Professional Documents

Culture Documents

Delpher Trades Corporation Vs IAC

Uploaded by

Tom Lui EstrellaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Delpher Trades Corporation Vs IAC

Uploaded by

Tom Lui EstrellaCopyright:

Available Formats

Delpher Trades Corporation vs.

IAC Ruling:

The legal right of a taxpayer to decrease the amount of what otherwise could The Court ruled in favor of the petitioner. The "Deed of Exchange" of property

be his taxes or altogether avoid them, by means which the law permits, between the Pachecos and Delpher Trades Corporation cannot be considered a

cannot be doubted. contract of sale. There was no transfer of actual ownership interests by the

Pachecos to a third party. The Pacheco family merely changed their ownership

from one form to another. The ownership remained in the same hands. Hence, the

Delfin Pacheco and sister Pelagia were the owners of a parcel of land in Polo (now

private respondent has no basis for its claim of a light of first refusal under the

Valenzuela). Subsequently, they leased to Construction Components International

lease contract.

Inc. the property and providing for a right of first refusal should it decide to sell the

said property.

By their ownership of a capital equal to 55% of the shares, the Pachecos have the

Construction Components International, Inc. assigned its rights and obligations control of the petitioner corporation. In effect, the petitioner corporation is a

under the contract of lease in favor of Hydro Pipes Philippines, Inc. with the signed business conduit of the Pachecos. What they really did was to invest their

conformity and consent of Delfin and Pelagia. In 1976, a deed of exchange was properties and change the nature of their ownership from unincorporated to

executed between lessors Delfin and Pelagia Pacheco and defendant Delpher incorporated form by organizing Delpher Trades Corporation to take control of

Trades Corporation whereby the Pachecos conveyed to the latter the leased their properties and at the same time save on inheritance taxes

property together with another parcel of land also located.

The execution of the deed of exchange on the properties for no par value shares,

On the ground that it was not given the first option to buy the leased property the Pachecos were able to provide for a tax free exchange of property, such that

pursuant to the lease agreement, respondent Hydro Pipes Philippines filed an they were able to execute the deed of exchange free from income tax and acquire

amended complaint for reconveyance of the lot under the conditions similar to a corporation. Sec. 35 of the NIRC provides that “No gain or loss shall also be

those of Delpher. The court ruled in favor of Hydro declaring the existence of its recognized if a person exchanges his property for stock in a corporation of which as

preferential right to acquire the subject property. IAC affirmed. a result of such exchange said person alone or together with others not exceeding

four persons gains control of said corporation."

Petitioner Delpher contend that there was actually no transfer of ownership, the

Pachecos having remained in control of the property. They alleged that petitioner The Court believes that there is nothing wring about the “estate planning” scheme

Delpher is a family corporation , organized by the children of Pelagia, who owned resorted to by the Pachecos. The legal right of a taxpayer to decrease the amount

the parcel of land leased to private respondent Hydro to perpetuate their control of what otherwise could be his taxes or altogether avoid them, by means which

over the property through the corporation and to avoid taxes. It also alleged that to the law permits, cannot be doubted.

accomplish this, the leased property was transferred to petitioner Delpher by

virtue of a deed of exchange, and in exchange for the properties they acquired

majority shares of petitioner Delpher corporation. In short, petitioners contend

that the Pachecos did not sell the leased property since they exchanged the land

for shares in their own corporation. Private respondent, however, contend that

petitioner Delher Trades is a corporation separate and distinct from the Pachecos.

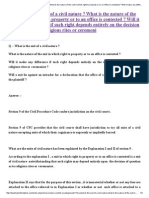

Issue: Whether or not the "Deed of Exchange" of the properties executed by the

Pachecos on the one hand and the Delpher Trades Corporation on the other was

meant to be a contract of sale which, in effect, prejudiced the private respondent's

right of first refusal over the leased property included in the deed of exchange

You might also like

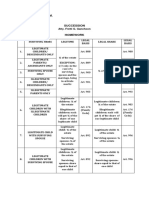

- Estrella, Tom Lui M. JD4301 SuccessionDocument3 pagesEstrella, Tom Lui M. JD4301 SuccessionTom Lui EstrellaNo ratings yet

- Pakiusap!: Isang Pindot Lang Sa Doorbell. Papunta Na Yung Magtitinda. SalamatDocument2 pagesPakiusap!: Isang Pindot Lang Sa Doorbell. Papunta Na Yung Magtitinda. SalamatTom Lui EstrellaNo ratings yet

- Garcia v. LacuestaDocument1 pageGarcia v. LacuestaTom Lui EstrellaNo ratings yet

- PNB V. Picornell FACTS: Bartolome Picornell, Following Instruction Hyndman, Tavera &Document6 pagesPNB V. Picornell FACTS: Bartolome Picornell, Following Instruction Hyndman, Tavera &Tom Lui EstrellaNo ratings yet

