Professional Documents

Culture Documents

Cost of Capital Solved Problems - Cost of Capital - Capital Structure

Uploaded by

Anonymous qOdzTznKEOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost of Capital Solved Problems - Cost of Capital - Capital Structure

Uploaded by

Anonymous qOdzTznKECopyright:

Available Formats

9/26/2018 Cost of Capital Solved Problems | Cost Of Capital | Capital Structure

Search Upload Sign In Join

Download

Home 1 of 16 Search document

Saved

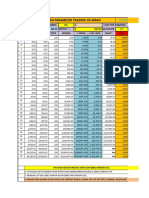

Calculate the cost of capital in the following cases:

i) X Ltd. issues 12% Debentures of face value Rs. 100 each and realize

Top Charts The Debentures are redeemable after 10 years at a premium of 10%.

ii) Y. Ltd. issues 14% preference shares of face value Rs. 100 each Rs. 9

are repayable after 12 years at par.

Books

Note: Both companies are paying income tax at 50%.

Audiobooks

Solution

Magazines

(i) Cost of Debt

News

k d [Int + (RV – SV) / N] (1 – t)

Documents

(RV + SV) / 2

Sheet Music Int = Annual interest to be paid i.e. Rs. 12

t = Company’s effective tax rate i.e. 50% or 0.50

RV = Redemption value per Debenture i.e. Rs. 110

N = Number of years to maturity = 10 years

SV = issue price per debenture minus floatation cost i.e. Rs. 95

[12 + (110 – 95) / 10] (1 – .5)

k d =

(110 + 95) / 2

[12 + 2.5](0.5) 7.25

= = = 7.43%

97.50 97.50

(ii) Cost of preference capital

D + (RV – SV) / N

k

https://www.scribd.com/doc/99700905/Cost-of-Capital-Solved-Problems 1/1

You might also like

- Chapter 7 Notes Question Amp SolutionsDocument7 pagesChapter 7 Notes Question Amp SolutionsPankhuri SinghalNo ratings yet

- Bond ValuationDocument15 pagesBond ValuationZahid Usman100% (1)

- Chapter 10Document42 pagesChapter 10LBL_LowkeeNo ratings yet

- Capital StructureDocument59 pagesCapital StructureRajendra MeenaNo ratings yet

- Cost of Capital Lecture Slides in PDF FormatDocument18 pagesCost of Capital Lecture Slides in PDF FormatLucy UnNo ratings yet

- Answers To Practice Questions: Risk and ReturnDocument11 pagesAnswers To Practice Questions: Risk and ReturnmasterchocoNo ratings yet

- Practice Problems SolutionsDocument13 pagesPractice Problems SolutionsEMILY100% (1)

- Lecture 7 Adjusted Present ValueDocument19 pagesLecture 7 Adjusted Present ValuePraneet Singavarapu100% (1)

- Weighted Average Cost of Capital: Banikanta MishraDocument21 pagesWeighted Average Cost of Capital: Banikanta MishraManu ThomasNo ratings yet

- Assignment 5 - CH 10 - The Cost of Capital PDFDocument6 pagesAssignment 5 - CH 10 - The Cost of Capital PDFAhmedFawzy0% (1)

- Cost of CaptialDocument72 pagesCost of CaptialkhyroonNo ratings yet

- Cost of Capital and Capital Structure DecisionsDocument21 pagesCost of Capital and Capital Structure DecisionsGregory MakaliNo ratings yet

- CH 05Document48 pagesCH 05Ali SyedNo ratings yet

- Based On Session 5 - Responsibility Accounting & Transfer PricingDocument5 pagesBased On Session 5 - Responsibility Accounting & Transfer PricingMERINANo ratings yet

- Principles of Consolidated Financial Statements: 1 The Concept of Group AccountsDocument58 pagesPrinciples of Consolidated Financial Statements: 1 The Concept of Group Accountssagar khadkaNo ratings yet

- Chapter 13 SolutionsDocument26 pagesChapter 13 SolutionsMathew Idanan0% (1)

- Answers To Problem Sets: Net Present Value and Other Investment CriteriaDocument9 pagesAnswers To Problem Sets: Net Present Value and Other Investment CriteriaTracywongNo ratings yet

- Chapter 16Document23 pagesChapter 16JJNo ratings yet

- International Portfolio Investment Q & ADocument7 pagesInternational Portfolio Investment Q & AaasisranjanNo ratings yet

- Working Capital Problem SolutionDocument10 pagesWorking Capital Problem SolutionMahendra ChouhanNo ratings yet

- Valuation Models: Aswath DamodaranDocument47 pagesValuation Models: Aswath DamodaranSumit Kumar BundelaNo ratings yet

- Assignment On: Managerial Economics Mid Term and AssignmentDocument14 pagesAssignment On: Managerial Economics Mid Term and AssignmentFaraz Khoso BalochNo ratings yet

