Professional Documents

Culture Documents

A. Background of The Study

Uploaded by

Ramil dela CruzOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A. Background of The Study

Uploaded by

Ramil dela CruzCopyright:

Available Formats

Chapter I

Introduction

A. Background of the Study

People became too acquainted with the continuous innovation of modern

inventions. Even at an early age, they have adapted the mentality of spending

money for one thing after another to inline themselves with the current trends.

With this habitual outlaying of money for passive enjoyment, people have

gained even bigger difficulties in financial management and the best measure

that has been learnt is saving.

Now that the society noticed the need to have financial stability, people

developed fondness of the idea of saving money. The good benefit of saving

money has been frequently discussed across people of different ages,

especially to students. According to Corpus (2010), the adolescence of an

individual starts at the age of 10 and ends at 20 years old. Corpus classified

adolescents into 3: Early adolescence occurs at ages 10-13, middle

adolescence ranges from 14-16 years old, and late adolescents are those

who are within 17-20 years old. Therefore, students falling under the category

of senior high school are now considered late adolescents. This means that

they are expected to start being responsible in handling money. It also helped

that most of academic institutions nowadays give financial literacy forums for

their learners to provide more knowledge regarding spending daily allowances

and allotting money for savings.

In spite of those financial literacy campaigns, the researchers have

observed that students still developed difficulties in financial management,

specifically in saving money from their daily allowances. A pre-test was

conducted by the researchers to verify the existence of the said problem. A

questionnaire was prepared and 40 respondents from grade 12 ABM students

are randomly picked. Based on the survey, results showed that 65 % of the

students often save money; while 35% of them are willing to save but don’t

know how to start. It was also explicitly implied that students are not used in

having any specific saving strategy except for the 2.5% that uses the “10%

saving rule”.

Even with the 10% saving strategy used by this 2.5%, there is still a

problem sited. According to kitces.com, saving something like 10% of the

available money also implicitly means spending the other 90%, and continuing

to do so over time means also saving (only) 10% and implicitly increasing the

standard of living by 90% of ever raise received in the future. On the contrary,

according to Anspach (2016), following the 10% saving rule is better than not

saving at all.

Caplovitz (1997) polished the idea of effective financial management and

came up with four distinct saving strategies- the increasing income, reducing

consumption, increasing the efficiency of resource used, and assuming debt.

The researchers assumed that among the four, reducing consumption has

more potential to be applied as saving strategy for the grade 12 ABM students

of Liceo de Cagayan University.

In this study, reducing consumption will be focused on the concept that

minimizing unnecessary consumption to decrease extra expenditures will

provide an increase in the students’ budget for savings.

B. Statement of the Problem

The study will be conducted to determine if Caplovitz Reducing

Consumption is an applicable saving strategy among Grade 12 ABM students

of Liceo de Cagayan University main campus. Specifically the study attempts

to answer the following questions:

1. Will the Caplovitz’s reducing consumption help the students to

effectively save money in terms of:

1.1. shopping only for necessities and avoids over spending

1.2. eat out less often

1.3. spending less on movies and other leisure activities

2. Is there a change to the saving practice of Grade 12 ABM students of

LDCU main campus?

3. Is there a significant difference between reducing consumption in terms

of: shopping only for necessities and avoids over spending, eat out less

often, and spending less on movies and other leisure activities?

C. Importance of the Study

The result of this study will be beneficial to the following people:

STUDENTS. Lack of savings is a serious problem of the students. Students

are very weak in managing their money because of not having the plan on

how to budget it properly. This study will help the students who have

difficulties in saving money. It will give them the idea on how to properly

control and budget their allowance and help them to have the practical aspect

of trying to plan ahead for major expenses.

TEACHERS. The results of this study will give an idea to the teachers on how

to properly manage their finances. Also, the teachers can share the ideas on

effective saving strategy through teaching. It will also improve their saving skill

in spite of having financial constraint.

PARENTS. This study will help the parents on how to wisely manage and

budget their finances for the daily needs of the family. Also it will help them to

lessen the burdens of sending their children to school.

FUTURE RESEARCHERS. The ideas presented in this study may be used as

reference data in conducting new researches or in testing the validity of other

related findings. This study will also serve as their cross-reference that will

give them a background or an overview about effective saving strategy of

students.

