Professional Documents

Culture Documents

Soal UTS - ALK Dan Valuasi Okt 2018

Uploaded by

Irwan Adimas0 ratings0% found this document useful (0 votes)

99 views1 pagealk

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentalk

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

99 views1 pageSoal UTS - ALK Dan Valuasi Okt 2018

Uploaded by

Irwan Adimasalk

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Hugo Boss AG is a German designer, manufacturer and distributor of men’s and women’s clothing, operating in

the higher end of the clothing retail industry. During the period 2001–2008, the company consistently earned

returns on equity in excess of 18 percent, grew its book value of equity (before special dividends) by 5.5 percent

per year, on average, and paid out 65–70 percent of its net profit as dividends. In 2008, the company paid out a

special dividend of €345.1 million. Consequently, the company’s book value of equity decreased from €546.8

million in 2007 to €199.0 million in 2008.

On April 1, 2009, one month before the publication of the first-quarter results, when Hugo Boss’s 70.4 million

common shares trade at about €11 per share, an analyst produces the following forecasts for Hugo Boss.

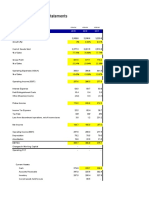

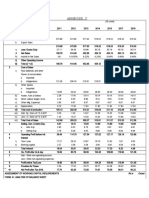

Income statement (€ millions) 2009E 2010E 2011E

Sales 1548.1 1493.9 1561.2

Gross profit 897.9 875.1 923.7

EBIT 179.6 176.9 196.2

Interest expense (45) (40) (35)

EBT 134.6 136.9 161.2

Tax expense (36.3) (37) (43.5)

Net profit 98.3 99.9 117.7

Balance sheet (€ millions) 2008R 2009E 2010E 2011E

Total non-current assets 459.2 480.8 499.1 512.0

Inventories 381.4 325.1 304.3 305.3

Trade receivables 201.0 175.4 160.8 156.1

Cash and cash equivalents 24.6 33.5 32.5 47.2

Other current assets 95.4 136.5 172.5 203.2

Total current assets 702.4 670.5 670.1 711.8

Shareholders’ equity 199.0 200.2 221.6 259.0

Non-current provisions 27.9 25.6 24.7 25.8

Non-current debt 588.5 576.7 565.2 553.9

Other non-current liabilities (noninterest

bearing) 26.7 24.5 23.6 24.8

Deferred tax liabilities 17.9 18.3 18.7 19.0

Total non-current liabilities 661.0 645.1 632.2 623.5

Current provisions 59.3 59.3 59.3 59.3

Current debt 40.2 40.2 40.2 40.2

Other current liabilities 202.1 206.5 215.9 241.8

Total current liabilities 301.6 306.0 315.4 341.3

TOTAL EQUITY AND LIABILITIES 1161.6 1151.3 1169.2 1223.8

You might also like

- Marel q3 2019 Condensed Consolidated Interim Financial Statements ExcelDocument5 pagesMarel q3 2019 Condensed Consolidated Interim Financial Statements ExcelAndre Laine AndreNo ratings yet

- Session 1 RatiosDocument1 pageSession 1 Ratios100507861No ratings yet

- Financial Statements-Kingsley AkinolaDocument4 pagesFinancial Statements-Kingsley AkinolaKingsley AkinolaNo ratings yet

- Case Study - Campari - Model - VFDocument99 pagesCase Study - Campari - Model - VFPietro SantoroNo ratings yet

- Excel Bodyshop EFDocument18 pagesExcel Bodyshop EFgestion integralNo ratings yet

- Tugas ALK Chapter 7Document8 pagesTugas ALK Chapter 7Alief AmbyaNo ratings yet

- Tarson Products (Woking Sheet - FRA)Document9 pagesTarson Products (Woking Sheet - FRA)RR AnalystNo ratings yet

- Exhibit 1 Horniman Horticulture Projected Horniman Horticulture Financial Summary (In Thousands of Dollars)Document2 pagesExhibit 1 Horniman Horticulture Projected Horniman Horticulture Financial Summary (In Thousands of Dollars)Hằng Dương Thị MinhNo ratings yet

