Professional Documents

Culture Documents

SMIC 1Q08Update 11july2008 1

Uploaded by

ResearchOracleOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SMIC 1Q08Update 11july2008 1

Uploaded by

ResearchOracleCopyright:

Available Formats

Tel.

+44 (0)20 7232 3090 Traded on

AIM, London

Fax +44 (0)20 7232 3099 Stock Exchange

www.iirgroup.com Regulated and

LSE: IIR authorised by

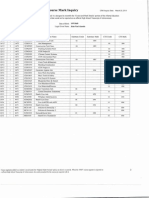

Semiconductor Manufacturing International Corporation 11 July 2008

Update Report – 1Q 08 Results

Management’s expectation of profitability from 4Q 08 onwards seems optimistic

ADR HOLD Fundamental research indicates a 2% upside in the ADR over the next 6-12 months. We have

Direct

calculatedaccess

the targetto thebased

price fullonreport free factors,

fundamental of charge

using aatweighted average of target prices

Fundamental Stock

http://www.iirgroup.com/researchoracle/viewreport/show/20293

obtained using DCF and comparative valuation methodologies. We have taken a 6-12 month

investment horizon for this stock, as the semiconductor industry in which the company operates is

Ticker: SMI

highly cyclical and therefore trends can be captured more accurately with a shorter investment horizon

Target price: US$2.75

We reiterate the ADR a HOLD on fundamental grounds with a 6-12 month target price of US$2.75.

Current price: US$2.70

Hong Kong HOLD The Hong Kong stock is expected to appreciate approximately 1% over the next 6-12 months as the

2% fundamental upside is offset by approximately 1 percentage point downside attributable to the

Stock anticipated increase in the Hong Kong stock discount1 over the same period. The currency impact on

the Hong Kong stock is neutral since the Hong Kong dollar is pegged to the US dollar.

Ticker: 0981.HK

Target price: HK$0.4224 We reiterate the Hong Kong stock (50 Hong Kong shares = 1 ADR) a HOLD with a 6-12 month target

Current price: HK$0.4200 price of HK$0.42.

Analyst: Shilpen Shah Investment horizon - short term actionable trading strategies

Editor: Heloise Capon This report addresses the needs of strategic investors with a long term investment horizon of 6-12 months. If this

Global Research Director: report is provided to you by your broker under the Global Settlement, you may now also access (free of charge) the

Satish Betadpur, CFA short term trading outlook that we publish from time to time for this issuer, looking at the coming 5-30 days for

readers with a shorter trading horizon. These are available online only at www.researchoracle.com

Next news due:

2Q 08 results, late July 2008 Report summary

Semiconductor Manufacturing International Corporation’s (SMIC) results were significantly below

expectations in 1Q 08. Management’s decision to curtail DRAM production hit shipments, while

inventory writedown impacted margins in the quarter. The change in business strategy has led to a

significant drop in available capacity due to the ongoing conversion of DRAM into Logic capacity at its

Beijing fab and potential impairment of the company’s assets subsequent to the halt of commodity-

DRAM manufacturing at the fab. The impact on the company’s sales and profitability in the short term

is evident. However, Management expects to report profits across the company from 4Q 08 onwards,

with profitability improving going forward. In contrast to Management expectations, we do not expect

profit at the net level in either FY 2008 or FY 2009. We have revised our estimates across the board

for the next two years. Although the SMIC ADR price has declined 38.2% since our 4Q 07 and FY 2007

update report, we do not believe there is significant fundamental upside in the coming 6-12 months.

Currency impact for US investors

The company reports in US dollars, which is its major trading currency. Earnings forecasts are

therefore also expressed in US dollars. Although the company has costs as well as revenues in other

currencies, we assume the net risk is minimized through effective hedging strategies. As a result the

impact of currency movements on the price of the ADR is assumed to be neutral. Where specific

currency risks are identified these will be highlighted in the report.

Currency impact on the Hong Kong stock

The Hong Kong dollar is currently pegged to the US dollar in the range of HK$7.75 and HK$7.85. We

are assuming a constant exchange rate to value this stock over our investment horizon. The ADR has

been calculated using the 09 July 2008 closing USD/HKD exchange rate of HK$7.80.

