Professional Documents

Culture Documents

Example of 5 Year, 9% Semi Annual Bonds

Uploaded by

Zoe ZengOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Example of 5 Year, 9% Semi Annual Bonds

Uploaded by

Zoe ZengCopyright:

Available Formats

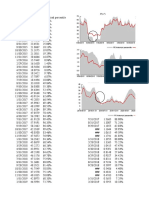

Example of 5 year, 9% semi annual bonds

30,000 bonds [$1,000 each face value] are issued on January 1, 2014.

The bonds mature on December 31, 2018.

The stated rate is 9%, and interest is paid semi-annually on June 30 and Dec 31.

The market rate (effective rate) when the bonds are issued is 10%.

Total bond price = 30,000,000 x 0.6139 = 18417000 PRINCIPAL

[factor of 0.6139 is 10 periods at 5% (10% divided by 2, since bond is semi-annual)]

Plus: 30000000 x 9%/2 = 1350000 cash interest paid x 7.7217 = 10424295 pv of interest

[factor of 7.7217 is 10 periods at 5% from the annuity table]

Total bond price = 18417000 + 10424295 = 28841295

28841295 divided by 30,000 bonds = $961.38 per bond ($961, or $962 are OK)

Interest Expense Calculation:

Int Expense Int Paid Discount BV

Issue 1/1/2014 BV BV x 5% in Cash Amortization 28841295

June 30 2014 28841295 1442064.75 1350000 92064.75 28933359.75

Dec 31 2014 28933359.75 1446667.99 1350000 96667.99 29030027.738

June 30 2015 29030027.738 1451501.39 1350000 101501.39 29131529.124

Dec 31 2015 29131529.124 1456576.46 1350000 106576.46 29238105.581

June 30 2016 29238105.581 1461905.28 1350000 111905.28 29350010.86

Dec 31 2016 29350010.86 1467500.54 1350000 117500.54 29467511.403

June 30 2017 29467511.403 1473375.57 1350000 123375.57 29590886.973

Dec 31 2017 29590886.973 1479544.35 1350000 129544.35 29720431.321

June 30 2018 29720431.321 1486021.57 1350000 136021.57 29856452.887

Dec 31 2018 29856452.887 1492822.64 1350000 142822.64 29999275.532

ONE 30000

Amortization of ONE bond Bond Bonds

Int Expense Int Paid Discount BV

Issue 1/1/2014 BV BV x 5% in Cash Amortization 961.38 28841400

June 30 2014 961.38 48.07 45 3.069 964.45 28933470

Dec 31 2014 964.45 48.22 45 3.22245 967.67 29030144

June 30 2015 967.67 48.38 45 3.3835725 971.06 29131651

Dec 31 2015 971.06 48.55 45 3.552751125 974.61 29238233

June 30 2016 974.61 48.73 45 3.7303886813 978.34 29350145

Dec 31 2016 978.34 48.92 45 3.9169081153 982.26 29467652

June 30 2017 982.26 49.11 45 4.1127535211 986.37 29591035

Dec 31 2017 986.37 49.32 45 4.3183911971 990.69 29720586

June 30 2018 990.69 49.53 45 4.534310757 995.22 29856616

Dec 31 2018 995.22 49.76 45 4.7610262948 999.98 29999447

should be 30000000

Notice rounding difference, because of rounding in the PV.

To compute INTEREST EXPENSE for a particular year, for example, 2015,

Interest Expense for 2015 is EITHER $1,451,501.4 + $1,456,576.5 = $2918,482

(or similar number due to rounding)

OR $48.383573 + $48.552751 = $97.281314 x 30,000 bonds = $2,918,494

So any number "around" $2,918490 is OK, (due to rounding; a computer would be exact)

Don't forget that since interest is paid semi-annually, we discount semi-annually as well.