D. Definition of Terms

Adolescence- the period following the onset of puberty during which a young

person develops from a child into an adult.

Financial Literacy- the ability to manage personal finance matters in an

efficient manner, and it includes the knowledge of making appropriate

decisions about personal finance such as investing, insurance, real estate,

paying for college, budgeting, retirement and tax planning.

Financial Stability- is a state in which the financial system is resistant to

economic shocks and is fit to smoothly fulfil its basic functions: the

intermediation of financial funds, management of risks and the arrangement of

payments.

Reducing Consumption- Is centered around the idea of limiting unnecessary

consumption to diminish additional consumptions enable to reserve funds.

Saving Strategy- refers to an effective way of saving money

10 % Saving Rule- is a saving strategy that allows a person to save 10% of

the amount available.

E. Scope and Limitation

The study focuses with the Caplovitz reducing consumption as a saving

strategy to help students who have difficulties in saving money. The study will

discuss about reducing consumption which includes shopping only for

necessities and avoids over spending, eat out less often, and spending less

on movies and other leisure activities. The respondents of the study are the

Grade 12 ABM students of Liceo de Cagayan University Main Campus.

Chapter 2

Review of Related Literature

Foreign Studies

Losby (2008) in his research, “Saving strategies: decision and

sacrifices low-income parents make to secure a better future for their families”

hypothesized that those who have a history of saving use significantly more

helpful saving strategies than respondents without a saving history. Parents

who have a history of saving experience less severe hardship than parents

who do not have a history of saving. It was not seen that there is a

relationship between the number of helpful saving strategies and the age of

the saver.

Losby cited an example where he compared the saving practices of

European from Americans: “across the 27 member states of the European

Union the personal savings rate was 10.6 percent in the last quarter of 2007

(EuroStat, 2008) and Americans had a personal savings rate near zero (U.S.

Department of Commerce, 2007)”. He presented that the decrease in

personal savings rate is primarily due to the term “conspicuous

consumption”― which was coined by Veblen (1989). In Losby’s study, he

used the term to give emphasis to the members of the upper class men who

use their wealth to signify social power—both actual and perceived.

Conspicuous consumption defines the excessive expenditures on goods and

services acquired primarily for the purpose of displaying wealth or

getting/maintaining high social status. Also according to Veblen, ―”invidious

consumption”, a necessary repercussion, is the term applied to the

consumption of goods and services for the considered purpose of inspiring

envy in others (Losby, 2008, Dugger, 2006; Veblen, 1899).

In the above mentioned study of Losby, the behavioral life-cycle

hypothesis (BLCH) was used―which argued that people build their own

motivations or restrictions to help them save (Shefrin & Thaler 1988, 1992).

Beverley et al. (2001) applied the BLCH to a saving strategy model. In the

model, savers use either psychological or behavioral saving strategies. The

results from Losby’s study showed that low-income parents have the potential

success in saving money through using the behavioral strategies “using

resources more efficiently” and the “reducing consumption”.

People enjoy buying product if it justifies their reasons to their needs

(Mishra & Mishra, 2005). The right decision to save can lead to a better

financial well-being in the future. Although, saving is an important step to

financial well-being, people still have difficulties to shorten their expense and

save money (Maki & Palumbo, 2001).

The Behavioral Economic theory says that although people want to

save, they still have difficulty to restrain the temptation to spend (Beverly,

2008). Young people spend their money mostly to their priorities than saving it

(Samson et al., 2004), though this does not limit to young people.

According to Victoria (2017), people become wealthy in the future

because of their great habits in saving money. And rich people become richer

because of their successful habits in controlling their expenses and careful

spending of money. Saving is an important step to achieve the financial goal

of a person. It does not mean to be thrifty, but people who set goals in saving

must learn to save first before spending their money.

The perception of people towards saving is it is an activity that can

contribute to their goals and achievements. A study about the saving habit of

young people demonstrated that saving was a very important habit (Furnham,

1999) and that it can contribute to one’s life satisfaction (Xiao et al., 2008).

Dominant studies on saving (Furnham,1999) have demonstrate that

people save money when they want something special which can be

understood as a goal. But saving should not be done after satisfying the

needs and wants. Setting aside the money before using or spending it is a

good practice towards a successful and continuous habit of saving.