- FINM7044 Assignment 1 Group Company ModelDocument42 pagesFINM7044 Assignment 1 Group Company ModelMesh MohNo ratings yet

- Nike - Case Study MeenalDocument9 pagesNike - Case Study MeenalAnchal ChokhaniNo ratings yet

- Nike - Case StudyDocument9 pagesNike - Case StudyAnchal ChokhaniNo ratings yet

- Ratio Analysis - DABURDocument9 pagesRatio Analysis - DABURabhilash hazraNo ratings yet

- 9M 2023 Reviewed Financial StatementsDocument64 pages9M 2023 Reviewed Financial StatementsZain RehmanNo ratings yet

- q1 Financial Supplement en FinalDocument9 pagesq1 Financial Supplement en FinalDebsingha SirkarNo ratings yet

- Q3 2022 Quarterly Financial Statements VT Group AGDocument6 pagesQ3 2022 Quarterly Financial Statements VT Group AGAmr YehiaNo ratings yet

- XLS EngDocument26 pagesXLS EngcellgadizNo ratings yet

- Financial Section - Annual2019-08Document11 pagesFinancial Section - Annual2019-08AbhinavHarshalNo ratings yet

- Financial Supplement Fy 2022 enDocument9 pagesFinancial Supplement Fy 2022 enAntonelly Baca MoncayoNo ratings yet

- Prospective Analysis 1Document5 pagesProspective Analysis 1MAYANK JAINNo ratings yet

- ANJ AR 2013 - English - Ykds3c20170321164338Document216 pagesANJ AR 2013 - English - Ykds3c20170321164338Ary PandeNo ratings yet

- BIOCON Ratio AnalysisDocument3 pagesBIOCON Ratio AnalysisVinuNo ratings yet

- Trent LTDDocument23 pagesTrent LTDpulkitnarang1606No ratings yet

- Also Annual Report Gb2022 enDocument198 pagesAlso Annual Report Gb2022 enmihirbhojani603No ratings yet

- Campari Model VFDocument97 pagesCampari Model VFJaime Vara De ReyNo ratings yet

- 9M 2022 Reviewed Financial StatementsDocument62 pages9M 2022 Reviewed Financial StatementsEiad WaleedNo ratings yet

- XLS728 XLS EngDocument10 pagesXLS728 XLS EngFRANKNo ratings yet

- Ey Aarsrapport 2021 22 13Document1 pageEy Aarsrapport 2021 22 13Ronald RunruilNo ratings yet

- E603 Jumbopresentation Sept23 GRDocument11 pagesE603 Jumbopresentation Sept23 GRpithikose2tou52No ratings yet

- FinanceShowcase - KADMCapitalDocument73 pagesFinanceShowcase - KADMCapitalJason TTWNo ratings yet

- Indiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Document9 pagesIndiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)hemant goyalNo ratings yet

- Campari Model VFDocument97 pagesCampari Model VFJaime Vara De ReyNo ratings yet

- Nestle Income Statement & Balance SheetDocument10 pagesNestle Income Statement & Balance SheetDristi SinghNo ratings yet

- Siddhi Chokhani - 65: Rahul Gupta - 31 Shyam Parasrampuria - 40 Reema Parkar - 54 Vidhi Gala - 57 Radhika Bajaj - 64Document31 pagesSiddhi Chokhani - 65: Rahul Gupta - 31 Shyam Parasrampuria - 40 Reema Parkar - 54 Vidhi Gala - 57 Radhika Bajaj - 64avinash singhNo ratings yet

- Fima Midterm ActsDocument4 pagesFima Midterm ActsKatrina PaquizNo ratings yet

- Golden State Canning Company, Inc.: Selected Income Statement Items, Year Ending December 31Document1 pageGolden State Canning Company, Inc.: Selected Income Statement Items, Year Ending December 31dynaNo ratings yet

- Sun Pharma FSDocument20 pagesSun Pharma FSNISHA BANSALNo ratings yet

- Marriott (2) ..Document13 pagesMarriott (2) ..veninsssssNo ratings yet

- DG Annual Report 2019 Pages DeletedDocument17 pagesDG Annual Report 2019 Pages DeletedShehzad QureshiNo ratings yet

