Professional Documents

Culture Documents

Financial Ratio

Uploaded by

toseruCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Ratio

Uploaded by

toseruCopyright:

Available Formats

Financial Ratio

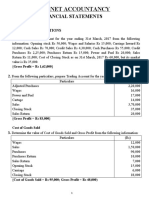

Net Income

Return on Sales (ROS) =

1 Sales

Measure management's ability to control expenses

COGS

COGS/Sales =

2 Sales

Measure management's ability to control inventory cost

Opex

Opex/Sales =

3 Sales

Measure management's ability to control operating expenses

Beginning Asset + Ending Asset

4 Average Assets =

2

Sales

Asset Turnover =

5 Average Assets

Measure efficiency of assets in producing sales… marketing effectiveness

Net Income

Return on Assets (ROA) =

6 Average Assets

Measure efficiency of using assets to produce profit

Average Assets

Financial Leverage =

7 Average Equity (Beginning Equity + Ending Equity)/2

Measures how much you're leveraging the equity using OPM

Net Income

Return on Equity (ROE) =

8 Average Equity (Beginning Equity + Ending Equity)/2

Measure the economic rewards accruing the shareholders as a result of the company's transactions

Total Debt

Debt to Equity =

9 Total Equity

Measure the mix of debt vs. shareholders in financing the company

Cash + Account Receivable

Quick Ratio =

10 Account Payable + Other Current Liabilities

A measure of a company's ability to cover its current liabilities from only cash

© Copyright by Gratyo.com + YohanesGPauly.com for Business is FUN!™ Online Resources

Financial Ratio

Total Current Asset

Current Ratio =

11 Total Current Liabilities

A measure of a company's ability to cover all short term obligations with existing short term resources

Sales

Fixed Asset Turnover =

12 Average Net Fixed Assets

Measure how effectively the fixed assets of the business are at producing assets

Earnings

ROA Employees =

13 No of Employee

Measure efficiency of employees to produce profits

Earnings

ROA Payroll =

14 Total Payroll

Measure efficiency of payroll to produce profits

© Copyright by Gratyo.com + YohanesGPauly.com for Business is FUN!™ Online Resources

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Hotel Budget TemplateDocument44 pagesHotel Budget TemplateClarisse30No ratings yet

- Calculations For HV and LVDocument40 pagesCalculations For HV and LVAerwin BautistaNo ratings yet

- Understanding ReceivablesDocument8 pagesUnderstanding ReceivablesKian BarredoNo ratings yet

- Line Trap Function and DesignDocument12 pagesLine Trap Function and DesignOsama AhmadNo ratings yet

- Line Trap Function and DesignDocument12 pagesLine Trap Function and DesignOsama AhmadNo ratings yet

- Steps of Sap FicoDocument10 pagesSteps of Sap FicoAniruddha Chakraborty100% (1)

- Quiz 2 KeysDocument15 pagesQuiz 2 KeysLeslieCastro100% (1)

- Cost of Production ReportDocument2 pagesCost of Production ReportAdam Cuenca100% (2)

- UTL STM 1 StanaloneDocument1 pageUTL STM 1 StanalonetoseruNo ratings yet

- RS8000NC DatasheetDocument8 pagesRS8000NC DatasheettoseruNo ratings yet

- BHB Sicam Emic Eng PDFDocument318 pagesBHB Sicam Emic Eng PDFtoseruNo ratings yet

- SWT 3000 - 51965-10634-C PB - Product Safety - Cover SheetDocument6 pagesSWT 3000 - 51965-10634-C PB - Product Safety - Cover SheettoseruNo ratings yet

- Itu-T: Characteristics of A Single-Mode Optical Fibre CableDocument24 pagesItu-T: Characteristics of A Single-Mode Optical Fibre CableHamid BoazizNo ratings yet

- Single-Phase Power Supply Unit, Primary Switched For Universal Use QUINT-PS-100-240AC/48DC/20Document10 pagesSingle-Phase Power Supply Unit, Primary Switched For Universal Use QUINT-PS-100-240AC/48DC/20toseruNo ratings yet

- Em Sicam Emic Broschuere enDocument8 pagesEm Sicam Emic Broschuere entoseruNo ratings yet

- BHB Sicam Emic EngDocument318 pagesBHB Sicam Emic EngtoseruNo ratings yet

- PS 663x ENG PDFDocument10 pagesPS 663x ENG PDFtoseruNo ratings yet

- Acuvim II Series Brochure V2.01Document6 pagesAcuvim II Series Brochure V2.01toseruNo ratings yet

