Professional Documents

Culture Documents

NTT FY2008Update 10july2008 1

Uploaded by

ResearchOracleOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NTT FY2008Update 10july2008 1

Uploaded by

ResearchOracleCopyright:

Available Formats

Tel.

+44 (0)20 7232 3090 Traded on

AIM, London

Fax +44 (0)20 7232 3099 Stock Exchange

www.iirgroup.com Regulated and

LSE: IIR authorised by

10 July 2008

Nippon Telegraph and Telephone Corporation

Update Report – FY 2008 Results

NTT Data to support growth in revenues going forward

Common BUY Fundamental research indicates a 13.8% upside in the common stock over the next 6-24 months. We

Direct

have access

calculated the to theprice

target fullbased

report free of charge

on fundamental at a weighted average of target

factors, using

Stock prices obtained using DCF and comparative valuation methodologies.

http://www.iirgroup.com/researchoracle/viewreport/show/20267

Ticker: 9432.T

Target price: ¥598,0001 We upgrade the common stock from a HOLD to a BUY with a 6-24 month target price of ¥598,279 per

share.

Current price: ¥526,000

ADR BUY The ADR is expected to appreciate by approximately 14.5% over the next 6-24 months as the 13.8%

fundamental upside is expected to be further augmented by approximately 0.7 percentage points

upside attributable purely to the anticipated appreciation of the Japanese yen against the US dollar

over the same period. As the current ADR price supports BUY rating, we upgrade our ADR rating from a

Ticker: NTT HOLD to a BUY.

Target price: US$27.96 We upgrade the ADR (1 ADR = 0.005 shares) from HOLD to BUY with a 6-24 month target price of

US$27.96.

Current price: US$24.42

Supervisor: Jinesh Joshi

Analyst: Saurabh Jain Investment horizon- short term trading strategies

This report addresses the needs of strategic investors with a long term investment horizon of 6-24 months. If

Editor: Shem Pennant

this report is provided to you by your broker under the Global Settlement, you may now also access (free of

Global Research Director: charge) the short term trading outlook that we publish from time to time for this issuer, looking at the coming

Satish Betadpur, CFA 5-30 days for readers with a shorter trading horizon. These are available on-line only at

www.researchoracle.com.

Next news due:

1Q 082 results, August 2008

Report summary

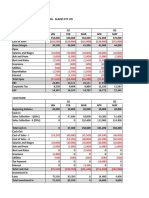

Nippon Telegraph and Telephone Corporation (NTT) reported a 0.7% y-o-y decline in revenues in FY

2008, in line with our estimate. The y-o-y decline in revenues was due to a decrease in NTT East, NTT

West and NTT DoCoMo, Inc. (NTT DoCoMo) revenues, which was partially offset by higher NTT Data

and NTT Communications revenues. In addition to the y-o-y decline in revenues, adjusted3 EBITDA and

EBIT margins experienced a y-o-y decline of 40 bps and 116 bps in FY 2008, respectively, below our

estimates of 30.9% and 11.1%. Going forward, we expect revenues from the fixed-line segment to

decline further due to a reduction in subscriber-base and Average Revenue Per User (ARPU). However,

steady growth in revenues from NTT Data and NTT DoCoMo is expected to partially offset the overall

revenue decline. Margins are expected to show a diminishing trend after FY 2009 as we expect

operating expenses, as a percentage of revenues, to increase going forward. However, as the common

stock currently trades below its fair value we upgrade the common stock from a HOLD to BUY

Currency impact for US investors

The impact by itself of the anticipated currency movements on the ADR (now US$24.42), without

considering changes in the share price, is positive and is expected to be:

Over 6 months: US$28.59

Over 12 months: US$25.05

Over 24 months: US$24.58

Page 1 Refer to page 4 for all footnotes

You might also like

- XLCapital NewsAlert 11july2008 1Document1 pageXLCapital NewsAlert 11july2008 1ResearchOracleNo ratings yet

- WNS NewsAlert 11july2008 1Document1 pageWNS NewsAlert 11july2008 1ResearchOracleNo ratings yet

- Nissan 4QANDFY2008Update 11jul08 1Document1 pageNissan 4QANDFY2008Update 11jul08 1ResearchOracleNo ratings yet