Annual interest expense is BOTH semiannual amounts added together

total bond price 30000000

pv of principal 18417000

pv of interest expense 10424295

pv of total bond price 28841295

pv of each bond 961.3765

You might also like

- Summary Output - Airtel: Regression StatisticsDocument25 pagesSummary Output - Airtel: Regression StatisticsKaran MalhotraNo ratings yet

- Monthly Return Annual Return Annual RiskDocument25 pagesMonthly Return Annual Return Annual RiskLiani Rante PutriNo ratings yet

- CPR Detail Wau Bkiap PeshawarDocument2 pagesCPR Detail Wau Bkiap PeshawarSaad AhmedNo ratings yet

- Datos para Beta Fundamental, MesDocument12 pagesDatos para Beta Fundamental, MesJuan Sebastian Daza BonillaNo ratings yet

- DataDocument1 pageDataShivram TabibuNo ratings yet

- Latam Factors Excel FinalDocument74 pagesLatam Factors Excel FinalfranciscoNo ratings yet

- Class ExercisesDocument32 pagesClass ExercisesJavier RubiolsNo ratings yet

- 2A Beta Estimation Coke Cola StudentDocument64 pages2A Beta Estimation Coke Cola StudentJack BauerrNo ratings yet

- Cronograma de PagosDocument8 pagesCronograma de PagosAlex Ostos AlvaNo ratings yet

- Date Bombay Dying Adj Close Nifty Adj Close Return Nifty ReturnDocument15 pagesDate Bombay Dying Adj Close Nifty Adj Close Return Nifty ReturnPreticia ChristianNo ratings yet

- TUGAS MAKRO Gladisa AngelinaDocument4 pagesTUGAS MAKRO Gladisa AngelinaLevin LombanNo ratings yet

- Cetes Version 3.0Document8 pagesCetes Version 3.0German BinzhaNo ratings yet

- Gradesheet - ES36 - Dynamics - BSME3 - Quiz 1 Finals and Class StandingDocument4 pagesGradesheet - ES36 - Dynamics - BSME3 - Quiz 1 Finals and Class StandingGyd Lester CanalisoNo ratings yet

- Top Glove LatestDocument3 pagesTop Glove LatestAishiterru Gurl'sNo ratings yet

- 7-8. HaftaDocument29 pages7-8. Haftahasansekercioglu03No ratings yet

- Rem 111 Group 9Document7 pagesRem 111 Group 9Nicole CantosNo ratings yet

- Olah Data FarahDocument13 pagesOlah Data Farahnabilafarah442No ratings yet

- 06679-Money Market PDFDocument2 pages06679-Money Market PDFkiokoNo ratings yet

- Calculo Indicadores Financieros Industria Retail - EJEMPLODocument7 pagesCalculo Indicadores Financieros Industria Retail - EJEMPLOPaolo Esteban Nicolás SuarezNo ratings yet

- Check Validasi INVOICE - DA INVOICE - NODocument6 pagesCheck Validasi INVOICE - DA INVOICE - NODanu PrasetyaNo ratings yet

- Years Unemployment, Total (% of Total Labor Force) (Modeled ILO Estimate)Document16 pagesYears Unemployment, Total (% of Total Labor Force) (Modeled ILO Estimate)Yash AndhrutkarNo ratings yet

- Inflation, Deflation, and Macro Policy: Because Learning Changes EverythingDocument30 pagesInflation, Deflation, and Macro Policy: Because Learning Changes EverythingAhmet AksaçNo ratings yet

- Exemplos BetasDocument12 pagesExemplos BetasinesNo ratings yet

- SPY IndexDocument3 pagesSPY IndexDavid MuckianNo ratings yet

- Universidad Nacional de Chimborazo Facultad de Ciencias Políticas Y Administrativas Carrera de EconomíaDocument10 pagesUniversidad Nacional de Chimborazo Facultad de Ciencias Políticas Y Administrativas Carrera de EconomíaJohanna GomezNo ratings yet

- FIN 511 - Quiz 3 AnswersDocument32 pagesFIN 511 - Quiz 3 AnswersAsma AyedNo ratings yet

- Vigencia Int Mor Int - Corr I.DiarDocument4 pagesVigencia Int Mor Int - Corr I.DiarmanuelNo ratings yet

- Calificaciones LaboratorioDocument1 pageCalificaciones Laboratoriolesly virginia castilloNo ratings yet

