Professional Documents

Culture Documents

PF Declaration Form 11

Uploaded by

kumar45ca0 ratings0% found this document useful (0 votes)

9 views3 pagesGST

Original Title

Pf Declaration Form 11

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGST

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views3 pagesPF Declaration Form 11

Uploaded by

kumar45caGST

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 3

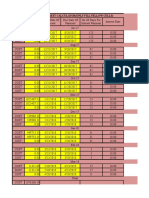

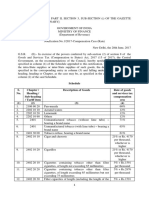

CHECKLIST FOR FILING OF GSTR - 3B

FOR THE MONTH OF SEPTEMBER 2018

! BUA Boga Matiasjna Gopi

=| Sit Sate Saree Aor CST

‘One of the main features of Goods and Service Tax is

the availability of the Input Tax Credit across the

supply chain cycle. This statement provides. very

soothing sound to the ceade and industry but it has

certain conditions to be fulfilled to take advantage of

this statement. As there is no matching for the time

being as the Government has differed it, nov it has

become more critical to ensute that all the conditions:

‘mentioned in the Aet and Rules ate fulfilled and for

this, che fling of the GSTR — 3B zetur for the month

‘of September 2018 is very vital. As per the provisions

of Sub-section 4 of Section 16 of the CGST Act 2017,

input tax credit can be claimed on the tax invoices oF

debit aotes issued by the supplier in the previous

‘nancial year for supply of goods or services or both.

has to be claimed by 20% October 2018 ie. before

fling of the monthly rerun for the month of

September 2018 basis of provisions of Section 39 of

the CGST Act of filiag of annual fetun a6. per

provisions of Section 44 whichever is eater. As GST

1s rolled out from 1" July 2077, the input tax eredit on

all in the inward supply of goods or services or both

haas co be claimed by 20% October as the due date for

Gling of September 2018 GSTR = 3B 4s that date

based on the provisions notified wide Notification No,

34/2018 — Central Tax dated 10% August 2018,

Basis of the above provisions itis clear that input tax

credit can be claimed only for all the transaction from

1* July 2018 to 31" March 2019 by 30 September

2019.

‘The following are the points to be considered before

fling the GSTR — 3B for the month of September

2018.

1, Verify all the tax invoices / debit notes issued

as per the provisions of Section 12, 13, 14, 31

&34 bythe supplier of goods of services of

booth are received and accounted.

2. Verify and ensure that tax invoice is received

for the goods or services or both for which

input tax credit is being claimed ~ clause “a” of

sub-section 2 of section 16 of the CGST Act

2017

4

Verify and ensure that all the goods or services

‘or both have been received before claiming the

credit — clause b of sub-section 2 of section 16

of the CGST Act 2017. Certain cases like

Annual Maintenance Contracts, the invoice is

issued before the completion of service and it

js spread over a period of time, in such cases

properly informed decisions have to be taken

clse the input tax credit claimed has to be

eversed along with the interest i€ found ducing

scrutiny or audit of at part of some

‘vestigation by the departments

Verify and ensure that in ease if goods are

being received in lots, the final ot is received, -

the fret proviso of sub-section 2 of section 16

of the CGST Act 2017

Verify and ensure that all che information

related to tax invoice or debit note is there on

the documents issued by the suppliet of the

goods as per provisions of Rule 46 of the

CGSL Rules 2017 like GSTIN Numbers, date

fof tavoice, Invoice Number, Place of Supply,

HSN Code, Tax Rate and Tax Amounts are

there on the tax invoice

Verify and ensure that the tax amoust is

catered in the financials for the amount issued

by the supplier om his tax invoice. Nosmal

practice is overriding the value of the tax

tavoice in ease of any shortages / breakages or

vvatiation in the quality ete, If any such cases

exist insist for a credit note feom the supplice

as per provisions of Section 34 of the CGST

‘Aet 2017,

Verify and ensure that all such edit notes

issued by the supplier are accounted

accordingly

Verify the time of supply for the reverse charge

transactions correctly ~ the time of supply for

reverse charge transactions is based on the

conditions given in section 12 and 13 of the

CGST Act. ~ especially for transactions where

the payments of goods or received before 13%

TAX BULLETIN SEPTEMBER, 2018 VOLUME - 24 - THE INSTITUTE OF COST ACCOUNTANTS OF INDIA 3

12.