Money is an enabler of personal and social activities that can

contribute to the experiences of the people (Seligman and Csikszentnihalyi,

2000). This is done by the act of defining intention that let people commit to a

goal that saving is the best way in achieving the desires. Dunn and Norton

(2013) studied the increase of happiness through spending money in a

meaningful way. The study revealed that the more people spend their money

for different products the lesser the saving they have done.

Teenagers started saving often as a response to withdrawal of financial

support from their parents. And those who save earlier in life would save for

something specific for the future than putting money for a rainy day. Some

teenagers are pressured to save for something that is “worthwhile” like saving

for a drive lesson or a car (Whyley & Kempson, 2006). In another study, some

young adults (aged 18 to 24) tend to save for a university (Synovate, 2004).

According to Leon Monkedi, a leader of America Saves Week, the key

to financial success knows on how an individual spends his money. It is not

always easy for a student to commit to save. Students tend to get caught up

with the trend of living beyond of what they can afford. Savings is important to

students to help them for their college to less their huge financial burden. And

college students can already show his/her financial maturity to track their

expenses. (Monkendi, 2004)

Saving can also be a learning experiment. Students have many career

opportunities in the future. Time will come that they will spend most of their

time to their friends and family. It will be hard for them to spend time in saving.

People who save money in their hand at young age are also a great saving for

learning and experiences (Dhoot, 2016).

According to Croy et al.,(2010) many students are experiencing

financial hard times when they finished their studies, especially in finding a job

and when they get older because they never get the facts on saving. Financial

problems caused stress and crisis. Not only the poor people are worried about

the financial problems, but also the middle and high income people are

included. It is not the high salary can guarantee people not having the

financial problems but it is their financial management (Sporakowaki, 1979).

Furthermore, based on a study, it was indicated that financial

knowledge is one of the strongest predictor of financial behavior among the

students. Financial education or knowledge should be based on the needs,

interest, and abilities of each student (Norvilities et al., 2006 and Hilgert

&Hogart, 2003). Despite of this it was stated in Croy et. Al., 2010 other

students don’t practice saving because they do not know how useful and

relevant it is.

Students face many hard financial decisions in regards to satisfying

their wants and needs. Many students end up making some costly money

mistakes, thus this mistake can actually cause damage that lingers for

decades (Xiao et al., 2007). According to Wong (2013), the lack of financial

knowledge can lead to student to face financial problems. Students are very

weak when it comes to saving money. They always make the wrong decision

in satisfying their wants and needs.

Local Studies

The total annual family income of the Philippines in 2009 was

estimated to be PHP 3.804 trillion, which equal to PHP 206,000 average

annual income per family. The upper 70 percent income group earned an

average of PHP 268,000 per family. The poor, who belonged to the bottom 30

percent of the income group, lived on an average annual family income of

PHP 62,000 or PHP 5,166 per month (Diaz et. al., 2011). According to the

2009 official estimates, 26.5 % of Filipinos are poor, which is equivalent to

23.14 million Filipinos subsisting on monthly family income of PHP 7,017 or

below. Within the last four years, the number of Filipinos living in poverty

increased from 22.17 million in 2006 to 23.14 million in 2009.

It is said by National Statistics Office (2006-2009) that people belong to

the poor class spent money more than how much they earned which gives

idea that they cannot save money for future use. In addition to that, it is

reported that 70 % of the population which belongs to upper class have

increased their savings from PHP 38,000 to PHP 44,000. This indicates that

as income increases savings also increases.

Furthermore, according to Diaz et. Al., (2011), in their study entitled,’’

Savings for the Poor in the Philippines’’, that the microfinance industries in the

Philippines are innovating which includes a variety of institutions offering

broad range of products operating in a highly supportive regulatory

environment. This tells that people are more prone to or tempted by the

products which are continuously innovating that leads them to spend money.

Based on the study of Orbeta (2006), ‘’ Children and Household

Savings in the Philippines’’, savings is the vehicle for consumption smoothing

as argued in the celebrated life-cycle hypothesis because saving money can

help you become financially secure and provide a safety net in case of an

emergency. Although it is good thing, it was revealed by the researchers

Mapa and Bersales (August 2008) from the University of the Philippines that

studied the savings data from 1985-2003 and found that Filipinos have

difficulties in saving money.