- FocusMedia 1Q08Update 11july2008 1Document1 pageFocusMedia 1Q08Update 11july2008 1ResearchOracleNo ratings yet

- SMIC 1Q08Update 11july2008 1Document1 pageSMIC 1Q08Update 11july2008 1ResearchOracleNo ratings yet

- Covidien 2q08update 11jul08 1Document1 pageCovidien 2q08update 11jul08 1ResearchOracleNo ratings yet

- O2Micro 1Q08Update 11july2008 1Document1 pageO2Micro 1Q08Update 11july2008 1ResearchOracleNo ratings yet

- SouthernCopper NewsAlert 11jul2008 1Document1 pageSouthernCopper NewsAlert 11jul2008 1ResearchOracleNo ratings yet

- Repsol 1Q08Update 11jul2008 1Document1 pageRepsol 1Q08Update 11jul2008 1ResearchOracleNo ratings yet

- Noble 1Q08Update 11jul2008 1Document1 pageNoble 1Q08Update 11jul2008 1ResearchOracleNo ratings yet

- GrupoAeroCentroNorte NewsAlert 11july2008 1Document1 pageGrupoAeroCentroNorte NewsAlert 11july2008 1ResearchOracleNo ratings yet

- Infosys 1Q09Alert 11july2008 1Document1 pageInfosys 1Q09Alert 11july2008 1ResearchOracleNo ratings yet

- ACE 1Q08Update 11jul2008 1Document1 pageACE 1Q08Update 11jul2008 1ResearchOracleNo ratings yet

- Advantest NewsAlert 11july2008 1Document1 pageAdvantest NewsAlert 11july2008 1ResearchOracleNo ratings yet

- UnileverNV 1Q08Update 10jul08 1Document1 pageUnileverNV 1Q08Update 10jul08 1ResearchOracleNo ratings yet

- UnileverPLC 1Q08Update 10jul08 1Document1 pageUnileverPLC 1Q08Update 10jul08 1ResearchOracleNo ratings yet

- TokioMarine (Formerlymillea) FY2008Update 10july2008 1Document1 pageTokioMarine (Formerlymillea) FY2008Update 10july2008 1ResearchOracleNo ratings yet

- Roundup 10 July 2008Document2 pagesRoundup 10 July 2008ResearchOracleNo ratings yet

- SiliconwarePrecisionIndustries 1Q08Update 10july2008 1Document1 pageSiliconwarePrecisionIndustries 1Q08Update 10july2008 1ResearchOracleNo ratings yet

- NationalGrid FY2008Update 10july2008 1Document1 pageNationalGrid FY2008Update 10july2008 1ResearchOracleNo ratings yet

- Companhia de Bebidas Das Americas 1Q08Update 10jul08 1Document1 pageCompanhia de Bebidas Das Americas 1Q08Update 10jul08 1ResearchOracleNo ratings yet

- Mitsui FY2008Update 10july08 1Document1 pageMitsui FY2008Update 10july08 1ResearchOracleNo ratings yet

- Baidu 1Q08Update 10july2008 1Document1 pageBaidu 1Q08Update 10july2008 1ResearchOracleNo ratings yet

- GrupoAeroPacifico NewsAlert 10july2008 1Document1 pageGrupoAeroPacifico NewsAlert 10july2008 1ResearchOracleNo ratings yet

- BancoBradesco 1Q08Update 10jul2008 1Document1 pageBancoBradesco 1Q08Update 10jul2008 1ResearchOracleNo ratings yet

- Votorantim Celolose 1Q08Update 09jul08 1Document1 pageVotorantim Celolose 1Q08Update 09jul08 1ResearchOracleNo ratings yet

- EnduranceSpecialty NewsAlert 10july2008 1Document1 pageEnduranceSpecialty NewsAlert 10july2008 1ResearchOracleNo ratings yet

- AngiotechPharmaceuticalInc NewsAlert 10jul08 1Document1 pageAngiotechPharmaceuticalInc NewsAlert 10jul08 1ResearchOracleNo ratings yet

- XLCapital NewsAlert 09july2008 1Document1 pageXLCapital NewsAlert 09july2008 1ResearchOracleNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Reauthorization of The National Flood Insurance ProgramDocument137 pagesReauthorization of The National Flood Insurance ProgramScribd Government DocsNo ratings yet

- Joint Venture Master AgreementDocument176 pagesJoint Venture Master AgreementHaYoung KimNo ratings yet