- AirThread Valuation SheetDocument11 pagesAirThread Valuation SheetAngsuman BhanjdeoNo ratings yet

- Body Shop ClaseDocument29 pagesBody Shop ClaseChristian CabariqueNo ratings yet

- Dufry HY 2022 ReportDocument27 pagesDufry HY 2022 ReportHaden BraNo ratings yet

- Bal SheetDocument4 pagesBal SheetVishal JainNo ratings yet

- T Hi Liv S: - Ouc NG e OverDocument9 pagesT Hi Liv S: - Ouc NG e OverRavi AgarwalNo ratings yet

- 2012 2013 2014 2015 2016e Input Profit and Loss Statement: Cash Flow EstimatesDocument3 pages2012 2013 2014 2015 2016e Input Profit and Loss Statement: Cash Flow EstimatesBilal AhmedNo ratings yet

- Sanitärtechnik Eisenberg GMBH - FinancialsDocument2 pagesSanitärtechnik Eisenberg GMBH - Financialsin_daHouseNo ratings yet

- Valuation, Case #KEL790Document40 pagesValuation, Case #KEL790neelakanta srikarNo ratings yet

- Pidilite Industries Financial ModelDocument39 pagesPidilite Industries Financial ModelKeval ShahNo ratings yet

- Burberry AR 2016-17 CleanDocument10 pagesBurberry AR 2016-17 Cleanqiaocheng2023No ratings yet

- CV Case 3Document40 pagesCV Case 3neelakanta srikarNo ratings yet

- Analysis of Asian Paints Financial StatementsDocument12 pagesAnalysis of Asian Paints Financial StatementsSahil SondhiNo ratings yet

- Hero DetailsDocument11 pagesHero DetailsLaksh SinghalNo ratings yet

- Case ExhibitsDocument7 pagesCase Exhibitsug8No ratings yet

- Business FinanceDocument3 pagesBusiness FinanceCezanne Pi-ay EckmanNo ratings yet

- Tugas Pertemuan 10 - Sopianti (1730611006)Document12 pagesTugas Pertemuan 10 - Sopianti (1730611006)sopiantiNo ratings yet

- Adv EnzDocument4 pagesAdv EnzSafwan BhikhaNo ratings yet

- JODY2 - 0 - Financial Statement Analysis - MC - CorrectedDocument6 pagesJODY2 - 0 - Financial Statement Analysis - MC - Correctedkunal bajajNo ratings yet

- Symphony - DCF Valuation - Group6Document17 pagesSymphony - DCF Valuation - Group6Faheem ShanavasNo ratings yet

- Tugas Chapter 12-13Document5 pagesTugas Chapter 12-13Irwan AdimasNo ratings yet

- Tugas Chapter 8-9 - Discussion Questions and ProblemsDocument5 pagesTugas Chapter 8-9 - Discussion Questions and ProblemsIrwan AdimasNo ratings yet

- Performance CovenantsDocument1 pagePerformance CovenantsIrwan AdimasNo ratings yet

- Irwan Adimas Ganda Saputra, S.PD., M.A.: Personal ProfileDocument4 pagesIrwan Adimas Ganda Saputra, S.PD., M.A.: Personal ProfileIrwan AdimasNo ratings yet

- Tugas Chapter 12-13Document5 pagesTugas Chapter 12-13Irwan AdimasNo ratings yet

- Tugas Chapter 14 Dan 16Document4 pagesTugas Chapter 14 Dan 16Irwan AdimasNo ratings yet

- Purchase Order: Cv. Teguh Karya MandiriDocument1 pagePurchase Order: Cv. Teguh Karya MandiriIrwan AdimasNo ratings yet

- Performance CovenantsDocument1 pagePerformance CovenantsIrwan AdimasNo ratings yet

- The Impact of Audit Committee Characteristics 2015 Journal of InternationalDocument11 pagesThe Impact of Audit Committee Characteristics 2015 Journal of InternationalIrwan AdimasNo ratings yet

- 1 s2.0 S1467089515300701 MainDocument14 pages1 s2.0 S1467089515300701 MainIrwan AdimasNo ratings yet