1B

14,

15.

fof October 2017 and are patt of the imprest

statements accounted after 134 October 2017

as most of the assume that reverse charge is

rot applicable from this date basis of the

Notification No. 38/2017 — Central Tax (Rate)

But the provisions of the time of supply for

reverse charge has tobe considered and

accounted accordingly

If any of such transactions are found, pass

secessary accounting entries for reverse charge

including interest and pay the same,

Verify and cnsuse that tax invoices are issued

for the reverse charge transactions, a single

Favoice can be issued for all the reverse chatge

transactions basis of the First proviso for Rule

46.0 the CGST Rules 2017,

‘Verify and ensure that for all the advances paid

to unregistered taxpayers, payment vouchers

issued as per provisions of clause g of sub-

section 3 of section 31 of the CGST Act 2017,

Verify and ensure that receipt vouchers are

issued for the all the customer advances il 15%

November, 2017 the date on which

Notification No. 66/2017 — Centeal Tax is

issued. As pe the Explanation 2 given in the

Sub-section 2 of Section 12 of the CGST Act,

the eatler of the dates on which the amount is

deposited in the bank account or credited in

the books of accounts has (© be considered.

Verify the bank statement and ensure that

receipt vouchers are issued accordingly

Were ever customer advances are retuined

verify if refund voucher is issued for the same

for sot If not issue / generate the same

preserve the same for future audit and

verifications. Also ensure that accounting

cetries are passed in the accounting system.

Verify the Creditors aging

supplier invoices for where payment is not

made partially for fully within 180 days feom

the Supplier's invoice date. As per the second

proviso of Section 16 of CGST Act 2017 and

Role 37 of the CGST Rules, the amount of

input tax credit availed has to he reversed along

with interest as per provisions of Section 50 of

the CGST Act, The tate of interest is notified

wide Notification No, 13/2017 = Central Tax

Gated 28% June 2017, the rate is 18% p.a and if

the same’ is observed and found by the

department during scrutiny or audit then

penalty also has to be paid @ 24% pa

Verify the date on which returns have been

filed and the actual due date for fling of the

16

18

19.

at

retums. If the renums ate filed after the due

date, ensue that interest is paid for the delayed

days as per the provisions of Section 50 of the

CGST Act 2017, in ease iF the same is found

‘out during the auditor scrutiny then penalty is

also applicable along with interest

Verify If all the accounting entries related to

liability payment, input tax credit utization are

passed and the balances of the taxes lability,

fapur tax credit and cash tally with the

accounting ledgers and ledgers maintained at

GSTIN. If there ase any differences, pass

nccessary accounting entries For the same.

Verify if any debit notes have to be issued to

the customers, if yes issue the same before the

filing of the September 2018 monthly return

cle the customer cannot avail the input tax

credit on it and it has ۩ be unnecessarily

absorbed in the P & 1, account,

Verify the stock as per the book balance sad

physical stock, if there is any difference, the

‘input tax credit claimed has to be reversed on

the shortages / differences. Input tax credit

can be claimed only on the goods or services

for both used or intended to be used in the

course of in the furtherance of business as per

the provisions of sub-section 1 of section 16 of,

the CGST Aer and the reversal has to be done

based on the provisions of clause h of sub:

section 5 of section 17 of the CGST Act.