In addition to this, recently saving on a regular basis has been found to

enable households to move out of slum areas (Lall et al. 2005). Both of these

macroeconomic and microeconomic concerns are evident in the case in the

Philippines. The savings rates in the country are low, even lower than

Indonesia, which has lower per capita income (Orbeta 2005a). This had been

identified as one the main reasons why the country has not grown as fast as

its neighbours. Low household savings also exposes families to the risk of

income shortfalls. In fact, determining the role of children in household

savings provides an added dimension to the low savings rate of the country.

Norvilities et al. (2006) and Hilgert and Hogart (2003) indicated that, financial

knowledge is one 16 of the strongest predictor of financial behaviour among

university students. Financial education or knowledge should be based on the

needs, interests, and abilities of each student. Clearly, more financial

education is needed for young adults to better the economy.

You might also like

- The Impact of Financial Literacy On Budgeting Management Among Abm StudentsDocument12 pagesThe Impact of Financial Literacy On Budgeting Management Among Abm StudentsDatu Abdullah Sangki MpsNo ratings yet

- CHAPTER 2 Tvl-HeDocument3 pagesCHAPTER 2 Tvl-HeNicolette Dayrit Dela PenaNo ratings yet

- Final Chap 1 5Document35 pagesFinal Chap 1 5emarites ronquilloNo ratings yet

- Concept PaperDocument5 pagesConcept PaperRhorrie RosalesNo ratings yet

- 3i's CHAPTER 1,2Document11 pages3i's CHAPTER 1,2Ampy SasutonaNo ratings yet

- Bauan Technical High School Senior High School: The Study Aimed To Determine The Effects of Relationship To The AcademicDocument10 pagesBauan Technical High School Senior High School: The Study Aimed To Determine The Effects of Relationship To The AcademicPrincess Lheakyrie Casilao0% (1)

- Please Follow The Format For The TITLE PAGEDocument14 pagesPlease Follow The Format For The TITLE PAGEjay-ar dimaculanganNo ratings yet

- Chapter 1 To 5 PRDocument38 pagesChapter 1 To 5 PRNes NesNo ratings yet

- Philippine Christian University Union High School of Manila Senior High SchoolDocument24 pagesPhilippine Christian University Union High School of Manila Senior High SchoolDaniela Mae Pangilinan100% (1)

- Abm ResearchDocument13 pagesAbm ResearchRuby BaltarNo ratings yet

- Financial Literacy and Its Relation To The Budgetary Practices of The Grade 12 Students at Quezon National High SchoolDocument19 pagesFinancial Literacy and Its Relation To The Budgetary Practices of The Grade 12 Students at Quezon National High SchoolNormi Anne TuazonNo ratings yet

- A Research On The Allowance and Budgeting of Grade 12 Students in Asist Main CDocument26 pagesA Research On The Allowance and Budgeting of Grade 12 Students in Asist Main Cndeez9598No ratings yet

- Practical ResearchDocument15 pagesPractical ResearchArchie BadilloNo ratings yet

- Research-De Blas Michael SampleDocument17 pagesResearch-De Blas Michael SampleJhon Michael CabaelNo ratings yet

- Table 1 Students' Profile in Terms of AgeDocument4 pagesTable 1 Students' Profile in Terms of AgewelpNo ratings yet

- Practical ResearchDocument67 pagesPractical ResearchAramae Dagami50% (2)

- Group 3 - Cash Course - Level of Financial Literacy of Mindanao State University - General Santos City Senior High School Students-1Document49 pagesGroup 3 - Cash Course - Level of Financial Literacy of Mindanao State University - General Santos City Senior High School Students-1James PogiNo ratings yet

- St. Vincent College of Cabuyao: The Problem and Its BackgroundDocument26 pagesSt. Vincent College of Cabuyao: The Problem and Its BackgroundJuliana Kimberly ViernesNo ratings yet

- Kidapawan City National High SchoolDocument33 pagesKidapawan City National High SchoolNeil Christian CercadoNo ratings yet

- Financial Stability Affecting The Student Engagement of Grade 12 Students at Bucal National High SchoolDocument17 pagesFinancial Stability Affecting The Student Engagement of Grade 12 Students at Bucal National High SchoolReign Maxinne BallesterosNo ratings yet