- Current Trends in Internal Audi 2014 Procedia Social and Behavioral SciencDocument4 pagesCurrent Trends in Internal Audi 2014 Procedia Social and Behavioral SciencIrwan AdimasNo ratings yet

- Contemporary Approaches in Internal Audit 2014 Procedia Economics and FinancDocument8 pagesContemporary Approaches in Internal Audit 2014 Procedia Economics and FinancIrwan AdimasNo ratings yet

- Factors Associated With Internal Audit Function I 2017 International JournalDocument12 pagesFactors Associated With Internal Audit Function I 2017 International JournalIrwan AdimasNo ratings yet

- Conceptual Framework: A. Analysis Backgroud Should Identify: Green CVDocument5 pagesConceptual Framework: A. Analysis Backgroud Should Identify: Green CVIrwan AdimasNo ratings yet

- Regression: NotesDocument8 pagesRegression: NotesIrwan AdimasNo ratings yet

- Lennox 2018 Audit AdjustmentsDocument20 pagesLennox 2018 Audit AdjustmentsIrwan AdimasNo ratings yet

- Chapter 9Document10 pagesChapter 9Irwan AdimasNo ratings yet

- Chapter 7 Prospective Analysis: Valuation Theory and ConceptsDocument9 pagesChapter 7 Prospective Analysis: Valuation Theory and ConceptsIrwan AdimasNo ratings yet

- Correlations: Correlations /VARIABLES X1.1 X1.2 X1.3 X1.4 X1.5 X1 /print Twotail Nosig /missing PairwiseDocument13 pagesCorrelations: Correlations /VARIABLES X1.1 X1.2 X1.3 X1.4 X1.5 X1 /print Twotail Nosig /missing PairwiseIrwan AdimasNo ratings yet

- Conceptual Framework: A. Analysis Backgroud Should Identify: Green CVDocument5 pagesConceptual Framework: A. Analysis Backgroud Should Identify: Green CVIrwan AdimasNo ratings yet

- Lennox 2018 Audit AdjustmentsDocument20 pagesLennox 2018 Audit AdjustmentsIrwan AdimasNo ratings yet

- Frequency Table: Kualitas Sistem 1Document6 pagesFrequency Table: Kualitas Sistem 1Irwan AdimasNo ratings yet

- Reliability: Reliability /VARIABLES X1.1 X1.2 X1.3 X1.4 X1.5 /scale ('All Variables') All /model AlphaDocument7 pagesReliability: Reliability /VARIABLES X1.1 X1.2 X1.3 X1.4 X1.5 /scale ('All Variables') All /model AlphaIrwan AdimasNo ratings yet

- Frequencies VariablesDocument2 pagesFrequencies VariablesIrwan AdimasNo ratings yet

- Istilah Akun Dalam Bahasa InggrisDocument4 pagesIstilah Akun Dalam Bahasa InggrisIrwan AdimasNo ratings yet

- Pengaruh Kompleksitas Tugas Dan Locus of Control Terhadap Hubungan Antara Gaya Kepemimpinan Dan Kepuasan Kerja Auditor Cecilia Engko GudonoDocument34 pagesPengaruh Kompleksitas Tugas Dan Locus of Control Terhadap Hubungan Antara Gaya Kepemimpinan Dan Kepuasan Kerja Auditor Cecilia Engko GudonoIrwan AdimasNo ratings yet

- Journal of Corporate Finance: The Impact of Board Gender Composition On Dividend PayoutsDocument20 pagesJournal of Corporate Finance: The Impact of Board Gender Composition On Dividend PayoutsIrwan AdimasNo ratings yet

- Frequencies Variable1Document14 pagesFrequencies Variable1Irwan AdimasNo ratings yet

- K-Amen 07Document21 pagesK-Amen 07Muammar KhadafyNo ratings yet

- IFRS 5 Final 10112023 094140amDocument6 pagesIFRS 5 Final 10112023 094140amSidra MumtazNo ratings yet

- The Secretary The Election Commission of India, Nirvachan Sadan Ashokroad, New DelhiDocument15 pagesThe Secretary The Election Commission of India, Nirvachan Sadan Ashokroad, New DelhiAkshat GoyalNo ratings yet