- Shear Moment ExampleDocument10 pagesShear Moment ExampleAlejo ZabalaNo ratings yet

- 估值Document3 pages估值Yiang QinNo ratings yet

- Corporate Finance AssignmentDocument16 pagesCorporate Finance AssignmentHekmat JanNo ratings yet

- 1) Most Economic Hauling Distance (M) CalculationDocument3 pages1) Most Economic Hauling Distance (M) Calculationahmet yavuzNo ratings yet

- 1% Savings Calculator: (Recommend To Invest at Least 25% of Your In-Hand Salary)Document3 pages1% Savings Calculator: (Recommend To Invest at Least 25% of Your In-Hand Salary)vaibhav srivastavaNo ratings yet

- Tugas Ekonometrika: Disusun Oleh Agnes Greatassa F0117007Document7 pagesTugas Ekonometrika: Disusun Oleh Agnes Greatassa F0117007Agnes GreatassaNo ratings yet

- Olimpyc Park Atraction International SRLDocument15 pagesOlimpyc Park Atraction International SRLvictor emanuelNo ratings yet

- CAPMDocument4 pagesCAPMjoseph AlbaNo ratings yet

- 17a Charts Histogram V3Document7 pages17a Charts Histogram V3jyotsnaNo ratings yet

- US - India ToT AnalysisDocument13 pagesUS - India ToT AnalysisKartik ChopraNo ratings yet

- Retirement Problem: Annual Deposit 29386.551001Document8 pagesRetirement Problem: Annual Deposit 29386.551001Mahmood AhmadNo ratings yet

- Monthly Returns (In Percent) For 5 Pharmacueticals Listed CompaniesDocument5 pagesMonthly Returns (In Percent) For 5 Pharmacueticals Listed CompaniesSaurabh SharmaNo ratings yet

- HANNAN ProjectDocument12 pagesHANNAN ProjectAveen SiddiquiNo ratings yet

- Modelos de PronosticosDocument5 pagesModelos de PronosticosCarlos Augusto Millan OrtizNo ratings yet

- VAluation Dample DataDocument8 pagesVAluation Dample DatavenkatNo ratings yet

- IB.9.Malaysia - Session 2Document14 pagesIB.9.Malaysia - Session 2Phuoc Tran Ba LocNo ratings yet

- Ejercicio Calculo Beta AFGII 2019Document12 pagesEjercicio Calculo Beta AFGII 2019DARYA JEANNETTE BARILLAS GOMEZNo ratings yet

- 7a Simple Interest 2020Document32 pages7a Simple Interest 2020Eli KriNo ratings yet

- Step Up SIP Calculator FinCalC TVDocument4 pagesStep Up SIP Calculator FinCalC TVRamji MishraNo ratings yet

- Computaion ExamDocument4 pagesComputaion Examjennie martNo ratings yet

- Loan ScheduleDocument5 pagesLoan ScheduleNirajanNo ratings yet

- New Prob (Bonds)Document5 pagesNew Prob (Bonds)Khristine EnadNo ratings yet

- Decision ScienceDocument3 pagesDecision ScienceRiyaNo ratings yet

- International Finance Assignment 1Document4 pagesInternational Finance Assignment 1niveditawagh88No ratings yet

- R1P2Document8 pagesR1P2QandeelNo ratings yet

- Tugas 1 Kelompok Pemrograman ParalelDocument6 pagesTugas 1 Kelompok Pemrograman ParalelFarhan AssariyNo ratings yet

- Volume of Trade 1991-2020Document11 pagesVolume of Trade 1991-2020tp077535No ratings yet

- T7 PPJ A Garish Marcell 2017410186Document4 pagesT7 PPJ A Garish Marcell 2017410186GARISH MARCELLNo ratings yet

- Distribuciones de ProbabiidadDocument6 pagesDistribuciones de ProbabiidaddanielaNo ratings yet

- Akshayakalpa Farms and Foods Pvt. Limited, Tiptur, Karnataka Milk Procurement Chart Based On Total Solid - Effective From October 16 2020Document3 pagesAkshayakalpa Farms and Foods Pvt. Limited, Tiptur, Karnataka Milk Procurement Chart Based On Total Solid - Effective From October 16 2020Madan NNo ratings yet

