Professional Documents

Culture Documents

Income Tax 2017-18 Rules

Uploaded by

Babu Sundararaman0 ratings0% found this document useful (0 votes)

24 views3 pagesrules

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentrules

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views3 pagesIncome Tax 2017-18 Rules

Uploaded by

Babu Sundararamanrules

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 3

BOA DOd - SDH) Hide, (ROIT-18)

~BHQSY BOGE, wofPod emedd: 9440027220, 7396242536

dogtiehds erred Sy dyo - 1961 ofp BES

192 HHOOD GS AGA 8 SHS ecrcirom ag GO

Hose swrahis Sy DYoorHaiatwd. 2017-

18 G86 KoSdo 12 Bow Jssew, ast ordre

AudoD ecrdhip Giy Daogwowknsood Sgr sBoxy

Bare.

2017-18 GQS SosseyOrOs Sonoed eOSsyo-

2017 BsGo, KS 6S SosgFos'd scraby Say,

pester Srtiyen dabcio wonod.

Grd Say Edod® dros Sry dt.

% — ecnddiy Siiy Pons Sonogod Sorte astybe

NOG PES scree OMS toy 250,000, LOGE

Regt ema SOB Seu 3,00,000 Secs

36 AnabE Ras errcs S889 ton 5,00,000

SomOBr SSRAOSBSA

4 SD & afssoS8)So emdhH Sty bys!

Sgqytrtyjes Sets, wcrcios Shy S68

2,50,001 08 5 oge emcho sth Dhod

wcrchih Sys 10% sok 5% OB sAosBSS.

DADS mek. Srive Sik rardgr

Sisd-nowgna.

% soraey Sip OG0d Aba-Q Daaroolurd

Srige wdrron. TOS wtiade 50 ofe Hod

S68 Grothe S6 fo aO8 sorcbsy saiyp

SESOP 10% SEQ seoain a8 SO 0B ass

srrcborier6S 15% S5mQ Atoriateon,

RES 87 Gods ah GEE ofieie & HS Xouto

Gm 5000 He Hof tom 2500 ax spossso,

Sorcha SOMBMSL Emi 5 exp Lok mi 35

effet ShosgsS.

4 sErdsy) SSQB 3% Dery BSy aerogm

ESERosats&0B.

4 BES 80-b Bots eioBoS Shoye 4OHSA Gon

1,50,000 ei dhorDfrr SS2AoxsAS.

4 BES 80-8 Bos sassy Soh Sgsoe* sori

1,580,000 6% SOmaE Hod Seow Soe

siete THPAodaNe,

% «PES 80-bN4 (10) Gerde bar WEE Hgvow

dswee* wiisorr 50,000 © S6h roParsiS

iissoworws THAT,

% «BES 80-6, 80-26, 80-260, 80-cip © Bots

GH) dhiisFonowod® deross srtaydich.

S88 earche :-

d) 808 sodfme 38S vmrdires

Ssworchor Boridosataran.

1%, 2)8.5., 8) ao #8 woB%y GR Stoow

GeB), 4) 8.5..5) wes GB, 6) CAs sokBotn,

7) SoSQ, 8) SaSarranen, Jas womsge 9) B45

10) $0005 O% 11) 85, 12) edSa) earaioo

(Perquisites - doi 5395 ens, SHB Gos, oR

Show EntiersD), 13) sactoash 14) ergiS ber

bononSyot5.

O) SdSorr S6idosata wowes:

D) (raged 2) Sioy85 B45 3) ISSN 4)

B.S. Bower 5) aS /UrSs6 6.0/2.9. 6) OBE

ond DSS OS OS syRhotS — 7) SxabS) ood 8)

BOSS SononbymotS 9) aciySaS

Bots w weSA) dvsfonow: ey 10 (135)

aan 0g soak ASRooKyRond aol oF

DedHcncigr cb Gob Ertodst wrod SHES Togo

©88 BSamrdo Ho8 Shosetsvo8.

2) BSSorr Go8S molt

D) 88508" 10 eWiotod wiser” Boas nobeg

&) _ Basos* 40 edo.

BBO 2-1. WwS.66.a. os sr 3000/-ws

Frotbtogpond aod 08 Skt edited. eodting

SiyS wS.68.5. Fothssyrds dro she

BSSESSSSS0DH, FD OF UDSQhin eotSHRoK

cory.

2) sod sep do 0% dd Ssaysros*

DEMOS aod 98 Missarod seoced.

Income from self occupied House Property: (035 24)

1) MoS Bod Aoywo Bio Sey supp Bpod

s§ SdmOD Moyorr 2019-14 Sosm eae Sood

OX Etre Oh Uru 1,50,000 © 48% soln 2013-

1A Sars i BSLAYrES Sou 2,00,000 © 8%

DSxtona.