- Kaef LK TW Ii 2022Document208 pagesKaef LK TW Ii 2022Nida Maulida HaviyaNo ratings yet

- Internal Test - 2 - FSA - QuestionDocument3 pagesInternal Test - 2 - FSA - QuestionSandeep Choudhary40% (5)

- Chapter 7 Practice ProblemsDocument6 pagesChapter 7 Practice Problemsaccounting prob100% (1)

- A) Chart of Accounts: 1. On March 1, 2020, Tahir Muktar, A Famous Businessman in Addis, Opened A BusinessDocument12 pagesA) Chart of Accounts: 1. On March 1, 2020, Tahir Muktar, A Famous Businessman in Addis, Opened A Businessrediet solomonNo ratings yet

- Simple Example of Original Issue Discount (OID) On The Financial StatementsDocument1 pageSimple Example of Original Issue Discount (OID) On The Financial StatementsziuziNo ratings yet

- Emaar Properties PJSC and Its Subsidiaries: Unaudited Interim Condensed Consolidated Financial StatementsDocument52 pagesEmaar Properties PJSC and Its Subsidiaries: Unaudited Interim Condensed Consolidated Financial StatementssafSDgSggNo ratings yet

- WBS WPL PT Palu GadaDocument10 pagesWBS WPL PT Palu GadaLucky AristioNo ratings yet

- Template Persiapan Nikah @ridwanpapuyDocument22 pagesTemplate Persiapan Nikah @ridwanpapuyAmelia widya PutriNo ratings yet

- Final AccountsDocument20 pagesFinal Accountsabhimanbehera0% (1)

- Financial Management Chapter 2Document28 pagesFinancial Management Chapter 2beyonce0% (1)

- Hardhat LTD Projected Income Statement 2000/2001Document12 pagesHardhat LTD Projected Income Statement 2000/2001Rajeshkumar NayakNo ratings yet

- (Solved) Dahlia Colby, CFO of Charming Florist LTD., Has Created The Firm's... - Course HeroDocument3 pages(Solved) Dahlia Colby, CFO of Charming Florist LTD., Has Created The Firm's... - Course Heromisonim.eNo ratings yet

- Work Sheet AnalysisDocument7 pagesWork Sheet AnalysisMUHAMMAD ARIF BASHIRNo ratings yet

- Cfas - Module 2 SynthesisDocument10 pagesCfas - Module 2 SynthesisjenNo ratings yet

- Rekha V.V.I. Commerce (Hons.) Part-3Document20 pagesRekha V.V.I. Commerce (Hons.) Part-3Ankur JhaNo ratings yet

- Maynard A SolutionDocument3 pagesMaynard A SolutionStranger SinhaNo ratings yet

- Ratio Analysis and Equity ValuationDocument68 pagesRatio Analysis and Equity ValuationDui Diner MusafirNo ratings yet

- Final Asian Paints RATIO ANALYSISDocument15 pagesFinal Asian Paints RATIO ANALYSISEr Shafique GajdharNo ratings yet

- Impactul Modelului de Contabilitate Asupra Performanţei Economico-FinanciareDocument10 pagesImpactul Modelului de Contabilitate Asupra Performanţei Economico-FinanciareDumnici Beatrice LarisaNo ratings yet

- Account No. Account Name Trial Balance Debit CreditDocument8 pagesAccount No. Account Name Trial Balance Debit CreditRachelle JoseNo ratings yet

- Financial ReportingDocument156 pagesFinancial ReportingAkanksha singhNo ratings yet

- Trial Balance TantiDocument1 pageTrial Balance TantiSMK Bisnis InformatikaNo ratings yet

- Profit Prior To IncorporationDocument12 pagesProfit Prior To Incorporationhk7012004No ratings yet

- Delta Djakarta TBK.: Company Report: January 2017 As of 31 January 2017Document3 pagesDelta Djakarta TBK.: Company Report: January 2017 As of 31 January 2017Solihul HadiNo ratings yet

- ACTG240 - Ch09 Prac QuizDocument14 pagesACTG240 - Ch09 Prac QuizxxmbetaNo ratings yet