- The Relationship Between Money Allowance and Budgeting Skills of Abm Students in Holy Nazarene Christian School Year 2023-2024Document19 pagesThe Relationship Between Money Allowance and Budgeting Skills of Abm Students in Holy Nazarene Christian School Year 2023-2024neilcasupang1No ratings yet

- I Miss YouDocument11 pagesI Miss YouAl Vincent100% (1)

- Struggles of Senior Highschool Students With Ofw ParentsDocument5 pagesStruggles of Senior Highschool Students With Ofw ParentsNezerie Noah100% (1)

- 1.targeting Procrastination Using Psychological Treatments: A Systematic Review and Meta-AnalysisDocument5 pages1.targeting Procrastination Using Psychological Treatments: A Systematic Review and Meta-AnalysisJohn100% (2)

- Group IvDocument30 pagesGroup IvRonald ArtilleroNo ratings yet

- The Relationship Between Money Allowance and Budgeting SkillDocument22 pagesThe Relationship Between Money Allowance and Budgeting SkillHerald ReyesNo ratings yet

- Entrepreneurial Intentions FinalDocument74 pagesEntrepreneurial Intentions FinalNeil Patrick Lajera CruzNo ratings yet

- (13.5) Student Life Under High Price Level - DungnttDocument2 pages(13.5) Student Life Under High Price Level - DungnttNgaymai TrongxanhNo ratings yet

- Group 1 Kaye PRDocument6 pagesGroup 1 Kaye PRJazreen Kylle Gonzales DiazNo ratings yet

- FINANCIAL PROBLEM OF STUDENTS in Terms of Transportion 2.0Document2 pagesFINANCIAL PROBLEM OF STUDENTS in Terms of Transportion 2.0robert habonNo ratings yet

- Scope and DelimitationsDocument3 pagesScope and DelimitationsEddie ViñasNo ratings yet

- BUSINESS FINANCE AS A CORE SUBJECT AND ITS IMPACT ON THE BUDGETING AND FINANCIAL DECISION-MAKING OF SELECTED SENIOR HIGH SCHOOL GRADE 12 ACCOUNTING, BUSINESS AND MANAGEMENT (ABM) STUDENTS OF DASMARIÑAS INTEGRATED HDocument16 pagesBUSINESS FINANCE AS A CORE SUBJECT AND ITS IMPACT ON THE BUDGETING AND FINANCIAL DECISION-MAKING OF SELECTED SENIOR HIGH SCHOOL GRADE 12 ACCOUNTING, BUSINESS AND MANAGEMENT (ABM) STUDENTS OF DASMARIÑAS INTEGRATED HJOSEPH QUIZONANo ratings yet

- Research Chapter1 3Document24 pagesResearch Chapter1 3Kristine CabalNo ratings yet

- Final ResearchxxDocument27 pagesFinal Researchxxhyunsuk choiNo ratings yet

- Review of Related LiteratureDocument6 pagesReview of Related LiteraturewilfredandrewagustinNo ratings yet

- Increasing Financial Literacy Among Senior High School Non Abm Students Through Interactive MultimediaDocument11 pagesIncreasing Financial Literacy Among Senior High School Non Abm Students Through Interactive MultimediaSandralyne Dela Merced Pascua100% (1)

- Effect of Financial Status To The Abm Students in DmnhsDocument2 pagesEffect of Financial Status To The Abm Students in DmnhsJemimah ObispadoNo ratings yet

- Spending and Saving PR2Document6 pagesSpending and Saving PR2Jona Unabia100% (2)

- Superfinal Research PaperDocument54 pagesSuperfinal Research PapercgNo ratings yet

- Introduction PR 2Document16 pagesIntroduction PR 2James Redoblado0% (1)

- Resear: Department of EducationDocument30 pagesResear: Department of EducationJoyce Sarmiento100% (1)

- Chapter IvDocument11 pagesChapter IvHazel NacionalNo ratings yet

- Correlation of Spending Habits of Grade 11 Studets To Their Financial Literacy in WITI. II AIONDocument11 pagesCorrelation of Spending Habits of Grade 11 Studets To Their Financial Literacy in WITI. II AIONrainier reoladaNo ratings yet