- Chapter 4 Financing Decisions PDFDocument72 pagesChapter 4 Financing Decisions PDFChandra Bhatta100% (1)

- Chapter 11 - Cost of Capital - Text and End of Chapter QuestionsDocument63 pagesChapter 11 - Cost of Capital - Text and End of Chapter QuestionsSaba Rajpoot50% (2)

- Chapter 12Document34 pagesChapter 12LBL_Lowkee100% (1)

- CH 4Document6 pagesCH 4Jean ValderramaNo ratings yet

- Financial Management 2: UCP-001BDocument3 pagesFinancial Management 2: UCP-001BRobert RamirezNo ratings yet

- FalseDocument13 pagesFalseJoel Christian Mascariña100% (1)

- Balance of Payments:: Chapter Objectives & Lecture Notes FINA 5500Document27 pagesBalance of Payments:: Chapter Objectives & Lecture Notes FINA 5500Anonymous H0SJWZE8100% (1)

- Chap 5Document52 pagesChap 5jacks ocNo ratings yet

- Risk & Return PPDocument40 pagesRisk & Return PPAnneHumayraAnasNo ratings yet

- Practice Questions - Ratio AnalysisDocument2 pagesPractice Questions - Ratio Analysissaltee100% (5)

- Coba BDocument4 pagesCoba BCesar Felipe UauyNo ratings yet

- Chapter 08-Risk and Rates of Return: Cengage Learning Testing, Powered by CogneroDocument7 pagesChapter 08-Risk and Rates of Return: Cengage Learning Testing, Powered by CogneroqueenbeeastNo ratings yet

- Risk Adjusted Discount Rate Method: Presented By: Vineeth. KDocument13 pagesRisk Adjusted Discount Rate Method: Presented By: Vineeth. KathiranbelliNo ratings yet

- CS Executive MCQ and Risk AnalysisDocument17 pagesCS Executive MCQ and Risk Analysis19101977No ratings yet

- Kota Tutoring: Financing The ExpansionDocument7 pagesKota Tutoring: Financing The ExpansionAmanNo ratings yet

- ACCA F9 Lecture 2Document37 pagesACCA F9 Lecture 2Fathimath Azmath AliNo ratings yet

- Sem 2 Question Bank (Moderated) - Financial ManagementDocument63 pagesSem 2 Question Bank (Moderated) - Financial ManagementSandeep SahadeokarNo ratings yet

- Examples WACC Project RiskDocument4 pagesExamples WACC Project Risk979044775No ratings yet

- Presentation 2. Understanding The Interest Rates. The Yield To MaturityDocument30 pagesPresentation 2. Understanding The Interest Rates. The Yield To MaturitySadia SaeedNo ratings yet

- Chapter 5 Financial Decisions Capital Structure-1Document33 pagesChapter 5 Financial Decisions Capital Structure-1Aejaz MohamedNo ratings yet

- Discounted Cash Flow (DCF) Definition - InvestopediaDocument2 pagesDiscounted Cash Flow (DCF) Definition - Investopedianaviprasadthebond9532No ratings yet

- M09 Gitman50803X 14 MF C09Document56 pagesM09 Gitman50803X 14 MF C09dhfbbbbbbbbbbbbbbbbbhNo ratings yet

- Cost of CapitalDocument4 pagesCost of Capitalshan50% (2)

- Chapters 11 and 12 EditedDocument13 pagesChapters 11 and 12 Editedomar_geryesNo ratings yet

- Growth of Corporation Occurs Through 1. Internal Expansion That Is Growth 2. MergersDocument8 pagesGrowth of Corporation Occurs Through 1. Internal Expansion That Is Growth 2. MergersFazul Rehman100% (1)

- Problem Set - Cost of CapitalDocument19 pagesProblem Set - Cost of CapitalSagar Bansal100% (1)

- 2 Risk&ReturnDocument23 pages2 Risk&ReturnFebson Lee MathewNo ratings yet

- 07 Time Value of Money - BE ExercisesDocument26 pages07 Time Value of Money - BE ExercisesMUNDADA VENKATESH SURESH PGP 2019-21 BatchNo ratings yet

- Some Exercises On Capital Structure and Dividend PolicyDocument3 pagesSome Exercises On Capital Structure and Dividend PolicyAdi AliNo ratings yet

- Dividend Policy - Sample Problems - ICAIDocument2 pagesDividend Policy - Sample Problems - ICAIgfahsgdahNo ratings yet

- Revision Pack 4 May 2011Document27 pagesRevision Pack 4 May 2011Lim Hui SinNo ratings yet

- P4 Chapter 04 Risk Adjusted WACC and Adjusted Present Value PDFDocument45 pagesP4 Chapter 04 Risk Adjusted WACC and Adjusted Present Value PDFasim tariqNo ratings yet