2) 1-4-2016 so8 31-3-2017 Soe 35 exe oS

moll 6S and8o Sivmxyerod don 50 do Shh

SED eetisorr Distonde.O¥5 80a8)

SB ass’, wgdor sod wF serrate Sod

1 BS Bey, aodsayo dod SOs te oan

Sayer SHS eorchod* 30% Ssh sodsysrer,

BanoB3§, 1 BSEL MSitonot Bow.

ShoHeo (Deductions) : ash Azo eer Gok

TPS,06.0, absHaney OS ADS exrabo Hob &

Gob Some warsogosarss.

YSSAQ: AUS 16(il): eohp psy ga Sey ogse

ERQOVI-A Sows SHOW

2. BES BOS Beso Bod showes gxego

SHaBoso thx.

i) LIC Gtncko oh Sasos* 10% HOG SOD

Hoch eotinvet, Ades ayoribed

15% Moy BODES")

ii) PF doo

iii) asd Look aggsed (Vid aisy)

iv) UTI cients 0085 ago% a5

v) LIC (80g, syed SoE

vi) scteBodads Supsd So (YS 10 (238) )

Vil) MysPOoyetis BS SonfexR Gssdgo / eyoBes /

26.0.8./ SESE SRoFieRE Hoh

BOBS exper Sty BBA BQNS exer

vill) ExyS $s KBgorr ay byot S Say SoseBe

BQoDKe,

ix) city DBE Goofy See Seynd:

X) SihunBoueds SHEGHS rok

xi) BN5 Gok

xii) BRHSS dor NG UsyS ayoke* SAwo 5

Souew SEE Sos 8) Goreen,

xiii) Snab5 AeS Looky 43%, 2004

B Boles Kigdho BHHBONS Ay BGS hyow BOODS

SoWEyWS (YS SOMKH) tom 1,50,000 58x

dor: dod. dss rose

B -BrBS DHS Ayo IFsivod* BQods 10%

(Ervabo HES BORLE KL)

BASS DAS ob Gedsjod BQodats Sssoc*

10% SgOoK Soars (HES 80 BAA(2))

MsoOS: 1) BOR, BO AAD, BODREC) & Bods shows

Eno Gru 1,50,000 0% HOSS Ses hotmod

ES 80 Ba)

B. DEES sxyOS) Gmado : (YS 808)

1) ABSA, OGRA grty/eG worSS Deen, SQSoUdeR

BQSS Pooasoky Busia te. 25

do Keg Somes’ SROs.

2) RNabE Ra, PoYSy, egrOS bye, SPsoltoos

BQdS (bivabo Bogin Sr.

30,000 deo reg HOmoa* Snow

8) OGY, arts / oS Socin eroevea CdS oes

BEe5 Aso Gru 5000 o Ss BS

‘Doyh fog SOMBowh S'n’ Giy sod awssonod

~atiseood.

GOH. DYeroIHBS wTPoHo ly (BES 80 BB) :

Swans ds wbss Beso ho epbse Bho, Bio

Modis Nigra ES eyow 1) 40% Sod DHS Beso

Soll Gon 75,000 KOH SEBS? 2) 80% oH Iss

igo Gr. 1,25,000 Hox SOMES" Shoimtooron.

2. Be OBES ptyeo (BES 80 BBD) :

ao%N dsod Ddavoetma, esses

hincbhetorra 345, donk) vot 6 stro oes

Bas args Bey wdQe tod Gru 40,000 som, hnadd

Adadsd sr. 60,000 © sds odin 36 AnadS

HOEK com 80,000 arsistanoip Meth. & Sthdeabo

Brodit at Sends GMS YS Oye seOjh

HOBeos.

WS. DTS She ES 80a) :

ABSA, EPEIES, Boo Stowe Sto OBS qrSsed),

ORE Soffe tok SiN wth BQOOS SEO SEM

wordbo Hook 8 St) 48h dor wtkp 68 48% 58 dnogd

syd Set sfododebos,

wm. Dortifees (AYES 80 2)

1) GR) Ackewa 26, Werswoe bao

Haus 08, Sorsio— riod sata 26, rad roe

28, mba wos Senos 05, coraiqde dor eis

%% bah Doy Sogo anys dower, eo.s.

BoggoG HFG Sic IS, eee Syser Savas,

eebcs Gtie 288 ands Doowen, andi» exrdho Sof

100 eo Socata.