- Combatting Extreme Absenteeism of Grade 11 TVL Learners Using Strategic Task-Based Affirmative Reinforcements (Star) Technique in Practical Research 1 ClassroomDocument11 pagesCombatting Extreme Absenteeism of Grade 11 TVL Learners Using Strategic Task-Based Affirmative Reinforcements (Star) Technique in Practical Research 1 ClassroomGlobal Research and Development ServicesNo ratings yet

- Creative WritingDocument8 pagesCreative WritingOnallera Mae Arellano100% (1)

- Review of Related LiteratureDocument22 pagesReview of Related Literatures o d a p o pNo ratings yet

- Perception On Financial Management On Teachers in LNHSDocument28 pagesPerception On Financial Management On Teachers in LNHSanjie_delarosa100% (2)

- Draft For Chapter 1 - 5 Impacts of SHS CurriculumDocument61 pagesDraft For Chapter 1 - 5 Impacts of SHS CurriculumGabrielle IbascoNo ratings yet

- Readiness of Senior High School Graduates For Business Education Programs in Selected Higher Education Institutions in IsabelaDocument32 pagesReadiness of Senior High School Graduates For Business Education Programs in Selected Higher Education Institutions in Isabelarhoda reynoNo ratings yet

- FINALPADocument15 pagesFINALPANadssNo ratings yet

- Ateneo de Davao University Study On Monthly Allowance of StudentsDocument3 pagesAteneo de Davao University Study On Monthly Allowance of StudentschxrlttxNo ratings yet

- Carpio Camille Practical Research Final123Document45 pagesCarpio Camille Practical Research Final123Richelle Althea OponeNo ratings yet

- The Influence of Kpop On The Spending Habits of Grade 11 Abm Student of GFMINHSDocument22 pagesThe Influence of Kpop On The Spending Habits of Grade 11 Abm Student of GFMINHSNobi NobiNo ratings yet

- Chapter 1Document6 pagesChapter 1Maria MacelNo ratings yet

- Group 1 - Relationship of Financial Literacy To Budgetary Practices of Senior High School Working StudentsDocument70 pagesGroup 1 - Relationship of Financial Literacy To Budgetary Practices of Senior High School Working StudentsChristian LloydNo ratings yet

- Coping-Mechanism-Of-Grade-10-Students - Edited June 04Document5 pagesCoping-Mechanism-Of-Grade-10-Students - Edited June 04Wenslee AloneNo ratings yet

- Reviews of Related LiteratureDocument7 pagesReviews of Related LiteratureShereen Grace GaniboNo ratings yet

- Thesis Final Na JudDocument73 pagesThesis Final Na JudAlgie Rose Otero TolentinoNo ratings yet

- The Impact of Inflation On Farmers and AgricultureDocument43 pagesThe Impact of Inflation On Farmers and AgricultureSharif BalouchNo ratings yet

- 2Document37 pages2Caroline Joy GargalicanoNo ratings yet

- Management Advisory Services ReviewDocument1 pageManagement Advisory Services ReviewRamil dela CruzNo ratings yet

- Journal of Religion & Film: Scorsese's Silence: Film As Practical TheodicyDocument36 pagesJournal of Religion & Film: Scorsese's Silence: Film As Practical TheodicyRamil dela CruzNo ratings yet

- Application ControlsDocument3 pagesApplication ControlsChess Nuts100% (1)

- OmelasDocument1 pageOmelasRamil dela CruzNo ratings yet

- DomesticatesDocument1 pageDomesticatesRamil dela CruzNo ratings yet

- Is A Miracle A Good Proof For The Existence of GodDocument1 pageIs A Miracle A Good Proof For The Existence of GodRamil dela CruzNo ratings yet

- OmelasDocument1 pageOmelasRamil dela CruzNo ratings yet

- DomesticatesDocument1 pageDomesticatesRamil dela CruzNo ratings yet

- Batas Pambansa 22Document1 pageBatas Pambansa 22Ramil dela CruzNo ratings yet

- Convenience-At These Trying Times, It Is Convenient and Safe To Pay Bills Electronically Without Having ToDocument1 pageConvenience-At These Trying Times, It Is Convenient and Safe To Pay Bills Electronically Without Having ToRamil dela CruzNo ratings yet

- Ad Absurdum That Supposes God, The Greatest Conceivable Being, Exists Only in The UnderstandingDocument1 pageAd Absurdum That Supposes God, The Greatest Conceivable Being, Exists Only in The UnderstandingRamil dela CruzNo ratings yet