- Cost of Capital Problems Solved Financial Management Solved Problems CompressDocument13 pagesCost of Capital Problems Solved Financial Management Solved Problems CompressKiran A SNo ratings yet

- Lecture 20Document5 pagesLecture 20laxmikushwah7272No ratings yet

- Module-2 Cost of Capital and LeverageDocument79 pagesModule-2 Cost of Capital and Leveragevinit PatidarNo ratings yet

- CH 9 Solutions Solution Manual Principles of Corporate FinanceDocument7 pagesCH 9 Solutions Solution Manual Principles of Corporate FinanceMercy Dadzie100% (1)

- CH - 09 - The Cost of Capital 1Document15 pagesCH - 09 - The Cost of Capital 1Mahmoud Nabil Al HadadNo ratings yet

- Axa Philippines Mock Exam-Investment Link Products (Vul)Document7 pagesAxa Philippines Mock Exam-Investment Link Products (Vul)SHAMIR LUSTRE100% (1)

- Solution - Interest Rate RiskDocument8 pagesSolution - Interest Rate RiskTuan Tran VanNo ratings yet

- Assignment IDocument3 pagesAssignment IAparna RajasekharanNo ratings yet

- Moody's - PBC - 79004Document46 pagesMoody's - PBC - 79004Umut UzunNo ratings yet

- Leasing (Compatibility Mode)Document19 pagesLeasing (Compatibility Mode)Sameer ThakurNo ratings yet

- CFA InstituteDocument4 pagesCFA InstituteJaya MuruganNo ratings yet

- Walmart Moneycard Bank StatementDocument2 pagesWalmart Moneycard Bank StatementClifton Wilson50% (2)

- History and Growth of Islamic Banking and FinanceDocument13 pagesHistory and Growth of Islamic Banking and FinancerababNo ratings yet

- MBA Finance1YearDocument10 pagesMBA Finance1Yearshahmonali6940% (1)

- 2257 Chapter 21Document3 pages2257 Chapter 21melody shayanwakoNo ratings yet

- TAX399 - 2024 - Chapter 3-6 - RevisionDocument54 pagesTAX399 - 2024 - Chapter 3-6 - Revisionobenakemtiku15No ratings yet

- Prasun Patel - Banking & FinanceDocument3 pagesPrasun Patel - Banking & FinanceGhanshyam NfsNo ratings yet

- The Institution of Engineers (India) : (For Member Technologist Applicants)Document8 pagesThe Institution of Engineers (India) : (For Member Technologist Applicants)dipinnediyaparambathNo ratings yet

- The Balance of Payments: Definitions and ConceptsDocument32 pagesThe Balance of Payments: Definitions and ConceptsAditya KumarNo ratings yet

- Dan Kennedy - Big Mouth Big Money PDFDocument241 pagesDan Kennedy - Big Mouth Big Money PDFGTP100% (4)

- Mindmap Chapter 13 Capital BudgetingDocument1 pageMindmap Chapter 13 Capital BudgetingSimon ErickNo ratings yet

- Internal Rate of ReturnDocument16 pagesInternal Rate of ReturnAnnalie Alsado BustilloNo ratings yet

- Financial Management 2iu3hudihDocument10 pagesFinancial Management 2iu3hudihNageshwar singhNo ratings yet

- Money Management TradingDocument4 pagesMoney Management TradingBagus Krida0% (1)

- Solutions Paper - TVMDocument4 pagesSolutions Paper - TVMsanchita mukherjeeNo ratings yet

- Acc431 Quiz2 Answers V1Document7 pagesAcc431 Quiz2 Answers V1novaNo ratings yet

- Balance of Payments AUSDocument36 pagesBalance of Payments AUSKoushik SenNo ratings yet

- Accounting 1A Exam 1 - Spring 2011 - Section 1 - SolutionsDocument14 pagesAccounting 1A Exam 1 - Spring 2011 - Section 1 - SolutionsRex Tang100% (1)

- 20200915232440XXXXXXX9378Document8 pages20200915232440XXXXXXX9378rakesh kumarNo ratings yet

- Aston SoloDocument2 pagesAston SoloVonny LamorenNo ratings yet

- Andhra Bank Account Opening FormDocument2 pagesAndhra Bank Account Opening FormSanthosh Reddy BNo ratings yet

- 1683017424040KE12qarqkpITHwM4 PDFDocument3 pages1683017424040KE12qarqkpITHwM4 PDFselvavinayaga AssociatesNo ratings yet

- Arnold Van Den Berg Power Point Jan 29 2020Document60 pagesArnold Van Den Berg Power Point Jan 29 2020Gonzalo Vera MirandaNo ratings yet

- Zeus MillanDocument7 pagesZeus MillanannyeongNo ratings yet

- PF Form 19 10 - CDocument4 pagesPF Form 19 10 - CMadhaw KumarNo ratings yet