- FdgdfgfdfdhfgfhkujDocument2 pagesFdgdfgfdfdhfgfhkujTom Lui EstrellaNo ratings yet

- Lasam V UmenganDocument2 pagesLasam V UmenganTom Lui EstrellaNo ratings yet

- Supreme Court: Attorney-General Jaranilla For Appellant. Salvador Franco For AppelleesDocument3 pagesSupreme Court: Attorney-General Jaranilla For Appellant. Salvador Franco For AppelleesTom Lui EstrellaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Human Rights in India - An OverviewDocument26 pagesHuman Rights in India - An Overviewabhishek502100% (1)

- Cycle of American L 030045 MBP 3Document345 pagesCycle of American L 030045 MBP 3avid2chatNo ratings yet

- Pale Case DoctrinesDocument28 pagesPale Case DoctrinesSheena MarieNo ratings yet

- India and The Contemprorary World1Document160 pagesIndia and The Contemprorary World1சுப.தமிழினியன்75% (4)

- Copyright and Neighbouring Rights Act 2006Document42 pagesCopyright and Neighbouring Rights Act 2006Patricia NattabiNo ratings yet

- Man or Other Animals - Laws #2 - Alfred Adask - Adask's LawDocument28 pagesMan or Other Animals - Laws #2 - Alfred Adask - Adask's LawVen Geancia75% (4)

- Tatjana Visak, Robert Garner, Peter Singer-The Ethics of Killing Animals-Oxford University Press (2015)Document267 pagesTatjana Visak, Robert Garner, Peter Singer-The Ethics of Killing Animals-Oxford University Press (2015)Carla Suárez Félix100% (1)

- Westlaw Document 01-38-56Document52 pagesWestlaw Document 01-38-56jef_xavier1938No ratings yet

- Chapter 5-7 PIL Bernas BookDocument7 pagesChapter 5-7 PIL Bernas BookroansalangaNo ratings yet

- The Late February, 2012 Edition of Warren County ReportDocument40 pagesThe Late February, 2012 Edition of Warren County ReportDan McDermottNo ratings yet

- Unlawful DetainerDocument4 pagesUnlawful DetainerJudiel ParejaNo ratings yet

- Art 1620 SalesDocument3 pagesArt 1620 SalesCMLNo ratings yet

- Human RightsDocument22 pagesHuman RightsMohammedAhmedRazaNo ratings yet

- Solution of Case Study Unocal in BurmaDocument32 pagesSolution of Case Study Unocal in Burmaernimas50% (2)

- Suitof Civil NatureDocument3 pagesSuitof Civil NatureoasisiNo ratings yet

- State of Nature Social ContractDocument4 pagesState of Nature Social Contractapi-240737404No ratings yet

- Zubiya Moorish Estate Trust RevisedDocument8 pagesZubiya Moorish Estate Trust RevisedZubiya Yamina El (All Rights Reserved)100% (1)

- Liberation of Thliberation of The Peoplee PeopleDocument427 pagesLiberation of Thliberation of The Peoplee PeopleLuciana PintoNo ratings yet

- (Anthony Pagden (Ed.) ) The Languages of PoliticalDocument374 pages(Anthony Pagden (Ed.) ) The Languages of PoliticalPabloMoscoso100% (3)

- The Fashwet ConstitutionwetDocument3 pagesThe Fashwet ConstitutionwetBethany RamosNo ratings yet

- 2004, Shiva Earth DemocracyDocument15 pages2004, Shiva Earth Democracylia_haroNo ratings yet

- PetitionersspeechDocument8 pagesPetitionersspeechAnirudh AroraNo ratings yet

- Robert Dahl - Decision Making in A Democracy: The Supreme Court As A National Policy-MakerDocument13 pagesRobert Dahl - Decision Making in A Democracy: The Supreme Court As A National Policy-Makergreghelms0% (1)

- Property Dean NavarroDocument6 pagesProperty Dean NavarrojurispazNo ratings yet

- (Tom Cliff, Tessa Morris-Suzuki, Shuge Wei (Eds.) ) T (B-Ok - Xyz) PDFDocument246 pages(Tom Cliff, Tessa Morris-Suzuki, Shuge Wei (Eds.) ) T (B-Ok - Xyz) PDFgootNo ratings yet

- Position Paper RH BillDocument14 pagesPosition Paper RH BillClaire DumdumaNo ratings yet

- SLD Document PDFDocument95 pagesSLD Document PDFTamash MajumdarNo ratings yet

- Manish Kumar KhungerDocument5 pagesManish Kumar KhungerAnonymous CwJeBCAXpNo ratings yet

- Legalization of Marijuana Marywood University Tyler DohertyDocument6 pagesLegalization of Marijuana Marywood University Tyler DohertyTyler DohertyNo ratings yet

- Affirmative Action and Core Democratic ValuesDocument11 pagesAffirmative Action and Core Democratic Valuesapi-287301687100% (1)