‘There it is clearly mentioned as blocked ITC,

that means input tax credit has to be reversed,

Verify and ensure that in ease of eapital goods,

the date on which the input tax credit availed

aad che date of capitalization of the assets are

same, if not pass necessary adjustments for

reversal of ITC slong with payment of interest

in the GSTR — 3 B of September 2018 and also

the necessary accounting entries. This is

required due to the definition of the capital

goods given in sub-section 19 of section 2 of

the CGST ct 2017,

Ensure thar TEC on all the tax invoices is

claimed where ever eligible like bank charges

and on business related expenses, if not claim

them in the month of September before fling

GSTR ~ 3B, For avatling input tax exedit on

bank charges ensure that the GSTIN of the

bank and taxable person's GSTIN. are

‘mentioned on the bank statement.

Ensure that the provisions on the blocked

credit are followed else penal provisions as per

section 74 will be levied if found during the

TAX BULLETIN SEPTEMBER, 2018 VOLUME - 24 - THE INSTITUTE OF COST ACCOUNTANTS OF INDIA 4

2

30

auditor scrutiny or as pact of any other

‘vestigation excred out by the depaciments

Verify and ensuce that for the tax invoices

issues, the provisions of Rule 46 of the CGST

Rules are followed and issued basis of Seetion

12, 13 and 14 of the CGST Act 2017,

Verify and ensure thatthe valuation for the tax

invoices is done in accordance with provisions

‘of Section 15 of the CGST Act and from Rule

27 to Rule 36 of CGST Rales 2017 are

followed propery.

‘Take a tral balance for the 31% march after

considering all the above points and verify the

GST ‘elated account balances are matching

with your GST Return balances, if 10 find the

reasons and rectify the same before the fling

‘of the September GSTR — 3B,

In case if you are having more than one

registration number casure that the financial

data matches with the sum of all the states

retuins for outward supplies, ITC ete

If any stansition credit is availed, ensare chat

you have all the supporting documents, in case

if there are any missing documents oF excess

claimed, reverse the same before filing GSTR -

BB of Septembes

In case if you feel any of the registration

numbers aze aot used and sf required you ean

surrender the same so that your compliance

cost comes down,

In case of stock transfers, reconcile the stock

sent from one GSTIN and received at the

other GSTIN, if there any differences rectify

the same before filing GSTR - 3B

In case if the stocks ate transfesred at a higher

price and the same is sold at a lower price in

the branches, ensuce that there is no excess

credit being held at the branches if possible

issue a credit note to the branches and reduce

the excess eredit a the branches.

Ensure that all the inward / outward / tax

payable / TTC / Production / Stock registers

fre maintained for the financial year and in

case of contracts they are maintained project

31. Have a mechanism to capture all the supplier

and customer data like name and addeess

32, In case of B2C maintain the name and address

fof the B2C eustomers for transactions above

Rs 50,000,

‘The above some of the important points which need

to be considered before the flingof the monthly

return for the month of September 2018. IF any

transactions are found after the filing of the retwin,

then on such transactions TTC cannot be levied and

this results in cash loss indireetly to the business. All

the adjustments have to be completed before30™

September 2018in case if you have not done the

above activities at the time of preparation of the

financial statements for year ending 31° March 2018.

In case if the books of the accounts are closed and the

above are observed now, proper care has to be taken

fn accounting basis on the provisions of the

Companies Net 2013, This being the first year of

rollout of GST and the GST audit is not noted, #

makes it more important to consider them while fling

the September 2018 GST Returns

TAX BULLETIN SEPTEMBER, 2018 VOLUME - 24 - THE INSTITUTE OF COST ACCOUNTANTS OF INDIA 5

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Form 12BB Tax Deduction ClaimsDocument4 pagesForm 12BB Tax Deduction Claimskumar45caNo ratings yet

- TDS & TCS Rates Made EasyDocument2 pagesTDS & TCS Rates Made Easykumar45caNo ratings yet