2) GePNaW Soh Sita 088, dS rroh

BrodHS, aoBorrmos AySS OG, Goi Bobs waka

Frhow, Bas mistonoiy Hobs Smrecho, shes,

Be fof DS dose, Skee skquyete, chy

ons Oetiieed 50% earache mod shoteti,

* at, DorwSwer Cri 2,000 Sof Oss

BWodsyond Bw) / 6.6. SrSing* Bord.

B. “Bdof war deve 56 (xs 80 58a)

¢ = hom - Mehwes’ hooky wer birey oye

S08 SE Grn 10,000 ABg SomaSt era sy

Hod BStrovosarssos,

B. DowroihBd ad ps Gay shows (YS

B09) +

BOPOS aly GSstinw af 40% ol oes

BSqjo Ho TOE dru 75,000 Sow, 80% oH avs

Blejo ai 208 Mo gorr 1.25 of drdraber Dione}

Hees,

Hikyy Dodi warabo :

@6%sN Budo waraioo od wS.a5.0.

SaSstonod Hoan HS LoySnSS Spowgsen da DADS

erase Shy DHowtkiry ecraborw Seridosincevos.

G08 4 Giswio & exraboy Sin BosSehainoenod.

ee pedis Say, Grdonod')

Sony roves?) = eee AncsB B8eS) Senses

Samiy, dome) | (60-80KomoMad,reme)| AEE

LE 2,50,000 se - - =

2. 2,50,001-3,00,000 = = 5%

3. $,00,001-5,00,000 = 5% 5%

4. _ | 5,00,001~10,00,000 20% 20% 20%

5. 10,00,001 Boks sxrcso 30% 30% (30%

© B Sg GsWo emrddH Shy S80, 3.5 ofp 6%

ecrcio fle sPO8 ton 2,500/- en NOG SOMOS Sinet

Gays Oakey wt. HES 872)

¢ 50 efi Gok SE srFate sao Ko Tok

Src SKYB etior 10% Erg ody as SS

ee DthyS ecraborioms8 SEag 15% Bhodntosiok.

werrdby Sib wtisiorr 3% Dory Bis Bord.

aSéotnh BeBy 2 Si) DGoSit> eorchio Son

2.8 efosod SHyshe eG ye Jerod 08)

BQ cers Sisto deo. oe wordbo Si, Sones

sd) 8 achp Gas 908 Howeo 2017-18 SH

Bonegod Bs each ddires) domogeos dsirek

DBS BG, Zo. 16 E SosoGs ook woos

QodsTm. srrchy Sigs T8od 316%re

Bpomo. dor © Sy Mod sdSstanciy Sotho

SENS Swsins DOG Hedi) SPsimec! aod

EasHavow Brom.

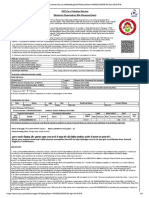

COMPUTATION OF INCOME TAX FOR THE

FINANCIAL YEAR 2017-2018

(MODEL SHEET)

1, Name of the Employee: M. MURALAIAH

2, Designation S.A.

3. Nameofthe —: ZPHS Duginavelly, Dist

Nalgonda.

Office Address

4. Salary Income

a) Pay 5 Rs 542,010

b) DA $ Rs 145,469

©) HRA : Rs.

Rs.

Rs.

Rs

Rs 7,93,628

5. HARLA. Exemption, (Laat ofthe following)

i) HRA actually received: Rs 65,037

ii) Rent paid in excess = Rs $1,250

of 10% of Salary

ili) 40% of Salary : Rs, 2,72,992

Least of the Above 3 : Rs. $1,250

6. Total Income (4-5) 3 Rs.

7. Deductions:

a) PTax (us 16) = Rs.

'b) Intrest Paid on Housing Loan: Rs.

(ws 24-b)

©) Medical Reiumbersment if any: Rs.

Total(AtoC) + Rs. :

8. Net Income (6-7) Rs, 7,39,978

9, Deductions Under Chapter VIEA

(Seetion 80C.80-CCC, 80CCD{i) Maximum 1.5 Laksh)

Rs, 38,114

Rs, 3,000

Rs. 1440.