Page 1 Refer to page 5 for footnotes

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- WNS NewsAlert 11july2008 1Document1 pageWNS NewsAlert 11july2008 1ResearchOracleNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- ACE 1Q08Update 11jul2008 1Document1 pageACE 1Q08Update 11jul2008 1ResearchOracleNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- GrupoAeroCentroNorte NewsAlert 11july2008 1Document1 pageGrupoAeroCentroNorte NewsAlert 11july2008 1ResearchOracleNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Roundup 10 July 2008Document2 pagesRoundup 10 July 2008ResearchOracleNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- UnileverNV 1Q08Update 10jul08 1Document1 pageUnileverNV 1Q08Update 10jul08 1ResearchOracleNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- EnduranceSpecialty NewsAlert 10july2008 1Document1 pageEnduranceSpecialty NewsAlert 10july2008 1ResearchOracleNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Sappi 2Q08Update 09july2008 1Document1 pageSappi 2Q08Update 09july2008 1ResearchOracleNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- ChinaEastern FY2007Update 09july2008 1Document1 pageChinaEastern FY2007Update 09july2008 1ResearchOracleNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Biotech NewsDocument116 pagesBiotech NewsRahul KapoorNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Sap Consultant Cover LetterDocument3 pagesSap Consultant Cover LetterrasgeetsinghNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- UNIT 5-8 PrintingDocument17 pagesUNIT 5-8 PrintingNOODNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Quotation of Suny PDFDocument5 pagesQuotation of Suny PDFHaider KingNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- OM CommandCenter OI SEP09 enDocument30 pagesOM CommandCenter OI SEP09 enGabriely MuriloNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Coding Rubric Unifix XXXX 75Document2 pagesCoding Rubric Unifix XXXX 75api-287660266No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Combined South Dakota Motions To Reconsider in ICWA CaseDocument53 pagesCombined South Dakota Motions To Reconsider in ICWA CaseLee StranahanNo ratings yet

- Enlightened ExperimentationDocument8 pagesEnlightened ExperimentationRaeed HassanNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- VRPIN 01843 PsychiatricReportDrivers 1112 WEBDocument2 pagesVRPIN 01843 PsychiatricReportDrivers 1112 WEBeverlord123No ratings yet

- Mushroom Project - Part 1Document53 pagesMushroom Project - Part 1Seshadev PandaNo ratings yet

- Smart Door Lock System Using Face RecognitionDocument5 pagesSmart Door Lock System Using Face RecognitionIJRASETPublicationsNo ratings yet

- Isi Rumen SBG Subtitusi HijauanDocument3 pagesIsi Rumen SBG Subtitusi HijauanBagas ImamsyahNo ratings yet

- De Thi Hoc Ki 1 Lop 11 Mon Tieng Anh Co File Nghe Nam 2020Document11 pagesDe Thi Hoc Ki 1 Lop 11 Mon Tieng Anh Co File Nghe Nam 2020HiềnNo ratings yet

- HUMSS - Introduction To World Religions & Belief Systems CGDocument13 pagesHUMSS - Introduction To World Religions & Belief Systems CGAliuqus SirJasper89% (18)

- SEILDocument4 pagesSEILGopal RamalingamNo ratings yet

- Nutridiet-Enteral and Parenteral FeedingDocument3 pagesNutridiet-Enteral and Parenteral FeedingBSN 1-N CASTRO, RicciNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Coaxial Cable Attenuation ChartDocument6 pagesCoaxial Cable Attenuation ChartNam PhamNo ratings yet

- Practice - Test 2Document5 pagesPractice - Test 2Nguyễn QanhNo ratings yet

- Dating Apps MDocument2 pagesDating Apps Mtuanhmt040604No ratings yet

- Zomato Restaurant Clustering & Sentiment Analysis - Ipynb - ColaboratoryDocument27 pagesZomato Restaurant Clustering & Sentiment Analysis - Ipynb - Colaboratorybilal nagoriNo ratings yet

- BiografijaDocument36 pagesBiografijaStjepan ŠkalicNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Registration ListDocument5 pagesRegistration ListGnanesh Shetty BharathipuraNo ratings yet

- Jonathan Livingston Seagull - Richard Bach - (SAW000) PDFDocument39 pagesJonathan Livingston Seagull - Richard Bach - (SAW000) PDFAdrià SonetNo ratings yet

- China Training WCDMA 06-06Document128 pagesChina Training WCDMA 06-06ryanz2009No ratings yet

- 7Document6 pages7Joenetha Ann Aparici100% (1)

- Angle Modulation: Hệ thống viễn thông (Communication Systems)Document41 pagesAngle Modulation: Hệ thống viễn thông (Communication Systems)Thành VỹNo ratings yet

- Perdarahan Uterus AbnormalDocument15 pagesPerdarahan Uterus Abnormalarfiah100% (1)

- Note!: Rear Shock Absorber For YAMAHA N-MAXDocument4 pagesNote!: Rear Shock Absorber For YAMAHA N-MAXAdityaArnas0% (1)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Nizkor Project Fallacies - LabossierDocument77 pagesNizkor Project Fallacies - Labossierapi-3766098100% (1)

- Img 20150510 0001Document2 pagesImg 20150510 0001api-284663984No ratings yet