover Sheet: COL Financial Group, IncIrene SalvadorNo ratings yet

- Intraperiod Tax AllocationDocument2 pagesIntraperiod Tax AllocationAllen KateNo ratings yet

- Govt BudgetDocument21 pagesGovt BudgetDaily SnapfeedNo ratings yet

- 2023 Slides On Exempt IncomeDocument31 pages2023 Slides On Exempt IncomeSiphesihleNo ratings yet

- 1 Basic SardaDocument12 pages1 Basic Sardaniko.tpNo ratings yet

- Week 1Document14 pagesWeek 1kohalehNo ratings yet

- GST Assignment1.1lDocument3 pagesGST Assignment1.1lHamza AliNo ratings yet

- Author Name: Shubham MishraDocument17 pagesAuthor Name: Shubham MishraShubham MishraNo ratings yet

- Income Tax Rates: For AY 2021-22 (New) & A.Y. 2020-21 (Old)Document2 pagesIncome Tax Rates: For AY 2021-22 (New) & A.Y. 2020-21 (Old)pankaj goyalNo ratings yet

- MTP 4 (Additional MCQ) - Q&ADocument19 pagesMTP 4 (Additional MCQ) - Q&ADeepsikha maitiNo ratings yet

- Voucher RegisterDocument7 pagesVoucher RegisterCharlotte AvalonNo ratings yet

- 5 The Project BudgetDocument15 pages5 The Project BudgetClaudia PescaruNo ratings yet

- Computer Assignment of ExcelDocument9 pagesComputer Assignment of ExcelAdeel KiayniNo ratings yet

- Consolidated Syllabus in Taxation 2Document21 pagesConsolidated Syllabus in Taxation 2Felix DiazNo ratings yet

- Hemarus Industries Income Tax Declaration Form SummaryDocument4 pagesHemarus Industries Income Tax Declaration Form SummaryShashi NaganurNo ratings yet

- Transfer and Business Taxation by Ballada Solution ManualDocument5 pagesTransfer and Business Taxation by Ballada Solution ManualAnonymous aU6BvWTIV20% (1)

- 2nd Semester Income Taxation Module 2 Taxes, and Tax LawsDocument7 pages2nd Semester Income Taxation Module 2 Taxes, and Tax Lawsnicole tolaybaNo ratings yet

- Introduction SARS Tax Practitioner Readiness ProgrammeDocument12 pagesIntroduction SARS Tax Practitioner Readiness ProgrammeCedric PoolNo ratings yet

- Kama (Seepz) 0700Document2 pagesKama (Seepz) 0700yogesh padilkarNo ratings yet

- Aaaaj5854c Q1 Ay201819 16aDocument2 pagesAaaaj5854c Q1 Ay201819 16aAnonymous V0UxsCdZo9No ratings yet

- Erd.2.f.006 Application For Vat Zero Rating Certification Rev.05Document1 pageErd.2.f.006 Application For Vat Zero Rating Certification Rev.05ivee.upak032023No ratings yet

- 2019 07 23 09 00 40 881 - 452619484 - PDFDocument6 pages2019 07 23 09 00 40 881 - 452619484 - PDFSadhana TiwariNo ratings yet

- Employee Declaration Form FY 2020-21Document2 pagesEmployee Declaration Form FY 2020-21Harsha I100% (2)

- Taxation 1Document4 pagesTaxation 1Raven Delos ReyesNo ratings yet