- Ad Absurdum That Supposes God, The Greatest Conceivable Being, Exists Only in The UnderstandingDocument1 pageAd Absurdum That Supposes God, The Greatest Conceivable Being, Exists Only in The UnderstandingRamil dela CruzNo ratings yet

- Chapter 7 Question Review PDFDocument12 pagesChapter 7 Question Review PDFChit ComisoNo ratings yet

- Annexes TOS Effective October 2022Document37 pagesAnnexes TOS Effective October 2022Rhad Estoque100% (12)

- FlowchartDocument1 pageFlowchartRamil dela CruzNo ratings yet

- FORECASTDocument12 pagesFORECASTRamil dela CruzNo ratings yet

- CES LLP: Committed To Quality. Committed To YouDocument1 pageCES LLP: Committed To Quality. Committed To YouRamil dela CruzNo ratings yet

- Chapter 7 Question Review PDFDocument12 pagesChapter 7 Question Review PDFChit ComisoNo ratings yet

- Midterm Exam (Questions)Document3 pagesMidterm Exam (Questions)JustineNo ratings yet

- Logo 1Document1 pageLogo 1Ramil dela CruzNo ratings yet

- The Importance of RA No. 1425Document1 pageThe Importance of RA No. 1425Ramil dela CruzNo ratings yet

- Working Paper TemplatesDocument9 pagesWorking Paper TemplatesTroisNo ratings yet

- Identity TheftDocument2 pagesIdentity TheftRamil dela CruzNo ratings yet

- Justine Mae NeriMath 4Document3 pagesJustine Mae NeriMath 4Ramil dela CruzNo ratings yet

- Econ Dev AssignmentDocument15 pagesEcon Dev AssignmentRamil dela CruzNo ratings yet

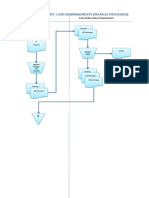

- System Flowchart-Cash Disbursements (Manual Processes) : AP Department Cash Disbursement DepartmentDocument1 pageSystem Flowchart-Cash Disbursements (Manual Processes) : AP Department Cash Disbursement DepartmentRamil dela Cruz0% (1)

- III. Product Presentation A. Product DescriptionDocument1 pageIII. Product Presentation A. Product DescriptionRamil dela CruzNo ratings yet

- Grade 12 - ABM 1 (Group 2) Oras, Erica Jean S. Neri, Justine Mae T. Navales, Lucille G. Adolfo, Mary RoseDocument1 pageGrade 12 - ABM 1 (Group 2) Oras, Erica Jean S. Neri, Justine Mae T. Navales, Lucille G. Adolfo, Mary RoseRamil dela CruzNo ratings yet

- Systemic Circulations, Such As The HeadDocument9 pagesSystemic Circulations, Such As The HeadRamil dela CruzNo ratings yet

- AnatomyDocument4 pagesAnatomyRamil dela CruzNo ratings yet

- World04 26 17Document40 pagesWorld04 26 17The WorldNo ratings yet

- RRLDocument15 pagesRRLVince Cinco Parcon100% (1)

- 03 Cpumrj Enciolt 2022Document22 pages03 Cpumrj Enciolt 2022nhestorfajardo2No ratings yet

- Bots Money Budgeting A Comparative Analysis of Grade 12 Lagro High Schools Abm and Humss Students Financial LiteracyDocument6 pagesBots Money Budgeting A Comparative Analysis of Grade 12 Lagro High Schools Abm and Humss Students Financial LiteracyJesfie VillegasNo ratings yet

- Financial Consumer Protection, Including Financial EducationDocument14 pagesFinancial Consumer Protection, Including Financial Educationjohn rithoNo ratings yet

- Setting Financial Goals PowerPoint 1.17.3.G1Document33 pagesSetting Financial Goals PowerPoint 1.17.3.G1smitanade10No ratings yet

- Kirumbi S - 2019 - The Impact of Financial Literacy On The Performance of Small and Medium Scale Enterprises in Morogoro MunicipalDocument101 pagesKirumbi S - 2019 - The Impact of Financial Literacy On The Performance of Small and Medium Scale Enterprises in Morogoro Municipalyuta nakamoto100% (1)