- ICSB Hand BookDocument39 pagesICSB Hand BookSubarna Saha100% (1)

- Chotukool: The $69 Fridge For Rural India: Suresh MunuswamyDocument3 pagesChotukool: The $69 Fridge For Rural India: Suresh MunuswamySwapnil KharadeNo ratings yet

- Government Support Options: Laura Kiwelu Norton Rose FulbrightDocument15 pagesGovernment Support Options: Laura Kiwelu Norton Rose FulbrightE BNo ratings yet

- CVPA ANALYSIS AND BEP CALCULATIONSDocument38 pagesCVPA ANALYSIS AND BEP CALCULATIONSLouie De La TorreNo ratings yet

- Rural Marketing Assignment PDFDocument6 pagesRural Marketing Assignment PDFSriram RajasekaranNo ratings yet

- Grant Thornton Dealtracker H1 2018Document47 pagesGrant Thornton Dealtracker H1 2018AninditaGoldarDuttaNo ratings yet

- CMA Case Study Blades PTY LTDDocument6 pagesCMA Case Study Blades PTY LTDMuhamad ArdiansyahNo ratings yet

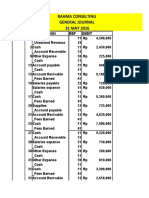

- Rahma ConsutingDocument6 pagesRahma ConsutingEko Firdausta TariganNo ratings yet

- Palais Royal Vol-4 PDFDocument100 pagesPalais Royal Vol-4 PDFrahul kakapuriNo ratings yet

- T-Accounts E. Tria Systems ConsultantDocument8 pagesT-Accounts E. Tria Systems ConsultantAnya DaniellaNo ratings yet

- Problems: Solution: Philip MorrisDocument21 pagesProblems: Solution: Philip MorrisElen LimNo ratings yet

- Central Surety and Lnsurance Company, Inc. vs. UbayDocument5 pagesCentral Surety and Lnsurance Company, Inc. vs. UbayMarianne RegaladoNo ratings yet

- Online Transfer Claim FormDocument2 pagesOnline Transfer Claim FormSudhakar JannaNo ratings yet

- What Are Equity Securities?Document2 pagesWhat Are Equity Securities?Tin PangilinanNo ratings yet

- Cost AccountingDocument13 pagesCost AccountingJoshua Wacangan100% (2)

- Annual Report 2019Document228 pagesAnnual Report 2019Rohit PatelNo ratings yet

- Credit Card Response Rates and ProfitsDocument6 pagesCredit Card Response Rates and ProfitskkiiiddNo ratings yet

- Regression Analysis Application in LitigationDocument23 pagesRegression Analysis Application in Litigationkatie farrellNo ratings yet

- CONTRACT OF LEASE (Virgo)Document7 pagesCONTRACT OF LEASE (Virgo)Grebert Karl Jennelyn SisonNo ratings yet

- Patrick Morgan: HighlightsDocument1 pagePatrick Morgan: HighlightsGhazni ProvinceNo ratings yet

- Syllabus - Wills and SuccessionDocument14 pagesSyllabus - Wills and SuccessionJImlan Sahipa IsmaelNo ratings yet

- Auditor Appointment Letter FormatDocument2 pagesAuditor Appointment Letter Formateva100% (3)

- Deco404 Public Finance Hindi PDFDocument404 pagesDeco404 Public Finance Hindi PDFRaju Chouhan RajNo ratings yet

- List of Consultants For Solar Power Plant InstallationDocument6 pagesList of Consultants For Solar Power Plant InstallationSanjeev Agarwal0% (1)

- Bharti Airtel Services LTD.: Your Account Summary This Month'S ChargesDocument4 pagesBharti Airtel Services LTD.: Your Account Summary This Month'S ChargesVinesh SinghNo ratings yet

- Essentials of a Contract - Formation, Validity, Performance & DischargeDocument25 pagesEssentials of a Contract - Formation, Validity, Performance & Dischargesjkushwaha21100% (1)

- Credit Rating AgenciesDocument40 pagesCredit Rating AgenciesSmriti DurehaNo ratings yet

- Pro Forma Invoice: Proline TechnologiesDocument1 pagePro Forma Invoice: Proline TechnologiesKanth KodaliNo ratings yet