- PS 663x ENGDocument10 pagesPS 663x ENGtoseruNo ratings yet

- Coming Soon To A Substation Near You . Packetized Data Ethernet/IP TeleprotectionDocument1 pageComing Soon To A Substation Near You . Packetized Data Ethernet/IP TeleprotectiontoseruNo ratings yet

- Manual Communication Cable Adapter 1310 enDocument27 pagesManual Communication Cable Adapter 1310 entoseruNo ratings yet

- Energy101 3.EnergyEconomyDocument9 pagesEnergy101 3.EnergyEconomytoseruNo ratings yet

- OTDR report with span loss, average loss, splice loss and OTDR traceDocument2 pagesOTDR report with span loss, average loss, splice loss and OTDR tracetoseruNo ratings yet

- Energy 101: Dr. Sam SheltonDocument9 pagesEnergy 101: Dr. Sam SheltontoseruNo ratings yet

- 3 - 2 - The Wealth of Villages (12 - 53)Document5 pages3 - 2 - The Wealth of Villages (12 - 53)toseruNo ratings yet

- NPV Analysis of MBAT Plant Subsidy AlternativesDocument4 pagesNPV Analysis of MBAT Plant Subsidy AlternativesAprva100% (1)

- Capital Investment Decisions GuideDocument5 pagesCapital Investment Decisions GuideIvan BendiolaNo ratings yet

- Financial Model Template by SlidebeanDocument388 pagesFinancial Model Template by SlidebeanAtthippattu Srinivasan MuralitharanNo ratings yet

- 38-Article Text-232-3-10-20211009Document15 pages38-Article Text-232-3-10-20211009KeziaNo ratings yet

- RECONCILING FI-AM ISSUESDocument3 pagesRECONCILING FI-AM ISSUESchrreddyNo ratings yet

- 08 Chapter-2Document16 pages08 Chapter-2Shazaf KhanNo ratings yet

- Ifric 17Document8 pagesIfric 17Xyriel RaeNo ratings yet

- Receivables and Revenue RecognitionDocument21 pagesReceivables and Revenue RecognitionLu CasNo ratings yet

- Master of Commerce Term-End Examination / 1:3 1-June, 2019Document4 pagesMaster of Commerce Term-End Examination / 1:3 1-June, 2019Tushar SharmaNo ratings yet

- Dangote Cement's financial charges and tax cut into profit as sales revenue grows slowlyDocument16 pagesDangote Cement's financial charges and tax cut into profit as sales revenue grows slowlygregNo ratings yet

- Fsa 06Document36 pagesFsa 06ferahNo ratings yet

- LUMS ACCT 100 Financial AccountingDocument7 pagesLUMS ACCT 100 Financial AccountingZulfeqar HaiderNo ratings yet

- Group 2 - CaseStudy Bigger Isnt Always Better - FINMA1 - BDocument14 pagesGroup 2 - CaseStudy Bigger Isnt Always Better - FINMA1 - BAccounting 201No ratings yet

- Maf 620 Dutch LadyDocument9 pagesMaf 620 Dutch LadyNur IfaNo ratings yet

- GSA TestDocument14 pagesGSA TestYuvaraj BaghmarNo ratings yet

- Financial Statement AnalysisDocument18 pagesFinancial Statement AnalysisShailyn AngcayNo ratings yet

- Assignment 6Document1 pageAssignment 6aafNo ratings yet

- FINANCIAL STATEMENT For PrintDocument4 pagesFINANCIAL STATEMENT For PrintGkgolam KibriaNo ratings yet

- Dividend Discount Models: Relative Valuation - IIDocument92 pagesDividend Discount Models: Relative Valuation - IIbhaskkarNo ratings yet

- FAC4764 Study Pack 2Document41 pagesFAC4764 Study Pack 2Muvhusi NethonondaNo ratings yet

- CH 1Document19 pagesCH 1Chiheb DzNo ratings yet

- Far 360Document24 pagesFar 360Kirana SofeaNo ratings yet

- Incomplete RecordsDocument51 pagesIncomplete RecordssoniaNo ratings yet

- Practical Questions (Sandeep Garg 2018-19)Document10 pagesPractical Questions (Sandeep Garg 2018-19)Kanishk SinglaNo ratings yet

- NOTES On Mesures of Leverage - CFA LEVEL 1Document22 pagesNOTES On Mesures of Leverage - CFA LEVEL 1أوفي سرNo ratings yet