- COORDEDocument1 pageCOORDEjose RevattaNo ratings yet

- Revision II (Ratio Analysis)Document6 pagesRevision II (Ratio Analysis)Allwin GanaduraiNo ratings yet

- DR Ashraf Elsafty E SC 50A Samer Sohry FinalDocument41 pagesDR Ashraf Elsafty E SC 50A Samer Sohry FinalMahmoud SaeedNo ratings yet

- Income Tax - MidtermDocument9 pagesIncome Tax - MidtermThe Second OneNo ratings yet

- Common-Size Financial StatementsDocument16 pagesCommon-Size Financial StatementsApril IsidroNo ratings yet

- Study GuideDocument96 pagesStudy GuideKate Karen AlombroNo ratings yet

- HR GeneralistDocument3 pagesHR GeneralistBasuNo ratings yet

- Chapter 15Document13 pagesChapter 15IshahNo ratings yet

- Ac102 Rev01-03Document24 pagesAc102 Rev01-03Aaron DownsNo ratings yet

- Holding Company ProblemsDocument2 pagesHolding Company ProblemsSiva SankariNo ratings yet

- 2009 Summer Great Peninsula Conservancy NewsletterDocument8 pages2009 Summer Great Peninsula Conservancy NewsletterGreat Peninsula ConservancyNo ratings yet

- CIR v. Hantex Trading Co., Inc.Document3 pagesCIR v. Hantex Trading Co., Inc.Junmer OrtizNo ratings yet

- 9706 m19 QP 12Document12 pages9706 m19 QP 12Ryan Xavier M. BiscochoNo ratings yet

- Egypt Economic AnalysisDocument28 pagesEgypt Economic AnalysisShashank ShuklaNo ratings yet

- Religious Freedom Non Impairment of ContractsDocument4 pagesReligious Freedom Non Impairment of ContractsJean Jamailah Tomugdan100% (1)

- HP Final... GRP 04Document6 pagesHP Final... GRP 04Sowjanya Reddy PalagiriNo ratings yet

- SheDocument2 pagesSheRhozeiah LeiahNo ratings yet

- Annual Report of IOCL 185Document1 pageAnnual Report of IOCL 185Nikunj ParmarNo ratings yet

- Marcelo Steel Corporation vs. Collector of Internal RevenueDocument2 pagesMarcelo Steel Corporation vs. Collector of Internal RevenuesakuraNo ratings yet

- ACCA F2 2014 Examiner ReportDocument4 pagesACCA F2 2014 Examiner Reportolofamojo2No ratings yet

- PLZL Olympiada Site Visit Aug 08Document20 pagesPLZL Olympiada Site Visit Aug 08tennertyNo ratings yet

- Marginal CostingDocument31 pagesMarginal Costingdivya dharmarajan50% (4)

- Project Report Format in Excel TemplateDocument20 pagesProject Report Format in Excel Templatejambakajimba0% (2)

- Maintenance RoiDocument8 pagesMaintenance Roiganeshji@vsnl.comNo ratings yet

- Aggregation of IncomeDocument2 pagesAggregation of IncomeHarnoor SinghNo ratings yet

- Business Plan Furniture and UpholsteryDocument41 pagesBusiness Plan Furniture and UpholsteryHyacinth AugustineNo ratings yet

- BT Lựa Chọn Dự Án EDocument2 pagesBT Lựa Chọn Dự Án EstormspiritlcNo ratings yet

- Wateen Telecom 19-04-10Document3 pagesWateen Telecom 19-04-10Muhammad BilalNo ratings yet

- Fixed Asset PolicyDocument20 pagesFixed Asset PolicyMandar Jayesh Patel100% (4)

- Chapter 5 Standard Costing PDFDocument107 pagesChapter 5 Standard Costing PDFjigyasaNo ratings yet

- Business Cycle: Is The Economy Getting Better or Worse?Document22 pagesBusiness Cycle: Is The Economy Getting Better or Worse?Earl Russell S PaulicanNo ratings yet