@) Housing Loan Pil. amount: Rs. zi

©) Tuition Fees + Rs, 90,000

NSC : Rs, =

g) LIC : Rs. 2

h) Anyothers Rs. =

Total (80C,80CCC,8OCCD() Rs, 1,52,554

Limited to 150,000

10. Total Income (8-9): Rs, 5,89,978

11, Deductions Under Chapter VIeA

@) Medical Insurance(80-D); Rs, *

bb) Handicapped Dependent (80 DD): Rs, -

©) Medical Treatment (S0DDB): Rs. -

d) Int. Paid on Edn. Loan (80E): Rs. -

©) Donations CM, Relief Fund (80G):Rs, -

A) PAH. Assess (80-U Rs. -

12. Agaregate of deductible above (a to f):Rs. :

13. Net Taxable Income( 10-12%: Rs. 5,89,978

Rounded to i Rs, 5,89,980

14. Tax Payable on total Income : Rs. 30,496

15. Rebate(Sec. 87A} : Rs, -

16, Net Tax : Rs, 30,496

17.Add, Surcharge: Rs, -

18. Edu m Cess(3%) = Rs. OS

19.Tax Payable (16+17+18): Rs 31411

20, Less: Already paid Tax: Rs, 11,000

21.Tax. Payable/Refundabl Rs. 20411

Sign of the Employer Sing of the Employee

You might also like

- Latest Who Is Who - PDF Download For Competitive Exams by ENTRANCEGEEKDocument7 pagesLatest Who Is Who - PDF Download For Competitive Exams by ENTRANCEGEEKMohammed Rizwan Ali0% (1)

- Crystal Report SelectDocument1 pageCrystal Report SelectBabu SundararamanNo ratings yet

- Mahashivratri - 2018 Message-EngDocument5 pagesMahashivratri - 2018 Message-EngBabu SundararamanNo ratings yet

- Gita SarDocument17 pagesGita Sarkushal jaitwaniNo ratings yet

- Family Must KnowDocument16 pagesFamily Must KnowKhalilahmad Khatri83% (6)

- How To Save Tax For Fy 2018 19 PDFDocument45 pagesHow To Save Tax For Fy 2018 19 PDFsenthilkumarkskNo ratings yet

- Wa0017 PDFDocument31 pagesWa0017 PDFpawanNo ratings yet

- B-4 Sy. NO. 35 PDFDocument16 pagesB-4 Sy. NO. 35 PDFBabu SundararamanNo ratings yet

- Onward VizagDocument2 pagesOnward VizagBabu SundararamanNo ratings yet

- Amazingly Beautiful Cactus Flowers PDFDocument30 pagesAmazingly Beautiful Cactus Flowers PDFBabu SundararamanNo ratings yet

- Lion PrintDocument5 pagesLion PrintsangopsNo ratings yet

- Design of Cantilever Retaining-2071 PDFDocument9 pagesDesign of Cantilever Retaining-2071 PDFSaiSowmithGoudNaramalaNo ratings yet

- Raz Li34 Lionandmouse CLR PDFDocument9 pagesRaz Li34 Lionandmouse CLR PDFBabu SundararamanNo ratings yet

- Issue of New Ration Card (Pink) Application FormDocument2 pagesIssue of New Ration Card (Pink) Application FormPraveen Kumar MadupuNo ratings yet

- B-4 Sy. NO. 35 PDFDocument16 pagesB-4 Sy. NO. 35 PDFBabu SundararamanNo ratings yet

- 15 of 16 Piping Standards 2 PDFDocument134 pages15 of 16 Piping Standards 2 PDFBabu SundararamanNo ratings yet

- 04 1 Sec IV STD Specs PipingDocument152 pages04 1 Sec IV STD Specs PipingdzungNo ratings yet

- PipeHanger Feb18Document300 pagesPipeHanger Feb18Babu SundararamanNo ratings yet

- Pipe Hangers and SupportsDocument334 pagesPipe Hangers and Supportsandreiasbd100% (2)

- India 2018 CFA Final-ExtensionDocument2 pagesIndia 2018 CFA Final-ExtensionBabu SundararamanNo ratings yet

- Steel Beam Marked B6Document27 pagesSteel Beam Marked B6Babu SundararamanNo ratings yet

- Pipe Supports, Guides, Shields & SaddlesDocument46 pagesPipe Supports, Guides, Shields & SaddlesruzlaNo ratings yet

- Spread Footing DesignDocument3 pagesSpread Footing Designjkem_fontanilla542580% (10)

- Rev StaircaseDocument6 pagesRev StaircaseD SRINIVASNo ratings yet

- RC RepairDocument20 pagesRC Repairer_zaheerNo ratings yet

- Awareness WorksheetsDocument19 pagesAwareness Worksheetsjgkothavade420No ratings yet

- CBSE Worksheet KG1andKG2 1394713481 PDFDocument29 pagesCBSE Worksheet KG1andKG2 1394713481 PDFBabu SundararamanNo ratings yet

- Society Loan Simple InterestDocument6 pagesSociety Loan Simple InterestBabu SundararamanNo ratings yet

- Column C2Document6 pagesColumn C2Babu SundararamanNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)