- Sample ResultsDocument13 pagesSample ResultsDon James VillaroNo ratings yet

- Financial Literacy SACCO ManualDocument38 pagesFinancial Literacy SACCO ManualMukalele RogersNo ratings yet

- Financial Literacy ThesisDocument26 pagesFinancial Literacy ThesisCristwizer SaysonNo ratings yet

- 15 161 Research Article FinalDocument16 pages15 161 Research Article FinalFernandoNo ratings yet

- BUSINESS FINANCE AS A CORE SUBJECT AND ITS IMPACT ON THE BUDGETING AND FINANCIAL DECISION-MAKING OF SELECTED SENIOR HIGH SCHOOL GRADE 12 ACCOUNTING, BUSINESS AND MANAGEMENT (ABM) STUDENTS OF DASMARIÑAS INTEGRATED HDocument16 pagesBUSINESS FINANCE AS A CORE SUBJECT AND ITS IMPACT ON THE BUDGETING AND FINANCIAL DECISION-MAKING OF SELECTED SENIOR HIGH SCHOOL GRADE 12 ACCOUNTING, BUSINESS AND MANAGEMENT (ABM) STUDENTS OF DASMARIÑAS INTEGRATED HJOSEPH QUIZONANo ratings yet

- Curriculum Review Cha Ching Full Report 2021Document117 pagesCurriculum Review Cha Ching Full Report 2021get.bryanpunzalanNo ratings yet

- Retail ManagementDocument77 pagesRetail ManagementSri VenigandlaNo ratings yet

- Strama Case AnalysisDocument4 pagesStrama Case Analysiskororo mapaladNo ratings yet

- Final Research Paper Group 1Document95 pagesFinal Research Paper Group 1leanielpayos911No ratings yet

- Financial Literacy and Spending Habits of Accountancy Students in Saint Francis Xavier College FinalDocument21 pagesFinancial Literacy and Spending Habits of Accountancy Students in Saint Francis Xavier College FinalAngelika Panilag100% (9)

- National Standards in K12 Personal Finance EducationDocument52 pagesNational Standards in K12 Personal Finance Educationmaster45No ratings yet

- Financial Literacy ResumeDocument1 pageFinancial Literacy Resumeapi-275255440No ratings yet

- An Evaluation On The Levels of Personal Financial Mastery of Selected Senior High School Students at Unida Christian Colleges For The A.Y. 2020-2021Document42 pagesAn Evaluation On The Levels of Personal Financial Mastery of Selected Senior High School Students at Unida Christian Colleges For The A.Y. 2020-2021Gemver Baula BalbasNo ratings yet

- Session 3-2: Fintech, Financial Literacy, and Consumer Saving and Borrowing: The Case of Thailand by Thammarak MoenjakDocument23 pagesSession 3-2: Fintech, Financial Literacy, and Consumer Saving and Borrowing: The Case of Thailand by Thammarak MoenjakADBI Events100% (1)

- Group 4 St. Teresa Gender Based Assessment of Financial Literacy Among Grade 12 Senior High School StudentsDocument91 pagesGroup 4 St. Teresa Gender Based Assessment of Financial Literacy Among Grade 12 Senior High School StudentsDonnamae TormisNo ratings yet

- Alhamd Islamic University: We Change LivesDocument4 pagesAlhamd Islamic University: We Change LivesRiaz MirzaNo ratings yet

- Financial Literacy in College StudentsDocument9 pagesFinancial Literacy in College StudentsAnh Thu VuNo ratings yet

- Financial Literacy The University Student PDFDocument21 pagesFinancial Literacy The University Student PDFAnonymous tZ0LPVUNo ratings yet

- Bradley 2021Document12 pagesBradley 2021chisa meiNo ratings yet

- Matatu-17-Tersiah Kyalo-Investment Dependent VariableDocument4 pagesMatatu-17-Tersiah Kyalo-Investment Dependent VariableJoram MutuaNo ratings yet

- Chapter 1: Financial Inclusion - Global PerspectiveDocument74 pagesChapter 1: Financial Inclusion - Global PerspectivenitmemberNo ratings yet

- RP @sebi GuidelinesDocument8 pagesRP @sebi GuidelinesGouri ShankarNo ratings yet

- Financial Literacy Among YouthDocument14 pagesFinancial Literacy Among Youthjack100% (1)