- Jurnal Sak Emkm (Fix)Document23 pagesJurnal Sak Emkm (Fix)Nuke AdhyantiNo ratings yet

- Acct 108 Accounting For Business Combinations Quiz 3 - Consolidated Financial StatementsDocument5 pagesAcct 108 Accounting For Business Combinations Quiz 3 - Consolidated Financial StatementsGround ZeroNo ratings yet

- Recording: Jade Angelie B. Flores BS Accountancy 2Document21 pagesRecording: Jade Angelie B. Flores BS Accountancy 2Najima MangontawarNo ratings yet

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumFrom EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumRating: 3 out of 5 stars3/5 (12)

- Summary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedRating: 2.5 out of 5 stars2.5/5 (5)

- Waiter Rant: Thanks for the Tip—Confessions of a Cynical WaiterFrom EverandWaiter Rant: Thanks for the Tip—Confessions of a Cynical WaiterRating: 3.5 out of 5 stars3.5/5 (487)

- The Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyFrom EverandThe Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyNo ratings yet

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesFrom EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesRating: 4.5 out of 5 stars4.5/5 (8)

- Dealers of Lightning: Xerox PARC and the Dawn of the Computer AgeFrom EverandDealers of Lightning: Xerox PARC and the Dawn of the Computer AgeRating: 4 out of 5 stars4/5 (88)

- AI Superpowers: China, Silicon Valley, and the New World OrderFrom EverandAI Superpowers: China, Silicon Valley, and the New World OrderRating: 4.5 out of 5 stars4.5/5 (398)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomFrom EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomNo ratings yet

- The United States of Beer: A Freewheeling History of the All-American DrinkFrom EverandThe United States of Beer: A Freewheeling History of the All-American DrinkRating: 4 out of 5 stars4/5 (7)

- The Kingdom of Prep: The Inside Story of the Rise and (Near) Fall of J.CrewFrom EverandThe Kingdom of Prep: The Inside Story of the Rise and (Near) Fall of J.CrewRating: 4.5 out of 5 stars4.5/5 (26)

- Sweet Success: A Simple Recipe to Turn your Passion into ProfitFrom EverandSweet Success: A Simple Recipe to Turn your Passion into ProfitRating: 5 out of 5 stars5/5 (2)

- Pit Bull: Lessons from Wall Street's Champion TraderFrom EverandPit Bull: Lessons from Wall Street's Champion TraderRating: 4 out of 5 stars4/5 (17)

- An Ugly Truth: Inside Facebook's Battle for DominationFrom EverandAn Ugly Truth: Inside Facebook's Battle for DominationRating: 4 out of 5 stars4/5 (33)

- Power and Prediction: The Disruptive Economics of Artificial IntelligenceFrom EverandPower and Prediction: The Disruptive Economics of Artificial IntelligenceRating: 4.5 out of 5 stars4.5/5 (38)

- Data-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseFrom EverandData-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseRating: 3.5 out of 5 stars3.5/5 (12)

- All The Beauty in the World: The Metropolitan Museum of Art and MeFrom EverandAll The Beauty in the World: The Metropolitan Museum of Art and MeRating: 4.5 out of 5 stars4.5/5 (83)

- Unveling The World Of One Piece: Decoding The Characters, Themes, And World Of The AnimeFrom EverandUnveling The World Of One Piece: Decoding The Characters, Themes, And World Of The AnimeRating: 4 out of 5 stars4/5 (1)

- All You Need to Know About the Music Business: Eleventh EditionFrom EverandAll You Need to Know About the Music Business: Eleventh EditionNo ratings yet

- The Formula: How Rogues, Geniuses, and Speed Freaks Reengineered F1 into the World's Fastest Growing SportFrom EverandThe Formula: How Rogues, Geniuses, and Speed Freaks Reengineered F1 into the World's Fastest Growing SportNo ratings yet

- The Responsible Company: What We've Learned From Patagonia's First 40 YearsFrom EverandThe Responsible Company: What We've Learned From Patagonia's First 40 YearsRating: 4.5 out of 5 stars4.5/5 (18)