- InvoiceDocument1 pageInvoicekumar45caNo ratings yet

- GST - Interest - Calculator - OKDocument4 pagesGST - Interest - Calculator - OKkumar45caNo ratings yet

- Notfctn 04 Central Tax English 2019Document1 pageNotfctn 04 Central Tax English 2019kumar45caNo ratings yet

- Msmed Act 2006Document10 pagesMsmed Act 2006kumar45caNo ratings yet

- Mygov 15537546821Document1 pageMygov 15537546821ram sankarNo ratings yet

- GKEPL and GATI SAC Codes for Courier, Transport and Warehousing ServicesDocument4 pagesGKEPL and GATI SAC Codes for Courier, Transport and Warehousing Serviceskumar45caNo ratings yet

- GSTR-9C Reconciliation StatementDocument24 pagesGSTR-9C Reconciliation Statementkumar45caNo ratings yet

- Accelerated Depriciation - Heat Pumps - See III.8.Ix.C.cDocument8 pagesAccelerated Depriciation - Heat Pumps - See III.8.Ix.C.cPradeepRathiNo ratings yet

- Tally Ledger Listing for All Account TypesDocument12 pagesTally Ledger Listing for All Account TypesGaurav RawatNo ratings yet

- in The Said Rules, After FORM GSTR-8, The Following FORMS Shall Be Inserted, NamelyDocument12 pagesin The Said Rules, After FORM GSTR-8, The Following FORMS Shall Be Inserted, Namelyhemanvshah892No ratings yet

- Classification Scheme For Services Under GSTDocument37 pagesClassification Scheme For Services Under GSTArul PrakashNo ratings yet

- E Flier Credit Notes in GSTDocument2 pagesE Flier Credit Notes in GSTSneha AgarwalNo ratings yet

- TDSDocument4 pagesTDSkumar45caNo ratings yet

- TN VatDocument6 pagesTN VatSwetha SrikanthiNo ratings yet

- 38 - Ratio - Analysis - KPMGDocument12 pages38 - Ratio - Analysis - KPMGjatin sainaniNo ratings yet

- Taxguru - In-All About DEFERRED TAX and Its Entry in BooksDocument8 pagesTaxguru - In-All About DEFERRED TAX and Its Entry in Bookskumar45caNo ratings yet

- Press Release Clarification Regarding Applicability Standard Deduction Pension Received Former Employer 5-4-2018Document1 pagePress Release Clarification Regarding Applicability Standard Deduction Pension Received Former Employer 5-4-2018kumar45caNo ratings yet

- Form No. 49A: See Rule 114Document8 pagesForm No. 49A: See Rule 114deepdxtNo ratings yet

- Notfctn-40-Cgst-English 13.10.17Document1 pageNotfctn-40-Cgst-English 13.10.17kumar45caNo ratings yet

- DIR 3 KYC Time Extended To 15-09-2018Document14 pagesDIR 3 KYC Time Extended To 15-09-2018kumar45caNo ratings yet

- 22 GST Council MeetDocument2 pages22 GST Council Meetkumar45caNo ratings yet

- Employees' Provident Fund Organization: Declaration FormDocument3 pagesEmployees' Provident Fund Organization: Declaration FormroseNo ratings yet

- Notfctn 1 Compensation Cess EnglishDocument5 pagesNotfctn 1 Compensation Cess Englishkumar45caNo ratings yet

- Mca NotificationDocument16 pagesMca Notificationkumar45caNo ratings yet

- GST - ITC 04 - Guidelines - GSTN Official - 10-04-2018Document36 pagesGST - ITC 04 - Guidelines - GSTN Official - 10-04-2018kumar45caNo ratings yet

- Press Information Bureau Government of India Ministry of FinanceDocument3 pagesPress Information Bureau Government of India Ministry of Financekumar45caNo ratings yet

- Int. Caluculator On Income TaxDocument4 pagesInt. Caluculator On Income Tax88punitNo ratings yet